TimkenSteel Corporation (ticker: TMST)

2024-02-07

TimkenSteel Corporation (ticker: TMST) is a leading specialty steel manufacturer based in the United States, known for its production of high-quality alloy steel. The company operates primarily within the energy, automotive, and industrial sectors, providing customized steel solutions that meet rigorous performance standards. TMST's product line includes seamless mechanical tubing as well as high-performance alloy bars and billets, catering to demanding applications that require exceptional strength, toughness, and precision. As a spin-off from The Timken Company in 2014, TimkenSteel has capitalized on its heritage of manufacturing excellence, leveraging advanced technologies and innovative processes to enhance its product offerings. Financially, TMST has shown resilience amidst fluctuating market conditions, focusing on operational efficiency, strategic investments in growth areas, and maintaining a strong customer base. Their commitment to sustainability and reducing environmental impact is also a notable aspect of their corporate ethos, aiming to meet the growing demand for environmentally responsible manufacturing practices within the steel industry.

TimkenSteel Corporation (ticker: TMST) is a leading specialty steel manufacturer based in the United States, known for its production of high-quality alloy steel. The company operates primarily within the energy, automotive, and industrial sectors, providing customized steel solutions that meet rigorous performance standards. TMST's product line includes seamless mechanical tubing as well as high-performance alloy bars and billets, catering to demanding applications that require exceptional strength, toughness, and precision. As a spin-off from The Timken Company in 2014, TimkenSteel has capitalized on its heritage of manufacturing excellence, leveraging advanced technologies and innovative processes to enhance its product offerings. Financially, TMST has shown resilience amidst fluctuating market conditions, focusing on operational efficiency, strategic investments in growth areas, and maintaining a strong customer base. Their commitment to sustainability and reducing environmental impact is also a notable aspect of their corporate ethos, aiming to meet the growing demand for environmentally responsible manufacturing practices within the steel industry.

| Full Time Employees | 1,700 | Previous Close | 20.18 | Market Cap | 872,158,464 |

| Day Low | 20.14 | Day High | 20.5 | Volume | 137,693 |

| Average Volume (10 days) | 196,900 | Bid | 18.22 | Ask | 23.28 |

| 52 Week Low | 15.59 | 52 Week High | 24.3 | Price to Sales (TTM) | 0.6815336 |

| Enterprise Value | 671,158,848 | Profit Margins | 0.02727 | Shares Outstanding | 43,154,800 |

| Shares Short | 2,260,358 | Held Percent Insiders | 13.656% | Held Percent Institutions | 79.443% |

| Short Ratio | 7.25 | Book Value | 16.886 | Price to Book | 1.1968495 |

| Net Income to Common | 34,900,000 | Trailing EPS | 0.82 | Forward EPS | 1.92 |

| Total Cash | 225,400,000 | Total Debt | 24,400,000 | Total Revenue | 1,279,699,968 |

