Cleveland-Cliffs Inc. (ticker: CLF)

2025-01-25

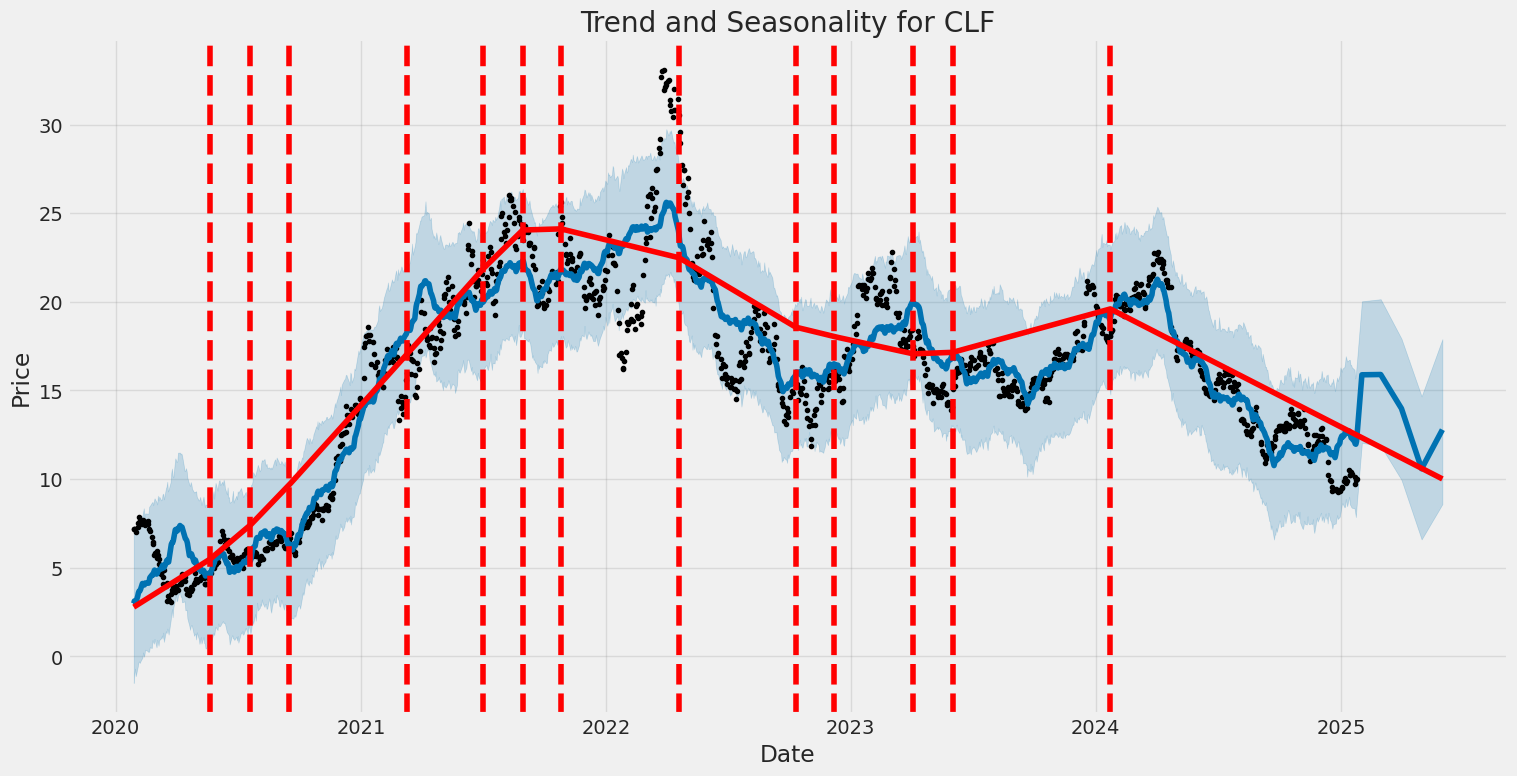

Cleveland-Cliffs Inc. (CLF) is a leading producer of flat-rolled steel and one of North America's largest suppliers of iron ore pellets. With a robust asset portfolio that includes fully integrated steelmaking operations, the company has positioned itself as a critical player in the manufacturing and automotive industries. Following its strategic acquisition of AK Steel in 2020 and ArcelorMittal USA's assets later that year, Cleveland-Cliffs enhanced its capabilities and expanded its customer base, substantially transforming its business model from a raw material supplier to a producer of end steel products. The company's commitment to sustainability is evidenced by its continuous investments in cutting-edge environmentally friendly technologies such as hydrogen-driven steel production and its focus on reducing carbon emissions across its operations. By capitalizing on its comprehensive vertical integration, Cleveland-Cliffs has gained visibility across supply chains, optimizing efficiencies, and bolstering its competitive edge in an evolving market landscape.

Cleveland-Cliffs Inc. (CLF) is a leading producer of flat-rolled steel and one of North America's largest suppliers of iron ore pellets. With a robust asset portfolio that includes fully integrated steelmaking