Equinix, Inc. Common Stock REIT (ticker: EQIX)

2023-12-24

Equinix, Inc., denoted by its ticker EQIX, is a multinational company specializing in data center and colocation services, operating as a Real Estate Investment Trust (REIT). The company offers a platform where more than 10,000 businesses, including enterprises, cloud and IT service providers, and networking companies, can interconnect with partners and customers to accelerate their performance and protect their digital assets. Equinix operates more than 220 data centers across five continents, providing customers with reliable and secure space, power, and interconnection services. Its data centers are strategically located near internet exchange points for increased speed and reduced transport costs. As a REIT, Equinix is required to distribute at least 90% of its taxable income to its shareholders annually in the form of dividends, making it an attractive option for income-seeking investors. The company's stock is traded on the NASDAQ stock exchange and is commonly included in various financial indices and ETFs that cover real estate and technology sectors, highlighting its significant role in the intersection of real estate and data management industries.

Equinix, Inc., denoted by its ticker EQIX, is a multinational company specializing in data center and colocation services, operating as a Real Estate Investment Trust (REIT). The company offers a platform where more than 10,000 businesses, including enterprises, cloud and IT service providers, and networking companies, can interconnect with partners and customers to accelerate their performance and protect their digital assets. Equinix operates more than 220 data centers across five continents, providing customers with reliable and secure space, power, and interconnection services. Its data centers are strategically located near internet exchange points for increased speed and reduced transport costs. As a REIT, Equinix is required to distribute at least 90% of its taxable income to its shareholders annually in the form of dividends, making it an attractive option for income-seeking investors. The company's stock is traded on the NASDAQ stock exchange and is commonly included in various financial indices and ETFs that cover real estate and technology sectors, highlighting its significant role in the intersection of real estate and data management industries.

| As of Date: 12/24/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 75.08B | 67.95B | 73.35B | 67.43B | 60.62B | 52.64B |

| Enterprise Value | 90.10B | 82.79B | 87.72B | 81.99B | 74.14B | 67.08B |

| Trailing P/E | 86.08 | 83.86 | 88.88 | 94.01 | 85.74 | 81.03 |

| Forward P/E | 71.43 | 66.23 | 82.64 | 74.07 | 67.57 | 60.24 |

| PEG Ratio (5 yr expected) | 3.58 | 3.22 | 4.05 | 3.66 | 3.10 | 2.72 |

| Price/Sales (ttm) | 9.41 | 8.74 | 9.62 | 9.12 | 8.43 | 7.47 |

| Price/Book (mrq) | 6.32 | 5.67 | 6.10 | 5.86 | 5.44 | 4.95 |

| Enterprise Value/Revenue | 11.34 | 40.17 | 43.46 | 41.03 | 39.63 | 36.44 |

| Enterprise Value/EBITDA | 27.78 | 95.85 | 109.09 | 94.66 | 104.36 | 87.18 |

| Address | One Lagoon Drive, 4th Floor, Redwood City, CA, 94065-1562, United States | Phone | 650 598 6000 | Fax | 650 598 6900 |

| Website | https://www.equinix.com | Industry | REIT - Specialty | Sector | Real Estate |

| Full Time Employees | 13,046 | Previous Close | 801.60 | Open | 805.48 |

| Day Low | 795.165 | Day High | 810.16 | Dividend Rate | 17.04 |

| Dividend Yield | 2.13% | Payout Ratio | 143.49% | Beta | 0.642 |

| Trailing PE | 86.17 | Forward PE | 73.43 | Volume | 222,732 |

| Average Volume | 398,181 | Market Cap | 75,256,922,112 | Fifty Two Week Low | 648.23 |

| Fifty Two Week High | 824.86 | Price to Sales Trailing 12 Months | 10.05 | Fifty Day Average | 771.9666 |

| Two Hundred Day Average | 751.61694 | Trailing Annual Dividend Rate | 13.33 | Trailing Annual Dividend Yield | 1.66% |

| Enterprise Value | 90,125,164,544 | Profit Margins | 11.62% | Float Shares | 93,576,425 |

| Shares Outstanding | 93,883,400 | Book Value | 126.61 | Price to Book | 6.32 |

| Earnings Quarterly Growth | 30.20% | Net Income to Common | 870,372,992 | Trailing EPS | 9.28 |