| EBITDA | 103,600,000 | Current Ratio | 3.046 | Debt to Equity | 3.341 |

| Statistic Name | Statistic Value | Statistic Name | Statistic Value |

| Sharpe Ratio | 0.12580163830140229 | Sortino Ratio | 2.03690481885443 |

| Treynor Ratio | 0.03040766229713594 | Calmar Ratio | 0.10019201603008618 |

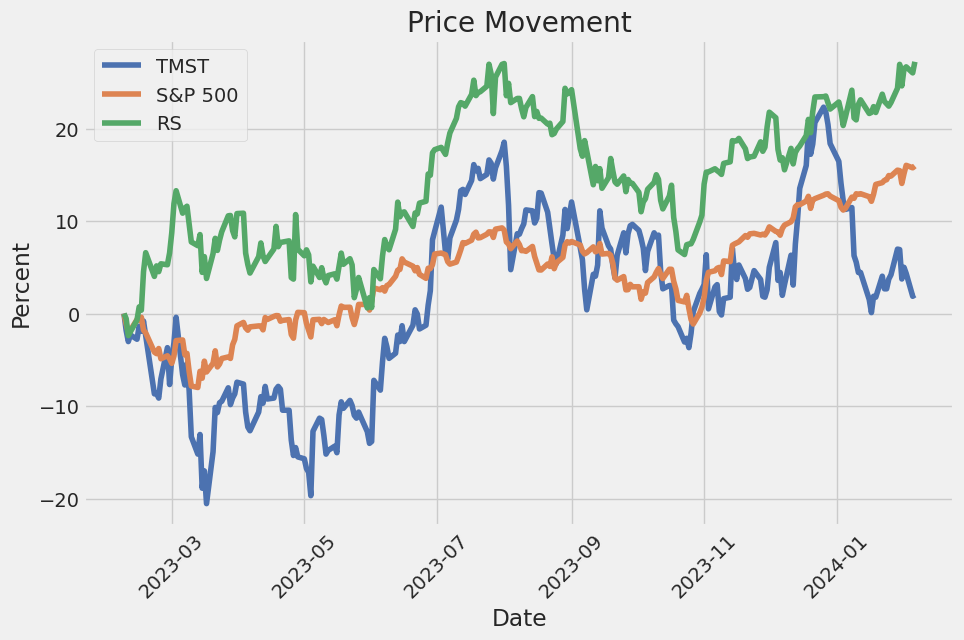

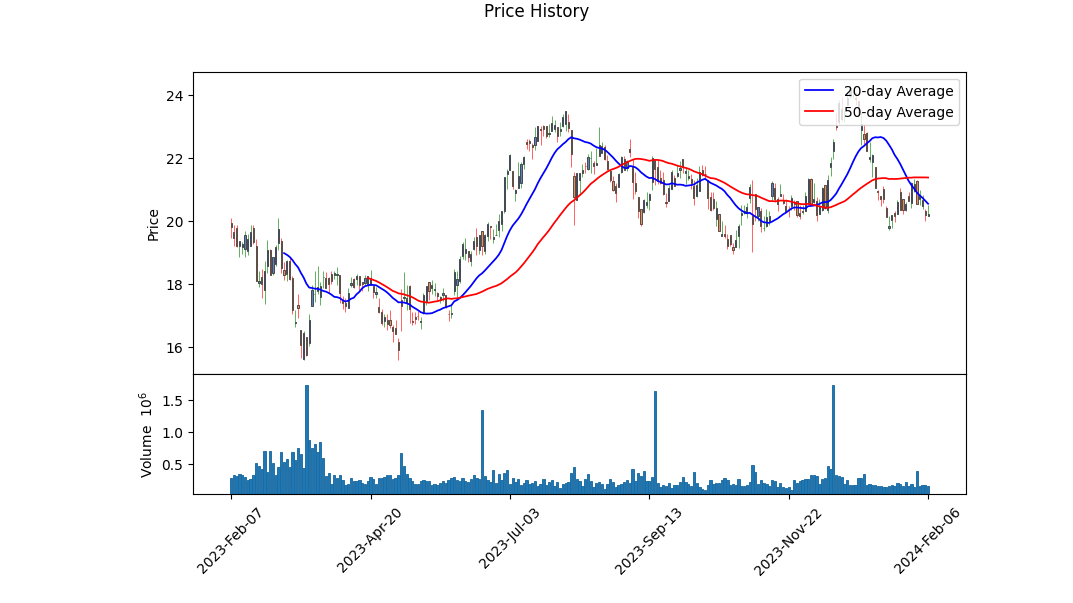

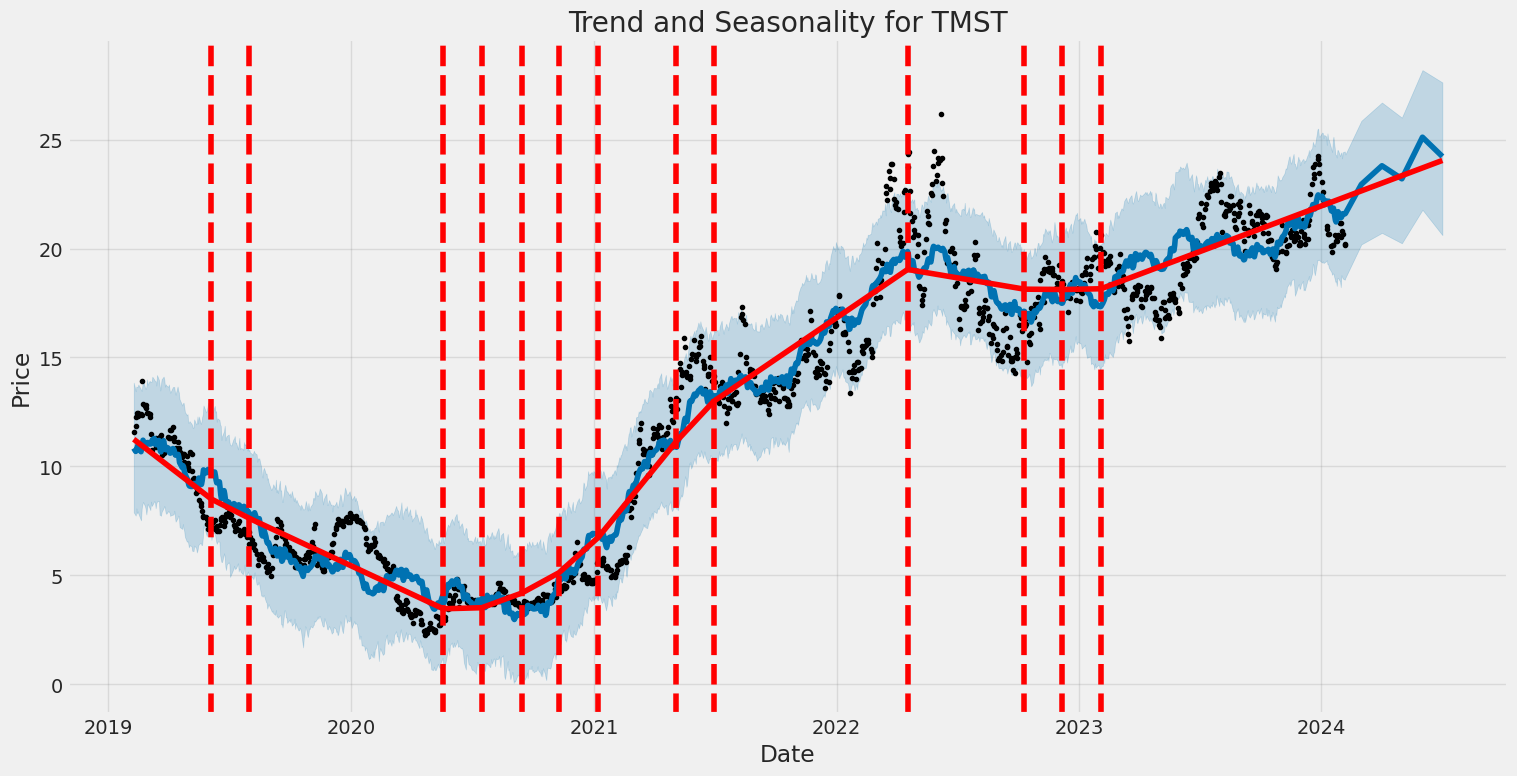

Technical analysis (TA) of TMST illustrates a nuanced landscape with emerging opportunities and risks on the horizon. While examining the last trading day's technical indicators, alongside comprehensive fundamental and financial data, several key trends and potential outlooks have become apparent.

The technical indicators, particularly the On-Balance Volume (OBV) and Moving Average Convergence Divergence (MACD), hint at the underlying momentum and investor sentiment surrounding TMST. The increment in the OBV, from early negatives to positive territories, reflects growing buying pressure. This is pivotal, as OBV is often seen as a precursor to price trends. The late appearance of the MACD histogram points towards the development of bullish momentum, although it's important to acknowledge the histogram dipping into the negatives in the most recent data point, suggesting a potential cooling-off or consolidation phase.

When integrating the risk-adjusted performance metricsSharpe, Sortino, Treynor, and Calmar Ratiosinto the analysis, the picture becomes more nuanced. The relatively low Sharpe Ratio suggests that excess returns on TMST, when adjusted for volatility, are modest. Conversely, the high Sortino Ratio indicates that TMST has yielded substantial returns on negative volatility, implying resilience against downward market movements. The Treynor and Calmar Ratios, while on the lower end, still offer insight into TMSTs performance relative to systematic risk and the maximum drawdown, respectively.