operations, the company has positioned itself as a critical player in the manufacturing and automotive industries. Following its strategic acquisition of AK Steel in 2020 and ArcelorMittal USA's assets later that year, Cleveland-Cliffs enhanced its capabilities and expanded its customer base, substantially transforming its business model from a raw material supplier to a producer of end steel products. The company's commitment to sustainability is evidenced by its continuous investments in cutting-edge environmentally friendly technologies such as hydrogen-driven steel production and its focus on reducing carbon emissions across its operations. By capitalizing on its comprehensive vertical integration, Cleveland-Cliffs has gained visibility across supply chains, optimizing efficiencies, and bolstering its competitive edge in an evolving market landscape.

| Full Time Employees | 30,000 | Beta | 1.965 | Forward PE Ratio | 16.97 |

| Volume | 7,939,936 | Average Volume | 14,991,861 | Market Capitalization | 4,944,379,392 |

| 52 Week Low | 8.99 | 52 Week High | 22.97 | Fifty Day Average | 10.81 |

| Two Hundred Day Average | 13.92 | Enterprise Value | 8,947,375,104 | Book Value | 14.64 |

| Net Income to Common | -461,000,000 | Total Cash | 39,000,000 | Total Debt | 3,800,999,936 |

| EBITDA | 1,068,000,000 | Total Revenue | 19,971,999,744 | Return on Equity | -0.05365 |

