American Tower Corporation (ticker: AMT)

2024-01-20

American Tower Corporation (AMT), a leading global owner, operator, and developer of wireless and broadcast communications real estate, is an S&P 500 company with a wide-reaching influence in the telecommunications infrastructure sector. The corporation specializes in leasing space on multi-tenant communications sites to a variety of wireless service providers, radio and television broadcast companies, as well as wireless data providers among others. As of its most recent reports, American Tower operates a portfolio of approximately 220,000 communication sites, comprising cell towers, broadcast towers, and distributed antenna system (DAS) networks, across 19 countries on six continents. With the growing demand for wireless services and data consumption, American Tower has been focused on expanding its global footprint through strategic acquisitions and organic growth, thereby benefitting from the transition to 5G technology and the expansion of mobile connectivity worldwide. AMT's revenue model is primarily driven by long-term lease contracts with its tenants, insulating it from short-term market fluctuations and providing a stable cash flow. The company's financial performance, strategic market position, and its commitment to investing in technological advancements underscore its pivotal role in the communications sector's ongoing evolution.

American Tower Corporation (AMT), a leading global owner, operator, and developer of wireless and broadcast communications real estate, is an S&P 500 company with a wide-reaching influence in the telecommunications infrastructure sector. The corporation specializes in leasing space on multi-tenant communications sites to a variety of wireless service providers, radio and television broadcast companies, as well as wireless data providers among others. As of its most recent reports, American Tower operates a portfolio of approximately 220,000 communication sites, comprising cell towers, broadcast towers, and distributed antenna system (DAS) networks, across 19 countries on six continents. With the growing demand for wireless services and data consumption, American Tower has been focused on expanding its global footprint through strategic acquisitions and organic growth, thereby benefitting from the transition to 5G technology and the expansion of mobile connectivity worldwide. AMT's revenue model is primarily driven by long-term lease contracts with its tenants, insulating it from short-term market fluctuations and providing a stable cash flow. The company's financial performance, strategic market position, and its commitment to investing in technological advancements underscore its pivotal role in the communications sector's ongoing evolution.

| Full Time Employees | 6,391 | Previous Close | 203.91 | Open | 204.66 |

| Day Low | 202.78 | Day High | 205.14 | Dividend Rate | 6.8 |

| Dividend Yield | 0.0334 | Payout Ratio | 312.67% | Five Year Avg Dividend Yield | 2.14 |

| Beta | 0.699 | Trailing PE | 135.01 | Forward PE | 42.12 |

| Volume | 1,982,096 | Average Volume | 2,210,688 | Average Volume 10 Days | 2,118,660 |

| Bid | 203.0 | Ask | 209.0 | Bid Size | 800 |

| Ask Size | 1,100 | Market Cap | 95,037,054,976 | Fifty Two Week Low | 154.58 |

| Fifty Two Week High | 235.49 | Price To Sales TTM | 8.59 | Fifty Day Average | 205.81 |

| Two Hundred Day Average | 190.36 | Trailing Annual Dividend Rate | 6.31 | Trailing Annual Dividend Yield | 0.0309 |

| Enterprise Value | 146,435,588,096 | Profit Margins | 6.46% | Float Shares | 465,246,773 |

| Shares Outstanding | 466,164,992 | Shares Short | 6,035,004 | Shares Short Previous Month | 6,209,078 |

| Shares Percent Shares Out | 1.29% | Held Percent Insiders | 0.156% | Held Percent Institutions | 93.483% |

| Short Ratio | 2.83 | Short Percent Of Float | 1.5% | Implied Shares Outstanding | 466,164,992 |

| Book Value | 9.725 | Price To Book | 20.96 | Last Fiscal Year End | Dec 31, 2022 |

| Net Income To Common | 714,600,000 | Trailing Eps | 1.51 | Forward Eps | 4.84 |

| Peg Ratio | 9.0 | Enterprise To Revenue | 13.237 | Enterprise To Ebitda | 21.892 |

| 52 Week Change | -5.47% | S&P 52 Week Change | 20.39% | Last Dividend Value | 1.7 |

| Total Cash | 2,118,899,968 | Total Cash Per Share | 4.545 | Ebitda | 6,688,999,936 |

