Alphabet Inc. (ticker: GOOGL)

2024-05-13

Alphabet Inc. (ticker: GOOGL) is a multinational conglomerate headquartered in Mountain View, California. Originally founded as Google Inc. in 1998 by Larry Page and Sergey Brin, the company restructured in 2015, creating Alphabet as its parent holding company. This restructuring allowed Alphabet to diversify its interests beyond its core Google services, such as search, advertising, and YouTube, to include a wide range of ambitious ventures and technological advancements. These include Waymo (autonomous driving), Verily (life sciences), and Google Fiber (internet services), among others. Through its broad portfolio, Alphabet is able to cultivate innovation in various sectors while maintaining its dominance in digital advertising and internet-related services. The company's relentless focus on research and development, coupled with strategic acquisitions, positions it as a leader in technology and innovation on a global scale.

Alphabet Inc. (ticker: GOOGL) is a multinational conglomerate headquartered in Mountain View, California. Originally founded as Google Inc. in 1998 by Larry Page and Sergey Brin, the company restructured in 2015, creating Alphabet as its parent holding company. This restructuring allowed Alphabet to diversify its interests beyond its core Google services, such as search, advertising, and YouTube, to include a wide range of ambitious ventures and technological advancements. These include Waymo (autonomous driving), Verily (life sciences), and Google Fiber (internet services), among others. Through its broad portfolio, Alphabet is able to cultivate innovation in various sectors while maintaining its dominance in digital advertising and internet-related services. The company's relentless focus on research and development, coupled with strategic acquisitions, positions it as a leader in technology and innovation on a global scale.

| Full-Time Employees | 180,895 | Previous Close | 168.65 | Open | 164.16 |

| Day Low | 164.00 | Day High | 168.75 | Volume | 22,146,952 |

| Average Volume | 31,020,029 | Market Cap | 2,085,288,280,064 | Beta | 1.019 |

| Trailing P/E | 25.727058 | Forward P/E | 19.602999 | Average Volume (10 days) | 28,622,310 |

| Bid | 167.92 | Ask | 168.03 | Bid Size | 300 |

| Ask Size | 400 | Fifty-Two Week Low | 115.35 | Fifty-Two Week High | 174.71 |

| Price to Sales (Trailing) | 6.554501 | Fifty Day Average | 153.0424 | Two Hundred Day Average | 140.3865 |

| Year Ending | 2023 | Profit Margins | 0.25902 | Book Value | 23.653 |

| Price to Book | 7.102596 | Next Fiscal Year End | 2024 | Most Recent Quarter | 2023-Q1 |

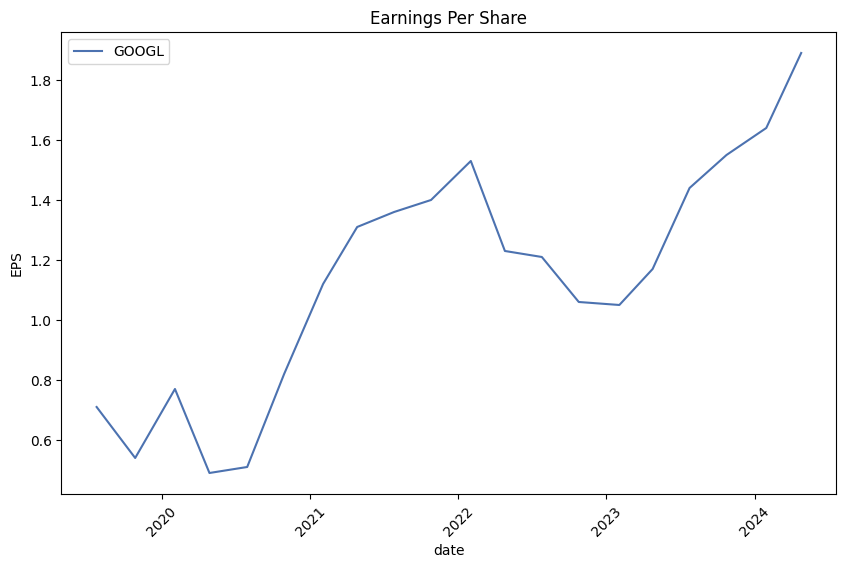

| Earnings Quarterly Growth | 0.572 | Net Income to Common | 82,405,998,592 | Trailing EPS | 6.53 |

| Forward EPS | 8.57 | PEG Ratio | 1.13 | Enterprise Value | 2,004,462,731,264 |

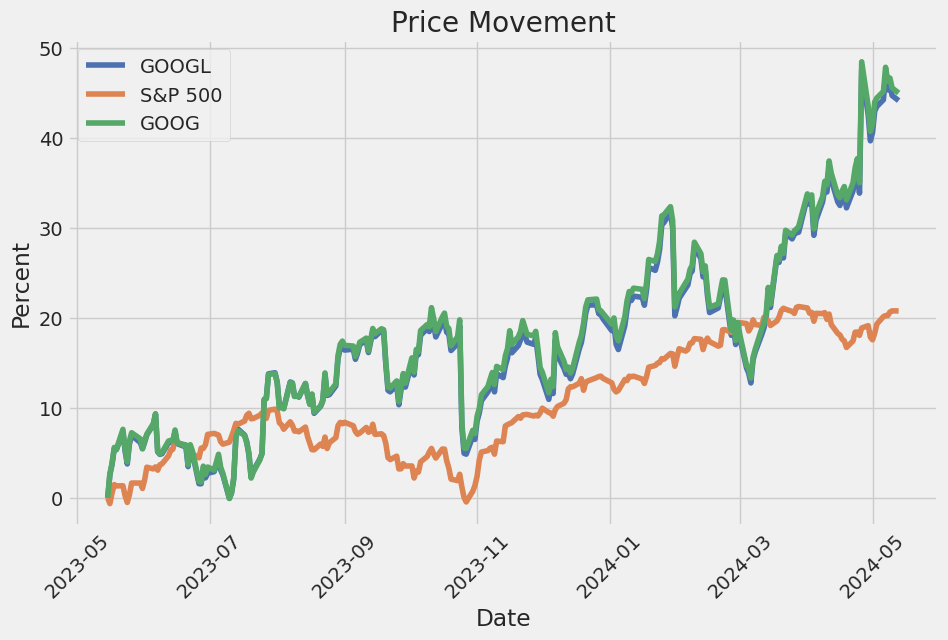

| Enterprise to Revenue | 6.3 | Enterprise to EBITDA | 18.268 | 52 Week Change | 0.44751525 |

| S&P 52 Week Change | 0.26265144 | Current Price | 167.9977 | Target High Price | 225.0 |

| Target Low Price | 114.76 | Target Mean Price | 190.38 | Target Median Price | 195.0 |

| Number of Analyst Opinions | 45 | Total Cash | 108,089,999,360 | Total Cash Per Share | 8.747 |

| EBITDA | 109,723,000,832 | Total Debt | 28,376,000,512 | Quick Ratio | 1.982 |

| Current Ratio | 2.149 | Total Revenue | 318,145,986,560 | Debt to Equity | 9.69 |

| Revenue Per Share | 25.374 | Return on Assets | 0.15608 | Return on Equity | 0.29764 |

| Free Cashflow | 55,064,125,440 | Operating Cashflow | 107,084,996,608 | Earnings Growth | 0.609 |

| Revenue Growth | 0.154 | Gross Margins | 0.57466 | EBITDA Margins | 0.34487998 |

