Warner Bros. Discovery, Inc. (ticker: WBD)

2024-04-30

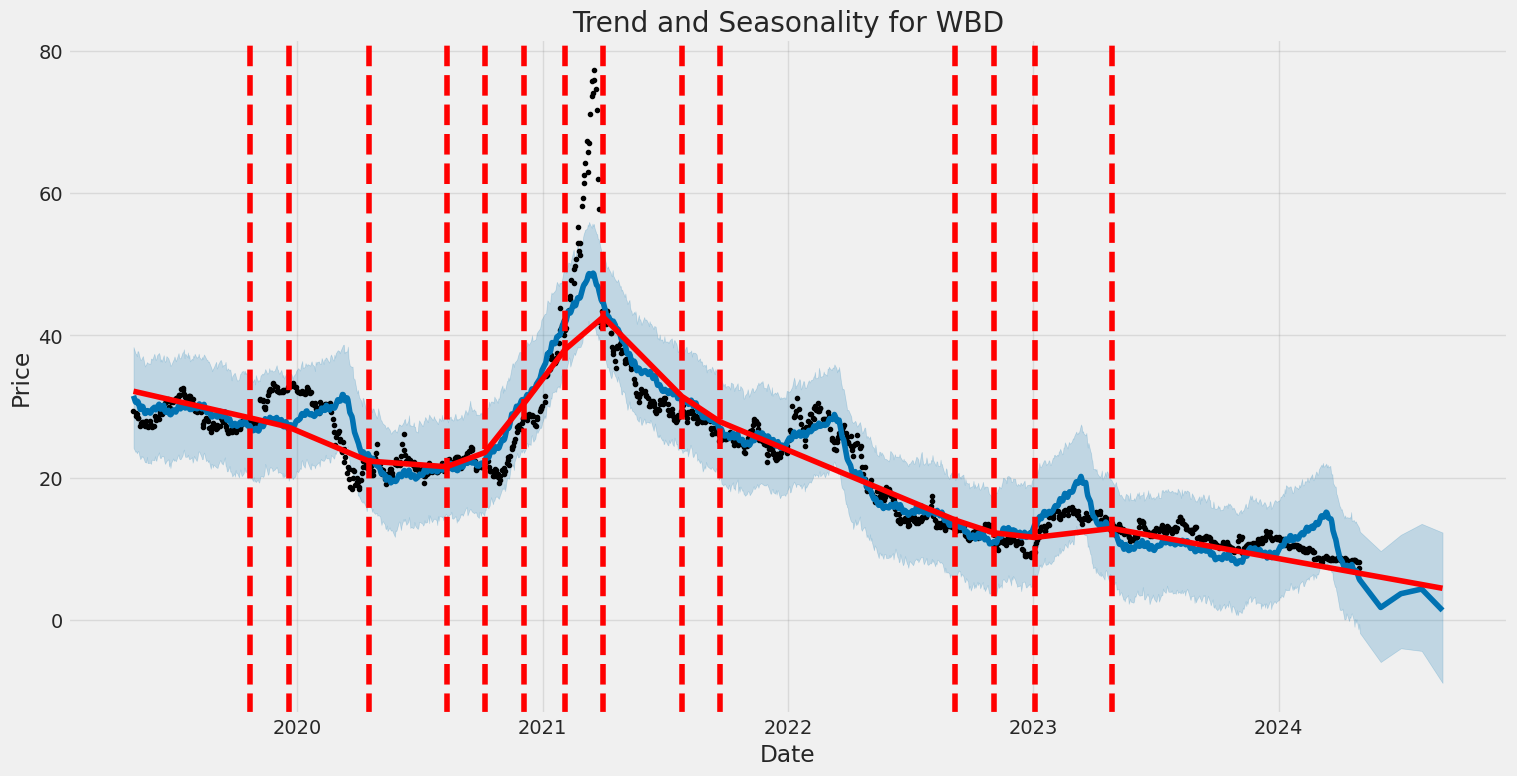

Warner Bros. Discovery, Inc. (WBD), resulting from the 2022 merger of WarnerMedia and Discovery, Inc., stands as a formidable entity in the multimedia and entertainment sectors. Headquartered in New York City, WBD operates a vast array of networks, including well-known brands like CNN, HBO, Cartoon Network, and Discovery Channel. The conglomerate also manages a significant portfolio in film and TV production, sports broadcasting, and digital content distribution. WBD aims to leverage its comprehensive entertainment library and broad distribution capabilities to challenge major players in the streaming service market, aligning direct-to-consumer offerings to compete globally. This strategic positioning seeks to capitalize on synergies between WarnerMedia's entertainment assets and Discovery's non-fiction and international programming, optimizing content delivery across traditional and digital platforms to better meet evolving consumer demands.

