Diamondback Energy, Inc. (ticker: FANG)

2024-01-31

Diamondback Energy, Inc. (ticker: FANG) is a prominent player in the oil and natural gas sector, primarily focusing on the exploration, development, and production of unconventional, onshore oil and natural gas reserves in the United States. With its operational base situated in the Permian Basin of West Texas, one of the most prolific hydrocarbon-producing regions in North America, Diamondback has established a reputation for its efficient production techniques and strategic acreage acquisitions. The company's growth strategy emphasizes organic drilling opportunities within its extensive leasehold portfolio, alongside a disciplined approach to capital expenditure and an unwavering commitment to delivering shareholder value. Financially, Diamondback Energy has consistently demonstrated robust performance, marked by a strong balance sheet, commendable revenue growth, and a commitment to returning value to shareholders through dividends and share repurchases. As of the last reports, Diamondback continues to optimize its asset portfolio, focusing on operational excellence and sustainability initiatives to mitigate environmental impacts and ensure compliance with evolving regulations.

Diamondback Energy, Inc. (ticker: FANG) is a prominent player in the oil and natural gas sector, primarily focusing on the exploration, development, and production of unconventional, onshore oil and natural gas reserves in the United States. With its operational base situated in the Permian Basin of West Texas, one of the most prolific hydrocarbon-producing regions in North America, Diamondback has established a reputation for its efficient production techniques and strategic acreage acquisitions. The company's growth strategy emphasizes organic drilling opportunities within its extensive leasehold portfolio, alongside a disciplined approach to capital expenditure and an unwavering commitment to delivering shareholder value. Financially, Diamondback Energy has consistently demonstrated robust performance, marked by a strong balance sheet, commendable revenue growth, and a commitment to returning value to shareholders through dividends and share repurchases. As of the last reports, Diamondback continues to optimize its asset portfolio, focusing on operational excellence and sustainability initiatives to mitigate environmental impacts and ensure compliance with evolving regulations.

| Full Time Employees | 972 | CEO & Chairman of the Board | Mr. Travis D. Stice | CEO Total Pay | 3,518,019 |

| Previous Close | 156.93 | Open | 156.81 | Day Low | 153.50 |

| Day High | 156.81 | Dividend Rate | 7.99 | Dividend Yield | 0.0509 |

| Payout Ratio | 0.3902 | Five Year Avg Dividend Yield | 3.05 | Beta | 1.87 |

| Volume | 1,635,350 | Market Cap | 27,517,153,280 | 52 Week Low | 119.01 |

| 52 Week High | 171.4 | Price to Sales Trailing 12 Months | 3.5534 | Enterprise Value | 33,855,139,840 |

| Profit Margins | 0.41193 | Shares Outstanding | 178,984,992 | Shares Short | 5,819,101 |

| Held Percent Insiders | 0.00555 | Held Percent Institutions | 0.94865 | Book Value | 91.044 |

| Price to Book | 1.6886 | Net Income to Common | 3,164,999,936 | Trailing EPS | 17.62 |

| Forward EPS | 18.46 | PEG Ratio | 4.34 | Enterprise to Revenue | 4.372 |

| Total Cash | 827,000,000 | Total Debt | 6,461,000,192 | Current Ratio | 0.895 |

| Total Revenue | 7,744,000,000 | Debt to Equity | 38.042 | Return on Assets | 0.10664 |

| Return on Equity | 0.21261 | Gross Margins | 0.85615 | EBITDA Margins | 0.7837 |

