Devon Energy Corporation (ticker: DVN)

2024-01-31

Devon Energy Corporation (DVN), a prominent player in the energy sector, has established itself as a leading independent natural gas and oil company. With its headquarters in Oklahoma City, the company's operations are primarily concentrated in the United States. Devon Energy boasts a diverse portfolio that prioritizes high-return assets, focusing on the exploration, development, and production of oil and natural gas. The corporation has made significant strides in enhancing its operational efficiency and sustainability practices, aiming to reduce its carbon footprint while optimizing production. Its strategic acquisitions and divestitures over the years have streamlined its asset base, focusing on its core areas where it can leverage technological advancements to improve recovery rates and reduce operating costs. Financially, DVN has demonstrated resilience and adaptability in the volatile energy market, consistently working to deliver value to its shareholders through competitive dividends and robust capital returns. The company's commitment to safety, environmental stewardship, and corporate responsibility further underscores its role as a key player in the energy industry's ongoing evolution.

Devon Energy Corporation (DVN), a prominent player in the energy sector, has established itself as a leading independent natural gas and oil company. With its headquarters in Oklahoma City, the company's operations are primarily concentrated in the United States. Devon Energy boasts a diverse portfolio that prioritizes high-return assets, focusing on the exploration, development, and production of oil and natural gas. The corporation has made significant strides in enhancing its operational efficiency and sustainability practices, aiming to reduce its carbon footprint while optimizing production. Its strategic acquisitions and divestitures over the years have streamlined its asset base, focusing on its core areas where it can leverage technological advancements to improve recovery rates and reduce operating costs. Financially, DVN has demonstrated resilience and adaptability in the volatile energy market, consistently working to deliver value to its shareholders through competitive dividends and robust capital returns. The company's commitment to safety, environmental stewardship, and corporate responsibility further underscores its role as a key player in the energy industry's ongoing evolution.

| Address | 333 West Sheridan Avenue | City | Oklahoma City | State | OK |

|---|---|---|---|---|---|

| Zip | 73102-5015 | Country | United States | Phone | 405 235 3611 |

| Website | https://www.devonenergy.com | Industry | Oil & Gas E&P | Sector | Energy |

| Full Time Employees | 1,800 | CEO Total Pay | 4,119,850 | CEO Name | Mr. Richard E. Muncrief |

| CFO Total Pay | 1,845,566 | CFO Name | Mr. Jeffrey L. Ritenour | COO Total Pay | 1,976,317 |

| COO Name | Mr. Clay M. Gaspar | Capitalization | 26,922,215,424 | Dividend Rate | 2.87 |

| Dividend Yield | 0.0663 | Market Cap | 26,922,215,424 | Volume | 6,948,718 |

| Beta | 2.226 | PE Ratio (Trailing) | 7.158433 | PE Ratio (Forward) | 7.612319 |

| Total Cash | 654,000,000 | Total Debt | 6,481,999,872 | Revenue | 14,929,999,872 |

| Profit Margins | 0.25425 | Operating Margins | 0.30034 | Shares Outstanding | 640,700,032 |

| Book Value | 18.158 | Earnings Growth | -0.507 | Revenue Growth | -0.259 |

| Return on Assets | 0.12971 | Return on Equity | 0.33573 | Current Price | 42.02 |

| Target High Price | 75.0 | Target Mean Price | 53.4 | Target Median Price | 52.0 |

