Iron Mountain Incorporated (ticker: IRM)

2024-02-08

Iron Mountain Incorporated (IRM) is an American enterprise information management services company founded in 1951 and headquartered in Boston, Massachusetts. It specializes in records management, information destruction, and data backup and recovery services. As a global leader in storage and information management services, Iron Mountain caters to clients in various sectors, including financial services, healthcare, retail, and government. With over 1,450 facilities in approximately 50 countries, Iron Mountain stores and protects billions of valued assets, including critical business information, highly sensitive data, and cultural and historical artifacts. The company operates through its real estate investment trust (REIT) structure, enabling it to deliver reliable dividend returns to investors. Over the years, Iron Mountain has expanded its portfolio of services to include digital transformation solutions, aiming to meet the growing demand for digital storage and management amidst the advancing technological landscape. This comprehensive suite of services, along with its vast global footprint, positions Iron Mountain as a key player in the information management industry.

Iron Mountain Incorporated (IRM) is an American enterprise information management services company founded in 1951 and headquartered in Boston, Massachusetts. It specializes in records management, information destruction, and data backup and recovery services. As a global leader in storage and information management services, Iron Mountain caters to clients in various sectors, including financial services, healthcare, retail, and government. With over 1,450 facilities in approximately 50 countries, Iron Mountain stores and protects billions of valued assets, including critical business information, highly sensitive data, and cultural and historical artifacts. The company operates through its real estate investment trust (REIT) structure, enabling it to deliver reliable dividend returns to investors. Over the years, Iron Mountain has expanded its portfolio of services to include digital transformation solutions, aiming to meet the growing demand for digital storage and management amidst the advancing technological landscape. This comprehensive suite of services, along with its vast global footprint, positions Iron Mountain as a key player in the information management industry.

| City | Portsmouth | State | NH | Zip Code | 03801 |

| Country | United States | Phone | 617 535 4766 | Website | https://www.ironmountain.com |

| Industry | REIT - Specialty | Sector | Real Estate | Full Time Employees | 26,000 |

| Market Cap | 19,902,040,064 | 52 Week Low | 48.94 | 52 Week High | 70.66 |

| Dividend Rate | 2.6 | Dividend Yield | 0.0383 | 5 Year Avg Dividend Yield | 6.27 |

| Beta | 0.92 | Volume | 231,446 | Average Volume | 1,358,357 |

| Market Cap | 19,902,040,064 | Enterprise Value | 34,207,291,392 | Profit Margins | 0.0521 |

| Total Revenue | 5,339,509,248 | Debt to Equity | 3383.806 | Return on Assets | 0.041279998 |