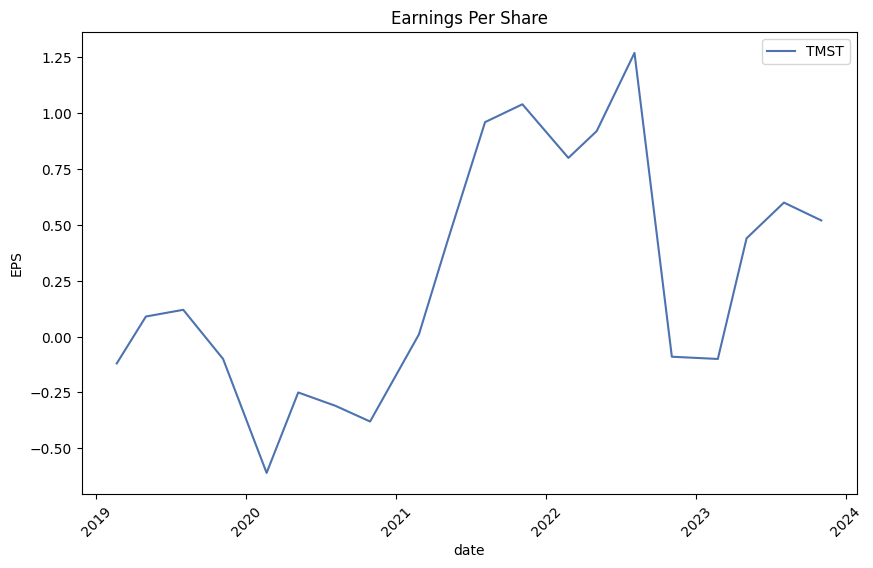

Fundamental analysis contributes an essential layer to understanding TMSTs potential trajectory. Notably, TMSTs fundamentals depict a company in a transformation phase with improving gross margins and notably positive operating margins. The Earnings Estimate reflects optimism among analysts, expecting a rise in EPS for the coming year. These estimates, coupled with the Earnings History showcasing a mixed but predominantly positive surprise percentage, suggest growing operational efficiency and revenue-generation capacity.

The Balance Sheet and Cash Flows present a solid financial structure with significant cash reserves and a manageable debt level. The increase in tangible book value alongside a streamlined capital structure accentuates TMST's financial health and its ability to navigate market uncertainties.

Given this analysis, the next few months for TMST are anticipated to feature fluctuating but generally upward-trending prices. The solid fundamentals, positive revenue, and earnings outlook provide a strong base. However, investors may need to weather short-term volatility, as hinted by the technical indicators and the modest risk-adjusted performance metrics.

Conclusively, TMST stands at a pivotal juncture with a positive medium to long-term outlook, justified by its strengthening fundamentals, constructive analyst sentiment, and emerging technical indicators. Market participants would do well to monitor forthcoming financial results and market conditions closely, as these factors will likely influence TMST's trajectory significantly in the ensuing months.

In analyzing TimkenSteel Corporation (TMST) through the lens of Joel Greenblatt's methodology outlined in The Little Book That Still Beats the Market, we focus on two key metrics: Return on Capital (ROC) and Earnings Yield. These metrics are essential in assessing TMST's investment quality and potential future performance. For TimkenSteel Corporation, the Return on Capital (ROC) is noteworthy at 16.028%, indicating a robust ability to generate profits relative to the capital invested in the business. This is a strong sign of operational efficiency and a well-managed company, as a higher ROC reflects the companys adeptness in deploying its capital to generate earnings. On the other side, TMST's Earnings Yield is observed at 7.026%, serving as an indicator of its valuation; this metric compares the company's earnings relative to its market price. Although not as high as its ROC, the earnings yield still represents an attractive valuation, suggesting that TMST shares might offer a good return considering the earnings it generates against its current market price. Together, these metrics offer a promising outlook for TimkenSteel Corporation, positioning it as a potentially lucrative investment opportunity when applying Greenblatt's investment philosophy.

| Statistic Name | Statistic Value |

| R-squared | 0.189 |

| Adj. R-squared | 0.189 |

| F-statistic | 292.5 |

| Prob (F-statistic) | 4.15e-59 |

| Log-Likelihood | -3494.6 |

| No. Observations | 1256 |

| AIC | 6993 |

| BIC | 7003 |

| Const | 0.0485 |

| Beta | 1.4332 |

| Std Err | 0.084 |

| t | 17.103 |

| P>|t| | 0.000 |

| [0.025 | 1.269 |

| 0.975] | 1.598 |

In the linear regression model examining the relationship between TMST and SPY, where SPY is used to represent the overall market, one of the most critical numbers to note is the alpha value of 0.0485. This alpha, also known as the intercept, signifies that when the market's movement (SPY) is at a standstill, TMST is expected to yield a 4.85% return. This figure, although seemingly modest, is crucial in understanding the intrinsic value that TMST presents independently of market movements. The model boasts an R-squared value of 0.189, suggesting that approximately 18.9% of the variance in TMST's returns can be explained by the movements in the SPY, pointing toward a relatively weak dependence on the broader market's fluctuations for its performance.

