Marvell Technology, Inc. (ticker: MRVL)

2024-01-27

Marvell Technology, Inc. (ticker: MRVL) is a prominent player in the semiconductor industry, designing and producing a broad range of integrated circuit solutions and embedded technology that is essential in powering high-performance computing infrastructure. The company's product portfolio is diverse, including storage, networking, and connectivity solutions that are critical for data centers, enterprise networks, and telecommunications equipment. Marvell has strategically positioned itself to ride the wave of data growth, cloud computing, and the increased demand for efficient processing and movement of massive amounts of data. Over the years, Marvell has expanded through organic growth as well as strategic acquisitions, allowing it to broaden its technological capabilities and market reach. Financially, the company's performance is closely watched by investors and is often seen as a bellwether for the semiconductor sector, with its stock price reflecting the market's expectations for the company's growth and profitability prospects.

Marvell Technology, Inc. (ticker: MRVL) is a prominent player in the semiconductor industry, designing and producing a broad range of integrated circuit solutions and embedded technology that is essential in powering high-performance computing infrastructure. The company's product portfolio is diverse, including storage, networking, and connectivity solutions that are critical for data centers, enterprise networks, and telecommunications equipment. Marvell has strategically positioned itself to ride the wave of data growth, cloud computing, and the increased demand for efficient processing and movement of massive amounts of data. Over the years, Marvell has expanded through organic growth as well as strategic acquisitions, allowing it to broaden its technological capabilities and market reach. Financially, the company's performance is closely watched by investors and is often seen as a bellwether for the semiconductor sector, with its stock price reflecting the market's expectations for the company's growth and profitability prospects.

| Industry | Semiconductors | Sector | Technology | Full Time Employees | 7,418 |

| Previous Close | 70.00 | Open | 68.7 | Day Low | 67.78 |

| Day High | 69.565 | Dividend Rate | 0.24 | Dividend Yield | 0.34% |

| Payout Ratio | 11.01% | Five Year Avg Dividend Yield | 0.63 | Beta | 1.516 |

| Forward PE | 33.85 | Volume | 14,043,004 | Average Volume | 10,577,593 |

| Market Cap | 58,820,579,328 | 52 Week Low | 36.64 | 52 Week High | 73.53 |

| Price to Sales Trailing 12 Months | 10.695 | 50 Day Average | 59.3942 | 200 Day Average | 55.2006 |

| Trailing Annual Dividend Rate | 0.24 | Enterprise Value | 64,211,800,064 | Profit Margins | -10.111% |

| Shares Outstanding | 864,499,968 | Held Percent Insiders | 0.499% | Held Percent Institutions | 87.463% |

| Short Ratio | 1.98 | Book Value | 17.625 | Price to Book | 3.8604 |

| Currency | USD | Current Price | 68.04 | Target High Price | 100.00 |

| Target Low Price | 56.00 | Target Mean Price | 72.00 | Target Median Price | 70.00 |

| Recommendation Mean | 1.8 | Total Cash | 725,600,000 | Total Debt | 4,422,400,000 |

| Total Revenue | 5,499,700,224 | Operating Cash Flow | 1,175,399,936 | Free Cash Flow | 1,475,849,984 |

| Revenue Growth | -7.7% | Gross Margins | 42.102% | EBITDA Margins | 18.166% |

| Operating Margins | -10.073% | Return on Assets | -1.101% | Return on Equity | -3.612% |