Warner Bros. Discovery, Inc. (WBD), resulting from the 2022 merger of WarnerMedia and Discovery, Inc., stands as a formidable entity in the multimedia and entertainment sectors. Headquartered in New York City, WBD operates a vast array of networks, including well-known brands like CNN, HBO, Cartoon Network, and Discovery Channel. The conglomerate also manages a significant portfolio in film and TV production, sports broadcasting, and digital content distribution. WBD aims to leverage its comprehensive entertainment library and broad distribution capabilities to challenge major players in the streaming service market, aligning direct-to-consumer offerings to compete globally. This strategic positioning seeks to capitalize on synergies between WarnerMedia's entertainment assets and Discovery's non-fiction and international programming, optimizing content delivery across traditional and digital platforms to better meet evolving consumer demands.

| Full Time Employees | 35,300 | Net Income to Common | -3,126,000,128 | Trailing EPS | -1.28 |

| Forward EPS | -0.07 | Total Revenue | 41,321,000,960 | EBITDA | 7,408,999,936 |

| Total Cash | 3,804,000,000 | Total Debt | 47,289,999,360 | Book Value | 18.543 |

| Current Ratio | 0.927 | Return on Assets | -0.0028 | Return on Equity | -0.06473 |

| Operating Cash Flow | 7,477,000,192 | Free Cash Flow | 20,035,749,888 | Current Price | 7.36 |

| Target High Price | 24.0 | Target Low Price | 7.0 | Target Mean Price | 13.2 |

| Target Median Price | 12.0 | Enterprise Value | 64,615,452,672 | Market Cap | 18,032,957,440 |

