Global X Data Center REITs & Digital Infrastructure ETF (ticker: VPN)

2024-01-19

The Global X Data Center REITs & Digital Infrastructure ETF, trading under the ticker symbol VPN, is an investment vehicle focusing on the digital infrastructure sector, particularly data center Real Estate Investment Trusts (REITs) and companies that are involved in the digital communications industry. This ETF seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Data Center REITs & Digital Infrastructure Index. Given the rapid expansion of cloud computing, data consumption, and the ongoing deployment of 5G technology, VPN offers investors a specialized and targeted exposure to infrastructure assets designed to underpin the digital economy. The ETF's portfolio comprises firms that own, operate, or provide services to data centers, telecom towers, fiber optics, and related infrastructure, making it a potentially strategic choice for those looking to diversify and tap into the growth of digital infrastructure.

The Global X Data Center REITs & Digital Infrastructure ETF, trading under the ticker symbol VPN, is an investment vehicle focusing on the digital infrastructure sector, particularly data center Real Estate Investment Trusts (REITs) and companies that are involved in the digital communications industry. This ETF seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Data Center REITs & Digital Infrastructure Index. Given the rapid expansion of cloud computing, data consumption, and the ongoing deployment of 5G technology, VPN offers investors a specialized and targeted exposure to infrastructure assets designed to underpin the digital economy. The ETF's portfolio comprises firms that own, operate, or provide services to data centers, telecom towers, fiber optics, and related infrastructure, making it a potentially strategic choice for those looking to diversify and tap into the growth of digital infrastructure.

| Previous Close | 14.0889 | Open | 14.149 | Day Low | 14.0 |

|---|---|---|---|---|---|

| Day High | 14.149 | Trailing P/E | 29.758215 | Volume | 7,289 |

| Average Volume | 32,328 | Average Volume 10 days | 17,990 | Bid | 13.4 |

| Ask | 15.56 | Bid Size | 1,400 | Ask Size | 1,100 |

| Yield | 0.0118 | Total Assets | 50,573,608 | 52 Week Low | 11.86 |

| 52 Week High | 14.86 | Fifty Day Average | 14.10578 | Two Hundred Day Average | 13.33493 |

| NAV Price | 14.34 | YTD Return | -3.89563% | Beta 3 Year | 1.15 |

| Three Year Average Return | -1.47166% | Currency | USD | Category | Real Estate |

Upon a detailed examination of the financial and technical data provided for the ETF symbol VPN, a nuanced analysis yields the following insights and forecast for the potential movement of its stock price over the upcoming months:

Upon a detailed examination of the financial and technical data provided for the ETF symbol VPN, a nuanced analysis yields the following insights and forecast for the potential movement of its stock price over the upcoming months:

