United States Steel Corporation (ticker: X)

2024-01-06

United States Steel Corporation, commonly referred to as U.S. Steel and represented by the ticker symbol X on the New York Stock Exchange, is an integrated steel producer with a storied history in the American industrial landscape. Founded in 1901 by business magnates including J.P. Morgan and Elbert H. Gary, the company played a crucial role in the development of the steel industry during the 20th century. U.S. Steel operates with a diverse steelmaking and finishing portfolio, producing a range of steel sheet, plate, and tubular products for a variety of sectors, including automotive, construction, and energy. With a commitment to innovation and sustainability, U.S. Steel is actively involved in modernizing its operations and has been investing in more efficient and environmentally friendly technologies. This legacy company has faced various market challenges, including globalization and competition from emerging markets, yet remains a significant player in the steel industry, adapting through restructuring and strategic initiatives to strengthen its market position in an ever-evolving economic landscape.

United States Steel Corporation, commonly referred to as U.S. Steel and represented by the ticker symbol X on the New York Stock Exchange, is an integrated steel producer with a storied history in the American industrial landscape. Founded in 1901 by business magnates including J.P. Morgan and Elbert H. Gary, the company played a crucial role in the development of the steel industry during the 20th century. U.S. Steel operates with a diverse steelmaking and finishing portfolio, producing a range of steel sheet, plate, and tubular products for a variety of sectors, including automotive, construction, and energy. With a commitment to innovation and sustainability, U.S. Steel is actively involved in modernizing its operations and has been investing in more efficient and environmentally friendly technologies. This legacy company has faced various market challenges, including globalization and competition from emerging markets, yet remains a significant player in the steel industry, adapting through restructuring and strategic initiatives to strengthen its market position in an ever-evolving economic landscape.

| Address | 600 Grant Street | City | Pittsburgh | State | PA |

| Zip | 15219-2800 | Country | United States | Phone | 412 433 1121 |

| Website | https://www.ussteel.com | Industry | Steel | Sector | Basic Materials |

| Full-Time Employees | 22,740 | Dividend Rate | 0.2 | Dividend Yield | 0.41% |

| Payout Ratio | 4.31% | Five Year Avg Dividend Yield | 0.89% | Beta | 2.072 |

| Trailing PE | 10.42 | Forward PE | 15.35 | Volume | 3,987,126 |

| Average Volume | 6,676,470 | Average Volume (10 days) | 5,066,190 | Bid | 48.31 |

| Ask | 48.25 | Bid Size | 800 | Ask Size | 900 |

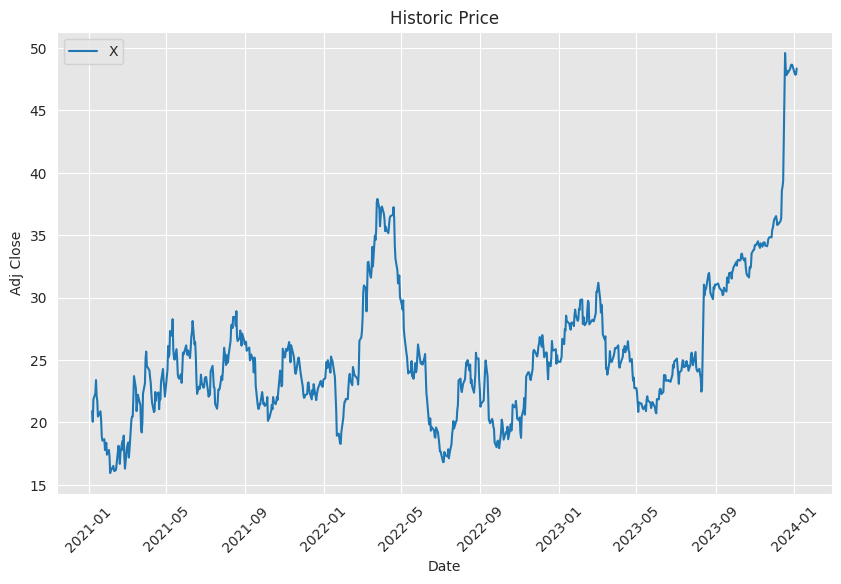

| Market Cap | $10,788,577,280 | 52 Week Low | 20.4 | 52 Week High | 50.2 |

| Price to Sales (TTM) | 0.5913 | Fifty Day Average | 38.5108 | Two Hundred Day Average | 29.4874 |