| Earnings Growth | -0.53 | Revenue Growth | 0.079 | Gross Margins | 0.56991 |

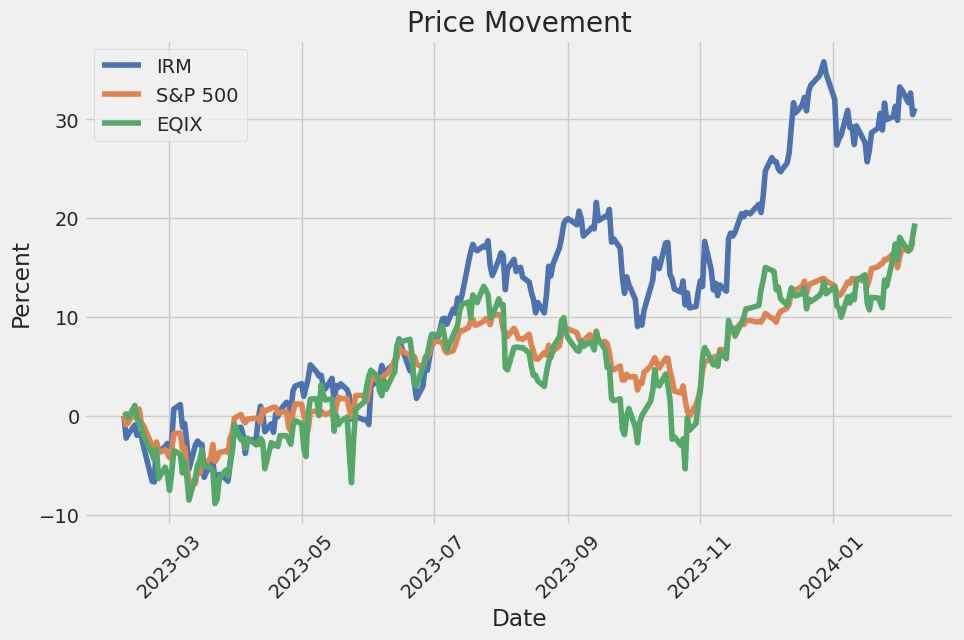

| EBITDA Margins | 0.33554 | Operating Margins | 0.20327999 | 52 Week Change | 0.27865767 |

| Sharpe Ratio | 1.1685948590234507 | Sortino Ratio | 18.788007385277137 |

| Treynor Ratio | 0.24517572668803356 | Calmar Ratio | 3.025660119444849 |

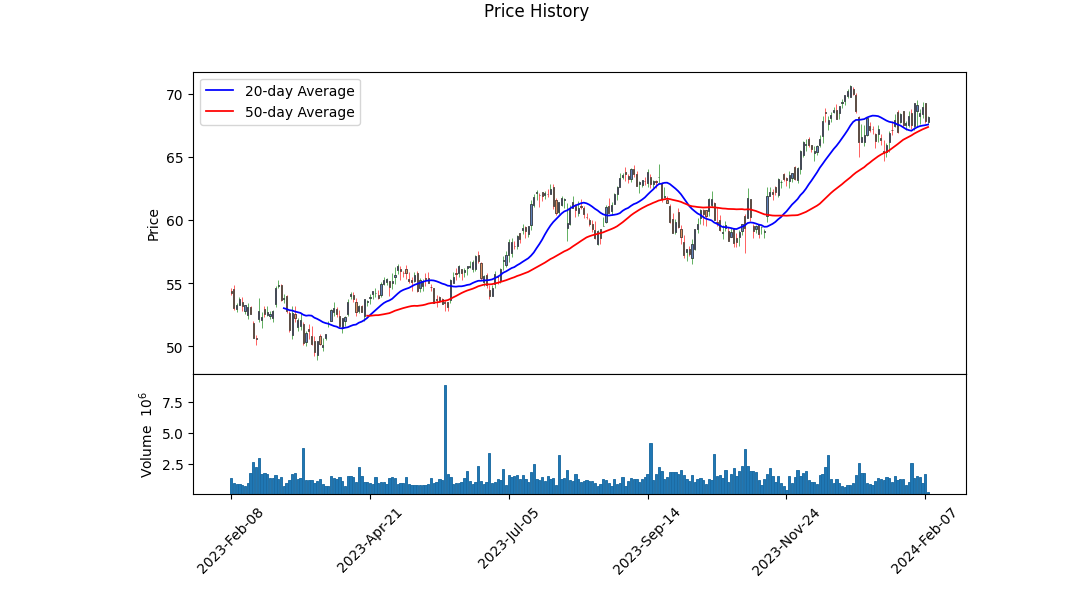

Analyzing the provided data for IRM, including technical indicators, fundamentals, balance sheets, cash flows, and risk-adjusted return measures, a comprehensive stock performance prediction can be made. The last few months have demonstrated a steady uptrend in the stock price, with a clear increase from the open price of $60.13 on October 11 to a higher level by February 8, indicating a bullish momentum. This uptrend is substantiated by the technical indicators such as the OBV (On-Balance Volume) which has shown an overall increase, reflecting higher volume on up days than on down days, a positive signal for continued bullish behavior. However, the MACD histogram values towards the end of the observed period suggest a deceleration in the bullish momentum, indicating potential short-term consolidation or pullback.