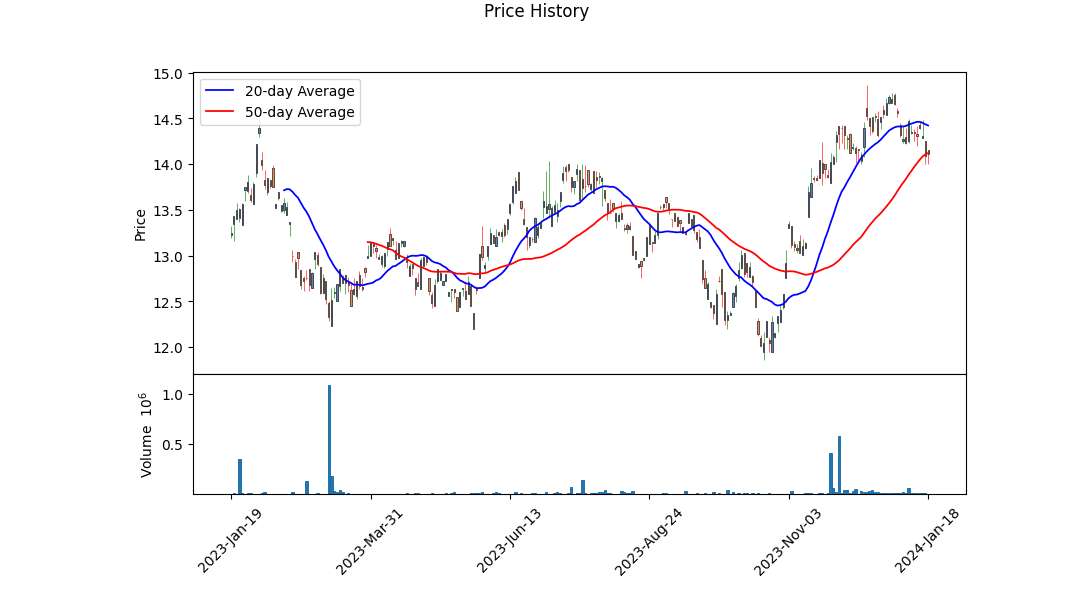

- Technical Indicators Overview:

- The Open to Close range in VPN has expanded over the reviewed period, indicating an increased volatility.

- The On-Balance Volume (OBV) has shown an uptrend, suggestive of accumulating volume and potentially positive price momentum.

-

The Moving Average Convergence Divergence (MACD) histogram has been in the negative territory, raising caution for some bearish sentiment.

-

Fundamental Analysis:

- The trailing Price-to-Earnings (P/E) ratio stands at 29.76, which can be considered high, indicating that the market may be pricing in future growth expectations.

- A beta of 1.15 implies that the stock is slightly more volatile than the market.

-

The ETF has experienced a Year-To-Date (YTD) total return of -3.90%, showing some underperformance in the current year.

-

Market Sentiment:

- A yield of 1.18% is relatively modest but could offer some downside protection through the distribution of dividends.

- The 52-week price range shows capability for significant swings, with current prices close to the 52-week high, hinting at resistance levels that may be tested.

Considering these technical and fundamental factors, VPN appears poised for a period of increased volatility. The expanding range on the daily charts suggests that investor sentiment is mixed, with substantial buying and selling pressures. The positive trend in OBV is encouraging and indicates that despite some daily declines, overall volume is accumulating on up days, which could suggest underlying strength.

However, the negative MACD histogram values warn of caution, as they imply that short-term momentum is declining relative to longer-term momentum. Investors will want to monitor this closely, as a sustained move into positive territory for the MACD histogram could signal a stronger bullish sentiment.

From a fundamental perspective, the relatively high P/E ratio commands careful consideration. It is crucial to assess whether the anticipated growth justifies the premium valuation. The historical performance, as denoted by the negative YTD return, indicates that the stock has yet to prove it can deliver value commensurate with its valuation.

The moderate yield and high beta further contribute to a mixed outlook; income-oriented investors might find the yield appealing, while growth-focused investors may be deterred by its recent performance. The proximity to the 52-week high may serve as a psychological barrier for the stock price, potentially limiting upside in the near term.

In conclusion, the collective analysis suggests that VPN may experience continued volatility with the potential for both upside and downside price movements. While OBV trends and volume analysis provide a degree of optimism, the bearish MACD readings and mixed fundamental signals temper expectations for substantial appreciation in the short term. Investors would benefit from a strategy that allows for flexibility in response to price movements while watching key technical levels for further indications of direction. The possibility of churn and consolidation within its current range appears likely, with external market factors and investor sentiment also playing crucial roles in the directional bias.

