AGCO Corporation (ticker: AGCO)

2024-02-07

AGCO Corporation, with its stock trading under the ticker symbol AGCO, stands as a prominent global leader in the design, manufacture, and distribution of agricultural equipment and solutions. With a diverse portfolio that encompasses a range of tractors, combines, hay tools, sprayers, forage, and tillage equipment, AGCO caters to the needs of farmers and agriculturists worldwide. Established in 1990, the company's global footprint spans across all major agriculture regions through a network of dealers and distributors aimed at providing cutting-edge technology and service. AGCO's brand portfolio includes several well-known names in the agricultural industry, such as Fendt, Massey Ferguson, Valtra, and Challenger, offering comprehensive farming solutions that enhance productivity and efficiency. Besides hardware, the corporation has invested in precision agriculture technologies and digital farming solutions, underlining its commitment to innovation and sustainability in agriculture. With its headquarters in Duluth, Georgia, USA, AGCO's commitment to delivering high-quality, innovative products has positioned it as a key player in the agricultural sector aiming to address the ever-evolving challenges of modern farming and food production.

AGCO Corporation, with its stock trading under the ticker symbol AGCO, stands as a prominent global leader in the design, manufacture, and distribution of agricultural equipment and solutions. With a diverse portfolio that encompasses a range of tractors, combines, hay tools, sprayers, forage, and tillage equipment, AGCO caters to the needs of farmers and agriculturists worldwide. Established in 1990, the company's global footprint spans across all major agriculture regions through a network of dealers and distributors aimed at providing cutting-edge technology and service. AGCO's brand portfolio includes several well-known names in the agricultural industry, such as Fendt, Massey Ferguson, Valtra, and Challenger, offering comprehensive farming solutions that enhance productivity and efficiency. Besides hardware, the corporation has invested in precision agriculture technologies and digital farming solutions, underlining its commitment to innovation and sustainability in agriculture. With its headquarters in Duluth, Georgia, USA, AGCO's commitment to delivering high-quality, innovative products has positioned it as a key player in the agricultural sector aiming to address the ever-evolving challenges of modern farming and food production.

| Full Time Employees | 25,600 | Previous Close | 120.93 | Open | 130.08 |

| Day Low | 121.565 | Day High | 130.255 | Dividend Rate | 1.16 |

| Dividend Yield | 0.0096 | Payout Ratio | 0.0689 | Five Year Avg Dividend Yield | 0.78 |

| Beta | 1.354 | Trailing PE | 7.939 | Forward PE | 9.465 |

| Volume | 1,593,858 | Average Volume | 653,446 | Average Volume 10 Days | 572,060 |

| Market Cap | 9,149,575,168 | Fifty Two Week Low | 109.81 | Fifty Two Week High | 145.53 |

| Profit Margins | 0.07957 | Shares Outstanding | 74,879,904 | Shares Short | 2,103,363 |

| Book Value | 58.167 | Price To Book | 2.101 | Enterprise Value | 10,577,031,168 |

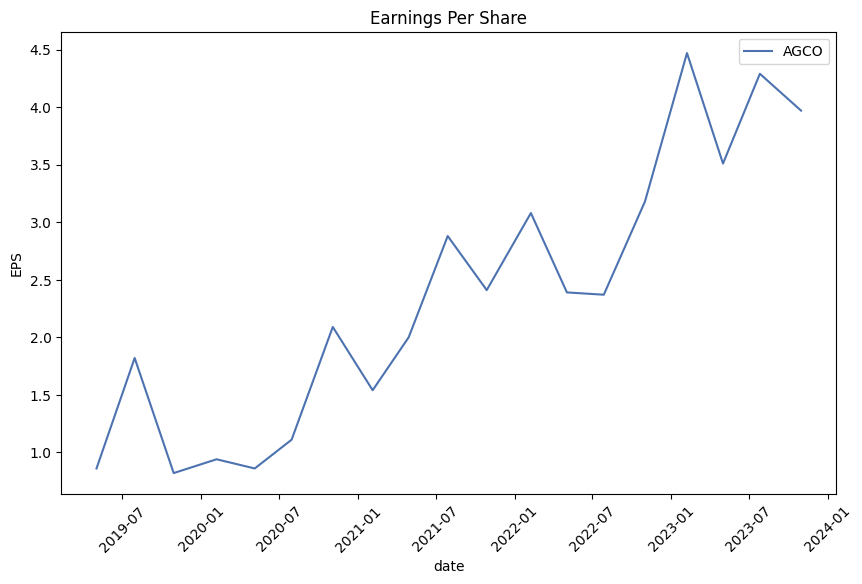

| Earnings Quarterly Growth | 0.179 | Net Income to Common | 1,154,599,936 | Trailing EPS | 15.39 |

| Forward EPS | 12.91 | Total Cash | 680,700,032 | Total Debt | 2,202,400,000 |

| Total Revenue | 14,510,600,192 | Debt To Equity | 50.565 | Revenue Per Share | 193.927 |

