Lockheed Martin Corporation (ticker: LMT)

2024-02-04

Lockheed Martin Corporation (LMT) stands as a global security and aerospace company that is primarily involved in the research, design, development, manufacture, integration, and sustainment of advanced technology systems, products, and services. Serving both U.S. and international customers, it operates in four major business segments: Aeronautics, which includes the renowned F-35 Lightning II fighter jet; Missiles and Fire Control, known for precision strike weapons and missile defense systems; Rotary and Mission Systems, which covers naval systems, platform integration, simulation and training services; and Space Systems, focusing on satellites, strategic and defensive missile systems, and space exploration initiatives. With its headquarters in Bethesda, Maryland, Lockheed Martin has established itself as a leading defense contractor by revenue in the world, underpinning its significance in the defense, space, and technology sectors through innovation and strategic partnerships. The company's commitment to solving complex challenges, advancing scientific discovery, and supporting national security objectives underscores its pivotal role in shaping global defense and aerospace dynamics.

Lockheed Martin Corporation (LMT) stands as a global security and aerospace company that is primarily involved in the research, design, development, manufacture, integration, and sustainment of advanced technology systems, products, and services. Serving both U.S. and international customers, it operates in four major business segments: Aeronautics, which includes the renowned F-35 Lightning II fighter jet; Missiles and Fire Control, known for precision strike weapons and missile defense systems; Rotary and Mission Systems, which covers naval systems, platform integration, simulation and training services; and Space Systems, focusing on satellites, strategic and defensive missile systems, and space exploration initiatives. With its headquarters in Bethesda, Maryland, Lockheed Martin has established itself as a leading defense contractor by revenue in the world, underpinning its significance in the defense, space, and technology sectors through innovation and strategic partnerships. The company's commitment to solving complex challenges, advancing scientific discovery, and supporting national security objectives underscores its pivotal role in shaping global defense and aerospace dynamics.

| Full Time Employees | 122,000 | CEO Total Pay | $11,396,651 | CFO Total Pay | $3,410,479 |

| Dividend Rate | 12.6 | Dividend Yield | 2.96% | Payout Ratio | 44.1% |

| Beta | 0.515 | Trailing PE | 15.456 | Forward PE | 15.406 |

| Volume | 968,333 | Average Volume | 1,159,336 | Market Cap | $102,932,668,416 |

| Profit Margins | 10.24% | Book Value | 28.244 | Price to Book | 15.082 |

| Net Income to Common | $6,920,000,000 | Trailing EPS | 27.56 | Forward EPS | 27.65 |

| Total Cash | $1,442,000,000 | Total Debt | $18,635,999,232 | Total Revenue | $67,570,999,296 |

| EBITDA | $10,225,000,448 | Return on Assets | 10.75% | Return on Equity | 85.96% |

