AGCO Corporation (ticker: AGCO)

2024-02-06

AGCO Corporation, trading under the ticker AGCO, stands as a formidable entity in the agricultural sector, supplying a comprehensive range of equipment and related services. With a global footprint, AGCO caters to the varied needs of the modern farmer, emphasizing innovation and efficiency. The company's portfolio spans high-performance tractors, combines, hay tools, sprayers, forage, and tillage equipment under renowned brands such as Massey Ferguson, Challenger, Fendt, and Valtra. Established to enhance agricultural productivity, AGCO has consistently invested in technology and acquisitions to expand its market reach and product offerings. Its commitment to sustainability and precision agriculture has allowed it to adapt to changing industry demands, solidifying its position as a key player in the global agricultural machinery market. Financial performance reports indicate a stable growth trajectory, attributable to its strategic initiatives and a strong global dealer network, which ensure AGCO remains at the forefront of addressing the challenges and opportunities within the agricultural sector.

AGCO Corporation, trading under the ticker AGCO, stands as a formidable entity in the agricultural sector, supplying a comprehensive range of equipment and related services. With a global footprint, AGCO caters to the varied needs of the modern farmer, emphasizing innovation and efficiency. The company's portfolio spans high-performance tractors, combines, hay tools, sprayers, forage, and tillage equipment under renowned brands such as Massey Ferguson, Challenger, Fendt, and Valtra. Established to enhance agricultural productivity, AGCO has consistently invested in technology and acquisitions to expand its market reach and product offerings. Its commitment to sustainability and precision agriculture has allowed it to adapt to changing industry demands, solidifying its position as a key player in the global agricultural machinery market. Financial performance reports indicate a stable growth trajectory, attributable to its strategic initiatives and a strong global dealer network, which ensure AGCO remains at the forefront of addressing the challenges and opportunities within the agricultural sector.

| Full Time Employees | 25,600 | Previous Close | 120.93 | Day Low | 121.565 |

| Day High | 130.255 | Dividend Rate | 1.16 | Dividend Yield | 0.0096 |

| Payout Ratio | 0.0689 | Beta | 1.354 | Trailing PE | 7.94 |

| Forward PE | 9.46 | Volume | 1,301,937 | Average Volume | 655,542 |

| Average Volume 10 days | 572,060 | Market Cap | 9,146,579,968 | Fifty Two Week Low | 109.81 |

| Fifty Two Week High | 145.53 | Price to Sales Trailing 12 Months | 0.6303 | Enterprise Value | 10,577,031,168 |

| Profit Margins | 0.0796 | Shares Outstanding | 74,879,904 | Book Value | 58.167 |

| Price to Book | 2.1 | Earnings Quarterly Growth | 0.179 | Net Income to Common | 1,154,599,936 |

| Trailing EPS | 15.39 | Forward EPS | 12.91 | Total Cash | 680,700,032 |

| Total Debt | 2,202,400,000 | Total Revenue | 14,510,600,192 | Revenue Per Share | 193.927 |

| Return on Assets | 0.10469 | Return on Equity | 0.29316 | Free Cash flow | 780,275,008 |

| Operating Cash flow | 1,336,000,000 | Earnings Growth | 0.176 | Revenue Growth | 0.107 |

| Gross Margins | 0.25741 | EBITDA Margins | 0.14143 | Operating Margins | 0.12198 |