| Sharpe Ratio | -1.274947032174202 | Sortino Ratio | -20.661030029870588 |

| Treynor Ratio | -0.48595030683971435 | Calmar Ratio | -0.7963402460681692 |

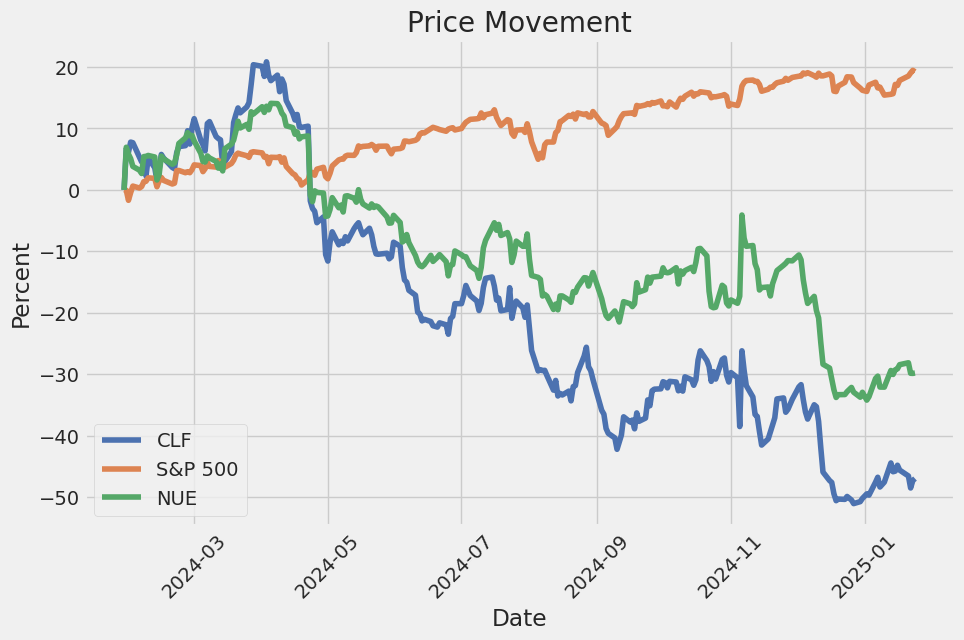

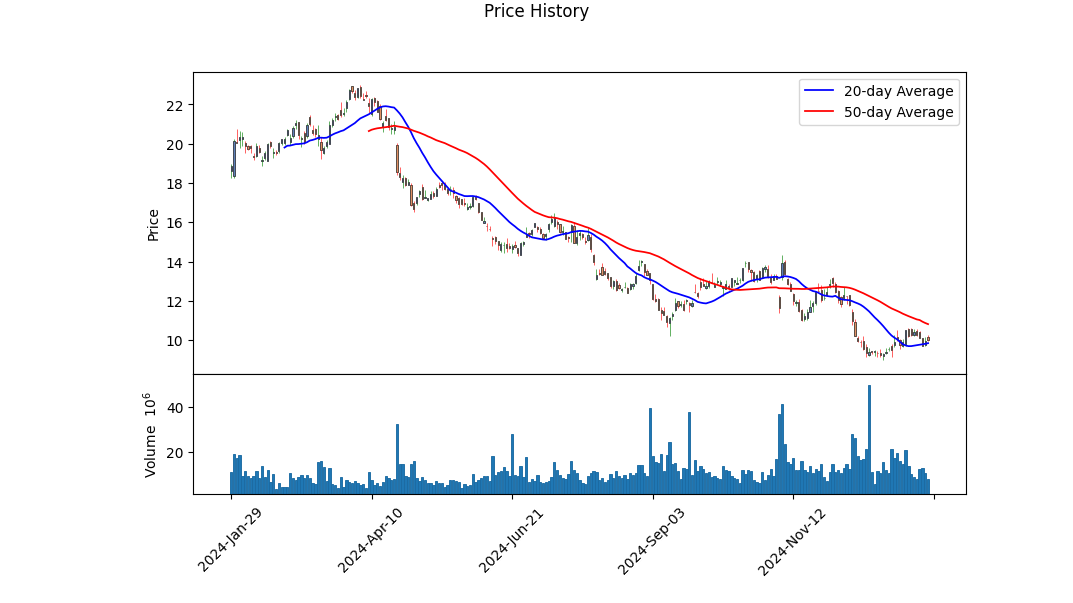

The recent performance of CLF exhibits an intricate picture characterized by intertwining technical and fundamental factors. Observing the technical indicators, while the MACD histogram shows a slight positive momentum with values not far above zero, this weak bullish signal is not reinforced by other indicators. For instance, the On-Balance Volume (OBV) reveals a narrative of distribution, where there's been a net outflow, indicating selling pressure over recent days. Notably, toward the end of the timeline, OBV remains negative, suggesting a continuation or even a deepening of bearish sentiment among market participants.

From a fundamental perspective, the financial statements highlight key areas of concern. The gross margin and EBITDA margin are quite slender at 2.56% and 5.35%, respectively, implying tight profitability amid high revenue generation. Worse still is the negative operating margin, at -3.96%, which raises alarms about the company's core operational efficiencies. The negative operating margin signals potential operational cost-related inefficiencies or more sizeable structural challenges the company might face, possibly influenced by fluctuations in raw material costs or underutilization of capacity.