Further analysis into the beta coefficient, highlighted at 1.4332, amplifies the notion of TMST's responsiveness to the market changes denoted by SPY. A beta value greater than one suggests that TMST is theoretically more volatile than the market. This is to say, for every 1% change in the market, TMSTs return is expected to change by approximately 1.43%. However, the existence of a statistically significant alpha conveys that TMST has the potential to yield positive returns over and above what is predicted by its market movements alone. This interplay between the alpha and beta values furnishes a nuanced overview of TMST's performance dynamics in relation to the market, highlighting the simultaneous presence of intrinsic value independent of the market and sensitivity to market movements.

TimkenSteel Corporation held its third-quarter earnings call for 2023, demonstrating the company's dedication to growth and its focus on improving safety, profitability, and strategic investments. Mike Williams, President and CEO, highlighted the company's continuous commitment to fostering a strong safety culture as pivotal to its operations. The launch of their second employee safety survey was a noteworthy effort towards enhancing workplace safety and hazard awareness. Despite facing a slight sequential decrease in sales and shipments, Williams emphasized solid base prices across all end market sectors. However, EBITDA was affected by decreased surcharges following lower market prices for scrap and alloys. The third quarter saw a modest improvement in melt utilization to approximately 76%, and TimkenSteel expected a sequential decrease in Q4 due to planned annual shutdown maintenance.

Financially, TimkenSteel reported for the third quarter net sales of $354.2 million and a net income of $24.8 million or $0.51 per diluted share. These figures, compared to the second quarter's results, show a slight decrease in net income from $28.9 million or $0.62 per diluted share. Nevertheless, the year-over-year comparison to the third quarter of the previous year shows significant improvement from a net loss. This financial performance was supported by positive operating cash flow, marking the companys consistent financial health. The third quarter's achievements were attributed to the collaboration and hard work of TimkenSteel employees, emphasizing the company's strategic initiatives in commercial excellence, manufacturing, reliability, and administrative process simplification.

The earnings call also featured insights into TimkenSteel's various market sectors, including mobile, industrial, and energy shipments. In mobile, customer shipments were flat compared to the second quarter despite minimal impacts from the United Auto Workers strike. The company reported a record third quarter for EV-related product sales, indicating a 62% net sales increase and expanding its offerings in this sector. In the industrial market, shipments increased by 5%, driven by demand for high-quality steel grades and a strong performance in the defense sector. Conversely, energy shipments saw a 27% decrease due to a conservative approach in the industry, reflecting a reduced average U.S. rig count.

Looking forward, TimkenSteel is positioning itself for growth by introducing Tim Lynch as Vice President of Corporate Development, focusing on pursuing strategic acquisitions to enhance the company's market presence and product portfolio. As they continue to work towards their profit improvement targets of $80 million by 2026, TimkenSteel remains committed to its capital allocation strategy. This includes investing in profitable growth, maintaining a robust balance sheet, and returning capital to shareholders through share repurchases. Despite expecting a sequential decrease in fourth-quarter shipments due to seasonal trends and anticipated volatility, the company is optimistic about maintaining positive operating cash flow and continued strong base sales prices, albeit with lower surcharge revenue per ton.

The TimkenSteel Corporation's SEC 10-Q filing for the quarterly period ending September 30, 2023, provides a comprehensive look at the company's financial performance, liquidity, market trends, and future outlook. This analysis focuses on key financial metrics, operational challenges, market dynamics, and strategic endeavors as detailed in the filing.