| Forward EPS | 10.89 | Last Split Factor | 1:32 | Last Split Date | 1041292800 |

| Total Cash | 2,357,497,088 | Total Cash Per Share | 25.11 | EBITDA | 2,769,467,904 |

| Total Debt | 17,381,287,936 | Total Revenue | 7,489,844,224 | Debt to Equity | 145.92 |

| Revenue Per Share | 80.37 | Return on Assets | 1.93% | Return on Equity | 7.55% |

| Gross Profits | 2,971,686,000 | Free Cashflow | 2,781,564,160 | Operating Cashflow | 2,978,070,016 |

| Earnings Growth | 27.40% | Revenue Growth | 16.50% | Gross Margins | 45.17% |

| EBITDA Margins | 36.98% | Operating Margins | 14.59% | Current Price | 799.68 |

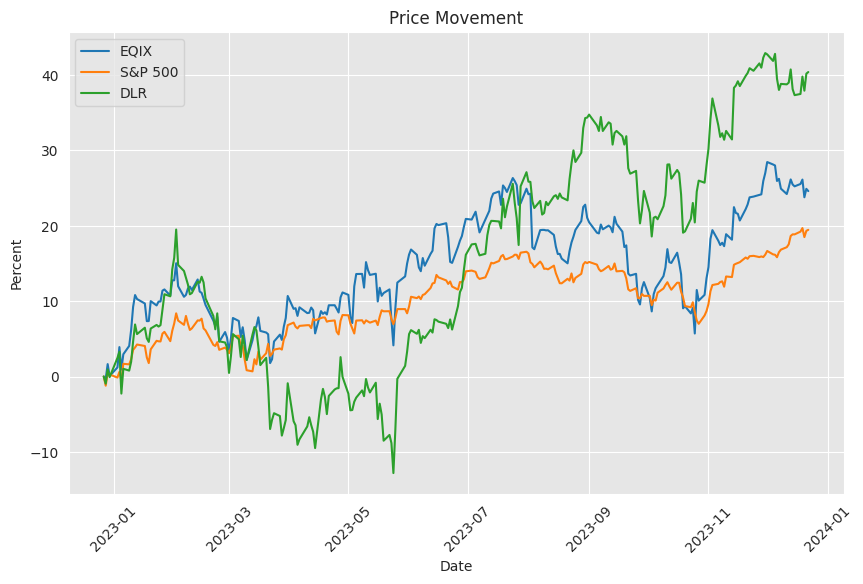

Equinix, Inc. (EQIX) has presented an interesting profile based on the latest technical analysis and fundamental data. As an expert in the field of Technical Analysis equipped with insights into market dynamics, several indicators suggest potential price movement for EQIX in the forthcoming months.

Technical Analysis Perspective: - The On-Balance Volume (OBV) has shown a fluctuating trend but ended on a positive note as of the last day, which may indicate a growing interest from investors and potential bullish sentiment in the market. - The stock has been showing higher lows, as reflected in Parabolic SAR (stop and reverse), with the PSAR indicating a bullish trend with the dots below the price on the last trading day. - The Moving Average Convergence Divergence (MACD) histogram shows a negative reading, suggesting a decrease in momentum; however, it's important to observe whether the MACD line might cross the signal line from below, which could indicate a change toward a bullish momentum.

Fundamental Analysis Perspective: - The market capitalization has shown an upward trend over the past quarters, indicating a growing valuation of the company by the market. - A high Enterprise Value/Revenue ratio suggests that the market assigns a premium to the company's revenue streams, which is often typical for companies with strong market positions or unique offerings. - The Price-to-Earnings (PE) ratios, both trailing and forward, have been fluctuating; however, it remains elevated, showing that investors have high expectations for future earnings. - PEG Ratio and Price/Sales ratio indicate that the stock might be overvalued when looking at growth projections and sales revenues, which can be a concern for value-focused investors.

Upon reviewing the summary of financials, one can note that while there have been unusual items impacting the financials, the core operating metrics such as EBITDA, net income, and revenue remain robust. The increase in Gross Profit over the past few years showcases the company's ability to maintain profitability which is an attractive point for investors.