| Statistic Name | 0.43905307052944215 | Statistic Value | 6.989881267279047 |

| Statistic Name | 0.16466766837163996 | Statistic Value | 0.8073289391510792 |

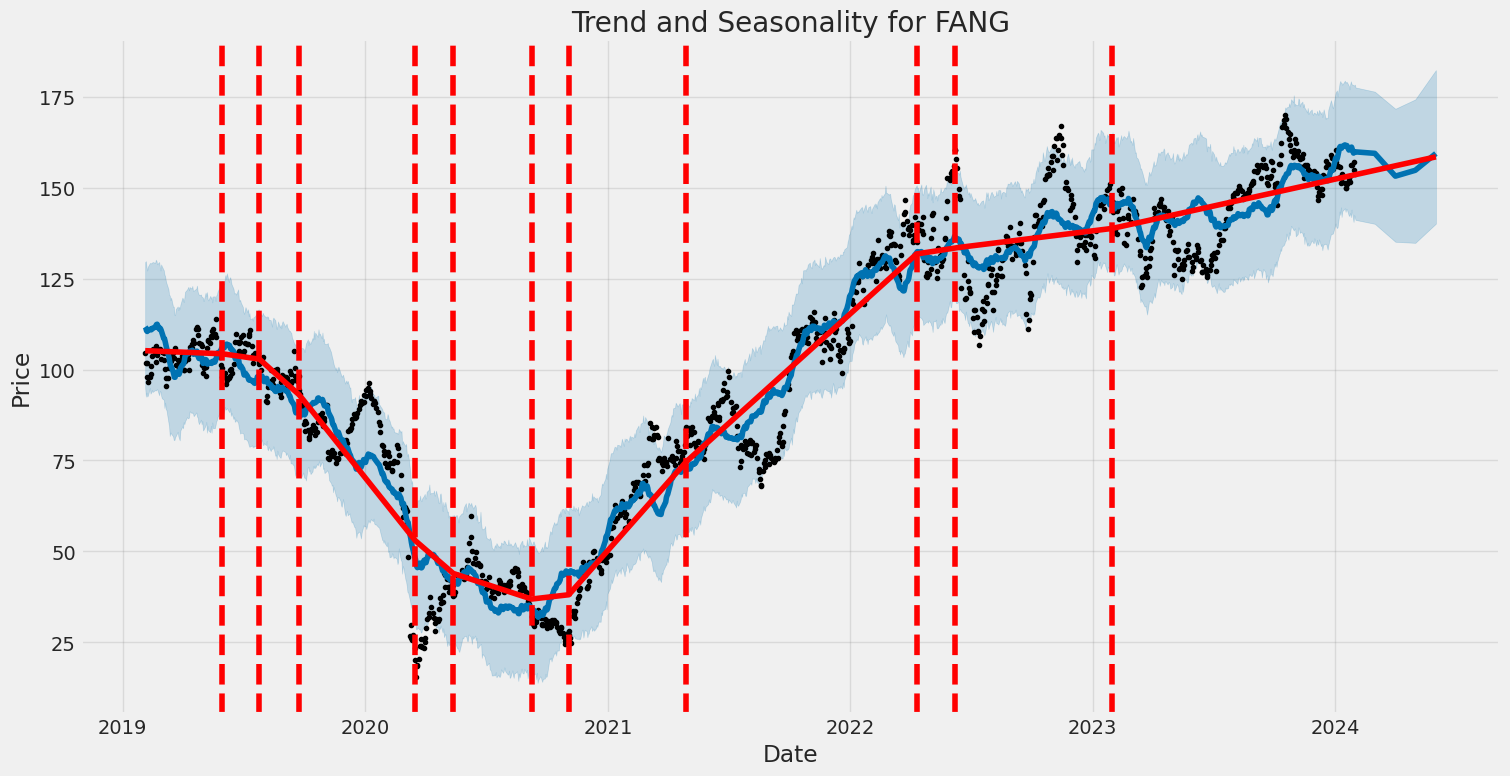

Analyzing the provided data on FANG, it's clear that an in-depth examination integrating technical analysis, fundamentals, and market ratios is crucial for an accurate forecast. Upon reviewing technical indicators, fundamentals, balance sheets, analysts' expectations, and risk-adjusted performance measures, a comprehensive outlook can be constructed.

