Gerdau S.A. (ticker: GGB)

2023-12-17

Gerdau S.A. (ticker: GGB) is one of the leading steel producers in the Americas and one of the largest suppliers of long steel in the world. The company, with its origins in Brazil, has a significant presence in North and South America and serves a diverse array of sectors including construction, industry, automotive, and agriculture. Gerdau operates through a vertically integrated network that includes steel mills, recycling operations, and downstream processing facilities, enabling it to convert scrap metal into a wide range of steel products. The company has made substantial investments in updating and modernizing its facilities, focusing on sustainable practices and energy efficiency. As of the latest updates, Gerdau continues to expand its market presence and capacity through strategic acquisitions, alliances, and an emphasis on innovation and quality. With a robust manufacturing base and a commitment to customer service, Gerdau has positioned itself to meet the evolving demands of the global steel industry.

Gerdau S.A. (ticker: GGB) is one of the leading steel producers in the Americas and one of the largest suppliers of long steel in the world. The company, with its origins in Brazil, has a significant presence in North and South America and serves a diverse array of sectors including construction, industry, automotive, and agriculture. Gerdau operates through a vertically integrated network that includes steel mills, recycling operations, and downstream processing facilities, enabling it to convert scrap metal into a wide range of steel products. The company has made substantial investments in updating and modernizing its facilities, focusing on sustainable practices and energy efficiency. As of the latest updates, Gerdau continues to expand its market presence and capacity through strategic acquisitions, alliances, and an emphasis on innovation and quality. With a robust manufacturing base and a commitment to customer service, Gerdau has positioned itself to meet the evolving demands of the global steel industry.

| As of Date: 12/16/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 8.04B | 8.15B | 8.72B | 8.33B | 8.71B | 7.09B |

| Enterprise Value | 9.44B | 9.69B | 10.28B | 9.95B | 9.72B | 8.14B |

| Trailing P/E | 5.26 | 4.59 | 3.97 | 4.06 | 3.64 | 2.56 |

| Forward P/E | 6.09 | 6.30 | 4.94 | 5.46 | 6.95 | 5.52 |

| PEG Ratio (5 yr expected) | - | - | - | - | - | - |

| Price/Sales (ttm) | 0.59 | 0.58 | 0.58 | 0.56 | 0.44 | 0.49 |

| Price/Book (mrq) | 0.80 | 0.86 | 0.91 | 0.95 | 0.99 | 0.86 |

| Enterprise Value/Revenue | 0.13 | 0.57 | 0.56 | 0.53 | 0.54 | 0.39 |

| Enterprise Value/EBITDA | 0.65 | 3.34 | 2.99 | 1.93 | 3.33 | 1.64 |

Based on a thorough analysis of the technical indicators and fundamentals for GGB, we observe the following:

Based on a thorough analysis of the technical indicators and fundamentals for GGB, we observe the following:

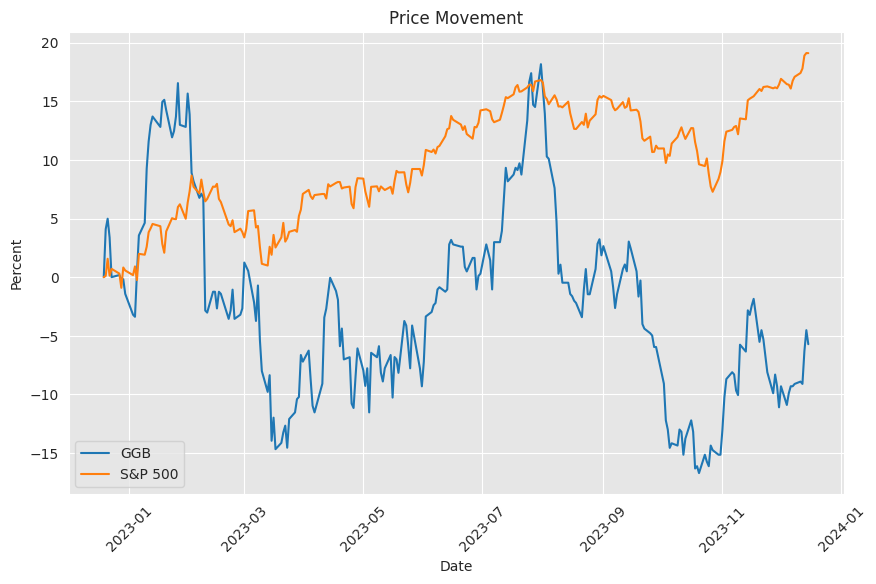

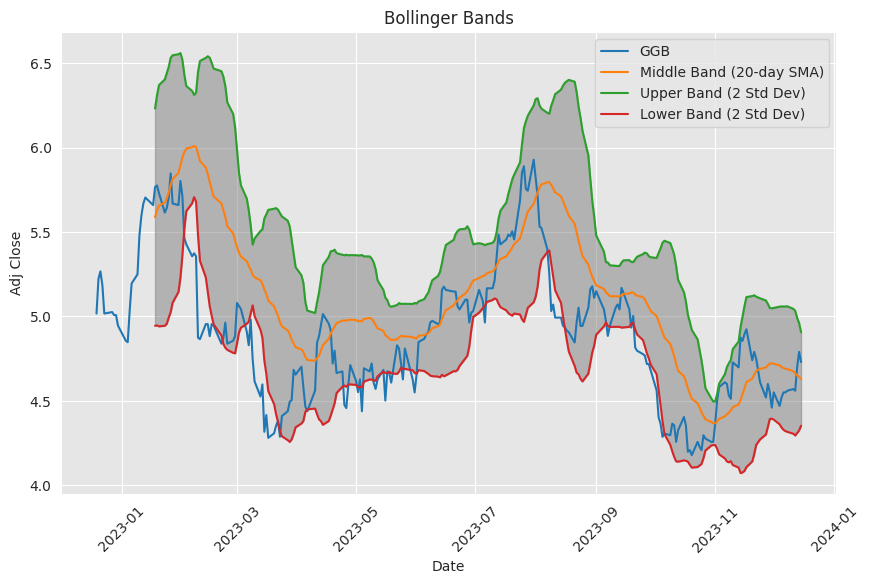

Technical perspectives: - The MACD line is positive, indicating recent upward momentum. The MACD histogram is also in positive territory, which suggests bullish momentum is potentially strengthening. - RSI at 55.95 hints at neither overbought nor oversold conditions, suggesting the stock has room for movement in either direction, but leans slightly towards positive momentum. - Bollinger Bands show the current price near the upper band, which may indicate a strong trend or conversely, potential overextension and a pullback if the price does not further push the band's limits. - The current stock price is above both the SMA_20 and EMA_50, which supports a bullish trend in the near term. - On Balance Volume (OBV) is negative, which could raise concerns about the current rally's volume support. - The Stochastic oscillator is in overbought territory, which may suggest caution as there could be a reversal or consolidation. - ADX is at 15.34, indicating a weak trend. The low ADX value, combined with a high Stochastic, implies that the current upward move may lack conviction. - Williams %R indicates that the market may be in an overbought condition, cautioning against assuming continued rapid growth immediately. - The Chaikin Money Flow (CMF) suggests outflows are stronger than inflows, which might signal waning buying pressure. - Parabolic SAR is indicating an upward trend since the current price is above the PSAR dot.

Fundamental perspectives: - The enterprise value, market capitalization, and EV/Revenue have decreased over the last year, suggesting a reduction in the company's valuation or market conditions favoring bearish sentiment. - The P/E ratio has increased, indicating that the stock's price has risen relative to its earnings, which might suggest that the stock is becoming more expensive. - However, a low price-to-sales ratio could indicate undervaluation relative to revenue. - Price-to-book value is below 1, which traditionally indicates undervaluation based on the companys book value. - The fundamentals exhibit mixed signals with decreased normalized EBITDA, net income, and total revenue over the past few years, while the latest figures show some improvements. The company's ability to improve its profitability will play a vital role in future stock performance.

Considering the technical indicators and the fundamentals together, one can infer that while there is a near-term bullish sentiment based on the moving averages and MACD indicators, several signs are cautioning against overly optimistic expectations. The volume indicators, such as the OBV and the CMF, suggest that the recent price increases may not be on strong footing, which could lead to a reversal. Furthermore, the Enterprise Value trends and high P/E indicate that the market might be pricing in future growth expectations which will need to be justified by corresponding financial performance improvements.

Given the positive technical signals, there's potential for GGB's stock price to experience continued growth over the short term, especially if it maintains its position above important moving averages. However, the overbought conditions suggested by the Stochastic oscillator and the Williams %R, combined with weak trend strength indicated by ADX, imply that the next few months may also see periods of consolidation or pullback.