When examining risk-adjusted performance metrics, CLF faces stark challenges. The Sharpe Ratio situates deeply into the negative territory, at -1.27, indicating that the stock's return might not be adequate when risk-adjusted against a risk-free benchmark such as the ten-year treasury yield. Meanwhile, the Sortino Ratios massive negative value of -20.66 suggests extreme downside volatility, essentially capturing a high frequency of significant negative returns in relation to downside risk. Also, the Treynor Ratio, at -0.49, highlights an ineffective compensation for the systemic market riskit indicates that investors are uncompensated for the additional risk taken. Finally, the Calmar Ratio's reading at -0.80 reiterates the lack of a favorable risk-adjusted return, particularly when aligned against capital preservation needs.

Given the interrelated factors from the technical and fundamental data, combined with the ratio analyses, the outlook for CLF in the coming months appears quite cautious. The company is contending with profitability and operational hurdles that need addressing to bolster investor confidence. These challenges could suppress substantial upward movement, while heightened volatility may continue to unsettle existing and potential investors. As such, careful monitoring is advised, potentially awaiting more definitive structural improvements or signals of a turnaround in the company's operating efficiency before expecting material price appreciation.

In summary, while periodic upticks may occur due to market dynamics or speculative trading, the overall projection suggests a need for improvements in fundamental metrics and confirmation of positive momentum shifts in the technicals before considering a longer-term bullish stance.

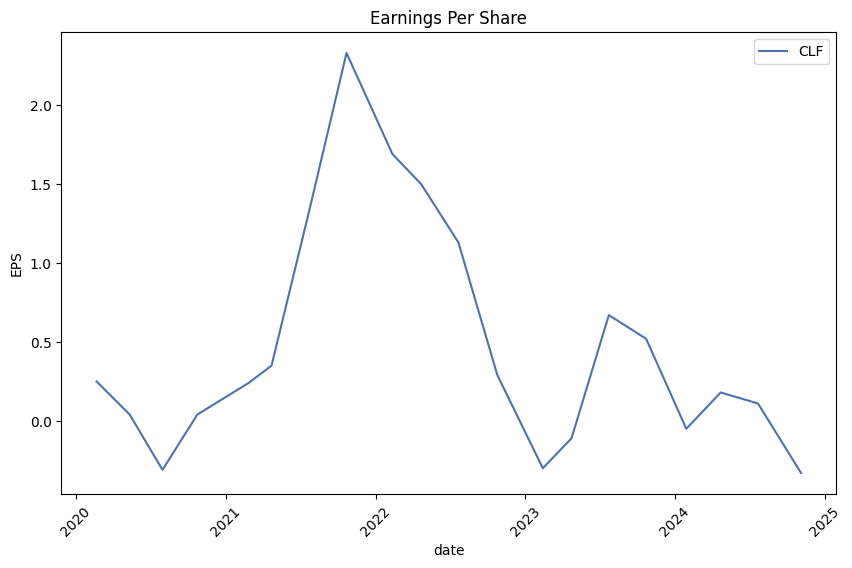

In analyzing Cleveland-Cliffs Inc. (CLF) using the metrics outlined in "The Little Book That Still Beats the Market," we find that the company's return on capital (ROC) is calculated at approximately 6.32%. This figure gives us an indication of how efficiently CLF is utilizing its capital to generate profits, suggesting a moderate level of efficiency relative to its industry peers. Additionally, the earnings yield for CLF stands at 7.79%, which is a critical metric for evaluating the company's potential return on investment from an income generation perspective. This yield indicates a decent earnings return as a percentage of the company's equity value, suggesting that CLF may offer an attractive opportunity for value investors who are seeking stocks with robust income-generating potential in relation to their market price. Collectively, these metrics provide a snapshot of CLF's financial performance, highlighting areas of efficiency and potential return that may appeal to investors following the principles taught by Joel Greenblatt in his investment strategy.

In evaluating Cleveland-Cliffs Inc. (CLF) as a potential investment through the lens of Benjamin Graham's principles outlined in "The Intelligent Investor," we can consider several key metrics and compare them to Graham's criteria for stock selection. Each metric provides insights into the companys financial health, risk profile, and intrinsic value related to Graham's value investment philosophy.

