NextEra Energy, Inc. (ticker: NEE)

2024-01-29

NextEra Energy, Inc. (ticker: NEE) is a leading clean energy company headquartered in Juno Beach, Florida, with a significant presence in the generation, transmission, and distribution of renewable energy. As one of the largest electric power companies in North America, NextEra Energy primarily operates through two subsidiaries: Florida Power & Light Company (FPL), which serves more than five million customer accounts in Florida, and NextEra Energy Resources, which is considered the world's largest generator of renewable energy from the wind and sun. Aside from its strong focus on sustainability, the company places emphasis on innovation and smart grid infrastructure development. With a growing portfolio of investments in wind, solar, and nuclear power, NextEra Energy has become a notable player in the efforts to reduce carbon emissions within the energy sector. The company's commitment to environmental responsibility, coupled with its robust financial performance, makes it an attractive stock for investors interested in clean energy and long-term growth. Its market position and forward-looking strategies are reflected in its financial health and the strategic investments it continues to make in the energy transition landscape.

NextEra Energy, Inc. (ticker: NEE) is a leading clean energy company headquartered in Juno Beach, Florida, with a significant presence in the generation, transmission, and distribution of renewable energy. As one of the largest electric power companies in North America, NextEra Energy primarily operates through two subsidiaries: Florida Power & Light Company (FPL), which serves more than five million customer accounts in Florida, and NextEra Energy Resources, which is considered the world's largest generator of renewable energy from the wind and sun. Aside from its strong focus on sustainability, the company places emphasis on innovation and smart grid infrastructure development. With a growing portfolio of investments in wind, solar, and nuclear power, NextEra Energy has become a notable player in the efforts to reduce carbon emissions within the energy sector. The company's commitment to environmental responsibility, coupled with its robust financial performance, makes it an attractive stock for investors interested in clean energy and long-term growth. Its market position and forward-looking strategies are reflected in its financial health and the strategic investments it continues to make in the energy transition landscape.

| City | Juno Beach | State | FL | Zip | 33408 |

| Country | United States | Phone | 561 694 4000 | Industry | Utilities - Regulated Electric |

| Sector | Utilities | Previous Close | 57.98 | Open | 58.33 |

| Day Low | 58.22 | Day High | 59.015 | Dividend Rate | 1.87 |

| Dividend Yield | 0.032 | Payout Ratio | 0.5196 | Five Year Avg Dividend Yield | 2.16 |

| Beta | 0.517 | Trailing PE | 16.244444 | Forward PE | 16.021917 |

| Volume | 11,649,977 | Average Volume | 11,503,100 | Average Volume 10 days | 12,424,510 |

| Market Cap | 119,983,996,928 | Fifty Two Week Low | 47.15 | Fifty Two Week High | 79.78 |

| Price to Sales Trailing 12 Months | 4.267767 | Fifty Day Average | 59.5052 | Two Hundred Day Average | 66.27675 |

| Trailing Annual Dividend Rate | 1.87 | Trailing Annual Dividend Yield | 0.0322525 | Enterprise Value | 203,165,696,000 |

| Profit Margins | 0.26001 | Float Shares | 2,066,251,740 | Shares Outstanding | 2,051,709,952 |

| Shares Short | 19,190,902 | Book Value | 22.925 | Price to Book | 2.550927 |

| Earnings Quarterly Growth | -0.205 | Net Income to Common | 7,310,000,128 | Trailing Eps | 3.6 |

| Forward Eps | 3.65 | Peg Ratio | 2.09 | Total Cash | 2,689,999,872 |

| Total Cash Per Share | 1.299 | Ebitda | 16,227,999,744 | Total Debt | 73,211,002,880 |

| Quick Ratio | 0.312 | Current Ratio | 0.549 | Total Revenue | 28,113,999,872 |

| Debt to Equity | 124.036 | Revenue Per Share | 13.842 | Return on Assets | 0.03744 |

| Return on Equity | 0.115839995 | Free Cashflow | -16,351,375,360 | Operating Cashflow | 11,301,000,192 |

| Earnings Growth | -0.24 | Revenue Growth | 0.116 | Gross Margins | 0.6394 |

| Ebitda Margins | 0.57722 | Operating Margins | 0.33833 | Current Price | 58.48 |

