United States Steel Corporation (ticker: X)

2023-12-19

The United States Steel Corporation, trading under the ticker symbol X, stands among the most storied steel producers in the American industry. Founded in 1901 by industrial magnates including Andrew Carnegie and J.P. Morgan, U.S. Steel was once the largest steel producer and largest corporation in the world. As of the latest information, the corporation has undergone significant transformations in response to the changing dynamics of the global steel industry, focusing on technological innovation and sustainable production practices. Headquartered in Pittsburgh, Pennsylvania, U.S. Steel continues to play a crucial role in supplying a wide range of high-value-added steel products to markets such as automotive, construction, and energy. Notably, U.S. Steel has been integrating both vertical and horizontal growth strategies, inclusive of acquisitions and development of new material solutions, maintaining its competitive edge in a highly cyclical industry. Financial performance and market activity for the ticker X are routinely scrutinized by investors who seek to gauge the health of the manufacturing sector and the broader U.S. economy.

The United States Steel Corporation, trading under the ticker symbol X, stands among the most storied steel producers in the American industry. Founded in 1901 by industrial magnates including Andrew Carnegie and J.P. Morgan, U.S. Steel was once the largest steel producer and largest corporation in the world. As of the latest information, the corporation has undergone significant transformations in response to the changing dynamics of the global steel industry, focusing on technological innovation and sustainable production practices. Headquartered in Pittsburgh, Pennsylvania, U.S. Steel continues to play a crucial role in supplying a wide range of high-value-added steel products to markets such as automotive, construction, and energy. Notably, U.S. Steel has been integrating both vertical and horizontal growth strategies, inclusive of acquisitions and development of new material solutions, maintaining its competitive edge in a highly cyclical industry. Financial performance and market activity for the ticker X are routinely scrutinized by investors who seek to gauge the health of the manufacturing sector and the broader U.S. economy.

| As of Date: 12/19/2023Current | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |

|---|---|---|---|---|---|---|

| Market Cap (intraday) | 11.07B | 7.24B | 5.60B | 5.93B | 5.87B | 4.24B |

| Enterprise Value | 12.19B | 8.55B | 6.90B | 6.55B | 6.59B | 5.30B |

| Trailing P/E | 10.69 | 6.04 | 3.61 | 2.85 | 2.07 | 1.05 |

| Forward P/E | 17.39 | 16.23 | 6.22 | 6.36 | 6.11 | 4.42 |

| PEG Ratio (5 yr expected) | - | - | - | - | - | - |

| Price/Sales (ttm) | 0.70 | 0.44 | 0.33 | 0.34 | 0.32 | 0.23 |

| Price/Book (mrq) | 1.01 | 0.68 | 0.54 | 0.58 | 0.55 | 0.42 |

| Enterprise Value/Revenue | 0.67 | 1.93 | 1.38 | 1.47 | 1.52 | 1.02 |

| Enterprise Value/EBITDA | 5.07 | 18.04 | 9.17 | 15.39 | 20.66 | 7.00 |

| Full Time Employees | 22,740 | Total Pay for CEO | $9,488,434 | Year Born of CEO | 1955 |

|---|---|---|---|---|---|

| Total Pay for CFO | $1,124,703 | Year Born of CFO | 1973 | Total Pay for General Counsel | $2,291,747 |

| Year Born of General Counsel | 1973 | Total Pay for Chief Manufacturing Officer | $2,341,737 | Year Born of Chief Manufacturing Officer | 1967 |

| Total Pay for President of U. S. Steel Kosice | $4,063,871 | Year Born of President of U. S. Steel Kosice | 1966 | Market Cap | $10,818,458,624 |

| Fifty Two Week Low | $20.40 | Fifty Two Week High | $50.20 | Enterprise Value | $12,282,479,616 |

| Profit Margins | 6.297% | Float Shares | 221,363,481 | Shares Outstanding | 223,038,000 |

| Shares Short | 13,137,515 | Shares Percent Shares Out | 5.89% | Held Percent Insiders | 1.27% |

| Held Percent Institutions | 81.194997% | Book Value | $49.339 | Price To Book | 0.9831 |

| Net Income To Common | $1,148,999,936 | Trailing EPS | $4.64 | Forward EPS | $3.11 |

| Total Cash | $3,222,000,128 | Total Debt | $4,351,000,064 | Total Revenue | $18,247,000,064 |

| Operating Cashflow | $2,465,999,872 | Revenue Growth | -14.8% | Gross Margins | 13.295001% |

Technical Analysis Overview:

The stock under consideration has displayed notable characteristics as of the last trading day, with technical indicators exhibiting a combination of bullish momentum and potential overextension on certain metrics. Below is a comprehensive assessment of the indicators presented:

- The Adjusted Close price at $49.59 shows a marked improvement from the 20-day Simple Moving Average (SMA) of $36.76, suggesting a solid uptrend.

