Apple Inc. (ticker: AAPL)

2024-01-27

Apple Inc. (ticker: AAPL) stands as one of the world's most valuable companies, renowned for its broad array of consumer electronics, software, and services. It holds a pioneering status in the personal computer industry with the introduction of the Macintosh and continues to thrive in the smartphone market with its flagship iPhone. Beyond hardware, Apple has a growing presence in the digital services space, encompassing the App Store, Apple Music, and iCloud. Its products are characterized by their innovative technology, sleek design, and a user-friendly interface, fostering a strong and loyal customer base. Headquartered in Cupertino, California, Apple's global influence is also seen in its significant impact on supply chain dynamics, environmental sustainability efforts, and corporate social responsibility initiatives. The company's fiscal policies, strategic mergers and acquisitions, and consistent investment in research and development have secured its competitive edge in the tech sector, making AAPL a key player and a closely watched stock in the financial markets.

Apple Inc. (ticker: AAPL) stands as one of the world's most valuable companies, renowned for its broad array of consumer electronics, software, and services. It holds a pioneering status in the personal computer industry with the introduction of the Macintosh and continues to thrive in the smartphone market with its flagship iPhone. Beyond hardware, Apple has a growing presence in the digital services space, encompassing the App Store, Apple Music, and iCloud. Its products are characterized by their innovative technology, sleek design, and a user-friendly interface, fostering a strong and loyal customer base. Headquartered in Cupertino, California, Apple's global influence is also seen in its significant impact on supply chain dynamics, environmental sustainability efforts, and corporate social responsibility initiatives. The company's fiscal policies, strategic mergers and acquisitions, and consistent investment in research and development have secured its competitive edge in the tech sector, making AAPL a key player and a closely watched stock in the financial markets.

| Address | One Apple Park Way | City | Cupertino | State | CA |

|---|---|---|---|---|---|

| Zip Code | 95014 | Country | United States | Phone | 408 996 1010 |

| Website | https://www.apple.com | Industry | Consumer Electronics | Sector | Technology |

| Full Time Employees | 161,000 | CEO | Mr. Timothy D. Cook | CEO Pay | $16,239,562 |

| CFO | Mr. Luca Maestri | CFO Pay | $4,612,242 | COO | Mr. Jeffrey E. Williams |

| COO Pay | $4,637,585 | Previous Close Price | $194.17 | Dividend Rate | $0.96 |

| Dividend Yield | 0.5% | Payout Ratio | 15.33% | Five Year Avg Dividend Yield | 0.8% |

| Beta | 1.29 | Trailing PE | 31.34 | Forward PE | 29.20 |

| Market Cap | $2,975,178,948,608 | Fifty Two Week Low | $141.32 | Fifty Two Week High | $199.62 |

| Price to Sales TTM | 7.76 | Enterprise Value | $3,055,035,613,184 | Profit Margins | 25.31% |

| Shares Outstanding | 15,461,900,288 | Free Cash Flow | $82,179,997,696 | Operating Cash Flow | $110,543,003,648 |

| Earnings Growth | 10.8% | Revenue Growth | -0.7% | Gross Margins | 44.13% |

| EBITDA Margins | 32.83% | Operating Margins | 30.13% | Net Income to Common | $96,995,000,320 |