| Sharpe Ratio | -0.9337313543585946 | Sortino Ratio | -13.713555445303676 |

| Treynor Ratio | -0.29782362185390865 | Calmar Ratio | -0.8758006031004457 |

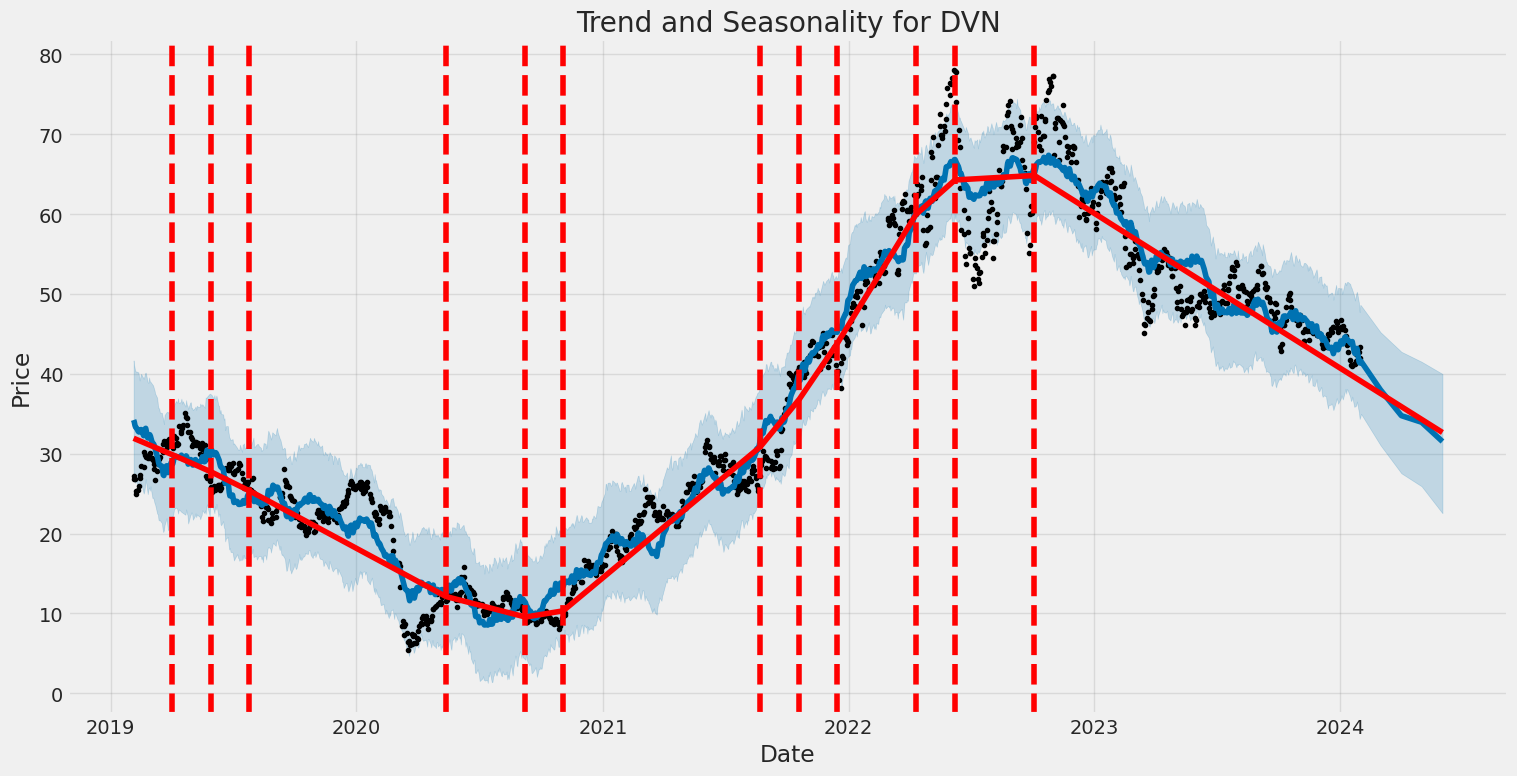

DVN has presented an intriguing mix of financial and technical data in recent months. The Technical Analysis (TA) data for DVN illustrates a volatile trajectory with recent trading activity showing a notable fluctuation in price points. The opening and closing figures, combined with the high and low points, suggest a significant level of market turbulence yet evident buying interest as denoted by periods of higher closing prices. Particularly, the increase in volume on days with positive price movement underlines a building momentum.

The core technical indicators, such as the On-Balance Volume (OBV), show a variation in market participation, which needs cautious interpretation. In more detail, the Parabolic SAR (PSAR) readings indicate that the market may be in a transitional phase; the shift between bullish and bearish territories requires careful analysis to pinpoint the exact market sentiment. Furthermore, the absence of MACD histogram values in the provided data limits a full momentum assessment but suggests a neutral to tentative market undercurrent in the recent trading period.