| Sharpe Ratio | -15.993424065541369 | Sortino Ratio | -243.12046551729583 |

| Treynor Ratio | -0.2784074730093995 | Calmar Ratio | -0.5463580101661639 |

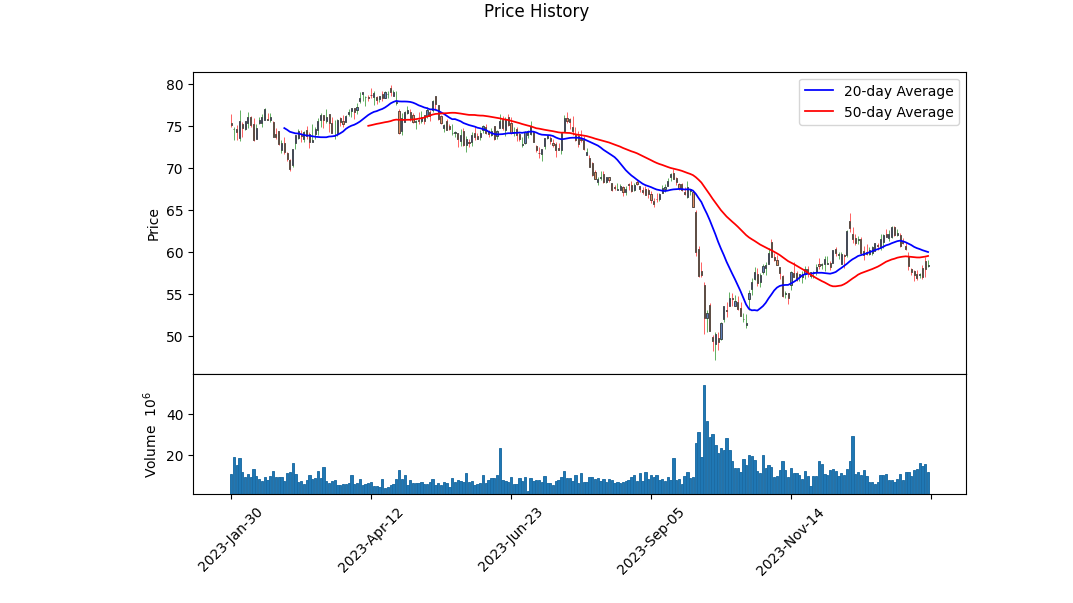

Nearest Energy (NEE) has presented a complex financial scenario through its technical, fundamental, and cash flow metrics. With the latest technical analysis summary showing MACD histogram values trending towards the positive territory indicating an initial sign of a possible reversal towards bullish sentiment. However, the progression of the On-Balance Volume (OBV) remains relatively flat, suggesting that new volume is not necessarily entering the stock, which could limit the potential for significant upwards momentum.

The fundamental analysis reveals a company with solid margins, particularly with a gross margin of 63.94%, an EBITDA margin of 57.72%, and an operating margin of 33.83%. These high margins suggest strong cost management and the potential for profitability. However, considerations such as a high debt level ($63.37B) should temper optimism as it could impose financial constraints and affect the company's flexibility.

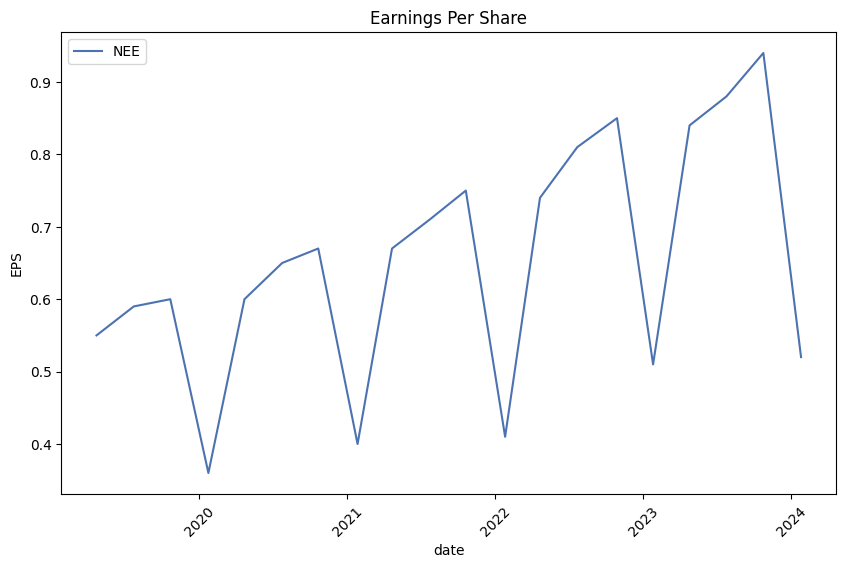

Assessing the balance sheets, the tangible book value of $33.62B relatively stabilizes the company's asset base, but steep retained earnings ($29.98B) reflect a company that has been profitable over the years. Static parameters, such as average diluted EPS at 2.1, indicate stability in earnings, if not significant growth. This mixed snapshot could cause investors to ponder NEE's growth potential moving forward.