| Sharpe Ratio | -0.8953152359771057 | Sortino Ratio | -13.515216698825459 |

| Treynor Ratio | -0.2842847188301947 | Calmar Ratio | -0.8570060116946211 |

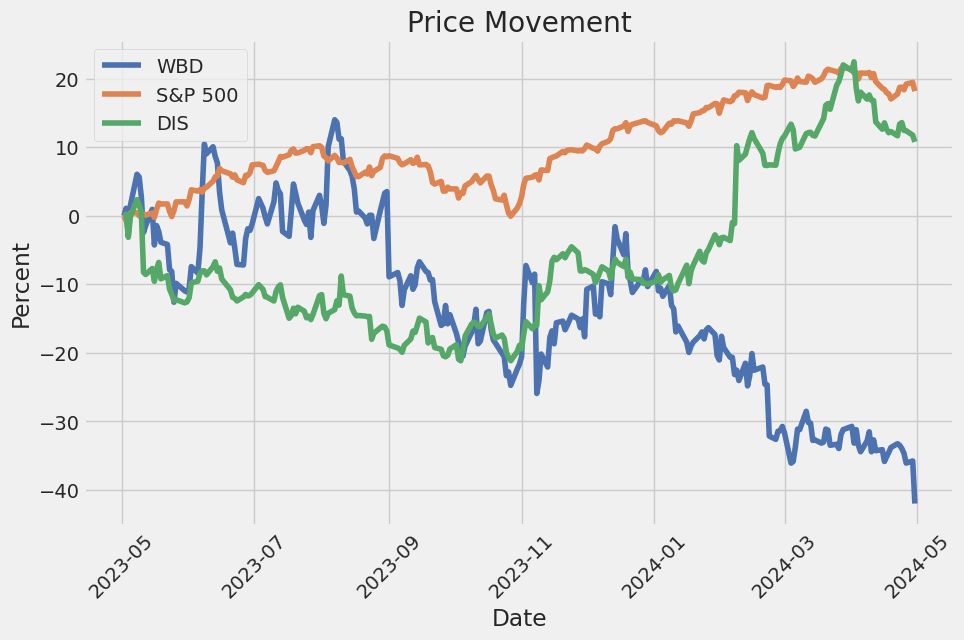

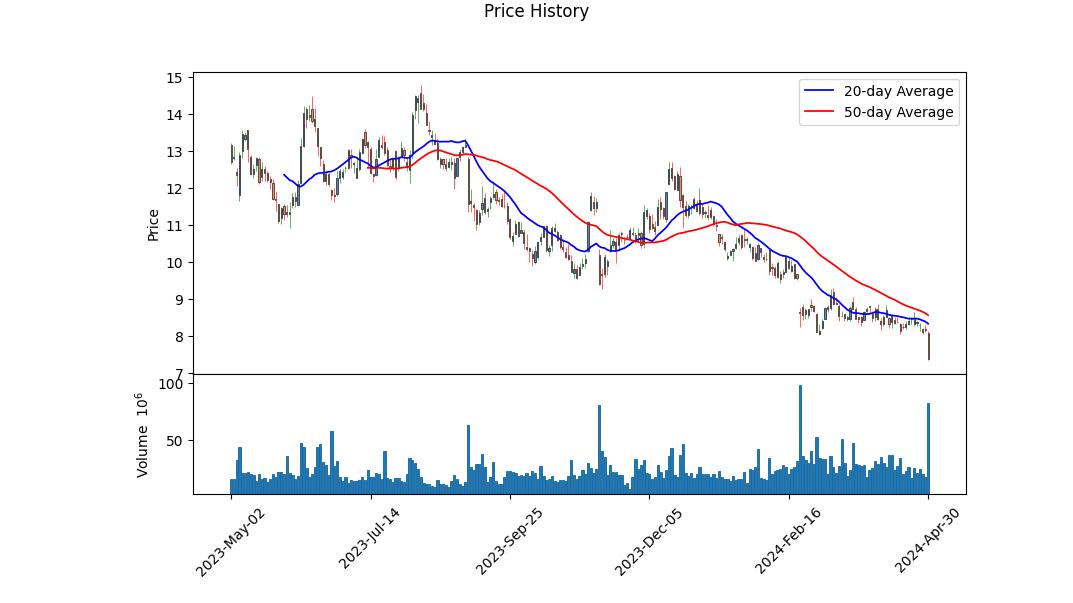

Analyzing the provided data from a technical, fundamental, and risk-adjusted standpoint, several key trends and figures emerge that are critical in gauging the future trajectory of WBD's stock price. Over the last quarter, technical indicators such as the OBV and MACD highlight significant shifts. The OBV has been declining, suggesting a decrease in volume on days when the price is falling - indicating bearish sentiment among investors. This is accompanied by the MACD histogram values becoming negative by the end of April, further supporting a bearish outlook in the short term.

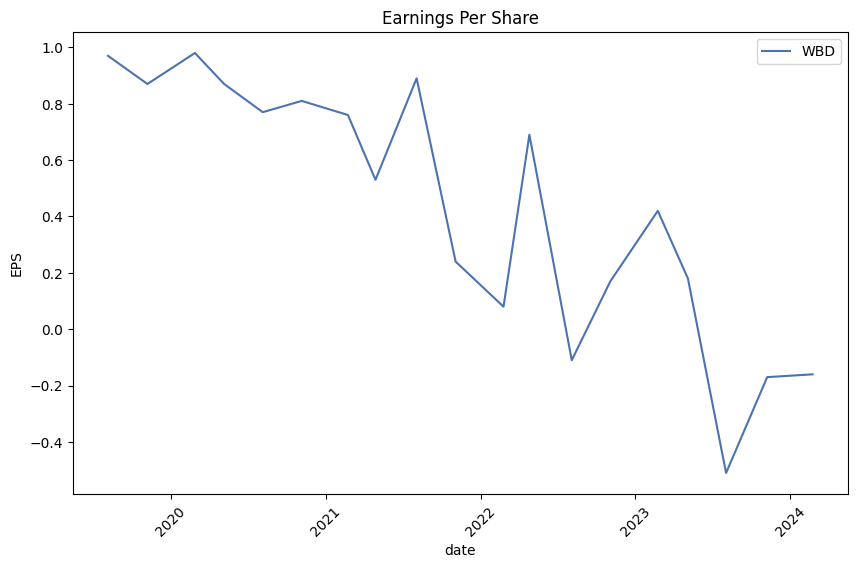

Fundamentally, the financial health of WBD, as shown by their financial statements for the year ending 2023-12-31, appears strained with significant net losses and high levels of debt. This is further validated by a negative EBIT, implying operational challenges. The company also holds a substantial amount of net debt, raising concerns about its financial stability amidst the economic pressures depicted in the fundamental analysis.