| Sharpe Ratio | -6.578350260654271 | Sortino Ratio | -133.71663271177056 |

| Treynor Ratio | 0.23100424329653352 | Calmar Ratio | 1.8741485945601641 |

Marvell Technology Group Ltd. (MRVL) Technical Analysis and Fundamental Outlook

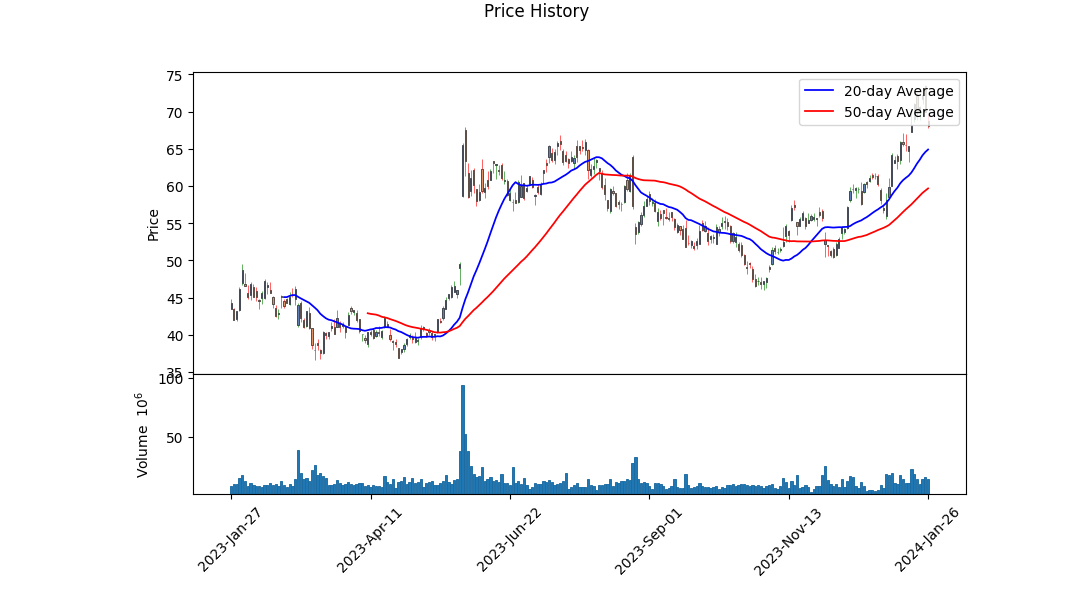

Analyzing the technical indicators from the recent trading activity, it's evident that the stock of Marvell Technology Group Ltd. (MRVL) has experienced significant upward momentum. Notably, the On-Balance Volume (OBV) has demonstrated a steady rise over the past months, which typically indicates accumulating volume and potential continued interest from buyers. Additionally, the positive values seen in the MACD histogram are consistent with bullish momentum.

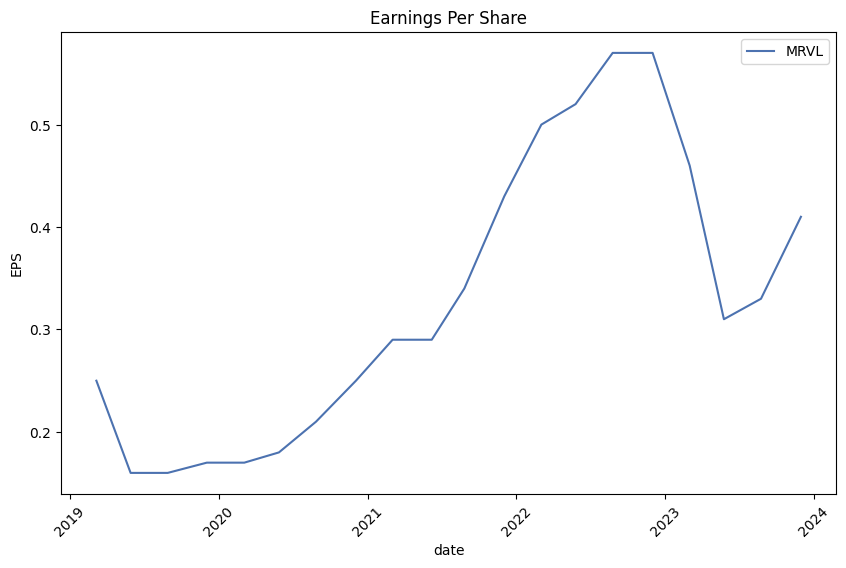

The analysis of key fundamental metrics presents a more complex picture. Gross margins are robust at 42.1%, but the company is showing an operating margin in negative territory, indicative of expenses outpacing revenue. Nevertheless, the EBITDA margins are positive. It is critical to scrutinize the details of the income statement, balance sheet, and cash flows to gain a more comprehensive understanding of the fundamentals.

