Edison International (ticker: EIX)

2024-01-08

Edison International (EIX) is a public utility holding company primarily engaged through its subsidiaries in the business of generating and distributing electric power. Based in Rosemead, California, Edison International is the parent company of Southern California Edison (SCE), one of the largest electric utilities in California, serving the industrial, commercial, residential, and agricultural sectors. Approximately 14 million people within a 50,000 square-mile area of central, coastal, and southern California receive their electricity from SCE. Edison International also invests in energy services and technologies, including renewable energy resources such as solar and wind, that help to meet California's ambitious environmental targets. The company's stock is traded on the New York Stock Exchange under the ticker symbol EIX. Financially, EIX's performance is influenced by regulatory decisions, the stability of the Californian economy, and consumer demand, among other factors. As of the cutoff of this report, Edison International continues to navigate the challenges and opportunities presented by the transitioning energy landscape, policy shifts, and extreme weather conditions.

Edison International (EIX) is a public utility holding company primarily engaged through its subsidiaries in the business of generating and distributing electric power. Based in Rosemead, California, Edison International is the parent company of Southern California Edison (SCE), one of the largest electric utilities in California, serving the industrial, commercial, residential, and agricultural sectors. Approximately 14 million people within a 50,000 square-mile area of central, coastal, and southern California receive their electricity from SCE. Edison International also invests in energy services and technologies, including renewable energy resources such as solar and wind, that help to meet California's ambitious environmental targets. The company's stock is traded on the New York Stock Exchange under the ticker symbol EIX. Financially, EIX's performance is influenced by regulatory decisions, the stability of the Californian economy, and consumer demand, among other factors. As of the cutoff of this report, Edison International continues to navigate the challenges and opportunities presented by the transitioning energy landscape, policy shifts, and extreme weather conditions.

| Full Time Employees | 13,388 | Previous Close | 72.57 | Open | 72.52 |

|---|---|---|---|---|---|

| Day Low | 72.22 | Day High | 73.25 | Dividend Rate | 3.12 |

| Dividend Yield | 4.3% | Payout Ratio | 91.9% | Five Year Avg Dividend Yield | 4.2% |

| Beta | 0.953 | Trailing PE | 22.79 | Forward PE | 14.32 |

| Volume | 1,154,460 | Average Volume | 2,182,204 | Average Volume 10 Days | 1,810,030 |

| Market Cap | 28,065,742,848 | Fifty Two Week Low | 58.82 | Fifty Two Week High | 74.92 |

| Price to Sales Trailing 12 Months | 1.686 | Fifty Day Average | 66.9962 | Two Hundred Day Average | 68.6407 |

| Trailing Annual Dividend Rate | 2.95 | Trailing Annual Dividend Yield | 4.065% | Enterprise Value | 66,036,580,352 |

| Profit Margins | 7.412% | Float Shares | 383,008,703 | Shares Outstanding | 383,568,992 |

| Shares Short | 4,305,647 | Held Percent Insiders | 0.119% | Held Percent Institutions | 91.45% |

| Short Ratio | 1.85 | Book Value | 35.696 | Price to Book | 2.05 |

| Net Income to Common | 1,234,000,000 | Trailing EPS | 3.21 | Forward EPS | 5.11 |

| Peg Ratio | 3.18 | Enterprise to Revenue | 3.967 | Enterprise to Ebitda | 11.315 |

| Total Cash | 446,000,000 | Total Cash Per Share | 1.163 | Ebitda | 5,836,000,256 |

| Total Debt | 34,767,998,976 | Quick Ratio | 0.414 | Current Ratio | 0.801 |

| Total Revenue | 16,647,999,488 | Debt to Equity | 197.871 | Revenue Per Share | 43.524 |

| Return on Assets | 2.781% | Return on Equity | 7.079% | Gross Profits | 9,414,000,000 |

| Free Cashflow | -2,517,499,904 | Operating Cashflow | 3,649,999,872 | Revenue Growth | -10.1% |

| Gross Margins | 59.076% | Ebitda Margins | 35.055% | Operating Margins | 22.416% |