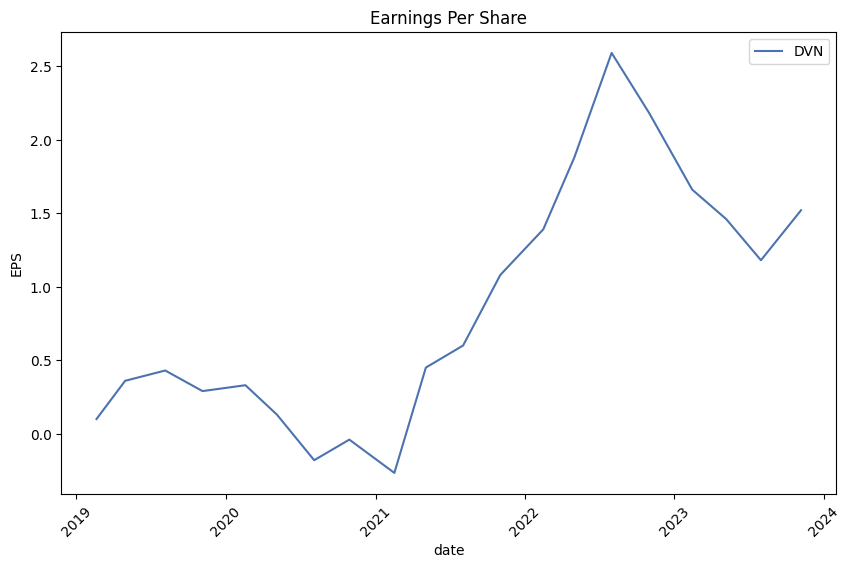

Reviewing the company's financials, the fundamental analysis provides mixed signals. The company shows a robust balance sheet with significant assets over liabilities, indicating financial stability. Moreover, the recent revenue, net income, and EBITDA figures suggest profitability. However, the negative growth estimates highlight potential concerns about the company's future growth prospects in earnings, which could influence market sentiment negatively. The cash flow statement, showcasing strong operating cash flow yet significant investing and financing outflows, delineates a company actively managing its capital structure amidst maintaining operational excellence.

The financial ratios further compound the analysis challenge, with negative scores across Sharpe, Sortino, Treynor, and Calmar ratios, suggesting that the stock's risk-adjusted returns have underperformed relative to the risk-free rate over the past year. These indicators imply that investors have been inadequately compensated for the risks they've taken with DVN stock.

Combining these insights, the outlook for DVN over the next few months remains cautiously optimistic from a technical standpoint, given the observed market momentum and interest. However, the fundamental analysis paints a more tempered view, especially concerning growth prospects and risk-adjusted performance metrics. Investors might see value at current levels, considering the company's financial stability and profitability. Yet, the overarching market sentiment and external economic factors will play significant roles in determining DVN's stock price movement. External factors such as commodity prices, regulatory changes, and macroeconomic conditions could act as catalysts or inhibitors to stock performance.

Hence, while there's potential for positive movement supported by solid fundamentals and active market interest, caution is advised. Investors should closely monitor upcoming earnings releases, analyst revisions, and sector-specific news, which may significantly impact the stock's direction. Market participants are encouraged to weigh the technical indicators alongside fundamental analyses and industry trends to make informed investment decisions.

In our recent analysis of Devon Energy Corporation (DVN), utilizing the principles outlined in "The Little Book That Still Beats the Market," we have computed two critical metrics that gauge the company's financial health and potential for investment returns: the Return on Capital (ROC) and Earnings Yield. Devon Energy Corporation boasts a remarkable Return on Capital (ROC) of 39.12495149398526%, a figure that significantly underscores the company's efficiency in deploying its capital to generate profits. This high ROC indicates that DVN is not only generating robust earnings from its capital investments but is also adept at allocating its financial resources in high-return ventures, a trait that's highly favored in the investment philosophy proposed in the book.

