Xcel Energy, Inc. (ticker: XEL)

2024-01-08

Xcel Energy, Inc. (ticker: XEL) is a prominent utility holding company based in the United States, primarily known for its significant electric and natural gas operations. It serves customers across various states such as Minnesota, Michigan, Wisconsin, North Dakota, South Dakota, Colorado, Texas, and New Mexico. Founded in 1909 and headquartered in Minneapolis, Minnesota, Xcel Energy has garnered a reputation for its commitment to clean energy and sustainability, positioning itself as an industry leader in reducing carbon emissions and advancing renewable energy sources. It focuses on delivering reliable services to its consumers while concurrently investing in infrastructure and technology to improve its energy grid and reduce its environmental impact. As of the latest financial reports, Xcel Energy has demonstrated steady financial performance with growth in revenues and an emphasis on delivering shareholder value through consistent dividends. The company operates within a highly regulated industry, necessitating close cooperation with state and federal regulators to ensure compliance and ongoing operational feasibility. Xcel Energy's strategic vision is to provide energy that is increasingly green, and it continues to make strides in transitioning towards renewable energy.

Xcel Energy, Inc. (ticker: XEL) is a prominent utility holding company based in the United States, primarily known for its significant electric and natural gas operations. It serves customers across various states such as Minnesota, Michigan, Wisconsin, North Dakota, South Dakota, Colorado, Texas, and New Mexico. Founded in 1909 and headquartered in Minneapolis, Minnesota, Xcel Energy has garnered a reputation for its commitment to clean energy and sustainability, positioning itself as an industry leader in reducing carbon emissions and advancing renewable energy sources. It focuses on delivering reliable services to its consumers while concurrently investing in infrastructure and technology to improve its energy grid and reduce its environmental impact. As of the latest financial reports, Xcel Energy has demonstrated steady financial performance with growth in revenues and an emphasis on delivering shareholder value through consistent dividends. The company operates within a highly regulated industry, necessitating close cooperation with state and federal regulators to ensure compliance and ongoing operational feasibility. Xcel Energy's strategic vision is to provide energy that is increasingly green, and it continues to make strides in transitioning towards renewable energy.

| Address | 414 Nicollet Mall | City | Minneapolis | State | MN |

| Zip Code | 55401 | Country | United States | Phone | 612 330 5500 |

| Website | https://www.xcelenergy.com | Industry | Utilities - Regulated Electric | Sector | Utilities |

| Full Time Employees | 11,982 | Previous Close | 63.73 | Open | 63.65 |

| Day Low | 63.21 | Day High | 63.695 | Dividend Rate | 2.08 |

| Dividend Yield | 3.26% | Payout Ratio | 64.79% | Five Year Avg Dividend Yield | 2.75% |

| Beta | 0.421 | Trailing PE | 20.12 | Forward PE | 17.76 |

| Volume | 3,738,911 | Average Volume | 4,003,179 | Average Volume 10 Days | 3,131,210 |

| Market Cap | 35,084,464,128 | Fifty Two Week Low | 53.73 | Fifty Two Week High | 72.97 |

| Price to Sales TTM | 2.37 | Fifty Day Average | 60.976 | Two Hundred Day Average | 62.4241 |

| Trailing Annual Dividend Rate | 2.048 | Trailing Annual Dividend Yield | 3.21% | Enterprise Value | 61,718,253,568 |

| Profit Margins | 11.75% | Float Shares | 551,159,658 | Shares Outstanding | 551,816,000 |

| Shares Short | 6,258,174 | Shares Percent Shares Out | 1.13% | Held Percent Insiders | 0.145% |

| Held Percent Institutions | 82.357% | Short Ratio | 1.41 | Short Percent of Float | 1.13% |

| Total Cash | 635,000,000 | Total Cash Per Share | 1.151 | EBITDA | 5,040,999,936 |

| Total Debt | 27,185,999,872 | Quick Ratio | 0.51 | Current Ratio | 0.868 |

| Total Revenue | 14,817,000,448 | Debt to Equity | 157.063 | Revenue Per Share | 26.903 |

| Return on Assets | 2.535% | Return on Equity | 10.334% | Gross Profits | 5,770,000,000 |