The balance sheet elucidates a heavy debt load with negative tangible book value, potentially raising concerns about financial stability. However, recent cash flows are healthy, with significant free cash flow generation. This free cash flow, if sustained, may support further investment, debt reduction, or provide the ability to return capital to shareholders.

Analyst expectations anticipating considerable growth for the next fiscal year suggests confidence in the company's pipeline and market position. According to analyst estimates, Marvell is expected to see revenue growth and has positive EPS revisions for the next year, further bolstering the bullish case.

Risk-adjusted performance metrics, including the Sharpe, Sortino, Treynor, and Calmar Ratios, provide insight into the company's returns relative to its risk profile. The low or negative Sharpe and Sortino Ratios over the past year reflect poor risk-adjusted returns, but a higher Calmar Ratio suggests that the investment might perform better in recovery phases post-downturns.

Combining the technical outlook with the fundamental perspective, there are signs of strength balanced by areas of concern. Investors and potential shareholders should acknowledge that despite technical bullishness and a strong growth outlook, there remain risks associated with negative operating margins and a significant level of debt.

In the next few months, given the positive technical indicators and analyst growth projections, it is plausible that MRVL could continue its upward trajectory if the broader market conditions remain favorable and the company successfully manages its debt and operational efficiency. However, monitoring upcoming earnings reports, news releases, and sector performance will be critical in assessing whether MRVL can sustain its positive momentum and whether the companys fundamentals will align with its recent technical performance.