| Statistic Name | Statistic Value |

| R-squared | 0.504 |

| Adj. R-squared | 0.503 |

| F-statistic | 818.6 |

| Prob (F-statistic) | 8.33e-125 |

| Log-Likelihood | -1117.5 |

| No. Observations | 808 |

| AIC | 2,239 |

| BIC | 2,248 |

| Alpha | -0.0405 |

| Beta | 0.8912 |

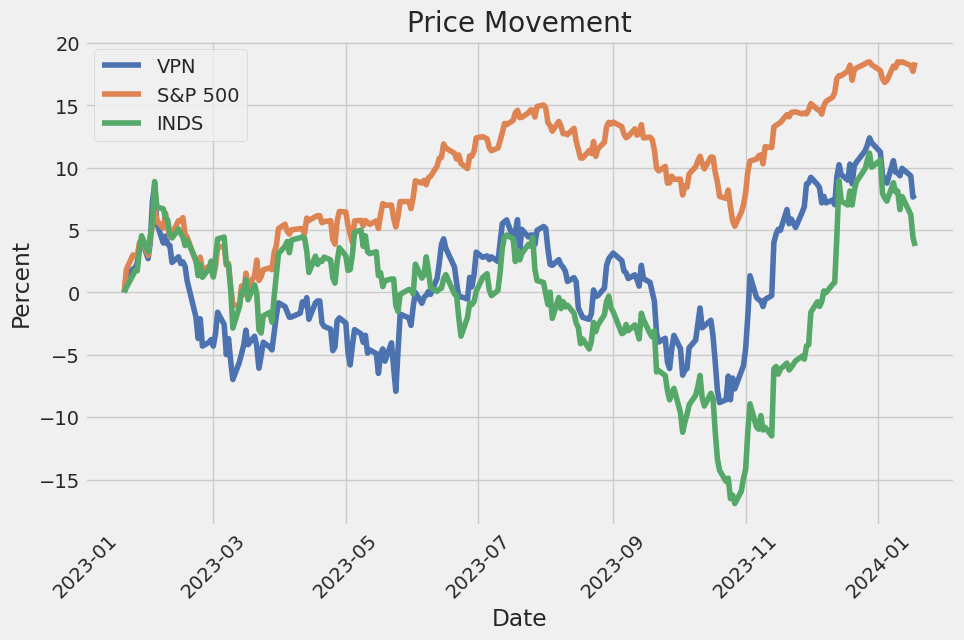

The linear regression model analyzing the relationship between VPN (variable 0) and SPY shows that the beta coefficient (the slope of the regression line) is 0.8912, indicating that there is a positive relationship between the two variablesmeaning, on average, a unit increase in VPN is associated with a 0.8912 unit increase in SPY. The R-squared value of 0.504 suggests that approximately 50.4% of the variability in SPY can be explained by the VPN. This model has an alpha (constant term) value of -0.0405, which represents the point where the regression line intersects the Y-axis when VPN is zero. However, the alpha is not statistically significant at conventional levels (p-value of 0.235), which implies that this intercept is not different from zero from a statistical standpoint, indicating that when VPN is zero, the expected value of SPY does not significantly differ from zero.

In terms of diagnostics, the F-statistic value of 818.6 with a very low p-value (approximately 0) strongly rejects the null hypothesis that the model with no independent variables fits the data as well as our model, supporting the inclusion of VPN to explain variations in SPY. The regression's adjusted R-squared is similar to the unadjusted R-squared, which reaffirms the model's explanatory power. With 808 observations, the model's statistical significance and confidence intervals for the slope suggest that the relationship found is well-established within the data. Despite a relatively strong model fit, the insignificant alpha value suggests that any predictive model for SPY using VPN should focus on the slope rather than the intercept.

The Global X Data Center REITs & Digital Infrastructure ETF is engineered to offer investors exposure to a burgeoning industry where physical and digital infrastructures intersect. It encapsulates enterprises which primarily operate data center Real Estate Investment Trusts (REITs), and digital communications businesses such as cell tower and telecommunication infrastructure companies. Given the current trajectory of growth in cloud services, e-commerce, and the sheer volume of data generation, the entities represented within this particular ETF are increasingly becoming fundamental to global economic operations.