| Trailing Annual Dividend Rate | 0.2 | Trailing Annual Dividend Yield | 0.4175% | Currency | USD |

| Enterprise Value | $12,005,911,552 | Profit Margins | 6.297% | Float Shares | 221,156,055 |

| Shares Outstanding | 223,135,008 | Shares Short | 11,790,115 | Held Percent Insiders | 1.191% |

| Held Percent Institutions | 80.687% | Short Ratio | 2.06 | Short Percent Of Float | 5.280% |

| Book Value | 49.339 | Price to Book | 0.9799 | Earnings Quarterly Growth | -39.0% |

| Net Income To Common | $1,148,999,936 | Trailing EPS | 4.64 | Forward EPS | 3.15 |

| PEG Ratio | 1.39 | Enterprise To Revenue | 0.658 | Enterprise To EBITDA | 5.579 |

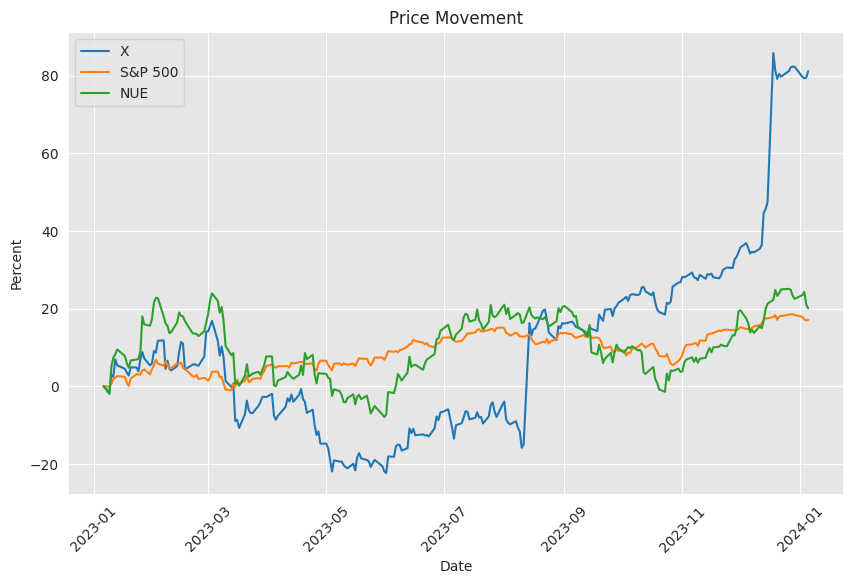

| 52 Week Change | 82.6596% | S&P 52 Week Change | 20.6868% | Total Cash | $3,222,000,128 |

| Total Cash Per Share | 14.446 | EBITDA | $2,152,000,000 | Total Debt | $4,351,000,064 |

| Quick Ratio | 1.253 | Current Ratio | 1.946 | Total Revenue | $18,247,000,064 |

| Debt To Equity | 39.209 | Revenue Per Share | 80.354 | Return On Assets | 3.965% |

| Return On Equity | 10.626% | Gross Profits | $4,353,000,000 | Free Cashflow | -$393,000,000 |

| Operating Cashflow | $2,465,999,872 | Earnings Growth | -35.5% | Revenue Growth | -14.8% |

| Gross Margins | 13.295% | EBITDA Margins | 11.794% | Operating Margins | 6.455% |

Based on the technical analysis, we observe several key indicators that will influence our projection of stock price movement over the next few months:

Based on the technical analysis, we observe several key indicators that will influence our projection of stock price movement over the next few months:

- Parabolic SAR (PSAR) The latest data shows a clear switch from an upward to a downward trend, indicating possible bearish sentiment ahead.

- On-Balance Volume (OBV) There has been a gradual increase in OBV, which may suggest growing interest and possible accumulation by investors.