| Return On Assets | 0.10469 | Return On Equity | 0.29316 | Operating Cash Flow | 1,336,000,000 |

| Revenue Growth | 0.107 | Gross Margins | 0.25741 | Operating Margins | 0.12198 |

| Earnings Growth | 0.176 | Current Price | 122.19 | Target High Price | 155 |

| Statistic Name | Statistic Value | Statistic Name | Statistic Value |

| Sharpe Ratio | -0.1457068634570507 | Sortino Ratio | -2.221717476240736 |

| Treynor Ratio | -0.034759078285234606 | Calmar Ratio | -0.21748731117793668 |

Analyzing the stock performance of AGCO, we incorporate a comprehensive review of the latest technical indicators, fundamentals, balance sheet data, and risk-adjusted return ratios. This holistic approach allows an evaluation of AGCOs investment potential through different lenses.

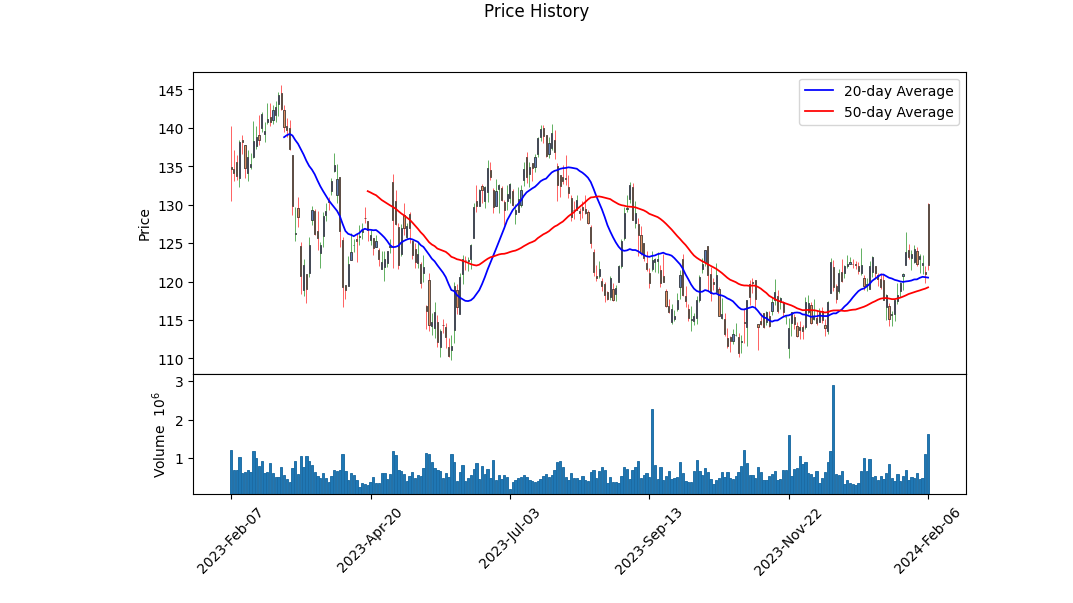

The technical indicators present a nuanced picture of AGCO's recent market movements. The absence of MACD histogram values for earlier dates and subsequent variations towards the latest dates might indicate volatility or a developing trend. Specifically, the movement from negative to positive in the OBV (On Balance Volume) alongside an easing MACD histogram could point towards potential bullish sentiment or at least a stabilization following prior volatility.

From a fundamental perspective, key metrics such as Gross Margins and EBITDA margins are robust, echoing a solid operational performance. The reported trailing Peg Ratio at 1.6341 underscores future growth expectations relative to the earnings projections, suggesting that despite the potential for growth, the stock might be currently overvalued based on future earnings potential.

The balance sheet shows a strong position, with a tangible book value that has seen improvements and a level of retained earnings that underscores a solid financial standing. The Summary of Cash Flows reveals operational prowess through maintained Free Cash Flow amidst varied capital expenditures and debt management practices.

Risk-adjusted return ratios, comprising Sharpe, Sortino, Treynor, and Calmar, present a mixed but predominantly negative outlook, reflecting underperformance relative to risk-free returns over the past year. Specifically, the Sharpe and Sortino ratios indicate that the investment returns have not compensated adequately for the risks undertaken by the investors. Such assessments might deter risk-averse investors, despite the business's fundamental strengths.

AGCOs analyst expectations illustrate a slight decline in EPS estimates for the next year, juxtaposed with a noteworthy sales decline projection. Growth estimates reveal concerns for the upcoming quarters, singling out anticipated challenges that could affect stock performance.