Furthermore, Devon Energy's Earnings Yield stands at an impressive 21.775345073774393%, showcasing the company's ability to generate earnings relative to its share price. This high earnings yield is an attractive trait for investors, suggesting that DVN is currently undervalued or poised for potential growth, offering a lucrative opportunity for those looking to invest in stocks that yield substantial earnings relative to their market price.

These metrics collectively suggest that Devon Energy Corporation represents a compelling investment opportunity, aligning well with the criteria for selection as outlined in "The Little Book That Still Beats the Market." The combination of a high return on capital and an attractive earnings yield highlights DVN's potential as a strong performer in the energy sector, making it a noteworthy consideration for our clients' investment portfolios.

Based on the principles of Benjamin Graham as outlined in "The Intelligent Investor," we can assess Devon Energy Corporation (DVN) against several of his key metrics for stock selection:

1. Margin of Safety: While Graham's principle of margin of safety is not directly calculable from the provided metrics, it emphasizes buying stocks at a price lower than their intrinsic value. This requires a detailed analysis of the company's financials beyond the provided metrics.

2. Diversification: As an individual stock, it's essential to place DVN within a diversified portfolio to follow Graham's advice. An investment in DVN should consider the overall portfolio composition.

3. Analyzing Financial Statements: Without detailed financial statements, we focus on the summary metrics provided. However, Graham would advise a closer examination of the companys balance sheet, cash flow, and income statement.

4. Debt-to-Equity Ratio: DVNs debt-to-equity ratio of 0.5997 signifies moderate leverage. Graham preferred companies with lower debt, but DVN's ratio suggests a balance between using debt for growth and maintaining a manageable level of financial risk.

5. Current and Quick Ratios: These metrics are not provided; however, Graham emphasized their importance for assessing a companys short-term financial health.

6. Earnings Growth: The dividend history indirectly suggests earnings growth, as dividends are typically paid from profits, and increasing dividends may indicate growing earnings. However, a detailed examination of DVNs annual earnings growth is necessary for a thorough analysis.

7. Price-to-Earnings (P/E) Ratio: With a P/E ratio of 19.1, DVN's valuation needs to be assessed against industry peers and the broader market. Graham favored stocks with low P/E ratios, indicating undervaluation. DVNs P/E suggests a moderate valuation, and its attractiveness would depend on the comparative P/E ratios within its industry.

8. Dividend Record: DVN has consistently paid dividends, with an increasing trend over several years. This consistent dividend payment aligns with Grahams preference for companies demonstrating a solid dividend track record, implying financial health and stability.

9. Price-to-Book (P/B) Ratio: DVNs P/B ratio of approximately 1.135 suggests the stock is priced closely to its book value, which Graham would find appealing as it may indicate the stock is not overvalued.

10. Defensive and Enterprising Investor Strategies: DVN appears to cater to elements of both strategies with its dividend history and reasonable debt levels. However, the moderate P/E ratio might require enterprising investors to conduct further analysis to unearth its bargain potential, while defensive investors might appreciate the dividend consistency.

Based on Grahams principles, Devon Energy Corporation shows promise, particularly in its dividend history and P/B ratio. The debt-to-equity ratio is within an acceptable range but warrants careful monitoring. Investors should conduct a thorough analysis beyond these metrics, including comparative industry analysis and deeper financial statement examination, to determine DVN's fit within Graham's value investing framework and its potential role in a diversified portfolio.