| Total Debt | 46,816,198,656 | Quick Ratio | 0.461 | Current Ratio | 0.56 |

| Total Revenue | 11,062,500,352 | Debt To Equity | 416.718 | Revenue Per Share | 23.744 |

| Return On Assets | 3.36% | Return On Equity | 5.41% | Free Cashflow | 4,745,762,304 |

| Operating Cashflow | 4,765,499,904 | Earnings Growth | -30.10% | Revenue Growth | 5.50% |

| Gross Margins | 70.584% | Ebitda Margins | 60.466% | Operating Margins | 34.939% |

| Sharpe Ratio | -15.819690664448766 | Sortino Ratio | -267.4889910859247 |

| Treynor Ratio | 0.0008921718070487314 | Calmar Ratio | -0.07694652407414844 |

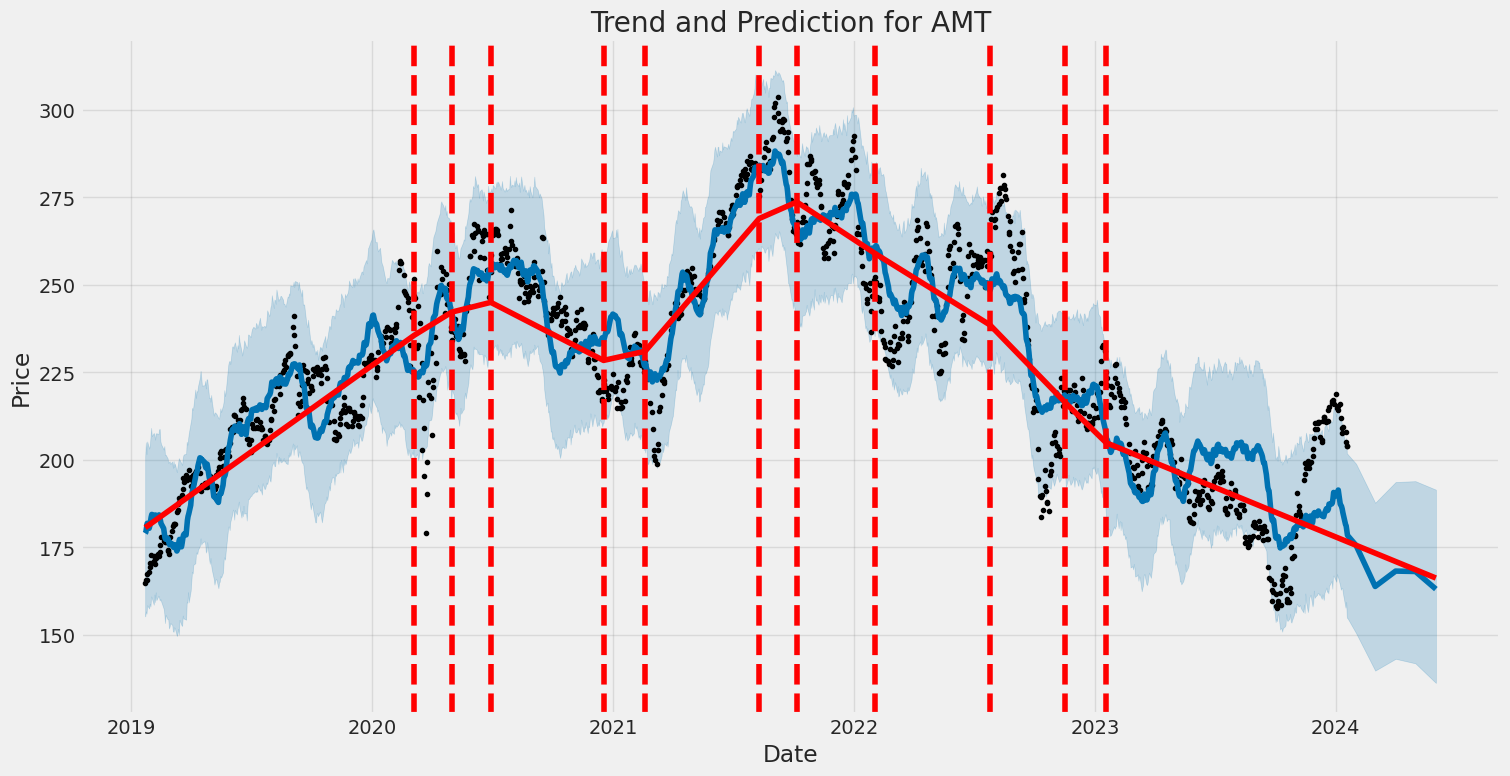

Analyzing the provided data for AMT, several critical observations emerge from the technical, fundamental, and market sentiment perspectives, offering insights into the stock's potential trajectory over the next few months.

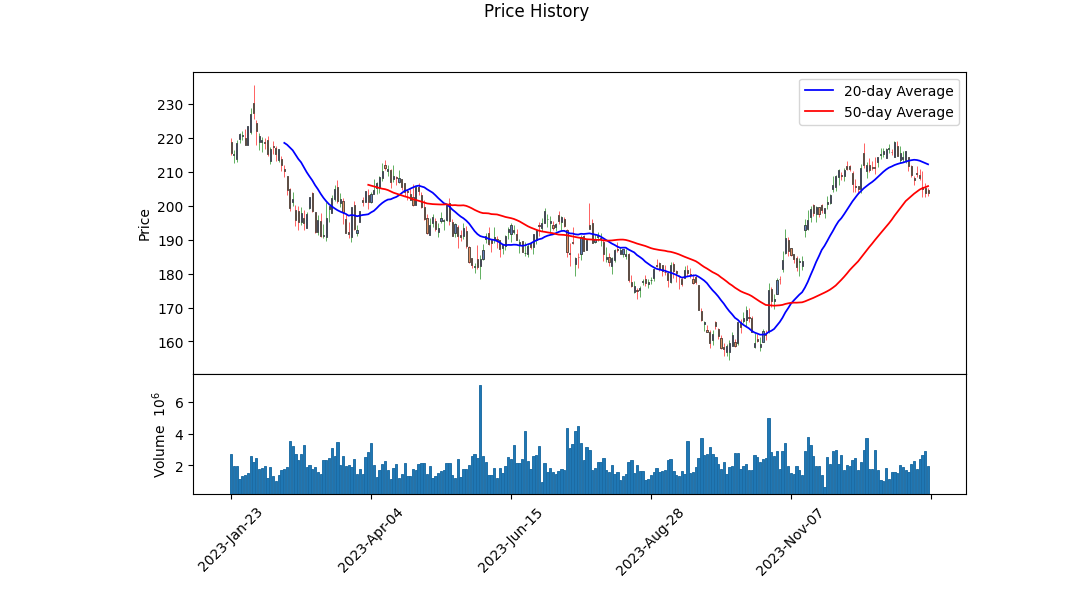

Technical Analysis: - The MACD Histogram reflects a downward trend in momentum, with values becoming less negative, indicating a potential slowing in selling pressure. - The negative On-Balance Volume (OBV) trend suggests waning buying enthusiasm, which might lead to concerns over eventual support levels. - Parabolic SAR (PSAR) readings, while not provided in complete detail, would likely indicate trend strength and potential direction reversals; current trend positioning in correlation with price action could inform bullish or bearish biases.

Fundamental Analysis: - Strong gross and EBITDA margins indicate healthy profitability, although operating margins show room for improvement. - The negative growth ratios, including the Sharpe, Sortino, and Calmar ratios, imply that the stock may not be adequately compensating for the risks taken by investors. - The balance sheet showcases a considerable amount of debt, which could be a concern, especially in a rising interest rate environment or if company revenue growth does not meet expectations.

Balance Sheet & Cash Flows: - High levels of total debt when juxtaposed with the net debt figures underscore the importance of cash flow management. - The free cash flow figures provide a buffer, but repurchase and debt repayment obligations necessitate careful monitoring of liquidity and solvency ratios.

Analyst Expectations: - Revisions to earnings expectations have been modest, suggesting a relatively stable outlook from the analyst community. - Projected sales and EPS growth for upcoming quarters indicate optimism surrounding the company's ability to expand financially.