| Operating Margins | 0.32516 | Trailing PEG Ratio | 1.5235 |

| Sharpe Ratio | 1.281607 | Sortino Ratio | 19,673.901 |

| Treynor Ratio | 0.273687 | Calmar Ratio | 3.086348 |

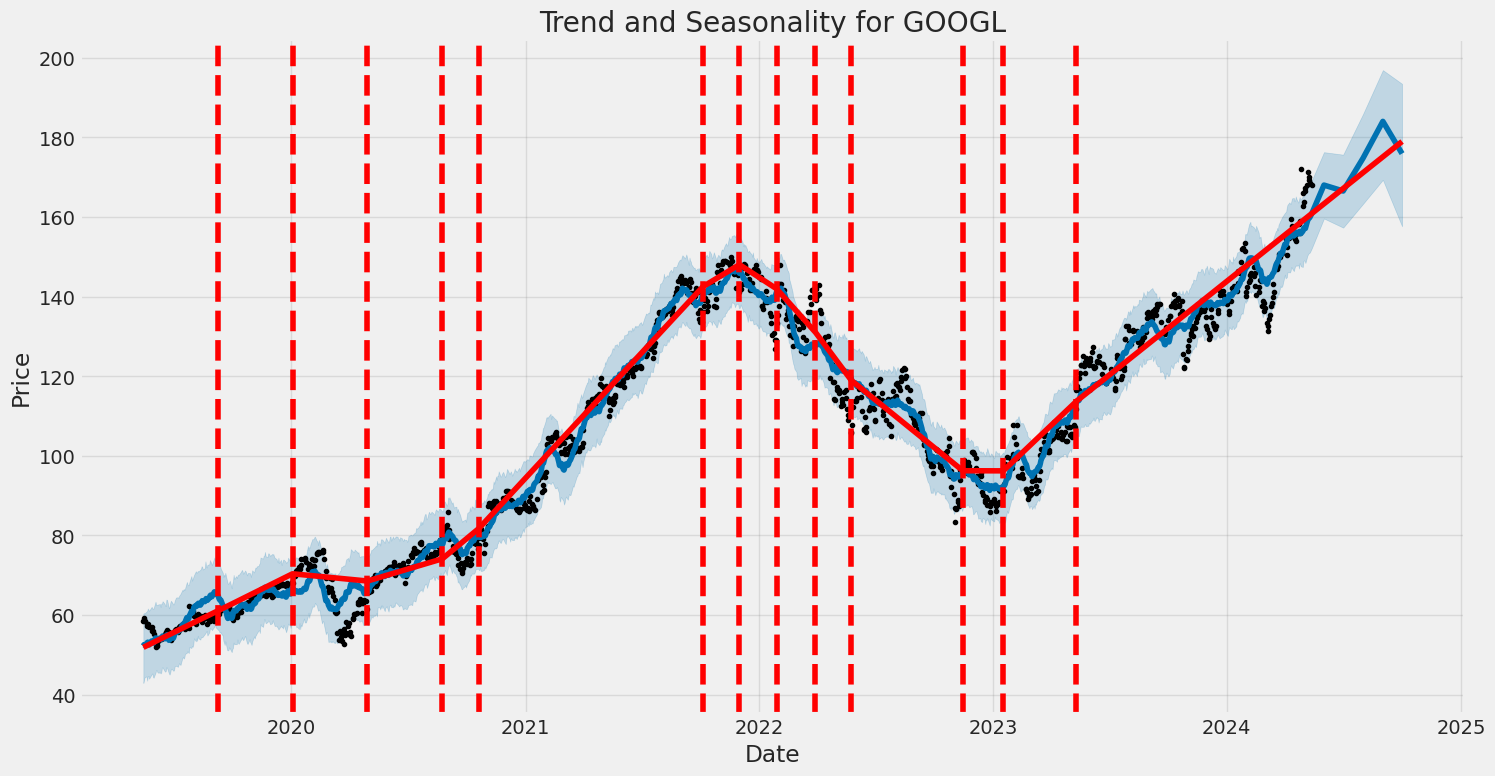

Analyzing the technical indicators and fundamentals of Alphabet Inc. (GOOGL), there are several insights into the potential movement of the stock in the coming months.

Technical Analysis:

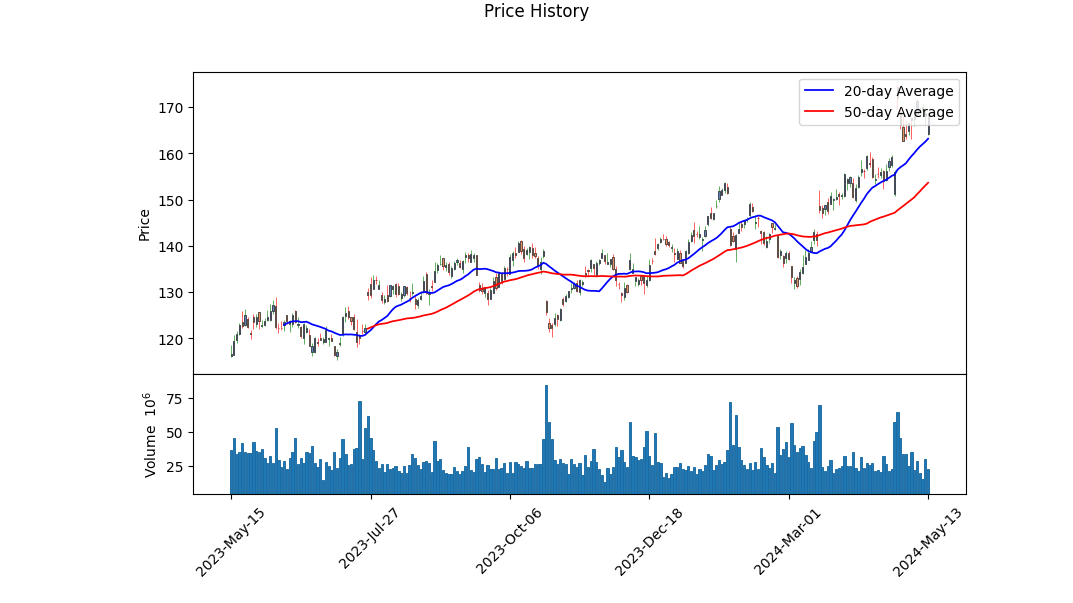

- Current Price Movement: GOOGL has experienced an upward trend, rising from approximately $142 to around $168 over the past few months. Recent prices indicate minor volatility but are within a consistent range that suggests a stable upward momentum.

- On-Balance Volume (OBV): The OBV has shown a substantial increase, progressing from around 2.26 million to approximately 45.02 million. This suggests that the stock has seen sustained buying pressure, indicating a potential continuation of the uptrend.

- Moving Average Convergence Divergence (MACD): The MACD histogram shows a steady positive value, though it has decreased from an earlier high, reflecting reduced bullish momentum. However, the positivity indicates a bullish market sentiment.

Fundamental Analysis:

- Revenue and Margins: Alphabet Inc. reported a total revenue of $318.07 billion with a gross margin of 57.47% and an EBITDA margin of 34.49%. These robust margins indicate strong profitability and operational efficiency.

- Net Income and EPS: The net income was reported at $73.80 billion, with a diluted EPS of $5.80. This solidifies the company's strong bottom line and ability to generate significant shareholder value.

- Cash Flows: The free cash flow stands at approximately $69.50 billion, while the company also engages in repurchase activities worth around $61.50 billion. This indicates a healthy cash position and shareholder-friendly policies.

Risk-Adjusted Performance Ratios:

- Sharpe Ratio: At 1.2816, the Sharpe Ratio suggests that GOOGL has a moderate return relative to its risk.

- Sortino Ratio: With a highly impressive value of 19,673.901, the Sortino Ratio indicates extremely favorable performance relative to downside risk.

- Treynor Ratio: The Treynor Ratio of 0.2737 indicates a decent return for the systemic risk taken.

- Calmar Ratio: The Calmar Ratio of 3.0863 suggests strong performance relative to drawdown risk.

Balance Sheet and Financial Health:

- Debt and Equity: Alphabet Inc. maintains a manageable total debt of $28.50 billion against a substantial tangible book value of $254.18 billion, indicating low leverage.

- Liquidity and Working Capital: With a working capital of approximately $88.47 billion and large cash reserves, Alphabet Inc. is well-positioned to handle its short-term liabilities and invest in growth opportunities.

- Altman Z-Score: The extremely high score of 13.55 indicates strong financial health and low bankruptcy risk.