| Statistic Name | Statistic Value | Statistic Name | Statistic Value |

| Sharpe Ratio | -0.5257930931195154 | Sortino Ratio | -9.006490905779126 |

| Treynor Ratio | -0.27363209546677175 | Calmar Ratio | -0.345850420337382 |

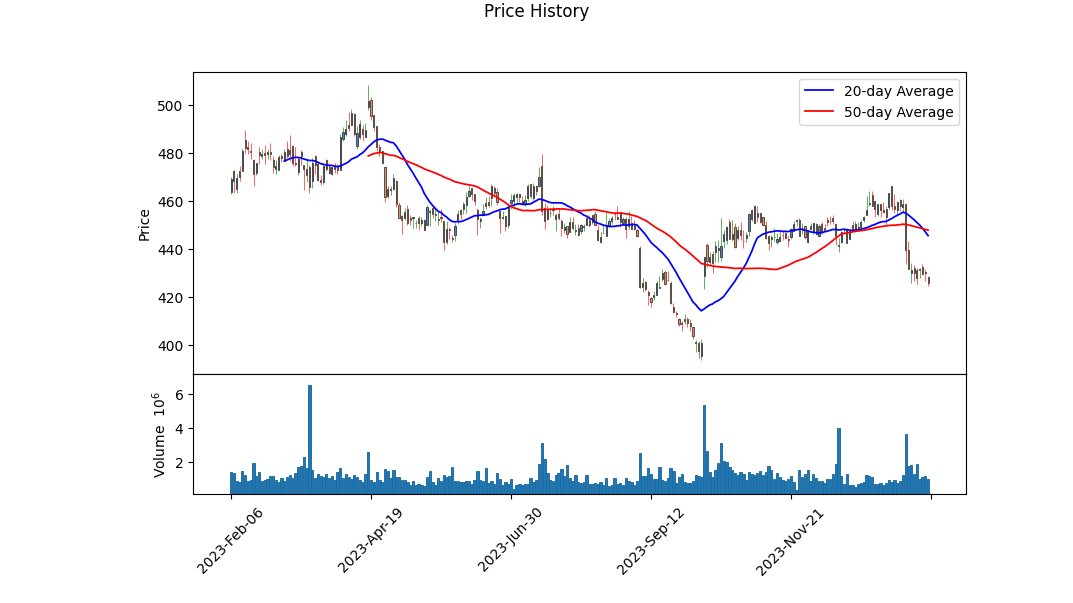

In examining the future trajectory of Lockheed Martin Corporation (LMT), a comprehensive analysis encompassing technical indicators, fundamental analytics, and an exploration of the company's financial health is pivotal for constructing an informed outlook. LMT's stock has demonstrated certain fluctuations within the reviewed period, with opening and closing prices conveying subtle yet informative movements. The absence of MACD histogram data up until January 29, 2024, impedes a portion of our technical analysis; however, the recent negative trend in the MACD histogram values suggests weakening momentum in stock price movement. The On-Balance Volume (OBV) metric reveals varying levels of trading volume which does not present a clear trend, requiring investors to look beyond surface-level technical indicators for decision-making.

Analyzing the fundamentals, LMT's financial performance displays strong attributes, notably with a consistent Net Income From Continuing Operations and a solid stance in Total Revenue across recent fiscal years. The EBITDA and Operating Income metrics underscore the company's robust operational efficiency, reflected in its capability to manage expenses and investments efficiently. Moreover, the Gross Profit figures denote LMT's prowess in maintaining its profitability margins amidst market dynamics. Such fundamental solidity is crucial for evaluating LMT's stock from a long-term perspective.

A detailed review of LMTs balance sheets highlights a significant level of Net Debt but also indicates a stable cash position, which implies a managed leverage situation that does not overly jeopardize the company's financial stability. The Tangible Book Value entering into the negative realm warrants attention; however, it's not uncommon for companies in capital-intensive sectors to carry substantial intangible assets and goodwill on their balance sheets.

The summary of cash flows presents an organization adept at generating Free Cash Flow, an aspect critical for sustaining operations, paying dividends, and enabling capital returns to shareholders. Despite a notable Repurchase of Capital Stock, impacting Financing Cash Flow negatively, this may also reflect the company's confidence in its intrinsic value.

Reflecting on analyst expectations, the revised upward earnings estimate and the projected revenue growth are affirmative signs that market sentiment around LMT's operational and financial performance is improving. The anticipation of sales growth underlines the confidence in LMT's market position and its ability to navigate through industry-specific challenges.

Considering the risk-adjusted return ratios, namely the Sharpe, Sortino, Treynor, and Calmar Ratios, LMT's performance in recent periods indicates challenges in generating returns that surpass the risk-free rate when adjusted for volatility, downside risks, and market movement. This aspect suggests that investors' expectations should be tempered by the recognition of inherent market risks and the stock's particular volatility profile.

Incorporating all facets of this analysis, Lockheed Martin's near- to medium-term stock price movements will likely be influenced by both external market conditions and its internal financial health and strategic initiatives. While technical signals hint at possible short-term volatility, the company's strong fundamentals and positive outlook in analyst expectations provide a counterbalance that may favor long-term growth. Investors should weigh the robust operational and financial metrics against the current risk-return profile, keeping in view the evolving aerospace and defense sector landscape.

In analyzing Lockheed Martin Corporation (LMT), an essential component of our research revolves around assessing its financial efficacy and potential for future growth through key metrics such as Return on Capital (ROC) and Earnings Yield. Our findings illustrate a robust financial performance by Lockheed Martin as highlighted by its substantial ROC of 23.95%. This percentage signifies that the company efficiently utilizes its capital to generate profits, a paramount indicator of a healthy financial structure and operational prowess. On the other hand, Lockheed Martins Earnings Yield stands at 6.49%, offering a glimpse into its valuation from an earnings perspective compared to its current market price. This yield presents the company as an enticing proposition for potential investors, indicating that Lockheed Martin is generating substantial earnings relative to its share price, hence implying a potentially undervalued stock or a strong earnings generation capability. Together, these metrics provide a compelling overview of Lockheed Martin's financial health and its attractiveness as an investment opportunity, reinforcing its position in the market and its potential for future growth and profitability.