Market Sentiment: - The reported negative risk-adjusted return measures could act as a detriment to investor confidence. Sustained underperformance relative to risk-free assets might impact future stock valuations. - It is essential to weigh these sentiment indicators against the company's growth prospects and the broader market environment.

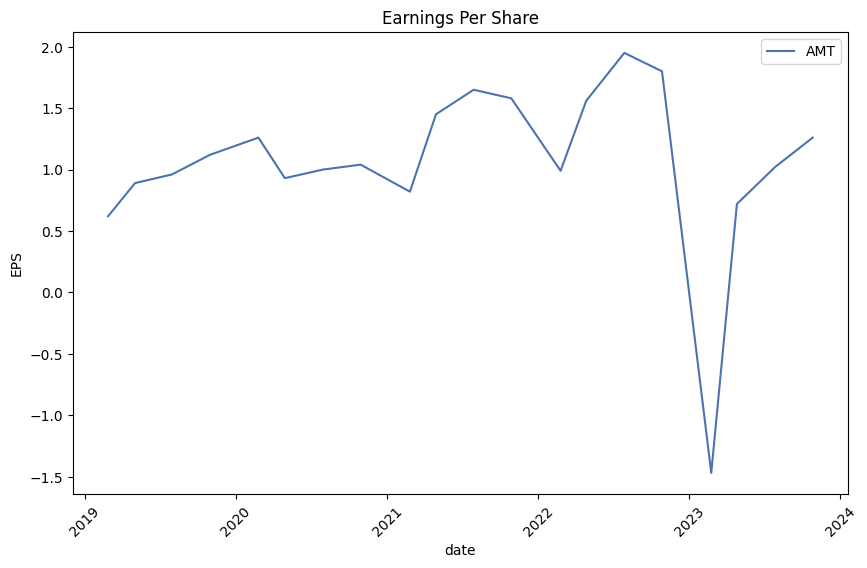

The recent EPS performance alongside projected growth estimates paints a picture of resilience despite negative market sentiment as reflected through poor risk-adjusted return measures. It is crucial to observe whether subsequent earnings validate these forecasts and sway investor perception positively.

Regarding the financial scorecard summary, the Altman Z-Score suggests caution with a value near 1.2, indicating possible financial distress. However, the Piotroski Score of 7 out of 9 hints at sound financial health, implying that the company may have sufficient strength to weather potential challenges.

In conclusion, together these elements provide a nuanced view of AMT's immediate financial future. While the company's strong profit margins and analyst sentiment champion its growth potential, the concerning risk-adjusted return measures and technical indicators call for a cautious approach. Given these mixed signals, it's prudent to remain vigilant for any shifts in fundamental performance or market conditions that could significantly affect projected price movements. Investors should balance optimism regarding the company's growth prospects with caution over its debt levels and negative market sentiment, maintaining readiness to adapt to changes in the stock's technical and fundamental landscape.