During the third quarter of 2023, TimkenSteel reported net sales of $354.2 million, marking an 11.8% increase from the $316.8 million reported in the same period of 2022. This improvement in net sales is attributed mainly to favorable price/mix and higher volumes, despite a decrease in surcharges. Specifically, favorable price/mix contributed to a $28.1 million increase in sales, and higher volumes led to a $22.7 million rise, showcasing the company's ability to adapt to market demands significantly. The decrease in surcharges, however, impacted the overall sales performance negatively by $13.4 million. The figures underline TimkenSteel's resilient market position and its strategic pricing mechanisms to combat raw material cost fluctuations.

The companys gross profit for the same period saw a dramatic 810.7% increase, jumping from $5.6 million in Q3 2022 to $51.0 million in Q3 2023. This significant surge was driven by favorable price/mix, lower manufacturing costs, higher volumes, and favorable raw material spread. The comprehensive efforts in optimizing production efficacy and strategic pricing adjustments played a crucial role in this substantial profit growth.

On the operational front, the filing highlights several critical aspects, including operating costs and the impact of global market trends. The company faced challenges related to labor and benefits costs, fluctuations in raw material and energy prices, and competitive pressures. However, TimkenSteel's strategic initiatives aimed at cost reduction, productivity enhancement, and market diversification have helped them navigate these challenges effectively.

In terms of liquidity and capital resources, TimkenSteel emphasized its strategic financing decisions and capital allocation. With $293.7 million available under the Amended Credit Agreement as of September 30, 2023, and maintaining a strong cash position of $225.4 million, the company is well positioned to fund its operational needs, capital investments, and strategic initiatives. Notably, TimkenSteel highlighted its share repurchase activities as a part of its commitment to returning value to shareholders. Throughout the nine months ending September 30, 2023, the company repurchased approximately 1.5 million common shares for $28.5 million, showcasing its proactive approach to capital management.

The company's strategic focus on market segments such as industrial, mobile, energy, and others, as demonstrated by their net sales performance, indicates a balanced approach to tapping into diverse revenue streams. Despite the volatility in commodity prices and challenges in global supply chains, TimkenSteels strategic pricing and surcharge mechanisms have effectively mitigated impacts, allowing the company to maintain its competitive edge.

Overall, TimkenSteel's 10-Q filing paints a picture of a company that is strategically navigating the complexities of the global steel industry. With a strong emphasis on financial health, operational efficiency, and strategic growth initiatives, TimkenSteel is positioning itself for sustained success amidst fluctuating market conditions. The companys resilience in the face of global economic pressures, strategic capital management, and focus on lucrative market segments underscore its robust outlook for future growth and profitability.

In recent developments within TimkenSteel Corporation, now transitioning to Metallus Inc., various financial maneuvers and significant insider transactions have drawn the attention of investors and industry analysts alike. Notably, a series of insider selling incidents, alongside the company's strategic rebranding efforts and financial performance revelations, provide a composite view of its current market standing and future aspirations.

The transaction involving EVP and CFO Kristopher Westbrooks, who sold 15,949 shares of the company on December 27, 2023, at $24.1 each, is a substantial insider activity highlighting the pattern of stock sales by insiders over the past year. This places the company's market capitalization at approximately $1.030 billion. This pattern of insider sales, totalling 35,418 shares with no insider purchases reported during the same duration, prompts a deeper analysis of the insiders' perspective on the company's valuation and market performance.

TimkenSteel Corp., now poised to adopt the name Metallus Inc., specializes in the production of special bar quality (SBQ) bars, seamless mechanical tubing, and precision steel components. The companys decision to rebrand, announced on January 10, 2024, signifies a significant pivot towards amplifying its leadership in the high-performance metals sector. This rebranding, including the transition to a new ticker symbol (MTUS), and a commitment to profitable growth through exceptional products and partnerships, marks a strategic endeavor to align with future advancements in metallurgy and quality excellence.

The insider transaction by Michael Williams, the President & CEO who disposed of 12,453 shares on January 12, 2024, at an average price of $20.65, further correlates with the pattern of insider transactions over the year. Following this, Williams completed another sale of 9,500 shares on January 29, 2024, contributing to a cumulative sale of 23,106 shares by him over the past year. These transactions, notably absent insider purchases, suggest a noteworthy trend among company insiders which warrants analysis within the broader context of the company's financial health and market valuation.