- The Moving Average Convergence Divergence (MACD) is positive at 2.041862. The accompanying MACD histogram value at 0.975017 also indicates strong bullish momentum.

- An exceptionally high Relative Strength Index (RSI) of 95.09 often signals an overbought condition and may hint at a potential pullback or consolidation phase.

- Bollinger Bands reflect a substantial price increase, with the Adjusted Close at the upper Bollinger Band, supporting the notion of an overextended price move.

- The volume-based On Balance Volume (OBV) at 16.66 million highlights significant buying pressure.

- Stochastic oscillators (STOCHk_14 and STOCHd_14) near the 94-95 level reinforce the overbought condition.

- The Average Directional Index (ADX) reading at 55.43 indicates a very strong trend in the stock price.

- Williams %R (WILLR_14) near -4 implies the stock might be at a short-term peak.

- Chaikin Money Flow (CMF_20) remains positive at 0.135372, suggesting bullish sentiment due to buying pressure.

- The Parabolic SAR (PSARl_0.02_0.2) lies below the price, supporting the continuation of the uptrend.

Reviewing the presented fundamentals indicates an intriguing trajectory:

- Market capitalization shows a steady increase, reflecting market confidence and growth.

- The trailing P/E ratio at 10.69 is relatively low, often viewed as undervalued by market standards.

- The Price/Sales and Price/Book ratios are well within reasonable ranges, supporting an attractive valuation standpoint.

- Enterprise value multiples appear stable and do not indicate overvaluation.

- Financials reveal significant net income and EBITDA in recent periods, with stabilizing effects on unusual items and a healthy tax rate.

Considering the comprehensive analysis, the following outlook is projected:

In the immediate to near term, the stock may witness a consolidation or minor pullback due to the overbought conditions signified by the high RSI and Stochastic readings. However, the strong fundamentals and a firm market capitalization growth trend support underlying strength in the stock. The solid MACD and OBV readings indicate continued buyer interest, which may counterbalance profit-taking from short-term traders.

For the forthcoming months, if the stock sustains its earnings momentum and manages to stabilize after any potential drawdown from its current overextended technical position, we can anticipate a continuation of the uptrend. If positive sentiment is maintained and market conditions remain favorable, the likes of the EMA_50, Parabolic SAR, and the Bollinger Bands may provide dynamic support levels for the stock's price action.

Investors should monitor the stock closely for signs of trend exhaustion or continuation patterns. Any dip towards fundamental support levels, such as the EMA_50 or SMA_20, could present buying opportunities. Assuming that fundamental financial performance does not diverge negatively, it would be reasonable to expect the stock to carve a path of continued growth, albeit with possible volatility indicative of a stock that has recently seen sharp advances.

In conclusion, the general forecast for this stock suggests that while short-term corrections are commonplace after such strong advances, the solid foundation laid by fundamental growth and robust technical momentum positions the stock favorably for continued upward price movements over the next few months. Investors should remain attuned to both technical inflection points and fundamental milestones, such as earnings releases and sector developments, that could influence future price action.

