Zions Bancorporation, National Association (ticker: ZION)

2024-02-16

Zions Bancorporation, National Association, traded under the ticker symbol ZION, stands as a noteworthy entity within the financial sector, specifically focusing on banking and financial services. Established with roots that trace back to the early history of banking in the American West, it has evolved through time to serve a broad spectrum of financial needs ranging from personal banking to corporate financing. The organization operates primarily within the United States, offering a comprehensive array of products and services that include but are not limited to, checking and savings accounts, wealth management, mortgage services, and business loans. As a part of its growth strategy, Zions has focused on expanding its digital banking capabilities to cater to the increasing demand for online financial services, ensuring competitiveness in a rapidly evolving banking landscape. Notably, Zions Bancorporation has been recognized for its commitment to community banking and local economic development, which manifests through its active participation in community service and lending programs designed to support small businesses and promote economic growth in the regions it serves. Investors and stakeholders monitor ZION closely, as its performance not only offers insights into the company's health but also reflects broader economic trends within the banking industry and the U.S. economy at large.

Zions Bancorporation, National Association, traded under the ticker symbol ZION, stands as a noteworthy entity within the financial sector, specifically focusing on banking and financial services. Established with roots that trace back to the early history of banking in the American West, it has evolved through time to serve a broad spectrum of financial needs ranging from personal banking to corporate financing. The organization operates primarily within the United States, offering a comprehensive array of products and services that include but are not limited to, checking and savings accounts, wealth management, mortgage services, and business loans. As a part of its growth strategy, Zions has focused on expanding its digital banking capabilities to cater to the increasing demand for online financial services, ensuring competitiveness in a rapidly evolving banking landscape. Notably, Zions Bancorporation has been recognized for its commitment to community banking and local economic development, which manifests through its active participation in community service and lending programs designed to support small businesses and promote economic growth in the regions it serves. Investors and stakeholders monitor ZION closely, as its performance not only offers insights into the company's health but also reflects broader economic trends within the banking industry and the U.S. economy at large.

| Full Time Employees | 9,679 | Dividend Rate | 1.64 | Dividend Yield | 0.0406 |

| Payout Ratio | 0.377 | Beta | 1.149 | Trailing PE | 9.5448 |

| Forward PE | 8.9483 | Volume | 2,642,054 | Market Cap | $6,151,312,384 |

| 52 Week Low | 18.26 | 52 Week High | 51.54 | Price to Sales Trailing 12 Months | 1.9959 |

| Enterprise Value | $9,745,174,528 | Profit Margins | 0.2719 | Shares Outstanding | 148,152,992 |

| Book Value | 32.907 | Price to Book | 1.2617 | Net Income To Common | $801,000,000 |

| Trailing EPS | 4.35 | Forward EPS | 4.64 | Total Cash | $3,188,999,936 |

| Total Debt | $6,505,999,872 | Total Revenue | $3,081,999,872 | Return On Assets | 0.00954 |

| Return On Equity | 0.16742 | Operating Cash Flow | $1,624,000,000 | Operating Margins | 0.2052 |