- Moving Average Convergence Divergence (MACD) The histogram showing a decline from positive to negative values may imply a loss of bullish momentum and potential crossover to bearish territory.

Fundamentally, the company shows differing results over the past three years:

- EBITDA has decreased compared to the previous year, suggesting a potential weakening in operational efficiency or declining revenues.

- A noticeable decrease in net debt is seen, indicating an improvement in the companys financial standing and potential reduction in financial risk.

- The free cash flow is lower than the previous year but still positive, supporting the company's ability to fund its operations and invest in growth.

- Although total revenue has increased, there is a concern around the gross profit and EBIT margins, which have shown a contraction.

The balance sheet points to an improvement in liquidity with a considerable increase in cash and equivalents. The reduction in the total debt is another positive sign for the stability of the company.

Considering the technical indicators and the fundamentals, a nuanced picture emerges. On one hand, technicals hint at potential short-term weakness in stock price movement, reflecting the recent trend reversal on the PSAR and the bearish signals from the MACD. Yet, the solid growth in OBV could be indicating a more supportive or bullish longer-term outlook as accumulation takes place.

Fundamentals offer both strengths and weaknesses; the reduction in debt and strong cash position may provide some cushion in the stock price, reflecting improved financial health and liquidity. In contrast, decreasing EBITDA and margin pressures might weigh on investor sentiment and limit upside potential.

In summary, the next few months could see volatility in the stock price, with possible bearish trends in the short term based on technical analysis. However, if investors focus on the improved balance sheet and liquidity profile, coupled with a longer-term perspective indicated by the positive OBV trend, there might be support for the stock price in the longer term.changes It is evident that market participants will have to carefully weigh the immediate technical signals against the underlying financial improvements, paying close attention to upcoming quarterly reports and market conditions that could affect sentiment and, subsequently, price action.

The linear regression model exploring the relationship between the variable X and SPY, an exchange-traded fund that mirrors the S&P 500 index, indicates a moderate degree of explanatory power during the training phase but less so in the out-of-sample testing phase. The r-squared (R2) values of 0.361148 and 0.29703 for the training and test scores, respectively, suggest that the model fits the training data reasonably well, explaining about 36.1% of the variance, whereas its predictive power drops to explaining nearly 29.7% of the variance in the test data. These values, however, are notably higher than the prior score R2 of 0.134227, which may indicate that the model has learned some patterns from the training data that did not entirely generalize to unseen data.

Alpha, commonly referred to as the intercept in a regression model, represents the expected value of the dependent variable (in this case, SPY) when all the independent variables (X in the model) are set to zero. The posterior distribution of alpha in the model has a range across draws from the model's predictive simulations, indicating variability in its estimation. Since alpha captures the average effect on SPY that is not explained by X, the observed distribution suggests heterogeneity in this unexplained component of the model. The statistical output provides us with insights into alpha's uncertainty, as evident by the range of values obtained through different simulation draws, illustrating the inherent stochastic nature of financial time series data and the challenges in accurately modeling and predicting market returns.

United States Steel Corporation (X), one of the leading integrated steel producers, filed its 10-Q form with the SEC for the quarter ended September 30, 2023. The financial summary demonstrates both the resilience and challenges faced by the company in a dynamic market environment. In the quarter, U. S. Steel reported net sales of approximately $4.4 billion, a decrease from the $5.2 billion reported in the corresponding quarter of the previous year. Earnings before interest and income taxes (EBIT) for the quarter stood at $277 million which was a decline from the $614 million reported in Q3 of the prior year.

The company categorizes its operations into four major reportable segments: North American Flat-Rolled (Flat-Rolled), Mini Mill, U. S. Steel Europe (USSE), and Tubular Products (Tubular). The revenue mix and profitability across these segments vary, with a noteworthy performance in the Flat-Rolled and Tubular segments, indicating a strategic emphasis on these areas. The Flat-Rolled segment fetched the highest net sales at approximately $2.7 billion, followed by the Mini Mill and USSE segments.

The company's detailed inventory analysis reveals that as of September 30, 2023, inventories amounted to approximately $2.3 billion with raw materials and semi-finished products dominating the inventory mix. United States Steel Corporation uses different inventory accounting methods across its segments, including Last-In, First-Out (LIFO), predominantly for Flat-Rolled and Tubular segments, and First-In, First-Out (FIFO) for other segments.