| Free Cash Flow | -1,033,875,008 | Operating Cash Flow | 5,118,000,128 | Earnings Growth | 0.7% |

| Revenue Growth | -10.3% | Gross Margins | 38.962% | EBITDA Margins | 34.022% |

| Operating Margins | 26.051% | Book Value | 31.376 | Price to Book | 2.03 |

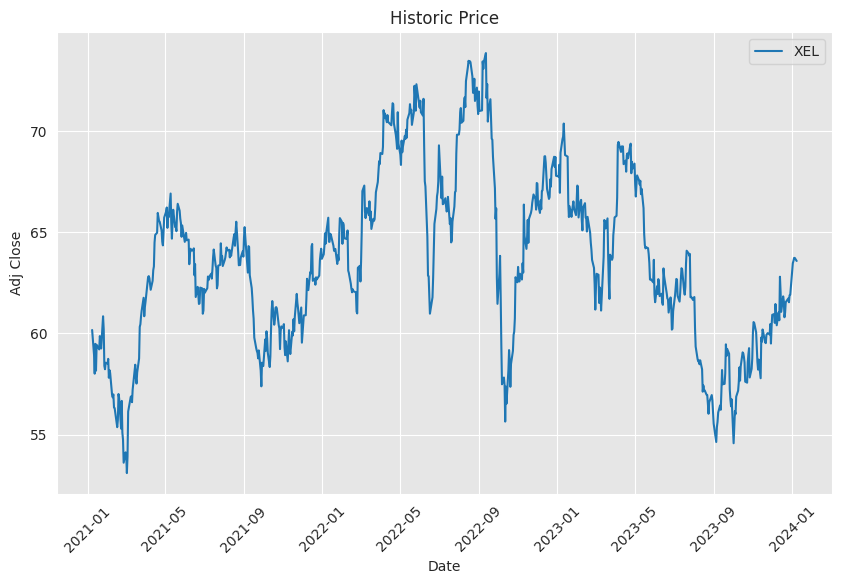

Based on the summary of technical indicators provided for XEL, we've observed a bullish signal on several fronts. The recent trading period has displayed a consistent uptrend with the closing prices on an upward trajectory since the beginning of the year. The Parabolic SAR (PSAR) shows the trend is likely to continue, as the indicator is below the price, which is a bullish signal. Additionally, the On-Balance Volume (OBV) indicator reveals a positive trend in volume, suggesting accumulation by investors. The Moving Average Convergence Divergence (MACD) histogram also aligns with this bullish sentiment, as it has remained positive over the latter periods.

Based on the summary of technical indicators provided for XEL, we've observed a bullish signal on several fronts. The recent trading period has displayed a consistent uptrend with the closing prices on an upward trajectory since the beginning of the year. The Parabolic SAR (PSAR) shows the trend is likely to continue, as the indicator is below the price, which is a bullish signal. Additionally, the On-Balance Volume (OBV) indicator reveals a positive trend in volume, suggesting accumulation by investors. The Moving Average Convergence Divergence (MACD) histogram also aligns with this bullish sentiment, as it has remained positive over the latter periods.

When considering the company's fundamentals, the picture becomes more nuanced. The company has shown a stable increase in net income over the past years with a consistent growth in operating margins. EBITDA margins have also improved, indicating effective management and operational efficiency. However, the company is operating with a notable level of debt, and the trailing PEG ratio suggests that the stock may be overvalued based on its earnings growth projections. The net debt and total debt levels have increased year-over-year, an aspect that warrants careful scrutiny.

The balance sheets further corroborate that the company maintains a significant amount of tangible book value, indicating solid asset backing. The increase in accounts receivable suggests potentially higher revenue in the pipeline, although it raises concerns about liquidity and cash flows. This is particularly evident in the negative free cash flow, reflecting high capital expenditures and cash outflows over the most recent fiscal period.

Examining the cash flows, the capital expenditure is notably high, signaling large investments in the business's operating capabilities or expansion efforts. The financing cash flow is positive largely due to issuances of debt, and there's a net issuance of capital stock, indicating equity financing activities that could dilute existing shareholders' value.