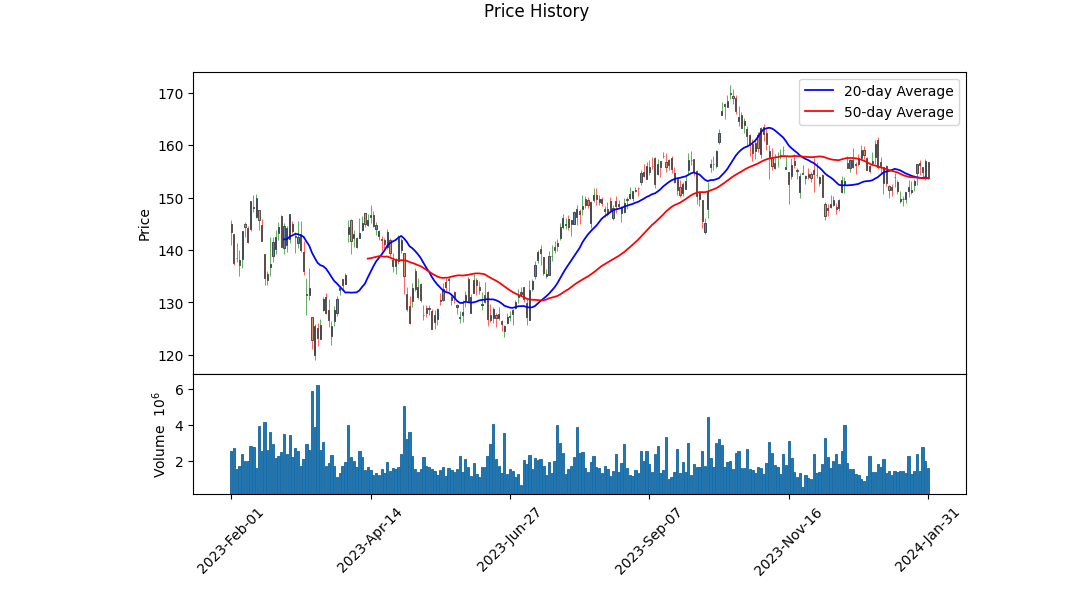

The technical indicators reveal a positive trajectory, with the stock experiencing a steady increase in closing prices over the observed period. The On Balance Volume (OBV) indicates positive momentum, suggesting an accumulation phase that could lead to higher prices. The Parabolic SAR (PSAR) and Moving Average Convergence Divergence (MACD) data points towards a bullish trend, albeit specific values for the MACD histogram were not provided, its inferred direction is positive. This upward movement is particularly notable in the latter part of the period, suggesting sustained buying interest.

Fundamental analysis adds depth to this outlook. The financial health of FANG appears strong, with substantial increases in Net Income, EBITDA, and Operating Income over the reviewed fiscal years. This solid financial performance aligns with the technical indicators that suggest stock price appreciation. However, it's worth noting the reduction in Cash and Cash Equivalents over the last year, which may warrant closer inspection. The diversity in revenue, alongside consistent growth, lays a firm foundation for ongoing stock stability and potential growth.

Risk-adjusted performance measures, such as the Sharpe, Sortino, Treynor, and Calmar ratios, provide a mixed outlook. The Sortino ratio, which focuses on downside deviation, is notably high, indicating that the stock's returns' positive performance significantly outweighs its risks when measured against its downside deviation. This is a favorable signal for risk-averse investors. Conversely, the Sharpe and Treynor ratios suggest modest risk-adjusted returns, pointing to inherent risks that must be considered. The Calmar ratio, which indicates the return per unit of downside risk, further solidifies the view that FANG has managed to navigate market volatilities efficiently.