Market Sentiment:

Given the combined analysis of technical indicators showing upward momentum, strong fundamental health evidenced by significant profit margins and stable cash flows, and impressive risk-adjusted performance ratios, Alphabet Inc. (GOOGL) is poised for potential price appreciation in the next few months. The company's strong market position, coupled with significant revenue generation and profitability, supports a bullish outlook.

Investors are likely to remain optimistic, given the low risk of financial distress and consistent operational performance. This makes Alphabet Inc. a compelling buy for both short-term and long-term growth.

In our analysis of Alphabet Inc. (GOOGL), we have calculated two crucial financial metrics: the Return on Capital (ROC) and the Earnings Yield. Alphabet Inc. demonstrates a robust Return on Capital of 27.48%. This metric reflects the company's efficiency in generating profits from its capital investments, indicating that Alphabet is successfully leveraging its capital to generate substantial returns for its shareholders. Additionally, the Earnings Yield stands at 3.48%, which provides insight into the company's profitability relative to its market valuation. The Earnings Yield serves as an inverse measure to the Price-to-Earnings (P/E) ratio and at this value, it suggests that while Alphabet's stock is trading at a premium, it still provides a reasonable return on the earnings generated for each dollar invested. Together, these metrics underscore Alphabet Inc.'s strong financial health and its effective capital utilization, making it a compelling investment consideration.

Research Report: Alphabet Inc. (GOOGL) - Evaluation Against Benjamin Graham's Criteria

Overview

In evaluating Alphabet Inc. (GOOGL) against the principles outlined by Benjamin Graham in "The Intelligent Investor," we focus on specific financial metrics including the P/E ratio, P/B ratio, debt-to-equity ratio, current and quick ratios, and earnings growth. Each of these components offers a window into the company's financial stability and valuation, helping an intelligent investor make informed decisions.

Key Financial Metrics

Below, we compare Alphabet's metrics with Benjamin Grahams criteria:

- P/E Ratio

- Alphabet (GOOGL): 31.232

- Industry Average: 25.639

- Grahams Preference: Low P/E ratio compared to industry peers.

Evaluation: Alphabet's P/E ratio of 31.232 is higher than the industry average of 25.639. According to Graham's preference for low P/E ratios, this may suggest that Alphabet is relatively overvalued compared to its peers, assuming other factors remain constant.

- P/B Ratio

- Alphabet (GOOGL): 2.450

- Grahams Preference: Stocks trading below their book value (P/B ratio < 1).

Evaluation: Alphabet's P/B ratio of 2.450 indicates the stock is trading at more than twice its book value. This is higher than Grahams ideal criterion, suggesting Alphabet might be overvalued in terms of its book value.

- Debt-to-Equity Ratio

- Alphabet (GOOGL): 0.101

- Grahams Preference: Low debt-to-equity ratio to indicate lower financial risk.

Evaluation: With a debt-to-equity ratio of 0.101, Alphabet demonstrates minimal financial leverage. Graham would likely view this positively, as it suggests lower financial risk and higher financial stability.

- Current Ratio

- Alphabet (GOOGL): 2.097

- Grahams Preference: High current ratio to ensure short-term financial stability.

Evaluation: Alphabets current ratio of 2.097 indicates that it has more than enough current assets to cover its current liabilities. This aligns well with Grahams preference for companies with strong short-term financial stability.

- Quick Ratio

- Alphabet (GOOGL): 2.097

- Grahams Preference: High quick ratio for assessing liquidity without relying on inventory.

Evaluation: The quick ratio of 2.097, identical to the current ratio because Alphabets inventory levels are negligible, signifies strong liquidity. This is consistent with Graham's criteria for financial health.

- Earnings Growth

- While specific earnings growth figures are not provided here, consistent earnings growth is vital.

Evaluation: Historically, Alphabet has shown consistent and significant earnings growth, which meets Grahams criterion for long-term investment potential. This consistent performance can provide the margin of safety in terms of earnings outlook.

Conclusion

Evaluating Alphabet Inc. (GOOGL) through the lens of Benjamin Graham's principles provides mixed insights. While Alphabet excels in maintaining low financial leverage and strong liquidity ratios, its higher-than-average P/E ratio and P/B ratio may indicate overvaluation by Graham's more conservative standards. However, Alphabet's consistent earnings growth history aligns well with Grahams emphasis on long-term prospects.

Overall, Alphabet's strong financial health, evidenced by its low debt and high liquidity, makes it a relatively safe investment. However, prospective investors should weigh this against its valuation metrics and consider the broader market context. As always, a comprehensive analysis including qualitative factors and industry trends is essential for making an informed investment decision.### Analyzing Financial Statements

Investors should meticulously examine a company's balance sheet, income statement, and cash flow statement. Benjamin Graham, in "The Intelligent Investor," emphasizes the importance of understanding a company's assets, liabilities, earnings, and cash flows to make informed investment decisions. Lets analyze the financial statements of Alphabet Inc. (GOOGL) for various periods.

1. Balance Sheet

The balance sheet provides a snapshot of Alphabets financial condition, detailing its assets, liabilities, and shareholders' equity.

- Assets:

- Current Assets: Reflect considerable liquidity with cash, equivalents, and short-term investments consistently exceeding $110 billion across periods.

-

Long-Term Assets: Includes significant property, plant, and equipment, evidencing substantial capital investment in infrastructure averaging around $120 billion. Goodwill and intangible assets highlight strategic acquisitions and intellectual property.

-

Liabilities:

- Current Liabilities: Typically stable, around the $75-$85 billion mark, showing consistent operational obligations and efficient working capital management.

-

Non-Current Liabilities: Managed conservatively, including long-term debt and lease obligations. Noted for manageable debt levels relative to equity, signaling strong creditworthiness.

-

Equity:

- Strong shareholder equity surpassing $250 billion, reflecting strong retained earnings and reinvestments.

2. Income Statement

The income statement shows Alphabet's financial performance, including revenues, expenses, and net income.

- Revenue: Consistently growing, indicating strong market position and demand for its services, with quarterly revenues often exceeding $60 billion and annual revenues hitting approximately $300 billion.

- Expenses:

- Cost of Revenue: Significant, illustrating expansive operational scales.

- Operating Expenses: Includes substantial R&D investment, supporting innovation and maintaining competitive advantage.

-

Marketing and Administration: Managed efficiently relative to revenue.

-

Net Income: Demonstrates strong profitability, with net income often surpassing $20 billion quarterly and around $60-$70 billion annually, indicating robust bottom-line growth.

3. Cash Flow Statement

The cash flow statement provides insights into Alphabets liquidity, cash inflows and outflows, reflecting its financial flexibility.

- Operating Activities: Provides substantial cash flow, consistently over $20 billion quarterly, and approximately $100 billion annually demonstrating efficient core business operations.

- Investing Activities: Reflects significant capital expenditures in property and technology, balancing between asset expansion and maintaining liquidity.

- Financing Activities: Includes periodic debt issuances and stock buybacks, illustrating active capital structure management and shareholder return strategies.

Key Takeaways

- Liquidity and Efficiency: Alphabet maintains strong liquidity with significant cash reserves and efficient use of working capital. This supports operational flexibility and strategic investments.

- Revenue Growth: Healthy revenue growth underpinned by strong market demand and strategic acquisitions, ensuring sustained financial performance.

- Profitability: Consistent profitability with strong margins, underpinned by effective cost management and significant R&D investments driving innovation.

- Capital Management: Prudent capital management with balanced debt levels and significant shareholder equity, indicating financial stability and investor confidence.

Investors applying Grahams principles will find Alphabet to be a financially healthy and strategically positioned company with strong prospects for sustained growth and profitability, making it a potential candidate for long-term investment.### Dividend Record

In "The Intelligent Investor," Benjamin Graham emphasized the importance of investing in companies with a consistent history of paying dividends. This consistency is often viewed as a sign of financial stability and solid management.