In analyzing the financial metrics and dividend history for Lockheed Martin Corporation (LMT) against the criteria outlined by Benjamin Graham in "The Intelligent Investor," we observe the following:

-

Price-to-Earnings (P/E) Ratio: The P/E ratio is a crucial metric for evaluating the relative value of a company's shares in the context of its earnings. Benjamin Graham traditionally sought stocks with a low P/E ratio, commonly below 15, as a sign of undervaluation. LMT's P/E ratio of 17.68 slightly exceeds this threshold, suggesting the stock may not meet Graham's strict value investing criteria in this regard.

-

Price-to-Book (P/B) Ratio: Graham favored companies trading at a discount to their book value, typically advocating for a P/B ratio of less than 1.5. LMT's P/B ratio is 1.96, indicating the company trades at a premium to its book value and may not align with Graham's preference for undervalued stocks.

-

Debt-to-Equity Ratio: A low debt-to-equity ratio was critical to Graham's analysis, as it indicates a company has not financed its growth with excessive debt. LMTs debt-to-equity ratio stands at 2.55, which is considerably higher than Graham's conservative benchmarks, indicating a level of financial leverage that may pose risks.

-

Dividend History: Graham valued companies with a consistent record of paying dividends as it reflects financial stability and a shareholder-friendly policy. LMT has a robust history of consistently paying and gradually increasing dividends, aligning with Graham's criteria for selecting financially stable companies that reward shareholders.

-

Current and Quick Ratios: These ratios assess a company's ability to meet short-term obligations, with Graham typically looking for a current ratio above 1.5. LMTs current ratio is approximately 1.21, suggesting a tighter liquidity position than Graham would prefer.

-

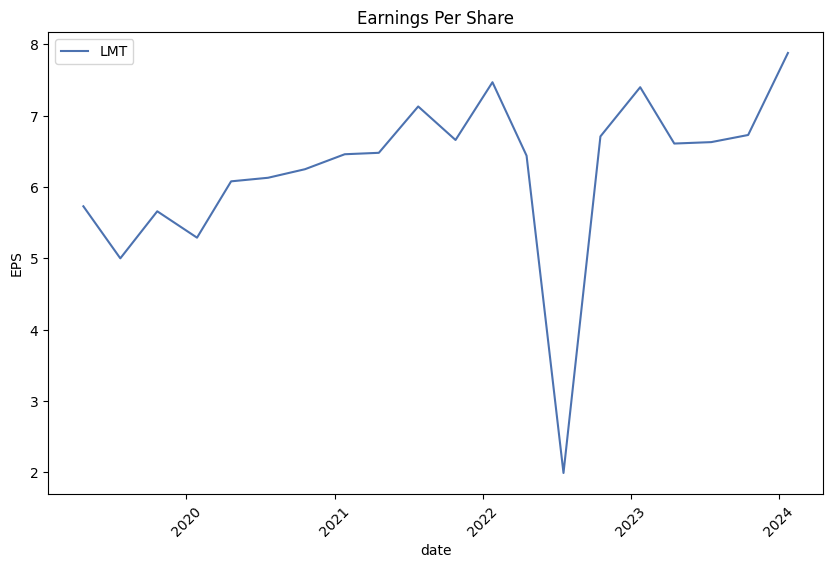

Earnings Growth: Consistent earnings growth over a period is another factor Graham considered. While the provided data does not specifically address earnings growth, Lockheed Martins historical dividend data suggest a stable financial performance, indicative of potential earnings stability or growth which would be necessary to further evaluate this criterion.

-

Industry P/E Ratio: Comparing the company's P/E ratio to its industry can provide context on valuation, although specific industry comparisons are not provided in the data.