The analyst expectations reflect the complexity in predicting NEE's future performance. Despite somewhat muted EPS growth estimates for the current and next year, the long-term outlook, as gauged by EPS growth estimates, asserts a more vigorous projection. The revisions in EPS estimates, which have seen slight adjustments upwards, provide a more favorable forward-looking perspective.

The sharp decline in ratios, particularly the Sharpe, Sortino, Treynor, and Calmar ratios, indicate that the stock's risk-adjusted returns have significantly underperformed against the risk-free rate, embodied by the ten-year treasury yield. Such poor historical risk-adjusted performance could deter investors who are risk-averse, though the ratios should be analyzed in conjunction with other factors.

Taking into account the Altman Z-Score of 1.099, which typically indicates potential distress, juxtaposed with a high Piotroski score of 7 suggesting financial health, presents a contradictory picture. NEE's market capitalization of approximately $119.98B positions it as a substantial entity, though market cap alone is not indicative of future performance.

In the near term, the technical indicators do show a possibility of a positive upturn, but given the overall risk assessment, the risk-adjusted return metrics, and the high levels of debt, caution is warranted. Investors may tread lightly unless subsequent financial reports demonstrate improved cash flow, debt reduction, and continued stability or growth in fundamentals. Moreover, larger market trends and sector-specific news should be closely monitored as they can dramatically impact stock performance regardless of individual company metrics.

In conclusion, based on the available data, the stock price of NEE may exhibit some volatility but has the potential to stabilize or grow modestly in the next few months if broader market conditions are favorable and the company continues to manage its margins and costs effectively. The long-term growth rate and EPS estimates for the next year provide a glimmer of optimism for patient investors. However, the substantial debt load, combined with mixed risk-adjusted return ratios, suggests that any investment should be approached with prudent analysis of ongoing financial disclosures and market trends.

In our analysis of NextEra Energy, Inc. (NEE), we have determined two key financial metrics that are instrumental for our investment evaluation process: the Return on Capital (ROC) and the Earnings Yield. The calculated ROC for NEE is 3.086%, which is a measure of the profitability of the company relative to the capital invested in the business. This percentage demonstrates how effectively the company is at turning the capital into profits. While the ROC gives us an idea of the efficiency of the company's use of capital, the Earnings Yield provides insight into the valuation of the stock. NextEra Energy's Earnings Yield is measured at approximately 2.787%, which is derived from the inverse of the price-to-earnings (P/E) ratio. This metric allows us to compare the potential earnings we could receive from the investment against the current price of the shares. In essence, the Earnings Yield is a tool for assessing the bang-for-the-buck that NextEra Energy offers to investors and can be compared against yields of other investments like bonds. When using these metrics for investing decisions, it is important to consider industry benchmarks and historical performance to fully grasp the implications of these figures with respect to NextEra Energy's investment potential.

Based on the detailed dividend history provided for NextEra Energy, Inc. (NEE), we can evaluate the consistency of dividend payments and growth over the years. The information provided covers dividend payments from February 21, 1973, through November 22, 2023. Let's consider a few key factors highlighted by Benjamin Graham:

-

Regularity of Payments: The company has consistently paid dividends. There is no indication of missed payments in the history provided, which shows that dividends have been paid at regular intervals, generally quarterly.

-

Dividend Growth: There is a clear pattern of increasing dividends over the years. Although not every payment period shows an increase from the last, when looking at the dividend amounts across longer periods (such as yearly), there is a trend of growth. For example, the adjusted dividend was $0.017188 in 1973 and increased to $0.4675 by November 2023. This indicates that the company is not just maintaining its dividend but actively growing it over time.