| Sharpe Ratio | -0.1476771979348641 | Sortino Ratio | -2.2516089236976495 |

| Treynor Ratio | -0.03525108539419451 | Calmar Ratio | -0.22013615341180895 |

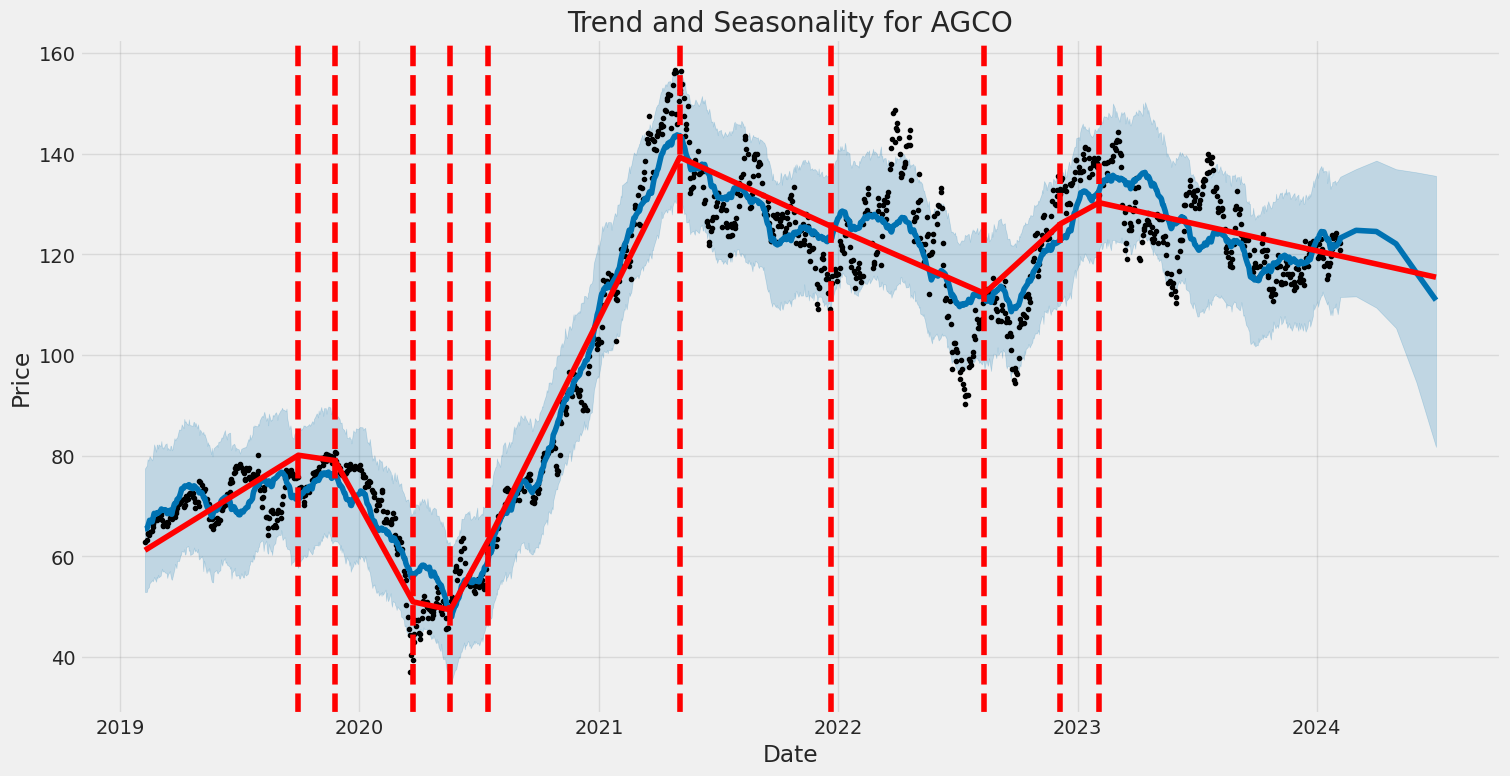

AGCO's stock performance in the future can be interpreted through a comprehensive analysis of the current technical indicators, fundamental performance, and balance sheet data. This analysis is underpinned by a combination of recent trends in key technical indicators, the company's financial health as inferred from its latest financial statements, and broader market conditions.