The company, amidst these insider transactions, has been experiencing an upswing in its financial returns, particularly noted in its Return on Capital Employed (ROCE), which surged to 4.9% based on trailing twelve months up to September 2023 from a position of losses five years prior. This improvement is a testament to the company's profitability and efficiency in capitol utilization, juxtaposed against an industry average of 9.7%. Such a performance, resulting in a solid 78% return to shareholders over the last five years, underscores a growing confidence in TimkenSteel's (soon to be Metallus Inc.) operational and financial strategy.

The company's market valuation and insider selling patterns elucidate critical insights into TimkenSteel's financial dynamics. Despite the companys stock being considered modestly overvalued with a price-to-GF-Value ratio of 1.22 as per GuruFocus metrics, the rebranding to Metallus Inc. and the strategic emphasis on advancing in the high-performance metals field highlight a concerted effort towards embracing future opportunities and cementing a robust market position. The GF Value assessment, which deems the stock as Fairly Valued or modestly overvalued after certain insider transactions, reveals a nuanced perspective on the company's intrinsic worth, juxtaposed against its ambitious growth and innovation strategies.

The series of insider transactions amidst the companys rebranding phase and financial performance metrics, primarily the significant uplift in ROCE, portray a complex yet promising outlook for Metallus Inc. As the company embarks on this new chapter, stakeholders, including investors and industry analysts, will closely monitor these developments to gauge the potential impact on the company's stock performance and its standing in the competitive landscape of the high-performance metals industry. While these insider transactions offer a peek into the sentiments of key company figures, the overall trajectory of Metallus Inc. is poised for scrutiny as it aims to leverage its legacy and innovation for future growth.

TimkenSteel Corporation (TMST) has experienced volatility reflected in its asset returns, as indicated by the ARCH model results. The model suggests that volatility is not constant over time but varies, with significant spikes captured by the omega and alpha parameters. Specifically, the omega parameter indicates the baseline level of volatility, and the alpha parameter suggests a persistence or continuation of volatility following past shocks.

| Statistic Name | Statistic Value |

|---|---|

| Mean Model | Zero Mean |

| Vol Model | ARCH |

| Log-Likelihood | -3593.86 |

| AIC | 7191.72 |

| BIC | 7201.99 |

| No. Observations | 1,256 |

| Omega | 13.7998 |

| Alpha[1] | 0.3336 |

To embark on an exploration of the financial risk tied to a $10,000 investment in TimkenSteel Corporation (TMST) over a one-year horizon, an intricate approach melding volatility modeling and machine learning predictions was undertaken. This multifaceted analysis serves to dissect the nuances of investment risks, offering a window into the potential perils that lie in equity investment within the volatile stock market landscape.

At the heart of understanding the erratic nature of TimkenSteel Corporation's stock volatility is the employment of volatility modeling. This methodology is pivotal in deciphering the intricate patterns of fluctuation that characterize the stock's pricing movements over time. By meticulously analyzing historical price data, volatility modeling unravels the statistical variances inherent in the stock, enabling a forward-looking perspective on potential volatility. This facet of the analysis is crucial, as it lays the groundwork for assessing risk through a lens that takes into account the inherent unpredictability of stock market investments.

Complementing the insights gleaned from volatility modeling, machine learning predictions emerge as a powerful tool in forecasting future returns of TimkenSteel Corporation. By leveraging a plethora of historical data points and market indicators, machine learning predictions harness advanced algorithms to project the trajectory of stock returns. The synergy between past performance data and algorithmically driven forecasts yields a nuanced view of potential future earnings, underpinning the risk assessment with a predictive edge that traditional analyses may overlook.

The harmonization of volatility modeling and machine learning predictions brings to light the Value at Risk (VaR) metric, an essential indicator of the risk magnitude associated with the $10,000 investment in TMST. Specifically, the calculated VaR at a 95% confidence interval stands at $382.13. This signifies that, within the bounds of this confidence level, there is a risk of a maximum loss not exceeding $382.13 over the one-year period, under normal market conditions. The VaR metric, thus, serves as a statistical beacon, illuminating the potential downside risk and providing investors with a quantifiable measure to gauge the financial exposure entailed in their investment endeavors.