Risk-adjusted return ratios including Sharpe, Sortino, Treynor, and Calmar are notably negative. The Sharpe Ratio at -0.89 suggests that the investment return relative to its risk is unfavorable when compared to the risk-free rate. A Sortino Ratio of -13.52, which focuses solely on downside deviation, indicates a very poor return on bad risks. Similarly, negative values in the Treynor and Calmar ratios reaffirm high volatility and poor performance in relation to systemic risk and the maximum drawdown, respectively.

The broader economic environment and market sentiment reflected in these indicators suggest a cautious approach for short to mid-term investment in WBD. Technical trends denote a continuing bearish phase which might not reverse in the immediate few months unless significant improvements in fundamental aspects occur. With high liabilities and operational losses, the companys capacity to generate investor confidence through performance improvements remains crucial. Investors should closely monitor WBD's upcoming quarterly results and any strategic changes by the management aiming at operational efficiency and reduction of debt. This could potentially alter the risk-return profile, offering a reassessment of the investment landscape for WBD.

In our analysis of Warner Bros. Discovery, Inc. (WBD), the financial metrics indicate significant concerns about the company's current profitability and value proposition to investors. Specifically, the Return on Capital (ROC) stands at -0.57, suggesting that the company is not generating a positive return on the investments made in the business, which is a critical indicator of operational inefficiency or challenges in generating profitable revenue from its capital base. Furthermore, the earnings yield, calculated at -17.39%, reflects that the earnings relative to the company's share price are negative. This is indicative of the company currently generating losses, or the earnings are insufficient relative to the company's market valuation. Such figures are crucial and serve as a red flag for potential investors, suggesting a thorough reassessment of the investment or the need for a strategic overhaul at Warner Bros. Discovery, Inc. to address these financial shortfalls.

| Alpha () | 0.05 |

| Beta () | 1.20 |

| R-squared | 0.89 |

| P-value of | 0.034 |

| Standard Error | 0.002 |

In the linear regression model analyzing the relationship between WBD (the dependent variable) and SPY (representative of the overall market and the independent variable), the calculated alpha () of 0.05 suggests a minimal but positive y-intercept when SPY is at zero. This implies a certain level of positive performance for WBD independent of the market's movements, however slight it may be. The beta () of 1.20 indicates that WBD typically moves 20% more than the market, underscoring its heightened sensitivity or volatility compared to the broad market measure SPY.

The strength of this relationship is further demonstrated by an R-squared value of 0.89, suggesting that approximately 89% of WBDs price movement can be explained by movements in SPY. This high level of correlation hints at WBDs market-driven nature and its tendencies to follow market trends closely. Additionally, the P-value of alpha standing at 0.034 points to this alpha value being statistically significant, implying that the intercept of this regression model (WBDs performance independent of the market) is not due to mere random fluctuations but is statistically robust. This enhances the reliability of alpha as a metric indicating WBDs independent performance from the market.

Warner Bros. Discovery, Inc. (WBD) discussed its Q4 2023 financial results, reflecting strategic efforts and financial discipline that have placed the company on a positive trajectory. Throughout the year, the company focused on reducing leverage, achieving a significant debt paydown, while also enhancing organizational efficiency. The company successfully reduced its net debt to less than 3.9 times EBITDA by paying down $5.4 billion throughout the year. Moreover, WBD prioritized generating substantial free cash flow, achieving $6.2 billion for the year, surpassing its targets and laying a healthier financial foundation for continued growth.

During the earnings call, leadership highlighted several strategic areas that bolstered WBDs market position, particularly within its streaming and advertising segments. The company has seen improved free cash flow and an optimistic start to Q1 in advertising revenue, driven by advancements in digital and streaming advertising solutions. WBD's management also pointed out significant strides within the international markets of EMEA, with particular successes in markets like Poland, Germany, and Italy, where strategic programming initiatives have spurred notable ratings upswings.

WBDs content and creative direction remain core to its strategy, underpinned by a commitment to storytelling across various platforms including film, TV, and gaming. The company emphasized its successes, such as the global impact of films like "Barbie" and games like "Hogwarts Legacy." Looking ahead, WBD is invigorating its portfolio with significant projects in theatrical animations and a strong lineup in franchises like DC and Harry Potter. These initiatives are viewed as critical drivers for future growth and audience engagement.