| Statistic Name | Statistic Value |

| R-squared | 0.263 |

| Adj. R-squared | 0.263 |

| F-statistic | 448.2 |

| Prob (F-statistic) | 2.73e-85 |

| Log-Likelihood | -3255.7 |

| AIC | 6515 |

| BIC | 6526 |

| Const | 0.0408 |

| Beta | 1.4673 |

| Std Err | 0.069 |

| t | 21.170 |

| P>|t| | 0.000 |

| [0.025 | 1.331 |

| 0.975] | 1.603 |

| Omnibus | 198.203 |

| Prob(Omnibus) | 0.000 |

| Jarque-Bera (JB) | 2947.469 |

| Skew | -0.145 |

| Kurtosis | 10.499 |

| Cond. No. | 1.32 |

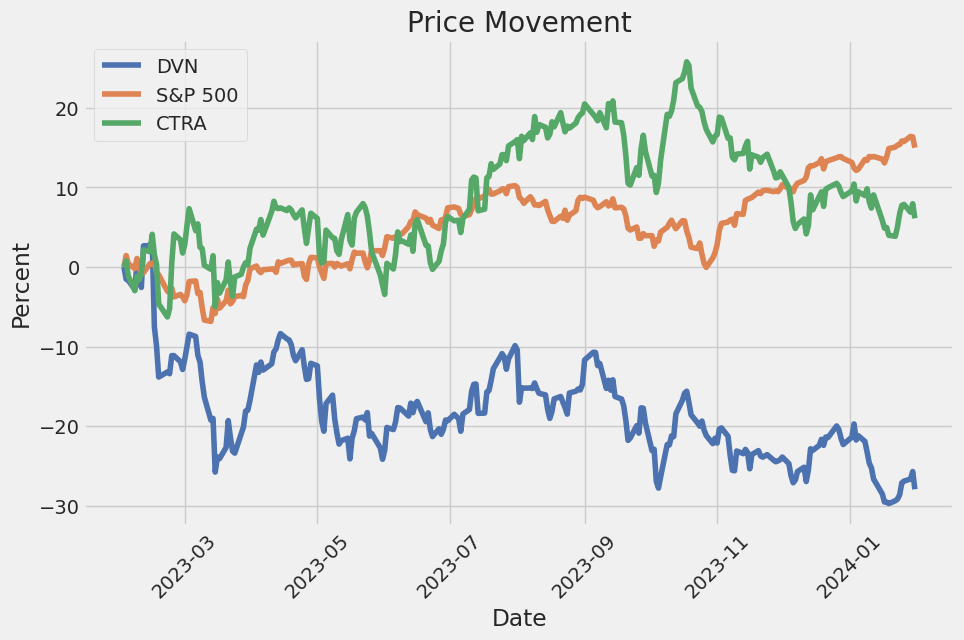

The linear regression analysis of DVN relative to SPY, reflecting the broad market, reveals a significant relationship where DVN exhibits a tendency to move in alignment with the SPY, yet with a distinct scaling factor, as indicated by the beta coefficient of 1.4673. This positive beta value suggests that DVN, on average, experiences a more pronounced change than the SPY for a given market movement, indicative of higher volatility or sensitivity to market trends compared to the general market. Alpha, determined to be 0.0408, although statistically not significant given its p-value, suggests an attempt to capture the average excess return DVN provides over the market baseline, after accounting for market movements. Despite the positive alpha, its confidence interval and lack of statistical significance suggest caution in interpreting this as evidence of systematic outperformance.

The analytical results, including R-squared value of 0.263, indicate that approximately 26.3% of the variability in DVN's returns can be explained through its relationship with SPY's returns. This partial explanation underscores the presence of other factors influencing DVN's performance that are not accounted for by SPY alone. Adjusted R-squared mirroring the R-squared value affirms the minimal impact of using one explanatory variable in this analysis. The F-statistic and its associated p-value firmly reject the null hypothesis, affirming the model's overall significance. Despite these findings, the application of this model should consider the relatively unexplored factors that might affect DVN's return, beyond its correlation with the SPY, to gain a comprehensive understanding of DVN's behavior in the context of market movements.

Devon Energy Q3 Earnings Call Summary

Introduction: Devon Energy held its third-quarter earnings conference call, led by Scott Coody, Vice President of Investor Relations. The call was attended by President and CEO, Rick Muncrief, COO, Clay Gaspar, CFO, Jeff Ritenour, and other senior management members. The team discussed quarterly performance, operational highlights, and provided an outlook for the remaining year and into 2024.

Performance Review and Future Outlook: Devon Energy reported a year-over-year production per share growth rate of 10%, primarily driven by its Delaware Basin asset, accretive acquisitions, and share repurchase activities. Despite facing temporary infrastructure constraints in the Delaware Basin and select well performance issues in the Williston Basin, the company managed to produce volumes within its guidance range. The disciplined capital plan resulted in a significant increase in free cash flow and a 57% surge in dividend payouts. For the fourth quarter, the company anticipates production to revolve around 650,000 barrels of oil equivalent (Boe) per day.