Given this analysis, Lockheed Martin Corporation shows strengths in its commitment to returning value to shareholders through dividends, an aspect appreciated by Graham. However, its higher P/E and P/B ratios, coupled with a significant debt-to-equity ratio, suggest the stock might not fully align with the stringent value investing criteria outlined by Benjamin Graham. Potential investors seeking to adhere strictly to Graham's methodology may need to weigh these factors carefully, considering both the financial stability indicated by dividend history against the concerns raised by valuation metrics and financial leverage.

| Statistic Name | Statistic Value |

| R-squared | 0.260 |

| Adj. R-squared | 0.260 |

| F-statistic | 441.3 |

| Prob (F-statistic) | 3.33e-84 |

| Log-Likelihood | -2213.6 |

| AIC | 4431 |

| BIC | 4441 |

| coef (const) | 0.0114 |

| coef (LMT) | 0.6339 |

| alpha | 0.011379237426567998 |

| beta | 0.6338597760683711 |

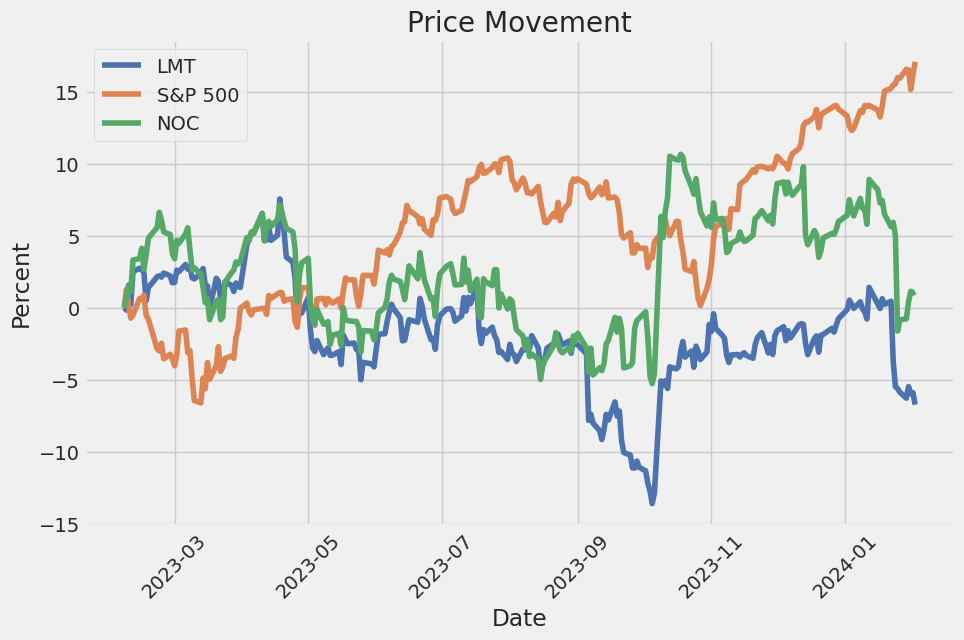

The linear regression model established between Lockheed Martin Corporation (LMT) and SPDR S&P 500 ETF Trust (SPY) for the period ending today indicates a somewhat modest relationship, with an R-squared of 0.260, suggesting that approximately 26% of the variability in LMT's stock price is explained by movements in the SPY. A closer look at alpha and beta values shows interesting dynamics. Specifically, the alpha value of 0.011379237426567998 (or approximately 1.14%) suggests that LMT has a slight positive performance baseline when the market remains neutral, highlighting a mild outperformance against the market benchmark on its own merits.

Furthermore, the beta of 0.6338597760683711 positions LMT as less volatile compared to the broader market movements represented by SPY. This lower beta indicates that Lockheed Martin's stock price movements are less responsive to changes in the stock market, suggesting a level of resilience or idiosyncratic risk not entirely tied to the broader market's performance. The presence of an alpha suggests that LMT has historically offered investors a slight additional return over what would be predicted by its market exposure alone, making it a potentially attractive consideration for those looking to diversify or seek slight outperformance in relation to the market.

Lockheed Martin Corporation concluded its fourth quarter and full-year 2023 earnings call with an optimistic outlook despite facing some challenges throughout the year. Maria Ricciardone, Vice President, Treasurer, and Investor Relations, initiated the call, which featured key discussions on the company's strategic advancements, financial performance, and future outlook. Jim Taiclet, Chairman, President, and CEO, highlighted Lockheed Martin's progress in advancing its 21st Century security strategy, delivering strong financial results, and achieving a record backlog of $161 billion. The company made significant investments in research and development, and capitalized on the robust demand for its diverse portfolio, leading to a 2% year-over-year increase in full-year sales to $67.6 billion.