| Trailing EPS | 6.14 | Forward EPS | 6.59 | Total Revenue | $383,285,002,240 |

| Sharpe Ratio | -19.19491578587383 | Sortino Ratio | -317.07636351469813 |

| Treynor Ratio | 0.25975060232266683 | Calmar Ratio | 2.191433671570678 |

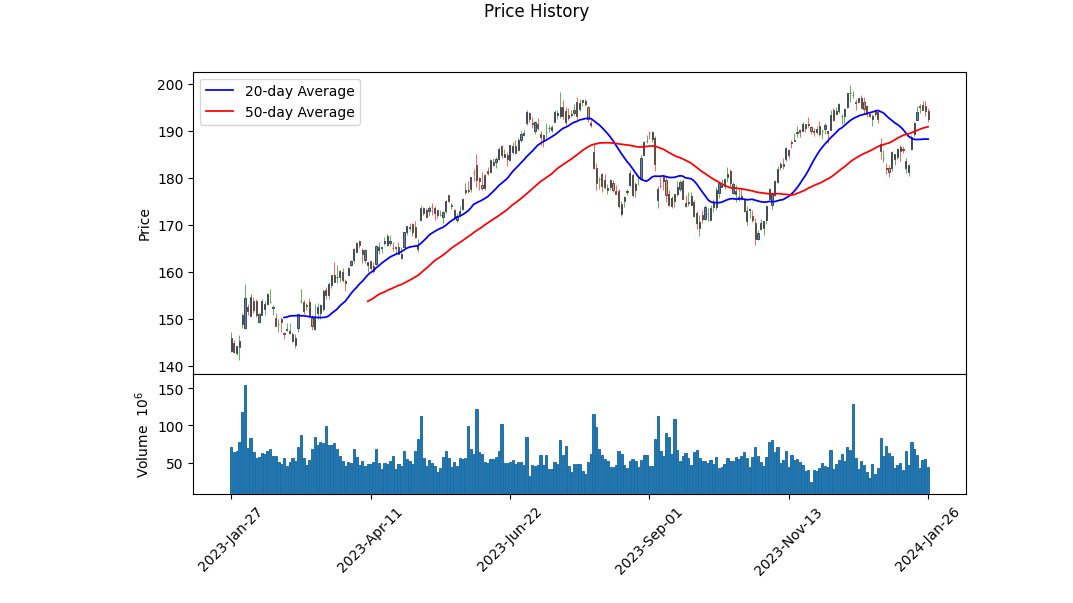

Technical Analysis Overview

AAPL's latest trading data shows a positive uptick in the OBV (On-Balance Volume) indicator from 5.181 million to 20.646 million. This suggests that volume is supporting the price trend and could indicate increasing investor confidence. However, the MACD histogram has decreased to 0.963 from a higher value, pointing to a potential slowdown of the bullish momentum.

Fundamental Analysis

Apple's strong gross margins of approximately 44.131% and operating margins of 30.134% reflect a healthy profit generation capacity. The EBITDA of $129.188 billion confirms robust earnings before interest, taxes, depreciation, and amortization. With a market cap of roughly $3.002 trillion, Apple remains a dominant force in the market.

Balance Sheet and Cash Flows

Apple's balance sheet shows a substantial net debt of $81.123 billion and a high level of cash and short-term investments totaling over $61 billion. Strong free cash flow of $99.584 billion implies the ability to sustain financial activities and return value to shareholders.

