Chesapeake Energy Corporation (ticker: CHK)

2024-02-04

Chesapeake Energy Corporation, operating under the ticker CHK, is a notable player within the energy sector, particularly focusing on the exploration, development, and production of natural gas, oil, and natural gas liquids within the United States. Known for its history of innovation and strategic asset management, Chesapeake has established itself as a key figure in the energy industry with a significant emphasis on sustainability and reducing its environmental footprint. The company has undergone various strategic transformations over the years to optimize its portfolio and improve operational efficiencies, ensuring it remains competitive in the dynamically changing energy market. Chesapeake's financial performance and strategic initiatives are closely watched by investors and industry analysts alike, as it plays a crucial role in meeting the energy needs of a broad consumer base while striving for environmental stewardship.

Chesapeake Energy Corporation, operating under the ticker CHK, is a notable player within the energy sector, particularly focusing on the exploration, development, and production of natural gas, oil, and natural gas liquids within the United States. Known for its history of innovation and strategic asset management, Chesapeake has established itself as a key figure in the energy industry with a significant emphasis on sustainability and reducing its environmental footprint. The company has undergone various strategic transformations over the years to optimize its portfolio and improve operational efficiencies, ensuring it remains competitive in the dynamically changing energy market. Chesapeake's financial performance and strategic initiatives are closely watched by investors and industry analysts alike, as it plays a crucial role in meeting the energy needs of a broad consumer base while striving for environmental stewardship.

| Full Time Employees | 1,200 | Previous Close | 76.93 | Open Price | 76.5 |

| Day Low | 76.18 | Day High | 77.7 | Market Cap | 10,017,588,224 |

| Volume | 1,071,995 | Average Volume | 1,900,536 | Bid Size | 800 |

| Ask Size | 900 | Fifty Two Week Low | 69.68 | Fifty Two Week High | 91.0 |

| Enterprise Value | 11,432,821,760 | Profit Margins | 68.673% | Shares Outstanding | 130,795,000 |

| Book Value | 78.272 | Current Price | 76.59 | Target High Price | 121.0 |

| Target Low Price | 90.0 | Target Mean Price | 101.88 | Total Debt | 2,107,000,064 |

| Total Revenue | 7,906,999,808 | Debt to Equity | 20.52 | Revenue Per Share | 59.146 |

| Return on Assets | 17.133% | Return On Equity | 65.363% | Gross Margins | 43.708% |

| EBITDA Margins | 69.47% | Operating Margins | 5.619% | Total Cash | 713,000,000 |

| Total Cash Per Share | 5.44 | EBITDA | 5,493,000,192 | Quick Ratio | 0.866 |

| Current Ratio | 1.558 | Operating Cashflow | 2,960,000,000 | Free Cashflow | -463,750,016 |

| Sharpe Ratio | -0.12760702619972197 | Sortino Ratio | -2.0707828928673533 |

| Treynor Ratio | -0.044352958264735974 | Calmar Ratio | -0.19291152262077738 |

Performing a comprehensive analysis on CHK's stock involves evaluating a blend of technical indicators, fundamentals, and balance sheet data. This analysis aims to provide an insightful view into the possible direction of CHK's stock price in the forthcoming months.