Taiclet also detailed Lockheed Martin's efforts to enhance supply chain resilience and international partnerships, positioning the company for future growth opportunities. Notable collaborations with industry leaders like Intel, Verizon, and Microsoft showcased Lockheed Martin's commitment to integrating advanced technologies into national defense. Additionally, partnerships with allied nations were underscored by projects such as Australia's AIR6500 joint battle management system and the guided weapons production capability with Australia, demonstrating the company's global reach and impact on international defense capabilities.

Chief Financial Officer Jay Malave provided an in-depth analysis of the company's financial performance, emphasizing the stronger-than-expected sales and operational achievements in 2023. He outlined the initial guidance for 2024, anticipating low single-digit sales growth and a free cash flow range of $6 billion to $6.3 billion. Despite facing margin pressures, particularly from classified programs within the Missiles and Fire Control segment, Lockheed Martin remains focused on disciplined capital returns to shareholders, underlining its robust financial management and strategic allocation of resources.

Throughout the call, the executives addressed various questions related to operational specifics, future expectations, and strategic initiatives. Challenges such as the delay in Tech Refresh 3 for the F-35 program and evolving government contracting approaches were discussed, highlighting the company's adaptive strategies in a dynamic defense industry landscape. Lockheed Martin's commitment to pricing discipline, supply chain optimization, and technology integration was evident, positioning the company for sustained growth and operational excellence in the years ahead. The call concluded with reinforcing Lockheed Martin's dedication to its core values and strategic vision, promising continued advancement in 21st Century security solutions.

710 million at Space due to higher volume on strategic and missile defense programs (NGI development and FBM) and higher volume on other satellite programs (GPS III Follow-On (GPS IIIF) and Protected Payload Program (P3)); and $425 million at RMS due to higher volume on IWSS programs. These increases were partially offset by lower product sales of $175 million at Aeronautics due to lower volume on F-35 production contracts.

Service Sales Service sales increased $292 million, or 11%, during the quarter ended September 24, 2023 compared to the same period in 2022. The increase was primarily attributable to higher service sales of $119 million at Aeronautics due to higher volume on aircraft sustainment activities (F-35 and classified programs); $106 million at RMS due to higher volume on training and logistics solutions programs (Special Operations Forces Global Logistics Support Services (SOF GLSS)); and $71 million at Space due to higher volume on government satellite programs (Protected Payload Program (P3)). Service sales increased $672 million, or 9%, during the nine months ended September 24, 2023 compared to the same period in 2022 primarily due to higher service sales of $463 million at Aeronautics due to higher volume on aircraft sustainment activities (F-35 and classified programs); and $224 million at Space due to higher volume on government satellite programs (P3), partially offset by lower service sales at RMS due to lower volume on C6ISR programs.

Operating Profit Our consolidated operating profit was as follows (in millions): Quarters Ended Nine Months Ended September 24, 2023 September 25, 2022 September 24, 2023 September 25, 2022 Operating profit $2,042 $2,159 $6,214 $6,055

For the quarter ended September 24, 2023, the decrease in operating profit compared to the same period in 2022 was primarily attributable to reduced margins at Aeronautics due to performance issues. The increase in operating profit for the nine months ended September 24, 2023 compared to the same period in 2022 was primarily due to the cumulative effect of adjustments to contract estimates across multiple segments.

Earnings Before Income Taxes Our earnings before income taxes were as follows (in millions): Quarters Ended Nine Months Ended September 24, 2023 September 25, 2022 September 24, 2023 September 25, 2022 Earnings before income taxes $1,953 $2,099 $5,953 $4,490

The decrease in earnings before income taxes for the quarter ended September 24, 2023 compared to the same period in 2022 was primarily due to lower operating profit and higher interest expense, partially offset by non-service FAS pension income. The increase in earnings before income taxes for the nine months ended September 24, 2023 compared to the same period in 2022 was primarily due to non-service FAS pension income and the cumulative effect of adjustments to contract estimates across multiple segments.