The fundamental analysis reveals strong financial health with consistent EBITDA and operating margins over recent years. The company has managed to maintain a stable gross margin, an indication of efficient cost management and profitability. However, the balance sheet indicates a high level of debt, which could pose a risk under adverse market conditions or if interest rates rise significantly. Despite this, the company's ability to generate free cash flow, albeit lower than in previous years, demonstrates financial agility to meet its obligations and invest in growth opportunities.

In the context of risk-adjusted return measures, the Sharpe, Sortino, Treynor, and Calmar ratios suggest that IRM has provided substantial returns compared to its risk level over the past year. The high Sortino ratio, in particular, indicates that the stock has offered excellent returns on the downside risk, appealing to risk-averse investors. These ratios, combined with analyst expectations of revenue growth and positive EPS estimates for the next year, reinforce the bullish sentiment.

However, the investment landscape is complex, and while technical and fundamental analyses suggest a positive outlook, investors must also consider macroeconomic factors, industry trends, and regulatory changes that could impact stock performance. The expected growth in earnings and revenue, coupled with a solid risk-adjusted return profile, suggests that IRM is positioned for strength in the coming months. Yet, the high level of debt and the impending deceleration signaled by the MACD histogram call for cautious optimism. Investors would do well to monitor these indicators closely, along with any news or events that could influence market dynamics and sentiment towards IRM.

In conclusion, given the current trends and data, IRM's stock price is likely to continue its upward trajectory in the near term, albeit with possible volatility and consolidation phases. The blend of strong fundamental health, positive analyst sentiment, and favorable risk-return measures form a solid base for the bullish outlook. Prudent investors should keep an eye on both the market's broader movements and any specific developments related to IRM to refine their investment strategy accordingly.

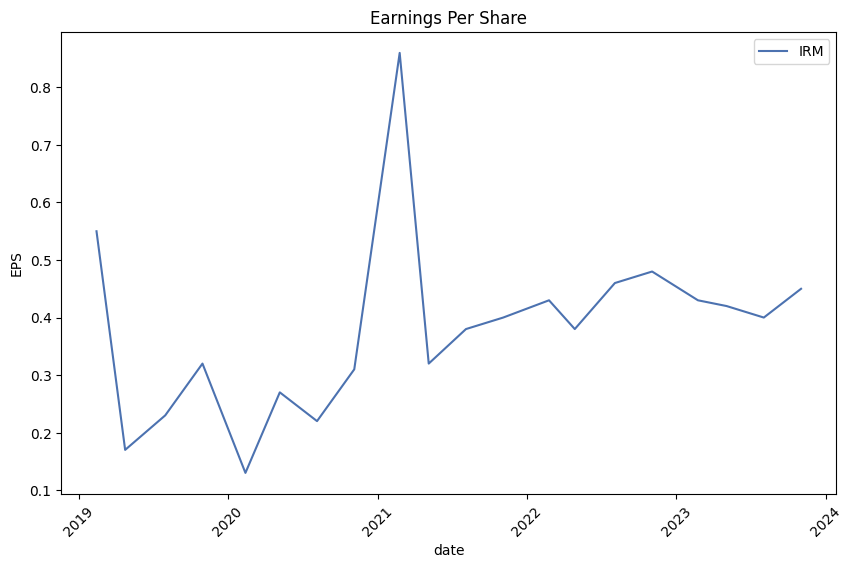

In our latest analysis focusing on the financial performance of Iron Mountain Incorporated (IRM) for potential investment opportunities, two critical metrics have been closely examined: the Return on Capital (ROC) and the Earnings Yield. Iron Mountain showcased a Return on Capital (ROC) of 7.38152774213507%, indicating how efficiently the company generates profits relative to its total capital, which includes both equity and debt. This figure suggests a moderate level of profitability and efficiency in utilizing capital to generate earnings. Additionally, the Earnings Yield for Iron Mountain was calculated to be 2.8177282066334017%, a metric that represents the company's earnings relative to its share price. This lower yield can offer insights into the company's valuation, implying that the stock may be priced on the higher side in relation to its earnings. Together, these metrics are pivotal for evaluating the company's financial health and potential for return on investment. Investors should weigh these figures within the broader context of their investment strategies and market conditions.