| Statistic Name | Statistic Value | Statistic Name | Statistic Value |

| Sharpe Ratio | 0.0176954714977217 | Sortino Ratio | 0.2673713685579183 |

| Treynor Ratio | 0.00474109666087031 | Calmar Ratio | -0.24460508385543894 |

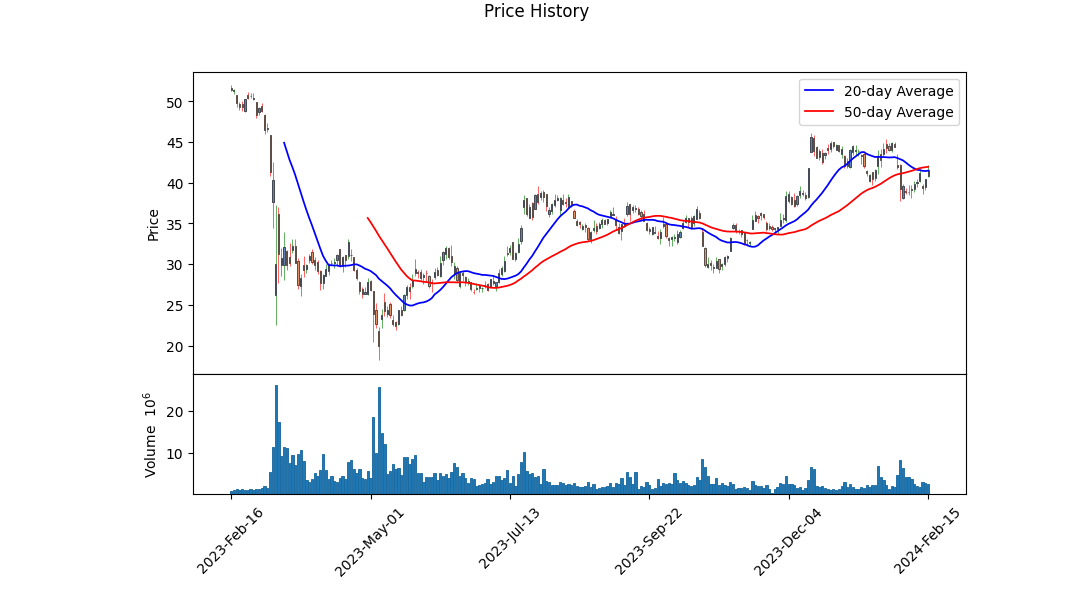

Analyzing ZION's last trading day technical data, the stock exhibited a bullish trend, as indicated by its closing at a higher price than its opening on the last day logged, with an upward movement in the On Balance Volume (OBV) and an improvement in the Moving Average Convergence Divergence (MACD) histogram over time. The rising OBV suggests increased buying pressure, while the ascending MACD histogram, moving towards positive territory, indicates strengthening bullish momentum despite the recent negative value. The consistent rise in stock prices from an open of 29.51 to a close of 40.84 over the observed period reinforces a positive momentum outlook.

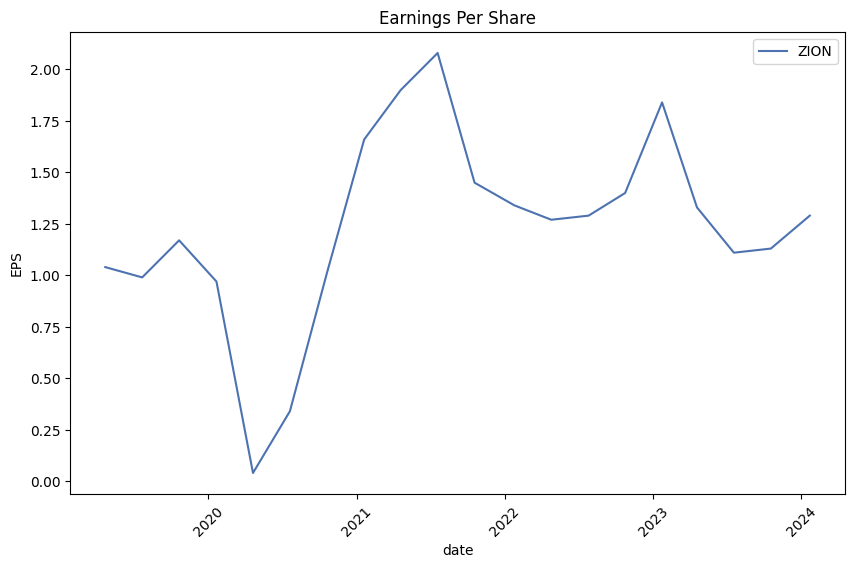

The fundamentals reveal a mixed performance with a significant dive in earnings growth at -57.5% and a moderate decline in revenue growth at -11.9%. However, operating margins remain healthy at 20.52%, although the trailing peg ratio stands at a lofty 10.6725, suggesting the stock may be overvalued based on expected growth rates. Financial health is solid with ample retained earnings and a notable increase in net income, highlighting ZION's capacity to generate profits. The balance sheets are robust, showcasing a strong tangible book value and a substantial capital base, despite a sizeable debt load. This financial standing underscores a resilient operational framework capable of weathering market uncertainties.