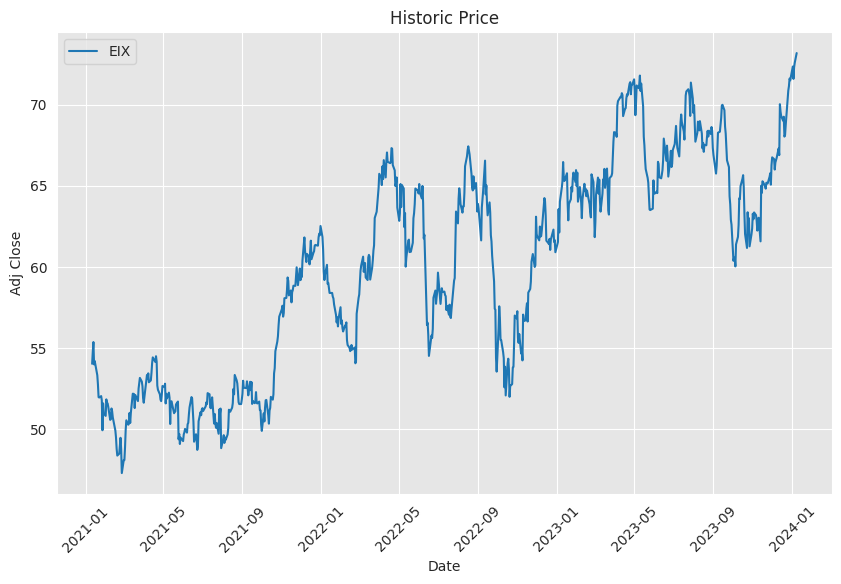

Technical Analysis Overview:

Based on the latest stock price activity and technical indicators for EIX (Edison International), we have observed the following:

- The stock has recently increased, with a closing price higher than the opening on the last trading day.

- The Parabolic SAR (PSAR) indicates an uptrend, as the PSAR values are below the price.

- The On-Balance Volume (OBV) in millions shows a positive trend, suggesting that volume is confirming the price movement.

- The Moving Average Convergence Divergence (MACD) histogram values are not provided for the majority of dates but show positive values in recent days, indicating bullish momentum.

Fundamental Analysis Summary:

A review of Edison International's financials reveals:

- Sustained revenue growth over the last three years.

- Gross and EBITDA margins have been stable, which is a positive indicator of the company's profitability.

- The company's Net Income has seen slight fluctuations but remains robust.

- An increasing net debt position over the past three years may be a concern, indicating higher leverage.

- Operating Cash Flow has improved significantly in the most recent period, which is a strong fundamental factor.

Balance Sheet Insights:

The balance sheet data for EIX suggests:

- A stable number of shares issued over the past three years, which implies a lack of significant dilution for existing shareholders.

- A modest increase in total debt, which could be seen as the company investing in growth but should be monitored for sustainability.

- A consistent increase in tangible book value, indicating the company is growing its intrinsic value.

- Cash and equivalents have increased considerably, which should help the company in managing short-term obligations and potential investments.

Cash Flow Analysis:

From the cash flow statement, the following observations are made:

- Cash from operations has been healthy, ensuring that the company is generating adequate cash from its core business.

- Financing activities have provided additional liquidity, primarily through the issuance of debt.

- The increase in End Cash Position is positive, providing the company with a buffer for operational needs and strategic maneuvers.

Considering all the technical and fundamental indicators, the forecast for EIX over the next few months is cautiously optimistic. The positive trend in technical indicators, such as the PSAR and OBV, align with a fundamentally sound financial position shown by stable margins and an improved cash position.

However, investors should remain watchful of the increasing debt levels, which could impact the company's financial flexibility and interest obligations in the longer term. Also, the recent improvement in operating cash flow needs to be sustained in subsequent periods to confirm a positive trend.

The most recent technical data suggests that the bullish momentum could continue, leading to potential further increases in the stock price in the short to medium term. The positive MACD histogram values support this perspective, indicating an upward price momentum.