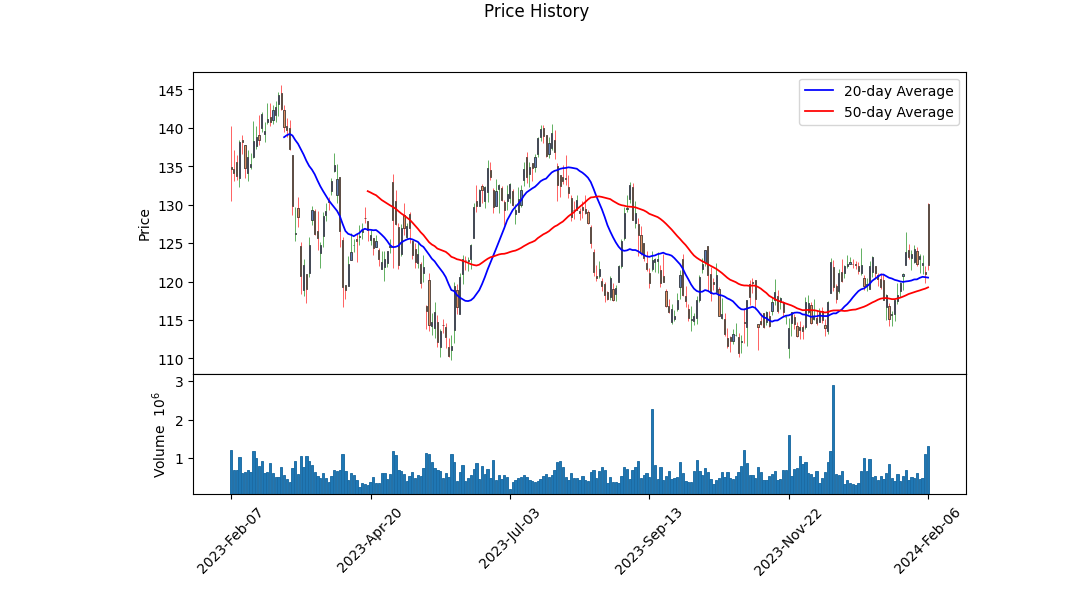

Starting with technical analysis, the Price Action over the observed period reveals a volatile journey with the share price witnessing fluctuations yet ending at a higher note. The absence of data for the MACD Histogram for a large portion of the initial period under review makes it difficult to draw a complete picture of the momentum early on. However, as data becomes available, a positive MACD Histogram in the most recent days suggests that the stock might be experiencing a bullish momentum. This bullish sentiment is further substantiated by a notable increase in price and a slight uptick in the OBV (On-Balance Volume), albeit with a dip just before the last date recorded, indicating a growing interest and potentially higher trading volumes.

Fundamentally, AGCO demonstrates a solid financial footing, with key indicators like gross margins, EBITDA margins, and operating margins showing healthy profitability ratios. The company's balance sheet is robust, highlighted by a reasonable level of net debt and a tangible book value that underscores a strong asset base. Financials over the past few years show a company that has been managing its revenues, expenses, and net income efficiently, aiming for sustainable growth. The cash flow statements reflect prudent capital management and operational efficiency.

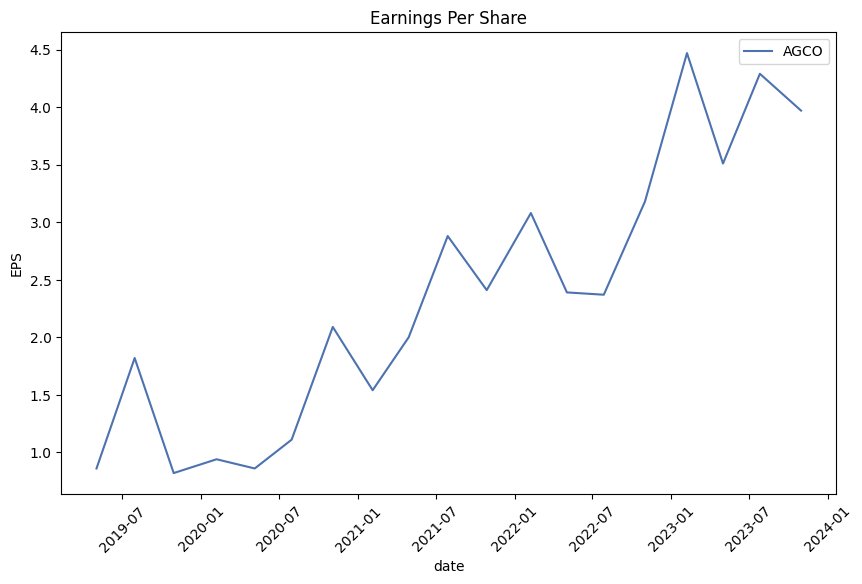

However, the negative values across Sharpe, Sortino, Treynor, and Calmar ratios highlight an investment that, over the past year, has faced difficulties in generating risk-adjusted returns that outpace the risk-free rate, largely due to market volatility and the specific challenges faced by the sector. This is compounded by analyst expectations of a downturn in sales growth and a significant EPS dip next year, despite a robust performance in recent quarters.

Looking ahead, while the technical indicators suggest a short-term bullish trend, the negative risk-adjusted return ratios cannot be overlooked. Also, the market sentiment as inferred from analyst growth estimates and revisions indicates an expectation of contracting revenues and pressures on profitability in the near term. These factors potentially signal a turbulent period ahead for AGCO's stock price.

This stock's forecast must consider a balance of its promising technical indicators against the backdrop of bearish analyst sentiment and less than favorable risk-adjusted return figures. In the coming months, while there may be opportunities for short-term gains based on technical momentum, investors should be cautious and vigilant about broader market trends and fundamental signals that suggest potential challenges. The balancing act between navigating short-term bullish signals and preparing for forecasted fundamental challenges will be paramount in defining AGCO's stock trajectory in the near term.