In summary, the long history of consistent and growing dividends is indicative of NextEra Energy, Inc.'s financial health and its commitment to returning value to shareholders. This aligns with Benjamin Graham's principle that favors companies with a reliable and progressive dividend record. Given these factors, NEE's dividend track record can be considered strong and meets one of the key criteria for defensive investors, which suggests stability and a potential fit within a value investment portfolio.

| Statistic Name | Statistic Value |

| R-squared | 0.340 |

| Adj. R-squared | 0.340 |

| F-statistic | 646.4 |

| Prob (F-statistic) | 2.45e-115 |

| Log-Likelihood | -2275.4 |

| No. Observations | 1,256 |

| AIC | 4,555 |

| BIC | 4,565 |

| coef (const) | -0.0021 |

| std err (const) | 0.042 |

| t (const) | -0.049 |

| P>|t| (const) | 0.961 |

| [0.025 (const) | -0.084 |

| 0.975] (const) | 0.080 |

| coef (SPY) | 0.8078 |

| std err (SPY) | 0.032 |

| t (SPY) | 25.423 |

| P>|t| (SPY) | 0.000 |

| [0.025 (SPY) | 0.745 |

| 0.975] (SPY) | 0.870 |

| Omnibus | 183.680 |

| Prob(Omnibus) | 0.000 |

| Skew | -0.407 |

| Kurtosis | 8.253 |

| Cond. No. | 1.32 |

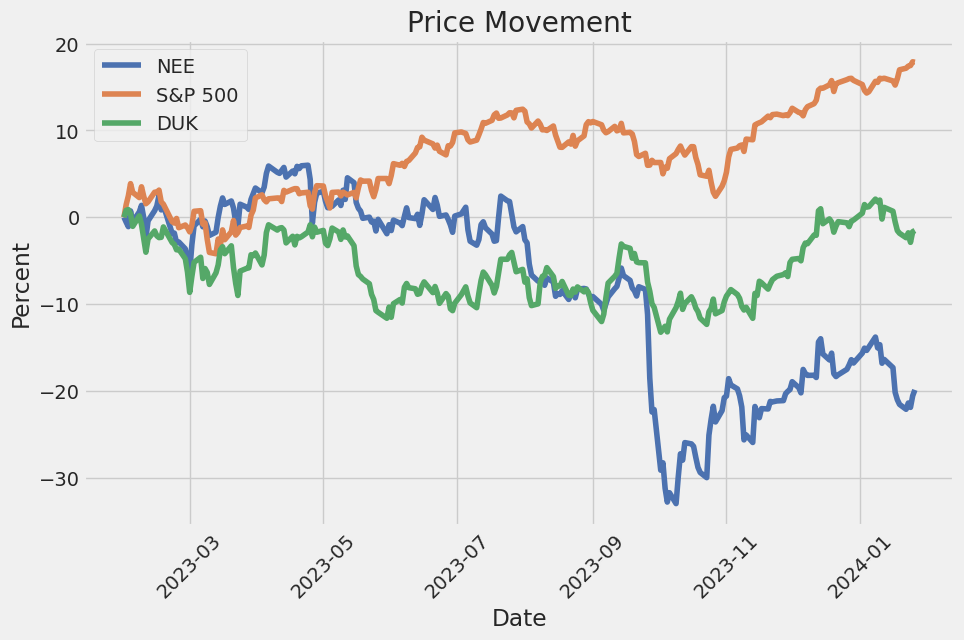

The linear regression analysis comparing NEE's performance to the SPY, which is an ETF that tracks the performance of the S&P 500 and thus represents the broader market, indicates a reasonably considerable relationship with an R-squared value of 0.340. This suggests that approximately 34% of the variability in NEE's returns can be explained by the variability in the SPY's returns. The regression's alpha, representing the model's intercept and theoretically analogous to the expected return on NEE when the SPY's return is zero, is -0.0021. Despite being negative, its small magnitude coupled with a very high p-value of 0.961 suggests that the alpha is not significantly different from zero, indicating that NEE's performance does not substantially deviate from the market baseline when market movements are discounted.

In terms of NEE's sensitivity to the market, the beta coefficient is found to be 0.8078, indicating that for every 1% change in SPY, NEE is expected to change by about 0.808%. This beta suggests that NEE has a lower volatility compared to the market. The t-statistic for the beta coefficient is considerably high (25.423), and the p-value is virtually zero, indicating a very statistically significant relationship between NEE and SPY. Additionally, the confidence interval for the beta coefficient does not encompass 1, which implies that NEE's systematic risk is distinct from that of the broader market. Overall, while there is a significant relationship between NEE and SPY, the analysis suggests that NEE does not offer a substantial risk-adjusted return advantage against the market as an investment, given the alpha's insignificance.