| Statistic Name | Statistic Value |

| R-squared | 0.427 |

| Adj. R-squared | 0.427 |

| F-statistic | 937.9 |

| Prob (F-statistic) | 2.63e-154 |

| Log-Likelihood | -2,903.5 |

| AIC | 5,811 |

| BIC | 5,821 |

| Const (alpha) | 0.0570 |

| Coefficient (beta) | 1.5976 |

| Standard Error | 0.052 |

| t-value | 30.625 |

| P>|t| | 0.000 |

| [0.025 | 1.495 |

| 0.975] | 1.700 |

| Durbin-Watson | 2.085 |

| Omnibus | 753.427 |

| Prob(Omnibus) | 0.000 |

| Jarque-Bera (JB) | 29,503.371 |

| Skew | 2.149 |

| Kurtosis | 26.332 |

| Cond. No. | 1.32 |

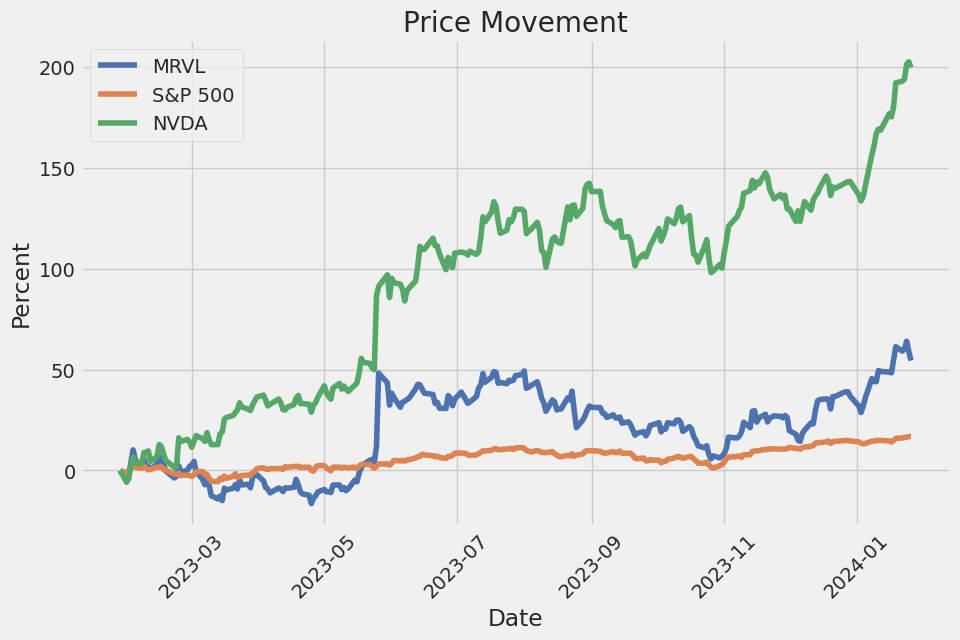

The relationship between Marvell Technology Group (MRVL) and the SPDR S&P 500 ETF Trust (SPY) over the specified period shows that MRVL has a positive alpha () of approximately 0.057, suggesting a slight performance advantage over the benchmark SPY index when the markets movements are netted out. This alpha value represents the average amount by which the returns of MRVL exceed or fall short of the returns predicted by the model due to market-wide moves. However, given the alpha's p-value of 0.407, this performance difference is not statistically significant, implying that the excess returns are not reliably different from zero from a statistical standpoint.

MRVLs beta () coefficient is roughly 1.598, indicating that the stocks returns are more volatile than the market: for each percentage point change in the market, MRVL's returns are expected to change by about 1.598 percentage points. This relationship's coefficient is statistically significant with a virtually zero p-value, meaning there's very strong evidence that MRVL exhibits this level of sensitivity relative to the SPY. The R-squared value of 0.427 means that approximately 42.7% of the variance in MRVL's returns can be explained by the movements in the SPY, which represents the broader market.

Summary of Marvell Technology, Inc.'s Fiscal Year 2024 Q3 Earnings Call

Introduction

During Marvell Technology Inc.'s Q3 FY2024 earnings call, the Senior Vice President of Investor Relations, Ashish Saran, and other executives discussed the company's financial results and future expectations. The call began with reminders about forward-looking statements and the availability of non-GAAP financial measures reconciliations on their website.

Q3 Financial Performance

Chairman and CEO Matt Murphy reported revenue of $1.42 billion, which marked a 6% sequential growth and exceeded guidance. The data center end market generated $556 million, surpassing forecasts due to AI revenue. Conversely, enterprise on-premise and data center storage demand declined. Strong AI and cloud infrastructure revenue was highlighted, as well as the anticipation of growth in PAM4 optical products, Teralynx Ethernet switches, and data center interconnect products.

Additional Insights and Projections

Marvell illustrated its deepening collaboration with NVIDIA, recognizing the use of Marvell's optical interconnect technology for AI acceleration. Furthermore, the company expects to sample its next-generation 1.6T PAM platform, with initial projections being positive. The company anticipated data center end market revenue to grow in the mid-30% range sequentially in Q4, with AI revenue significantly above earlier forecasts.

Financial Details and Outlook

CFO Willem Meintjes provided a detailed financial summary, including a revenue breakdown across end markets and explained expenses, margins, and operational costs. The company forecasted a sequential improvement in non-GAAP gross margin for Q4. Looking into Q1 FY2025, certain end markets such as enterprise and carrier are expected to face headwinds, but the company projects data center revenue growth will continue due to demand in AI and cloud solutions.

Q&A Highlights

During the Q&A session, executives responded to inquiries regarding the data center business outlook, enterprise networking demand, and custom silicon programs. The company expects further growth in data center and AI revenue despite softening demand in other areas. Concerning carrier and enterprise markets, the company predicts longer-term normalization in spending patterns. Marvell remained cautious about declaring a recovery in the data center storage segment.

In conclusion, Marvell Technology reported strong Q3 FY2024 results with marked growth and resilience driven by high demand in data center end markets, particularly in AI and cloud infrastructure. Future expectations remain cautiously optimistic with new product ramps and custom silicon programs anticipated to bolster revenues, counterbalanced by the current macroeconomic environment and the cyclical nature of the semiconductor industry.

Marvell Technology, Inc. (MRVL), a supplier of data infrastructure semiconductor solutions, reported in its Form 10-Q filing for the quarterly period ended October 28, 2023, a decrease in net revenue by 7.7% for the three-month period and by 9.3% for the nine-month period compared to the same periods of the previous year. This decrease in net revenue was primarily attributable to reduced sales in the data center end market by 11%, enterprise networking by 28%, and consumer end market by 5%. However, this downtrend was partly offset by a 26% increase in sales to the automotive/industrial end market and a 17% increase in sales to the carrier infrastructure end market.