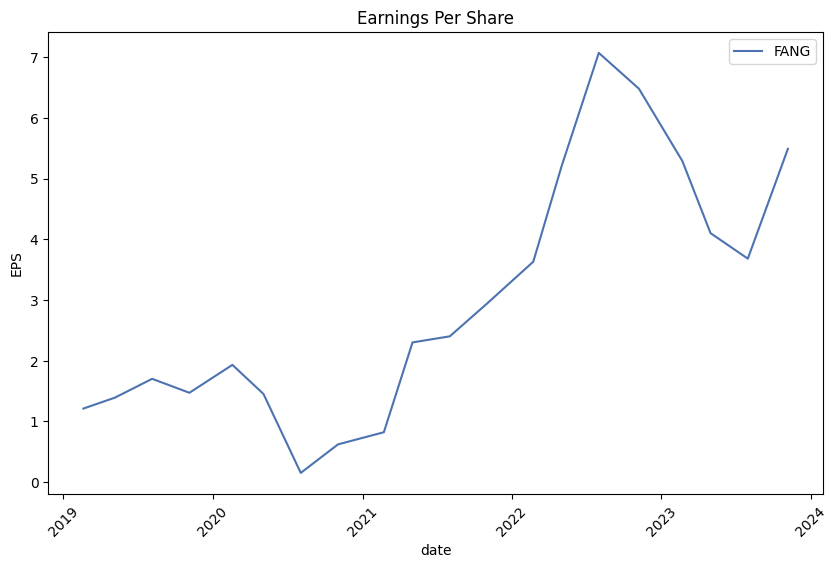

Analysts' expectations and growth estimates paint a less optimistic picture than one might hope for, highlighting a potential decline in EPS for the current year, followed by a modest recovery. The downgrade in EPS expectations over time and a projected decline in year-over-year growth could signal caution among investors. Yet, this sentiment is somewhat mitigated by the overall positive revision trends and the company's strong historical growth.

Taking the balance sheet into account, FANG's solid assets base, marked by a tangible book value increase, positions it well for leveraging opportunities or weathering potential downturns. The notable reduction in cash reserves and increase in debt levels are concerns that must be balanced against the company's ability to generate significant operating cash flows.

In conclusion, FANG presents an intriguing investment opportunity characterized by strong technical and fundamental markers interspersed with cautionary signals from risk-adjusted ratios and analysts' expectations. The stock appears poised for continued growth, underpinned by solid financial fundamentals and positive market momentum, albeit with an advised awareness of its potential risks and volatility. Investors and stakeholders should pay close attention to future financial disclosures, market trends, and analysts' revised estimates to refine their expectations and investment decisions in FANG.

In our analysis of Diamondback Energy, Inc. (FANG), we have meticulously calculated key financial metrics to assess its investment appeal, focusing on Return on Capital (ROC) and Earnings Yield. With a Return on Capital (ROC) of 26.57%, Diamondback Energy demonstrates a robust capacity in generating profit from its invested capital, a signal of operational efficiency and a competitive advantage in its industry. This high ROC indicates that the company is utilizing its capital effectively to generate earnings, a critical factor for investors seeking firms with efficient growth capabilities.

Additionally, the Earnings Yield for Diamondback Energy stands at 16.01%, providing an attractive proposition compared to traditional fixed-income investments. This metric is particularly useful for evaluating the relative value of stocks, showing that for every dollar invested in FANG, investors can expect to earn roughly $0.16 in earnings. This high earnings yield suggests that the stock is undervalued or that the company is in a strong financial position to deliver profits to its shareholders.

In summary, both the high return on capital and the substantial earnings yield position Diamondback Energy, Inc. as an attractive investment opportunity, signalling its potential for both efficient capital use and value generation for investors.