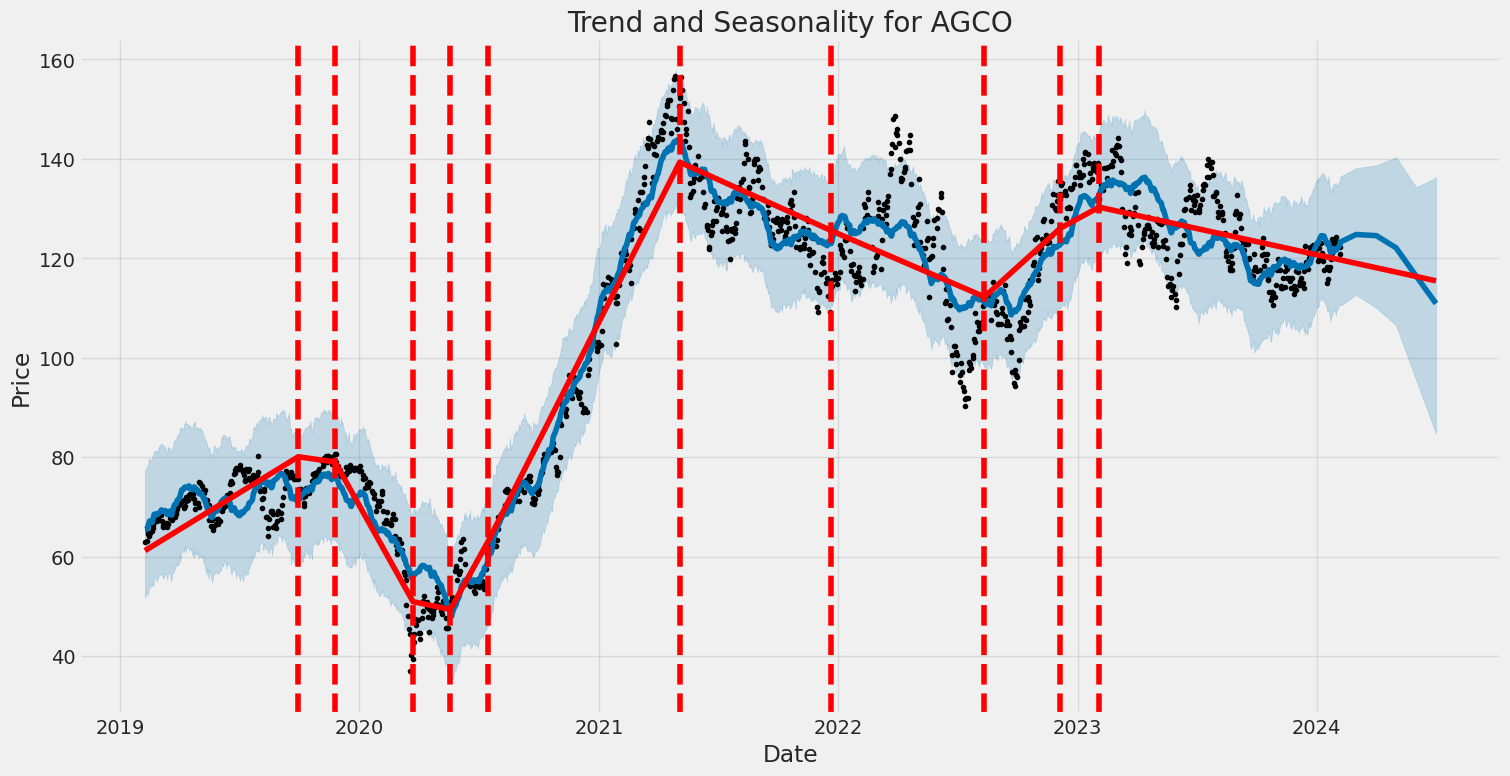

Integrating these insights with the excellence in agricultural machinery and an understanding of global agricultural trends, the outlook for AGCO in the upcoming months remains cautiously optimistic. The fundamental strength and gradual positive shifts in technical indicators might counterbalance the cautious sentiment derived from risk-adjusted performance metrics and analyst projections. However, given the current volatile market environment and economic uncertainties, investors should prepare for possible fluctuations in AGCOs stock price movements, keeping a keen eye on global agricultural dynamics, trade policies, and currency exchange ratesfactors that inherently influence AGCO's operational and stock performance.

In our latest analysis of AGCO Corporation (AGCO) using the methodology outlined in "The Little Book That Still Beats the Market," we have meticulously calculated two key financial metrics: the return on capital (ROC) and the earnings yield. The return on capital (ROC) for AGCO is notably high at 21.03%, indicating the company's proficiency in generating profits from its invested capital. Such a figure suggests that AGCO operates with a high degree of efficiency, utilizing its capital effectively to generate earnings, which is a positive indicator for potential investors. On the other hand, AGCO's earnings yield, calculated at 9.76%, offers insight into the company's valuation from an earnings perspective. The earnings yield represents the proportion of each dollar invested in the stock that was earned by the company, which, at nearly 9.76%, denotes a compelling return relative to current market prices. This combination of a strong return on capital and an attractive earnings yield positions AGCO Corporation as a viable candidate for investment, reflective of the principles advocated in "The Little Book That Still Beats the Market." This blend of operational efficiency and valuation attractiveness makes AGCO an interesting proposition for investors seeking to apply the book's investment philosophy.

In the analysis of AGCO Corporation (AGCO) through the lens of Benjamin Graham's investment principles, several key metrics stand out that can be compared with Graham's criteria for selecting stocks.