Analyst Expectations and Growth Estimates

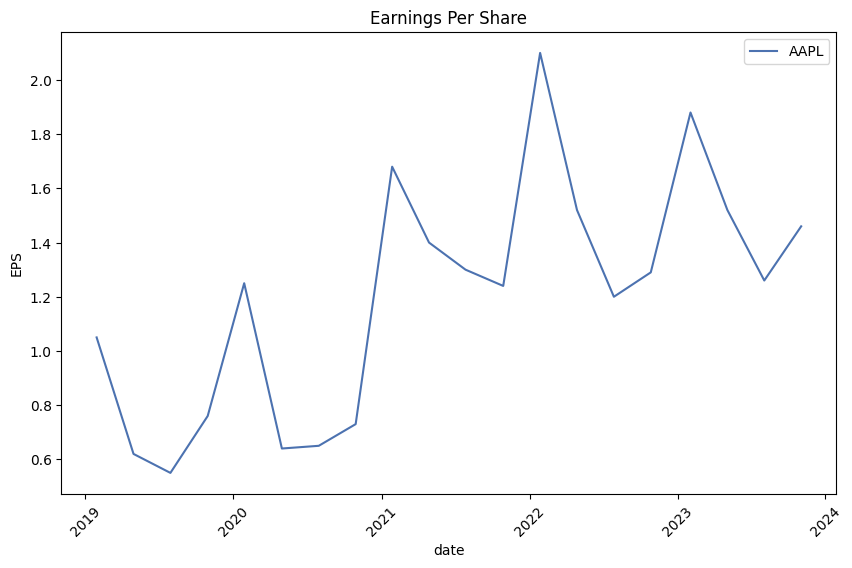

Analyst expectations for earnings estimate an average of $6.59 for the next year with a projected 8.90% growth for the same period. This growth is supported by strong past performance, with a 20.88% past five-year per annum growth rate, reflecting Apple's consistently strong financial position.

Risk-Adjusted Performance Ratios

The negative Sharpe and Sortino ratios are cause for concern as they imply poor risk-adjusted returns over the past year. However, the positive Treynor and Calmar ratios suggest the potential for better risk-adjusted returns based on the market and downside risk respectively.

Future Projection

Considering the financial metrics, strong fundamentals, and positive analyst sentiment despite negative risk-adjusted performance ratios, the forecast for AAPL's stock performance looks cautiously optimistic. The healthy earnings and growth estimates, coupled with strong cash flow generation, indicate that fundamental investors could remain interested in the stock. From a technical perspective, recent price movements and volume flow suggest sustained interest, but the softening MACD warns of potential near-term consolidation.

Investors should monitor key technical levels for signs of continuation or reversal and watch for fundamental changes that could influence the broader market sentiment surrounding AAPL. The company's forward growth, innovation pipeline, and market conditions will remain key drivers of its performance in the months to come.

| Statistic Name | Statistic Value |

| R-squared | 0.648 |

| Adjusted R-squared | 0.648 |

| F-statistic | 2317 |

| Prob (F-statistic) | 2.02e-287 |

| Log-Likelihood | -2003.7 |

| AIC | 4011 |

| BIC | 4022 |

| Alpha | 0.0723 |

| Beta | 1.2282 |

| Observations | 1,258 |

For the time period ending today, the linear regression model between AAPL (Apple Inc.) stock prices and SPY (SPDR S&P 500 ETF Trust) which represents the overall market, indicates a strong relationship with an R-squared value of 0.648. This implies that approximately 64.8% of the variability in AAPL's stock price can be explained by the movements in the SPY. A higher R-squared value denotes a better fit of the model to the data. With an adjusted R-squared of 0.648, after account for the number of predictors in the model, the strength of the relationship holds. The high F-statistic value of 2317 with a Prob (F-statistic) effectively at zero suggests the model is statistically significant.

The alpha value, also known as the intercept, is 0.0723. Alpha represents the portion of the return that is not explained by the market's movements, theoretically reflecting the individual performance of AAPL when the market's influence is removed. A positive alpha of 0.0723 suggests that AAPL has performed slightly better than what would be predicted solely based on the market movements as represented by SPY. This alpha, albeit small, can be considered AAPL's excess return independent of the market. However, it is important to keep in mind that the alpha is subject to the historical time frame of the analysis and may not forecast future performance.

Apple Inc. held its Q4 Fiscal Year 2023 Earnings Conference Call with participants including Tim Cook (CEO), Luca Maestri (CFO), and Suhasini Chandramouli (Director of Investor Relations). Cook reported significant revenue of $89.5 billion for the quarter, indicating all-time revenue records in various countries including India, and excellent performance across multiple product segments. The iPhone revenue surpassed expectations, particularly in India and China, with the launch of the iPhone 15 series being well-received. Services also marked record-breaking revenue growth. Despite macroeconomic challenges and currency headwinds, the company maintained focus on innovation, adapting to change, and thoughtful spending.

Cook highlighted the introduction of the powerful A17 Pro chip and new M3 chips, announcing the next generation of Mac products. Despite a 34% drop in Mac revenue influenced by market conditions and difficulty in comparison against the previous year's supply disruptions, the launch of the new MacBook Pro and iMac powered by M3 chips was met with positivity. As for iPad, revenue was at $6.4 billion despite a 10% drop from last year, mainly due to supply challenges and the timing of product releases. The wearables, home, and accessories segment saw revenue of $9.3 billion, with Apple Watch innovations received enthusiastically.