| Statistic Name | Statistic Value |

| R-squared | 0.204 |

| Adj. R-squared | 0.203 |

| F-statistic | 321.1 |

| Prob (F-statistic) | 4.16e-64 |

| Log-Likelihood | -3309.0 |

| No. Observations | 1256 |

| AIC | 6622 |

| BIC | 6632 |

| coef (const) | 0.0415 |

| coef | 1.2958 |

| std err | 0.072 |

| t | 17.919 |

| P>|t| | 0.000 |

| [0.025 | 1.154 |

| 0.975] | 1.438 |

| Omnibus | 303.012 |

| Prob(Omnibus) | 0.000 |

| Skew | -0.176 |

| Kurtosis | 19.421 |

| Cond. No. | 1.32 |

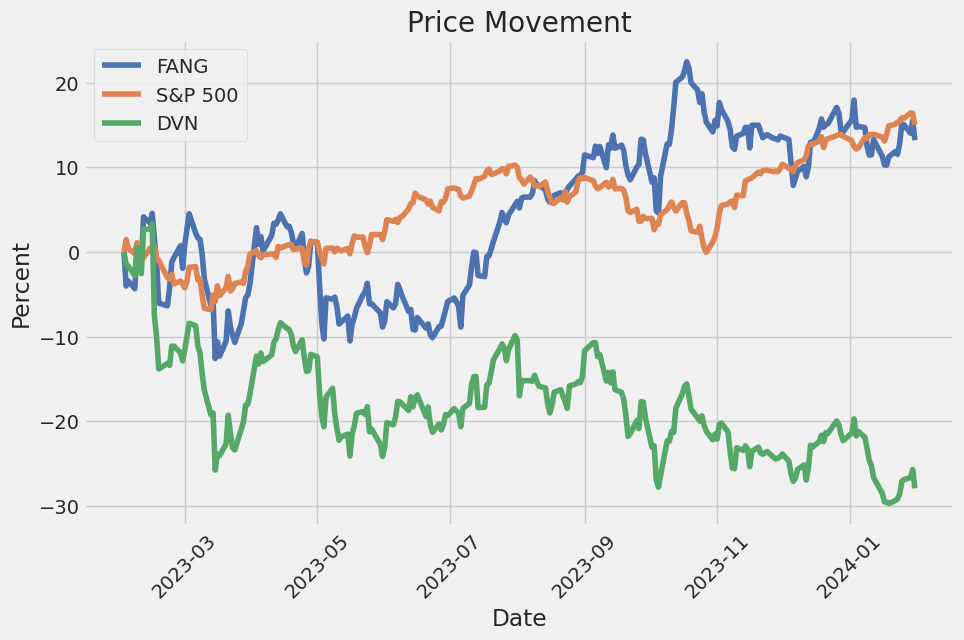

In examining the linear regression model between FANG stocks and the S&P 500 Index (SPY), we found that the intercept, commonly referred to as alpha, is approximately 0.0415. This suggests that FANG stocks, on average, have a baseline performance slightly above the SPY regardless of market movement. This alpha indicating a positive but minimal outperformance against the market can be reflective of the inherent growth and stability within the FANG group. However, it is important to note the significance level associated with this alpha, as the p-value of 0.663 indicates that it is not statistically significant. This highlights that while there may be a small positive alpha, it does not pass conventional thresholds for statistical significance, implying that the observed outperformance might not be robust across different time periods or market conditions.

Furthermore, the beta coefficient, measuring the volatility or systematic risk of FANG stocks relative to SPY, stands at approximately 1.2958. This implies that FANG stocks tend to be more volatile than the market, experiencing greater swings in response to market movements. A beta greater than 1 suggests that these stocks, on the whole, move more aggressively than the broader market, potentially offering higher returns at the expense of increased risk. The other statistics, such as the R-squared value of 0.204, suggest that only about 20% of the variations in FANG stock returns can be explained by movements in the SPY, indicating a modest correlation with the broader market. This analysis underscores the dynamic relationship between FANG stocks and the market at large, characterized by a slight potential for outperformance and a higher level of systematic risk.

Diamondback Energy, Inc. hosted their third quarter 2023 earnings conference call, where key executives including Chairman and CEO Travis Stice, President and CFO Kaes Van't Hof, and COO Danny Wesson discussed the company's financial results, future plans, and fielded questions from analysts. The executives emphasized the company's commitment to efficient capital allocation, targeting low-single-digit volume growth as a result of their strategic planning rather than pursuing aggressive production growth. This approach is a response to the current market volatility, emphasizing a shareholder return model over production growth in uncertain times.