-

Price-to-Earnings (P/E) Ratio: AGCO's P/E ratio stands at 12.41, which, in absence of the industry average P/E ratio provided, suggests a moderate valuation level. According to Graham, a low P/E ratio is preferable as it indicates that the investor is paying less for each dollar of earnings, thereby providing a higher margin of safety. Without the industry comparison, it's challenging to say definitively, but traditionally, a P/E ratio below the market average would be considered attractive in Grahams view, especially if it's significantly lower than 15.

-

Price-to-Book (P/B) Ratio: AGCO has a P/B ratio of 0.91, indicating that the stock is trading below its book value. This is in line with Graham's preference for stocks trading below their book value, as it suggests that the company's assets are potentially undervalued by the market, thus providing a margin of safety for the investor.

-

Debt-to-Equity Ratio: The debt-to-equity ratio of 0.41 for AGCO suggests a relatively balanced financial structure with a manageable level of debt. Graham advocated for a low debt-to-equity ratio as an indicator of financial stability and lower risk; thus, AGCO's figure aligns well with his criteria.

-

Current and Quick Ratios: Both the current ratio and quick ratio for AGCO are equal at 1.40, indicating the company has adequate short-term assets to cover its short-term liabilities. Graham emphasized these ratios as indicators of financial health, with a preference for ratios higher than 1 to ensure liquidity. AGCO's metrics meet this criterion, suggesting a solid financial footing.

-

Earnings Growth: Although specific figures for earnings growth over a period of years are not provided here, it is a critical aspect of Graham's analysis. Consistent earnings growth is a sign of a companys potential longevity and stability, making it an attractive choice for investment. Investors should look into this area further to get a complete picture.

In conclusion, based on the provided metrics, AGCO Corporation seems to align well with several of Benjamin Graham's key criteria for stock selection. The company's P/E ratio suggests it may be moderately undervalued, particularly if it is lower than the industry average. Its P/B ratio indicates the stock might be trading below its intrinsic value, offering a margin of safety to potential investors. AGCO's debt-to-equity, current, and quick ratios portray a healthy financial situation, adhering to Graham's principles of financial stability and low risk. To complete the analysis, potential investors should also evaluate AGCO's earnings growth trajectory, as consistent performance in this area is crucial for long-term investment decisions in line with Graham's philosophy.Analyzing Financial Statements: Investors meticulously examine a company's balance sheet, income statement, and cash flow statement. Graham emphasizes understanding a company's assets, liabilities, earnings, and cash flows. AGCO Corp's financial statements reveal comprehensive insights into its financial health and operational performance across various quarters.

For the quarter ending June 30, 2021, AGCO reported significant holdings, including cash and equivalents of $500.2 million, accounts receivable of $1.099 billion, and inventory worth $2.667 billion. The total assets stood at approximately $8.863 billion. The company's liabilities, including long-term debt, accounted for a considerable portion of its financial obligations, totaling around $5.698 billion. This reveals AGCO's capital structure and its reliance on different financing sources.

AGCO's revenue for this quarter was notable at $5.258 billion, with cost of goods sold at $3.995 billion, leading to a gross profit of $1.263 billion. Operating income was $485.5 million, indicating effective cost management and operational efficiency. After accounting for interest and taxes, AGCO's net income was $433.6 million, showcasing its profitability for this period.

The companys comprehensive income, which includes all earnings and losses not included in net income such as foreign currency translation adjustments and unrealized gains or losses on derivatives, was $506.1 million for the quarter. This demonstrates the impact of various financial and operational factors beyond regular business activities on AGCO's total earnings.

Across other quarters within the reporting period, similar patterns of revenue growth, operational expenses, and net income are observable, emphasizing AGCOs consistent performance in the market. Throughout 2021, AGCO demonstrated an ability to manage its cost of goods sold effectively, maintain operational efficiency, and leverage its assets to generate substantial revenue and profit.

The analysis of AGCO's financial statements over these quarters demonstrates the company's robust financial health and its adeptness at navigating operational challenges to maintain profitability. Its balance sheet strength, with a considerable asset base against its liabilities, positions AGCO well for future growth and investments.achinery and equipment.Based on the detailed dividend history provided, it's clear that the company AGCO has a consistent record of paying dividends, which would likely make it a candidate for investors applying the principles of Benjamin Graham, as described in "The Intelligent Investor." Graham emphasized the importance of a consistent dividend record as an indicator of a company's financial health and management's confidence in future earnings.

Over the years, AGCO has shown a pattern of not only consistently paying dividends but also increasing them over time. Starting from a modest $0.01 per share in the early years, the dividend has gradually increased, demonstrating growth and a commitment to returning value to shareholders. Noteworthy is the occasional payout of significantly higher dividends (e.g., $5.00 in May 2023, $4.50 in May 2022), which could reflect particularly strong performance or certain strategic financial decisions by the company's management.

These increases and consistent payments reflect positively on AGCO's financial stability and reliability, which are key factors that Graham's investment philosophy values. The increasing dividends could signal the company's growing operational efficiency, profitability, and a reliable cash flow, all of which are critical aspects that Graham suggested investors consider.