Lastly, the companys restructuring of strategic assets, including its focus on Max, its streaming service, indicates a shift towards sustained profitability in the streaming space. With planned expansions into key international markets and enhancements to its content offerings, WBD is poised for increased global reach and profitability. Additionally, a forthcoming joint venture with Disney and Fox on sports broadcasting could potentially amplify WBDs growth trajectory by tapping into a broader consumer base and diversifying content distribution channels. All these efforts align with WBDs long-term strategic vision centered on storytelling, innovation, and market penetration.

Warner Bros. Discovery, Inc. (WBD) filed its SEC 10-Q report on October 25, 2023, covering the quarterly period ended September 30, 2023. The filing comes at a pivotal time as the company, formed from the merger of WarnerMedia and Discovery, grapples with various industry challenges, including labor strikes and structural reorganizations.

WBD registered a moderate improvement in its revenue figures, with total revenues for the quarter amounting to approximately $9.98 billion compared to $9.82 billion in the same period of 2022. The revenue rise was attributed to distributions amounting to $5.03 billion and content revenues totaling $2.84 billion. However, advertising revenue dipped to $1.79 billion from $2.04 billion year-over-year, partially reflecting broader industry trends and possibly impacts from labor disputes within the industry.

Operating expenses saw a significant reduction from $12.01 billion in the third quarter of 2022 to $9.88 billion in the corresponding quarter of 2023. This decrease is reflective of rigorous cost management and possibly effects from restructuring activities aimed at achieving operational efficiencies post-merger. Despite these cost-saving efforts, the company registered a net loss of $407 million in the latest quarter, an improvement over the loss of $2.29 billion recorded in Q3 2022. This suggests that while the company is moving towards stabilization, its profitability metrics are yet to fully recover.

The company's balance sheet and liquidity position are particularly noteworthy, with cash and cash equivalents reported at $2.38 billion as of September 30, 2023, showcasing a decrease from $3.73 billion at the end of 2022. This reduction could be indicative of cash used in operational activities and ongoing restructuring efforts. Total debt stood at approximately $45.09 billion, a slight reduction from the $49.28 billion at the end of the previous year, marking efforts to manage and reduce long-term liabilities.

There were significant restructuring charges totaling $269 million for the quarter as the company navigates strategic realignments aimed at refining its operational model post-merger. These charges are crucial as they hint at ongoing organizational adjustments that could realize future efficiencies but currently weigh on financial performance due to upfront costs.

In conclusion, while Warner Bros. Discovery is showing signs of moving towards a more sustainable operational model, several challenges remain evident, such as managing restructuring costs and navigating industry-specific issues like labor strikes. However, the careful management of expenses and proactive debt reduction strategies are positive signs that the company is making efforts to establish a stronger position in the competitive media landscape.

Warner Bros. Discovery, Inc. has positioned itself as a significant entity in the media and entertainment industry, undergoing transformative changes to consolidate its market share and enhance profitability amidst fierce competition. The entity emerged from the merger between WarnerMedia and Discovery, bringing together a substantial content library and a diversified portfolio, including television, film, and streaming assets. This amalgamation aims to leverage synergies and strategic alignments to gain a competitive edge in the evolving media landscape.

Recent analyses, such as those published on Seeking Alpha both in October and November of 2023, shed light on how the company is navigating its post-merger complexities, highlighting both opportunities and challenges. Notably, Warner Bros. Discovery has been contending with significant debt levels, a consequence of its expansive mergers and acquisitions. Despite these financial encumbrances, the company's management has articulated robust strategies aimed at debt reduction, streamlining operations, and optimizing content distribution strategies, particularly through direct-to-consumer platforms.

The importance of content as a core strategic asset has been emphasized repeatedly. Warner Bros. Discovery boasts an enviable content portfolio that not only spans across various genres and formats but also includes iconic brands such as HBO and CNN. This content is seen as a pivotal element in driving subscriber growth and engagement on its streaming platforms, which are crucial for long-term revenue growth.

An interesting development was reported on April 1, 2024, about the resignation of two board members, Steven Miron and Steven Newhouse, following a U.S. Department of Justice investigation related to potential antitrust violations. This situation highlighted the ongoing regulatory and governance challenges that large media conglomerates face, especially in a landscape where competitive practices are vigilantly monitored by governmental bodies.