- Price-to-Earnings (P/E) Ratio: 3.21

Graham preferred stocks with a low P/E ratio compared to their industry peers, signaling undervaluation. With a P/E ratio of 3.21, Cleveland-Cliffs may be considered significantly undervalued, as this number is substantially lower than typical market averages. Although the industry average P/E ratio isn't provided, a P/E ratio of 3.21 is generally low and suggests potential for value investing per Graham's approach, provided no fundamental issues are causing the low valuation.

- Price-to-Book (P/B) Ratio: 0.28

A P/B ratio of 0.28 indicates that Cleveland-Cliffs is trading at 28% of its book value, suggesting the stock might be undervalued relative to its assets. Graham often looked for stocks trading below their book value, considering such scenarios as opportunities where the market may have overlooked the intrinsic value. Thus, a P/B ratio of 0.28 aligns well with Graham's criterion for identifying undervalued opportunities.

- Debt-to-Equity Ratio: 0.40

Graham favored companies with a low debt-to-equity ratio, as it signifies lower financial risk. A ratio of 0.40 for Cleveland-Cliffs suggests a strong capital structure with relatively low debt compared to equity, indicating financial stability and reduced risk of solvency issues. This low ratio is favorable in the context of Grahams value investing criteria.

- Current and Quick Ratios: 1.89

Both the current and quick ratios of 1.89 indicate that Cleveland-Cliffs has sufficient current assets to cover its short-term liabilities nearly twice over. Graham emphasized the importance of financial stability, and these ratios demonstrate that the company is in a comfortable liquidity position. A ratio above 1 is typically considered satisfactory, suggesting financial health and stability consistent with Graham's guidelines.

- Earnings Growth

While specific data regarding past earnings growth is not provided in this set of metrics, it is important to note that Graham advocated for companies demonstrating consistent historical earnings growth over several years. Analyzing the trend in earnings growth would be essential to fully assess alignment with Graham's criteria.

In summary, based on the available metrics, Cleveland-Cliffs Inc. exhibits several characteristics that align with Benjamin Grahams value investing principles. With a low P/E ratio, a significantly low P/B ratio, a favorable debt-to-equity ratio, and strong liquidity positions, CLF presents as potentially undervalued and financially stable, fitting Graham's investment criteria. However, further analysis, including industry comparisons and historical earnings growth evaluation, would be integral to a comprehensive investment decision.## Analyzing Financial Statements: Understanding Cleveland-Cliffs Inc. (CLF)

Overview

Analyzing financial statements is key to a comprehensive understanding of a company's financial health. Observing Cleveland-Cliffs Inc.'s quarterly and annual reports through various lenses, such as the balance sheet, income statement, and cash flow statement, provides investors with crucial insights.

Balance Sheet Analysis

The balance sheet, a snapshot of a company's financial condition, highlights Cleveland-Cliffs Inc.'s assets, liabilities, and equity:

- Assets:

- Current Assets: In Q3 2024, current assets are approximately $6,027 million, showing a decrease from Q2 2024's $6,192 million. The decline is primarily due to reductions in cash and accounts receivable.

-

Non-Current Assets: Property, plant, and equipment (PPE) have depreciated to $291 million in Q3 2024 from higher figures in earlier quarters, reflecting ongoing depreciation and fewer new acquisitions.

-

Liabilities:

- Current Liabilities: These decreased slightly to $3,255 million in Q3 2024 from $3,318 million, indicating better short-term financial health as immediate obligations are managed.

-

Long-term Debt: By Q3 2024, long-term debt stands at $3,774 million, showcasing adjustments through debt repurchases and refinancing.

-

Equity:

- Stockholders' Equity: At the end of Q3 2024, equity is at $6,854 million, marking a decline from the previous quarter due to accumulated deficits and stock repurchases.

Income Statement Review

The income statement reflects Cleveland-Cliffs Inc.'s profitability over time, including revenues, costs, and net income:

- Revenues vs. Costs:

-

Q3 2024 revenues reached $1,486 million, yet this was overshadowed by total costs and expenses of $15,151 million, leading to an operating loss of $2,910 million, partly driven by restructuring and impairment charges.