NextEra Energy experienced robust operational and financial performance in 2023 despite market challenges, including supply chain issues, inflation, and rising interest rates. With a strong focus on execution and leveraging their renewable energy expertise, the company managed to deliver a full year adjusted earnings per share (EPS) of $3.17, marking a 9% increase from the previous year and surpassing EPS expectations. They sustained a compound annual adjusted EPS growth of about 11.5% since 2021, outperforming their industry peers significantly over the last decade. Despite these achievements, the company's share price underperformance has been acknowledged, and they are committed to ongoing value creation for their shareholders as they move into 2024.

As we head into 2024, there is cause for optimism. Inflation and interest rates have receded from their peaks, and the Commerce Department's clarifications around solar equipment import regulations have added stability to the market. Solar panel and battery prices have dropped significantly over the past two years, and NextEra Energy has taken proactive steps to secure the necessary equipment for their renewable projects, ensuring that supply chain issues will not impede their progress through 2027. This preparatory work positions the company to meet growing demands for renewable energy in 2024 and beyond, building on consecutive record-setting years in new renewables originations at Energy Resources in 2022 and 2023.

Florida Power & Light (FPL), representing a substantial part of NextEra Energy's business, continues its legacy as America's largest electric utility and delivers exceptional customer value in one of the most rapidly growing states in the country. By investing in solar energy and upgrading the grid, FPL aims to diversify its energy mix and improve its service resilience. With a capital plan ranging between $32 billion to $34 billion through 2025 and Floridas favorable economic conditions, FPL is poised for growth and is strategically positioned for long-term success in the energy market.

Among other achievements, NextEra Energy Resources has distinguished itself as a leader in renewables and transmission, with a record year in new renewables and storage origination and substantial contribution to earnings growth. Looking forward to 2026, Energy Resources could be operating a renewable portfolio rivaling the capacity of top countries globally. Additionally, ongoing investments in repowering existing wind facilities and the potential co-location of battery storage offer attractive returns and long-term opportunities. In parallel, NextEra's competitive transmission business is set to expand significantly, with anticipated capital deployment to facilitate upwards of 12 gigawatts of new renewables.

On the NextEra Energy Partners front, the company remains dedicated to executing its strategic transition plans and achieving a 6% growth target in LP distributions through at least 2026. With smart financing strategies, the partnership is well positioned to meet its long-term growth plans without the need for new acquisitions in 2024 and aims to maintain a steady distribution growth pace while handling equity portfolio financings. As NextEra Energy closes 2023 and progresses into 2024, it emphasizes the importance of its team and the culture of continuous improvement, innovation, and execution that forms the cornerstone of its ongoing success.

NextEra Energy, Inc. ("NEE") is a leading American energy company that operates through its principal subsidiaries, including Florida Power & Light Company ("FPL") and NextEra Energy Resources, LLC ("NEER"). FPL is a rate-regulated electric utility in Florida, serving approximately 5.7 million customer accounts. NEER is the world's largest generator of renewable energy from the wind and sun and a world leader in battery storage. NEE also owns and operates several energy-related businesses.

For the third quarter of 2023, NEE reported operating revenues of approximately $7.2 billion, compared to $6.7 billion for the same period in 2022. The company's net income attributable to NEE for the third quarter of 2023 was approximately $1.2 billion, down from about $1.7 billion in the prior year's corresponding quarter. Earnings per share ("EPS") attributable to NEE for the third quarter were $0.60 per share, compared to $0.86 per share for the same period in 2022. For the nine months ended September 30, 2023, NEE reported net income attributable to NEE of approximately $6.1 billion, compared to about $2.6 billion for the same period in 2022.

NEE had total assets of $171.7 billion and total liabilities of $115.1 billion as of September 30, 2023, reflecting a solid financial position. The company's equity increased to $56.3 billion, up from $48.3 billion at the end of 2022, largely due to net income for the period and equity issuances, slightly offset by dividends paid.

The company's cash flows continue to be robust, with net cash provided by operating activities totaling approximately $8.4 billion for the nine months ended September 30, 2023. Cash and cash equivalents stood at $1.6 billion as of September 30, 2023. Capital expenditures remained substantial as NEE continues to invest in both traditional utilities and renewable energy.

On the derivatives front, NEE and FPL use various derivative instruments to manage risks related to energy commodity transactions, interest rates, and foreign currency exchange rates. These instruments help to optimize asset value, manage physical and financial risks in purchasing and selling fuel and electricity, and adjust exposure related to debt issuances and borrowings. Gains and losses on these derivatives are recognized in operating revenues or interest expense, and NEE ensures that its risk management procedures comply with prescribed limits for market, operational, and credit exposure.