Considering both technical and fundamental perspectives, ZION is poised for a favorable trajectory in the forthcoming months. The technical indicators suggest sustained bullish momentum with increasing investor interest, supported by fundamental strengths like solid operating margins and improving net income. However, the high peg ratio and the mixed performance in earnings and revenue growth signal the need for cautious optimism. Investors should consider these balanced insights against broader market conditions and ZION's strategic initiatives to navigate potential volatility.

Short-term movements are likely to favor an upward trend, riding on the current technical momentum. Yet, the fundamental analysis advises long-term investors to stay vigilant of any shifts in earnings growth and market sentiment that might impact stock performance. The financial health and strategic positioning of ZION, complemented by positive technical indicators, make it a compelling stock, but it's crucial to stay attuned to underlying market dynamics and sector-specific trends.

In our analysis of Zions Bancorporation, National Association (ZION), we have meticulously calculated key financial metrics to gauge its investment potency, particularly focusing on Return on Capital (ROC) and Earnings Yield. The ROC, which stands as a pivotal indicator of how efficiently a company can convert its capital into profits, is calculated at 1.51 for ZION. This figure, though it appears modest, signals a degree of efficiency in utilizing capital, which is essential for generating sustainable profits over time. On the other hand, the Earnings Yield for ZION is particularly notable, standing at 13.97%. This high yield indicates that the company is generating a significant amount of earnings relative to its share price, suggesting that it is potentially undervalued or that it is operating with substantial efficiency to reward its investors. These figures collectively paint ZION as a potentially attractive investment, with its robust earnings yield highlighting a promising return prospect and its ROC underscoring a competent capital utilization strategy.