| Statistic Name | Statistic Value |

| R-squared | 0.336 |

| Adj. R-squared | 0.335 |

| F-statistic | 634.1 |

| Prob (F-statistic) | 1.36e-113 |

| Log-Likelihood | -2412.8 |

| No. Observations | 1257 |

| AIC | 4830. |

| BIC | 4840. |

| Alpha | 0.03798784094293177 |

| Beta | 0.8903339992072992 |

In the linear regression model comparing IRM (Iron Mountain Incorporated) with SPY (a proxy for the entire market), the alpha value of approximately 0.038 suggests that IRM has a slight positive offset relative to the performance of SPY. Alpha, a measure of performance on a risk-adjusted basis, represents the excess return of IRM compared to the return of SPY. A positive alpha implies that IRM outperforms the market benchmark on a risk-adjusted basis, taking into account the volatility of its returns in relation to the market. In this context, the alpha indicates that even after adjusting for the market risks, IRM demonstrates a marginal outperformance beyond what would be predicted by its market exposure alone.

The beta coefficient of approximately 0.890 denotes IRM's sensitivity to movements in the SPY. In practical terms, this means that for every 1% change in the market, IRM's return is expected to change by about 0.89%. This figure demonstrates IRM's slightly less than one-to-one responsiveness to the market, indicating a somewhat lower volatility in comparison to the market as a whole. The relationship detailed by these figures, including a relatively mild positive alpha and a beta of less than one, suggests that IRM provides a slightly stable investment compared to the broader markets fluctuations, accompanying a minimal level of excess return over the market.

Iron Mountain Incorporated (IRM) showcased remarkable performance in its third quarter of 2023 earnings call, led by President and CEO, William Meaney, and EVP and CFO, Barry Hytinen. The company highlighted a record-breaking quarter, achieving its highest-ever quarterly revenue of $1.4 billion, attributing to an over $100 million year-over-year increase, and a record EBITDA of $500 million. This growth was significantly fuelled by Project Matterhorn, aimed at enhancing the company's operating model to foster cross-selling of products and services. The company's success in organic storage rental revenue growth and the data center business, which witnessed over 20% organic growth, underscored its strategic execution and market positioning.

Highlighting customer acquisitions, Meaney drew attention to significant wins across various sectors, including a public sector contract in the U.K., valued at nearly $2 million, and a prominent contract with the TV and film production division of a major technology company leveraging Iron Mountain's InSight platform. These wins not only reflected the company's ability to provide comprehensive solutions spanning physical and digital assets but also its prowess in navigating complex regulatory landscapes and delivering tech-enabled solutions that drive substantial business outcomes for clients.

Iron Mountain also detailed its strides in government business, securing projects aimed at digitizing public services in Europe and supporting the U.S. citizen and Immigration Services. Meaney emphasized the strategic importance of these ventures, illustrating Iron Mountain's critical role in facilitating efficient decision-making and operations for governmental agencies. The acquisition of Regency Technologies was another pivotal move, set to further the company's ambitions in the asset life cycle management (ALM) market. Regency, identified as a strategic fit, is expected to enhance Iron Mountain's operational scale and its offerings in the ALM space, a sector noted for its increasing demand for secure and circular solutions for end-of-life IT assets.

On the data center front, Iron Mountain made notable gains, signing deals amounting to 65 megawatts in the third quarter alone, surpassing the yearly target with a total of 120 megawatts signed by the quarter's end. The conversion of a records management facility in Miami into a data center, alongside leased land slated for conversion, reflects the company's strategic realignment towards expanding its data center capacity to match the growing demand fueled by digital transformation and AI.