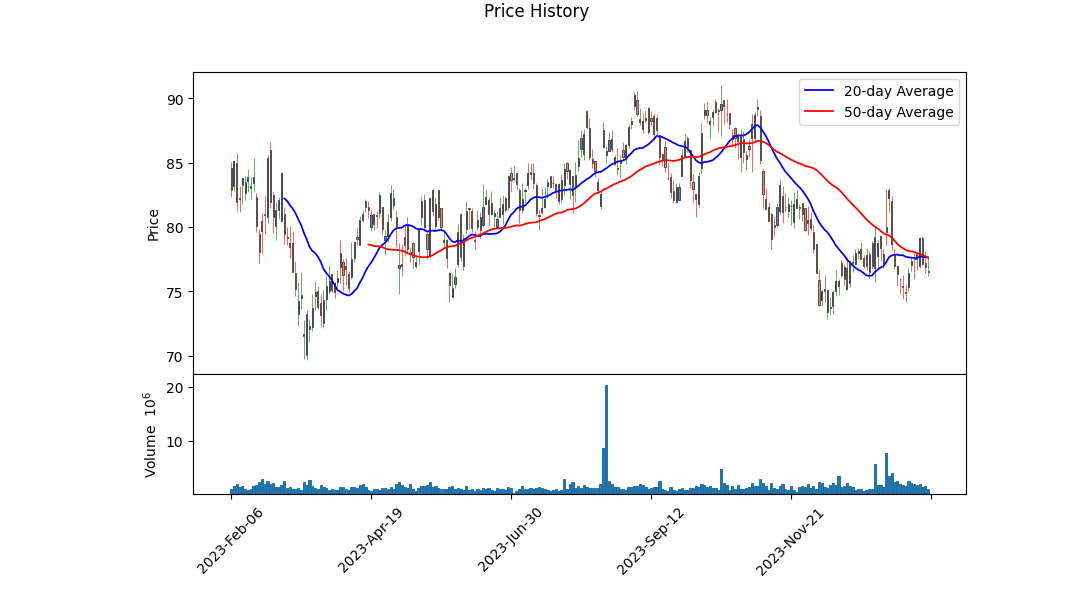

When examining the technical indicators over the last quarter, a notable fluctuation in stock price is observed, with a downward trend indicated by the closing prices. The most recent readings point toward a negative bias, with decreasing Open Balance Volume (OBV) figures highlighting reduced buying pressure and the Moving Average Convergence Divergence (MACD) histogram trending towards the positive, but still indicating bearish sentiment in the short term. These technical indicators suggest skepticism in the stock's immediate trajectory, warranting caution from a short-term investment perspective.

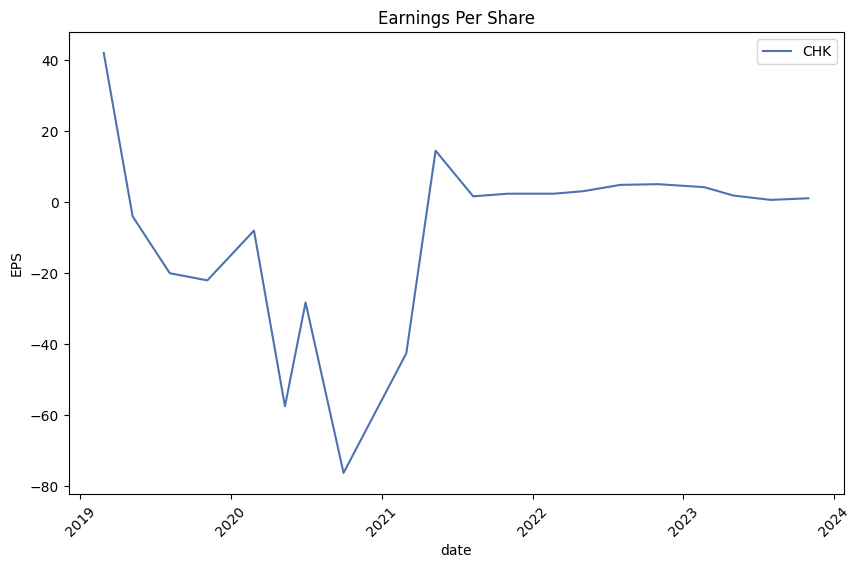

From a fundamental analysis standpoint, the provided summary of CHK's financial health and performance metrics paints a complex picture. Despite strong EBITDA margins and a gross margin that demonstrates a solid operational efficiency, the mixed signals from risk-adjusted return ratios including negative Sharpe, Sortino, Treynor, and Calmar ratios cast shadows on the stock's risk-return profile. Particularly, the negative Sharpe ratio implies that the stock's return does not compensate for the risk assumed by the investors over the past year.