| Statistic Name | Statistic Value |

| R-squared | 0.288 |

| Adj. R-squared | 0.288 |

| F-statistic | 507.9 |

| Prob (F-statistic) | 1.03e-94 |

| Log-Likelihood | -2941.6 |

| AIC | 5887. |

| BIC | 5897. |

| coef (const) | -0.0328 |

| coef (0) | 1.2133 |

| P>|t| | 0.000 |

| [0.025 | 1.108 |

| 0.975] | 1.319 |

| Omnibus | 297.814 |

| Prob(Omnibus) | 0.000 |

| Jarque-Bera (JB) | 14320.828 |

| Skew | -0.020 |

| Prob(JB) | 0.00 |

| Kurtosis | 19.536 |

| Cond. No. | 1.32 |

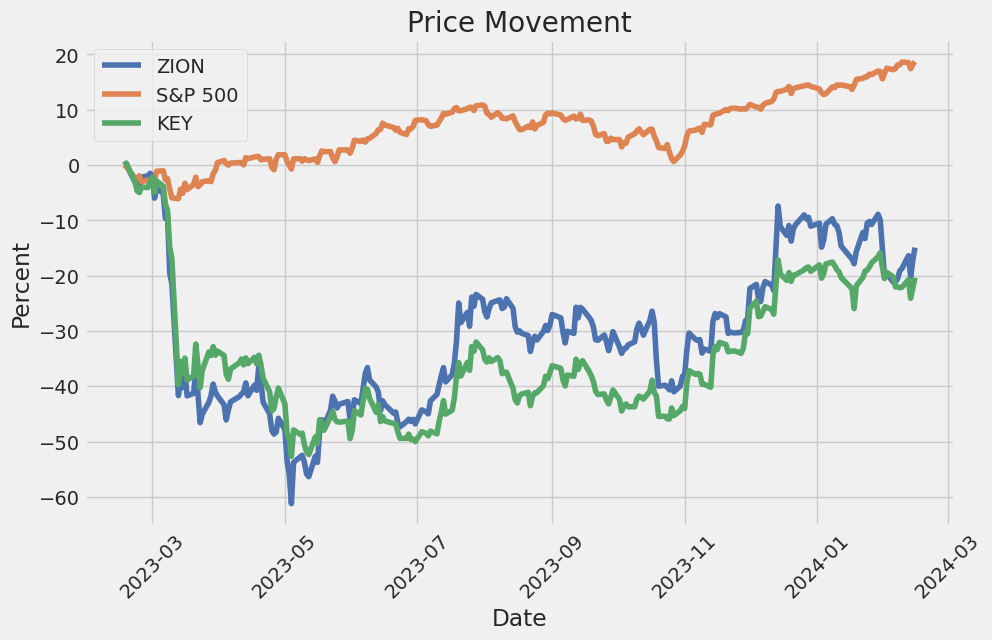

The linear regression model examining the relationship between ZION and SPY indicates a coefficient (beta) of 1.2133, suggesting a positive correlation between the movement of ZION's stock price and the SPY index, which is reflective of the market at large. A beta of more than 1 implies that ZION is more volatile in comparison to the broader market. However, the alpha value of this model, which stands at -0.0328, indicates that ZION underperforms the market by a small margin when the market is flat. Alpha is the intercept term in the regression equation and represents the expected return of ZION when the SPY return is zero. The negative value suggests that ZION may offer investors less than anticipated returns when adjusting for market movements.

Considering the statistical metrics, with an R-squared value of 0.288, the model explains approximately 28.8% of the variation in ZION's returns based on the returns of SPY. While this value shows some level of correlation between ZION and the market, it also indicates that a significant portion of ZION's price movements could be influenced by factors not accounted for by the market's movements. The F-statistic and its associated probability suggest the model is statistically significant. However, investors should interpret these findings within the broader context of their investment analysis, considering both the alpha and beta coefficients to understand ZION's performance relative to market movements and its potential risk-reward tradeoff within a diversified portfolio.

Zions Bancorporation's Q4 Earnings Conference Call for 2023 began with introductions and the usual formalities before diving into the details of their financial performance for the quarter. The corporation welcomed its new Chief Risk Officer, Chris Kyriakakis, who replaced the retiring Keith Maio. Chairman and Chief Executive Officer, Harris Simmons, highlighted the unusual circumstances of the past year, including an acceleration of deposit betas across the industry following spring events. The bank has been proactive in adjusting its balance sheet and hedging strategies to manage interest rate and liquidity risks effectively. The fourth quarter saw a stabilizing deposit mix and leveling out of deposit costs, with net interest margin and net interest income remaining stable. Despite higher concentrations of costly funding sources, the bank sees opportunities to improve revenue by reducing reliance on wholesale rates and maintaining deposit pricing discipline.

Paul Burdiss, the Chief Financial Officer, provided a thorough review of the bank's financial results, detailing components of pre-provision net revenue, net interest income, and margin trends. He also discussed the progress in deposit gathering, loan growth expectations, and the impact of the FDIC special assessments on non-interest income and expenses. Zions reported a decrease in linked-quarter diluted earnings per share due to these factors, alongside a decline in non-interest revenue contributing to a 38% year-over-year drop in pre-provision net revenue. The bank anticipates a slight increase in non-interest expenses for 2024 and moderate growth in customer-related non-interest income.

Funding sources and total funding trends were also scrutinized, showing a decline in short-term borrowings and an increase in customer deposit balances for the fourth quarter. The bank is aiming for a stable to slight increase in net interest income by the fourth quarter of 2024, compared to the same quarter in 2023. This outlook is based on managing technology and employment costs, maintaining solid regulatory capital, and a cautious approach towards the overall economic environment and potential shifts in interest rates. The bank acknowledges ongoing risks and opportunities, including the trajectory of loan growth and competition for deposits.

Credit quality at Zions remains robust, with classified loans increasing slightly and non-performing assets decreasing. The bank continues to monitor its commercial real estate portfolio closely, especially the office sector, recognizing increased levels of criticized loans but expecting the portfolio to perform well overall with limited losses. This confidence is underpinned by the bank's disciplined approach to CRE growth and its focused partnership strategy. The conversation around interest rate sensitivity highlighted the bank's balanced position, suggesting that Zions is well-positioned for net interest income growth in various rate scenarios. Overall, the call conveyed a careful optimism and strategic prudence in facing the year ahead, balancing risks with opportunities for stable financial performance.

Zions Bancorporation, National Association (ZION), in its SEC 10-Q filing dated October 31, 2023, presents a detailed account of its financial and operational performance for the third quarter of the fiscal year 2023, spanning from July 1, 2023, to September 30, 2023. The document provides comprehensive financial data, including the balance sheet, income statement, and cash flow statements, reflecting the company's financial health and performance over the reporting period.