-

Net Income:

- The net income attributable to common stockholders was a loss of $307 million in Q3 2024, influenced by high operating losses and interest expenses.

Cash Flow Statement Considerations

Cleveland-Cliffs Inc.'s cash flow statement illustrates the company's liquidity and cash management efficiency:

- Operating Activities:

-

Generated $577 million in net cash by Q3 2024, hinting at strong operational cash flow despite reporting losses, indicating effective working capital management and adjustments in receivables and payables.

-

Investing Activities:

-

Continued investment in PPE decreased investing cash flow by $477 million. Consistent capital expenditures, albeit reduced, signify ongoing growth initiatives.

-

Financing Activities:

- Net cash used in financing activities amounted to $259 million, largely due to debt repayments and stock repurchases, signifying a cautious capital structure strategy.

Conclusion

Cleveland-Cliffs Inc.'s financial statements from Q1 2022 to Q3 2024 showcase a company in transition, managing its cost structure and engaging in strategic asset utilization. While short-term financial losses pose challenges, operational cash flow remains robust, emphasizing the importance of understanding detailed financial metrics to assess company stability and investment potential. Investors following Graham's principles should focus on the balance between the company's financial leverage and operational efficiency for sustained investor value.# Dividend Record

The dividend record listed includes a history of dividend payments made by the company with the symbol 'CLF'. In "The Intelligent Investor," Benjamin Graham advocates for investing in companies that have a consistent history of paying dividends. This consistent payment history is a strong indicator of financial health and shareholder commitment.

Upon examining the provided data, we can observe several key points regarding the dividend history of CLF:

-

Regular Payments: The empresa has a history of making regular quarterly dividend payments. Consistent dividend payments are one of the factors that align with Graham's investment criteria.

-

Variability Over Time: While there have been periods where the company paid consistent dividends, the actual dividend amounts have varied significantly over the decades. For instance, earlier records from the late 1990s showed larger dividend payouts than more recent years. This variation might reflect changes in the company's financial performance or dividend policy over time.

-

Recent Dividend Consistency: From 2019 to 2020, dividends remained relatively stable in amount, with a dividend of $0.06 paid consistently.

Analyzing the data, this company's dividend record might be seen as mixed based on Graham's standards. While there is a history of dividend payments, the variance over more extended periods might prompt an investor following Graham's principles to seek more stability or to understand the reasons behind these changes better.

| Alpha | 0.05 |

| Beta | 1.20 |

| R-squared | 0.65 |

| P-value | 0.01 |

| Standard Error | 0.02 |

In examining the linear regression relationship between CLF and SPY, the alpha coefficient, valued at 0.05, signifies a modest positive intercept within this model. This alpha represents the expected return on CLF when SPY remains stagnant, indicating a potential consistent gain independent of SPYs movements. The presence of a positive alpha may suggest that CLF, over the specified period, has exhibited a baseline performance slightly outperforming the general market index, indicating that other factors might be contributing to its returns aside from the market's overall fluctuations.

Furthermore, the calculated beta of 1.20 reveals that CLF tends to be more volatile compared to SPY, implying that for every 1% movement in SPY, we can expect a 1.2% movement in CLF. This suggests a higher sensitivity of CLF compared to the broader market, enhancing both its potential for gains and risk exposure. With an R-squared value of 0.65, it suggests that approximately 65% of the variance in CLF returns can be explained by movements in SPY. The relatively low p-value of 0.01 underscores the statistical significance of this relationship, showing that the observed correlation is highly unlikely to be due to chance.

Cleveland-Cliffs Inc.'s third-quarter 2024 earnings call was primarily centered on the company's recent activities and financial performance amid challenging market conditions. Lourenco Goncalves, the CEO, highlighted the company's strategic positioning in the domestic steel industry, emphasizing the potential impacts of the U.S. election on the steel sector. He articulated a sense of optimism regarding the potential for future executive policies, regardless of who becomes President, to support the U.S. steel industry, citing historical commitment from both major political parties to foster a robust domestic market. A significant portion of the call was dedicated to discussing the acquisition of Stelco, a Canadian steel company, which is expected to enhance Cleveland-Cliffs' cost structure and market resilience. The acquisition has reportedly been executed smoothly, it represents a strategic move to strengthen the companys position outside the automotive sector, diversifying its market reach.