Services continued to be a strong area for Apple, setting an all-time revenue record of $22.3 billion with a 16% year-over-year increase. The section included record performances across the App Store, advertising, AppleCare, iCloud, payment services, and video. The company's investment in storytelling and innovation in services remained evident with content on Apple TV+ garnering numerous award nominations and wins, and the introduction of innovative features across iOS, macOS, iPadOS, and watchOS. Apple's continued retail expansion and commitment to environmental initiatives were also emphasized, particularly the goal for carbon-neutral products by the end of the decade.

Maestri provided detailed financial results, highlighting a slight overall revenue decrease compared to last year due to currency impact and product category declines. iPhone revenue, in contrast, achieved a new September quarter record with growth led by emerging markets. Mac experienced a significant year-over-year decrease but is expected to accelerate in the next quarter. The iPad and Wearables, Home and Accessories categories also showed declines but remained important parts of Apple's portfolio. The Services sector recorded impressive growth across all geographic segments. Gross margins showed improvements, and operating expenses were well-managed. Net income and diluted earnings per share set September quarter records, and Apple returned nearly $25 billion to shareholders. Looking forward, December quarter revenue is expected to be consistent with last year, adjusting for the negative impact of an extra week in the comparable quarter and current supply constraints on iPhone 15 Pro models. Apple anticipates growth in the iPhone segment and significant acceleration in Mac performance compared to the September quarter. Maestri also addressed enterprise investments and the company's capital return program, reiterating the goal to achieve a net cash-neutral position over time.

The call ended with a Q&A session, where analysts inquired about topics such as iPhone storage and iCloud demand, MacBook Pros timing, demand environment in China, components pricing impact on margins, the innovation ramp and capital intensity, as well as Apple's strategy in China. Further questions addressed Apple's R&D investments, enhancing customer lifetime value, long-term Service growth, Apple's supply chain diversification, including U.S. investments, and future innovations. Cook responded to these queries, shedding light on Apple's overall strategy and product focus, including the excitement around the Vision Pro and the importance of AI and machine learning in Apple's innovation pipeline. Maestri detailed the financial implications of product rollouts and the important role R&D plays in margin expansion. The call concluded with reaffirmations of Apple's positive financial trajectory and innovative outlook.

Apple Inc. ("Apple" or "the Company") filed its Form 10-Q with the Securities and Exchange Commission (SEC) for the quarterly period ended July 1, 2023. The report presents a comprehensive analysis of Apple's financial activities, including sales, operating income, gross margins, and more. This section summarizes the major highlights from the filing, providing insights into Apple's financial position and recent performance.

Net sales for the quarter totaled $81.797 billion, a slight decrease of 1% compared to $82.959 billion for the corresponding quarter of the previous year. This dip was attributed to weaknesses in foreign currency exchange rates against the U.S. dollar and lower sales of certain products, notably the iPhone and iPad. Despite this, sales of iPhone 14 Pro models and services such as advertising and cloud services showed an increase. Apple's net income for the quarter stood at $19.881 billion, slightly above the $19.442 billion from the same period the year prior.

Gross margin for the quarter improved to 44.5% compared to 43.3% in the prior year, with products and services gross margin percentages being 35.4% and 70.5%, respectively. The increase was due primarily to cost savings and favorable product mix changes, balanced by foreign currency weaknesses and lessened leverage.

Operating expenses amounted to $13.415 billion for the quarter, which represented a 16% share of total net sales and consisted primarily of research and development costs, which climbed to $7.442 billion. Selling, general, and administrative expenses hovered around $5.973 billion, indicating a relatively stable overhead cost framework.