Finally, NEE's condensed consolidated balance sheets and statements of income show that the company is focused on growth, with ongoing projects in renewable energy and capital expenditures to enhance its infrastructure. The solid operating performance and proactive risk management strategies are reflected in the positive financial results presented for the period.

The financial analyses herein are based on the unaudited condensed consolidated financial statements provided in the SEC 10-Q filing of NextEra Energy, Inc. for the quarter ended September 30, 2023. The company's investments in infrastructure, coupled with prudent financial management practices, underpin its growth trajectory and operational success.

NextEra Energy, Inc., one of the largest regulated utility companies in the United States and a leading producer of clean energy, entered 2024 on the back foot due to several challenges faced in the previous year. The company's decision to halve the anticipated distribution growth at its controlled master limited partnership (MLP), NextEra Energy Partners, particularly unsettled investor sentiment. As it was reported by The Motley Fool, rising interest rates had contributed to the diminishing confidence in clean energy assets, which led to a decline in NextEra Energy's share price, resulting in a more than 25% loss over the year. Despite the turbulent market conditions and downward revisions in its MLP's forecasts, the parent company maintained its earnings growth projection of 6% to 8% annually through 2026, with a promised dividend growth of 10% per annum at least through 2024, evident in The Motley Fool's analysis from January 8, 2024.

Furthermore, NextEra Energy Partners experienced a notable 58% decrease in its stock in 2023, adjusting its dividend growth rate from the projected 12%-15% to a more modest 5%-8%. The high-interest rates that ensued made it less feasible to finance new growth initiatives and dividend payments. However, the Partners group has committed to a turnaround strategy that emphasizes organic growth and repowering existing wind projects to sustain dividends and avoid raising new equity until at least 2027. With the expected cooling of interest rates, it presents a resilient dividend proposition for the next year.

With an ambition to diversify and grow, NextEra Energy presents a compelling case for investors. The company has increased its dividend for an impressive 29 consecutive years, evidencing its potential to withstand economic fluctuations and market crises. This trend of dividend growth, with a compound annual growth rate exceeding 10% over the past decade, underscores NextEra's exceptional performance compared to its industry peers. Currently, with a dividend yield around 3.1%, the stock offers an enticing opportunity for growth investors. The company's balance between stable revenues from its utility operations and the significant growth prospects of the clean-energy segment, with plans to double its capacity by 2026, is particularly compelling as Reuben Gregg Brewer suggested on December 28, 2023, in The Motley Fool.

Leading Wall Street analysts, as chronicled by Avi Kapoor for Benzinga, have also taken note of NextEras value proposition. Citigroup and JP Morgan have both rated the stock favorably with revised price targets, reflecting a consensus belief in the company's capacity to navigate the shifting market landscape and deliver substantial yields to stakeholders. The reputation for strong free cash flows and the shift towards sustainable energy solutions further reinforces NextEra Energy's esteemed position within the financial community as gleaned from Benzinga's report on January 4, 2024.

The essence of NextEra's approach is the duality of its business model. It integrates the predictable growth of Florida Power & Light with its formidable clean energy business which is well-positioned to ride the wave of the global transition to renewable energy sources. With a market cap of $120 billion, NextEra remains a giant within its sector and a popular choice for investors seeking a mix of stability and growth as the Motley Fool highlighted on December 16, 2023.

Nevertheless, the energy sector at large faced adversity in 2023, with an average downturn that clashed against a rising S&P 500 index, indicative of a broader skepticism for energy stocks. This makes NextEra's resilient performance and plans for ongoing expansion stand out even more starkly as potential avenues for substantial returns in the approaching year.

Looking specifically at NextEra Energy's renewable energy commitments as discussed by Travis Hoium on December 21, 2023, for The Motley Fool, the division experienced operational losses which demonstrated the risk inherent within non-regulated energy businesses. Fortunately, the predictable cash flow from Florida Power and Light provided a safeguard against market volatility. With an expected high dividend yield and a robust earnings growth plan backed by management, NextEra Energy appears well-placed to navigate through the ebbs and flows of the financial markets.

NextEra Energy certainly faced its share of investor skepticism in 2023, especially with concerns looming over the potential reduction of dividend growth rates following the step taken by its MLP. Yet, the company's unwavering strategy to double down on its capital investment in Florida Power & Light, and to continue expanding its clean energy arm, showed a clear intent to march onwards despite the macroeconomic pressures. This resolve was illustrated in an article by Matthew DiLallo, Neha Chamaria, and Reuben Gregg Brewer, posted on January 1, 2024, on The Motley Fool's website.