The balance sheet and cash flow summaries denote a company in the midst of significant financial maneuvering, indicated by a large net debt position, which has seen fluctuations in reduction and accumulation over the analysis period. This suggests that while CHK is actively managing its debt, there's still a substantial load to be accounted for. The repurchase of capital stock and repayment of debt activities indicate a strategic approach towards leveraging and share value management.

Analyst expectations, coupled with the context from earnings history and revisions, show a tempered optimism towards future earnings growth, despite a downward trend in current and next quarter's growth estimates. This suggests that while the market anticipates recovery or growth, it is cautious about near-term hurdles.

Considering the risk-adjusted performance metrics, which all trend negatively, and juxtaposing this with the technical analysis and fundamentals, it appears CHK faces considerable headwinds. However, potential investors might find solace in the long-term growth estimates and the company's strategic financial management as demonstrated in its balance sheet activities.

In conclusion, CHK's stock appears to be in a state of flux, with technical indicators leaning towards caution in the short term, fundamental analysis providing a mixed view on the company's operational performance, and financial strategies suggesting a company in transition. Considering these factors, it is advised to maintain a cautious approach regarding CHK's stock in the immediate future. The intricate dance between managing financial health and operational efficiency, coupled with uncertain market sentiment, places CHK in a precarious position for the next few months. Investors are advised to keep abreast of market trends, upcoming financial reports, and any shifts in management strategy that could influence the company's trajectory.

In evaluating Chesapeake Energy Corporation (CHK) through the lens of the principles outlined in "The Little Book That Still Beats the Market," we have conducted an analysis focusing on two pivotal metrics: Return on Capital (ROC) and Earnings Yield. For Chesapeake Energy, the Return on Capital (ROC) stands impressively at 29.614540896270764%. This metric is paramount as it indicates the efficiency with which Chesapeake Energy is allocating its financial resources to generate profit; a figure above 29% is notably high, suggesting that the company is utilizing its capital effectively to create substantial value. Alongside this, the Earnings Yield for Chesapeake Energy is calculated to be 50.5418461940201%, an extraordinarily high yield that emphasizes the significant earnings generated per dollar invested in the company's shares. This high earnings yield not only underscores the company's profitability but also suggests the stock could be undervalued, representing a potentially lucrative investment opportunity. Together, these metrics present a compelling case for Chesapeake Energy's financial health and investment potential, reflecting its proficient use of capital and its attractive valuation in the market.