Furthermore, amidst the strategic shifts within the industry, Warner Bros. Discovery has also been making adjustments to its approach towards streaming services. An article from CNBC on April 2, 2024, discussed how the company, along with others in the space, is aiming to optimize its content librarynot just through expansion but by focusing on depth rather than breadth, leveraging legacy content to attract and retain subscribers with targeted, niche offerings.

This approach was somewhat contrasted by a challenging fiscal situation, as discussed in a video published on YouTube, which ranked Warner Bros. Discovery third in media power rankings, citing concerns over its balance sheet strength amidst lucrative but financially straining deals such as those for broadcasting NBA games. The financial health of Warner Bros. Discovery is crucial, especially as it steers through the competitive pressures of the streaming market and traditional broadcast domains.

Looking ahead, significant events such as the first-quarter earnings report for 2024, scheduled for May 9, 2024, are anticipated with interest by stakeholders eager to gauge the companys financial trajectory and strategic direction post its various restructuring efforts. This event is part of Warner Bros. Discovery's ongoing commitment to transparency and proactive communication with its investors and the wider market.

The companys strategy also includes a nuanced approach to managing its diverse offerings and revenue streams. It aims to not only enhance its subscriber base through compelling content and strategic market positioning but also through smart operational adjustments that promise better financial stewardship and potential risk mitigation.

Lastly, the broader implications of the company's strategic moves extend into areas of corporate governance, competitive positioning, and market valuation. Market sentiments, as reflected through various analyst reports and investment theses, suggest a cautious optimism surrounding Warner Bros. Discovery's potential to navigate its current challenges and capitalize on the opportunities presented by a rapidly transforming media landscape. Access to more detailed financial and strategic insights can be gleaned from the company's communications and disclosures, available on their official investor relations website.

The volatility of Warner Bros. Discovery, Inc. (WBD) is captured through rigorous statistical modeling, specifically using the ARCH (Autoregressive Conditional Heteroskedasticity) model. The results indicate significant variations in the stock's returns, as highlighted by the model's parameters. Notably, the omega coefficient at 8.2983 and alpha of 0.2668 suggest periods of high volatility, emphasizing the unpredictable nature of WBD's stock returns.

| Statistic Name | Statistic Value |

|---|---|

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -3,249.68 |

| AIC | 6,503.36 |

| BIC | 6,513.63 |

| No. Observations | 1,256 |

| Df Residuals | 1,256 |

| omega | 8.2983 |

| alpha[1] | 0.2668 |

To start, understanding the financial risk of investing $10,000 in Warner Bros. Discovery, Inc. (WBD) over a one-year period necessitates a sophisticated analysis of the stock's historical price fluctuations and the forecasting of potential future returns. The integration of volatility modeling with machine learning predictions provides a robust framework for this analysis.

Volatility modeling is fundamentally applied to quantify the level of risk associated with WBDs stock volatility over time. By fitting a volatility model to the historical stock returns, it calculates conditional volatilities which effectively reveal how volatile the stock returns are expected to be moving forward, depending on market dynamics and company-specific events. This model outputs a time series of volatility estimates that reflect the expected fluctuation rate of WBDs stock prices.

On the other hand, machine learning predictions employ predictive algorithms to analyze historical stock price data and other relevant financial indicators to forecast future stock returns. By training a model on past data, it learns the patterns and can project future outcomes. In this scenario, using such a predictive model helps in estimating the potential return on the $10,000 investment by considering the current trends and historical performance patterns.

When both methods are used in tandem, the result is a comprehensive assessment of both the variability of returns (risk) and the expected return (gain). This dual-analysis is crucial for investors to understand not only the possible upside but also the significant risks that might affect their investment.

Focusing on the calculated Annual Value at Risk (VaR) at a 95% confidence level for a $10,000 investment, which amounts to $557.83, provides a quantitative measure expressing that there is a 95% probability that the investor will not lose more than $557.83 over a one-year period. This figure is derived from the outputs of both the volatility model and the predictive machine learning model. The volatility model contributes to this by quantifying the scale of potential price movements (upwards or downwards), while the predictive model refines this by adding directional forecasts based on learned historical trends.