Strategic Focus 2024: Moving into 2024, Devon aims to enhance capital efficiency by integrating learnings from the past year and refining capital allocation. The company plans a capital investment between $3.3 billion to $3.6 billion, aiming to maintain production levels around 650,000 Boe per day with oil production approximating 315,000 barrels per day. A significant portion of the capital spending will be allocated to the Delaware Basin, focusing on multizone Wolfcamp developments in New Mexico and high-grading activities across other assets to improve well productivity by 5% to 10%.

Operational Performance and Capital Efficiency: Devons operational focus in the Delaware Basin has led to strong well productivity, averaging 30-day rates of 3,000 Boe per day, with projects like Bora Bora and CBR 17 delivering outstanding results. By 2024, the company expects to optimize activity in the Delaware Basin further, benefiting from eased infrastructure constraints and improved service costs, which enhances capital efficiency. This strategic capital deployment is anticipated to result in a free cash flow growth of around 20% at $80 WTI pricing, translating into an attractive free cash flow yield of 11%.

Financial Review and Shareholder Returns: Jeff Ritenour highlighted that Devons financial performance in Q3 was in line with expectations, with higher-than-anticipated natural gas price realizations and a beneficial tax rate contributing to earnings. The company focused on strengthening its financial position by paying off maturing debt and increasing cash balances, aiming to further reduce debt in the upcoming years. Devon increased its fixed plus variable dividend by 57% from the previous quarter and has a $3 billion share repurchase authorization, emphasizing its commitment to returning cash to shareholders while maintaining a flexible approach towards capital allocation and potential share buybacks.

In summary, Devon Energy is positioning itself for sustainable growth and enhanced shareholder returns through disciplined capital deployment, operational efficiency improvements, and a strategic focus on its core assets, particularly in the Delaware Basin. The company's robust management of capital and focus on maintaining a strong balance sheet underpin its strategy to navigate macroeconomic uncertainties and capitalize on emerging opportunities.

Devon Energy Corporation (DVN) announced its financial results for both the third quarter of 2023 and the nine-month period ending September 30, 2023. During this period, the company focused on executing its strategic priorities, including moderating production growth, improving capital and operational efficiencies, optimizing reinvestment rates, maintaining low leverage, delivering cash returns to shareholders, and pursuing ESG excellence. Key highlights include a 9% year-over-year increase in oil production, significant progress on a $3.0 billion share repurchase program, debt reduction, robust liquidity, strong operating cash flow, and consistent dividend payments.

For the third quarter of 2023, Devon reported net earnings of $920 million, with a slight increase compared to the second quarter of 2023, primarily attributed to higher production volumes and realized prices for oil, gas, and NGLs, combined with effective management of production expenses. Earnings for the nine-month period ending September 30, 2023, totaled $2.6 billion, a decrease from the previous year, mainly due to lower realized prices for oil, gas, and NGLs, despite an increase in production volumes driven by acquisitions in the Eagle Ford and Williston Basin, new well activity in the Delaware Basin and Anadarko Basin, and effective cost management strategies.

Devon continued to focus on capital discipline and maximizing shareholder value through share repurchases and dividend payments. The company retired $242 million of senior notes in the third quarter, further strengthening its balance sheet. Additionally, Devon maintained a commitment to ESG excellence, aiming to build economic value while adhering to sustainable and responsible operational practices.

The company's strategic focus on maximizing free cash flow, returning cash to shareholders, and maintaining a strong financial position has contributed to its overall performance during the quarter. Devon Energy's emphasis on operational efficiency, disciplined capital spending, and shareholder returns, combined with its focus on core operational areas, positions it well for continued success in the dynamic energy market.