| Statistic Name | Statistic Value |

| R-squared | 0.130 |

| Adj. R-squared | 0.129 |

| F-statistic | 111.9 |

| Prob (F-statistic) | 1.79e-24 |

| Log-Likelihood | -1677.3 |

| AIC | 3359 |

| BIC | 3368 |

| coef (const) | 0.0878 |

| coef (0) | 0.7974 |

| Std err (const) | 0.083 |

| Std err (0) | 0.075 |

| t (const) | 1.056 |

| t (0) | 10.581 |

| P>|t| (const) | 0.291 |

| P>|t| (0) | 0.000 |

| [0.025 (const)] | -0.075 |

| [0.975 (const)] | 0.251 |

| [0.025 (0)] | 0.649 |

| [0.975 (0)] | 0.945 |

| Omnibus | 21.624 |

| Prob(Omnibus) | 0.000 |

| Jarque-Bera (JB) | 47.741 |

| Skew | 0.046 |

| Prob(JB) | 4.30e-11 |

| Kurtosis | 4.233 |

| Cond. No. | 1.11 |

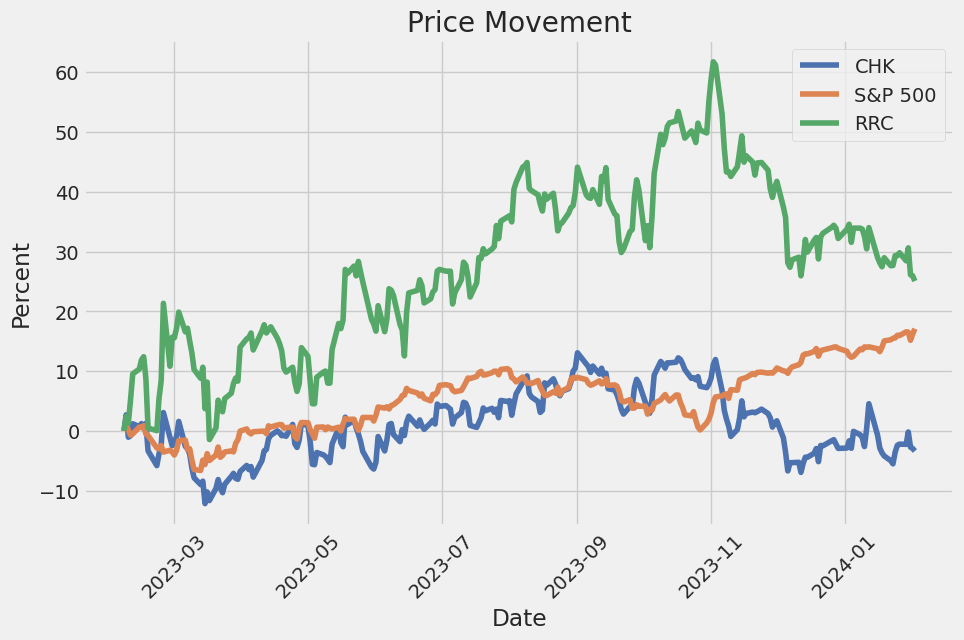

In assessing the relationship between CHK (Chesapeake Energy Corporation) and SPY (a proxy for the overall market represented by the S&P 500 index) up to today, our linear regression analysis sheds light on a statistically significant but relatively weak correlation between these two entities over the examined period. The alpha (), which represents the intercept of the regression line, is calculated at 0.08780564862802319 indicating that, holding market returns at zero, CHK is expected to earn an 8.78% return. This alpha suggests a positive performance by CHK irrespective of market movements. However, the degree of this performance is somewhat constrained, emphasized by the modest R-squared value of 0.130. The R-squared indicates that only 13% of the variability in CHK's returns can be explained by movements in the broader market as represented by SPY.

Further analysis of the relationship is underscored by the beta () coefficient of 0.7973819160422811, which measures CHK's volatility in relation to SPY or its sensitivity to movements in the market. This value suggests that for every 1% movement in the market, CHK's returns will, on average, move by 0.7974% in the same direction. This beta signifies that CHK exhibits slightly less volatility compared to the broader market. The significance of these findings is rooted in the t-statistics and P-values for the coefficients, with the beta coefficient showing a highly significant t-statistic of 10.581 and a P-value of 0.000, reinforcing the reliance on the predictive value of the market's movement on CHK's returns. Despite the statistical significance, it's crucial for investors to consider the relatively low R-squared value which signifies a large proportion of CHK's returns variability remains unexplained by this model, indicating the presence of other influencing factors beyond market movements.

In the third quarter earnings call for Chesapeake Energy Corporation, executives discussed the company's financial and operational highlights, demonstrating continued strength in their strategic operations aimed at delivering value to shareholders. The company reported exceptional performance, hitting the low end of capital and the high end of production targets despite elective curtailments in the Marcellus and a 60% deferral of planned third-quarter turn-in lines. Notably, Chesapeake's operations in the Marcellus Basin set a new company record, with rig efficiency improvements allowing for additional drilling at lower costs. This progress is poised to enhance the company's efficiency and offset inflationary pressures across its operations.

Chesapeake's focus on sustainable operational effectiveness and strategic growth was further demonstrated in their Haynesville operations. The company reported robust production for the quarter, with efforts to debottleneck midstream operations resulting in lowered line pressures and a reduction in interrupted volumes. This has led to an uptick in production guidance for the fourth quarter, indicating a strategic positioning to leverage improved production capabilities. The company's dedication to capital returns was exemplified through share repurchases and dividend payments, with approximately $725 million returned to shareholders in the quarter. Additionally, Chesapeake announced an LNG supply agreement with Vitol, highlighting its strategic move to enhance LNG readiness and leverage international pricing, thereby solidifying its competitive advantage in the gas sector.