During the Q&A session, the topic of capital allocation was a key point of interest. Travis Stice addressed inquiries regarding the potential shift towards a production growth model, clarifying that the company's focus remains on returning value to shareholders through efficient capital allocation. This strategy involves balancing growth with significant free cash flow payouts to shareholders, given the unpredictable market conditions characterized by both supply disruptions and demand changes.

Another focal point of the discussion was Diamondback's development strategy and operational efficiencies, particularly in the Midland Basin. The company highlighted its progress in executing large-scale project developments, averaging around 24 wells per project, which has been a significant factor in driving down costs and improving well productivity. These efficiencies, including reduced costs in casing and the advantages of running SimulFRAC crews, have supported the company's ability to maintain a competitive edge and deliver on their operational targets.

The conversation also ventured into topics such as return of capital to shareholders, non-core asset sales, and the overall market environment for mergers and acquisitions within the energy sector. Travis Stice articulated a cautious approach to share repurchases, emphasizing discipline to avoid pro-cyclical buying. Moreover, the discussion about the Deep Blue JV illustrated Diamondback's strategic move to monetize midstream assets while retaining a significant equity interest, showcasing their broader strategy of optimizing the asset portfolio for shareholder value.

Overall, the earnings call shed light on Diamondback Energy's deliberate emphasis on capital efficiency, shareholder returns, and strategic asset management amidst a complex market landscape. The executives' responses reiterated the company's focus on maintaining a strong balance sheet, leveraging operational efficiencies, and exploring strategic opportunities that align with their long-term vision for growth and value creation.

Diamondback Energy, Inc. (FANG), an independent oil and natural gas company, is engaged in the acquisition, development, exploration, and exploitation of unconventional, onshore oil and natural gas reserves in the Permian Basin, West Texas. Throughout 2023, Diamondback has actively managed its portfolio through acquisitions, divestitures, and strategic joint ventures, reflecting its focus on optimizing assets and leveraging opportunities within the sector.

In a significant move this year, Diamondback Energy completed a joint venture agreement with Five Point Energy LLC to form Deep Blue Midland Basin LLC. This JV saw Diamondback contributing certain water-related assets in exchange for cash and an equity interest, highlighting the company's strategy to capitalize on its midstream assets. This transaction not only generated substantial cash proceeds but also positioned Diamondback to benefit from future growth projects in the Midland Basin area.

Furthermore, Diamondback undertook several acquisitions to strengthen its core operational focus in the Permian Basin. Notably, the acquisition of Lario Permian, LLC added around 25,000 gross acres to Diamondback's portfolio, emphasizing its commitment to expanding its footprint in key areas. This acquisition was partly funded by issuing Diamondback common stock, demonstrating the company's ability to utilize its equity effectively in strategic growth initiatives.

On the divestiture front, Diamondback sold non-core assets and its stake in joint ventures to streamline operations and focus on its most productive assets. The sale of the Water Assets and oil gathering assets to Deep Blue Midland Basin LLC and the divestiture of its interest in OMOG JV LLC are examples of Diamondback's strategic portfolio realignment. These moves not only generated significant cash proceeds but also allowed Diamondback to reduce debt and focus on high-return opportunities within its core areas of operation.

Diamondback's financial management also included active debt management and returning value to shareholders through dividends and share repurchases. The company utilized the proceeds from asset sales for debt reduction, emphasizing its focus on maintaining a strong balance sheet. Moreover, Diamondback's board approved a common stock repurchase program, demonstrating confidence in the company's value and commitment to delivering shareholder returns.

Overall, Diamondback Energy's strategic initiatives in 2023 reflect a focused approach to capital allocation, portfolio optimization, and shareholder value creation. Through strategic acquisitions, divestitures, and joint ventures, Diamondback has strengthened its position in the Permian Basin, enhancing its growth prospects while maintaining financial discipline and operational efficiency.

In the intricate landscape of the energy exploration and production sector, Diamondback Energy, Inc. (NASDAQ: FANG) has carved out a distinctive presence, distinguishing itself through performance that frequently outpaces broader market trends and visible strategic maneuvers aimed at nurturing shareholder wealth. The company's adaptability to market volatilities and its focus on operational efficiency form the crux of its investment appeal, amidst a backdrop of fluctuating oil prices and evolving industry dynamics.