For the quarter, U. S. Steel's comprehensive income, including noncontrolling interest, was reported at $299 million, reflecting both net earnings and other comprehensive income (loss). The company also addresses various financial strategies, including employing derivative instruments like foreign exchange forwards and commodity purchase swaps to manage currency and commodity price risks. Furthermore, United States Steel Corporation has a robust capital structure with various forms of debt across different maturities, including Senior Notes, Senior Convertible Notes, Credit Agreements, and Revenue Bonds, ensuring liquidity and financial flexibility.

The company's tax provision for the nine months ended September 30, 2023, was $237 million, impacted by various factors such as the recent filing of the 2022 federal income tax return and adjustments of prior years federal income taxes. This represents a significant decrease from the tax provision of $684 million recorded in the same period of the previous year.

Lastly, the company's stock-based compensation plans are highlighted with recent grants under the 2016 Omnibus Incentive Compensation Plan mentioned. U. S. Steel recognized $37 million in stock-based compensation expense within the first nine months of 2023. Earnings per share (EPS) for the third quarter stood at $1.20 on a diluted basis, a decrease from the $1.85 in the same quarter last year. The decrease in EPS reflects the challenging conditions and the impact of various strategic and operational decisions made by the company.

The United States Steel Corporation, commonly referenced by its ticker symbol X, has experienced a noteworthy revision in the company's earnings estimates, suggesting a potential uptick in the stock's performance. Within the financial analysis community, there appears to be a consensus that the earnings outlook for the company is on an upward trajectory. This positive shift in sentiment is largely attributed to the revisions of earnings estimates from covering analysts who have expressed increasing optimism about the company's future earnings potential. Historically, empirical data supports the notion that there is a strong correlation between earnings estimate revisions and the immediate movement of stock prices.

The Zacks Rank, a stock rating system that ranges from a Zacks Rank #1 (Strong Buy) to a Zacks Rank #5 (Strong Sell), relies heavily on earnings estimate revisions to assess the performance potential of stocks. Notably, U.S. Steel has been conferred a Zacks Rank #1 (Strong Buy), indicating robust growth prospects as per the Zacks model. The positive Zacks Rank is primarily due to a harmonious view amongst analysts who have collectively raised earnings expectations for both the next quarter and the full fiscal year.

For the forthcoming quarter, expectations have been set at $0.20 per share, which marks a year-over-year decline of 77.01%. Nonetheless, the Zacks Consensus Estimate has recently increased by 18.53% over the last 30 days driven by upward revisions. Similarly, for the entire year, estimates suggest that U.S. Steel is projected to earn $4.34 per share, down 56.38% from the previous year. However, the consensus estimate has seen an upward correction of 7.43%, due to positive revisions without any countering downward adjustments.

The analysts' bullish outlook reinforced by the favorable Zacks Rank has already begun to stir investor interest, propelling the stock by 32.5% over the past four weeks. This surge reflects the market's response to the encouraging revisions in earnings estimates. Given the present data, there may still be potential for additional gains, which presents an opportunity for investors to consider U.S. Steel as a worthy addition to their investment portfolios.

Data indicates that Zacks #1 and #2 ranked stocks tend to outperform the S&P 500 significantly, suggesting the importance of such ranks in investment decision-making strategies. With U.S. Steel's current position and the momentum generated from analyst expectations, the company's stock may continue on a trajectory of growth, thereby appearing as an attractive candidate for future investment consideration.

In an analysis of the steel sector's investment potential, we turn our focus to the United States Steel Corporation and the broader market landscape as we step into 2024. The industry has caught the eye of investors due to various factors, including company valuations and growth prospects.

United States Steel Corporation drew significant attention in the previous year due to a takeover bid by Nippon Steel, which underscored the value proposition of the American steel industry. The event places a spotlight on the sector, prompting investors to closely examine other steel stocks as potential bargain buys.