In our analysis of AGCO Corporation (AGCO), two key metrics were carefully calculated to evaluate its financial health and investment potential: Return on Capital (ROC) and Earnings Yield. The Return on Capital for AGCO stands at a robust 21.03%, indicating the company's effectiveness in generating profitable returns from its capital investments. This figure is particularly insightful since a high ROC suggests efficient management and a strong potential for growth and value creation. Additionally, the Earnings Yield for AGCO was determined to be 9.74%, representing the proportion of each dollar invested in the company that was earned back as profit during the period. This metric is especially useful for comparing the profitability of investments across different companies or sectors, with AGCO's relatively high earnings yield signaling a potentially attractive investment opportunity. Overall, these figures highlight AGCO Corporations solid financial performance and suggest it could be a worthwhile consideration for our investment portfolio, pending further analysis of the companys market position, stability, and future growth prospects.

Based on the comprehensive financial and performance data you provided for AGCO Corporation (AGCO) spanning several quarters and detailing an array of metricsfrom P/E ratios and debt-to-equity ratios to earnings reports and dividend historieslet's analyze how this company aligns with the principles and criteria outlined by Benjamin Graham in "The Intelligent Investor."

Margin of Safety

- Observation: Without the explicit intrinsic value calculation available, it's challenging to determine the absolute margin of safety. However, considering factors like steady dividend payouts, a diversified financial structure, and consistent performance metrics, there might be an implicit margin of safety for conservative investors.

Analyzing Financial Statements

- Earnings Growth & Consistency: AGCO demonstrates considerable consistency in its revenue and profit margins across multiple quarters, indicating a stable earnings growth trend.

- Dividend Record: The data reveals continuous dividend payments, reflecting a positive and stable dividend record that would be appreciated by conservative investors.

Debt-to-Equity Ratio

- Observation: The specific debt-to-equity ratios per quarter aren't provided, but having long-term debt figures allows us to see there's considerable reliance on debt. However, without equity figures for comparison, an accurate debt-to-equity ratio analysis isn't feasible from the provided data.

Current and Quick Ratios

- Observation: Without explicit current assets and liabilities breakdowns for calculating the current and quick ratios directly, it's tough to analyze liquidity positions directly. Yet, the substantial cash and equivalents and receivables suggest a potentially healthy liquidity status.

Earnings Growth

- Consistency: The profitability figures, such as net income and operating income, indicate growth and operational efficiency, aligning with Graham's preference for companies showing consistent earnings growth.

Price-to-Earnings (P/E) Ratio

- Observation: The P/E ratio information isn't directly provided. However, with available earnings data and knowing the stock price (not provided), one could calculate the P/E ratio to see if it aligns with Grahams criteria for value investment.

Dividend Record

- Continuous dividend payouts suggest a commitment to returning value to shareholders, reflecting positively on the companys financial health and stability.

Price-to-Book (P/B) Ratio

- Without direct book value data, it's challenging to calculate the P/B ratio. However, Graham would advise investors to look for a P/B ratio lower than 1.5 as a sign of a potentially undervalued stock, assuming the company is fundamentally strong.

Financial Analysis Conclusion

AGCO Corporation shows signs of a robust financial foundation with consistent earnings growth and a solid dividend history, which are key indicators valued by Benjamin Graham. However, to fully evaluate AGCO against Graham's principles, additional specific data would be required, such as the debt-to-equity ratio, P/E ratio, and P/B ratio calculations. Investors should also consider the company's future growth potential, management efficiency, and industry position in their comprehensive analysis.

Recommendation

For potential investors who adhere to Benjamin Graham's investment philosophy, a deeper dive into AGCO's books and further analysis on missing financial ratios would be essential. Given the stability shown in the data provided, AGCO could be a candidate for value investment, but this should be confirmed with increased due diligence and a closer examination of the missing financial metrics.

| Statistic Name | Statistic Value |

| R-squared | 0.362 |

| Adj. R-squared | 0.361 |

| F-statistic | 710.1 |

| Prob (F-statistic) | 2.43e-124 |

| Log-Likelihood | -2639.0 |

| AIC | 5282. |

| BIC | 5292. |

| Alpha | 0.0244 |

| Beta | 1.1300 |

The linear regression analysis between AGCO and SPY reveals an intriguing relationship over the examined period, with Alpha () denoted as the intercept at 0.0244. This figure suggests that AGCO, independent of the market movement represented by SPY, has a slight positive baseline performance. The Alpha in this context reflects the expected performance of AGCO when SPY's returns are zero, providing a gauge for AGCO's performance relative to the broader market's inertia.

Moreover, the positive Alpha, albeit small, indicates that AGCO has outperformed the market's expectations, providing a modest cushion against market downturns. However, its essential to interpret this measure cautiously because Alpha alone does not capture the entire risk-return profile of a security. This analysis demonstrates the nuanced relationship between an individual security like AGCO and the broader market index SPY, highlighting the importance of understanding intrinsic stock performances alongside market movements.