The financial statements indicate various aspects of Zions Bancorporation's operations, focusing on its revenue streams, which include interest income from loans and securities, fees from commercial account services, card fees, retail and business banking fees, capital markets and foreign exchange fees, wealth management fees, and other customer-related fees. These are attributed across different segments of the bank, including Zions Bank, California Bank and Trust, Amegy Corporation, National Bank of Arizona, Nevada State Bank, Vectra Bank Colorado, and the Commerce Bank of Washington, alongside corporate reconciling items and eliminations.

This filing also delves into the banks asset quality, highlighting loan modifications, allowances for credit losses, and classifications of loans based on risk, such as pass, special mention, substandard, and nonaccrual. It reflects on the bank's approach to risk management, particularly through the use of diverse financial instruments like interest rate swaps and caps for both hedging and non-designated purposes, outlining their impact on financial position and performance.

Zions Bancorporation's commitment to regulatory compliance and capital adequacy is evident, providing detailed data on capital structure, including preferred and common stock movements, additional paid-in capital, retained earnings, accumulated other comprehensive income (loss), and long-term debt. These elements underscore the bank's efforts to maintain a robust capital buffer and liquidity position.

Insights on operational aspects, such as the bank's performance guarantees, standby letters of credit, and loan modification programs, including payment deferrals and interest rate adjustments, suggest a proactive approach to customer retention and financial stability. Modifications across commercial, industrial, real estate, and consumer loan portfolios illustrate adjustments to alleviate financial pressure on borrowers, reflecting the banks strategic responses to economic conditions.

Overall, the 10-Q filing for Zions Bancorporation offers a snapshot of the bank's financial health, operational achievements, and strategic initiatives, including risk management and customer engagement strategies, during a defined period of 2023. This report, encompassing a broad array of financial and non-financial data, serves as a critical tool for stakeholders to assess the bank's performance, stability, and future prospects within the dynamic banking environment.

Zions Bancorporation, National Association (ZION) has consistently been at the forefront of financial discussions, particularly when evaluated against the backdrop of its strategic decisions and market performance. The recent announcements regarding its substantial shareholder value enhancement initiatives through dividends and share repurchase programs have further solidified its standing in the financial sector. The board of directors' approval of a $35 million share repurchase program alongside the declaration of a regular quarterly dividend of $0.41 per share not only reflects the institution's robust financial health but also its bullish outlook on the stock's future performance. This aligns with Zions Bancorporation's inherent commitment to rewarding its shareholders, modulated by its operational achievements and strategic foresight.

Financial stability, as underscored by the estimated Common Equity Tier 1 (CET1) capital ratio of 10.3% and solid liquidity demonstrated through significant cash holdings, lays the groundwork for these shareholder value initiatives. Zions Bancorporations operational scale, boasting approximately $87 billion in total assets as of 2023, further manifests the institution's capability to sustain dividend payments and engage in share buybacks without compromising its growth trajectory or operational efficacy.

In evaluating the potential undervaluation of Zions Bancorporation, pertinent points emerge from the analysis provided by Zacks Equity Research, which assigns a Zacks Rank of #2 (Buy) to ZION. The focused valuation metrics, such as the Forward Price-to-Earnings (P/E) ratio and Price-to-Book (P/B) ratio, when juxtaposed with the industry averages, insinuate that Zions might be trading below its intrinsic value. This backdrop of potential market undervaluation, coupled with a solid earnings outlook, renders Zions an attractive proposition for value investors. Such an investment thesis is fortified by the institutions historical performance and its well-articulated future strategic directions that emphasize operational efficiency, risk management, and customer-centric service innovations.

Furthermore, the insider trading activities, particularly the consistent buying pattern exhibited by Harris Simmons, the Chairman, and CEO, denote a strong belief in the banks value and future performance. This sentiment is echoed within the broader context of the banking sector's challenges and operational dynamics, as elucidated through the earnings insights from similar institutions like New York Community Bancorp. The narrative around operational efficiency, risk management, and diversification of revenue streams within the sector underscores the exigency for Zions to persistently refine its operational and strategic blueprint in the face of evolving market dynamics.