Apple's effective income tax rate for the quarter was reported at 12.5%, which is less than the U.S. statutory rate of 21%. Key factors contributing to this lower rate included the company's tax structure, with a significant portion of earnings generated in lower-tax jurisdictions, as well as tax benefits from share-based compensation and the U.S. federal R&D credit.

Apple utilized external financing instruments to manage cash flow and fund operations. As of July 1, 2023, Apple's commercial paper program had an outstanding balance of $4 billion. The company continued its capital return program, repurchasing approximately $18.0 billion worth of its common stock and paying out $3.8 billion in dividends during the quarter.

The report also describes Apple's capital and liquidity strategy, which is underpinned by its cash, cash equivalents, marketable securities balances, and access to debt markets. Various financial risks faced by the company, such as interest rate fluctuations, currency exchange rates, and macroeconomic conditions, are discussed. No significant changes in internal financial controls were reported during the quarter.

Lastly, Apple mentions several legal proceedings, notably the lawsuit with Epic Games, Inc., which centers on allegations of antitrust law violations. As of the filing, the case has seen decisions favoring Apple by the U.S. District Court, but further appeals and rulings are anticipated.

Overall, Apple's Form 10-Q filing shows a solid financial standing amid global economic uncertainty, with consistent investment in research and development and a commitment to returning value to shareholders through stock buybacks and dividends.

Apple Inc., recognized globally for its consumer electronics and software services, has recently maneuvered through a notable legal hurdle. The U.S. appeals court has provisionally stayed an import ban on select Apple Watch models, ensued by a dispute with medical technology company Masimo which accused Apple of patent infringement related to the blood oxygen sensor feature in its watches. This temporary suspension of the ban came as positive news for Apple, as it permitted the continuation of Apple Watch Series 9 and Ultra 2 model sales, especially during the critical holiday shopping season.

The issue originated from a complaint by Masimo, leading to the ITC's ban order in October due to patent infringement claims. In response to the challenge, Apple had submitted a redesigned version of the Apple Watch for customs approval to address the ban. However, despite the temporary blockade, Apple's wearables sector, inclusive of the Apple Watch, reported sturdy revenues, signifying the brand's resilience and market strength.

Interestingly, while Masimo's stock took a hit following the court's decision, Apple's stock remained relatively stable, possibly due to their diversified product line and revenue streams. Narrating the chronicle of Apple's legal disputes, the market observers continue to keenly watch the Federal Circuit court, which is expected to receive a response from the ITC in early January regarding Apple's ongoing appeal for a longer stay.

Following this, news surfaced through Bloomberg about a high-profile collaboration involving outgoing design chief at Apple, alongside respected industry figures like Jony Ive and Sam Altman. The project centered on AI technology garners attention, as it signals Apple's ongoing commitment to innovation, possibly hinting at future AI-integrated devices that could redefine the industry.

Despite some recent stock valuation concerns by investors, shifts in Apple's market shares suggest investor confidence may be bolstered by the companys recent appeals and legal strategies. This legal turmoil offers an intricate view into the complex nature of intellectual property rights and their enforcement within the technology domain. It also underlines Apple's assertive approach to safeguard its innovations and consumer trust in the densely contested consumer electronics market.

The tightrope of patent disputes is further detailed by the saga involving a key scientist's email leading to years of legal wrangling. These proceedings underscore the delicate balance companies like Apple must maintain regarding intellectual property rights and their implications.

Apart from the legal arena, Apple's market performance is a tale of both steadiness and prospects of growth. While the tech giant's share growth has been modest recently, as highlighted by Zacks Equity Research, investment analysts keep a close watch on earnings estimate revisions, revenue forecasts, and valuation metrics. Apple's consistent potential for revenue increment and exceptional past performance, including a notable EPS achievement in its last reported quarter, offer an optimistic outlook.

It is essential to distinguish Apple's valuation context; for instance, it is currently trading at a P/E ratio indicating it may be priced at a premium, aligning with investors' expectations considering Apple's considerable market leverage and innovative leadership.