Significant customer orders have been lowered due to customers managing inventory, particularly affecting storage products. Marvell also observed an inventory correction that continued to impact storage customers and the enterprise networking and wired carrier markets, along with low demand from OEMs in China. However, a notable increase in demand for optical products was witnessed, primarily driven by AI applications.

The company's cost of goods sold (COGS) increased, resulting in a lower gross margin for both the three-month and nine-month periods. Operating expenses increased due to higher mask prototyping expenses and employee compensation, but selling, general and administrative expenses decreased, primarily due to reduced intangible amortization related to fully amortized intangibles and lower marketing expenses. No legal settlement charges were recorded in the three and nine months ended October 28, 2023, compared to a $100.0 million charge in the comparable period of fiscal 2023.

Marvell underwent restructuring to streamline its organization and optimize resources, incurring charges of $3.4 million and $105.3 million for the three and nine months ended October 28, 2023. Interest income remained relatively stable while interest expense increased due to higher costs associated with term loans. Other income net increased due to gains from equity investments and exchange rate fluctuations.

The company benefited from a $23.2 million income tax benefit in the third quarter, a contrast to the $52.0 million tax expense in the same quarter of the prior year. The reduction in tax benefit was mainly due to earnings taxed at rates lower than the U.S. statutory rate, impacts of U.S. taxation of foreign operations, tax credits, valuation allowance releases, and discrete tax benefits.

Marvell's liquidity position included cash and cash equivalents of $725.6 million, with $408.3 million held by foreign subsidiaries. Marvell repaid its 2024 Term Loan in full and made repayments on its 2026 Term Loan during the reported quarter. Additionally, the company has ongoing stock repurchase and dividend programs for stockholder value return and is in compliance with debt covenants for existing credit agreements.

Overall, Marvell Technology continues to navigate its end markets with strategic initiatives, inventory management, optimizing resources, taking advantage of tax incentives, and aiming for long-term growth despite the decrease in net revenue and current macroeconomic challenges.

Marvell Technology, Inc. (ticker: MRVL) is a significant and well-known entity in the semiconductor space, currently under review by investors seeking value within the Technology Services sector. The company's stock performance and financial metrics offer significant insight into its value proposition as an investment opportunity. According to a Zacks Equity Research report published on December 19, 2023, Marvell received a Zacks Rank of #3 (Hold), indicative of a performance in alignment with market expectations based on earnings estimate trends. However, this quantitative assessment could change with new earnings information.

Investors assessing Marvell's stock as a possible value investment have a range of metrics at their disposal from the mentioned Zacks report. Marvell's forward P/E ratio, standing at 39.53, suggests high market growth expectations or a possible overvaluation. Similarly, the PEG ratio of 5.17 and the P/B ratio of 3.39 offer insights into the stock's pricing relative to growth expectations and the company's net assets, respectively. Marvell's 'D' Value grade also suggests that, comparatively, it may not be the most appealing stock for value investors.

Marvell's financial performance for the fiscal year 2024's third quarter outdid Zacks Consensus Estimates for both top and bottom lines. However, with fourth-quarter guidance falling short of expectations and a subsequent 10% fall in stock price over the following week, investor sentiment was affected. Non-GAAP earnings for Q3 were reported at 41 cents per share with revenue totaling $1.42 billion. Despite these figures exceeding guidance, year-over-year declines were apparent, attributed to economic uncertainties and reduced demand in certain markets. Disparity in revenue performance was evident across sectors, with gains in Data Center revenues alongside declines in enterprise networking and growth in Carrier infrastructure.

Marvell finished Q3 with increased cash on hand and long-term debt, while actively returning capital to shareholders through buybacks and dividends. Estimates were also revised downward for the company's EPS looking ahead to the new fiscal year, with anticipation of approximately 46 cents per share for non-GAAP earnings in Q4 of fiscal 2024.

On a trading session reported by Zacks.com on January 12, 2024, Marvell's stock saw a decline of 0.29%, settling at $65.68, diverging from the mild gains of the broader market. The company's shares had, however, increased notably by 11.1% over the past month. Investor attention is focused on Marvell as the next earnings report approaches, and estimates are set for Marvell to announce EPS of $0.46 with projected revenue just shy of the previous years same quarter.