As TA experts, we find that while short-term price movements favor a bullish outlook, it is crucial to keep an eye on the evolving fundamental situation, notably the company's debt management strategy and its ability to maintain or improve net income margins and cash flows. The interplay between improving operational efficiencies and servicing the increasing debt will be critical factors influencing EIX's stock price trajectory in the upcoming months.

| Statistic Name | Statistic Value |

| Alpha (Intercept) | -0.000883 |

| Beta (Slope) | 0.8099 |

| R-squared | 0.328 |

| Adj. R-squared | 0.327 |

| F-statistic | 612.1 |

| Prob (F-statistic) | 2.26e-110 |

| Log-Likelihood | -2314.6 |

| No. Observations | 1,256 |

| AIC | 4,633 |

| BIC | 4,644 |

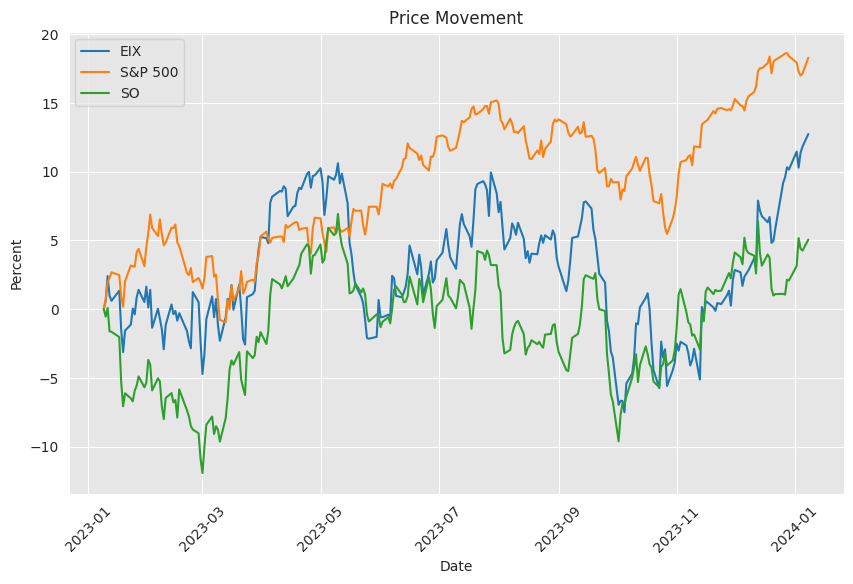

The linear regression model between EIX (Edison International) and SPY (an ETF that tracks the S&P 500 index) for the time period ending today indicates a positive relationship with an R-squared value of 0.328, which suggests that approximately 32.8% of the variability in EIXs returns can be explained by the variability in SPYs returns. The beta coefficient of 0.8099 implies that for every one unit change in SPY, EIX is expected to change by approximately 0.8099 units. While this indicates that EIX moves in the same direction as SPY, it does so to a lesser extent than the market overall.

The alpha value in the regression, which measures the intercept or the expected value of EIX when SPY is zero, is -0.000883. Since alpha is essentially the return of the stock independent of the market, a negative value suggests that EIX underperforms the market on a risk-adjusted basis. However, the alpha here is quite small and not statistically significant at traditional levels (p-value of the alpha is 0.984), which means we cannot reliably conclude that the intercept is different from zero and there is no substantial evidence of abnormal returns over the period in question.