Devon Energy Corporation (NYSE: DVN), an independent exploration and production company, has carved a notable place in the energy sector through strategic operational practices, financial prudence, and a forward-thinking dividend policy. Renowned for its robust presence in key U.S. shale basins such as the Delaware, Eagle Ford, Anadarko, Williston, and Powder River basins, Devon Energy's operational endeavors have been pivotal in driving not only its growth but also in contributing significantly to the U.S. energy landscape's dynamism.

A standout feature of Devon Energy's financial strategy is its unique dividend policy, which has been a subject of interest among investors, particularly those keen on dividends. Unlike the more conventional fixed dividend model, Devon has opted for a fixed-plus-variable dividend approach, which has fundamentally changed how investors perceive income generation potential from energy stocks. This model entails a stable base dividend complemented by a variable component tied directly to the company's operational cash flow, offering a transparent correlation between the companys performance and shareholder returns.

This innovative dividend policy proved especially lucrative for shareholders in 2022, thanks to elevated oil prices, but faced adjustments in 2023 following market volatility. Despite these fluctuations, Devon's approach to dividends reflects a commitment to financial health and shareholder value, making it a distinct option for income-focused investors. Even in a challenging market environment characterized by fluctuating oil and gas prices, Devon has maintained a competitive edge through efficient operational practices and a strategic focus on high-return regions.

Examining Devon's performance and strategies in light of broader market dynamics provides essential insights into its investment appeal. The 2023 downturn in oil prices, which saw a significant drop from their peak in 2022, presented challenges across the sector, affecting companies' cash flows and, by extension, their ability to sustain dividends and pursue growth opportunities. However, Devon's resilience was evident as it navigated these challenging times with strategic capital allocation, focusing on boosting its free cash flow and optimizing operational efficiencies.

Furthermore, Devon's attention to environmental stewardship and sustainable practices adds another layer to its investment appeal. As the energy sector grapples with the transition to a more sustainable and environmentally friendly future, Devon's initiatives around reducing its carbon footprint and enhancing operational efficiencies resonate with a growing demographic of socially conscious investors.

Looking ahead, Devon Energy appears well-positioned to capitalize on the gradual recovery in the energy market. The expected stabilization in oil prices, combined with the company's disciplined capital investment approach and emphasis on shareholder returns, signals a potential for robust performance. Additionally, Devon's strategic operations in key shale regions, characterized by low production costs and significant growth potential, provide a solid foundation for sustainable long-term growth.

In conclusion, Devon Energy Corporation embodies a blend of operational excellence, financial resilience, and strategic foresight. Its innovative dividend policy, coupled with a firm commitment to operational efficiencies and sustainable practices, positions it favorably within the volatile energy sector. For investors seeking to leverage the dynamics of the energy market, Devon presents a compelling narrative of growth, resilience, and shareholder value.

Devon Energy Corporation (DVN) has exhibited notable volatility, as captured in an ARCH model analysis. Specifically, the omega coefficient highlights the base level of volatility unrelated to past shocks at a value of 10.4338, indicating a significant inherent fluctuation in the asset's returns. The alpha[1] value of 0.2176 suggests that past returns do indeed influence future volatility, but this impact is moderate, pointing towards a mix of predictable and unpredictable elements in DVN's price movements.

| Statistic Name | Statistic Value |

|---|---|

| Log-Likelihood | -3370.52 |

| AIC | 6745.04 |

| BIC | 6755.31 |

| No. Observations | 1,256 |

| omega | 10.4338 |

| alpha[1] | 0.2176 |

Analyzing the financial risk associated with a $10,000 investment in Devon Energy Corporation (DVN) over a one-year period involves a sophisticated approach that integrates both volatility modeling and machine learning predictions. This dual-method analysis affords a comprehensive view of the potential risks inherent in equity investments, particularly highlighting how these advanced statistical tools can enhance our understanding and forecasting of investment risk.

Volatility modeling is a crucial first step in this analysis, focusing on the inherent variability in the stock price of Devon Energy Corporation. This model is adept at capturing the dynamic nature of stock market fluctuations, providing a detailed picture of how DVN's stock volatility behaves over time. By analyzing past price movements and volatility patterns, the model offers insights into the level of risk associated with DVN's stock, which is essential for understanding the potential for future price variations.