In closing, CFO Barry Hytinen recapped the strong financial performance, with revenue growth of 8% year-on-year on a reported basis and an adjusted EBITDA of $500 million, slightly above guidance despite significant foreign exchange impacts. The company reiterated its full-year guidance, underpinned by a disciplined capital allocation approach, emphasizing growth while providing substantial shareholder returns. This quarter's outcomes and strategic maneuvers highlight Iron Mountain's robust growth trajectory, underscored by effective execution of its business model and strategic initiatives aimed at long-term value creation.

interest expense associated with the amortization of certain deferred financing costs The income tax impact from the application of an estimated effective tax rate to the foregoing adjustments (excluding non-deductible items, for which the current year effective tax rate is utilized), which are included in the provision (benefit) for income taxes

Adjusted EPS should be considered in addition to, but not as a substitute for, other measures of financial performance reported in accordance with GAAP, such as earnings per share. Adjusted EPS is used by management to evaluate the operating profitability of our core operations.

RECONCILIATION OF REPORTED EARNINGS PER SHARE FULLY DILUTED FROM NET INCOME (LOSS) TO ADJUSTED EPS (IN THOUSANDS, EXCEPT PER SHARE DATA):

THREE MONTHS ENDED SEPTEMBER 30, 2023 2022 Net Income (Loss) Per Share Attributable to Iron Mountain Incorporated - Diluted $0.31 $0.66 Add/(Deduct) the impact of: Acquisition and Integration Costs Restructuring and other transformation Amortization related to the write-off of certain customer relationship intangible assets (Gain) loss on disposal/write-down of property, plant and equipment, net (including real estate) Other (income) expense, net Stock-based compensation expense Non-cash interest expense associated with the amortization of certain deferred financing costs Income tax impact from the application of an estimated effective tax rate to the foregoing adjustments Adjusted EPS [Adjustments to be calculated]

The adjustments necessary to calculate Adjusted EPS were not provided; these adjustments would include the specific amounts related to the items excluded from the Adjusted EPS calculation.

By adjusting for these items, Adjusted EPS aims to present a more consistent basis for comparing our operational performance across reporting periods.

Please note that without the specific numerical adjustments, the completion of the reconciliation calculation cannot be fully achieved in this summary.

Iron Mountain Incorporated, known for its stronghold in the storage and information management services sector, has carved out a significant niche for itself within the real estate investment trust (REIT) landscape. As a specialty REIT focusing on information management, storage, data center infrastructure, and asset lifecycle management, its recent activities and strategic decisions have turned heads in the financial community, signaling a company on the move amidst evolving digital landscapes.

A pivotal point of discussion around Iron Mountain is its valuation in comparison to its peers. As highlighted by a Seeking Alpha analysis, the company's trading at a premium has garnered attention, raising questions about the valuation's sustainability given the broader market trends. This concern stems from the evolving nature of digital transformation trends impacting traditional physical storage services, potentially threatening traditional revenue streams. Yet, Iron Mountain's strategy of pivoting towards digital solutions and expanding its service portfolio, particularly in the IT Asset Disposition (ITAD) space, suggests an adaptability that could counterbalance these challenges.

The acquisition of Regency Technologies, detailed in a Yahoo Finance article, underscores Iron Mountain's commitment to strengthening its position in the ITAD market. This move not only enhances its logistics network but also aligns with environmental sustainability practicesa growing concern in IT asset management. With an initial outlay of $200 million, the acquisition speaks to Iron Mountain's strategic vision of expanding its operational scale, thus capturing a significant share of the burgeoning IT asset disposition market.

However, this strategic expansion comes amidst a backdrop of insider activities that may raise eyebrows. Reports indicate a trend of insider selling within the company, exemplified by executive Mark Kidd's sale of 11,376 shares. While insider transactions can often prompt questions regarding confidence in the companys future, the context provided reveals these sales as part of pre-planned financial arrangements rather than a reflection of insider sentiment.

Moreover, Iron Mountain's financial performance, as per recent reports, has been noteworthy. Against other self-storage REITs, the company stands out with a sterling total return of 33.32% over the past 52 weeks. Such performance is indicative of strategic initiatives paying off, particularly its ventures into areas supporting the infrastructure needs of the burgeoning AI and tech industries.