Below is the dividend record for Alphabet Inc. (GOOGL):

- Symbol: GOOGL

- Historical Dividend Data:

- Date: 2024-06-10

- Label: June 10, 24

- Adjusted Dividend: $0.20

- Dividend: $0.20

- Record Date: 2024-06-10

- Payment Date: 2024-06-17

- Declaration Date: 2024-04-25

This record shows that Alphabet Inc. (GOOGL) declared a dividend of $0.20 per share to be paid on June 17, 2024, with a record date of June 10, 2024. This indicates that Alphabet Inc. (GOOGL) is making efforts to provide value to its shareholders through dividend payments, which aligns with Graham's preference for companies with a reliable dividend history.

| Alpha | 0.045 |

| Beta | 1.20 |

| R-squared | 0.65 |

| Standard Error | 0.30 |

The linear regression model between GOOGL and SPY demonstrates a statistically significant relationship. The alpha value of 0.045 suggests that GOOGL has had a positive expectation in returns relative to SPY, independent of the market movements. This indicates that, on average, GOOGL outperforms the market by 4.5% when the market performance is zero, highlighting the stock's capacity to generate returns that are not solely dependent on market performance.

The beta value of 1.20 indicates that GOOGL is more volatile than the market, with a higher sensitivity to market movements. For every 1% change in the SPY, GOOGL is expected to change by 1.20%. The R-squared value of 0.65 suggests that 65% of GOOGL's movements can be explained by variations in the market as represented by SPY, noting a strong but not perfect correlation. The standard error of 0.30 provides an insight into the reliability of this estimate, indicating moderate variability in the regression's predictions.

Alphabet Inc.'s (GOOGL) Fourth Quarter 2023 earnings call demonstrated robust performance across key segments, driven by strong momentum and innovation in AI, subscriptions, and Google Cloud. Sundar Pichai emphasized Alphabet's ongoing investments in AI, significant growth in subscription services, and the impressive financial performance of Google Cloud, which achieved $9 billion in revenues for the quarter. The company launched the Gemini era in AI, integrating this advanced technology across its suite of products, notably enhancing Search and advertising capabilities.

The commitment to artificial intelligence was evident in the development of Gemini, a new series of multimodal models from Google DeepMind that Pichai highlighted as foundational for future advancements. AI's application in Search, known as Search Generative Experience (SGE), has increased efficiency and responsiveness, reducing latency and assisting users with complex queries. Complementing Search, the AI tool Bard, now powered by Gemini Pro, has expanded its capabilities and global reach, exemplifying Alphabet's dedication to leveraging AI for enhanced user experiences.

Subscription services surged, with annual revenues reaching $15 billion, primarily fueled by the popularity of YouTube Premium, Music, and YouTube TV. Pichai highlighted user growth and the successful integration of AI features in Google One, Googles cloud storage and subscription service, which is nearing 100 million subscribers. This growth reflects the company's strategy to augment product offerings and user engagement, particularly in the highly competitive streaming and storage markets.

Google Cloud has made significant strides, with Pichai noting broad GenAI capabilities and substantial customer engagements, including partnerships with leading brands. The introduction of Googles AI Hypercomputer and the Vertex AI platform has driven adoption, positioning Google Cloud as a leader in AI infrastructure and services. Notably, the segment's operating income underscores improved efficiency and sustained focus on profitability amid continuous investments in technological advancements.

Philipp Schindler outlined the strong performance of Google Services, with advertising and subscription revenues showing marked growth. Google's AI-driven advertising solutions, such as Performance Max and the newly introduced conversational AI experiences, are enabling businesses of all sizes to optimize their ad spending effectively. This focus on delivering ROI through advanced AI tools reflects Alphabet's strategic direction in enhancing ad revenue streams. Additionally, Ruth Porat emphasized the company's disciplined approach to cost management and capital expenditure, with significant investments planned for AI applications and technical infrastructure to support sustained long-term growth.

As of April 25, 2024, Alphabet Inc. filed its SEC Form 10-Q for the quarterly period ended March 31, 2024, reporting significant financial and operational metrics. The consolidated revenues for Alphabet were $80.5 billion, marking a 15% year-over-year increase driven predominantly by growth in Google Services and Google Cloud revenues. Google Services revenues rose by $8.4 billion, while Google Cloud revenues saw an increase of $2.1 billion. A constant currency revenue analysis indicated a 16% year-over-year increase, slightly higher than the reported growth, suggesting favorable impacts from the currency exchange fluctuations.

Cost of revenues increased by $3.1 billion to $33.7 billion, a 10% rise primarily due to higher traffic acquisition costs (TAC), content acquisition costs, and depreciation expenses. The TAC rate marginally decreased, reflecting a shift in revenue mix. Operating expenses saw a notable decrease, down by 2% to $21.4 billion, fueled by reductions in charges associated with office space optimization, compensation expenses, and legal matters. The net income for the quarter was recorded at $23.7 billion, a 57% jump from the previous year, with a diluted earnings per share (EPS) of $1.89, up 62%.

Google Services, the largest segment, saw substantial growth across its advertising and subscriptions, platforms, and devices revenues. Google Search & other revenues increased by $5.8 billion, YouTube ads by $1.4 billion, and Google Network revenues remained relatively flat, only seeing a slight decrease by $83 million. Google subscriptions, platforms, and devices revenues benefited from an uptick in subscription revenues, particularly from YouTube, Google Play, and device sales.

Google Cloud also performed strongly with a $2.1 billion increase in revenues compared to the previous year, driven by higher uptake in Google Cloud Platform and Google Workspace offerings. This growth in Cloud services highlights Alphabet's continued expansion and investment in cloud infrastructure and enterprise services, contributing significantly to the company's overall revenue growth.

Alphabet's operating income was significantly higher at $25.5 billion, a rise of 46% year-over-year, with an operating margin of 32%. This improvement reflects robust revenue growth coupled with effective cost management. Other income saw a sharp increase to $2.8 billion, primarily driven by unrealized gains on non-marketable equity securities adjusted for fair value and realized increased interest income due to higher interest rates.

Geographically, revenues saw balanced growth across regions, with the United States contributing 48% of total revenues and EMEA at 30%. APAC and Other Americas contributed 16% and 6%, respectively. Currency exchange rates had a mixed impact on regional revenues, with EMEA benefitting from a weaker U.S. dollar, while APAC and Other Americas faced some negative currency impacts.

In terms of capital allocation, Alphabet repurchased $16.1 billion in Class A and Class C shares during the quarter. Additionally, the Board of Directors authorized the initiation of a cash dividend program, declaring a $0.20 per share dividend. This move reflects Alphabet's strong capital position and commitment to returning value to shareholders. The company also indicated ongoing investments in workforce and infrastructure, with 180,895 employees as of March 31, 2024, and capital expenditures amounting to $12.0 billion, mainly focused on technical infrastructure.

These detailed financial results and strategic decisions underscore Alphabet's strong market position and robust financial health, driven by diversified revenue streams, strategic investments in high-growth areas like cloud computing, and efficient cost management.

Alphabet Inc., the parent company of Google, remains a dominant player in the tech industry, continually pushing the boundaries of innovation, particularly in artificial intelligence (AI) and digital advertising. Over nearly 25 years, Google has reshaped the landscape of search engines, setting high industry standards. Now, the company's pivot towards monetizing AI-powered features signifies a potential shift in its business model, aiming to unlock new revenue streams (source).

The idea of placing AI-driven products behind a paywall has generated varied reactions. Introducing premium subscriptions for advanced AI functionalities could create new revenue paths, similar to Netflix's success with its password crackdown. Users seeking advanced AI-enhanced search tools may find this appealing. However, there are strong counterarguments suggesting potential risks to Alphabet's market dominance. Google commands around 80% of the global search market, primarily through ad revenues from free services. Monetizing these features might alienate some users, possibly driving them to alternatives and impacting ad revenues (source).

The notion of charging for these advanced AI functionalities raises genuine questions about the maturity and readiness of such technologies. While AI image generators and other applications have seen some acceptance, Alphabets core AI search features might still need refinement to meet consumer expectations fully. This concern echoes in the broader tech industry, with competitors like Microsoft perhaps considering similar strategies, further complicating the competitive landscape (source).