Price Movement Prediction: - Given the technical indicators' mixed signals with OBV and PSAR suggesting a bullish sentiment while MACD indicates bearish momentum, careful monitoring of upcoming trend confirmation signals is advised. - If the MACD converges positively, it could confirm a bullish case, especially if accompanied by increasing OBV, which would suggest accumulation among traders. - However, the relatively high valuation ratios and any negative changes in the company's earnings or revenue growth could dampen investor sentiment, leading to price consolidation or potential pullbacks.

In summary, the next few months for EQIX could see potential bullish price movements if investor sentiment remains positive and the company's fundamentals remain strong. However, the elevated valuation metrics warrant caution. Any adverse financial developments or broader market downturns could lead to volatility or price corrections, while technical confirmation could lead to sustained bullish momentum. Investors should balance their outlook by considering both the technical patterns and the context provided by the company's fundamentals. Continual monitoring of both spheres will be essential for predicting future price movements with more accuracy.

Equinix, Inc. (EQIX) stands as the global leader in digital infrastructure, with a significant announcement in December 2023 that marks a new era for its International Business Exchange (IBX) data centers. The implementation of advanced liquid cooling technologies across more than 100 data centers in over 45 metropolitan areas around the world showcases Equinix's dedication to innovation and customer needs, particularly as compute-intensive workloads from artificial intelligence (AI) applications grow in demand.

Traditional data center cooling methods are increasingly challenged by the heat generated from the high-density, high-performance computing equipment required for AI and similar workloads. Equinix's move to adopt direct-to-chip and rear-door heat exchanger liquid cooling technologies is not only a nod to efficiency but also a commitment to environmental sustainability as the company continues to steer the industry towards a zero-emissions future.

This commitment is reflected in the company's strategic initiative to provide customers with flexible and efficient cooling solutions critical for managing AI workloads. This approach aligns with the increasing importance placed on energy efficacy, environmental impact, and the effectiveness of cooling systems within the data center arenaa trend that industry experts, including My Truong, consider pivotal in overcoming deployment barriers for such advanced cooling solutions.

Equinix's readiness to support businesses with significant liquid-cooled deployments is evident through previous ventures and collaborations with partners, including industry leaders like CoolIT Systems Inc. and ZutaCore. This vendor-neutral approach not only enables flexibility for customers but also emphasizes Equinix's commitment to innovation and excellence within the data center domain.

This expansive rollout of liquid cooling technologies also sits well with Equinix's overarching strategy of sustainability, supporting the company's goal toward achieving a zero-emissions data industry. These efforts complement the company's successful track record in securing its place as a forward-thinking powerhouse in the digital infrastructure space, ready to meet the ever-evolving needs of tech-driven enterprises.

The strategic expansion is not only a response to immediate cooling needs but also a forward leap, ensuring Equinix maintains its competitive edge as a digital infrastructure provider. This move is expected to resonate well with stakeholders, fortifying Equinix's market position and reinforcing its reputation as the foundational infrastructure platform of choice for digital leaders.

While Equinix cements its position in the evolving technological landscape, it is often evaluated alongside other key players within the real estate investment and services sector. One such peer is SITE Centers Corp. (SITC), a company that, while not within the data center sphere, reflects the competitive dynamics of the REIT market. Despite operating in a diverse real estate sector, SITE Centers' recent stock performance and exceeding of third-quarter earnings forecasts demonstrate the breadth of investment potential within the REIT industry.

SITE Centers' report of a minor decrease in its lease rate yet an increase in base rent per square per foot captures a snapshot of successful operational performance with strategic emphasis on high-quality leasing spaces. This contrasts with Equinix's recent 9.2% gain in stock over a similar timeframe, where the company achieved a revenue upsurge of 12% year over year, showcasing the unique pathways to growth REITs can exhibit.

SITE Centers positive financial results have prompted an upward revision in its 2023 outlook, reinforcing its sound operational framework amid a climate where capital recycling and focused portfolio management are key growth drivers. Compared to Equinixs growth narrative, which focuses on leveraging technology and innovation, SITE Centers progression exemplifies a strong operational recalibration within the REIT sector.

Further into the realm of data center REITs, Equinix reported impressive financial results during its third-quarter earnings call in October 2023. With year-over-year revenue growth of 14%, driven by increased recurring revenue and power price upsurges, the company maintained impressive growth in adjusted EBITDA and Adjusted Funds From Operations (AFFO) per share, outpacing initial projections.