The tech industry's rapid expansion, driven by AI and data-intensive applications, accentuates the importance of services offered by Iron Mountain. The company's focus on supporting the infrastructure needs of this sector through data centers and secure storage facilities positions it as a critical player in the era of digital transformation. This strategic positioning not only boosts its growth prospects but also enhances its appeal as an investment option that balances income through dividends and growth potential driven by the digital revolution.

Despite the bullish performance and strategic expansions, challenges remain, notably the high-interest rate environment and the potential for operational hiccups in a rapidly evolving digital landscape. Yet, Iron Mountain's adaptability and strategic foresight, exemplified by its recent financial disclosures and strategic acquisitions, suggest a firm poised for continued relevance and growth in the information management space.

As Iron Mountain navigates these opportunities and challenges, investors and stakeholders alike will be watching closely, interpreting insider activities, financial health indicators, and strategic decisions to gauge the company's future trajectory in an increasingly digital and data-driven world.

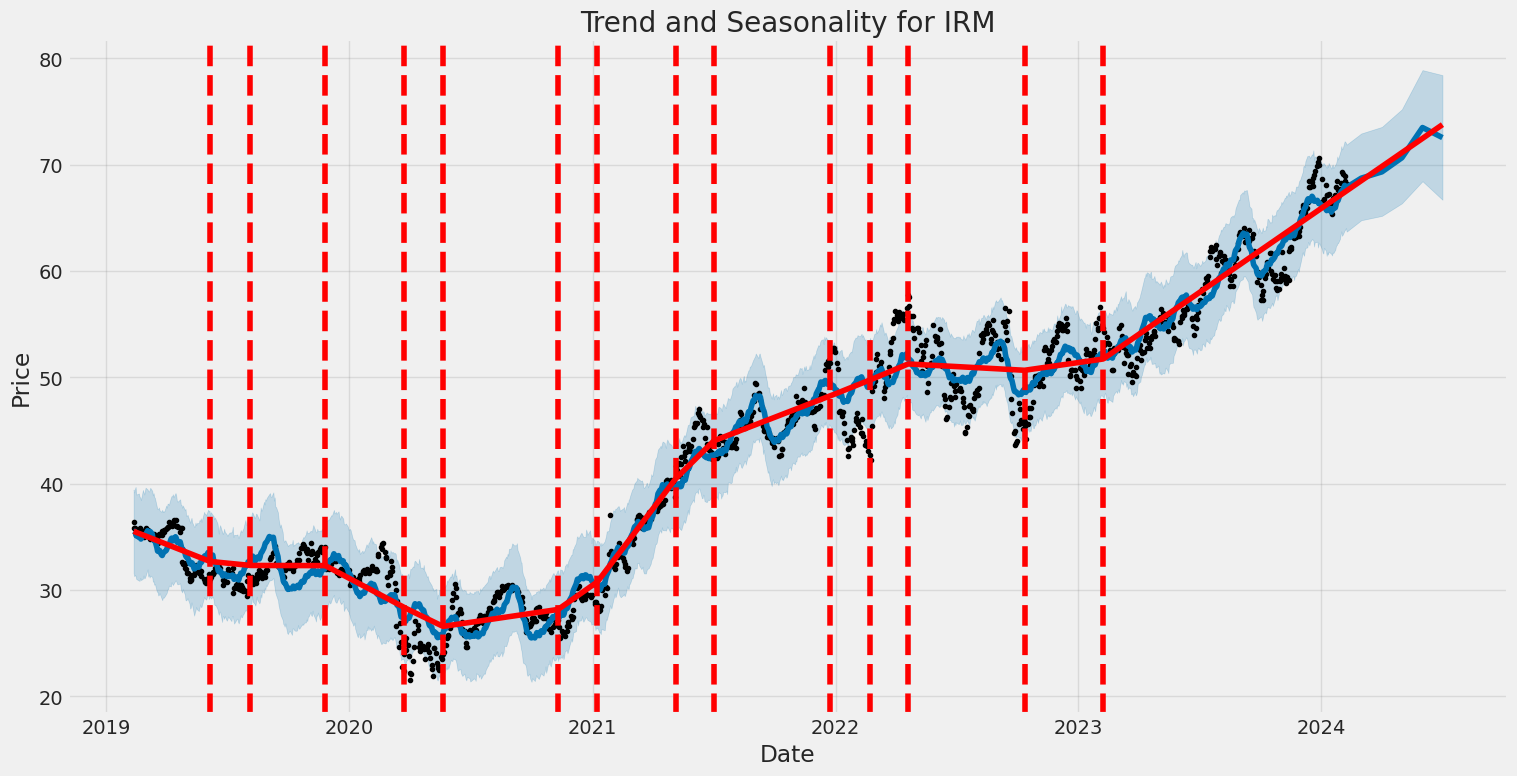

Iron Mountain Incorporated (IRM) has shown notable volatility from February 11, 2019, to February 8, 2024, as evidenced by the statistical analysis. Notably, the model applied reveals that the variance of the asset returns can significantly fluctuate, as demonstrated by the omega coefficient value of 2.5068, suggesting a high level of volatility. Additionally, the alpha[1] value of 0.4419 indicates persistence in volatility, meaning that if the stock experiences high volatility on one day, it is likely to continue experiencing high volatility in subsequent days.

| Statistic Name | Statistic Value |

|---|---|

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| Log-Likelihood | -2575.83 |

| AIC | 5155.65 |

| BIC | 5165.92 |

| No. Observations | 1257 |

| omega | 2.5068 |

| alpha[1] | 0.4419 |

When assessing the financial risk associated with a $10,000 investment in Iron Mountain Incorporated (IRM) over a one-year horizon, a blend of volatility modeling and machine learning predictions offers a robust approach. This dual-method analysis fosters a deeper understanding of the stock's volatility and potential future returns, ultimately equipping investors with a clearer picture of the risk involved.