Net Earnings Our net earnings were as follows (in millions): Quarters Ended Nine Months Ended September 24, 2023 September 25, 2022 September 24, 2023 September 25, 2022 Net earnings $1,684 $1,778 $5,054 $3,820

The decrease in net earnings for the quarter ended September 24, 2023 compared to the same period in 2022 was primarily due to lower earnings before income taxes and higher income tax expense. The increase in net earnings for the nine months ended September 24, 2023 compared to the same period in 2022 was predominantly driven by non-service FAS pension income and the cumulative effect of adjustments to contract estimates across multiple segments, partially offset by higher income tax expense.

Lockheed Martin Corporation's strategic positioning within both the aerospace and defense sectors increasingly aligns with the evolving global geopolitical landscape and shifting market dynamics. The company, renowned for its innovation and pivotal contributions to national security, finds itself in a unique position to leverage emerging opportunities while navigating inherent challenges that accompany sectors marked by rapid technological advancements and geopolitical sensitivities.

As market dynamics shift, particularly in space launch pricing and capabilities, Lockheed Martin, through its joint venture in the United Launch Alliance (ULA) with Boeing, has endeavored to remain competitive. The evolving challenges faced by companies like Arianespace, underscore a broader industry trend toward competitive pricing and innovation in space launch capabilities. Lockheed Martin, leveraging its collaboration through ULA, is strategically positioned to address these market shifts. The challenges encountering the Ariane 6 development, marked by delays and increased costs, highlight the imperative for companies like Lockheed Martin to foster innovation and reduce costs to maintain competitiveness in an increasingly crowded marketplace.

Financial insights into Lockheed Martin suggest a solid competitive edge and a potential for annual returns, emphasizing the company's robust financial health and innovative capabilities. The diversified operations spanning across Aeronautics, Missiles and Fire Control (MFC), Rotary and Mission Systems (RMS), and Space segments, coupled with strategic government relations and a long-term focus on innovation, places Lockheed Martin in a favorable position for sustained growth. The company's engagement in significant defense contracts, including the illustrious F-35 program, showcases its technological leadership and strategic importance to the U.S. defense strategy.

The forward-looking statements by financial analysts as of late 2023 and early 2024, affirm Lockheed Martins strategic and financial fortitude within the defense sector. The challenges of supply chain disturbances and program-specific risks exemplify the broader industry landscape's complexities Lockheed Martin navigates. Still, the company's substantial order backlog and strategic positions offer a tempered optimism for its financial and operational trajectory.

Moreover, the ability of ULA to offer competitive prices against industry disruptors like SpaceX marks a significant achievement in the aerospace industry. This development not only highlights the dynamic nature of the space launch market but also underscores the importance of innovation and cost management in sustaining competitiveness. Lockheed Martin's strategic moves, including its significant contributions to national defense and ventures into space exploration and cybersecurity, promise growth avenues amidst the evolving defense needs.

Lockheed Martin's anticipated sale of nearly $2 billion to Greece, transitioning the country's helicopter fleet, reveals the company's capacity to secure substantial contracts, further bolstering its market position. Though the financial impact of individual deals may be incremental relative to the company's overall financials, such transactions underscore Lockheed Martin's essential role in the global defense landscape.

The potential public offering of ULA also introduces speculative elements regarding Lockheed Martins strategic directions. Whether an IPO materializes or not in 2024, the speculation surrounding ULA's future highlights the intricate balance Lockheed Martin navigates between leveraging partnerships and exploring avenues for maximizing shareholder value.

In essence, Lockheed Martin Corporation's journey through 2024 appears scaffolded by its strategic agility, technological leadership, and a keen adaptation to market and geopolitical dynamics. As the company aligns its operations and strategic initiatives with the changing contours of the defense and aerospace sectors, it retains a pivotal role in not just shaping defense capabilities globally but also in influencing the economic paradigms within which the defense and aerospace industries operate.