The beginning of 2024 has been particularly notable for Diamondback Energy, evidenced by its capacity to surpass market returns, as illustrated in its stock performance on January 22, 2024. Such feats of financial robustness are accompanied by anticipation for the company's forthcoming earnings report, scheduled for February 20, 2024. Analyst expectations forecast a nuanced picture of potential year-over-year declines in earnings per share juxtaposed against projected revenue uplifts. These projections are instrumental in shaping investor sentiment, further nuanced by the Zacks Rank system's #3 (Hold) designation for Diamondback Energy, which underscores a balanced view on the company's near-term prospects.

From a valuation standpoint, despite trading at a moderate premium relative to the industry average, Diamondback Energy's favorable PEG ratio hints at an investment conducive to growth, attracting attention from both hedge and retail investors. This scenario is contextualized within a challenging industry landscape, with the Oils-Energy sector grappling with one of the lowest Zacks Industry Rank placements.

Amidst these strategic and financial deliberations, the company's dividend strategy emerges as a cornerstone of its value proposition to shareholders. The implementation of a robust base dividend coupled with the potential for bountiful variable dividends elucidates Diamondback Energy's commitment to capital returns. The strategic pivot towards electrifying operations as a measure to concurrently trim emissions and operational expenses further exemplifies the company's forward-thinking approach, despite the logistical challenges of integrating with the existing electrical grid.

The onset of 2024 has also seen industry analysts juxtapose Diamondback Energys performance against peers, underscoring competitive virtues in operational efficiencies, financial structuring, and shareholder returns. Such comparative analyses vividly illustrate the factors underpinning Diamondback Energy's preferential standing in the investment community, touching upon the intrinsic and extrinsic elements that shape its market valuation.

However, the shadow of market-wide and sector-specific volatilities looms large, with externalities such as geopolitical unrest and environmental regulations stirring uncertainty. The discernible shift towards sustainable operational models within the sector, while commendable, introduces additional layers of complexity to the already intricate operational frameworks of companies like Diamondback Energy. The strategic responses to these challenges are crucial in maintaining the company's trajectory towards sustainable growth and profitability.

In light of the broader economic indicators and market sentiments, Diamondback Energy presents a narrative of resilience, strategic acumen, and an unwavering focus on shareholder returns. Its journey through 2024 delineates a path characterized by cautious optimism, with a keen eye on leveraging operational efficiencies, navigating industry-wide challenges, and capitalizing on emerging opportunities within the energy sector. As the company heads into its scheduled earnings report, the investment community remains attentive to how Diamondback Energy will continue to maneuver through the landscape of opportunity and uncertainty that defines the ever-evolving energy market.

Diamondback Energy, Inc. (FANG) displayed a significant degree of volatility from February 4, 2019, to January 31, 2024. The volatility model indicates that price movements were sizable, with a high coefficient of omega signaling large variations in return. Moreover, the alpha value suggests that past returns had a substantial impact on future volatility, indicating a reactive market behavior to new information or changes in Diamondback Energy's business environment.

| Statistic Name | Statistic Value |

|---|---|

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| Log-Likelihood | -3298.30 |

| AIC | 6600.60 |

| BIC | 6610.88 |

| No. Observations | 1256 |

| omega | 8.0244 |

| alpha[1] | 0.4212 |

Analyzing the financial risk of a $10,000 investment in Diamondback Energy, Inc. (FANG) over a one-year period demands a sophisticated approach, integrating both volatility modeling and machine learning predictions. This integrated analysis not only enhances the accuracy of the risk assessment but also offers a nuanced view of the investment's potential volatility and return outcomes.