AGCO Corporation reported strong financial results for the third quarter of 2023, with sales reaching $3.5 billion, an almost 11% increase compared to the same quarter in 2022. Operating margins also improved, achieving 12.3%, and 12.6% on an adjusted basis, marking a significant improvement from the previous year. This consistent performance, with operating margins exceeding 10.5% for five consecutive quarters, is a testament to AGCO's structural transformation and move towards achieving its mid-cycle 12% operating margin target. The company credits this success to its Farmer-First Strategy, which focuses on enhancing its Precision Ag business, globalizing the Fendt branded products, and expanding its parts and service business.

AGCO's strategy has delivered robust growth, particularly in North and South American markets where Fendt sales have exceeded growth targets. The company is expanding its distribution networks in these regions to provide more farmers access to its leading-edge equipment, maintaining industry-best parts fill rates. AGCO's focus on high-margin, high-growth segments, such as the Precision Ag sector, is setting the stage for another record year in sales, operating margins, earnings per share, and free cash flow. Additionally, the company's technology advancements are elevating product performance and efficiency, strengthening AGCO's position as a trusted partner for smart farming solutions. The joint venture with Trimble, announced recently, is expected to be a transformative move for AGCO, enhancing its technology offerings and market position significantly.

In terms of market conditions, AGCO observed fluctuations in demand, with a general retreat from the highs seen in earlier years. While farm income remains relatively strong, leading to sustained demand for equipment, there's a shift towards more selective investments by farmers due to factors like lower commodity prices and younger fleet ages. Retail tractor sales have seen a slight decrease in major markets, including North America and Western Europe, attributed to economic pressures, interest rates, and ongoing global challenges such as the war in Ukraine. In South America, despite an initial slowdown, there's optimism for improved retail sales, buoyed by government-subsidized loan programs in regions like Brazil. Combine industry sales have shown varied trends across regions, reflecting a complex and changing global agricultural landscape.

Looking ahead, AGCO remains positive about the agriculture sector's fundamentals supporting long-term industry demand. Significant factors include relatively supportive commodity prices, growing demand for clean energy solutions, and decreased input costs from previous peaks. With improvements in supply chain and production, AGCO aims to strategically manage inventory levels, anticipating flat production levels in the fourth quarter compared to the previous year. The company's focus on producing farmer-focused products, combined with strong order books across regions, positions AGCO well for maintaining growth and profitability. This strategic direction, highlighted by the planned Trimble joint venture and continued investment in high-margin growth levers, aims to secure AGCO's target of 12% operating margins by 2026 and outperform overall industry growth.

AGCO Corporation, a leading manufacturer and distributor of agricultural equipment and solutions, filed its 10-Q for the third quarter ended September 30, 2023, with significant financial figures and strategic developments. The document presents a comprehensive overview of the company's financial health, operational updates, and forward-looking statements regarding its business activities.

During the third quarter, AGCO Corporation reported net sales of $3,455.5 million, a notable increase from the $3,121.6 million recorded in the corresponding period of the previous year. This growth can be attributed to robust demand across various regions, coupled with strategic price adjustments to mitigate the impacts of inflation and fluctuating currency exchange rates. The Cost of goods sold surged to $2,521.5 million from $2,382.7 million year-over-year, reflecting the inflating raw material costs and supply chain challenges that have been pervasive in the industry.

Operating expenses for AGCO witnessed a significant uptick, positioning at $353.6 million in selling, general, and administrative expenses, highlighting the company's investment in branding, marketing initiatives, and administrative infrastructure to support its expanding global operations. Engineering expenses, vital for innovation and product development, also rose to $139.6 million. Such strategic allocations underscore AGCOs commitment to maintaining its competitive edge through continuous innovation and market expansion.

During the reporting period, AGCOs strategic maneuvers included various restructuring efforts aimed at optimizing operations and enhancing profitability. This is evident from the $0.8 million recorded in restructuring expenses, a critical component of AGCOs strategy to streamline operations and focus on high-growth areas. Furthermore, the company finalized noteworthy acquisitions, such as the purchase of JCA and Appareo, which totaled around $111.3 million, net of cash acquired. These acquisitions are strategic moves to diversify AGCO's product offerings and enhance its technological capabilities, particularly in the areas of electronic systems and software development for agricultural equipment.