Equinix's resilience, coupled with an acceleration in digital transformation commitments from its clientele, has fortified the company's fiscal health and market confidence, evidenced by the increase in its quarterly cash dividend by 25% to $4.26 per sharea reward to shareholders reflective of Equinix's consistently strong performance metrics and optimism for continued value creation.

Operational investments, including the construction of multiple new projects across the globe, reinforce Equinix's strategic endeavor to boost capacity in the face of mounting interconnection service demands, a testament to the company's intent to remain at the forefront of digital services and infrastructure expansion.

Equinix, Inc. has also made considerable strides in environmental stewardship. It has allocated $4.9 billion in green bond proceeds toward sustainable projects, furthering the company's environmental initiatives and progressing toward its goal of climate neutrality by 2030. The significant investment in renewable energy capacity and energy efficiency projects underlines Equinix's role as an industry environmental leader, continuously seeking to reduce its carbon footprint.

The green bond allocation is put into perspective with impactful projects like the Co-Innovation Facility in Ashburn, VA, aimed at exploring innovative cooling technologies, and the MU4 IBX data center in Germany, which is a paradigm of design efficiency. Equinix's investment is a tangible embodiment of the company's commitment to sustainable energy use and reduction of greenhouse gas emissions.

Equinix demonstrates transparency by publishing annual Green Bond Allocation and Impact Reports. These spotlight the progress in renewable energy procurement and operational efficiency, revealing a marked reduction in Scope 1 and Scope 2 carbon footprintthe fruits of a concerted, company-wide effort to embrace renewable energy sources.

Simultaneous with these environmental strides, insider trading at Equinix has captured investor attention. Director Gary Hromadko's sale of company stock indicates the complexities of interpreting insider behavior. While insider sales might raise questions among investors about internal expectations, Equinix's expansive service offering and robust financial standing suggest that the company's strategic and operational performance should be weighed more heavily when considering the overall outlook for Equinix.

The valuation of Equinix's stock suggests that the market may view the company as fairly valued at present. Gary Hromadko's transaction took place with the company's stock trading at a significant market capitalization of approximately $75.27 billion. Despite a high price-earnings ratio, which may indicate expectations of future growth or sustained competitive advantage, the consideration of investment strategy challenges represented by a less favored VGM Score is necessary.

Given the expert analysis and the market indicators, Equinix represents a fusion of growth and income, offering a unique proposition within the technology-centric landscape of the Nasdaq. Its market positioning within critical digital infrastructure, coupled with a potential for continued dividend yields, renders Equinix a noteworthy investment opportunity for those looking to navigate the complexities of an evolving economic landscape.

Equinix continues to be well regarded by the investment community. Despite a downturn for REITs due to the macroeconomic factors such as rising interest rates in 2023, Equinix provides a reliable investment opportunity according to analysts. Its strategic placement in the digital infrastructure market and ability to deliver stable cash flows present Equinix as a standout in an industry where specialization, stability, and future growth prospects are vital factors for investment considerations.

Popular investment advisory platforms have favored Equinix's potential, especially as the digital economy continues to expand. The company's specialized real estate assets in data centers make it a unique case within REITs, offering investors an attractive balance between income through dividends and the future worth of the essential services it provides.

Equinix's value is seen both in the broader market downturn context for REITs and holistically as a "cheap" REITdefined here as a stock with attractive pricing in comparison to its inherent value and long-term earning potential in the data-centric narrative.

Scrutiny of Equinix's financial health and performance solidity, alongside industry tailwinds such as the necessity for substantial and reliable digital infrastructure, points to a steady investment paradigm overshadowing the immediate impacts of an industry beset by the rising cost of debt.

In addition, Equinix's engagement in persistent strategic expansion endeavors for market growth is exemplified by its advances in regions such as India and Southeast Asia, adopting strategic moves such as investing in undersea cable systems, which indicates the potential for sustainable long-term growth and value appreciation.

Lastly, investment opportunities within the REIT sector, as illustrated by the market reaction to Realty Income Corporation's move into data centers, highlight the strategic options for expansion and diversification within the industry. However, concerns such as the low spread in the capitalization rate and potential 'diworsification' indicate the risks of diverging from a proven investment philosophy that focuses on specialty and competitive advantage within the sector.