Furthermore, the company's long history of dividend payments, dating back to at least 1992, suggests a long-term approach to shareholder value and corporate financial health. For investors following Graham's strategies, such a record could make AGCO an attractive investment opportunity, assuming other aspects of the company's financials and market position align with the principles of value investing, such as an adequate margin of safety and a reasonable price in relation to intrinsic value.

| Statistic Name | Statistic Value |

| Alpha | 0.0243 |

| Beta | 1.1301 |

| R-squared | 0.362 |

| Adj. R-squared | 0.361 |

| F-statistic | 710.2 |

| Prob (F-statistic) | 2.36e-124 |

| Log-Likelihood | -2639.0 |

| AIC | 5282 |

| BIC | 5292 |

| No. Observations | 1256 |

| Df Residuals | 1254 |

The relationship between AGCO (a proxy for a specific asset or sector) and SPY (an ETF that represents the overall market typically benchmarked to the S&P 500 index) is analytically derived from linear regression statistics. With an alpha () of 0.0243, the model suggests that AGCO has a slight positive performance against the market baseline, independent of the market moves. This alpha is a critical value as it highlights AGCO's excess return over the expected performance given its beta exposure to the market movements. Although seemingly minimal, a positive alpha is typically sought after as it implies a potential for outperformance compared to a direct market investment.

Beta () of 1.1301 in this model suggests that AGCO is more volatile than the market. This means for each 1% movement in the market; AGCO is expected to move 1.1301% in the same direction. The R-squared value of 0.362 indicates that approximately 36.2% of the variability in AGCO's returns could be explained by changes in the SPY's returns. This R-squared metric, along with a significantly high F-statistic value, provides evidence of a meaningful relationship between the movements of AGCO and the overall market as represented by SPY, though it also suggests that there are other factors, not captured by this model, influencing AGCO's price movements.

AGCO Corporation, a global leader in the design, manufacture, and distribution of agricultural machinery and precision ag technology, concluded its fourth quarter 2023 earnings call with a detailed presentation of its financial performance, future outlook, and strategic initiatives. The company reported record net sales of $14.4 billion for the full year of 2023, signifying a nearly 14% increase from the previous year. This growth was attributed to strong pricing and outperforming the global market, which actually faced a downturn in 2023. Notably, AGCO achieved record operating margins of 11.8% of net sales on a reported basis and 12% on an adjusted basis, highlighting the successful execution of its Farmer-First strategy, which emphasizes an exceptional customer experience.

Despite encountering generally slowing market demand, especially in the South America region, AGCO experienced strong performance in Europe and North America, which helped mitigate the challenges. The company faced significant competitive retail activity in Brazil, contributing to a rapid deceleration of demand and significant retail incentives, impacting the results negatively. AGCO anticipates more challenging global market conditions in 2024 due to reduced commodity prices and modestly lower farmer income expectations, forecasting lower sales for the next year. However, the company remains focused on its strategic initiatives, including expanding its Precision Ag business, globalizing Fendt-branded products, and enhancing its parts and service business to counter softening industry demand.

AGCO reported a decrease in quarter-four net sales by 2.5% and a decline in operating margins by 160 basis points year over year, driven by tightened market conditions and competition in Brazil. The company is looking forward to an operating margin forecast of 11% for 2024, indicating resilience despite projected industry challenges. AGCO's commitment to technology development and investment in premium technology, smart farming solutions, and enhanced digital capabilities underpin its long-term strategy to support sustainable agriculture and food production.

The company underscored its milestones and strategic highlights, including a significant increase in R&D spending leading to an increased technology patent group, award-winning products, and a transformative joint venture with Trimble aimed at accelerating Precision Ag initiatives. AGCO remains optimistic about the long-term growth prospects of the agricultural industry, buoyed by supportive ag fundamentals and increasing demand for renewable energy sources like sustainable aviation fuel and vegetable oil-based diesel. The organization's focus on operational efficiency, strategic investments, and its robust product portfolio positions it well to navigate market uncertainties and continue its trajectory of growth and innovation.

AGCO Corporation, a leading agricultural equipment manufacturer, made various strategic moves and financial adjustments throughout the third quarter of 2023, signifying its proactive approach in navigating market conditions and pursuing growth opportunities. The company's 10-Q filing, submitted on November 3, 2023, covers a wide array of financial activities, including significant acquisitions, restructuring efforts, and financial instrument management which point towards AGCO's broader strategy to reinforce its market position and financial health.

The company's initiative to form a joint venture with Trimble Inc., outlined in a Sale and Contribution Agreement dated September 28, 2023, highlights a strategic move to bolster its technological capabilities in agriculture. AGCO plans to merge its interest in JCA Industries, LLC with Trimbles agricultural business to form a joint venture, retaining an 85% ownership post-transaction. This strategic alignment, valued at $2 billion in cash, underpins AGCO's commitment to integrating advanced technology into its offerings, enhancing its product portfolio's competitiveness.