| Statistic Name | Statistic Value |

| Alpha (Intercept) | -0.0122 |

| Beta (Slope) | 0.8729 |

| R-squared | 0.377 |

| Adj. R-squared | 0.377 |

| F-statistic | 760.5 |

| Prob (F-statistic) | 2.87e-131 |

| Log-Likelihood | -2,273.3 |

| AIC | 4,551 |

| BIC | 4,561 |

| No. Observations | 1,257 |

| Df Residuals | 1,255 |

| Df Model | 1 |

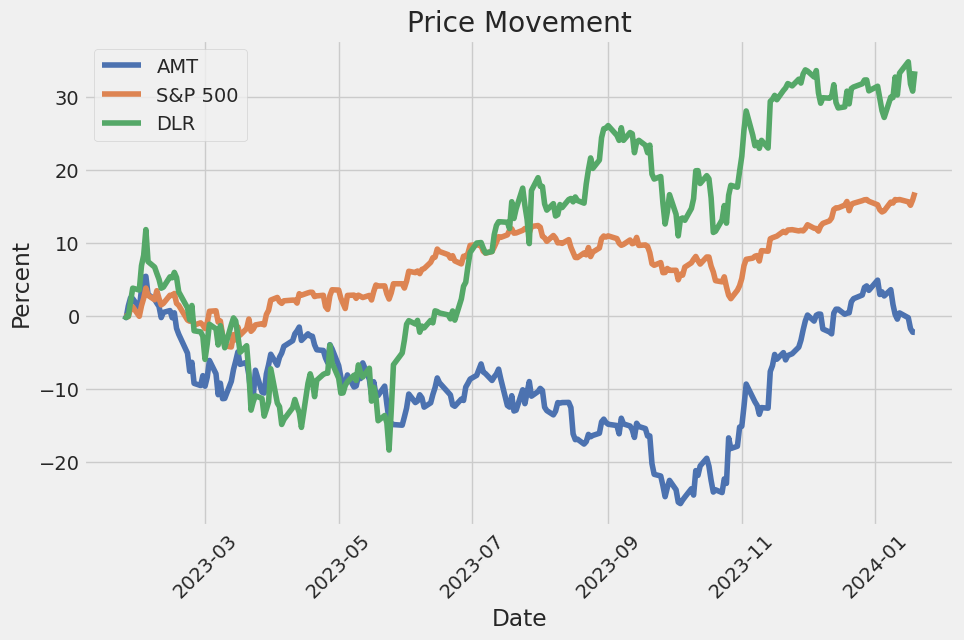

The relationship between AMT (American Tower Corporation) and SPY (SPDR S&P 500 Trust ETF) for the examined time period can be described through a linear regression model, where alpha stands for the intercept of the regression line and beta indicates the slope. The alpha, which is statistically insignificant with a p-value of 0.770, is estimated to be -0.0122. This suggests that when the SPYs performance is zero, the expected value of AMTs performance would slightly decrease, albeit this effect is not statistically different from zero. The low alpha further suggests that AMT does not significantly outperform or underperform the market return as represented by SPY on average, once market movements are accounted for.

The beta estimate for the model is 0.8729, showing a positive but less than one-for-one relationship between AMT and SPY. This implies that for every 1% increase in SPY, AMT is expected to increase by approximately 0.87%. With an R-squared value of 0.377, the model explains about 37.7% of the variability in AMTs return through fluctuations in SPY. Although the model indicates a moderate linear relationship, the majority of AMTs variability remains unexplained by SPY alone, indicating the presence of other factors influencing AMT's performance or the existence of non-linear aspects in the relationship.

Summary of American Tower Corporation (AMT) Earnings Call for Q3 2023:

Paragraph 1: American Tower Corporation's third-quarter 2023 earnings call was conducted, with a presentation available on their website. Tom Bartlett, President and CEO, discussed the impact of technology trends on wireless technology evolution and the company's portfolio positioning to benefit from this. Rod Smith, EVP, CFO, and Treasurer, presented Q3 results and revised the full-year outlook. Steve Vondran, EVP and current President of the U.S. Tower division, was announced to become the Global Chief Operating Officer and future CEO. The executives addressed forward-looking statements and potential risks, as detailed in press releases and SEC filings.

Paragraph 2: Tom Bartlett emphasized the unabated growth in mobile data consumption globally and forecasted an 18% CAGR in data usage per smartphone in key markets between 2023 and 2028. He outlined a three-phase 5G investment cycle in the U.S. that he expects will drive network investment, starting with the first coverage-focused phase and leading to a second phase where carrier spend moderates from peak levels as they start to see efficiency benefits from 5G deployments. He predicts that eventually, a third phase will significantly densify 5G networks.

Paragraph 3: Bartlett also updated on CoreSite and the data center segment, highlighting stronger-than-expected demand and consistent growth in interconnection revenue. He noted that trends such as AI and cloud environments are driving demand for CoreSite's services, which align with American Tower's broader interconnection ecosystem strategy. Bartlett discussed the evolving edge market and explained how American Tower is developing an edge model to accommodate growing customer demand, citing power availability, revenue opportunities, and customer experience as key factors.