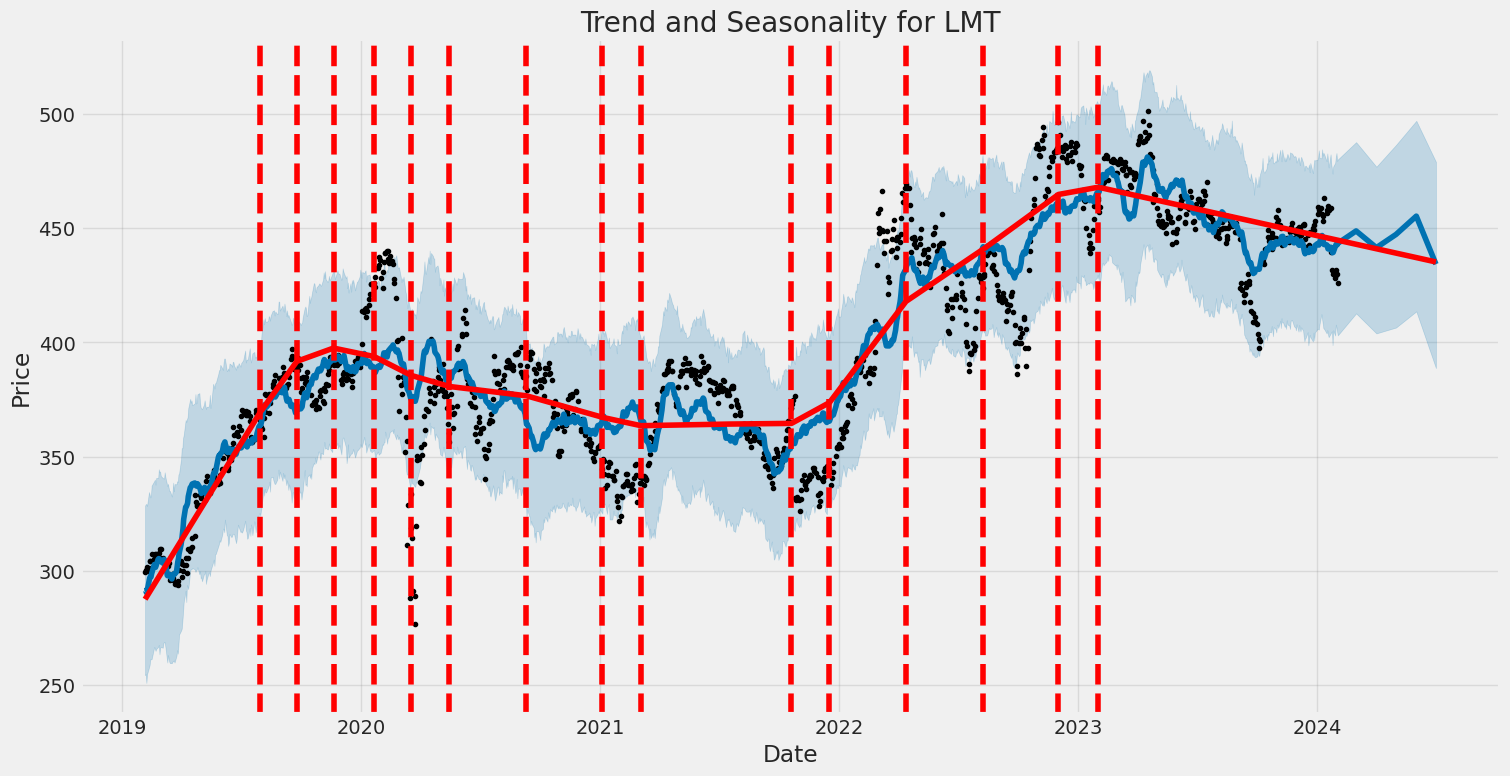

Lockheed Martin Corporation (LMT) experienced significant volatility between February 2019 and February 2024, as highlighted by the ARCH model results. The model indicates a nonzero omega value, suggesting a persistent level of volatility in LMT's asset returns over the observed period. Additionally, the significant alpha[1] coefficient signifies that past volatility spikes had a substantial impact on future volatility, pointing to a reactive market behavior around LMT's stock.

| Statistic Name | Statistic Value |

|---|---|

| Log-Likelihood | -2274.47 |

| AIC | 4552.93 |

| BIC | 4563.21 |

| omega | 1.6428 |

| alpha[1] | 0.3888 |

To evaluate the financial risk of a $10,000 investment in Lockheed Martin Corporation (LMT) over a one-year span, a blend of volatility modeling and machine learning predictions is used. The volatility modeling method provides insights into the variability of Lockheed Martin Corporation's stock prices over time, which is pivotal for understanding the nature of the risk associated with this investment. By fitting historical stock price data into the volatility model, we grasp how stock price fluctuations could potentially behave in the future, underpinning the foundational theory of financial risk analysis.