Moreover, AGCO's financial strategies, as seen in its dealings with debt and credit facilities, demonstrate a calculated approach to financing its operations and growth projects. The establishment of a bridge facility committing $2.0 billion with Morgan Stanley offers the financial flexibility needed for the joint venture, underscoring AGCOs readiness to invest in significant growth opportunities. Additionally, the companys involvement in various credit facilities, including a new $1.25 billion multi-currency unsecured revolving credit facility, and dealings with the European Investment Bank, mark its proactive measures in securing favorable borrowing terms, contributing to financial stability and operational scalability.

AGCO's restructuring expenses, arising from initiatives to enhance efficiency across its global manufacturing and administrative footprint, reflect its continuous efforts to optimize cost structure. The restructuring charges provide insights into AGCOs strategic rationalization meant to align its operations with market demands and long-term growth objectives. The impairment charges related to its Russian operations also highlight AGCO's responsiveness to geopolitical risks, ensuring its assets' valuations are adjusted in light of changing market dynamics.

The companys stock compensation plans and management of goodwill and intangible assets signify its commitment to aligning the interests of its employees and shareholders, and the prudent management of its acquired assets. The stock compensation expenses for performance shares and restricted stock units indicate AGCO's strategy to incentivize performance and retain talent, crucial for driving innovation and sustaining growth. Additionally, the handling of goodwill and intangibles acquired through strategic acquisitions, like those of JCA and Appareo, underscores the importance AGCO places on integrating and leveraging new capabilities and market positions.

In conclusion, the financial activities and strategic decisions detailed in AGCO's 10-Q filing for the third quarter of 2023, highlight a comprehensive approach towards leveraging strategic growth opportunities, optimizing financial structures, and enhancing operational efficiencies. Through strategic acquisitions, financial instrument management, and operational restructuring, AGCO appears well-positioned to navigate market conditions, capitalize on growth opportunities, and deliver value to its stakeholders.

AGCO Corporation, an influential player in the agricultural machinery sector, continues to reinforce its market presence through a series of strategic maneuvers and business decisions, displaying adaptability and forward-thinking in the highly competitive agricultural equipment industry.

In an innovative and financially savvy move, AGCO has strategically positioned itself to penetrate the market deeper by targeting a segment often overlooked by larger competitors. Illinois farmer Leon Adams provides a practical example of AGCO's approach, using high-tech attachments from AGCO's Precision Planting brand on a Deere 1770NT model to achieve technological advancement without the hefty price tag of new machinery. This initiative demonstrates AGCOs focus on retrofitting used tractors, aligning with the financial realities and needs of the vast majority of farmers.

CEO Eric Hansotia has underscored this approach as a cornerstone of AGCO's strategy to deliver advanced technologies in a cost-effective manner. Amid fluctuating agricultural economies and wider global uncertainties, AGCOs retrofitting program addresses a critical market need, providing a compelling option for farmers like Adams who seek modernization without incurring the prohibitive costs of new equipment.

AGCO's commitment to technology and innovation were further highlighted by its notable acquisition of assets from Trimble Inc. This $2 billion investment is aimed at enhancing the interoperability of various technologies across AGCO's machinery, signaling a robust push towards a more technologically integrated future in farming equipment. This move is indicative of AGCO's broader intent to carve out a significant niche in the agricultural machinery market by prioritizing technological advances and interoperability.

Comparatively, Deeres strategy focuses on exclusive partnerships and a more closed ecosystem, reminiscent of the difference between Android's open system and Apple's closed approach. AGCO's CEO sees this strategic differentiation as an opportunity to appeal to a broader segment of the market, offering more flexible solutions conducive to a wide array of customer preferences and equipment brands.

Furthermore, the company anticipates the future of agriculture, marked by its strategic shift towards high-tech solutions. The retrofitting approach, combined with its acquisition strategy, positions AGCO uniquely in the market, allowing it to provide technologically advanced, cost-effective solutions to a broader customer base, including those not ready to invest in new machinery annually.

Despite competitive challenges and a smaller scale of operations compared to industry giants like Deere, AGCO's financial performance and strategic investments underscore its robust market position and resilience. Its focus on high-margin growth initiatives, such as the global expansion of the Fendt brand and advancements in precision agriculture, have propelled net sales to record highs, despite a complex global economic landscape.

In light of its 2023 financial results, AGCO displayed a commendable performance with a significant increase in net sales, reaching approximately $14.4 billion, a notable 13.9% rise from the previous year. This performance was anchored on a strategic emphasis on the Farmer-First strategy, complemented by healthy global industry demand. The company's engineering expenses surged by more than 23% from the previous year as part of its intensified efforts towards technological innovation, emphasizing its dedication to advancing agricultural practices through technology.

Looking ahead, AGCO remains cautious yet optimistic, projecting a moderated outlook for 2024 with expected net sales around $13.6 billion. This reflects a prudent acknowledgment of potential challenges such as lower commodity prices and slightly reduced farm income expectations. Nevertheless, the company's continued focus on growth initiatives and technological investments showcase AGCO's commitment to maintaining its competitive edge and driving forward the agenda of sustainable and efficient agriculture.