Data Centers are the physical facilities that organizations use to house critical applications and dataa contemporary library of Alexandria for the digital age, if you will. The demand for data center services has surged, encouraged by the growth in big data, machine learning, and hungry consumer services such as streaming. As a consequence, the data center segment of the ETF is likely bolstered by sustained customer demand translating into remarkably stable revenue streams, even amid broader market fluctuations.

On the flip side, Digital Infrastructure is the backbone that keeps our connected world up and streaming. It includes cell towers and fiber optic cables, facilitating everything from wireless communication to broadband access. Firms that are centered on building, owning, or leasing such infrastructure can benefit from long-term contracts and the critical nature of these assets, which often results in steady, predictable cash flows.

Let us briefly delve into the ETF's portfolio composition to understand better where investments are being channeled. Looking at the top ten holdings of this specialized ETF, it's evident that there's a calculated emphasis on reputable and enduring companies.

| company | symbol | percent |

|---|---|---|

| American Tower Corp | AMT | 12.82 |

| Equinix Inc | EQIX | 11.74 |

| Crown Castle Inc | CCI | 11.68 |

| Digital Realty Trust Inc | DLR | 9.98 |

| DigitalBridge Group Inc Class A | DBRG | 4.87 |

| Nextdc Ltd | NXT.AX | 4.68 |

| SBA Communications Corp Class A | SBAC | 4.55 |

| China Tower Corp Ltd Ordinary Shares - Class H | 0788.HK | 4.14 |

| Keppel DC REIT | AJBU.SI | 3.61 |

| Intel Corp | INTC | 2.87 |

American Tower Corp, with the largest holding percentage within the ETF, is a leading independent owner, operator, and developer of multitenant communications real estate. Equinix Inc and Digital Realty Trust Inc, both significant positions in the ETF, are giants in the data center sphere offering an extensive range of colocation and interconnection solutions. The connectivity that Equinix and Digital Realty provide is fundamental to cloud management and the seamless working of the internet.

It is important to note that within the digital infrastructure landscape, tower companies such as Crown Castle Inc and SBA Communications Corp have flourished. These firms have leveraged their extensive tower portfolios to underpin the rapid deployment of 5G infrastructure, driving consistent revenue growth as operators look to expand their network coverage and capacity.

DigitalBridge Group Inc is notable for its unique investment focus on digital infrastructure and real estate solutions. Its diverse portfolio of data centers, cell towers, fiber networks, and small cells is designed to meet the rapid growth of mobile, internet, and cloud-based businesses.

Moving from traditional infrastructure to innovative markets, the inclusion of overseas assets such as Nextdc Ltd and China Tower Corp Ltd reflects the ETF's global approach. Nextdc Ltd is one of Australia's leading data centre operators, and China Tower Corp is one of the world's largest tower service providers, attesting to the spread of digital infrastructure not just in the US but around the globe.

Although not a classic REIT or tower company, Intel Corp finds a place in the top holdings, suggesting the ETF's approach to digital infrastructure isn't confined strictly to real estate or towers but also encompasses the technological components that generate and fuel the need for such infrastructure.

In essence, the Global X Data Center REITs & Digital Infrastructure ETF brings to light these pivotal growth sectors, providing investors an avenue to gain targeted exposure. The companies held within this ETF signify a mark of criticality and centrality in the digital age. With their essential services being requisites for both everyday Internet engagement and the function of global corporations, the importance of these sectors is likely to persist and expand as technology advances.

It is this understanding of the evolving realm of digital infrastructure that anchors investments within the Global X Data Center REITs & Digital Infrastructure ETF. Not just a passive vehicle for capital appreciation, the ETF offers a methodological investment in the foundational components of the data-driven economy of tomorrow.