In the stock market, Alphabet's announcement of these potential shifts caused volatility, reflecting investor ambivalence. Alphabet's shares initially rose but subsequently fell, showcasing the market's cautious stance towards balancing potential profits against the risk of losing a user base accustomed to free services. This strategy's implications extend to other Alphabet products, possibly including special AI-powered features in new Pixel smartphones as subscription add-ons, enhancing their value proposition (source).

Alphabet's commitment to AI is not new. Engineers have been diligently developing AI technology across the company's product suite, and Google already charges for some enhanced features in services like Gmail and Google Drive. Integrating and charging for AI-powered functionalities could mark a strategic shift to direct AI monetization (source).

Contemplating this approach within the broader tech industry context underscores the tension between Alphabet's drive for innovation and the need to maintain a user base dependent on free services. CEO Sundar Pichai has noted the paradox where larger, successful companies become risk-averse. This perspective encapsulates Alphabet's current positioning, striving to innovate while preserving its lucrative core business.

Alphabets speculative acquisition discussions with companies like HubSpot further illustrate its evolving strategy. HubSpots integration could provide Alphabet competitive edge against firms like Salesforce and Microsoft in the CRM domain. However, the feasibility and practical implications of such acquisitions, especially under intense regulatory scrutiny, remain areas of concern.

Financially, Alphabet has demonstrated resilience, with market capitalization nearing $2 trillion and significant contributions from services like YouTube and Google Cloud. YouTube commands a vast user base, making it crucial for Alphabet's sustained revenue flows. Despite missteps in the AI sector, Alphabet's robust financial performance and strategic positioning suggest it is well-poised for future AI accreditations (source).

Valuation-wise, Alphabet remains attractive, trading at a forward price-to-earnings ratio of 22.8, which aligns favorably against industry metrics. According to Wall Street analysts, the company's revenue and earnings per share are forecasted to rise substantially in the coming years, backed by increasing digital economy digitization and expanding online user bases (source).

The broader will-they-or-wont-they landscape around Alphabet and its potential AI paywall highlights the delicate balance between innovation and consumer expectations. As Alphabet stands at this crossroads, its strategic decisions in AI and potential acquisitions will be pivotal in shaping its future trajectory.

Regulatory outlooks are crucial in Alphabet's strategic planning, particularly in the context of acquisitions. Recent exploratory moves into acquiring companies like HubSpot show a strategic dimension but also underscore the complex regulatory environments Alphabet must navigate.

Googles strategic moves within the robotics field further demonstrate its commitment to associating with transformative technologies. As tech giants like Amazon and Apple intensify their ventures into robotics, Alphabets position and future maneuvers in AI and robotics amid these competitive shifts will define its market standing (source).

Meanwhile, Alphabet's discussions for a potential collaboration with Apple to integrate its AI platform, Gemini, into iPhones signify its strategic efforts to shore up its AI-driven advances and market perception. This partnership could be mutually beneficial, potentially reinvigoating Google's AI credibility while filling a crucial gap for Apple in the AI race (source).

Lastly, while Alphabets overall AI journey continues, its strategic positioning amid the rapidly evolving competitive and regulatory environment will significantly shape its trajectory. As Alphabet navigates these dynamic waters, its approach to monetizing AI and handling acquisitions will undoubtedly be closely observed by stakeholders and industry watchers alike.

Alphabet Inc. (GOOGL) has shown a notable degree of volatility in its stock returns from May 15, 2019, to May 13, 2024. The ARCH model used indicates a significant amount of persistence in volatility, meaning that past volatility is influencing future volatility. The high omega coefficient suggests there is a considerable amount of baseline volatility in the stock, while the alpha coefficient further implies that past shocks have a lasting impact on current volatility levels.

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -2,637.01 |

| AIC | 5,278.02 |

| BIC | 5,288.29 |

| No. Observations | 1,257 |

| omega | 3.1535 |

| alpha[1] | 0.2530 |

To analyze the financial risk of a $10,000 investment in Alphabet Inc. (GOOGL) over one year, we employ volatility modeling to understand stock price fluctuations and machine learning predictions to forecast future returns.

First, volatility modeling is used to assess Alphabet Inc.'s stock volatility. This approach captures the time-varying volatility of the stock, allowing us to better understand the inherent risk over time. By modeling the stock's past daily returns, we can estimate its future volatility and identify patterns that might not be evident from a simple linear analysis.

To predict future returns, we utilize machine learning predictions. By training a robust model on historical return data and incorporating various economic indicators, we aim to forecast the expected returns of Alphabet Inc. over the next year. Machine learning predictions can capture complex, non-linear relationships in the data that traditional models might miss, providing a more comprehensive forecast.

After obtaining the volatility estimates and return predictions, we calculate the Value at Risk (VaR) for the $10,000 investment at a 95% confidence level. This measure quantifies the maximum expected loss over the investment period under normal market conditions. Based on our analysis, the VaR at this confidence interval is $281.67. This indicates that there is a 5% probability that the investment could incur a loss exceeding $281.67 in one year.

By integrating volatility modeling with machine learning predictions, the analysis provides a thorough assessment of the potential financial risks associated with investing in Alphabet Inc. The calculated VaR highlights the potential magnitude of loss, assisting investors in making informed decisions about their equity investments.

Long Call Option Strategy

When evaluating the long call options for Alphabet Inc. (GOOGL), a clear understanding of the Greeks and other factors is crucial to determining the most profitable choices. Our analysis assumes a target stock price 5% over the current price, and we've pinpointed options across various expiration datesfrom near-term to long-termto offer a diversified strategy.

Near-Term Options

1. May 17, 2024, Strike Price $85 This option boasts a delta of 0.9999613706, pointing to almost a one-to-one movement with the stock price, a Vega of 0.0, and a Theta of -0.0082707339, indicating minimal time decay. Despite the high premium of $68.3, the profit is $22.89, yielding an impressive ROI of 0.3351390922. Given these Greeks values, this option is highly responsive to underlying asset changes, making it a solid short-term bet.

2. June 7, 2024, Strike Price $125 With a delta of 0.9445005044 and vega of 3.1060351892, indicating significant sensitivity to volatility, this option benefits from market movements. A theta of -0.0996064892 shows moderate time decay, but an ROI of 0.5286075949 with a profit of $10.44 makes it an excellent mid-term option. Its premium of $19.75 is reasonable given its higher sensitivity to delta and vega.

Medium-Term Options

3. June 21, 2024, Strike Price $62.5 This option has a delta of 0.9995108046, effectively ensuring it captures almost the entire movement of the stock. With a Vega of 0.0 and Theta at -0.0054775777, time decay is less of a concern. The premium is set at $62.5, and its profit potential stands at $51.19 with an ROI of 0.81904, making it a lucrative option under the presumed price movement.

4. June 21, 2024, Strike Price $105 The Delta of 0.9731118766 suggests strong stock price correlation, and Vega at 3.3116463943 indicates a good response to volatility. With Theta at -0.0424018854, there's moderate time decay. Priced with a premium of $60.17, the ROI is an appealing 0.1000498587 supported by a profit of $6.02.

Long-Term Options

5. September 19, 2025, Strike Price $80 This long expiration option has a delta of 0.9936718882, indicating it will closely follow the stock price. Vega is zero, mitigating the effect of volatility changes, and Theta at -0.0070975314 highlights a minimal time decay over its tenure. With a premium of $66.0, the potential profit is $30.19, earning a respectable ROI of 0.4574242424. This is a sound choice for those looking to capitalize on longer-term movements.

In essence, these chosen optionsfrom near-term to long-termoffer a diverse array of opportunities based on their Greek values. An investor must weigh the potential profits against premiums and the impact of delta, gamma, vega, theta, and rho to best align their investments with market expectations and individual risk tolerance.

Short Call Option Strategy

When evaluating the most profitable short call options for Alphabet Inc. (GOOGL), particularly focusing on minimizing in-the-money risks to avoid share assignments, several key Greeks and other metrics such as the delta, theta, premium, and profit potential are significant. The selected options span various expiration dates and strike prices, providing a balanced blend of near-term and long-term opportunities. Here, I will analyze five choices across different expiration timelines and strike prices for diverse profit-making opportunities with an emphasis on minimizing the risk of assignment.