Equinix's industry leadership, sizable market footprint, and a distinguished list of clientele, including extensive hosting of tech giants, have immensely contributed to its financial stability. The company's conversion to a REIT model in 2015 served as a pivotal shift, instigating a sustained growth in dividend payoutsa clear reflection of the balance Equinix has achieved between returning value to shareholders and reinvesting in growth.

Equinix's financial progress following its REIT transition, including the impressive dividend increment trajectory, emphasizes the company's strategic finesse and a deep-seated understanding of the evolving digital landscape. This understanding is substantiated by their direct participation in the global digital transformation, enabling Equinix to meet the increasing demands for data bandwidth and storage, and positioning the company as an irreplaceable component of the digital ecosystem.

Investors particularly appreciate Equinix for its higher dividend yields relative to benchmarks such as the Invesco QQQ ETF, while the company maintains an efficient governance structure adeptly navigating capital towards operations expansion and dividend maturity. This nuanced blend of income and growth investment, possible due to Equinix's intrinsic alignment with tech industry leaders' demands, suggests that the company is primed for continued success in the dynamic digital industry.

Equinix's ability to respond to industry trends while providing investors with a stable source of income through dividends places the company in a favorable position. As investors seek exposure to resilient dividend stocks with upside potential from growth driven by AI advancements, Equinix remains a strong candidate due to its scalability, market reach, and strategic growth initiatives.

Reflecting on its financial fundamentals, Equinix presents as a growth-centric dividend stock in the unique sphere of data centers and digital infrastructure. Equinix's aggressive dividend policy, strengthened by significant increases over specific years, indicates a prosperous future, buoyed by healthy cash flows and growth in the digitalization segment.

As a REIT with a specialized focus on data centers, Equinix stands as a testament to the successful fusion of growth potential and income generation. Efforts to harness the growth propelled by digital transformation trends and AI advancements bolster Equinix's expansion aspirations, drawing attention to the potential for capital appreciation that complements the income from dividends.

Bringing to light the recognition by market analysts and the investment potential that Equinix carries, it is clear that it remains not only a leader in the REIT landscape but also a prime example of a company leveraging the vast opportunities presented by the digital economya sector with persistent demand that ensures both stability and growth for savvy investors.

Similar Companies in REIT - Office:

Report: Digital Realty Trust, Inc. (DLR), Digital Realty Trust, Inc. (DLR), CyrusOne Inc. (CONE), CoreSite Realty Corporation (COR), QTS Realty Trust, Inc. (QTS), Switch, Inc. (SWCH), Report: Iron Mountain Incorporated (IRM), Iron Mountain Incorporated (IRM), Report: American Tower Corporation (AMT), American Tower Corporation (AMT), Report: Crown Castle International Corp. (CCI), Crown Castle International Corp. (CCI), SBA Communications Corporation (SBAC)

News Links:

https://finance.yahoo.com/news/equinix-accelerate-simplify-liquid-cooling-130000541.html

https://finance.yahoo.com/news/centers-corp-sitc-11-9-163026206.html

https://finance.yahoo.com/news/equinix-fully-allocates-4-9-130100417.html

https://finance.yahoo.com/news/insider-sell-director-gary-hromadko-020514855.html

https://www.fool.com/investing/2023/12/21/2-ai-powered-dividend-stocks-to-buy-for-income-and/

https://www.fool.com/investing/2023/10/13/beat-the-nasdaq-this-dividend-stock-has-actually-d/

https://www.fool.com/investing/2023/10/10/2-cheap-reits-to-buy-1-cheap-reit-to-sell/

https://seekingalpha.com/article/4653756-realty-income-is-going-down-a-concerning-path

https://www.fool.com/investing/2023/11/18/beat-the-nasdaq-this-dividend-stock-has-actually-d/

https://www.fool.com/investing/2023/11/23/4-dividend-stocks-im-most-thankful-i-owned-this-ye/

https://finance.yahoo.com/news/macerich-mac-15-8-since-163100894.html

https://www.fool.com/investing/2023/10/21/3-things-about-applied-digital-that-smart-investor/

https://www.fool.com/investing/2023/11/20/you-dont-have-to-pick-a-winner-in-reits-heres-why/

https://finance.yahoo.com/m/99111538-b111-3886-902d-73f0e0ffe653/2-ai-powered-dividend-stocks.html

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: XMbhb3

https://reports.tinycomputers.io/EQIX/EQIX-2023-12-24.html Home