Looking ahead to 2024, Chesapeake outlined its operational and strategic projections, focusing on maintaining rig counts in the Haynesville and Marcellus regions and potentially adding an additional rig to the Haynesville area in the second half of the year, contingent on favorable gas price trends. This cautious yet flexible approach underscores the company's commitment to adapt to market conditions while pursuing growth opportunities. The projected capital expenditure for the year suggested a strategy aligned with enhancing production efficiency and capitalizing on the expected increased demand for LNG. Chesapeake's positioning, bolstered by its operational excellence and strategic partnerships, appears to set the stage for sustained growth and shareholder value creation in the evolving energy landscape.

The discourse around industry consolidation also commanded attention, with Chesapeake leadership acknowledging the potential benefits of strategic mergers and acquisitions within the energy sector. The company's approach to possible consolidation activities remains prudent, adhering to strict criteria that prioritize accretion, balance sheet protection, and emissions profile considerations. This stance reflects a deliberate strategy to enhance company value through thoughtful expansion and optimization of its asset portfolio, with a particular emphasis on its strong presence in the Marcellus and Haynesville basins. As Chesapeake navigates the complexities of the energy market, its commitment to strategic decision-making and operational efficiency underscores its pursuit of leadership in delivering energy solutions and shareholder returns.

In summary, Chesapeake Energy's third-quarter earnings call articulated a clear vision for sustainable growth, operational excellence, and strategic positioning in the energy sector. The company's achievements in production efficiency, its strategic outlook for 2024, and proactive steps toward LNG market integration denote a comprehensive strategy aimed at capitalizing on emerging opportunities while addressing the dynamic challenges of the energy market. As Chesapeake continues to refine its operations and pursue strategic initiatives, its focus on delivering value to shareholders through innovative and efficient energy solutions remains paramount.

Due to the sheer scale of the data, a detailed analysis of specific segments such as acquisitions, disposals, derivative transactions, interest expenses, income taxes, production costs, gathering, processing and transportation expenses, severance and ad valorem taxes, as well as general administrative costs and depreciation, depletion, and amortization (DD&A) expenses, is crucial. For instance, the impact of acquisitions like the Marcellus Acquisition significantly bolstered Chesapeake's footprint, translating to increased operating cash flows and the addition of high-quality producing assets. Conversely, the disposal of assets, such as the Eagle Ford and Powder River Basin divestitures, not only refocused Chesapeakes asset portfolio but also realized significant gains, enhancing liquidity and potentially affecting long-term strategic positioning.

The fluctuations in derivative transactions, influenced by market conditions and Chesapeake's hedging strategies, underscore the volatility and the financial risk management maneuvers inherent in the energy sector. The considerable expenses attributed to interest, stemming from various financing activities, underline the companys reliance on debt instruments and the associated service obligations. Moreover, income tax considerations, impacted by legislative changes such as the Inflation Reduction Act of 2022, introduce additional layers of fiscal responsibility and planning complexity.

Operational costs associated with production, gathering, processing, and transportation, alongside taxes and DD&A, provide insight into the operational efficiency and asset quality of Chesapeake. Noteworthy is the management's strategic focus on reducing environmental impact through investments in sustainability projects, such as the collaboration with Momentum Sustainable Ventures LLC for a carbon capture and sequestration project aligning with broader ESG commitments and potential regulatory advantages.

These components collectively paint a picture of Chesapeake's strategic maneuvers within a complex, fluctuating energy market, underscored by significant financial and operational activities aimed at balancing growth, efficiency, and sustainability objectives. The financial strategies, asset management decisions, and adherence to regulatory and environmental standards are pivotal to Chesapeake's positioning and performance within the energy sector.

Chesapeake Energy Corporation's strategic movements within the energy sector, particularly its decision to merge with Southwestern Energy, have cast the spotlight on significant trends and shifts in the industry. The planned merger, announced with great anticipation, not only signifies a consequential step towards consolidating Chesapeake's stature in the natural gas domain but also positions the company to leverage the evolving dynamics of energy markets, both domestically and globally.