Within the complex and competitive semiconductor industry, Marvell has been successful in the AI space due to its networking solutions and AI accelerators, as highlighted in an article by Jose Najarro on December 13, 2023, for The Motley Fool. Marvell has to navigate challenges such as staying at the forefront of technological advancements and the ethical considerations in AI application.

Citi's recent promotion of Marvell Technology over Nvidia as the new top specialty semiconductor stock, reported on Yahoo Finance on January 19, 2024, reflects the buoyant expectations around Marvell's growth prospects. Wall Street bulls are optimistic about Marvell's position, evidenced by the ABR score of 1.22 between a Strong Buy and a Buy, from Zacks Equity Research on December 20, 2023. These ratings suggest a high level of confidence in Marvell's stock potential, but it is imperative to consider the Zacks Rank which is based on earnings estimate revisions and offers a more empirical evaluation of stock price trends.

Marvell is experiencing shifts in analyst sentiment, with a slight decline in its consensus estimate for current-year earnings. The Zacks Rank #5 (Strong Sell) is indicative of pessimism regarding the stock's short-term performance. Insightful information from a Yahoo Finance article dated January 19, 2024, highlights Marvell's formidable year-on-year stock growth amidst a focus on AI, with several financial institutions supporting a bullish outlook.

According to an article by Max Juang on Yahoo Finance, dated January 18, 2024, Marvell's stock value rose due to positive developments in the semiconductor industry following an impressive earnings announcement by TSMC. The company's share appreciated by 4.9% at the close reflecting an overall yearly stock increase of 17.7%. This enhancement was also attributed to broader market trends and investors leveraging low prices in the tech sector.

Shareholders of Marvell have over a period enjoyed impressive gains, with Simply Wall St noting an 8.2% return in just a week and a 295% total five-year gain. Marvell's stock performance has been supported by strong revenue growth, outshining many industry peers. Despite this, the lack of recent insider stock purchases contrasted with considerable selling raises questions regarding insider confidence. In particular, the largest sale was completed by Independent Director Fouad Tamer, worth approximately $5.4 million, at a price beneath the current market value, as reported by Simply Wall St on January 26, 2024.

Marvell's stock price dropped by 1.36% to $70.11 on a day when major indices gained, as analyzed by Zacks Equity Research on January 22, 2024. Expectations for the quarterly EPS to remain stable year-over-year at $0.46, and a marginal decline in quarterly revenues, continue to guide investor outlook. The company's Forward P/E and PEG ratios point to a premium valuation compared to industry averages, even as the company holds a strong position in the Technology Services industry.

Lastly, MRVL's potential in tapping into the AI-driven semiconductor market is highly regarded by analysts. A Yahoo Finance article dated January 24, 2024, highlights the company's prospects in custom AI chip production, with Marvell expected to benefit from the growing demand for AI optics and custom ASICs in the cloud data center markets.

Despite fluctuating stock prices and varying assessments by different financial analysts and industry observers, the overall narrative points to Marvell Technology as a company with substantial potential in a booming industry, albeit with careful consideration required for the timing and terms of investment.