Summary of Edison International's (EIX) Third Quarter 2023 Earnings Call

-

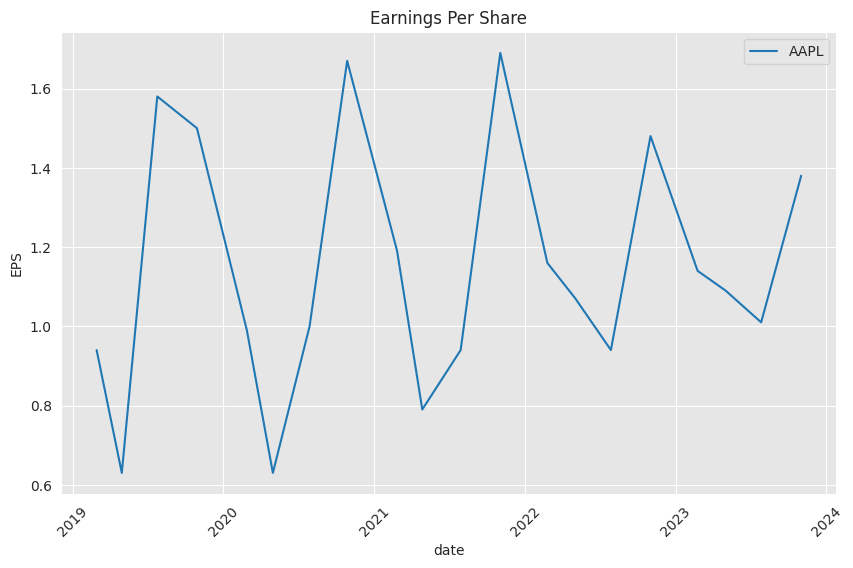

Performance and Guidance Confirmation: Edison International reported core earnings per share (EPS) of $1.38 for the third quarter and $3.48 for the first nine months of the year. The company reaffirmed its 2023 core EPS guidance range of $4.55 to $4.85 and expressed confidence in achieving this target. They also maintained their commitment to delivering 5 to 7% core EPS growth through 2025, extending this growth expectation into 2028.

-

Update on Legacy Wildfires: Edison has increased the best estimate for wildfire claim settlements by $475 million, largely due to higher-than-anticipated settlement levels and better-informed projections about claim types. Two-thirds of this increase is attributed to Woolsey fires. The company emphasized the importance of resolving lawsuits in a prudent manner for eventual cost recovery, noting that a deadline for claimants to notify complete claims by February 2024 will bring greater clarity on the matter.

-

Wildfire Mitigation and Regulatory Updates: SCE has made notable progress in its wildfire mitigation strategies, resulting in an 85% reduction in catastrophic wildfire risk since 2018. Methods include grid hardening and replacing over 5,200 miles of distribution lines with covered conductor, among other measures. SCE has also filed for cost recovery of $2.4 billion for wildfire-related expenses, presented a settlement for 2024 revenue requirements, and anticipates a potential 70-basis point increase to its return on equity starting January 2024, based on a cost of capital mechanism trigger.

-

Grid Expansion and Corporate Developments: An updated analysis, "Countdown to 2045," projects an 80% increase in electrical demand by 2045 driven by electrification of vehicles and buildings. Edison is planning for significant grid expansion to accommodate this surge in demand. Financially, Edison is also looking at monetizing contracts with wireless providers on its transmission infrastructure and announcing a tender offer to repurchase outstanding preferred stock, aiming to create value and manage its finances more efficiently.

During the call, EIX dove into further specifics on initiatives, such as capital investment projections, cost efficiencies, and EV adoption's impact on operational planning. They also discussed the progress on the electric vehicle infrastructure buildout, customer service improvements, and financial strategies for the future. The Q&A session covered additional topics like the implications of PG&E's rate case difficulties, the tender offer procedure for preferred stock, and the prospect of EV demand variations. The Edison team reaffirmed their strategic focus on regulatory commitments, operational excellence, and long-term investments to support California's transition to a carbon-free economy.

In the third quarter of 2023, Edison International (EIX) reported a notable increase in its earnings, with consolidated net income available for common stock rising to $239 million, a significant improvement from the prior year's comparative period loss of $80 million. This increase was largely driven by the performance of Southern California Edison Company (SCE), EIX's primary subsidiary, which supplies and delivers electricity to a substantial portion of Southern California.

SCE's earnings activities, which include revenues from regulated rates intended to cover the company's costs and provide a return on investment, were affected by various factors during the quarter. Despite a decrease in operating revenue due to factors such as lower customer service platform (CSRP) revenue requirements, this was partially offset by an escalation mechanism set forth in the 2021 General Rate Case (GRC) decision. Operational expenses were lower due to factors including reduced uncollectible expenses and the absence of certain charges incurred in the previous year regarding SCE's Upstream Lighting Program. These charges were related to disallowed costs and fines determined by the California Public Utilities Commission (CPUC).

SCE's earnings were also impacted by wildfire-related claims, which decreased for the quarter year-over-year, and higher interest expenses due to increased rates on long-term debt and balancing account overcollections. Other income rose due to a higher interest rate applied to balancing account undercollections.

The company's cost-recovery activities, which include authorized balancing accounts for specific costs and non-bypassable rates collected for SCE Recovery Funding LLC, saw lower purchased power and fuel costs. This decrease corresponded with lower purchased power volumes, lower power and gas prices, and reduced capacity costs, slightly moderated by hedging activities.

SCE's capital expenditures for the first nine months of 2023 amounted to $3.9 billion, a slight decrease from the same period in the previous year. The company has forecasted a total capital program of $43.3 billion for the period from 2023 to 2028, with significant investments expected in distribution, transmission, and generation, including wildfire mitigation expenditures.