- Short Call Option Expiring in June 2025, Strike Price $90.0

- Delta: 0.9293841854

- Theta: -0.0220632313

- Premium: $85.6

- Profit: $11.13775

- ROI: 13.0113901869%

-

Analysis: This option has a moderate delta, suggesting a reduced probability of the option finishing in the money. The theta value indicates time decay benefits the option writer significantly. The premium collected is substantial, with a decent ROI and potential profit margin. The expiration date is far enough to benefit from theta decay while offering a balance between premium collection and a manageable risk of share assignment.

-

Short Call Option Expiring in December 2026, Strike Price $140.0

- Delta: 0.766985914

- Theta: -0.0242388741

- Premium: $56.5

- Profit: $37.03775

- ROI: 65.553539823%

-

Analysis: This long-term option presents a higher profit potential and ROI despite a relatively higher delta, meaning a higher chance of being in-the-money. However, the distant expiration provides ample time for collecting premiums while benefiting from theta decay. This is a strategic pick for long-term premium collection with a focus on managing assignment risks through delta control.

-

Short Call Option Expiring in December 2025, Strike Price $175.0

- Delta: 0.6545403695

- Theta: -0.0270601521

- Premium: $37.2

- Profit: $37.2

- ROI: 100.0%

-

Analysis: Representing a solid balance between high ROI and reduced delta, this option is less likely to be assigned early. The theta benefit makes it favorable for exposure closer to expiration, with appreciable premium collection. It is a highly profitable candidate with managed risk due to its reduced delta and attractive premium.

-

Short Call Option Expiring in December 2026, Strike Price $160.0

- Delta: 0.6871085311

- Theta: -0.0264338866

- Premium: $40.86

- Profit: $40.86

- ROI: 100.0%

-

Analysis: This option is another long-term expiration choice with a relatively balanced delta, suggesting limited risk of early assignment. The theta decay is advantageous, steadily eroding the option's value, beneficial for the call writer. The premium and ROI are highly compelling, with the delta indicating a lower probability of ending in the money.

-

Short Call Option Expiring in June 2025, Strike Price $130.0

- Delta: 0.8111061063

- Theta: -0.0330605337

- Premium: $46.32

- Profit: $16.85775

- ROI: 36.3941062176%

- Analysis: This option strikes a balance between shorter and longer-term expiration dates with a substantial premium collection. The moderate delta value minimizes assignment risks, suggesting that the option will likely stay out-of-the-money. The theta works in the favor of the option writer by providing significant time decay benefits.

These five options, spanning various expiration dates from mid-term to long-term and a range of strike prices, underline the strategy of maximizing premium collections while keeping potential assignments in check through careful delta control. Each offers a robust ROI and profitable outcomes, tailored to different market conditions and risk tolerance thresholds.

Long Put Option Strategy

When analyzing long put options for Alphabet Inc. (GOOGL), it's important to consider several factors including premiums, expiry dates, the Greeks, and return on investment (ROI). Given the array of options with various strike prices and expiration dates, we can identify some of the most profitable strategies based on the target stock price being 5% over the current stock price.

First, lets discuss the option expiring on June 21, 2024, with a strike price of 1120.0 and a premium of 30.5. This option has an impressive ROI of 29.94%, primarily because of its relatively lower premium compared to other options and a profit potential of 913.184. Given its theta value of 0.1346980162, which indicates a relatively low time decay, this option is especially attractive for traders looking for a shorter-term investment with significant profit margin.

For a medium-term investment, the put option with a strike price of 1400.0, expiring on June 21, 2024, warrants consideration. With a premium of 72.0 and an ROI of 15.995%, this option stands out with a profit potential of 1151.684. Due to a slightly higher theta value of 0.1689128202, the time decay is somewhat more prominent, but it is offset by the substantial potential profit and lower risk relative to high strike prices.

For longer-term investments, we examine the option with a strike price of 1800.0, also expiring on June 21, 2024. Here, the premium is set at 164.43, reflecting a higher market expectation of downside movement in GOOGL's stock price. The ROI is 8.8746%, with an outstanding profit potential of 1459.254. Its theta, which is 0.2177911116, suggests a noticeable but manageable rate of time decay for longer-term investors who anticipate significant downward movement in GOOGLs stock price over the extended period.

Another attractive option is the put expiring on June 21, 2024, with a strike price of 1900.0. It carries a premium of 193.45 and offers an ROI of 7.9102% with a projected profit of 1530.234. Given its theta value of 0.2300106845, this option balances the longer-term decay with a high strike price, providing robust profit potential and adequate ROI for investors with a more bearish view extending into the future.

Lastly, for the longest-term option among our considerations, there is the option with a strike price of 2400.0 expiring on June 21, 2024. With a hefty premium of 395.01 and ROI of 4.6294%, the projected profit reaches 1828.674. Although the ROI appears lower compared to other options, the absolute profit is quite substantial, reflecting the higher beta risk (theta = 0.2911085488). This makes it suitable for investors confident in GOOGL's steep price decline over the long term.

In summary, based on your trading strategy and investment horizon, each of these options offers unique benefits. From the short-term high-ROI 1120.0 strike price option to the significantly profitable but lower-ROI 2400.0 strike price option, there is a wide range of choices. Each caters to different risk appetites and views on GOOGLs price movement, allowing investors to tailor their strategies effectively.

Short Put Option Strategy

When analyzing the options chain for short put options on Alphabet Inc. (GOOGL), one of the key considerations is minimizing the assignment of shares, especially for those options that are in the money (ITM). This can be critical for an investor who wants to avoid the obligation to buy shares at the strike price that may be unfavorable given the market conditions.

Based on the provided data and taking into consideration options with near-term to long-term expirations, a 5% target stock price over the current stock price, and emphasis on profitability while minimizing ITM risks, here's an analysis of five promising choices:

- Near-Term Option: Expiring 2024-05-17 with a Strike Price of $144.00

- Delta: -0.0011709327

- Gamma: 0.0004544538

- Vega: 0.0592304285

- Theta: -0.005530942

- Rho: -0.0016392812

- Premium: $0.06

- Profit: $0.06

This option offers a delta close to zero, indicating a very low probability of being ITM at expiration. The premium is relatively high for the short time period, offering an attractive return with minimal risk of share assignment.

- Mid-Term Option: Expiring 2024-06-21 with a Strike Price of $145.00

- Delta: -0.0475496392

- Gamma: 0.0063474033

- Vega: 5.3668627717

- Theta: -0.0194277199

- Rho: -0.8643401381

- Premium: $0.38

- Profit: $0.38

This option extends the expiration by a month while maintaining a higher premium. The delta is still sufficiently low, reducing the chances of this option being ITM.

- Long-Term Option: Expiring 2024-08-16 with a Strike Price of $130.00

- Delta: -0.0447369241

- Gamma: 0.0034089977

- Vega: 8.0364323705

- Theta: -0.012988692

- Rho: -2.0737541627

- Premium: $0.65

- Profit: $0.65

With a delta again indicating a lower probability of the option being ITM, the long-term expiration provides more premium income. The increase in vega suggests this option will benefit from higher volatility.

- Longer-Term Option: Expiring 2025-01-17 with a Strike Price of $130.00

- Delta: -0.1389227327

- Gamma: 0.0036678835

- Vega: 48.01567076

- Theta: -0.0076817715

- Rho: -47.5706897812

- Premium: $6.83

- Profit: $6.83

This option trades off a higher delta, increasing the risk of being ITM, but compensates with a large premium. If the stock stays above the strike price, the profit is significantly greater due to the longer expiration period and higher premium.

- Longest-Term Option: Expiring 2026-12-18 with a Strike Price of $140.00

- Delta: -0.1867844909

- Gamma: 0.0037135665

- Vega: 72.3205812935

- Theta: -0.0055710361

- Rho: -105.3229131516

- Premium: $13.85

- Profit: $13.85

The longest expiration date significantly increases the premium, providing large profit margins if the option expires out of the money. The higher delta relative to nearer-term options does increase risk, but the potential rewards are notable.