AGCOs financing activities also played a significant role in its strategic operations, with the company managing its debt portfolio effectively. Notably, AGCO entered into an amendment for its multi-currency unsecured revolving credit facility, increasing its borrowing capacity. Moreover, it issued senior notes and engaged in senior term loans to ensure liquidity and support its capital expenditure and strategic growth initiatives. The companys proactive financial management illustrates its dedication to maintaining a solid balance sheet while investing in growth opportunities.

In summary, AGCO Corporation's 10-Q filing for the third quarter of 2023 presents a picture of a company that is on a growth trajectory, supported by strong sales performance, strategic investments in acquisitions, and disciplined financial management. The company's focus on innovation, operational efficiency, and market expansion strategies, combined with its ability to navigate the complex global economic landscape, positions AGCO well for sustainable long-term growth.

AGCO Corporation, a key figure in the global agricultural machinery and precision ag technology sector, has been navigating a complex market landscape highlighted by fluctuations in demand, technological advancements, and geopolitical tensions, as underscored in an array of analyses and reports throughout early 2024. The company's financial strategies and operational maneuvers during this period tell a story of adaptation, strategic investment, and a perpetual commitment to innovation aimed at fortifying its market position.

According to a recent analysis by Zacks Equity Research, AGCO's financial performance in the fourth quarter of 2023 showcased varied outcomes across its regional markets, with projections for the following quarter suggesting a blended picture of growth and challenges. While anticipated revenues indicated growth, earnings per share expectations pointed towards a decline, attributing to a wider industry trend impacted by market demands and operational hurdles. Notably, AGCO's performance in the Asia/Pacific/Africa and North American regions was marked by positive growth, contrasting with projections of softer operational income in other segments, reflecting the diverse and unevenly distributed global challenges the company faces.

A strategic pivot evident in AGCO's recent operations is its investment in technology, particularly through retrofitting existing farm tractors with high-tech features. This initiative, primarily driven through its Precision Planting brand, has not only showcased AGCOs commitment to innovation but has also positioned the company as a customer-centric entity focused on enhancing agricultural efficiency and productivity. By offering technologically advanced upgrades at a more accessible price point, AGCO is directly addressing the needs of a significant segment of the farming community, showing foresight in market trends towards sustainability and efficiency.

AGCO's response to financial performance expectations has been multifaceted, including a detailed analysis of its operational strategies and market challenges. Despite a downturn in net sales and earnings per share in the fourth quarter of 2023, the year concluded with a notable increase in net sales, reflecting the company's resilience and strategic market positioning. AGCOs proactive approach towards anticipated softer market demand in 2024 further underscores its realistic yet optimistic outlook, focusing on growth initiatives and operational efficiencies aimed at navigating a potentially challenging market environment.

The company's global strategy, emphasizing the expansion of its parts and service business along with increased technology development efforts, has contributed to its robust financial and operational outcome. In 2023, AGCO reported an investment surge in technology development by over 23% from the preceding year, accentuating its commitment to innovation and market leadership in the agri-tech sector. This strategic focus is expected to pave the way for AGCO in sustaining its market position and addressing the evolving needs of the agricultural sector effectively.

Despite the challenges highlighted in its fourth-quarter earnings report for December 2023where both revenues and earnings per share fell short of analysts' expectationsAGCO's stock performance and investor confidence hint at a deeper market trust in the company's long-term strategy and growth potential. Unexpectedly, the stock witnessed notable movements, suggesting that beyond the immediate financial figures, investors might be valuing AGCO's strategic initiatives, technological advancements, and its forward-looking approach in the agriculture technology sphere.

In essence, AGCO Corporation's journey through the closing months of 2023 and into the early forecasts of 2024 paints a picture of a company steadfast in navigating market fluctuations, investing in technological innovation, and strategically adapting to global agricultural demands. With a clear focus on enhancing efficiency, productivity, and sustainability in farming practices, AGCO's initiatives resonate with the current and future needs of the agricultural industry. As the company continues to evolve and adapt, its strategic investments and operational focus are anticipated to fortify its position as a leader in the global agricultural machinery and precision agriculture technology markets, navigating through challenges with resilience and strategic foresight.

Volatility in AGCO Corporation's asset returns, analyzed through an ARCH model over the period from February 2019 to February 2024, demonstrates significant fluctuations. The model, which does not account for the mean return (indicating it assumes a constant mean of zero), identifies that these asset returns have a high level of variability, with the omega parameter highlighting substantial baseline volatility. Furthermore, the alpha parameter indicates that past squared returns have a considerable effect on current volatility, suggesting that returns are prone to clustering volatility, where large changes tend to be followed by more large changes, either positive or negative.

| Statistic name | Statistic value |

|---|---|

| Log-Likelihood | -2828.61 |

| AIC | 5661.21 |

| BIC | 5671.49 |

| No. Observations | 1256 |

| omega | 4.0634 |

| alpha[1] | 0.3114 |

Analyzing the financial risk associated with a $10,000 investment into AGCO Corporation over a one-year period involves a detailed examination of the stock's historical performance and potential future movements. The research employs a dual approach, integrating volatility modeling and machine learning predictions to forecast future stock behavior effectively. This comprehensive analysis aims to quantify the risks of equity investment in AGCO, allowing investors to make informed decisions.