In culmination, NextEra Energys approach to maintaining a balance between its reliable utility operations and a robust clean energy growth plan, coupled with a proven dividend track record, sets up an encouraging narrative for potential recovery and progress in 2024. With noteworthy endorsements from top financial analysts and a strategic business alignment poised for industry dominance, there is an optimistic perspective for NextEra Energy as it forges ahead in a transformative energy landscape.

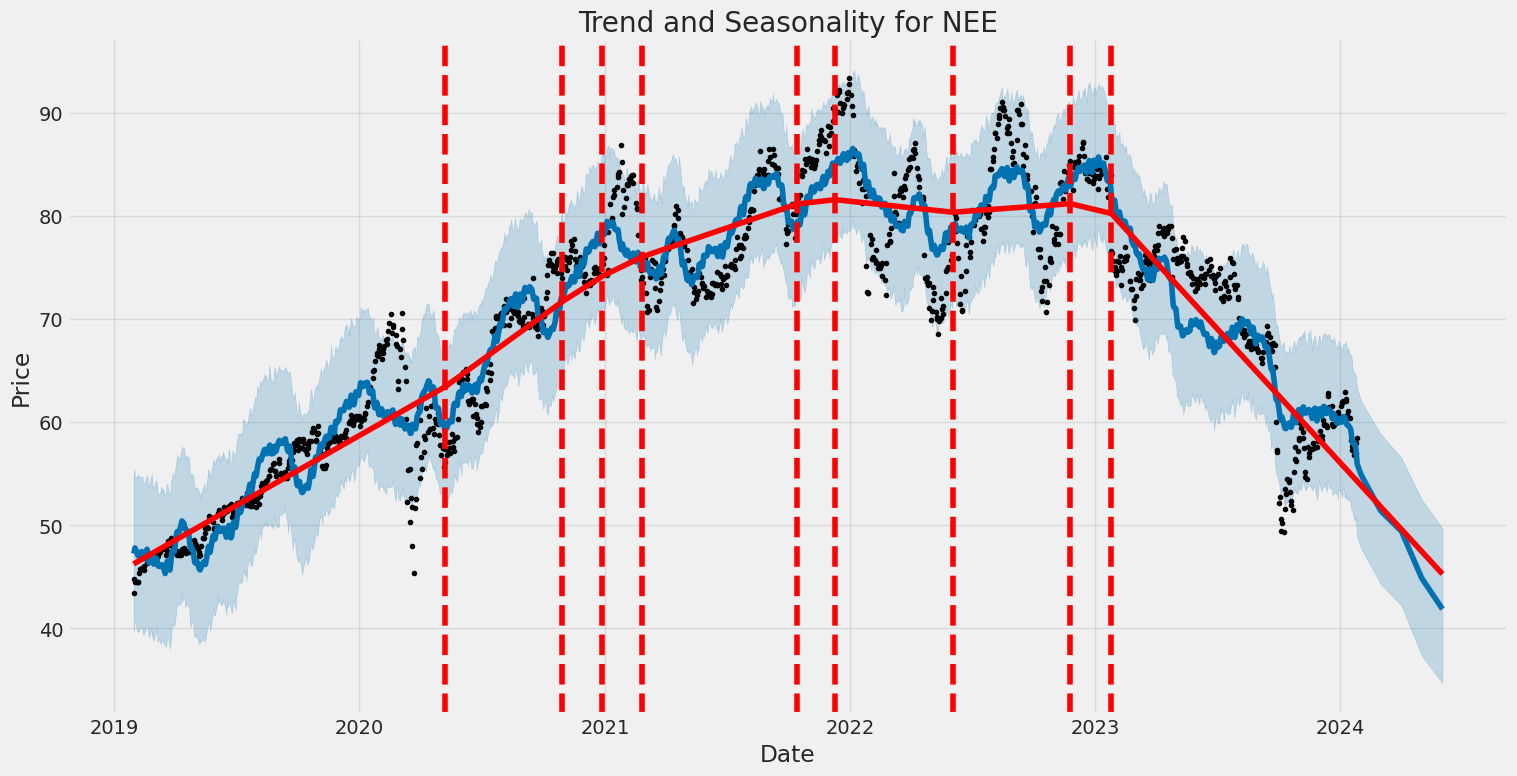

Over the period from January 30, 2019 to January 26, 2024, NextEra Energy, Inc. (NEE) exhibited some degree of volatility as indicated by the ARCH model results. The omega coefficient at a value of 2.1062 suggests that there was a baseline level of volatility in the stock's returns, unrelated to past shocks or volatility. The alpha[1] value of 0.4145 hints that past returns had a significant impact on the current level of volatility, indicating that the stock's volatility tended to increase following periods of large return fluctuations.