The all-stock deal valued at approximately $7.4 billion, as detailed, marks a transformative chapter for Chesapeake, aiming to create a powerhouse in natural gas production. This bold move is indicative of the company's adaptive and forward-thinking strategy, aiming to secure a dominant market position amidst fluctuating energy landscapes. With Chesapeake and Southwestern's combined assets, particularly in key regions such as the Marsalis and Haynesville, the merger is strategically poised to benefit significantly from the burgeoning demand for liquefied natural gas (LNG) exports. These regions are critical due to their proximity to crucial export facilities and infrastructure, underscoring the strategic merger's geographic and operational synergies.

The anticipated operational efficiencies and expanded production capabilities spell out a robust framework for the new entity to tap into international markets more effectively. This strategic alignment comes at a time when the LNG sector is experiencing an upward trajectory, driven by global energy demands and shifts towards cleaner fuel options. With the United States poised to increase its LNG export capacity, the merger positions Chesapeake to play a pivotal role in this expanding market, potentially impacting LNG's global pricing and supply dynamics.

Furthermore, the discussions surrounding the deal have brought to the fore the broader considerations of climate-related challenges and the imperative for energy companies to adopt more resilient and sustainable operating models. The emphasis on the need for producers to winterize their operations, as highlighted, points to the evolving regulatory and environmental landscapes that companies like Chesapeake must navigate.

The integration of Chesapeake and Southwestern is set against a backdrop of extensive consolidation within the energy sector, where major players seek to amplify their operational scale and adapt to the dual challenges of ensuring energy security and transitioning towards lower-carbon energy sources. This trend of strategic mergers and acquisitions underlines a significant reconfiguration of the industry, aiming to create entities that are not only more efficient and competitive but also aligned with broader environmental and sustainability goals.

The merger's timing is particularly noteworthy, considering the geopolitical nuances and the global push towards energy sustainability. By bolstering its natural gas production and export capabilities, Chesapeake is effectively positioning itself as a key player in the geopolitically strategic energy market. This move, set within the context of increasing natural gas demand and the global transition towards sustainable energy solutions, underscores the merger's strategic importance beyond mere business expansion.

Investor and market reactions to the merger announcement have been keen, reflecting optimism about Chesapeake's strategic direction and the overall implications for the energy sector. The deal is seen as a testament to Chesapeake's resilience and strategic foresight, coming after its emergence from bankruptcy and signaling a strong comeback in the competitive energy marketplace.

In essence, Chesapeake Energy Corporation's merger with Southwestern Energy represents a strategic recalibration aimed at capitalizing on current and emerging opportunities within the global energy landscape. As this deal progresses towards completion, industry observers, policymakers, and stakeholders will be closely monitoring its impact on market dynamics, competition, and the broader energy transition narrative. This pivotal moment for Chesapeake and the energy sector at large highlights the intricate interplay between strategic corporate decisions, market forces, and geopolitical factors shaping the future of global energy.