Volatility modeling is a crucial first step, enabling us to analyze Iron Mountain Incorporated's stock volatility over time. This method is particularly adept at capturing the dynamic nature of market volatility, relying on historical price data to forecast the variability of returns. By applying this approach, we can gauge the expected level of fluctuation in Iron Mountain's stock price, which is a vital component in assessing the investment's overall risk profile.

Building upon this, machine learning predictions serve to forecast future stock returns by examining patterns within a vast array of historical data points. The use of a sophisticated algorithm facilitates a nuanced analysis of these patterns, highlighting probable future price movements based on observed historical trends. This method is instrumental in refining our understanding of potential future returns on Iron Mountain's stock, adding an additional layer of insight to the risk assessment framework.

The culmination of these methodologies is reflected in the calculation of the Annual Value at Risk (VaR) at a 95% confidence level, which, for a $10,000 investment in Iron Mountain Incorporated, stands at $216.93. This figure represents the maximum expected loss over a one-year period, under normal market conditions, with a 95% confidence interval. Essentially, it signifies that there is a 5% chance that the investment could suffer a loss exceeding $216.93 over the course of a year due to normal market fluctuations.

The integration of volatility modeling and machine learning predictions not only enhances the accuracy of the risk assessment but also provides a more comprehensive view of the potential risks associated with equity investment in Iron Mountain Incorporated. By understanding both the expected volatility of the stock and the predicted future returns, investors can make more informed decisions regarding their investment, better equipping them to manage and mitigate potential financial risks.

Analyzing the options chain for Iron Mountain Incorporated (IRM) with a focus on call options presents an interesting opportunity to evaluate various contracts based on their Greek metrics. Given our target stock price is 5% over the current stock price, we'll look for options that provide high potential returns, balancing risk factors indicated by the Greeks.