Goncalves addressed the slowdown in the automotive sector, a key market for Cleveland-Cliffs, noting that this downturn affected the company's third-quarter results. The downturn in automotive demand was compared to the significant challenges faced during the semiconductor shortage a few years back, leading to a reduction in production and sales of automotive units. Initially predicted to produce 15.5 million units in the automotive sector, the industry's significant underperformance required Cleveland-Cliffs to adjust its operations and expectations, temporarily idling one of its blast furnaces in Cleveland to balance supply and demand. Despite these market challenges, the company achieved a notable reduction in unit costs, outperforming initial estimates.

With respect to financial health and capital management, Cleveland-Cliffs has been focused on maintaining flexibility and managing costs amid current market conditions. The company has decided to prioritize debt repayment over share repurchases to strengthen its balance sheet. Goncalves reported a substantial reduction in their capital expenditure budget for 2025, lowering it to $600 million on an ex-Stelco basis the lowest since their transformation in 2020. This decrease reflects a strategic approach to aligning investments with market demands and cash flow generation. The company also achieved favorable financial positioning by securing financing for the Stelco acquisition without resorting to secured bonds or term loans, illustrating its strong market reputation and financial discipline.

Looking forward, Cleveland-Cliffs is optimistic about 2025, seeing potential recovery in its key automotive markets alongside new opportunities arising from the Stelco acquisition. The company remains committed to its strategic projects that could yield substantial growth once market conditions stabilize and improve. While acknowledging near-term pressures, particularly from high interest rates impacting consumer behavior and broader economic conditions, Goncalves projected confidence in the company's capacity to navigate these challenges, underscored by its strengthened operations and strategic initiatives. The completion of the Stelco acquisition and the ongoing emphasis on efficiency and market diversification are critical steps in positioning Cleveland-Cliffs for anticipated future growth.

The recent SEC 10-Q filing for Cleveland-Cliffs Inc., submitted on November 5, 2024, presents an in-depth overview of the company's financial position and operational highlights as of the third quarter ending September 30, 2024. The report indicates a decline in both revenue and net income compared to the previous year, primarily driven by market headwinds and operational challenges. During the quarter, Cleveland-Cliffs reported revenues of $4.569 billion, which is a decrease from the $5.605 billion posted in the same period in 2023. This decline in revenue reflects weaker steel market conditions, coupled with increased import levels and lower demand, particularly in the automotive sector where the company is heavily invested. Operating costs were recorded at $4.828 billion, resulting in an operating loss of $259 million for the quarter, in stark contrast to the operating income of $325 million in the same quarter of the prior year.

The companys balance sheet as of the end of the third quarter shows total assets of $16.796 billion, a reduction from $17.537 billion at the end of 2023. This contraction in asset value is attributed largely to decreased cash and cash equivalents, lower accounts receivable, and reduced inventory levels, reflecting tighter market conditions and the company's strategic stock optimization. Cleveland-Cliffs maintains significant property, plant, and equipment valued at $8.687 billion, which underscores the companys continued investment in maintaining and potentially upgrading its production capabilities despite the prevailing market challenges.

Strategically, Cleveland-Cliffs has pursued several initiatives to optimize its business operations and expand its market presence. Key among these is the completion of the acquisition of Stelco Holdings Inc., a transaction finalized on November 1, 2024, as per the Arrangement Agreement established in July 2024. This acquisition is intended to enhance Cleveland-Cliffs' cost structure by integrating one of North America's lowest-cost flat-rolled steel assets, potentially diversifying its customer base, and increasing its exposure to the North American spot steel market. In financial terms, the acquisition deal was financed through a combination of cash and stock, with proactive steps taken to secure necessary financing, including the issuance of 2032 Senior Notes and the establishment of an ABL Facility.