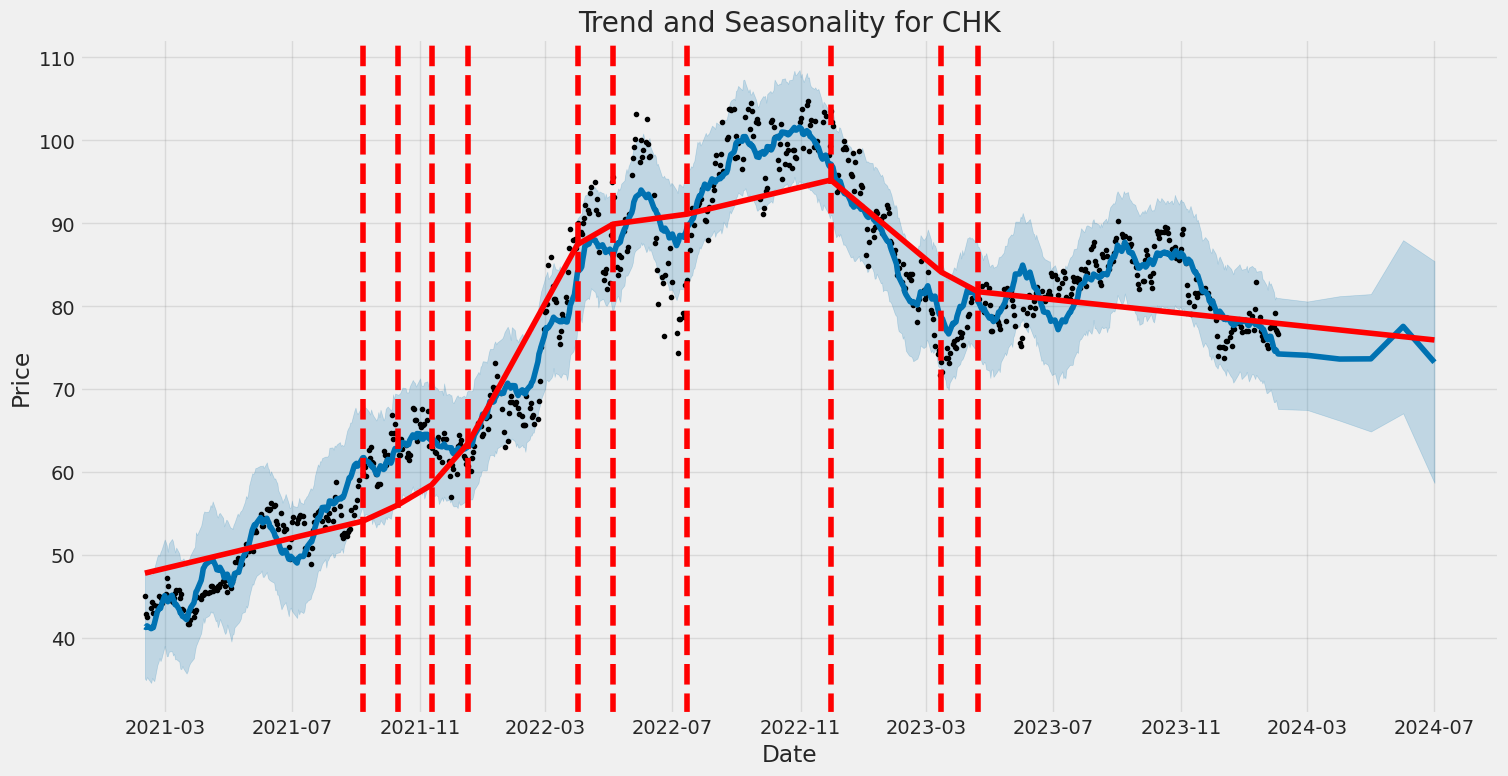

Chesapeake Energy Corporation (CHK) exhibited significant volatility from February 2021 to February 2024, demonstrating challenging predictability with a zero R-squared value in its ARCH model analysis. The omega coefficient, which is a measure of long-term average volatility, was notably high, suggesting that the price of CHK showed considerable fluctuations over the observed period. Additionally, the alpha coefficient indicates that recent past returns had a measurable impact on the future volatility, though this impact was relatively modest.

| Statistic Name | Statistic Value |

|---|---|

| R-squared | 0.000 |

| Log-Likelihood | -1723.30 |

| AIC | 3450.59 |

| BIC | 3459.83 |

| No. Observations | 749 |

| omega | 5.1829 |

| alpha[1] | 0.1268 |

Analyzing the financial risk of investing $10,000 in Chesapeake Energy Corporation (CHK) over a one-year period requires a nuanced approach, integrating volatility modeling with machine learning predictions. This multi-faceted analysis hinges on understanding the inherent stock price volatility and leveraging predictive analytics to forecast future returns.

The volatility modeling approach is pivotal in deciphering the intricate nature of Chesapeake Energy Corporations stock fluctuations. By examining historical price changes, this method enables a detailed comprehension of the stock's volatility pattern, which is essential for risk assessment. This modeling technique is especially adept at capturing the time-varying nature of volatility, a critical factor when evaluating the investment risk associated with Chesapeake Energy Corporation.