The Motley Fool, a respected financial advisory resource, identifies Steel Dynamics, Olympic Steel, and Ferroglobe as steel stocks worth watching. Each of these companies is characterized by free cash flow generation, low to moderate debt levels, and enticing valuations in terms of P/E (price-to-earnings) and P/FCF (price-to-free-cash-flow) ratios.

Steel Dynamics, in particular, is noted for its large market capitalization, relative to U.S. Steel, and its lower P/E ratio. The company boasts an impressive past 12 months of free cash flow generation. Forward-looking estimates suggest Steel Dynamics could maintain a robust annual earnings growth rate.

Olympic Steel, a specialist in processing and distributing steel products, reports substantial free cash flow significantly exceeding its net profits. Its advantaged P/FCF ratio coupled with high projected growth rates positions it as an appealing investment target.

Ferroglobe operates within the specialty metals segment, producing silicon-based chemicals for various steel alloys. With a solid record of profit and free cash flow, it maintains a moderate valuation and offers compelling financial metrics for risk-averse investors.

Prevailing market conditions and the recent performance of these steel companies provide a potentially lucrative opportunity for value investors. A thorough evaluation suggests that these stocks could indeed be undervalued, making them worth consideration in 2024's investment strategies.

The recent soaring of United States Steel Corporation's (U.S. Steel) stock can be directly attributed to Nippon Steel Corporation's announcement on December 18, 2023, of an acquisition agreement. The acquisition is notable for the price per share offered - $55 in cash, which is a significant premium over the market price at the announcement time - but also for the industry implications, potentially becoming the "best steelmaker with world-leading capabilities."

The market reacted favorably to the news, with U.S. Steel's stock price jumping by 26% on the announcement day. The valuation and resulting stock price increase reflect a roughly 40% premium from the closing price leading up to the weekend before the acquisition news broke.

Strategically, this acquisition was the culmination of a process that began in August 2023, when U.S. Steel started to explore strategic alternatives following several unsolicited takeover proposals. Eventually, the decision was made to accept Nippon Steel's comprehensive offer, which had favorable terms for U.S. Steel's shareholders.

The acquisition has successfully passed through approval by the boards of directors of both companies. However, the deal is still subject to the go-ahead from U.S. Steel's shareholders and regulatory authorities. Nippon Steel intends to finance the acquisition through loans from Japanese financial institutions, with commitments for the necessary funds already in place.

Should the acquisition proceed as planned, the completion is expected to occur sometime in the second or third quarter of 2024. U.S. Steel will maintain its brand and headquarters in Pittsburgh, Pennsylvania, and honor the collective bargaining agreements with the United Steelworkers Union.

U.S. Steel's shareholders face a decision regarding their investments. They may engage in merger arbitrage, benefiting from the acquisition's completion when they will receive $55 per share in cash. Alternatively, shareholders might choose to capitalize on the recent stock appreciation by selling their shares now.

This acquisition underscores a continued trend of consolidation in the global steel industry, striving to create more operationally and financially efficient units capable of weathering market volatilities and economic shifts. The merger presents an opportunity to combine strengths, create efficiencies, and contend for a leadership position within the global steel market.

In light of recent developments concerning United States Steel Corporation (NYSE: X), there has been a significant shift within the steel industry, which warrants a closer examination. Nippon Steel has executed a substantial acquisition of U.S. Steel, marking a pivotal transaction within this $1.6 trillion market. The purchase at an impressive premium indicates Nippon Steel's strategic vision and confidence in the future of the U.S. steel sector.

U.S. Steel, historically influential within the American industry, has been navigating a dynamic market. The recent surge is partly attributable to the announcement of Nippon Steel's acquisition, prompting investors to consider whether other steel producers, such as Nucor (NUE), Cleveland-Cliffs (CLF), Steel Dynamics (STLD), and Ternium (TX), could be viable investment targets in the wake of this deal.

The market's response to this acquisition has been noteworthy, with U.S. Steel's stock experiencing a slight downturn typical of the industrys response to major consolidation moves and market news.

The steel industry is crucial to the national and global infrastructure economy, serving as the backbone for construction, automotive manufacturing, and various other industrial sectors. The entrance of Nippon Steel into the U.S. market has implications for competitive dynamics, pricing, supply chains, and future investments in the sector.