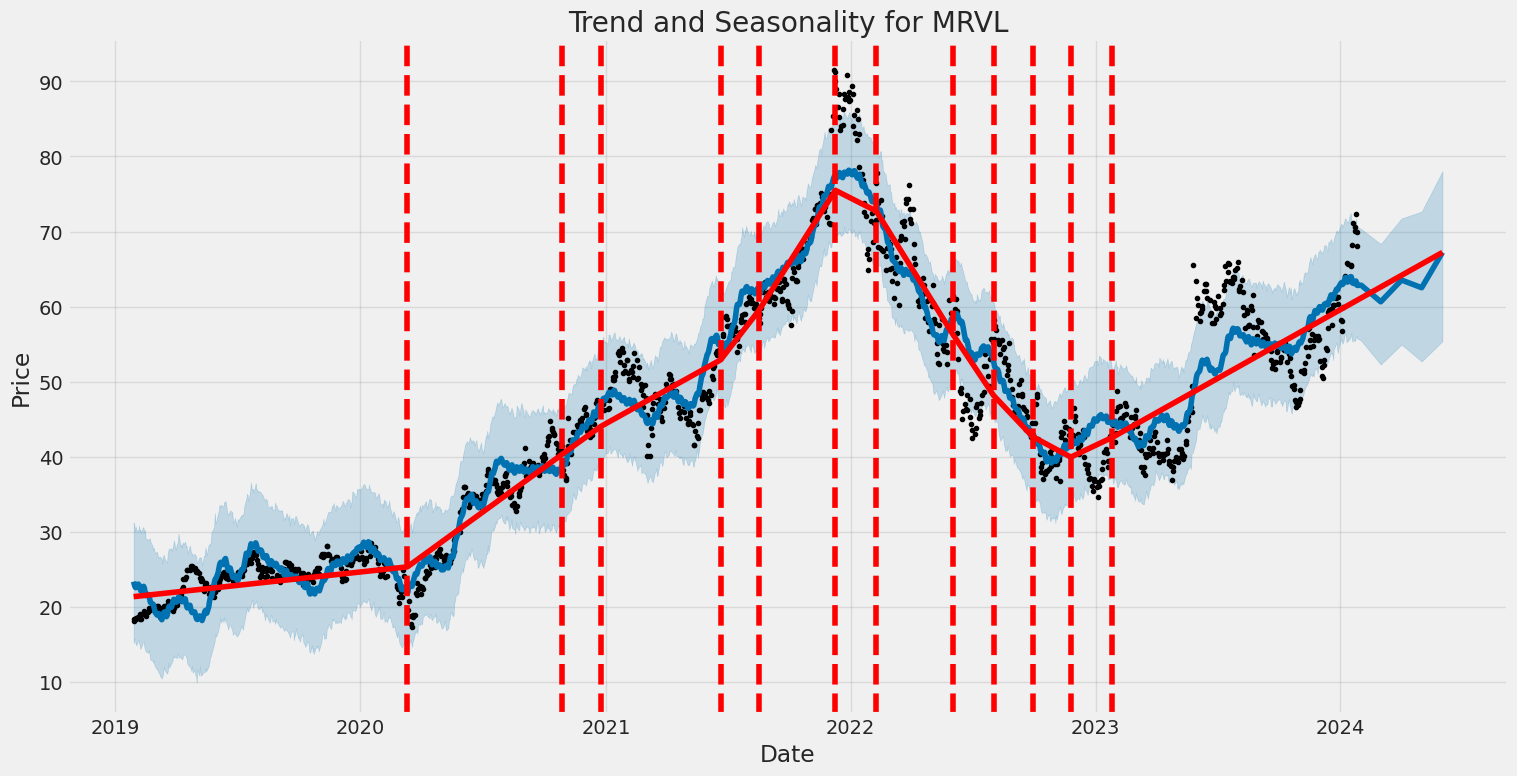

Marvell Technology, Inc. (MRVL) has exhibited significant volatility from 2019-01-28 to 2024-01-26, with the ARCH model suggesting notable fluctuation in its asset returns. The model indicates no predictability in returns (R-squared of almost 0), solely focusing on the variability of the asset with an estimation of the magnitude of volatility (omega) at 7.6549, which is considered substantial. Further detailed by the alpha[1] statistic at 0.2820, this indicates a notable reaction of the volatility to market movements or news specific to Marvell Technology.

| Statistic Name | Statistic Value |

|---|---|

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -3,213.05 |

| AIC | 6,430.10 |

| BIC | 6,440.38 |

| No. Observations | 1,258 |

| Df Residuals | 1,258 |

| Omega | 7.6549 |

| Alpha[1] | 0.2820 |

To assess the financial risk of a $10,000 investment in Marvell Technology, Inc. (MRVL) over a one-year period, we can leverage a comprehensive approach that combines volatility modeling with machine learning predictions. The volatility modeling technique serves as a tool to understand and project the future volatility of MRVL stock, which is a crucial component of risk assessment.