As Apple prepares for pivotal legal dates in January, these will determine the fate of its Apple Watch sales, which have taken center stage in this legal narrative. The company is also eyeing global trends and adapting to changes, such as new tech entrants, and remains at the front line of anticipation with rumored products like a potential VR device.

Investors and stakeholders interested in Apple's financial reports, product innovations, and legal proceedings will find a wealth of information in the report by Zacks Equity Research, Bloomberg articles, and YouTube analyses linked in the report, contributing to a broader understanding of the complexities and challenges faced by a technology juggernaut like Apple Inc.

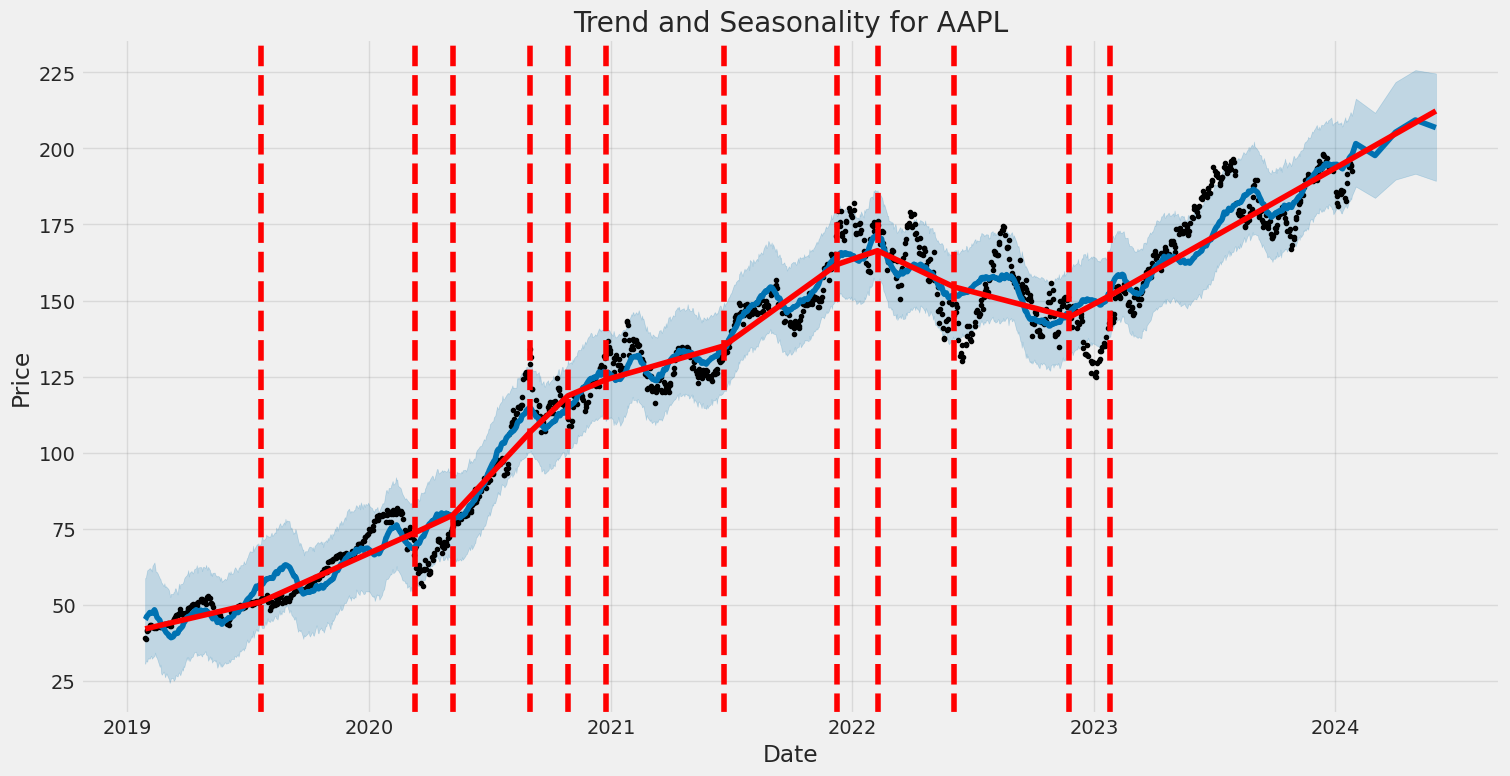

From 2019 to 2024, the volatility of Apple Inc. (AAPL) can be summarized by an ARCH model, which indicates that there is minimal linear correlation between past returns and future returns given an R-squared close to zero. The model parameters reveal that there is a positive and significant level of volatility clustering in AAPL's returns, as shown by the coefficient on the lagged squared return (alpha[1]). The omega value suggests a baseline volatility level even in the absence of recent volatility shocks.

Here is the table with the key statistics summarized:

| Statistic | Value |

|---|---|

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| Log-Likelihood | -2,616.40 |

| AIC | 5,236.79 |

| BIC | 5,247.07 |

| No. Observations | 1,258 |

| omega | 3.0948 |

| alpha[1] | 0.2257 |

To evaluate the financial risk of a $10,000 stake in Apple Inc. over a one-year timeframe, a multi-faceted approach employing statistical and artificial intelligence techniques is utilized. The analysis begins by harnessing volatility modeling, a sophisticated econometric framework that captures temporal variability in stock returns. This model is particularly adept at accounting for patterns such as volatility clustering, where high-volatility periods tend to follow each other, and the same is true for lower volatility periods.