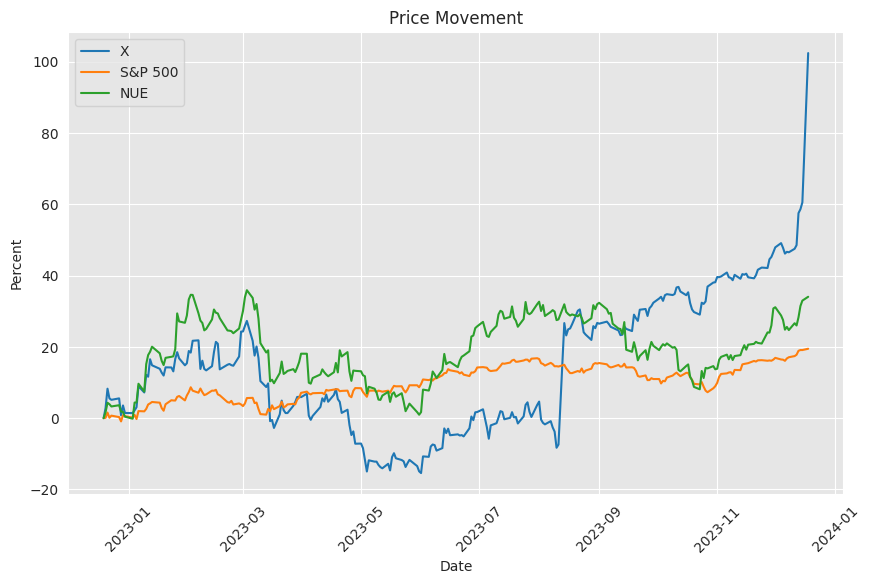

The United States Steel Corporation (NYSE: X), a mainstay of the American metals industry and a historically significant company, has come into the limelight with recent talks of an international acquisition. The Japanese steel powerhouse Nippon Steel (OTCPK:NPSCY) has proposed a colossal buyout amounting to $14.9 billion. This all-cash transaction exemplifies a premium of 40% on the stock price of U.S. Steel as of December 15, positioning it at $55.00 per share. This proposal came amidst strategic industry shifts and reflects Nippon Steels ambition to amplify its global footprint, especially in light of domestic market contractions and a decreasing population in Japan.

This acquisition strategy by the Japanese behemoth finds its optimum timing in alignment with the Infrastructure Investment and Jobs Act in the United States, assuming an increased domestic steel demand driven by the "Buy American" legislative initiatives. Despite the strategic significance, this move has sparked concern across various fronts. Political voices, such as Senators John Fetterman of Pennsylvania and J.D. Vance of Ohio, voice explicit opposition, and unions, notably the United Steelworkers, echo apprehension regarding the implications for national security and the American industrial workforce.

Within the broader context of international commerce, there has been advancement with the creation of a naval task force intended to secure commercial maritime navigation through the tempestuous Red Sea, countering increasing threats, notably from Houthi rebel factions. Multiple nations have come together in this initiative, aiming to safeguard a critical conduit for substantial global trade volumes.

Technology is another realm witnessing significant developments. Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) reached a conclusive settlement of $700 million relating to an antitrust case involving its Play app store. The resolution not only entails a monetary component but also commits to an expansion in billing options for developers, suggesting an evolutionary shift in the frameworks of app distribution and in-app commerce managed by technology conglomerates.

In the financial sphere, noteworthy movements have been observed. Innate Pharma (IPHA) experienced a surge in share value following the licensing of an oncology cell engager to Sanofi (SNY), demonstrating investor confidence in strategic partnerships and intellectual property valorization. Contrastingly, Cipher Mining (CIFR) underwent stock value appreciation due to acquisitions of new equipment, while bluebird bio (BLUE) weathered a downturn post the announcement of a public share offering.

On the corporate restructuring front, a statement from Enphase Energy (NASDAQ: ENPH) disclosed workforce reduction and cessation of operations at select locations, alluding to the company's strategy to mitigate challenges in the current market and streamline costs. Concurrently, a technological partnership between TomTom (OTCPK:TMOAF) (OTCPK:TMOAY) and Microsoft (NASDAQ: MSFT) signaled a leap into AI integration in vehicular systems, punctuating ongoing innovation in automotive technology.

On December 18, 2023, U.S. Steel's stock price reacted with a 26% jump in response to the acquisition arrangement with Nippon Steel. This significant premium on stock value delineates the Japanese steel manufacturer's strategy to reinforce its global dominance in a substantive fashion. The consolidation is exemplary of an all-encompassing corporate gamble, where U.S. Steel's evaluation includes debt considerations, marking a cornerstone event in the company's trajectory and the international steel market.

The agreement, which awaits regulatory and shareholder approvals, is poised to solidify the industrial stature of U.S. Steel with its retention of namesake and Pittsburgh headquarters. It also ensures the current labor agreements with unions like the United Steelworkers will be respected. Shareholders now grapple with a decision; they could exploit the current high in stock price and offload their shares or play the long game, banking on a smooth acquisition process clear from regulatory or shareholder opposition.

The proposed acquisition is indicative of far-reaching ramifications for the steel industry's competitive makeup. U.S. Steel's assimilation into Nippon Steel's operations could bear enhancements in efficiency and market reach. For stakeholders in U.S. Steel, the happening is an epochal pivot with considerable financial reward and enduring participation in the transformation of a leading global steel producer.

The story of U.S. Steel's buyout unfolds with Nippon Steel's intention to cement its global standing, seeking to push its production targets ambitiously. This comes at an opportune moment with favorable conditions for undervalued industries characterized by robust intrinsic value, such as energy, industrial, and materials sectors, drawing substantial investment attention. The Cleveland-Cliffs incidence casting a light on U.S. Steel generated vigorous market movement, exemplified by a stock value increase signaling a prelude to a projected industry-wide mergence and acquisition trend.