Parallel to the volatility analysis, machine learning predictions play a pivotal role in forecasting future returns of DVN. The machine learning approach, specifically the use of a model that learns from historical data to predict future outcomes, complements the volatility assessment by providing a forward-looking perspective. This predictive model leverages a wide range of factors, including historical price data and various market indicators, to forecast the likely future returns of DVN stock. The ability of this model to assimilate and analyze complex datasets enables a more nuanced prediction of stock performance, hence offering an additional layer of insight into the risk assessment.

Bringing together the insights from volatility modeling and machine learning predictions, the analysis calculates the Annual Value at Risk (VaR) at a 95% confidence level for a $10,000 investment in Devon Energy Corporation. The VaR, amounting to $361.89, represents the maximum expected loss over a one-year period with a 95% confidence level. This figure is instrumental in quantifying the level of financial risk associated with the investment. Essentially, it suggests that there is a 5% chance that the investment could lose more than $361.89 over the one-year period, providing a clear metric for evaluating the potential financial exposure.

The integration of volatility modeling with machine learning predictions thus offers a multifaceted approach to understanding and forecasting the financial risk linked to equity investments. Through the detailed volatility analysis, investors gain insights into the variability and risk profile of DVN's stock. Concurrently, the predictive modeling extends these insights by forecasting future stock performance, thereby enabling a more informed risk assessment. Together, these methodologies provide a robust framework for assessing the financial risk of investing in Devon Energy Corporation, as exemplified by the calculated VaR. This comprehensive analysis, therefore, stands as a testament to the efficacy of combining advanced statistical techniques in evaluating investment risks.

Similar Companies in Oil & Gas E&P:

Coterra Energy Inc. (CTRA), Diamondback Energy, Inc. (FANG), Report: EOG Resources, Inc. (EOG), EOG Resources, Inc. (EOG), ConocoPhillips (COP), Pioneer Natural Resources Company (PXD), Report: EQT Corporation (EQT), EQT Corporation (EQT), Report: Marathon Oil Corporation (MRO), Marathon Oil Corporation (MRO), Permian Resources Corporation (PR), Occidental Petroleum Corporation (OXY), Report: Apache Corporation (APA), Apache Corporation (APA), Report: Chevron Corporation (CVX), Chevron Corporation (CVX), Exxon Mobil Corporation (XOM)

https://www.fool.com/investing/2023/12/20/should-dividend-growth-investors-buy-the-dip-in-de/

https://www.fool.com/investing/2023/12/21/is-devon-energy-the-best-dividend-stock-for-you/

https://seekingalpha.com/article/4659683-devon-energy-stock-overly-beaten-down-and-unappreciated

https://www.fool.com/investing/2023/12/29/3-things-you-need-to-know-if-you-buy-devon-energy/

https://www.fool.com/investing/2024/01/04/3-dividend-stocks-to-buy-hand-over-fist-in-january/

https://www.fool.com/investing/2024/01/11/why-devon-energy-stock-tumbled-264-in-2023/

https://www.fool.com/investing/2024/01/13/will-devon-energy-have-enough-fuel-to-increase-its/

https://www.fool.com/investing/2024/01/15/stocks-in-trillion-industry-help-make-you-rich/

https://www.fool.com/investing/2024/01/20/2-ultra-high-yield-energy-stocks-to-buy-hand-over/

https://www.fool.com/investing/2024/01/21/bull-market-buys-3-dividend-stocks-to-own-for-the/

https://www.fool.com/investing/2024/01/21/these-3-great-value-stocks-are-set-to-soar-in-2024/

https://seekingalpha.com/article/4664243-devon-energy-vs-diamondback-energy-a-battle-of-the-permian

https://finance.yahoo.com/news/top-25-hawaii-retirement-alternatives-210450696.html

https://finance.yahoo.com/m/e1901ea9-6548-3a2f-b069-f6ce9b116219/2-ultra-high-yield-dividend.html

https://www.sec.gov/Archives/edgar/data/1090012/000095017023060838/dvn-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: aBtjNP

Cost: $1.33390

https://reports.tinycomputers.io/DVN/DVN-2024-01-31.html Home