Integration of the technical and fundamental analysis reveals a generally optimistic outlook for XEL's stock price movement in the months to come. The technical indicators suggest an ongoing bullish sentiment, likely supported by the market's response to sound operational performance and potentially expansive strategies indicated by high capital expenses.

To synthesize, while short-term bullish trends are evident via technical analysis, long-term prospects should consider the high level of debt, capital expenditures, and fundamental indicators of overvaluation. Prudent investors will weigh these against the backdrop of the current market environment, broader sector performance, and interest rate trends. Nevertheless, barring unforeseen macroeconomic shocks or company-specific reversals, the current technical momentum could see the stock's price continuing an upward trajectory in the short to medium term. Investors should maintain alertness to shifts in volume and price action, which may precede changes in the prevailing trend.

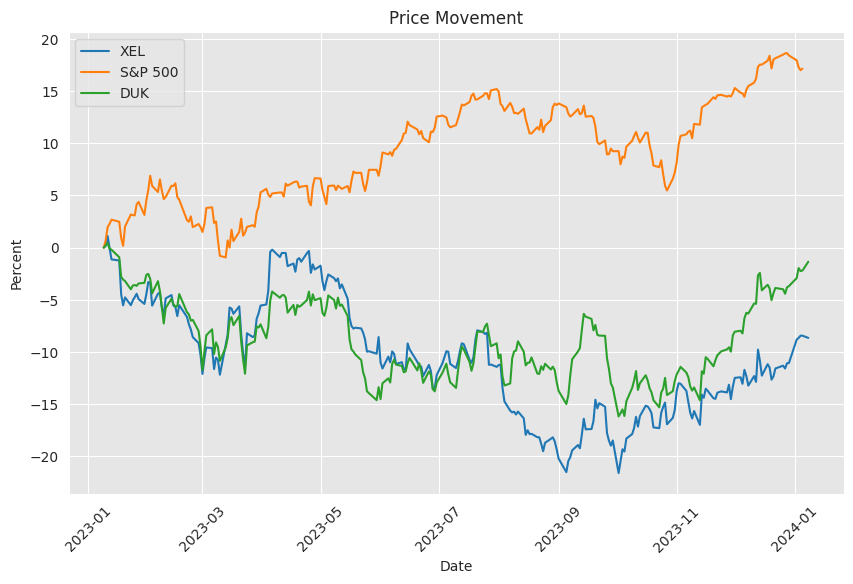

In the linear regression model that analyzes the relationship between Xcel Energy Inc. (XEL) and the SPDR S&P 500 ETF Trust (SPY), which is a proxy for the broader market, alpha represents the expected return on XEL when the return on SPY is zero. The calculated alpha for XEL over the observed period is 0.0021 (or 0.21%), indicating a minimal positive return when the market's excess return is factored out. The implication is that XEL could be expected to yield a small positive return independently of market movements. However, the statistical significance of the alpha is very low (P>|t|=0.954), suggesting that the alpha is not statistically different from zero, and hence it might not be reliable for investment decisions based on this factor alone.

The coefficient for SPY (beta) in the regression is 0.6540, suggesting that for every 1% change in the market (SPY), the return on XEL changes by 0.654%. The R-squared value is 0.312, indicating that approximately 31.2% of the variability in XEL's return can be explained by the market return as represented by SPY. The regression provides evidence of a positive, but not overly strong, relationship between XEL and the overall market. Observing the Prob (F-statistic) which is 6.28e-104, we can assert that the model is statistically significant, and SPY is a relevant predictor of XEL returns over the time period ending today.

| Dep. Variable: | R-squared: | Model: | Adj. R-squared: | Method: | F-statistic: | Prob (F-statistic): | Date: | Time: | No. Observations: | AIC: | Df Residuals: | Df Model: |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| y | 0.312 | OLS | 0.311 | Least Squares | 568.4 | 6.28e-104 | Mon, 08 Jan 2024 | 16:05:05 | 1,257 | 4,192 | 1,255 | 1 |

| coef | std err | t | P>|t| | [0.025 | 0.975] | Omnibus: | Log-Likelihood: | Skew: | Prob(JB): | |||