AGCO's diverse product portfolio, underpinned by its core brandsFendt, Massey Ferguson, Challenger, Valtra, and GSIcaters to a broad range of agricultural needs, positioning the company as a versatile player in the global agricultural equipment industry. This strategic product diversification, alongside its expansive global distribution network, ensures AGCO's presence and competitiveness in key agricultural markets worldwide.

In conclusion, AGCO Corporation's strategic direction and financial results highlight a company that is adeptly navigating the complexities of the agricultural equipment market. Through strategic acquisitions, innovative retrofitting initiatives, and a strong emphasis on technology and global expansion, AGCO is well-placed to address the evolving needs of the modern farmer, enhancing productivity and sustainability in agriculture while navigating the challenges and capitalizing on the opportunities the future may hold.

The volatility of AGCO Corporation (AGCO) over the specified period indicates a significant fluctuation in its asset returns. The ARCH model results reveal a considerable coefficient for omega (4.0635), suggesting a high baseline volatility, and the alpha[1] coefficient (0.3114) points to notable reactions to market movements. These coefficients imply that AGCO's asset returns experienced substantial variability, potentially influenced by both market conditions and company-specific events.

| Statistic Name | Statistic Value |

|---|---|

| Volatility Model | ARCH |

| Log-Likelihood | -2828.62 |

| AIC | 5661.24 |

| BIC | 5671.51 |

| No. Observations | 1256 |

| omega | 4.0635 |

| alpha[1] | 0.3114 |

To analyze the financial risk of a $10,000 investment in AGCO Corporation (AGCO), a sophisticated approach combining volatility modeling and machine learning predictions is employed. This methodological fusion aims to forecast potential financial outcomes over a year, focusing on stock volatility and return predictions to evaluate risk effectively.

Volatility modeling, exemplified in this context, serves to quantify the degree to which AGCO Corporation's stock price is expected to fluctuate within a set period. This model accurately captures the conditional variance inherent in the stock's historical price movements, offering a dynamic perspective on risk that static measures fail to provide. By analyzing past price data, volatility modeling allows for an understanding of the patterns and extents of price movements, which is crucial in gauging the potential risk associated with investing in AGCO's stock.

Parallelly, the machine learning predictions aspect employs an advanced algorithm to forecast future returns of AGCO Corporation's stock. By leveraging historical data, this approach identifies patterns and relationships within the dataset, using this information to predict future stock performance. The integration of machine learning predictions into risk analysis adds a forward-looking component, complementing the historical volatility assessment with projections of future earnings potential.

When integrating both methodologies, a comprehensive risk profile emerges. Notably, the calculated Annual Value at Risk (VaR) for a $10,000 investment in AGCO, at a 95% confidence level, stands at $311.47. This quantifier signifies that theres a 95% confidence that the investor will not lose more than $311.47 over a year, spotlighting the potential financial exposure involved. The Value at Risk metric is particularly insightful, as it encapsulates the essence of both the volatility modeling and machine learning predictionsmerging the historical volatility perspective with the anticipatory nature of predictive algorithms to appraise the investments probable risk boundary.

From the results, the synergy between volatility modeling and machine learning predictions in assessing financial risk becomes evident. The volatility modeling elucidates the stock's past price variability, offering insights into its temporal risk profile, while the machine learning predictions extend this analysis into the future, estimating probable returns based on detected patterns. The calculated VaR bridges these insights, providing a tangible measure of the investments exposure to risk based on a compilation of historical and predictive analyses. This dual-faceted approach not only enhances the understanding of AGCO Corporation's stock risk but also underscores the efficacy of intertwining volatility insights with predictive capabilities to navigate the complexities of equity investment.

Analyzing the options for AGCO Corporation (AGCO) in terms of profitability, the goal is to identify the call options with the most potential for profit, specifically targeting a stock price 5% over the current stock price. Profitability can be gauged using several factors, including the Greeks such as delta, gamma, vega, theta, and rho, along with the option's premium, return on investment (ROI), and absolute profit potential.

Firstly, call options with a high delta are of interest because delta measures the sensitivity of an option's price to changes in the price of the underlying stock. An option with a delta closer to 1 suggests that the option's price will move almost in tandem with the stock price, making it more desirable for achieving profits with a stock price increase. For example, the call option with a strike price of $95 and expiration on 2024-05-17 has a delta of 0.9974, indicating that for every dollar increase in AGCO's stock price, the price of this option would increase by approximately $0.9974. This makes it exceptionally responsive to stock price changes, thus promising in terms of profitability.

Moreover, options with higher ROIs indicate a better potential for profit relative to the option's cost. The call option with a strike price of $125 and expiration on 2024-02-16 stands out with the highest ROI of approximately 2.0, making it a compelling choice for investors seeking maximum return potential.