| Statistic Name | Statistic Value |

|---|---|

| Dep. Variable | asset_returns |

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| Log-Likelihood | -2443.26 |

| AIC | 4890.51 |

| BIC | 4900.78 |

| No. Observations | 1,256 |

| Df Residuals | 1256 |

| Df Model | 0 |

| omega | 2.1062 |

| alpha[1] | 0.4145 |

To analyze the financial risk of a $10,000 investment in NextEra Energy, Inc. (NEE) over a one-year period, a sophisticated approach combining volatility modeling and machine learning predictions was employed. The volatility modeling framework, which is standard in financial econometrics for analyzing time-series data, was used to capture the stochastic nature of stock price movements and provide an understanding of the underlying volatility in the stock of NEE.

By applying this volatility modeling technique, the conditional variance of NextEra Energy was estimated, giving specific attention to periods of financial turmoil and market uncertainty. The model captures the 'clustering effect' of volatility, where high volatility episodes tend to follow high volatility and calm periods tend to follow calm periods. Understanding this dynamic in NEE's stock is critical as it provides insights into the potential risk levels investors may face.

The machine learning predictions approach, particularly here involving an ensemble learning method, was tasked to utilize historical data to learn the patterns in NEE's stock returns and forecast future price movements. This prediction layer is computed after accounting for the conditional volatility derived from the volatility modeling. It leverages a multitude of decision trees to prevent overfitting and improve the predictive accuracy by analyzing the stock's features and their complex non-linear relationships with its price.

Combining the outputs from both methodologies enhances the forward-looking assessment of risk. Calculating the Value at Risk (VaR) at a 95% confidence interval for the $10,000 investment provides a quantifiable measure of the worst expected loss under normal market conditions over a specified time horizon. Derived from the volatility measures and the predictive distribution of returns gained through both aforementioned techniques, the VaR informs us that there is a 5% chance that the investment could lose more than $292.11 over the next year due to normal market movements.

This amount serves as a critical risk management tool, as it encapsulates both the forecasts of potential future returns and the considerations of the investment's inherent riskiness due to market volatility. Therefore, it offers a comprehensive view of the potential financial risks in equity investment, underlining the efficacy of incorporating volatility insights with machine learning-driven return projections.

Similar Companies in None:

Report: Duke Energy Corporation (DUK), Duke Energy Corporation (DUK), Report: Dominion Energy Inc (D), Dominion Energy Inc (D), Report: Southern Company (SO), Southern Company (SO), Exelon Corporation (EXC), Report: American Electric Power Company, Inc. (AEP), American Electric Power Company, Inc. (AEP), PG&E Corporation (PCG), Report: Edison International (EIX), Edison International (EIX), Public Service Enterprise Group Incorporated (PEG), Report: Xcel Energy Inc. (XEL), Xcel Energy Inc. (XEL), Consolidated Edison, Inc. (ED)

https://www.fool.com/investing/2023/12/16/start-2024-off-right-with-these-3-energy-stocks/

https://www.fool.com/investing/2023/12/21/is-nextera-energy-the-best-dividend-stock-for-you/

https://seekingalpha.com/article/4659088-3-dividend-divas-to-help-you-sleep-well-at-night

https://seekingalpha.com/article/4659759-my-best-dividend-aristocrats-for-january-2024

https://www.fool.com/investing/2023/12/28/heres-why-nextera-energy-is-a-no-brainer-dividend/

https://seekingalpha.com/article/4660144-3-undervalued-stocks-i-am-buying

https://seekingalpha.com/article/4660247-10-dividend-growth-stocks-december-2023

https://seekingalpha.com/article/4660480-nextera-energy-blue-chip-at-attractive-valuation

https://seekingalpha.com/article/4660602-my-top-10-high-yield-dividend-stocks-for-january-2024

https://www.fool.com/investing/2024/01/01/want-to-get-off-to-a-strong-start-in-2024-buy-thes/

https://seekingalpha.com/article/4660952-5-relatively-secure-cheap-dividend-stocks-january-2024

https://www.fool.com/investing/2024/01/08/after-a-down-year-in-2023-these-3-top-dividend-sto/

https://www.sec.gov/Archives/edgar/data/37634/000075330823000058/nee-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: y0ri3l

Cost: $0.71934

https://reports.tinycomputers.io/NEE/NEE-2024-01-29.html Home