Volatility modeling is a powerful tool in quantifying the fluctuation levels of Diamondback Energy, Inc.'s stock prices. By examining historical price data, this method enables us to estimate the future volatility of the stock. It effectively captures the persistence of volatility shocks over time, which is crucial for assessing risk in financial markets. In this specific case, the volatility modeling technique is deployed to map out the expected range of price movements for Diamondback Energy, Inc., thereby laying the foundation for determining the Value at Risk (VaR) for the investment.

On the other hand, machine learning predictions, particularly through the use of a decision tree-based ensemble method, focus on forecasting the stock's future returns based on a set of predictive variables. These may include historical stock prices, volume, market indices, economic indicators, and more. The primary role of this machine learning approach is to analyze complex relationships and patterns in the data that traditional models might overlook. By predicting future returns, it offers a complementary perspective to the volatility analysis, aiding in a comprehensive risk assessment.

When combining the insights from volatility modeling and machine learning predictions, a robust picture of financial risk materializes. Specifically, the Value at Risk (VaR) at a 95% confidence interval provides a quantifiable measure of the maximum expected loss over a specified period, under normal market conditions. In this context, the calculated VaR of $293.45 for a $10,000 investment in Diamondback Energy, Inc. signifies that with 95% confidence, the investor should not expect to lose more than $293.45 over the one-year period, under normal market conditions.

This dual-faceted analysis, leveraging both the predictive power of machine learning and the volatility insights from volatility modeling, offers a comprehensive evaluation of the potential risks associated with equity investments in volatile market segments. It underscores the importance of integrating diverse analytical approaches to enhance the understanding of financial risk, providing investors with a clearer view of what to expect from their investments in terms of both potential returns and associated risks.

Similar Companies in Oil & Gas E&P:

Report: Devon Energy Corporation (DVN), Devon Energy Corporation (DVN), Coterra Energy Inc. (CTRA), Report: EOG Resources, Inc. (EOG), EOG Resources, Inc. (EOG), ConocoPhillips (COP), Antero Resources Corporation (AR), Callon Petroleum Company (CPE), Vital Energy, Inc. (VTLE), Pioneer Natural Resources Company (PXD), Occidental Petroleum Corporation (OXY), Report: APA Corporation (APA), APA Corporation (APA), Hess Corporation (HES), Report: EQT Corporation (EQT), EQT Corporation (EQT), Report: Marathon Oil Corporation (MRO), Marathon Oil Corporation (MRO), Cimarex Energy Co. (XEC), Noble Energy, Inc. (NBL)

https://www.youtube.com/watch?v=-8fbplsSPS8

https://www.fool.com/investing/2024/01/07/are-you-missing-out-on-this-energy-stocks-monster/

https://seekingalpha.com/article/4662347-diamondback-energy-compelling-capital-returns-undervalued

https://finance.yahoo.com/m/77b4fcd3-0265-37a1-98b3-f08bbe808048/the-stock-market-just-hit-a.html

https://finance.yahoo.com/news/wall-street-analysts-just-trimmed-210848056.html

https://finance.yahoo.com/news/permian-oil-drilling-rig-count-130100922.html

https://seekingalpha.com/article/4664243-devon-energy-vs-diamondback-energy-a-battle-of-the-permian

https://finance.yahoo.com/news/diamondback-energy-fang-exceeds-market-231520794.html

https://finance.yahoo.com/news/diamondback-energy-fang-laps-stock-230016434.html

https://www.fool.com/investing/2024/01/27/3-great-dividend-stocks-to-spice-up-your-portfolio/

https://finance.yahoo.com/m/65a006a9-2621-3a62-b5e0-5e9990029fd0/3-great-dividend-stocks-to.html

https://finance.yahoo.com/m/50700944-3c36-3abe-affd-414e2341320d/u.s.-oil-drillers-are-going.html

https://www.youtube.com/watch?v=tt_Zmexifug

https://finance.yahoo.com/news/diamondback-energy-fang-increases-despite-230017096.html

https://www.sec.gov/Archives/edgar/data/1539838/000153983823000134/fang-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: ZzMsUR

Cost: $0.96612

https://reports.tinycomputers.io/FANG/FANG-2024-01-31.html Home