| const | 0.0021 | 0.036 | 0.058 | 0.954 | -0.069 | 0.073 | 148.321 | -2,094.2 | -0.279 | 0.000 | ||

| X | 0.6540 | 0.027 | 23.842 | 0.000 | 0.600 | 0.708 | Durbin-Watson: | 2.070 | Jarque-Bera (JB): | 1,047.103 | ||

| Cond. No.: | 1.32 |

Executive Summary - Xcel Energy Inc. Q3 2023 Earnings Call

Overview of Financial Outcomes and Guidance In the third quarter of 2023, Xcel Energy missed earnings expectations with a reported EPS of $1.19 compared to the expected $1.31. The earnings included a one-time charge related to a legal dispute. Nevertheless, the company recorded solid ongoing earnings of $1.23 per share for the quarter, compared to $1.18 per share in the same period last year. Consequently, Xcel Energy is narrowing its 2023 earnings guidance to $3.32 to $3.37 per share, and has initiated a 2024 guidance of $3.50 to $3.60 per share, aligning with its long-term growth rate of 5% to 7%.

Capital Investment and Clean Energy Initiatives Xcel Energy has revised its infrastructure plan, estimating a need for $34 billion in capital investment for 2024-2028an increase of $4.5 billion from the previous plan. These investments emphasize resilience in transmission and distribution and account for upgrades supporting the Colorado Energy Plan. Potential clean energy investments, dependent on commission approvals, could require a further $10 billion, significantly reducing carbon emissions across multiple states. Recent filings outline plans to double renewable energy in Colorado, portraying an $11 billion investment. Xcel Energy is positioned to lead a cost-effective transition for customers through strategic resource planning and by leveraging the Inflation Reduction Act's benefits.

Regulatory Updates and Operational Developments The company has been active in regulatory proceedings, securing approval for rate increases in both Colorado and New Mexico and progressing with rate case settlements in Texas and Wisconsin. Xcel Energy is gearing up for a lighter rate case framework in 2024 following a busy regulatory schedule in 2023. They also announced substantial federal support for their innovative energy projects, including a large hydrogen hub and two long-duration energy storage pilots, with grants totaling nearly $1.5 billion.

Financial Strategy and Rate Base Growth Xcel Energy continues to fund its infrastructure plans with a balanced financing approach, planning for $15 billion in debt and $2.5 billion in equity over the next five years. Anticipated additional investment opportunities could translate into $10 billion more, funded by a mix of debt and equity. The updated capital expenditure program and resulting rate base growth are positioned to deliver strong shareholder returns and enhanced customer value while adhering to their commitment to maintaining affordable energy bills.

Conclusion and Forward Outlook Xcel Energy's third quarter results, despite missing initial EPS expectations, still reflect a company on a robust financial footing with a clear vision for growth and a strong commitment to renewable energy and infrastructure investment. The company's prudent financial management, strategic investments, and favorable regulatory outcomes position it well to continue delivering on its promises to customers and shareholders alike. The guidance for 2023 and the initiation of 2024 guidance, along with the significant capital investments planned, underscore Xcel Energy's confidence in achieving long-term earnings growth and leading a cost-effective clean energy transition.

Xcel Energy Inc. (XEL) is a major U.S. electric and natural gas company with regulated operations spanning eight Western and Midwestern states. In its SEC 10-Q filing, which reflects the financial and operational status of the company for the quarterly period ending September 30, 2023, the company details its financial results, provides updates on regulatory proceedings, and discloses risks and future prospects related to its activities.

The financial results section typically includes information on Xcel Energy's revenues, expenses, net income, and earnings per share. Key financial metrics such as operating income, regulatory rate base growth, capital expenditures, and cash flow from operating activities are discussed, providing insight into the company's profitability and financial health. This section also often includes a comparison with previous years or quarters, highlighting variances in financial performance and attributing them to factors such as changes in demand, fuel costs, weather conditions, or regulatory environments.

Xcel Energy also elucidates its regulatory developments. This may involve discussing rate case filings, outcomes, and ongoing proceedings before various state commissions that impact the company's ability to adjust pricing and recover costs. Details about infrastructure investments, renewable energy initiatives, or grid modernization projects that require regulatory approval and may affect future revenue streams are typically part of this discussion.