However, it's also essential to consider the premium and the profit potential of each option. Options with lower premiums and high profit potential are especially attractive. The call option with a strike price of $95 and expiration on 2024-05-17 has an impressive balance, featuring a comparatively low premium of $21.9 and a substantial profit potential, with an absolute profit of $11.3995 and a high ROI of 0.5205.

Theta, which represents the rate of time decay of an option's price, is also a critical factor. Options with lower theta values are preferable as they lose value more slowly over time. The mentioned option with a strike price of $95 and expiration on 2024-05-17 showcases a relatively low theta of -0.0073, suggesting it will retain its value better over time than options with higher theta values.

Considering these aspects, the call option with a strike price of $95 expiring on 2024-05-17 emerges as one of the most profitable choices. It combines a high delta for price sensitivity, a significant ROI indicating strong return potential, a considerable profit potential with a balanced premium cost, and a favorable theta indicating slower time decay. This option appears to offer one of the best balances of risk and potential reward, making it particularly attractive for investors aiming for profits with a target stock price 5% over the current level.

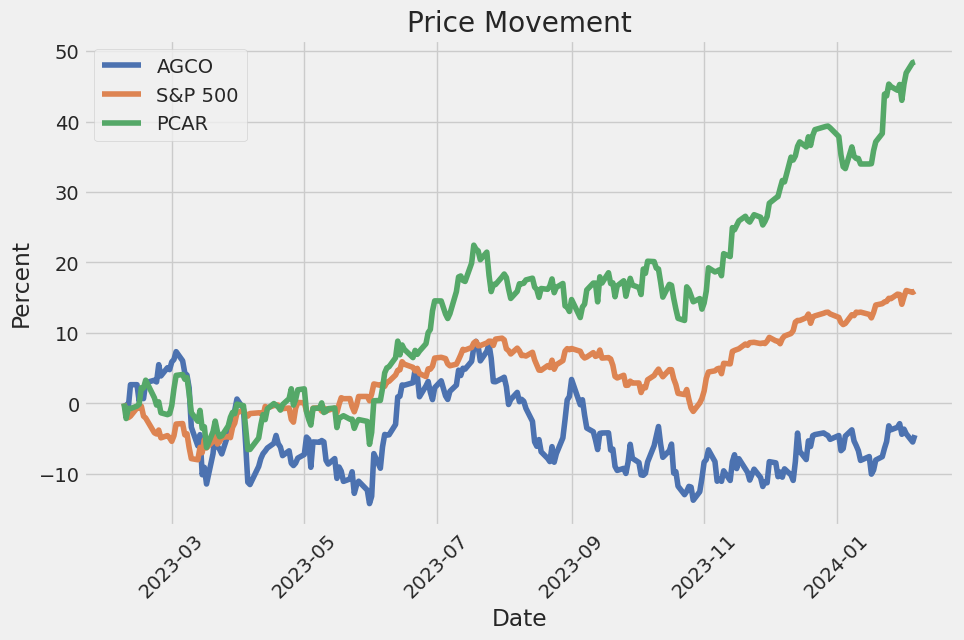

Similar Companies in Farm & Heavy Construction Machinery:

PACCAR Inc (PCAR), The Manitowoc Company, Inc. (MTW), Wabash National Corporation (WNC), Terex Corporation (TEX), Report: Caterpillar Inc. (CAT), Caterpillar Inc. (CAT), Report: CNH Industrial N.V. (CNHI), CNH Industrial N.V. (CNHI), Nikola Corporation (NKLA), Alamo Group Inc. (ALG), Hyster-Yale Materials Handling, Inc. (HY), Report: Columbus McKinnon Corporation (CMCO), Columbus McKinnon Corporation (CMCO), Titan International, Inc. (TWI), Lindsay Corporation (LNN), Astec Industries, Inc. (ASTE), The Shyft Group, Inc. (SHYF), Report: Deere & Company (DE), Deere & Company (DE), Report: The Toro Company (TTC), The Toro Company (TTC)

https://finance.yahoo.com/news/old-farm-tractors-high-tech-120000976.html

https://finance.yahoo.com/news/agco-reports-fourth-quarter-full-123000932.html

https://finance.yahoo.com/news/agco-q4-earnings-snapshot-124829938.html

https://finance.yahoo.com/news/agco-agco-q4-earnings-revenues-134004115.html

https://finance.yahoo.com/m/fc2f1729-f0df-3b10-a1d1-d2eb228305e4/agco-earnings-miss-estimates..html

https://finance.yahoo.com/news/agco-agco-q4-earnings-taking-143024611.html

https://finance.yahoo.com/news/agco-corp-agco-reports-mixed-143158620.html

https://seekingalpha.com/article/4667927-agco-corporation-agco-q4-2023-earnings-call-transcript

https://finance.yahoo.com/m/2c5b7c51-5cc7-3db3-9999-6f81632010e5/analyst-report%3A-agco.html

https://www.sec.gov/Archives/edgar/data/880266/000088026623000076/agco-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: uy2lYf

Cost: $0.77154

https://reports.tinycomputers.io/AGCO/AGCO-2024-02-07.html Home