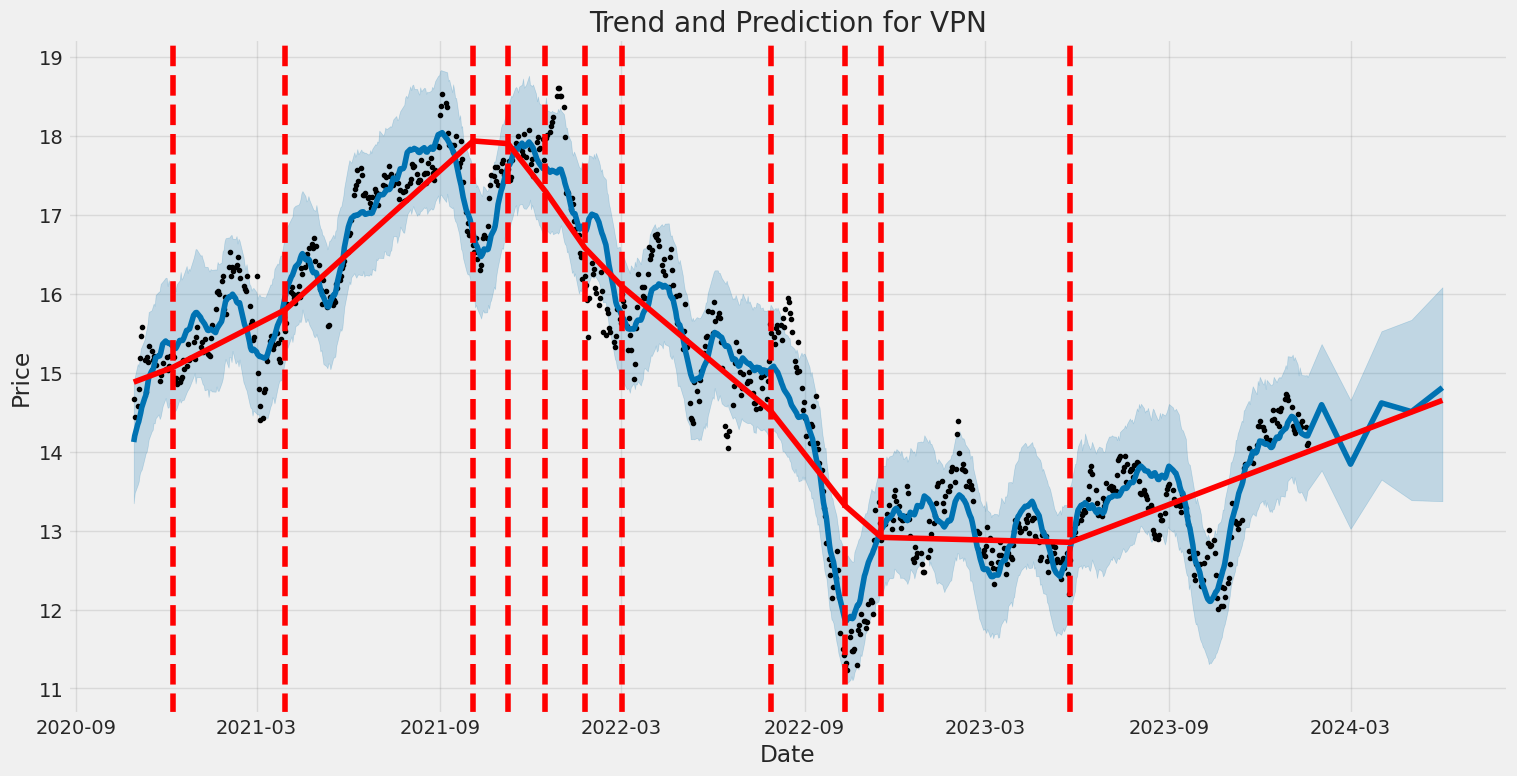

The Global X Data Center REITs & Digital Infrastructure ETF (VPN) experienced notable volatility from October 29, 2020, to January 18, 2024. The fund's returns did not show a consistent trend (with an R-squared of 0), indicating that the model explaining volatility does not predict the returns well. The volatility was significantly influenced by past returns, as indicated by the ARCH model's alpha coefficient, suggesting that large changes in the ETF's price could lead to greater volatility.