This volatility modeling technique enables us to estimate the conditional variance of stock returns over time, considering the long-memory properties typical of financial time series data. By modeling the variance in this way, we can better understand the nature of the risk inherent in MRVL stock due to market movements, news, or other company-specific events that may drive stock price fluctuations.

In our analysis, we use historical stock prices to calibrate the volatility model, and through this model, we're able to forecast the potential variability in stock returns. This forecasted volatility is a vital input in evaluating the Value at Risk (VaR), which is a standard risk metric that quantifies the maximum expected loss over a specified time frame, under normal market conditions, at a given confidence level.

Subsequently, machine learning predictions are utilized to augment the analysis provided by the volatility model. A predictive algorithm, specifically the one based on decision trees that operate as an ensemble to improve predictive accuracy and control over-fitting, allows us to generate projections of future stock returns based on patterns found in historical data.

The machine learning model can incorporate a wide range of features, such as past returns, volume changes, macroeconomic factors, and technical indicators, to inform its predictions. The output of the predictive model includes estimates of future returns, which together with the volatility forecast, are fundamental to a comprehensive risk assessment.

The result of combining these two sophisticated analytical techniques gives us a more robust view of the potential risks. For instance, if our risk metrics using volatility modeling calculate a VaR at a 95% confidence interval, this suggests that there is a 95% probability that the investment will not lose more than a certain percentage or dollar amount over the chosen time horizon.

Applying these methods to our $10,000 investment in MRVL, with a VaR at a 95% confidence interval, we determine that the value at risk over the one-year period would be $548.03. This figure represents the maximum expected loss, under normal market conditions, which helps an investor understand the potential downside risk of the investment in monetary terms.

Through this analysis, an investor in MRVL can gauge the possible financial risk and make an informed decision about their investment, taking into consideration the integrated view of volatility and expected stock performance as indicated by the analytical models employed.

Similar Companies in Semiconductors:

Report: NVIDIA Corporation (NVDA), NVIDIA Corporation (NVDA), Report: Intel Corporation (INTC), Intel Corporation (INTC), Report: Taiwan Semiconductor Manufacturing Company Limited (TSM), Taiwan Semiconductor Manufacturing Company Limited (TSM), Report: Micron Technology, Inc. (MU), Micron Technology, Inc. (MU), QUALCOMM Incorporated (QCOM), Report: Advanced Micro Devices, Inc. (AMD), Advanced Micro Devices, Inc. (AMD), Broadcom Inc. (AVGO), Texas Instruments Incorporated (TXN), Analog Devices, Inc. (ADI), Skyworks Solutions, Inc. (SWKS), Xilinx, Inc. (XLNX), Lattice Semiconductor Corporation (LSCC), Maxim Integrated Products, Inc. (MXIM)

https://www.fool.com/investing/2023/12/13/marvell-technologys-artificial-intelligence-ai-suc/

https://www.zacks.com/stock/news/2200098/psn-or-mrvl-which-is-the-better-value-stock-right-now

https://seekingalpha.com/article/4661141-semiconductors-winners-losers-start-of-2024

https://www.zacks.com/commentary/2209236/bear-of-the-day-marvell-mrvl

https://finance.yahoo.com/news/why-marvell-technology-mrvl-stock-164051682.html

https://finance.yahoo.com/m/100f7d36-25d4-3206-95a9-b7b0ea4b5513/nvidia-is-no-longer.html

https://finance.yahoo.com/video/spirit-airlines-marvell-technology-celsius-214332974.html

https://finance.yahoo.com/news/8-2-return-week-takes-110022889.html

https://finance.yahoo.com/news/marvell-technology-mrvl-stock-sinks-225019222.html

https://finance.yahoo.com/news/mrvl-tsm-mu-chip-stock-230040379.html

https://finance.yahoo.com/news/possible-bearish-signals-marvell-technology-120013570.html

https://www.fool.com/investing/2024/01/26/a-wall-street-analyst-believes-this-semiconductor/

https://www.sec.gov/Archives/edgar/data/1835632/000183563223000046/mrvl-20231028.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: Tk1Mna

Cost: $0.95027

https://reports.tinycomputers.io/MRVL/MRVL-2024-01-27.html Home