The emergence of macroeconomic uncertainties, particularly the challenges faced in the U.S. commercial real estate sector as highlighted in the analysis by Telis Demos for The Wall Street Journal, presents a nuanced risk landscape for financial institutions with significant real estate exposures. For Zions Bank, navigating the intricacies of a potentially tumultuous real estate sector, especially in major U.S. cities, demands a sophisticated risk mitigation and portfolio management strategy to safeguard against localized downturns and broader economic volatilities. This is imperative for maintaining operational stability and sustaining investor confidence, especially when considered alongside the aforementioned stabilization in the broader regional banking market following a brief period of volatility.

In sum, Zions Bancorporation, through its adept management of financial health, strategic shareholder value initiatives, and an acute understanding of the broader operational challenges and opportunities, remains a compelling narrative within the banking sector. The blend of operational robustness, strategic foresight, and a nuanced approach to market dynamics and risks positions Zions Bancorporation as an intriguing entity for stakeholders across the spectrum, from value investors to customers seeking reliable banking partnerships.

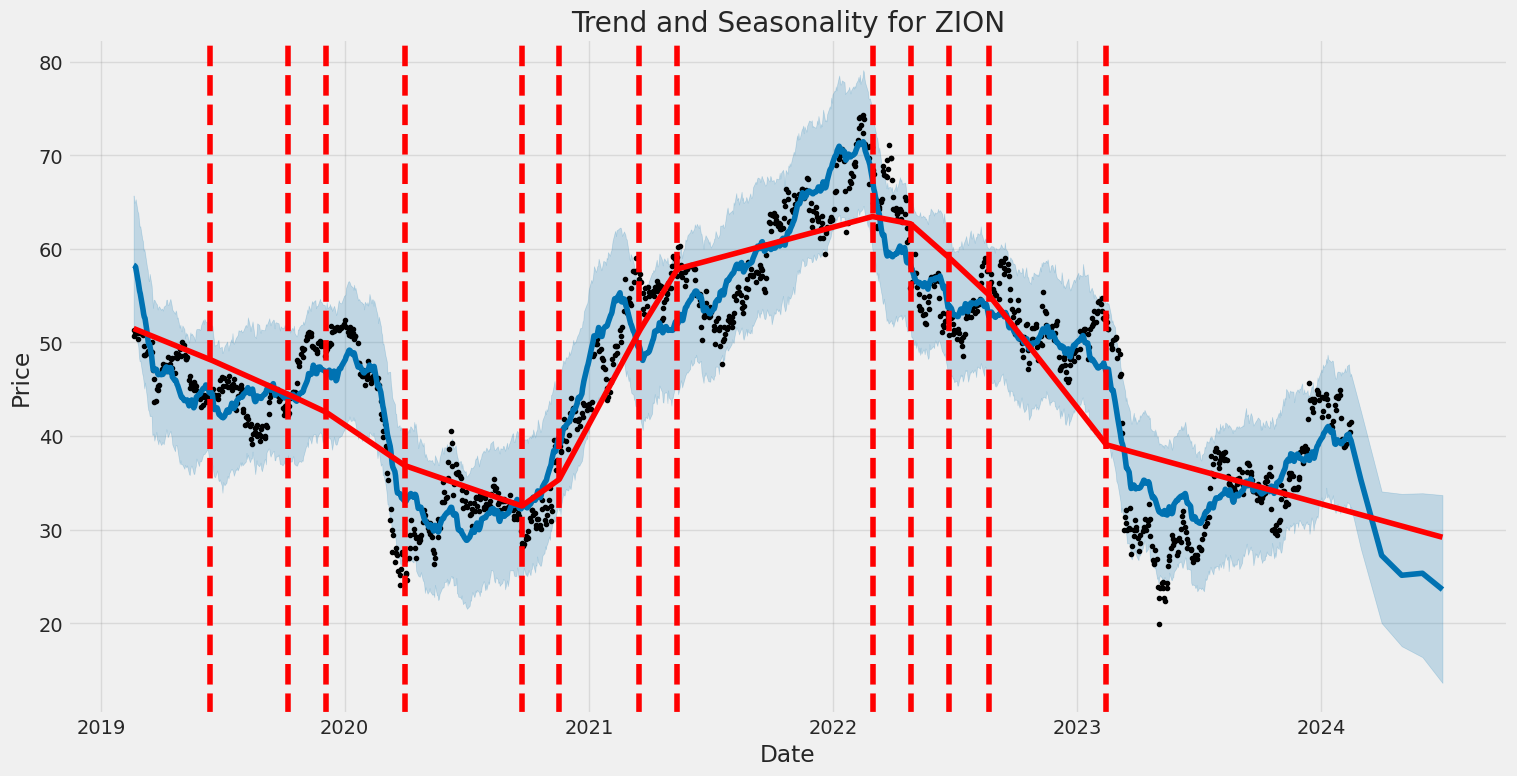

Zions Bancorporation, National Association (ZION) displayed significant volatility between February 2019 and February 2024, as evidenced by the statistical analysis of its asset returns. The ARCH model, a tool used for quantifying volatility, indicates a notable coefficient for omega at 6.4206 with a high level of statistical significance, suggesting persistent volatility over the period. The alpha[1] value at 0.3248 further confirms this volatility, indicating that past returns had a substantial impact on the future volatility of ZION's asset returns.

| Statistic Name | Statistic Value |

|---|---|

| omega | 6.4206 |

| alpha[1] | 0.3248 |

Analyzing the financial risk associated with a $10,000 investment in Zions Bancorporation, National Association (ZION) over a one-year period involves a detailed approach that combines volatility modeling and machine learning predictions. This diversified method provides a nuanced understanding of potential future scenarios by evaluating past performance trends and predicting future stock behavior.

To begin with, volatility modeling is a crucial step in assessing the stock's historical volatility. This technique enables us to estimate how much Zions Bancorporation, National Association's stock price might fluctuate over time. Specifically, this model quantifies the degree of variation in the stock price, focusing on the magnitude of price movements rather than the direction. By analyzing past price movements, it captures patterns and trends that provide insight into the level of risk associated with the stock. This information is paramount in determining the inherent market risk and aids in crafting strategies to mitigate potential losses.