In summary, while the initial outlook for the coming months looks cautiously positive, investors might expect fluctuations as the underlying fundamental issues and overbought technical conditions are likely to cause some resistance to an uninterrupted upward trajectory. Longer-term price movement will be heavily dependent on improvements in fundamental financial health, presenting a mixed yet cautiously optimistic picture. Investors should closely monitor upcoming earnings reports, company developments, and the broader market conditions as these will provide essential clues to the stock's potential future movements.

Penny stocks are typically characterized by their low share price and high volatility, traditionally trading for less than $5 per share. These stocks can offer significant returns, but not without a high level of risk and the necessity for diligent research and strategic trading approaches. Gerdau S.A. (NYSE: GGB), a significant player in the long steel producing sector in the Americas and a key supplier internationally, represents a unique investment opportunity in this market segment.

As with all penny stocks, Gerdaus performance is subject to the whims of market volatility, but it is also greatly influenced by the cyclical nature of the steel industry it operates within. The price of steel fluctuates in response to global economic conditions, and any shifts, particularly with respect to inflation and supply-demand dynamics, can have an outsized impact on GBB's share price. July, for instance, is a month known for potential seasonal market shifts, which could further augment these effects for an investor considering GGB stock.

When the macroeconomic environment is clouded by concerns such as inflation and rising interest rates, a bearish sentiment can pervade the market, and commodity-centric stocks like Gerdau may suffer. Despite these broader market challenges, Gerdau has built-in structural advantages such as its vertical integration, which involves controlling all aspects of production from raw materials to finished products, and geographical diversification, spreading its operations across various global markets. These factors can offer a buffer against some market volatility and serve as a hedge against region-specific economic downturns.

Investors looking towards companies like Gerdau are wise to consider the underlying fundamentals of the business. Gerdaus involvement in critical sectors such as infrastructure and construction positions it as a potential beneficiary of public and private sector investment, particularly in the periods of growth or economic recovery that often follow downturns. This interplay between the company's market and the broader economic context should not be overlooked.

The ability to leverage industry trends is an essential skill in trading penny stocks. If industrial activity shows signs of a resurgence, particularly after a period of contraction like that experienced amid the pandemic, manufacturers like Gerdau stand to gain. These types of sector-specific insights can be invaluable for investors hoping to make timely and informed trades with companies like GGB.

Given the inherently volatile nature of penny stocks, adopting a sound trading strategy is non-negotiable. Investors must put in place clear guidelines for when to enter and exit trades, and determine suitable position sizes that appropriately balance the potential for reward with risk management. Analyzing the catalysts of volatilityranging from announcements specific to the company to broader industry shifts or changes in market sentimentis critical for any investor engaging with penny stocks such as Gerdau.

The performance of penny stocks like Gerdau should always be evaluated within the context of both microeconomic company-specific factors and the overarching macroeconomic environment. The steel industrys fortunes are closely tied to global economic health, and as such, fluctuations in economic indicators are likely to reverberate through GGB's stock price.

Investing in penny stocks like Gerdau S.A. can be a complex endeavor, demanding a nuanced understanding of diverse factors that can influence market behaviors. Investors must be prepared to undertake thorough research, cultivate a deep understanding of the sectors relevant to their investments, and respond agilely to both expected and unforeseen market developments.

Approaching investments such as Gerdau with a blend of cautious optimism, supported by robust research and strategic planning, is advisable. Should governments around the world continue to invest in infrastructure and construction, Gerdau, with its solid presence in these sectors, might be well-positioned to capture a share of this growth. With these considerations in mind, the companys penny stock status may offer an interesting proposition for the informed and disciplined investor.

Similar Companies in Steel:

Report: Nucor Corporation (NUE), Nucor Corporation (NUE), Companhia Siderurgica Nacional (SID), Report: Steel Dynamics, Inc. (STLD), Steel Dynamics, Inc. (STLD), Ternium S.A. (TX), Report: United States Steel Corporation (X), United States Steel Corporation (X), Report: ArcelorMittal (MT), ArcelorMittal (MT), Report: Commercial Metals Company (CMC), Commercial Metals Company (CMC)

News Links:

https://pennystocks.com/featured/2022/07/17/need-knows-trading-penny-stocks-july/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: b3ZunE

https://reports.tinycomputers.io/GGB/GGB-2023-12-17.html Home