| Statistic Name | Statistic Value |

|---|---|

| Mean Model | Zero Mean |

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Vol Model | ARCH |

| Log-Likelihood | -1378.49 |

| AIC | 2760.99 |

| BIC | 2770.38 |

| No. Observations | 808 |

| Df Residuals | 808 |

| omega | 1.3903 |

| alpha[1] | 0.2704 |

To analyze the financial risk of a $10,000 investment in the Global X Data Center REITs & Digital Infrastructure ETF (ticker symbol VPN) over a one-year period, a tandem approach involving volatility modeling and machine learning predictions has been employed. This combination allows for a robust understanding of the ETF's past price movements and forecasting return distributions with a focus on extreme risks.

Volatility modeling plays a crucial role in financial risk analysis. For the VPN ETF, volatility modeling is used to capture the dynamic nature of the ETF's market risk. By fitting historical return data to this model, we can quantify the persistence of volatility shocks and their mean-reverting nature. In essence, this model gives us insights into how volatile the ETF is likely to be in the future, based on its past performance.

In parallel to volatility modeling, machine learning predictions are leveraged to provide a forward-looking assessment. The machine learning approach employed in this case is a form of a decision tree known as a forest-based method. This ensemble learning technique constructs multiple decision trees during training time and outputs the mean prediction of the individual trees. Notably, using this method allows for capturing complex, non-linear relationships that may not be apparent in historical volatility, thus potentially improving predictive accuracy.

The historical return distributionwith additional specificity provided by volatility modelingfeeds into the machine learning model. This combined intelligence is then used to simulate potential future returns for the ETF, producing a forecasted distribution of outcomes for the coming year.

Analyzing the risk of the VPN ETF investment involves calculating the Value at Risk (VaR). VaR is a statistical technique used to measure and quantify the level of financial risk within a firm, portfolio, or position over a specific time frame. The VaR results estimate at a 95% confidence interval, which means there is a 5% chance that the portfolio will experience a loss exceeding this value over the one-year period. Given the calculated Annual VaR at 95% confidence level of $198.75 on a $10,000 investment, this denotes that there's a 95% probability that the investor won't lose more than $198.75 over the one-year period.

This analysis, utilizing a mix of historical volatility understanding and future-oriented predictions through machine learning, underscores the multifaceted nature of financial risk. It provides a nuanced view of what an investor in the VPN ETF might expect in terms of the variability of returns. The calculated VaR further quantifies the potential downside risk, offering a benchmark against which investors can evaluate the level of risk they are assuming with a $10,000 stake in this particular ETF.

Similar Companies in None:

Report: Pacer Benchmark Industrial Real Estate SCTR ETF (INDS), Pacer Benchmark Industrial Real Estate SCTR ETF (INDS), Vident U.S. Diversified Real Estate ETF (PPTY), Global X Thematic Growth ETF (GXTG), Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF (SRVR), Global X Telemedicine & Digital Health ETF (EDOC), CyrusOne Inc. (CONE), Report: Digital Realty Trust, Inc. (DLR), Digital Realty Trust, Inc. (DLR), Report: Equinix, Inc. (EQIX), Equinix, Inc. (EQIX), CoreSite Realty Corporation (COR), QTS Realty Trust, Inc. (QTS), Switch, Inc. (SWCH), Report: American Tower Corporation (AMT), American Tower Corporation (AMT), Report: Crown Castle International Corp. (CCI), Crown Castle International Corp. (CCI), Report: SBA Communications Corporation (SBAC), SBA Communications Corporation (SBAC), Report: Iron Mountain Incorporated (IRM), Iron Mountain Incorporated (IRM)

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: Wo0mrw

https://reports.tinycomputers.io/VPN/VPN-2024-01-19.html Home