A notable development in SCE's regulatory environment is the approval of its expanded use of self-insurance for wildfire-related claims. The program, funded through CPUC-jurisdictional rates, reduces current revenue requirements and provides for an adjustment mechanism to increase rates in subsequent years as needed for full recovery of amounts accrued, subject to a maximum shareholder contribution for costs exceeding certain thresholds.

In the third quarter of 2023, SCE filed an application for a 2025 General Rate Case with the CPUC, in which it seeks authorization for a 2025 revenue requirement of approximately $10.3 billion, representing a 23% increase over the anticipated 2024 revenue requirements. This increase is aimed at covering expected costs related to infrastructure replacement, grid readiness for increased electrification, and safety investments. Additionally, an all-party settlement has been filed in Track 4, and if approved, will authorize an $8.4 billion revenue requirement for 2024.

Edison International Parent and Other incurred higher operating losses in both the three and nine-month periods ended September 30, 2023, primarily because of increased interest expenses.

In summary, Edison International's performance in the third quarter of 2023 shows a substantial recovery from losses in the prior year, bolstered by SCE's regulated revenue streams, notwithstanding ongoing wildfire-related claims costs. The company's multi-year capital program underscores its commitment to infrastructure enhancement, safety, and operational efficiency, consistent with California's clean energy and decarbonization goals.

Edison International, one of the largest electric utility holding companies in the United States, has recently announced an increase in its common stock dividend. The decision marks a significant milestone for the company and its stakeholders, revealing a 5.8% rise from the previous dividend rate. With the new annual dividend rate set at $3.12 per share, the organization's financial acumen and performance shine through, as this reflects the 20th consecutive year of annual dividend increases.

This steady incline in dividend payouts demonstrates Edison International's commitment to delivering value to its shareholders. It is also reflective of a broader strategy to ensure a competitive total return, which combines both capital appreciation and dividend income. Pedro J. Pizarro, the president and CEO of Edison International, underscored the dividend increase as a token of confidence in the company's growth prospects and an assurance of an attractive yield for shareholders.

The company's robust financial status further translates into rewards for investors across different equity classes, as evident from the declarations such as the semiannual dividend on Southern California Edison's Series E preference stock. This gesture reiterates the financial health and capability of the company to value all forms of investment.

Rooted in California, Edison International's growth narrative pivots around its subsidiaries. Southern California Edison serves millions of individuals with electricity, playing a significant role in the company's scale and reach. Edison Energy LLC further complements the companys stature by offering integrated sustainability and energy solutions to a diverse range of clients, showcasing Edison International's versatility in the energy sector.

In terms of community impact, Edison International has taken active stances such as combating food insecurity through employee volunteerism. The packing of thousands of food boxes in partnership with the Community Action Partnership of Orange County is one such initiative that underscores the company's commitment to social welfare. Edison International extends its philanthropy to educational and workforce development, supporting the Kindergarten to College STEM program to prepare upcoming generations for a technology-driven future.

When it comes to financial transparency and stakeholder communication, the company's regular updates, including performance and strategic decisions, are an embodiment of its responsible corporate conduct. Notably, these updates often have a positive effect on Edison International's stock price (NYSE symbol: EIX), as was evidenced by the favorable market response to the dividend increase announcement.

The disclosure of financial performances is a critical moment for utility companies like Edison International, and their third-quarter earnings report was much anticipated. Despite fluctuating weather conditions impacting energy demand, Edison International's revenues and earnings results have been a focal point for analysts and investors alike.

Strategic rate cases, wildfire mitigation expenses, and varying operational costs are factors that impact the company's financial outcomes and will continue to do so in the foreseeable future. Notably, the anticipated revenue increase and rate case effects, along with the challenges such as heightened wildfire-related expenses, have nuanced interplay in the company's profitability dynamics.

At the international level, Edison International showcased its commitment to green energy and environmental initiatives at significant gatherings such as the COP28 climate summit. The company took this platform to emphasize the importance of efficient infrastructure for emissions reduction and called for reforms in siting and permitting regulations. This advocacy aligns with tangible commitments such as tripling global renewable energy capacity by 2030 and aiming to achieve net-zero greenhouse gas emissions by 2050.