Another focus area is the company's operational highlights and strategy. Here, Xcel Energy elaborates on operational achievements, including advancements in renewable energy generation, energy efficiency programs, and technology deployment. The company might discuss its efforts to meet environmental regulations and progress towards reducing carbon emissions, as well as updates on major construction projects or acquisitions that contribute to the expansion and modernization of its asset portfolio.

The filing also discusses liquidity and capital resources, providing insight into the company's financial flexibility and ability to meet short-term obligations, invest in its operations, and return value to shareholders through dividends or share repurchases. This includes information on credit facilities, debt levels, and credit ratings.

Lastly, the company presents a comprehensive risk analysis in its SEC 10-Q filing, detailing various risk factors that could impact future operations and financial conditions. These could include risks associated with regulatory changes, fluctuations in energy prices, competition, technological advancements, and operational hazards like severe weather events or cybersecurity threats.

It is important to note that the SEC 10-Q filing is a snapshot of the company's status as of the filing date and may not encompass all developments or fully reflect the company's trajectory beyond that time. Investors and stakeholders use the data within this document to assess Xcel Energy's current operations, financial stability, growth prospects, and overall market position.

Xcel Energy Inc. is a leading utility holding company in the United States that distinguishes itself in the energy sector with a substantial customer base across an eight-state territory, serving 3.8 million electric customers and 2.1 million natural gas customers. The company's significant footprint is underscored by its subsidiaries, which include Northern States Power, the Public Service Company of Colorado, and the Southwestern Public Service Company. Xcel Energy not only spearheads the provision of energy but also champions the integration of renewable energy on a large scale. As one of the most significant renewable energy proponents in the nation, Xcel Energy's over half of electricity sales from carbon-free sources place it at the forefront of the industry's green shift.

The societal push towards sustainable energy practices, coupled with evolving regulatory expectations, has been responded to by the company with a pivotal commitment to renewable resources. This strategic positioning in renewable energy marks Xcel Energy as a potential trendsetter, as the demand for clean energy continues to increase and regulations tighten. The adaptability and forward-looking stance of Xcel Energy position it well against regulatory pressures and the capital demands that come with necessary infrastructure and technological updates.

This focus on sustainability and green energy positions Xcel Energy as an innovative figure within the utility sector, aligned with consumer trends and policy directions. As a result, the company is poised to navigate the opportunities and challenges of the energy transition. The large customer base spread across geographically diverse locations underpins the company's scalability and hints at its potential for enduring growth.

Xcel Energy, with its increasing significance in renewable energy assets, has shown that it understands the rising wave of electric vehicles (EVs) and the corresponding surge in electricity demand they will bring. As a substantial player in the electric utility sector, the company's positioning allows it to cater to this upcoming demand without directly facing the competitive tensions of the EV manufacturing industry. With its market capitalization reflecting a robust position in the energy market, Xcel Energy demonstrates financial stability and market influence. Its engagement in the utility market, underscored by reliable dividends and a stable business model, makes it a salient component of a long-term investment strategy aimed at leveraging dynamics in the electricity sector, particularly those driven by the EV market.

Colorado's Public Utilities Commissions decision to approve a scaled-down version of Xcel Energy's $15 billion Clean Energy Plan emanates caution and a balance-seeking approach in energy policy. Even though the approved 5,800 MW falls short of the originally intended increase in renewable energy resources, the plan underscores a significant commitment to cleaner energy, calling attention to Xcel Energy's environmental and climatic ambitions. As Colorado moves towards a cleaner energy portfolio, Xcel Energy continues to navigate the regulatory landscape and the consequential shifts it imposes on energy policies.

In an event distinct from operational challenges typically assumed in the energy sector, Xcel Energy Inc. faced a fine from the Minnesota Pollution Control Agency (MPCA) for a procedural oversight related to the handling of contaminated groundwater. This fine, though relatively small, highlights the regulatory environment in which Xcel Energy operates and the company's attentive approach to environmental regulations. Xcel's quick compliance with directives and proactive measures to manage the groundwater contamination incident underscores its capacity to swiftly address and mitigate such challenges, staying steadfast in its commitment to environmental stewardship.