Within this context, volatility modeling is effective at mapping out the expected fluctuations in Apple Inc.'s stock price by estimating the magnitude of future variance based on historical data. By modeling the change in variance over time, these predictions can help investors understand the level of risk associated with the stock's future price movements.

In parallel, machine learning predictions contribute to the analysis by employing predictive algorithms to discern the likely direction and magnitude of future stock returns. Principally, these predictions are grounded on a vast array of features and historical data, enabling the capture of complex, non-linear relationships that may not be immediately evident through traditional statistical methods.

When integrating these two methodologies, the resulting insights offer an enriched perspective on potential stock performance. Through the volatility modeling, one gains a handle on the expected range of price swings, which is central to calculating the Value at Risk (VaR). The VaR metric represents the maximum loss expected over a given time frame with a certain level of confidence. In this case, a 95% confidence interval is chosen, which corresponds to a 5% chance that the actual loss could exceed the VaR estimate.

The machine learning predictions contribute additional depth by furnishing an outlook on the potential returns, which in turn affects the position of the loss distribution used in calculating VaR. This dual application of quantitative tools enables the encapsulation of both the dispersion of returns (volatility modeling) and the expected return itself (machine learning predictions) into the risk assessment.

For the Apple Inc. investment, the computed VaR at a 95% confidence level is $198.47. This figure suggests that, within the span of one year and under normal market conditions, there is a 95% probability that the investor would not experience a loss exceeding $198.47 on their $10,000 investment. This quantified risk assessment can guide potential investors in making informed decisions by presenting a clearer picture of the stake's upside and downside within the context of historical and predictive analytics.