Paragraph 4: Rod Smith reviewed the Q3 financials, with consolidated property revenue growth of 7% and a 6.3% increase in consolidated organic tenant billings growth. Adjusted EBITDA grew over 10%, with margins improving due to strong organic growth and effective cost management. The full-year outlook was raised due to this performance, though headwinds from foreign exchange rates were noted. Smith then detailed the company's capital allocation plans, reiterating its aim to distribute roughly $3 billion in dividends for the year and maintain a CapEx spend of $1.7 billion, aligning with strategies to maximize shareholder returns.

Closing Statements:

The diverse portfolio of global communications assets is demonstrating resilience, providing attractive growth through organic leasing and effective cost management. Efforts continue to strengthen and de-risk the balance sheet. The company is committed to creating and sustaining attractive returns for shareholders over the long term. The call ended with a Q&A session where management discussed topics including service revenue trends, U.S. colocation and amendment activity, and capital allocation strategies, especially in light of increasing interest rates and the macroeconomic environment.

American Tower Corporation (AMT) is a leading independent owner, operator and developer of multitenant communications real estate. Its SEC 10-Q filing for the quarter ended September 30, 2023, provides a financial snapshot, highlighting various aspects of its operations, financial position, and future obligations.

Property and services revenue collectively amounted to $2,818.6 million in the quarter, with the property segment significantly dominating the revenue figures. This revenue is primarily derived from leasing space for communications equipment on the company's extensive portfolio of towers and data centers. Lease revenue is the main contributor to AMT's earnings, and the company recognizes lease revenue based on the straight-line method over the lease terms. During this quarter, the company recorded straight-line revenue of $108.6 million. AMT's revenue streams also include non-lease property revenue which, among others, consists of distributed antenna system networks and services revenue from tower-related services provided in the United States.

The company also reported operating expenses of $2,159.9 million, including significant figures attributed to costs of operations, depreciation, and amortization. Specifically, depreciation, amortization and accretion expenses amounted to $762.9 million, which reflects the capital-intensive nature of AMT's business. Additionally, the company reported a goodwill impairment of $322.0 million associated with its India reporting unit, impacting its operating income which totaled $658.7 million for the quarter.

The total liabilities stood at $54,418.5 million. Long-term obligations, which include debt securities and credit facilities, formed a significant portion at $35,442.4 million. During the quarter, the company addressed its debt structure by repaying certain senior notes upon maturity, utilizing credit facilities for repayment, and issuing new senior unsecured notes. These transactions are vital in managing the company's capital structure and ensuring financial flexibility.

Total equity attributable to shareholders equaled $11,234.5 million, including common stock, additional paid-in capital, and accumulated other comprehensive loss. The value of equity reflects the ownership interests and the financial health of the company.

The filing also detailed the provision for income taxes, recognizing a tax provision of $65.7 million for the quarter, indicative of its operations across different tax jurisdictions and the related complexities. However, as a REIT, the company has the capacity to deduct distributions to shareholders against income generated by REIT operations, subject to regulations.

American Tower Corporation's future lease obligations, both as a lessor and as a lessee, are significant considerations. The company expects to receive approximately $61 billion in future minimum rental receipts. Conversely, it has lease liabilities, mainly for land and equipment pertinent to its operations, amounting to $8,216.3 million.

Finally, stock-based compensation is an integral part of AMT's remuneration strategy, with $158.0 million expenses recorded for the nine months ending September 30, 2023. The company's 2007 Plan provides various equity awards to employees, and the company has made several grants during the quarter, reflecting its commitment to aligning employee interests with those of shareholders.

Throughout the report, AMT indicates the importance of strategic financial management, maintaining a sound balance sheet, and structuring its debt to support ongoing and future operations. While the report does not provide explicit forward-looking statements, the described activities and financial positions infer the company's ongoing efforts to remain a competitive and robust entity within the communications real estate sector.

American Tower Corporation (AMT), a leading global real estate investment trust (REIT) and owner of communication infrastructure, has seen robust growth through strategic expansion and diversification efforts. AMT's recent endeavors in strengthening its portfolio, highlighted by the expansions of CoreSite's data center campuses, contribute significantly to the company's strong prospect for future growth.