Analysts and contributors at Motley Fool have varying positions within the steel industry, including holdings in Steel Dynamics, Cleveland-Cliffs, Nucor, and Ternium. This diversity underscores the multifaceted industry and the different investment strategies employed to navigate it. As the industry responds to this significant acquisition, investment decisions will be shaped by company performance, market trends, and strategic movements by industry players.

While the acquisition of U.S. Steel by Nippon Steel signals confidence in the U.S. steel industry, it also emphasizes the inherent uncertainties within this sector. Investors are encouraged to conduct thorough research and analysis when considering engaging with this market, especially in light of this transformational deal.

United States Steel Corporation is at the center of a significant business deal with broader implications for the steel industry, potentially catalyzing a bull market in 2024. Nippon Steel's agreement to purchase U.S. Steel following U.S. Steel's exploration of strategic alternatives for its business operations illustrates this point.

The acquisition, an all-cash transaction estimated at $14.1 billion, and the substantial premium contributed to the pre-market stock price surge of 29%, indicative of investor enthusiasm. Nippon Steel's strategic acquisition is seen as a diversification effort to forge a more extensive global presence, reinforcing production capabilities, and moving closer to producing up to 100 million metric tons of crude steel worldwide.

The broader stock market has been performing well, with indices like the Dow Jones Industrial Average hitting new record highs. Despite this, there remained a notable divergence in stock valuations. Many of the undervalued stocks come from sectors like energy, industrials, and materials, which could be prime targets for mergers and acquisitions.

This strategic acquisition indicates an opportunity for firms with intrinsic value, indicated by low P/E ratios, to buyers. Companies such as Ford and General Motors, ExxonMobil, and Shell exhibit single-digit P/E ratios, suggesting they may be undervalued. However, the validity of P/E ratios as an evaluation metric is debated, especially for leveraged firms in an environment of rising interest rates.

Speculation around companies like DocuSign may help the market realize the hidden value in undervalued stocks. A new trend towards these stocks could fuel momentum for a bull market in 2024. A shift towards undervalued sectors would benefit a broader investor base.

The anticipation of increased merger and acquisition activity exemplified by the Nippon and U.S. Steel deal signals a potential lift for the stock market. The prospect of more firms undertaking strategic buyouts could bring renewed investor focus to these sectors, possibly igniting a bull market in the year ahead.

United States Steel Corporation, referred to as "X" on stock tickers, has recently been highlighted as a potential momentum stock. Momentum investing involves capitalizing on existing trends in a stock's price, with the belief of purchasing stocks on an upward trajectory.

A key tool for such momentum is the Zacks Momentum Style Score, part of the Zacks Style Scores system. This score assesses price changes and earnings estimate revisions, with United States Steel achieving a Momentum Style Score of A, indicating its robust performance.

The bullish case for United States Steel is further supported by its Zacks Rank #1, categorized as a Strong Buy. Stocks with Zacks Rank #1 or #2, combined with Style Scores of A or B, typically outperform the market. This makes United States Steel an attractive option for momentum-driven returns.

Evaluating United States Steel's performance, the company's stock has outperformed its industry peers and the market over various time frames, experiencing growth at a significantly faster pace. Liquidity and investor interest are also evident in the stock's average trading volume, underscoring healthy interest and potential positive investor sentiment.

Moreover, the outlook based on earnings estimates is optimistic. In the past two months, there have been upward revisions to earnings estimates for the full year. These revisions not only signal confidence in the company's financial performance but also contribute to the strong momentum score and Zacks Rank.

In recent developments, Nippon Steel has shown confidence in finalizing the acquisition of United States Steel Corporation. The proposed deal has faced challenges, with domestic opposition in the United States. The United Steelworkers union, representing a significant workforce, has expressed apprehension regarding the takeover.

Nippon Steel's president remains positive that the acquisition would not harm the United States but instead align with economic security strategies. The company intends to integrate sophisticated steel-making technologies within the U.S. industry, which could enhance competitive capabilities.