In parallel, machine learning predictions play an integral role in forecasting future returns of ZION. By ingesting historical data, including stock prices, volumes, and other relevant financial metrics, the model learns from patterns and can project future stock performance. The use of a machine learning technique, which learns from past data to predict future outcomes, is especially beneficial in the dynamic and often unpredictable landscape of the stock market. This approach allows for a more informed estimation of the investment's potential growth or decline, thereby contributing to a well-rounded risk analysis.

Bringing these two analyses together, the calculated Value at Risk (VaR) for a $10,000 investment in ZION at a 95% confidence interval stands at $681.31. This VaR figure essentially means that there is a 95% chance that the investor will not lose more than $681.31 over the one-year period, under normal market conditions. It's an important metric that quantifies the financial risk and helps investors understand the maximum potential loss they might face.

In sum, the combination of volatility modeling and machine learning predictions provides a comprehensive analysis of the financial risk associated with investing $10,000 in Zions Bancorporation, National Association. By understanding both the potential volatility of ZION's stock and leveraging predictions on its future returns, investors can make more informed decisions that consider both the opportunities and risks present in the equity market. This dual-analysis approach underscores the effectiveness of integrating sophisticated financial analysis and predictive modeling techniques to gauge potential investment outcomes.

Analyzing the options chain of Zions Bancorporation, National Association (ZION) call options while targeting a stock price increase of 5% over the current price, we delve into the calculations of "the Greeks" to discern the most profitable options. Our exploration focuses on identifying the call options that offer a formidable combination of Delta, Gamma, Vega, Theta, and Rho, which are quintessential in gauging an option's sensitivity to various market factors, including the stock's price change, the passage of time, volatility, and interest rates.

A standout option in the analysis with an impending expiration date of February 23, 2024, has a strike price of $38. Returning an ROI (Return on Investment) of 2.1615819209, this option showcases a compelling Delta of 0.916134058, indicating a high likelihood that the option will move almost in tandem with the stock price, a beneficial trait for an expected price increase. Accompanied by a Gamma of 0.0562026575, it signifies that Delta's change in response to a $1 move in the stock price is reasonably moderate, providing a balance between profitability and risk as the stock price approaches the strike price. Vega stands at 0.8150146231, denoting a decent sensitivity to implied volatility changes, which could enhance the option's value if the market's volatility expectations rise.