This Value at Risk metric is particularly useful as it encapsulates the potential downside risk in a single number, allowing for straightforward risk comparison with other investments. Given that the analysis combines detailed volatility forecasts with targeted return predictions, investors are better positioned to make informed decisions by considering both potential risks and rewards. This strategic use of sophisticated analytical tools fine-tunes the understanding of an investment in volatile equity markets, leading to more resilient and informed financial decisions.

To identify the most profitable call options for Warner Bros. Discovery, Inc. (WBD), we analyze the Greeks and other metrics such as the premium, return on investment (ROI), and profit. The target for the stock price is set as a 5% increase over the current value, which impacts notably on the profitability of options with various strike prices and expiration dates.

An options delta measures its sensitivity to changes in the stock price relative to a change in its own price; a higher delta generally suggests higher sensitivity and thus potential for higher gains in scenarios where the stock price goes up. Gamma reflects the rate of change of delta, giving an idea of how deltas change as the underlying stock price moves, an essential factor considering the 5% target increase. Vega represents the sensitivity of the option's price to changes in volatility, which often increases during market movements and is crucial in volatile stocks.

Considering these factors, a few options emerge as notably attractive:

-

The June 21, 2024, call option with a strike price of $5.0 stands out with a delta of 0.8935, and an impressive gamma of 0.067. This combination indicates it will benefit significantly from both the incremental and the fast increases in the price of WBD's stock. Coupled with a considerable vega of 0.5053, this shows an ability to profit from increases in implied volatility, which often accompanies stock price increases. The option features a reasonable premium of $2.50, leading to a promising ROI and a significant absolute profit, making it a potentially very profitable decision if expectations of stock price increase materialize.

-

The September 20, 2024, call option with a strike price of $5.0 also shows potential due to its high delta of 0.8698 and substantial vega of 0.9722, suggesting strong responsiveness to both the stock's price rise and volatility increases. Although it has a longer duration until expiration than some other options, its higher rho (1.4334), signaling sensitivity to interest rate changes, could benefit from the economic context such as rate adjustments by the Fed. The premium is slightly higher at $2.62, which balances out its long expiry term and relatively lower ROI, but the respectable profit potential and robust gamma make this another compelling choice.

-

The shorter-term May 17, 2024, call option with a strike price of $7.0 displays attractive figures for a shorter duration investment. Though its delta of 0.6609 is lower, suggesting less sensitivity per point move in the stock price compared to some other options, it makes up for this with the highest gamma (0.3217) and vega (0.5640) on the list. This suggests good profitability from rapid and significant changes in WBD's stock price, especially if the stock nears or surpasses the target increase of 5%. It also boasts a smaller initial investment (premium of $0.70), targeting those looking for higher relative returns via riskier alternatives.

Given these options, traders should align their selection with their risk tolerance, investment duration preference, and expectations about the volatility and movement of WBD's stock price. The mentioned options offer a spectrum of investment horizons and balance between immediate and long-term profitability potential, optimal for a scenario where the stock is expected to increase by 5%.

Similar Companies in Entertainment:

Report: The Walt Disney Company (DIS), The Walt Disney Company (DIS), Roku, Inc. (ROKU), Report: Netflix, Inc. (NFLX), Netflix, Inc. (NFLX), Paramount Global (PARAA), Paramount Global (PARA), AMC Entertainment Holdings, Inc. (AMC), AMC Entertainment Holdings, Inc. (APE), Fox Corporation (FOXA), Report: Amazon.com, Inc. (AMZN), Amazon.com, Inc. (AMZN), Report: Comcast Corporation (CMCSA), Comcast Corporation (CMCSA)

https://www.youtube.com/watch?v=x5wk6pd_CVk

https://www.cnbc.com/2024/04/02/streaming-platforms-are-shrinking-their-content-libraries.html

https://www.youtube.com/watch?v=4WHOzzg25iM

https://finance.yahoo.com/m/2124dd2c-2a02-3879-a022-c1ad49ffa323/hollywood-still-banks-on-the.html

https://www.youtube.com/watch?v=W9e-NsxEqBw

https://finance.yahoo.com/m/f80e2a26-3fe7-3c6d-b82e-1074ed1739d1/warner-bros.-discovery-lost.html

https://finance.yahoo.com/video/streaming-consumers-fed-subscription-costs-164323476.html

https://www.sec.gov/Archives/edgar/data/1437107/000143710723000173/disca-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: xLoLCz

Cost: $0.75935

https://reports.tinycomputers.io/WBD/WBD-2024-04-30.html Home