Conversely, machine learning predictions, particularly using an ensemble method, play a crucial role in forecasting future stock returns. The ensemble method, known for its ability to reduce overfitting and improve prediction accuracy by combining multiple models, specifically provides an edge in foreseeing potential returns from the investment. This predictive capacity is invaluable, as it contributes a forward-looking perspective to the risk assessment, complementing the backward-looking volatility analysis.

The intersection of volatility modeling and machine learning predictions culminates in the calculation of the Value at Risk (VaR) at a 95% confidence interval. For a $10,000 investment in Chesapeake Energy Corporation, the annual VaR is determined to be $295.64. This figure represents the potential loss in value that could be expected with a 5% likelihood, given normal market conditions, over a one-year period. Essentially, it quantifies the maximum expected loss, reinforcing the criticality of integrating both volatility understanding and return forecasts in assessing financial risk.

The use of volatility modeling to grasp the stock's fluctuation patterns, combined with the forward-looking insights provided by machine learning predictions, offers a comprehensive analysis of the investment risk. This dual approach not only facilitates a deeper understanding of the stocks behavior but also enhances the capability to foresee and quantify potential financial losses. The calculated VaR stands as a testament to the effectiveness of blending these analytical techniques, providing investors with a clearer picture of the risks involved in equity investment, specifically regarding Chesapeake Energy Corporation.

| Strike Price | Expiration Date | Profit | Delta | Gamma | Theta | Vega |

|---|---|---|---|---|---|---|

| 41 | 2023-06-15 | 4,619.5 | 0.843907 | 0.005525 | Not Provided | 10.308734 |

| 93 | 2023-08-21 | 4,429.5 | 0.776442 | 0.003371 | Not Provided | 22.589917 |

| 2 | 2023-03-22 | 2,919.5 | 0.796366 | 0.021822 | Not Provided | 3.744841 |

| 42 | 2023-06-29 | 2,819.5 | 0.785619 | 0.009772 | Not Provided | 12.917464 |

| 24 | 2023-05-07 | 2,719.5 | 0.758681 | 0.014312 | Not Provided | 10.471905 |

Similar Companies in Oil & Gas E&P:

Range Resources Corporation (RRC), Antero Resources Corporation (AR), Report: EQT Corporation (EQT), EQT Corporation (EQT), Comstock Resources, Inc. (CRK), Report: Southwestern Energy Company (SWN), Southwestern Energy Company (SWN), Matador Resources Company (MTDR), Coterra Energy Inc. (CTRA), Report: Diamondback Energy, Inc. (FANG), Diamondback Energy, Inc. (FANG), Pioneer Natural Resources Company (PXD), Permian Resources Corporation (PR), Report: Devon Energy Corporation (DVN), Devon Energy Corporation (DVN), Report: EOG Resources, Inc. (EOG), EOG Resources, Inc. (EOG), ConocoPhillips (COP), Report: APA Corporation (APA), APA Corporation (APA), Hess Corporation (HES), Cabot Oil & Gas (COG)

https://www.youtube.com/watch?v=TyBail9yITE

https://finance.yahoo.com/m/022f1b31-1c27-3d68-bc4e-ad01de78027d/the-chesapeake-southwestern.html

https://finance.yahoo.com/m/14831794-b8a1-3e71-981e-8c1ce5295e36/the-energy-industry.html

https://finance.yahoo.com/video/oil-prices-tick-iran-seizes-221744992.html

https://finance.yahoo.com/m/c1c1c611-0c08-34e8-8e82-bfd55c3b0b34/russian-war%2C-energy.html

https://finance.yahoo.com/video/oil-prices-spike-us-uk-151552538.html

https://finance.yahoo.com/news/ultimate-growth-trio-3-stocks-152305602.html

https://finance.yahoo.com/m/24976398-180a-31c6-b115-5a6a5c07fa91/buy-chesapeake-stock.-a.html

https://www.sec.gov/Archives/edgar/data/895126/000089512623000123/chk-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: tZyFJV

Cost: $0.66249

https://reports.tinycomputers.io/CHK/CHK-2024-02-04.html Home