By integrating the analytical prowess of volatility modeling and the predictive capabilities of machine learning, this exploration offers a detailed examination of the potential risks inherent in a $10,000 equity investment in TimkenSteel Corporation. The combined approach not only sheds light on the probable volatility patterns but also forecasts future stock returns, culminating in the estimation of the Value at Risk. This comprehensive analysis underscores the multidimensional aspects of financial risk assessment, demonstrating the merits of leveraging both historical volatility and predictive analytics in navigating the complexities of stock market investments.

Analyzing the provided options data for TimkenSteel Corporation (TMST) with the goal of identifying the most profitable call options, we focus on the key Greeks: delta, gamma, vega, and theta, in addition to the specifics such as strike price, expiration date, and potential return on investment (ROI).

Given the target for the stock price to increase by 5% over the current value, we carefully examine the options chain to identify options that pose a high potential for profitability while maintaining a balance between risk and reward.

One notable option in our analysis is a call option with a strike price of $20, set to expire on February 16, 2024. This option has several compelling Greek values and characteristics that warrant a deeper look:

-

Delta () of 0.5804600292: This suggests that for every $1 increase in the price of TMST stock, the price of the call option is expected to increase by approximately 58 cents. Given the anticipated 5% increase in the stock price, this relatively high delta points to significant potential price movement in the options value in response to the stocks price change, making it an attractive choice for profit-seeking investors.

-

Gamma () of 0.2945393782: This value is quite high, indicating that the delta of the option is highly sensitive to changes in the underlying stocks price. This could mean greater profitability potential as the stock price moves towards our target, especially considering the expected increase.

-

Vega of 1.1690537088: Since Vega measures an option's sensitivity to volatility, a high Vega in this case suggests that the options price is likely to increase significantly with an uptick in the stock's volatility. This can be particularly advantageous if the 5% stock price increase occurs accompanied by market volatility.

-

Theta () of -0.0334143185: Although a negative Theta indicates that the option loses value as time progresses, the relatively small magnitude suggests that time decay is not as rapid, offering a more favorable scenario for longer-term strategies up to the expiration date.

-

The premium of $1.00, coupled with an ROI of 0.2205, or 22.05%, highlights the potential for a substantial return on investment. Considering the input costs versus the projected gains, this call option emerges as notably profitable if the stock behaves as anticipated.

Given these parameters, this specific call option presents a compelling investment opportunity for those looking to profit from an anticipated increase in TimkenSteel Corporation's stock price. The high delta and gamma indicate strong responsiveness to the stock price movement towards the 5% target increase, while the manageable theta suggests that time decay is not significantly detrimental over the short term leading to the option's expiration in February 2024.

Investors should continuously monitor the stocks performance, especially considering the impact of Vega in volatile markets, to adjust their positions accordingly. However, based on the given data, this option stands out for its potential profitability in light of the anticipated market movement.

Similar Companies in Steel:

Report: Reliance Steel & Aluminum Co. (RS), Reliance Steel & Aluminum Co. (RS), Universal Stainless & Alloy Products, Inc. (USAP), Report: Outokumpu Oyj (OUTKY), Outokumpu Oyj (OUTKY), Report: Olympic Steel, Inc. (ZEUS), Olympic Steel, Inc. (ZEUS), POSCO Holdings Inc. (PKX), Usinas Siderurgicas de Minas Gerais S.A. (USNZY), Mesabi Trust (MSB), Companhia Siderurgica Nacional (SID), Report: United States Steel Corporation (X), United States Steel Corporation (X), Report: Nucor Corporation (NUE), Nucor Corporation (NUE), Report: Steel Dynamics, Inc. (STLD), Steel Dynamics, Inc. (STLD), AK Steel Holding Corporation (AKS), Report: Cleveland-Cliffs Inc. (CLF), Cleveland-Cliffs Inc. (CLF)

https://finance.yahoo.com/news/evp-cfo-kristopher-westbrooks-sells-180140430.html

https://finance.yahoo.com/news/timkensteel-announces-intent-change-name-133000867.html

https://finance.yahoo.com/news/timkensteel-corp-president-ceo-michael-140234135.html

https://finance.yahoo.com/news/returns-timkensteel-nyse-tmst-way-123319462.html

https://finance.yahoo.com/news/timkensteel-corp-president-ceo-michael-040139492.html

https://www.sec.gov/Archives/edgar/data/1598428/000095017023058233/tmst-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: Ky5FQS

Cost: $0.58225

https://reports.tinycomputers.io/TMST/TMST-2024-02-07.html Home