This nascent investor zeal towards recognizing latent value across a range of undervalued equities is propelling a redistribution of market dynamics, possibly leading to an inclusive industry growth movement. Wary of the allure of low P/E ratios, given the increasing costs arising from interest rate hikes, investors remain vigilant. This market behavior, especially in light of the Nippon Steel and U.S. Steel agreement, embodies the market's proclivity for reevaluation and ultimate expansion in sectors poised for infrastructure investment and industrial manufacturing resurgence.

In the wake of initial acquisition dialogues led by Cleveland-Cliffs, U.S. Steel has been catapulted into a speculative sizzle within the mergers and acquisitions arena. Offers exceeding the $40 barrier represent substantial premiums and reflect the surge of interest from multiple industry magnates including ArcelorMittal, Nucor Corporation, and Steel Dynamics. With such diverse interest, U.S. Steels rich asset value and profitability prospects become apparent.

Despite the recent surge, U.S. Steel's constructive financial report from the third-quarter 2023 earnings call set these events in motion. A healthy balance sheet, strong liquidity, consistent operational performance, and shedding light on successful strategic projects, such as the NGO electrical steel line, became a beacon for potential acquirers, anticipating a significant shift in the company's financial stature as strategic investments start bearing fruit. With this strategic review underway, shareholders are afforded a worthwhile consideration, potentially leading to transformative changes in shareholder value.

Amidst this flurry of activity, U.S. Steel finds itself at a critical junction where investors must ponder cyclical risks, the potential windfall from advanced technological investments, and the uncertainties seeded by heightened acquisition activity. These factors coalesce into a complex scenario whereby U.S. Steel navigates through a transformative epoch, wrestled by economic cycles and potential change of ownership.

This heightened interest in U.S. Steel is underscored by its transition to more cost-efficient, flexible mini-mill operations. With this technology soon operational and contributing positively to the company's cash flow, U.S. Steel stands on the cusp of a material shift that could rewrite its financial narrative. This strategic edge is precisely what might have underlined the allure for other industry titans, setting off a domino effect of bidding interest.

However, for the investor, the scenario is decidedly more nuanced. The sharp increase in U.S. Steel's share price has imbued a speculative cast over its true intrinsic value, raising questions about the investment potential from this juncture forward. With market participants weighing their options between immediate gains and an uncertain yet promising future, the course appears fraught with potential shifts contingent upon the outcomes of the acquisition soap opera.

All things considered, the developments in and around U.S. Steel present a captivating case study of corporate intrigue. Investors and shareholders alike find themselves at an inflection point, where the strategic steer of the company could herald a new age for an enduring titan of industry or recast it under the auspices of a global powerhouse. An anxious market now watches on, as the pieces of U.S. Steel's fate move inexorably across the corporate chessboard.

Similar Companies in Steel:

Report: Nucor Corporation (NUE), Nucor Corporation (NUE), Report: ArcelorMittal (MT), ArcelorMittal (MT), Report: Steel Dynamics, Inc. (STLD), Steel Dynamics, Inc. (STLD), Report: Commercial Metals Company (CMC), Commercial Metals Company (CMC), Report: Cleveland-Cliffs Inc. (CLF), Cleveland-Cliffs Inc. (CLF), Carpenter Technology Corporation (CRS), Report: Reliance Steel & Aluminum Co. (RS), Reliance Steel & Aluminum Co. (RS), Allegheny Technologies Incorporated (ATI), TimkenSteel Corporation (TMST), Report: Olympic Steel, Inc. (ZEUS), Olympic Steel, Inc. (ZEUS)

News Links:

https://seekingalpha.com/article/4658644-naval-task-force-japanese-takeover

https://www.fool.com/investing/2023/12/18/why-united-states-steel-stock-soared-today/

https://www.fool.com/investing/2023/12/18/how-a-weekend-steel-deal-could-fuel-a-2024-bull-ma/

https://www.fool.com/investing/2023/11/09/3-things-you-need-to-know-if-you-buy-united-states/

https://www.fool.com/investing/2023/11/09/this-industrial-stock-is-finally-ready-to-shine-is/

https://www.fool.com/investing/2023/10/24/us-steel-stock-up-40-on-possible-acquisition-is-th/

Copyright © 2023 Tiny Computers (email@tinycomputers.io)

Report ID: H3Vktx