According to Zacks Equity Research detailed on December 13, 2023, CoreSite, a subsidiary of American Tower, announced significant extensions to its data center campuses in New York and Denver. The expansion aims to fulfill the increasing demands of the digital era, adding an impressive 685,000 square feet to American Tower's data center offerings. The NY3 data center in New York is set to construct an 85,000-square-foot facility whereas Denver's expansion includes conceptual approval for a three-building campus. These developments emphasize American Tower's commitment to cater to various businesses, particularly cloud and service providers, thus enhancing its role as a data center entity and aligning with its mission to deliver better application performance and accelerate market presence for enterprises.

Besides CoreSite's expansions, American Tower Corporation has also expanded its global presence. Notably, the agreement with MTN Nigeria in November 2023 aimed at enhancing wireless connectivity in Africa reinforces AMT's strategic positioning in international markets. Furthermore, American Tower's acquisition of CoreSite Realty has been instrumental in advancing its portfolio significantly, adding more than 20 data centers and expanding its non-tower offerings.

During the third quarter of 2023, AMT demonstrated solid financial performance with a notable increase in property revenue growth and Adjusted EBITDA. This growth trajectory is expected to continue, with management projecting sustained increases in property revenues and adjusted EBITDA. American Tower's financial strength is reflected in its $9.7 billion total liquidity and a net leverage ratio of 5 for the third quarter of the year, coupled with its commitment to shareholders through consistent dividend increases.

Nevertheless, American Tower is not without its challenges. The company's business model heavily relies on a few major carriers, making it susceptible to adverse changes in these relationships. Additionally, the broader economic climate, particularly fluctuations in interest rates, could impact the cost of servicing its considerable debt, currently standing at about $38.6 billion.

Despite these potential risks, the company's stock performance has demonstrated resilience, rallying significantly and outperforming the industry average. As the REIT sector anticipates a possible turnaround due to a forecasted decrease in interest rates in 2024, American Tower is poised to capitalize on its strategic investments in technology such as 5G networks and data centers.

In the context of mergers and acquisitions, American Tower has been noted for its significant consolidation within the cell tower industry. In line with this trend, AMT is mentioned as a possible suitor for the acquisition of Helios Towers, further indicating the company's potential for growth in high-value markets.

Looking ahead, American Tower appears to be navigating a challenging 2024 in terms of financial forecasts, with management predicting a dip in EBITDA and adjusted funds from operations (AFFO). Yet, the company's international expansion and investment into data centers strategically position AMT for future growth. The company's lower distribution payout ratio compared to competitors and a rapid growth rate in distributions lend it a competitive edge despite the anticipated temporary pause in dividend growth aimed at reducing leverage.

American Tower's strategy to dispose of its cellular tower operations in India is a decision that reflects the company's responsiveness to optimizing its global portfolio. The expected proceeds from the sale are planned to further reduce debt levels. This move is regarded as favorable for American Tower's financial health, contributing to a reduced leverage ratio, while leaving room for value creation in the long run.

For investors and retirees seeking stable income, American Tower's dividend policy and yield are substantial motivations. Despite plans to maintain its dividend payout in 2024, the company's strong fundamentals, growth potential, and commitment to shareholder returns make it an attractive investment for those reliant on passive income streams.

Given its strategic initiatives, operational success, and focus on shareholder value, American Tower Corporation stands out as an investment with considerable potential for both income-focused and growth-oriented investors, possessing the resilience and robustness to navigate market shifts while capitalizing on the explosive growth within the telecommunications and data center sectors.

During the period from January 22, 2019, to January 19, 2024, American Tower Corporation (AMT) exhibited volatility characterized by the ARCH model in financial econometrics. The model indicates that there isn't any significant trend or average change in the return (the R-squared statistic is 0.000), suggesting that volatility might not be explained by past returns but rather by external factors. Two key features of the volatility include the constant term 'omega' at 2.2003, indicating the baseline level of volatility, and 'alpha[1]' at 0.3190, reflecting the extent to which past volatilities impact current forecast volatility, with a relatively high coefficient indicating significant effects from previous periods.