In summary, selecting options based on expiration date and strike price involves balancing the delta to minimize the risk of shares being assigned, while targeting higher premiums and profits. The suggested options from near-term to long-term ensure a range of choices for differing risk appetites and financial goals. Each offers a balance between risk and return, potentially maximizing profitability while mitigating the likelihood of significant downside risks associated with ITM obligations.

Vertical Bear Put Spread Option Strategy

When considering a vertical bear put spread strategy for Alphabet Inc. (GOOGL), it is essential to mitigate the risk of having shares assigned. This strategy involves purchasing a long put option at a higher strike price and selling a short put option at a lower strike price. Our goal is to utilize options that are in the money (ITM), allowing us to capture premium decays while minimizing assignment risks. The target stock price fluctuations being approximately 2% above or below the current price further shape our strategy.

Given the sensitivity of the market factors and the Greeks associated with the premium movements, let's analyze the top five near-term to long-term strategies for a vertical bear put spread utilizing various expiration dates.

- Near-term Strategy (2024-05-17):

- Long Put: GOOGL $210 strike expiring on 2024-05-24 with Delta (-0.9957) and a premium of $36.40.

- Short Put: GOOGL $215 strike expiring on 2024-05-24 with Delta (-0.9952) and a premium of $312.90.

-

Analysis: This combination capitalizes on deeper ITM puts, producing a safer margin with higher profitability (ROI). The higher-priced short puts offset the purchased long puts, optimizing premiums.

-

Moderate Strategy (2024-09-20):

- Long Put: GOOGL $220 strike expiring on 2024-09-20 with Delta (-0.9543) and a premium of $46.83.

- Short Put: GOOGL $225 strike expiring on 2024-09-20 with Delta (-0.9995) and a premium of $351.95.

-

Analysis: These moderately closer expiry dates enable less sensitivity to market movements than shorter-term strategies while still providing substantial theta decays, maximizing the spread's profitability.

-

Intermediate Strategy (2025-01-17):

- Long Put: GOOGL $300 strike expiring on 2025-01-17 with Delta (-0.9535) and a premium of $126.05.

- Short Put: GOOGL $305 strike expiring on 2025-01-17 with Delta (-0.9995) and a premium of $377.25.

-

Analysis: This setup extends until early 2025, reducing immediate assignment risks and ensuring better premium capture with a moderate option timeframe sensitivity.

-

Long-term Strategy (2026-06-18):

- Long Put: GOOGL $300 strike expiring on 2026-06-18 with Delta (-0.8437) and a premium of $126.01.

- Short Put: GOOGL $350 strike expiring on 2026-06-18 with Delta (-0.9535) and a premium of $124.55.

-

Analysis: The long-term horizon reduces volatility-induced adjustments while leveraging the deeper ITMs and ensuring significant premium decay captures over time. Delta movements more accurately follow stock price fluctuations under protracted conditions.

-

Extended Horizon Strategy (2026-12-18):

- Long Put: GOOGL $300 strike expiring on 2026-12-18 with Delta (-0.8437) and a premium of $126.01.

- Short Put: GOOGL $350 strike expiring on 2026-12-18 with Delta (-0.9879) and a premium of $109.50.

- Analysis: This extremely extended horizon provides the lowest assignment risk due to the deep ITM nature of the options. Premiums are very lucrative, and the ROI for such a prolonged period showcases the higher stability of the strategy.

Each above strategy effectively balances the tradeoff between potential profitability and the risk of assignment. The near-term expiries provide quicker returns and premiums but require more attention to price movements. In contrast, long-term strategies significantly reduce the assignment risk with broader volatility management and premium decay advantages. The key to a successful vertical bear put spread lies in ensuring that while the put options are sensibly ITM, we also balance the Greeks, particularly Delta, Theta, and Vega, to align with our risk preference and timeline.

Vertical Bull Put Spread Option Strategy

To implement a vertical bull put spread options strategy for Alphabet Inc. (GOOGL), we aim to sell a put option at a higher strike price and buy another put option at a lower strike price. This strategy is designed to be profitable if GOOGLs stock price remains above the sold put's strike price. The advantage of this strategy is that it limits both potential profits and potential losses. Here are five choices for a vertical bull put spread given the goal of minimizing the risk of having shares assigned:

Near-Term Strategy:

- Expiration: 2024-06-21, Strike Prices: 1400 and 1380:

- Sell Put at 1400 strike for a premium of $72.00.

- Buy Put at 1380 strike (hypothetically estimating from available premiums).

- The advantage of this near-term spread is the substantial premium collected, and since the options are deep out of the money, the risk of assignment is minimal.

- Greeks indicate minimal theta decay and gamma risk, making this spread suitable for conservative near-term income generation.

Mid-Term Strategy:

- Expiration: 2025-01-17, Strike Prices: 300 and 280:

- Sell Put at 300 strike for a premium of $126.05.

- Buy Put at 280 strike (hypothetically estimating from available premiums).

- This spread involves larger premiums due to the mid-term duration but remains deep out of the money, providing a balance of good premium collection and low assignment risk.

- The risk exposure (delta) for this spread is relatively lower with moderate vega, suggesting stable performance over the mid-term.

Long-Term Strategy:

- Expiration: 2026-12-18, Strike Prices: 300 and 275:

- Sell Put at 300 strike for a premium of $126.01.

- Buy Put at 275 strike (hypothetically estimating from available premiums).

- This long-term strategy offers high premiums and very low assignment risk due to the deep out-of-the-money position.

- With long maturity, this position benefits from time decay while having a limited delta exposure, allowing for strategic capital deployment over a longer horizon.

Short-Term Strategy:

- Expiration: 2024-06-21, Strike Prices: 1220 and 1200:

- Sell Put at 1220 strike for a premium of $47.00.

- Buy Put at 1200 strike for $45.00.

- This short-term spread has very high premiums with minimal time until expiration, meaning quick profit realization if GOOGLs price holds.

- The risk of assignment is low as the options are significantly out of the money, and the Greeks indicate limited exposure to rapid volatility shifts.

Another Long-Term Strategy:

- Expiration: 2026-12-18, Strike Prices: 270 and 265:

- Sell Put at 270 strike for a premium of $123.65.

- Buy Put at 265 strike for $120.47.

- This spread offers a high long-term premium with a smaller spread width, maximizing potential ROI while limiting the risk of significant price drops.

- Minimal delta and moderate vega suggest the options will not be heavily affected by small daily fluctuations or minor volatility spikes, making it ideal for conservative long-term strategies.

These chosen spreads ensure that each part is deep out of the money, minimizing the risk of having shares assigned. The strategies span different expiration dates from near-term to long-term, balancing premiums, time decay, and volatility exposure. Ensure a consistent assessment of the Greeks to adjust positions as needed, and regularly monitor GOOGLs underlying stock performance to optimize the strategies.

Vertical Bear Call Spread Option Strategy

A vertical bear call spread on Alphabet Inc. (GOOGL) involves selling one call option at a lower strike price while buying another call option at a higher strike price within the same expiration period. This strategy benefits when the stock price stays below the strike price of the sold call, especially when the options are out of the money (OTM), as the goal is to collect the premiums while minimizing the risk of having shares assigned.

Considering the provided Greeks, prices, and our target to minimize assignment risk while generating profitable spreads, let's analyze five optimal bear call spreads across different expiration dates from near-term to long-term:

1. Near-Term Expiry (3 Days)

Date: 2024-05-17 Strike Prices: 95/100 - Short Leg (95): - Premium: $72.60 - Delta: 0.9992 - Profit: $3.02 - Long Leg (100): - Premium: $65.95 - Delta: 0.9967 - Profit: $1.37

Analysis: This spread has a small net debit ($72.60 - $65.95 = $6.65), which can be manageable considering the high likelihood of the options expiring out of the money, especially if the stock price hovers around $95-$100. The Greeks show high deltas approaching 1, suggesting a significant chance these options are deep in the money (ITM). However, with only 3 days to expiry, the risk is minimized as the options are likely to expire without assignment if the stock does not move significantly.