Xcel Energy also stands as an attractive investment option, supported by stable revenues and a consistent dividend policy. The upward trend in dividends and revenues reflect the company's commitment to long-term shareholder returns. Its financial footing and dividend yield suggest that Xcel Energy maintains a balanced offering of stability and continued growth, creating appeal among investors, especially given the backdrop of steady consumer demand for essential utilities like electricity and natural gas.

Speaking to the recent announcement regarding Xcel Energy's participation in the development of a hydrogen hub, this reflects the company's strategic alignment with national clean energy goals. The Hydrogen hubs, which arose from a Biden administration initiative and bipartisan infrastructure push, represent a monumental step towards low-carbon fuel production and signals a pertinent shift in the country's energy infrastructure priorities. Xcel Energy's involvement in such projects points to its readiness to partake and prosper in the future energy market, characterized by sustainable initiatives and partnerships geared towards an economy with reduced carbon emissions.

As the utility sector encounters the momentum of a global commitment to triple renewable energy capacity by 2030, Xcel Energy's strategic execution and profitability signal its potent presence in the evolving marketplace. Institutional confidence, evidenced by hedge fund investments, signifies belief in the company's capacity to navigate and capitalize on the industry's transformations. Despite the headwinds presented by potential economic changes, the company's positioning and responsiveness to renewable energy trends validate its role as a critical player in the utility sector.

In view of Jeffrey Gundlach's advisory on high-cap public technology stocks, a sector like utilities emerges as an attractive alternative to investors wary of the volatility of more aggressive market segments. The utility sector, characterized by the essential nature of its services and consistent demand, offers buffer against market uncertainties. XLU, as a diversified ETF in this sector, further provides investors with a hedged option that combines the potentials for reliable dividends and reduced exposure to single-entity risks.

In the context of this broader financial landscape, Xcel Energy's forthcoming year-end earnings conference call is eagerly anticipated by stakeholders looking to garner insights into the company's latest financial results, strategic directions, and clean energy advances. Such corporate events keep investors informed, opening clear lines of communication regarding the company's performance and prospects in the competitive energy sector. As Xcel Energy continues to reinforce its mission to provide sustainable and reliable energy, its market influence is anticipated to expand in alignment with global clean energy redirections.

Similar Companies in Electric Utilities:

Report: Duke Energy Corporation (DUK), Duke Energy Corporation (DUK), Report: Dominion Energy Inc (D), Dominion Energy Inc (D), Report: Southern Company (SO), Southern Company (SO), Report: NextEra Energy, Inc. (NEE), NextEra Energy, Inc. (NEE), Report: American Electric Power Company, Inc. (AEP), American Electric Power Company, Inc. (AEP), PG&E Corporation (PCG), Edison International (EIX), PPL Corporation (PPL), Consolidated Edison, Inc. (ED), Public Service Enterprise Group Incorporated (PEG), FirstEnergy Corp. (FE)

https://www.fool.com/investing/2023/11/07/3-top-stocks-to-buy-in-november-2/

https://finance.yahoo.com/news/3-most-attractive-dividend-stocks-013501911.html

https://finance.yahoo.com/m/a45b8a18-ceb5-3bee-be87-4cfe8b2fbf2c/analyst-report%3A-xcel-energy.html

https://www.fool.com/investing/2023/09/29/if-you-love-evs-youll-love-these-stocks/

https://finance.yahoo.com/news/xcel-energy-fined-14-000-221211352.html

https://finance.yahoo.com/m/a978850a-160e-39b2-977e-081d5d50c437/colorado-puc-delays-2.1-gw-of.html

https://finance.yahoo.com/news/xcel-energy-2023-end-earnings-221500405.html

https://www.fool.com/investing/2023/10/20/the-biden-administration-is-spending-7-billion-on/

https://finance.yahoo.com/news/13-most-profitable-utility-stocks-101449060.html

https://finance.yahoo.com/news/xcel-energy-inc-nasdaq-xel-163143390.html

https://www.sec.gov/Archives/edgar/data/0000007323/000006598423000094/etr-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: RleTNt

https://reports.tinycomputers.io/XEL/XEL-2024-01-08.html Home