The volatility modeling technique is instrumental in understanding the nature of AGCO Corporation's stock price movements. By examining historical price data, this model identifies patterns in the fluctuation rates of the stock, providing insights into the level of volatility investors might expect. This method is particularly valuable because stock volatility is a key driver of market risk. Understanding past volatility helps to gauge the expected range of price movements, which is crucial for risk management.

In parallel, the role of machine learning predictions cannot be overstated. Specifically, using a predictive model based on decision trees that learn from historical data, future returns of AGCO Corporation's stock are forecasted. This approach leverages the vast amount of historical market data, extracting patterns and relationships that may not be immediately evident. The predictive capability of this method is significant, given its ability to assimilate multiple variables that influence stock prices, from market sentiment to economic indicators, and forecast future stock behavior.

When these two methods are combined, they offer a potent tool for financial analysis. The volatility modeling provides a robust framework for understanding and quantifying stock volatility, which is a precursor to evaluating the investment risk. Meanwhile, the machine learning predictions furnish forward-looking insights, projecting stock performance based on learned data patterns. This combination facilitates a dynamic analysis, incorporating both historical volatility and future stock return projections.

The results of this comprehensive analysis, particularly the calculation of the Value at Risk (VaR) at a 95% confidence interval, are pivotal for assessing the investment risk. The VaR, calculated at $311.47 for a $10,000 investment in AGCO, highlights the potential downside risk over a one-year horizon. It indicates that, with 95% confidence, the maximum expected loss would not exceed $311.47 under normal market conditions. This figure is crucial for investors as it quantifies the risk of loss, aiding in the decision-making process regarding the allocation of their investment into AGCO Corporation.

This analysis highlights the effectiveness of using volatility modeling alongside machine learning predictions in evaluating the financial risk of equity investments. By understanding the volatility and predicting future returns with a degree of accuracy, investors can navigate the complexities of the stock market with greater confidence. The calculated VaR provides a quantitative measure of risk, allowing investors to assess the viability of their investment in AGCO Corporation with a clear perspective on potential financial exposure.

Analyzing the options for AGCO Corporation, we aim to identify the most profitable call options, focusing on achieving a stock price that is 5% over the current stock price. The GreeksDelta, Gamma, Vega, Theta, and Rhoeach provide insight into how the price of an option is expected to move relative to various factors, such as the underlying stock's price (Delta, Gamma), time decay (Theta), volatility (Vega), and interest rates (Rho).

Starting with the short-term expiration options on February 16, 2024, the call option with a strike price of $125 presents an exceptionally high return on investment (ROI) of 1.6816 and a profit of $2.102. This option stands out due to its relatively low premium of $1.25, combined with a substantial Delta of 0.3477175571, signaling a reasonable sensitivity to the stock's price movement. However, its high Gamma (0.0584840215) suggests that this sensitivity could increase quickly with price movements of AGCO's stock, potentially leading to higher profitability as the target stock price is approached.

For those looking at a slightly longer investment period leading up to March 15, 2024, the call option with a strike price of $120 showcases an attractive balance between risk and potential return. It posts a solid ROI of 0.3759472817 and a profit of $2.282. Despite a moderate premium of $6.07, its Delta of 0.6027717999 indicates a strong position to benefit from stock price increases. Coupled with a substantial Vega of 14.9879978591, this option is particularly appealing for investors anticipating increased volatility in AGCO's stock.

When considering the options with a 100-day expiration until May 17, 2024, the call option with a strike price of $95 emerges as a standout, boasting an impressive ROI of 0.5229223744 and a profit of $11.452. Its near-perfect Delta of 0.9973733189 virtually guarantees that the option's price will move almost dollar-for-dollar with the stock's price, making it an optimal choice for investors confident in AGCO's stock reaching the target price. Despite its zero Gamma indicating no change in Delta, this characteristic might actually suit investors looking for a less volatile option.

Finally, looking at the longer-term horizon with expiration on August 16, 2024, the call option with a strike price of $80 is notable. It maintains a healthy balance between growth potential and risk, with a Delta of 0.8861801093 and a substantial ROI of 0.3064577141, alongside a profit of $11.342. This option benefits from a higher Vega (16.4745566224) suggesting it could gain significantly from increases in implied volatility over the longer term. Its Rho of 32.2366442589 also indicates a sensitivity to interest rates that could either pose a risk or additional benefit depending on economic conditions.