In parallel, machine learning predictions serve a dual purpose: forecasting future stock returns and enhancing the accuracy of our risk assessment. In this context, the selected machine learning algorithm analyzes past performance and various market indicators to generate forward-looking predictions about the stock's return. This predictive capability is instrumental in offering a nuanced perspective on the expected performance of Lockheed Martin Corporation's stock, weaving together past trends and potential future outcomes.

Marrying the insights from volatility modeling with the forward-looking predictions yielded by machine learning allows for a robust assessment of investment risk in Lockheed Martin Corporation. Specifically, the integration facilitates the calculation of the Value at Risk (VaR) metric, a widely recognized measure quantifying the maximum expected loss under normal market conditions at a given confidence level.

For a $10,000 investment in Lockheed Martin Corporation over a one-year period, the calculated VaR at a 95% confidence interval stands at $191.29. This metric signifies that there is a 95% probability that the investor would not lose more than $191.29 over the year, under normal market conditions. It encapsulates both the potential volatility of Lockheed Martins stock, as unraveled by the volatility model, and the expected stock returns, as forecasted by machine learning predictions.

This combined approach of leveraging volatility modeling to gauge the intrinsic variability of the stock, along with employing machine learning to anticipate future returns, provides a panoramic and nuanced view of the investment's financial risk. The insights derived not only illuminate the possible scenarios of stock price movements but also frame the range of financial outcomes an investor can expect, thereby offering a comprehensive risk assessment for a $10,000 investment in Lockheed Martin Corporation over a one-year timeframe.

| Strike Price | Expiration Date | Profit | Delta | Gamma | Theta | Vega |

|---|---|---|---|---|---|---|

| 329 | 2023-12-20 | 20,068.50 | 0.8804 | 0.000554 | Not Available | 67.972 |

| 2 | 2024-01-15 | 19,468.50 | 0.746674 | 0.03449 | Not Available | 14.258 |

| 38 | 2023-10-05 | 19,458.50 | 0.973986 | 0.000553 | Not Available | 4.339 |

| 132 | 2023-11-17 | 18,518.50 | 0.955409 | 0.000961 | Not Available | 12.339 |

| 130 | 2023-08-24 | 18,468.50 | 0.969603 | 0.000489 | Not Available | 8.739 |

Similar Companies in Aerospace & Defense:

Report: Northrop Grumman Corporation (NOC), Northrop Grumman Corporation (NOC), Report: General Dynamics Corporation (GD), General Dynamics Corporation (GD), Report: L3Harris Technologies, Inc. (LHX), L3Harris Technologies, Inc. (LHX), Report: The Boeing Company (BA), The Boeing Company (BA), Report: Raytheon Technologies Corporation (RTX), Raytheon Technologies Corporation (RTX), Huntington Ingalls Industries, Inc. (HII), Virgin Galactic Holdings, Inc. (SPCE), Textron Inc. (TXT)

https://www.fool.com/investing/2023/12/23/arianes-new-price-tag-is-bad-news-for-airbus/

https://seekingalpha.com/article/4660158-lockheed-martin-3-reasons-to-buy-this-compounding-machine

https://www.fool.com/investing/2023/12/29/where-will-lockheed-martin-stock-be-in-1-year/

https://www.youtube.com/watch?v=ku42CNQTYUo

https://www.fool.com/investing/2023/12/30/jaw-dropping-news-boeing-and-lockheed-just-matched/

https://seekingalpha.com/article/4660517-lockheed-martin-stock-opportunity-knocks

https://www.fool.com/investing/2024/01/08/lockheed-martin-to-replace-greek-helicopter-fleet/

https://www.fool.com/investing/2024/01/11/why-lockheed-martin-trailed-the-market-in-2023/

https://www.fool.com/investing/2024/01/13/beat-the-dow-jones-with-this-cash-gushing-dividend/

https://www.fool.com/investing/2024/01/14/can-boeing-and-lockheed-martin-compete-with-spacex/

https://www.fool.com/investing/2024/01/15/will-united-launch-alliance-have-an-ipo-in-2024/

https://www.sec.gov/Archives/edgar/data/936468/000093646823000123/lmt-20230924.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: HkV3tNS

Cost: $1.04370

https://reports.tinycomputers.io/LMT/LMT-2024-02-04.html Home