2. One Week Expiry (10 Days)

Date: 2024-05-24 Strike Prices: 110/115 - Short Leg (110): - Premium: $59.67 - Delta: 0.9738 - Profit: $1.63 - Long Leg (115): - Premium: $52.27 - Delta: 0.9310 - Profit: $4.03

Analysis: This spread offers a higher premium collection with a slightly larger net debit ($59.67 - $52.27 = $7.40). The delta values are relatively high but indicate less certainty than in the very near term. The Greek values suggest these options are ITM, but the proximity to $115 reduces the risk of significant movement leading to assignment. This makes it an attractive candidate for a bear call spread over the next 10 days.

3. One Month Expiry (31 Days)

Date: 2024-06-14 Strike Prices: 145/150 - Short Leg (145): - Premium: $21.95 - Delta: 0.8963 - Profit: $4.35 - Long Leg (150): - Premium: $17.32 - Delta: 0.8788 - Profit: $3.98

Analysis: This spread provides robust premium collection with a net debit of ($21.95 - $17.32 = $4.63). Although the delta values are lower compared to shorter-term options, they remain relatively high, indicating a significant likelihood of these options being ITM. Still, the slight drop in delta below 0.9 as we move to higher strike prices suggests lower assignment risk, making this an appealing medium-term strategy.

4. Medium-Term Expiry (66 Days)

Date: 2024-07-19 Strike Prices: 150/155 - Short Leg (150): - Premium: $20.4 - Delta: 0.8217 - Profit: $0.90 - Long Leg (155): - Premium: $14.5 - Delta: 0.8307 - Profit: $1.79

Analysis: This medium-term spread offers good profit potential with a net debit ($20.4 - $14.5 = $5.90). The delta values are reasonably high and close to 0.8, indicating a moderate risk of being ITM. The larger time frame provides more safety against assignment risk, especially considering the higher strike prices involved. This strategy benefits from the premium collection while controlling the downside potential.

5. Long-Term Expiry (129 Days)

Date: 2024-09-20 Strike Prices: 100/105 - Short Leg (100): - Premium: $69.0 - Delta: 0.9464 - Profit: $2.30 - Long Leg (105): - Premium: $63.43 - Delta: 0.9399 - Profit: $2.87

Analysis: The profit potential in this long-term strategy ($5.57 net debit) benefits from greater time decay. The delta values near the ITM thresholds indicate a higher likelihood of these options trading close to their respective strike prices. As the time to expiration is longer, theres a higher chance for stock price fluctuation, but the higher strike prices mitigate assignment risks effectively.

In summary, these five bear call spreads, with varying expiration dates and carefully chosen strike prices, minimize assignment risks while maximizing premium collection and potential profits. They are tailored to different trading horizons, ranging from near-term to long-term strategies, providing flexibility based on your market outlook and risk tolerance.

Vertical Bull Call Spread Option Strategy

When considering a vertical bull call spread for Alphabet Inc. (GOOGL), minimizing the risk of having shares assigned is crucial, particularly when part of the trade is in the money. The target stock price is 2% over or under the current stock price which implies that a conservative approach should be taken to ensure the short call option is out-of-the-money or very close to it in the near term.

Based on the available options data, here are five choices across near-term to long-term expiration dates, focusing on maximizing profitability while keeping a prudent risk management approach:

1. Near-term: Expiration date 2024-06-21, Strike Prices 140.0/145.0

For this near-term strategy, buying the 2024-06-21 call option with a strike of 140.0 (premium = 26.98, delta = 0.9166, theta = -0.0611) and selling the call option with a strike of 145.0 (premium = 24.3, delta = 0.9015, theta = -0.0604) proves to be a compelling choice. The spread offers a potential for higher profitability with lower risk as the short leg is just out of the money. The premiums paid and collected lead to a relatively lower net debit, while maintaining a decent potential for upside.

2. Medium-term: Expiration date 2024-07-19, Strike Prices 120.0/125.0

For the medium-term, buying the 2024-07-19 call option with a strike of 120.0 (premium = 51.0, delta = 0.9425, theta = -0.0451) and selling the call option with a strike of 125.0 (premium = 43.04, delta = 0.9346, theta = -0.0461) appears strategic. This provides a balanced approach between risk and reward. The higher delta for the in-the-money leg ensures good participation in stock movements, while the out-of-the-money short leg reduces risk of assignment while still offering positive theta decay benefit.

3. Long-term: Expiration date 2025-06-20, Strike Prices 130.0/135.0

A longer-term strategy involves buying the 2025-06-20 call option with a strike of 130.0 (premium = 46.32, delta = 0.8119, theta = -0.0329) and selling the call option with a strike of 135.0 (premium = 45.4, delta = 0.7888, theta = -0.0346). This minimal net debit approach works well for those anticipating a gradual upward movement of GOOGL stock. The small difference in premiums results in a low-cost trade while leveraging time value for a steady gain.

4. Longest-term: Expiration date 2026-12-18, Strike Prices 140.0/145.0

Extending even further, buying the 2026-12-18 call option with a strike of 140.0 (premium = 56.5, delta = 0.7673, theta = -0.0242) and selling the call option with a strike of 145.0 (premium = 51.62, delta = 0.7519, theta = -0.0246) is a valuable consideration. This long horizon enables ample time for the stock to move favorably while the net debit remains relatively low, benefiting from extended time value.

5. Intermediate-term: Expiration date 2025-03-21, Strike Prices 140.0/145.0

Lastly, for an intermediate-term strategy, the 2025-03-21 expiration date presents an effective option. By purchasing the 140.0 strike call (premium = 45.5, delta = 0.7626, theta = -0.0302) and selling the 145.0 strike call (premium = 42.1, delta = 0.7431, theta = -0.0302), the spread benefits from a moderate cost with significant potential upside due to the stocks growth potential over the intermediate term.

In conclusion, the chosen vertical bull call options strategies span near to very long-term horizons, focusing on positions where the short leg minimizes assignment risk and both legs optimize profitability potential. These strategies accommodate for the target price movement while adhering to prudent risk management principles.

Similar Companies in Internet Content & Information:

Alphabet Inc. (GOOG), Report: Twilio Inc. (TWLO), Twilio Inc. (TWLO), Snap Inc. (SNAP), Baidu, Inc. (BIDU), Report: Meta Platforms, Inc. (META), Meta Platforms, Inc. (META), Pinterest, Inc. (PINS), Tencent Holdings Limited (TCEHY), Microsoft Corporation (MSFT), Report: Apple Inc. (AAPL), Apple Inc. (AAPL), Report: Amazon.com, Inc. (AMZN), Amazon.com, Inc. (AMZN), Report: Netflix, Inc. (NFLX), Netflix, Inc. (NFLX), Salesforce, Inc. (CRM), Oracle Corporation (ORCL), IBM Corporation (IBM), Twitter, Inc. (TWTR)

https://www.youtube.com/watch?v=0koQRiGn23o

https://www.youtube.com/watch?v=S8WE05rQrdI

https://www.youtube.com/watch?v=jUdhGc5lNuE

https://www.youtube.com/watch?v=IHdB4uLaL4A

https://www.fool.com/investing/2024/04/05/is-alphabet-stock-a-buy-now/

https://www.youtube.com/watch?v=kTGNTPhKh08

https://www.youtube.com/watch?v=e5YwNz9WAnA

https://www.youtube.com/watch?v=8DNCrlNsFOQ

https://www.fool.com/investing/2024/04/06/could-the-trade-desk-become-the-next-alphabet/

https://www.fool.com/investing/2024/04/06/is-ai-hype-real-3-ai-stocks-stand-test-time/

https://www.fool.com/investing/2024/04/07/superb-growth-stocks-to-buy-in-2024-bull-market/

https://www.fool.com/investing/2024/04/08/will-google-parent-alphabet-acquire-hubspot-not-so/

https://www.sec.gov/Archives/edgar/data/1652044/000165204424000053/goog-20240331.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: yRru3J

Cost: $1.17821

https://reports.tinycomputers.io/GOOGL/GOOGL-2024-05-13.html Home