Starting with the options that have shorter expiration periods, we notice a call option with a strike of $67.5, expiring on 2024-02-16. This option stands out due to its high return on investment (ROI) of 2.0659090909 and profit of $2.727. The delta value of 0.6206364058 indicates a moderate sensitivity to the stock's price changes, which is balanced by a high gamma of 0.1715183613, suggesting the delta will increase rapidly if the stock moves in our favor. However, its high vega of 3.5871482443 also means the price is quite sensitive to changes in implied volatility, which is a risk factor to consider.

For a slightly longer-term position, the call option with a strike of $65.0, expiring on 2024-03-15, appears very promising. It has a ROI of 0.5662679426 and a profit of $2.367, with a delta of 0.7094874379, indicating a strong position if the stock price rises as anticipated. The gamma of 0.0539028908 and vega of 7.171717189 suggest a sensitivity to the stock's price and implied volatility, but this seems manageable over the medium term of the contract.

Looking at longer expiration dates, the option expiring on 2024-07-19 with a strike of $52.5 particularly catches the eye due to its high ROI of 0.3702877698 and profit of $5.147. With a delta of 0.835170052, its very responsive to price changes in the stock, though this is somewhat balanced by a relatively low gamma of 0.0113966094. The higher vega of 10.402559847 indicates a need to watch for volatility changes, but the longer time to expiration provides room for adjustments.

Another remarkable option is the one with a strike of $42.5, expiring on 2026-01-16. It offers an exceptional ROI of 0.6048066298 with a profit of $10.947. The delta of 0.8676841462 suggests this option will significantly appreciate with an uptick in IRM's stock price. Although the gamma is low at 0.0048321499, indicating less sensitivity to changes in the delta, the high vega of 11.2309005332 suggests that volatility swings could impact this option's price notably. However, the extended period until expiration allows for a strategic approach to manage this volatility risk.

From these observations, it appears that for notional investors aiming for substantial gains over different time horizons, and who are willing to manage the associated risksespecially the sensitivity to implied volatilityoptions such as the $52.5 strike expiring on 2024-07-19 and the $42.5 strike expiring on 2026-01-16 offer compelling prospects. These options blend both high potential returns with manageable risk profiles, assuming a bullish outlook on IRM's stock and considering the leverage effect of Greeks on options pricing.

Similar Companies in REITSpecialty:

Report: Equinix, Inc. (EQIX), Equinix, Inc. (EQIX), Report: Crown Castle Inc. (CCI), Crown Castle Inc. (CCI), Report: American Tower Corporation (AMT), American Tower Corporation (AMT), Report: Hannon Armstrong Sustainable Infrastructure Capital, Inc. (HASI), Hannon Armstrong Sustainable Infrastructure Capital, Inc. (HASI), Report: Digital Realty Trust, Inc. (DLR), Digital Realty Trust, Inc. (DLR), Report: SBA Communications Corporation (SBAC), SBA Communications Corporation (SBAC), Gaming and Leisure Properties, Inc. (GLPI)

https://finance.yahoo.com/news/iron-mountain-irm-closes-regency-133400250.html

https://finance.yahoo.com/news/insider-selling-reits-picking-significant-172457524.html

https://finance.yahoo.com/news/best-performing-self-storage-reits-215814670.html

https://finance.yahoo.com/news/iron-mountain-incorporated-announces-tax-120000324.html

https://finance.yahoo.com/news/iron-mountain-schedules-fourth-quarter-120000608.html

https://finance.yahoo.com/news/iron-mountain-inc-evp-general-021059613.html

https://seekingalpha.com/article/4667616-iron-mountain-narrative-driven-market-pricing

https://finance.yahoo.com/news/iron-mountain-inc-president-ceo-080613866.html

https://finance.yahoo.com/news/ai-revolutions-hidden-gem-reit-164844302.html

https://www.sec.gov/Archives/edgar/data/1020569/000102056923000214/irm-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: cFuEaZ

Cost: $0.65570

https://reports.tinycomputers.io/IRM/IRM-2024-02-08.html Home