Despite challenges, including scrutiny from government agencies, Nippon Steel is prepared to navigate through the regulatory landscape. The U.S. Steel stock has indicated a slight increase in share price post-announcement, reflecting mixed market reactions. Navigating through political, labor, and regulatory challenges, Nippon Steel aims to reshape the American steel industry in the years to come.

The United States Steel Corporation found itself at the epicenter of significant market movement in December 2023. Japan's Nippon Steel agreed to acquire U.S. Steel for $14.9 billion, representing a substantial premium over U.S. Steel's share price. The all-cash deal resulted in a significant rise in U.S. Steel's stock price, drawing immediate responses from unions and political figures.

With corporate shakeups, international naval task force formation aimed at protecting commercial vessels in the Red Sea has occurred. This move is pivotal in safeguarding a significant fraction of world trade at risk from Houthi attacks.

The overall market sentiment has been positive, with U.S. stocks ending higher ahead of the Christmas weekend, influenced by favorable economic data. Major U.S. indexes showed modest gains, reflecting confidence in the downward trend of inflation and speculations of lowering interest rates in 2024.

Other market movements include a halt in U.S. sales of Apple Watch models amid patent disputes and warnings from Nike of a difficult retail environment. These events, combined with the upcoming acquisition of U.S. Steel, contribute to the market's perception of the future trajectory.

Zacks Equity Research has highlighted the potential of Basic Materials stocks, with United States Steel Corporation standing out due to its promising outlook. The company holds a Zacks Rank #1, demonstrating strong potential for outperformance. As the earnings report release date nears, United States Steel Corporation's Most Accurate Estimate diverges from the Zacks Consensus Estimate, providing an Earnings ESP of 42.5%, a key metric for investors.

Another stock, International Paper, with a Zacks Rank #2, also shows a positive Earnings ESP figure, suggesting a robust chance that both companies will surpass analyst earnings predictions. These positive trends, reflected in increased share prices, suggest a growing investor interest in the Basic Materials sector.

The United States Steel Corporation's acquisition by Nippon Steel and the formation of a naval task force are among the significant market events. Additionally, Google's settlement in an antitrust lawsuit highlights the scrutiny tech companies face. These developments signal market shifts, with U.S. Steel's acquisition altering the American steel industry's landscape and reflecting international industrial consolidation and national security considerations. The naval task force's formation emphasizes ongoing security challenges. In contrast, the Google settlement demonstrates the legal challenges major tech companies face.

Similar Companies in Steel:

Report: Nucor Corporation (NUE), Nucor Corporation (NUE), Report: Steel Dynamics, Inc. (STLD), Steel Dynamics, Inc. (STLD), Report: ArcelorMittal (MT), ArcelorMittal (MT), Report: Commercial Metals Company (CMC), Commercial Metals Company (CMC), Report: Cleveland-Cliffs Inc. (CLF), Cleveland-Cliffs Inc. (CLF), Report: Reliance Steel & Aluminum Co. (RS), Reliance Steel & Aluminum Co. (RS), Carpenter Technology Corporation (CRS), Allegheny Technologies Incorporated (ATI), TimkenSteel Corporation (TMST), Report: Olympic Steel, Inc. (ZEUS), Olympic Steel, Inc. (ZEUS)

News Links:

https://www.fool.com/investing/2023/12/18/how-a-weekend-steel-deal-could-fuel-a-2024-bull-ma/

https://finance.yahoo.com/news/u-steel-x-run-higher-172003788.html

https://www.fool.com/investing/2023/12/22/huge-acquisition-in-this-16-trillion-market-time-t/

https://finance.yahoo.com/news/united-states-steel-x-great-170005906.html

https://www.fool.com/investing/2024/01/02/3-bargain-steel-stocks-to-buy-in-2024/

https://www.fool.com/investing/2023/12/18/why-united-states-steel-stock-soared-today/

https://finance.yahoo.com/news/nippon-steel-confident-completing-us-114451770.html

https://seekingalpha.com/article/4659385-wall-street-breakfast-what-moved-markets

https://finance.yahoo.com/news/boost-portfolio-top-basic-materials-140006923.html

https://seekingalpha.com/article/4658644-naval-task-force-japanese-takeover

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: MenZyq