In summary, for investors aiming to capitalize on a 5% increase in AGCO's stock price, diversifying across these options might provide a strategic blend of high potential profit and manageable risk. Each option presents a combination of Greeks suggesting profitability under certain market conditions, with short-term options offering rapid gains at higher risks and longer-term options providing steadier, albeit possibly lower, returns.

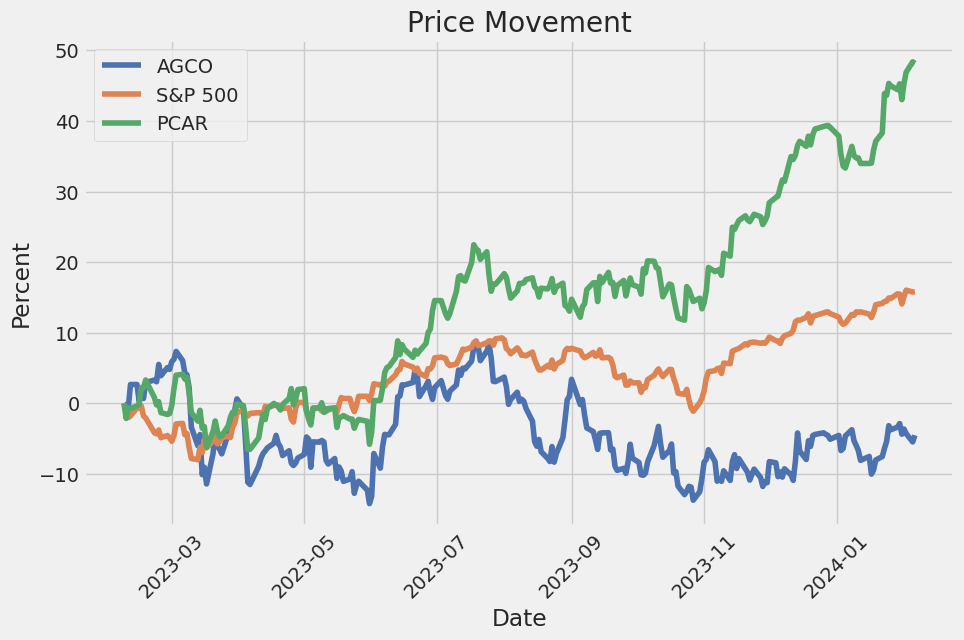

Similar Companies in Farm & Heavy Construction Machinery:

PACCAR Inc (PCAR), The Manitowoc Company, Inc. (MTW), Wabash National Corporation (WNC), Terex Corporation (TEX), Report: Caterpillar Inc. (CAT), Caterpillar Inc. (CAT), Report: CNH Industrial N.V. (CNHI), CNH Industrial N.V. (CNHI), Nikola Corporation (NKLA), Alamo Group Inc. (ALG), Hyster-Yale Materials Handling, Inc. (HY), Report: Columbus McKinnon Corporation (CMCO), Columbus McKinnon Corporation (CMCO), Titan International, Inc. (TWI), Lindsay Corporation (LNN), Astec Industries, Inc. (ASTE), The Shyft Group, Inc. (SHYF), Report: Deere & Company (DE), Deere & Company (DE), Report: The Toro Company (TTC), The Toro Company (TTC)

https://finance.yahoo.com/news/unveiling-agco-agco-q4-outlook-141606946.html

https://finance.yahoo.com/news/old-farm-tractors-high-tech-120000976.html

https://finance.yahoo.com/news/agco-reports-fourth-quarter-full-123000932.html

https://finance.yahoo.com/news/agco-q4-earnings-snapshot-124829938.html

https://finance.yahoo.com/news/agco-agco-q4-earnings-revenues-134004115.html

https://finance.yahoo.com/m/fc2f1729-f0df-3b10-a1d1-d2eb228305e4/agco-earnings-miss-estimates..html

https://finance.yahoo.com/news/agco-agco-q4-earnings-taking-143024611.html

https://finance.yahoo.com/news/agco-corp-agco-reports-mixed-143158620.html

https://seekingalpha.com/article/4667927-agco-corporation-agco-q4-2023-earnings-call-transcript

https://www.sec.gov/Archives/edgar/data/880266/000088026623000076/agco-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: Xlbrb1

Cost: $0.77999

https://reports.tinycomputers.io/AGCO/AGCO-2024-02-06.html Home