The company's financial resilience is also discernible in its cash position, which saw substantial growth by the third quarter of 2023. Cash inflow from operations also saw an uptick, demonstrating the company's capability to generate funds that can support its shareholder-centric activities such as the continued increase in dividends.

Prospects for future dividend hikes appear strong, underscored by Edison International's sound financial management and projections of 5-7% core earnings per share growth. Approval of rate cases by the California Public Utilities Commission (CPUC) could further strengthen this outlook, adding to the company's dividend distribution capacity.

While Edison International thrives in fostering shareholder value through dividends, it is not alone. The broader utilities sector is also home to companies that prioritize increasing returns to investors, as shown by similar dividend growth activities by peers such as Atmos Energy, Entergy Corp., and American Electric Power.

Edison International stands out as a dividend achiever, having increased its dividend for over two decades. The forward yield predictions and a stable track record of dividend growth highlight the company's reliability and shareholders' returns commitment. However, the payout ratio, as of the end of September 2023, suggests a cautious approach, ensuring that dividend distribution does not compromise the companys ability to invest in future growth or mitigate financial downturns.

Shifting focus from the company's financials to efforts in promoting sustainability, Edison International has taken proactive steps to encourage its Southern California customers to adopt greener practices. Levying actions such as promoting off-peak electricity consumption and energy-efficient appliance upgrades, the company is not only impacting individual behavior but is also working on achieving broader environmental goals such as California's 'Countdown to 2045' targets for carbon neutrality.

Investment evaluations of utility companies necessitate a careful study of valuation metrics and earnings estimate revisions. In a comparison between E.ON SE (EONGY) and Edison International (EIX), the financial ratios and Zacks Rank paint different investment attractiveness pictures. EONGY's favorable P/E, PEG ratio, and Value grade indicate a potentially better investment value, which might attract investors looking for undervalued opportunities within the electric power sector.

Another utility company, AES Corporation, has also demonstrated commitment to shareholder value through a dividend rate increase. Signaling financial stability and a promise of continued or enhanced future dividend distributions, AESs 4% hike parallels the historic consistency and strength of dividend provisions in the utility industry, including those well-established by Edison International.

Lastly, Edison International's stewardship extends beyond dividends into operational performance. Their second-quarter financial results for 2023 illustrated a continued ability to surpass analyst expectations in earnings per share. However, revenue figures pointed towards the complexity of market dynamics and its impacts on the company's financial health. Their operational efficiency and prompt responsiveness to shifting economic conditions are perpetually significant to their financial narratives, as reflected in their consistent EPS guidance for the fiscal year.

Similar Companies in Electric Utilities:

Report: The Southern Company (SO), The Southern Company (SO), Report: Dominion Energy, Inc. (D), Dominion Energy, Inc. (D), Report: Duke Energy Corporation (DUK), Duke Energy Corporation (DUK), Report: NextEra Energy, Inc. (NEE), NextEra Energy, Inc. (NEE), Exelon Corporation (EXC), Pacific Gas & Electric Co. (PCG), Report: American Electric Power Company, Inc. (AEP), American Electric Power Company, Inc. (AEP), FirstEnergy Corp. (FE), Public Service Enterprise Group Inc. (PEG), Consolidated Edison, Inc. (ED)

https://finance.yahoo.com/news/edison-international-eix-announces-dividend-113900774.html

https://finance.yahoo.com/news/cop28-moving-promises-progress-173000315.html

https://finance.yahoo.com/news/edison-internationals-dividend-analysis-100939528.html

https://finance.yahoo.com/news/edison-international-raises-common-stock-214200995.html

https://finance.yahoo.com/news/fighting-food-insecurity-one-box-142000295.html

https://www.zacks.com/stock/news/2160170/eongy-vs-eix-which-stock-should-value-investors-buy-now

https://www.zacks.com/stock/news/2196640/aes-board-rewards-shareholders-with-4-dividend-hike

https://finance.yahoo.com/news/10-years-resolutions-greener-2024-210000456.html

https://www.zacks.com/stock/news/2129446/edison-international-eix-q2-earnings-top-revenues-fall-y-y

https://www.sec.gov/Archives/edgar/data/0000827052/000082705223000084/eix-20230930x10q.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: bDZDn7

https://reports.tinycomputers.io/EIX/EIX-2024-01-08.html Home