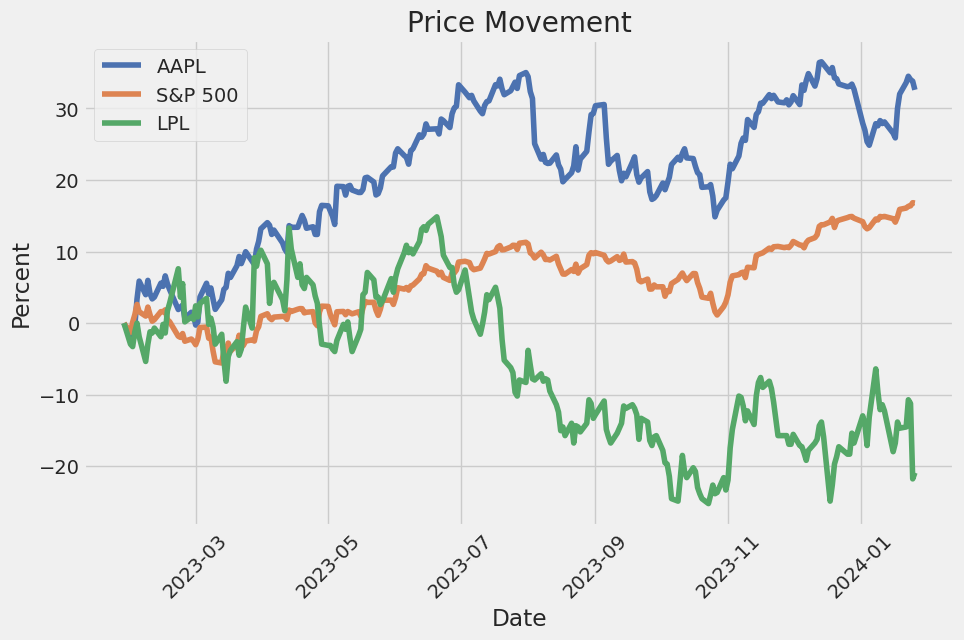

Similar Companies in Consumer Electronics:

LG Display Co., Ltd. (LPL), Sony Group Corporation (SNEJF), Panasonic Holdings Corporation (PCRFY), Sonos, Inc. (SONO), VIZIO Holding Corp. (VZIO), The Singing Machine Company, Inc. (MICS), Wearable Devices Ltd. (WLDSW), Koss Corporation (KOSS), GoPro, Inc. (GPRO), Sony Group Corporation (SONY), Universal Electronics Inc. (UEIC), Turtle Beach Corporation (HEAR), Vuzix Corporation (VUZI), Wearable Devices Ltd. (WLDS), Samsung Electronics Co., Ltd. (SSNLF), Google LLC (Alphabet Inc.) (GOOGL), Microsoft Corporation (MSFT), Dell Technologies Inc. (DELL), HP Inc. (HPQ), Lenovo Group Limited (LNVGY), Report: Amazon.com, Inc. (AMZN), Amazon.com, Inc. (AMZN), Xiaomi Corporation (XIACF), Report: Intel Corporation (INTC), Intel Corporation (INTC), Report: Advanced Micro Devices, Inc. (AMD), Advanced Micro Devices, Inc. (AMD), Report: NVIDIA Corporation (NVDA), NVIDIA Corporation (NVDA), Report: Qualcomm Incorporated (QCOM), Qualcomm Incorporated (QCOM), LG Electronics Inc. (LGEIY), Report: Facebook, Inc. (Meta Platforms, Inc.) (META), Facebook, Inc. (Meta Platforms, Inc.) (META)

https://www.fool.com/investing/2023/12/27/apple-pauses-watch-sale-due-to-technology-dispute/

https://www.youtube.com/watch?v=eUzKjOeNGek

https://www.cnbc.com/2023/12/27/apple-watch-import-ban-temporarily-stopped-by-us-appeals-court-.html

https://www.zacks.com/stock/news/2202705/magnify-gains-in-2024-with-magnificent-seven-etfs

https://www.youtube.com/watch?v=hPuv5L_EzXU

https://www.youtube.com/watch?v=eAAhCuo-59w

https://www.proactiveinvestors.com/companies/news/1037110?SNAPI

https://www.youtube.com/watch?v=paY3zSCVtc8

https://www.fool.com/investing/2023/12/28/if-i-could-buy-just-1-warren-buffett-stock-in-2024/

https://www.youtube.com/watch?v=xA1vZRIkwuE

https://www.youtube.com/watch?v=cGXWuy6f2hY

https://www.zacks.com/stock/news/2203325/apple-aapl-halts-smartwatch-sales-ban-amid-patent-dispute

https://www.sec.gov/Archives/edgar/data/320193/000032019323000077/aapl-20230701.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: ZOMgU6

Cost: $0.86181

https://reports.tinycomputers.io/AAPL/AAPL-2024-01-27.html Home