Another notable mention with the expiration date of March 1, 2024, at a strike of $36, reflects an ROI of 0.9832898172, supported by a robust Delta of 0.8117768588. This option benefits from a fairly positive Gamma (0.0362118663) and a high Vega (2.1028873214), suggesting a good balance of responsiveness to the stock's price movement and volatility. Such characteristics make it an attractive consideration for traders expecting a modest upswing in ZION's stock price.

An intriguing long-term option expires on January 17, 2025, with a strike price of $17.5, offering a sky-high ROI of 0.9048175182. This option exhibits a perfect Delta of 0.9634227104, indicating near-full price movement capture relative to the stock, an ideal scenario for a bullish outlook. Although Gamma is zero, indicating a flat curve and Delta will not change as the underlying stock price changes, the extremely high Delta suggests confidence in the stock's upward trajectory. With no Vega or Rho listed, the primary allure here is in its Delta and ROI, positioning it as an exceptionally profitable bet if the stock rises as anticipated.

Lastly, transitioning to a longer-term perspective, the option expiring on January 16, 2026, with a strike of $27.5, merits attention for its considerable ROI (0.2120481928) and strong Delta of 0.7579823639. Coupled with a Vega of 13.9846400931, it suggests a high level of sensitivity to volatility changes, potentially amplifying gains if market volatility increases ahead of the expected rise in ZION's stock price. Gamma of 0.0067485052 indicates a slight curvature change in the Delta, providing gradual responsiveness to the stock's price evolution.

In summary, when assessing ZION call options, considerations extend beyond the immediate return potential to include the intricate balance of the Greeks. The highlighted options represent a spectrum from short-term to long-term investments, tailored to diverse market conditions and investor expectations regarding stock price movements, volatility shifts, and time decay impacts. Selecting the most profitable call options involves a strategic analysis of these factors, aligning them with the investor's risk tolerance and market outlook.

Similar Companies in BanksRegional:

KeyCorp (KEY), Comerica Incorporated (CMA), First Horizon Corporation (FHN), Western Alliance Bancorporation (WAL), Report: Fifth Third Bancorp (FITB), Fifth Third Bancorp (FITB), Report: Huntington Bancshares Incorporated (HBAN), Huntington Bancshares Incorporated (HBAN), U.S. Bancorp (USB), Report: The PNC Financial Services Group, Inc. (PNC), The PNC Financial Services Group, Inc. (PNC), Report: Wells Fargo & Company (WFC), Wells Fargo & Company (WFC), JPMorgan Chase & Co. (JPM), Report: Bank of America Corporation (BAC), Bank of America Corporation (BAC), Report: Citigroup Inc. (C), Citigroup Inc. (C), Truist Financial Corporation (TFC), Report: Regions Financial Corporation (RF), Regions Financial Corporation (RF)

https://finance.yahoo.com/news/division-ceo-anderson-sells-shares-000154851.html

https://finance.yahoo.com/m/e977c802-0f6e-34cf-b304-b06c6de8711f/why-major-u.s.-cities-are.html

https://finance.yahoo.com/m/2c4d31ca-caf2-33d0-be0e-7e3135c9561e/new-york-community-bancorp.html

https://finance.yahoo.com/news/zions-bancorporations-board-declares-dividends-201900186.html

https://finance.yahoo.com/news/zions-zion-announces-share-repurchase-145200713.html

https://finance.yahoo.com/news/chairman-ceo-harris-simmons-acquires-080848746.html

https://finance.yahoo.com/news/zions-bancorporation-national-association-nasdaq-101041101.html

https://finance.yahoo.com/news/investors-undervaluing-zions-bancorporation-zion-144011692.html

https://www.sec.gov/Archives/edgar/data/109380/000010938023000172/zions-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: jlwKpT

Cost: $0.52113

https://reports.tinycomputers.io/ZION/ZION-2024-02-16.html Home