Here is the HTML table with the table of statistics:

| Statistic | Value |

|---|---|

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -2,453.71 |

| AIC | 4,911.42 |

| BIC | 4,921.70 |

| No. Observations | 1,257 |

| omega | 2.2003 |

| alpha[1] | 0.3190 |

To assess the financial risk of a $10,000 investment in American Tower Corporation (AMT) over a one-year period, a combined approach utilizing volatility modeling and machine learning predictions is employed.

Volatility modeling is crucial for understanding the stock price movements of AMT. This approach is particularly adept at capturing the time-varying nature of market volatility, leading to a more accurate depiction of risk. By analyzing historical stock price data, volatility modeling helps to quantify the level of uncertainty or risk related to changes in AMT's stock price. This is instrumental when estimating the potential swings in investment value, which in turn is key for deriving the Value at Risk (VaR) metric.

On the other side, machine learning predictions play a pivotal role in forecasting future stock returns. Using historical data, the predictive model learns patterns that could imply future performance. For instance, the model could incorporate features such as past stock returns, trading volume, and broader economic indicators to forecast AMTs future stock price behavior. The machine learning algorithm, specifically the one akin to a forest of decision trees designed for regression tasks, has been trained to predict the direction and magnitude of potential stock moves.

Combining these two methods allows for a comprehensive risk analysis. Volatility modeling offers a deep look into the expectations of future volatility based on past trends, while machine learning predictions provide a forward-looking forecast of potential stock price movements.

Regarding the calculated Value at Risk (VaR) at a 95% confidence interval for AMT, it is determined to be $275.44 for a $10,000 investment. This metric offers a crucial perspective on what an investor might expect to lose with a 5% probability over the course of a year due to normal market fluctuations. In other words, under normal market conditions, there is a 95% chance that an investor would not lose more than $275.44 on a $10,000 investment in AMT over one year.

This VaR outcome is a direct result of both the volatility modeling, which provides the necessary volatility inputs, and machine learning predictions that contribute to the anticipation of the stocks performance. This consolidated view accentuates the temporal and probabilistic nature of the investments risk profile, allowing investors to gauge the appropriate level of risk they are taking on with a potential investment in AMT.

Similar Companies in REITOffice:

Report: Digital Realty Trust, Inc. (DLR), Digital Realty Trust, Inc. (DLR), Report: Equinix, Inc. (EQIX), Equinix, Inc. (EQIX), Report: SBA Communications Corporation (SBAC), SBA Communications Corporation (SBAC), Report: Iron Mountain Incorporated (IRM), Iron Mountain Incorporated (IRM), Report: Crown Castle Inc. (CCI), Crown Castle Inc. (CCI), Report: Hannon Armstrong Sustainable Infrastructure Capital, Inc. (HASI), Hannon Armstrong Sustainable Infrastructure Capital, Inc. (HASI), Gaming and Leisure Properties, Inc. (GLPI), Report: EPR Properties (EPR), EPR Properties (EPR)

https://seekingalpha.com/article/4657310-whos-ready-for-a-santa-claus-reit-rally

https://seekingalpha.com/article/4659818-2-reits-that-could-soar-in-2024

https://www.zacks.com/stock/news/2202698/why-should-you-retain-american-tower-amt-in-your-kitty-now

https://seekingalpha.com/article/4660808-3-specialty-reits-you-definitely-should-not-ignore-in-2024

https://seekingalpha.com/article/4660997-my-top-5-reit-holdings-revealed

https://seekingalpha.com/article/4661115-true-compounding-the-essential-stocks

https://seekingalpha.com/article/4661281-american-tower-theres-still-time-to-buy-this-reit

https://www.zacks.com/stock/news/2206623/american-tower-amt-stock-sinks-as-market-gains-here-s-why

https://www.fool.com/investing/2024/01/08/3-stocks-that-make-the-perfect-investment-for-the/

https://seekingalpha.com/article/4661720-american-tower-the-bullish-case-remains-intact

https://finance.yahoo.com/m/8c027393-1c0a-37e7-ad11-bef4f2e652c8/3-stocks-that-make-the.html

https://www.sec.gov/Archives/edgar/data/1053507/000105350723000161/amt-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: PPNnnMv

Cost: $1.24079

https://reports.tinycomputers.io/AMT/AMT-2024-01-20.html Home