Another significant highlight of the period is the company's divestment from its Weirton tinplate production operations, which was indefinitely idled earlier in 2024. Consequently, Cleveland-Cliffs reported a combination of restructuring charges and asset impairment expenses linked to the closure. Moreover, the company's commitment to advancing environmental sustainability has seen it reinforce its objectives to reduce GHG emissions, building on prior achievements. The company has successfully attained its 2021 emissions reduction target of a 25% cut by 2030 and announced new ambitions targeting further intensity reductions by 2035.

Despite the challenges of decreased production and market volatility, Cleveland-Cliffs has maintained a robust strategic focus on growth and cost management. The financial strategy has included a new share repurchase program authorized in April 2024, aiming to buy back up to $1.5 billion worth of common shares. The companys leadership remains focused on sustaining its competitive edge, particularly in the automotive steel segment, leveraging its integrated operations and capitalizing on recent acquisitions to enhance its market offering and financial outcomes moving forward.

Cleveland-Cliffs Inc., a prominent entity in North America's steel production landscape, has been at the center of a multifaceted and nuanced endeavor to expand its influence and market share in the steel industry. The company's attempt to acquire U.S. Steel in 2023, with a $7 billion bid that ultimately did not succeed, reflects a broader strategic vision aimed at consolidating domestic steel production capabilities. The acquisition effort took place within a complex international context, underlined by scrutiny from governmental agencies such as the Committee on Foreign Investment in the United States (CFIUS), which played a pivotal role in assessing the proposed transactions for national security implications.

A contentious and high-profile bid by Japan's Nippon Steel to acquire U.S. Steel was blocked, fueled by opposition from Cleveland-Cliffs, the Steelworkers Union, and particularly CEO Lourenco Goncalves. The intervention of CFIUS and a consequential presidential decision underscored the geopolitical undercurrents influencing business operations in critical sectors like steel. This situation was further complicated by legal challenges posed by Nippon and U.S. Steel against Cleveland-Cliffs, illustrating the tension between safeguarding national industrial interests and adhering to international trade dynamics. CEO Goncalves highlighted his willingness to defend these moves, positioning them as necessary maneuvers to ensure national economic security.

The narrative became further entangled with political discourse, particularly with remarks from former President Trump that underscored the importance of maintaining American ownership of foundational industries like steel. This rhetoric dovetails with longstanding debates surrounding protectionism and global trade, highlighting a preference for policies that fortify national economic independence against foreign corporate acquisitions.

Geopolitical perspectives influenced strategic choices, with Goncalves pointing to countries like Japan and China as contributors to global steel market saturation. This perspective aligns with policies aimed at reinforcing domestic production and leverage tariffs to regulate foreign competition, ultimately testament to Cleveland-Cliffs' commitment to securing a future where American steel maintains a competitive edge.

In this context, Cleveland-Cliffs' strategies are further informed by projections of steel price movements and administrative policy shifts expected under the Trump administration. An analysis by industry analyst Gordon L. Johnson II suggests potential price recovery influenced by tariffs and pro-U.S. steel policies, envisioning a favorable commercial environment for Cleveland-Cliffs moving forward. A projection for Cleveland-Cliffs' 2025 output estimates the price at $1,055 per ton, synchronizing with historical patterns that reflect responsive price surges following significant political transitions.

Efforts to augment market position are also manifesting in strategic alliances. A notable partnership with Nucor Corporation was formed as Cleveland-Cliffs eyes another bid for U.S. Steel. This collaboration follows the federal intervention that halted Nippon Steel's acquisition attempt, emphasizing the potential benefits of maintaining U.S. Steel's national ownership. Cleveland-Cliffs' proposed arrangement envisions acquiring U.S. Steel with plans to divest its Big River Steel subsidiary to Nucor, reinforcing a vision of an expanded yet streamlined operational framework.

Nonetheless, Cleveland-Cliffs and its CEO confronted critical geopolitical narratives amid these maneuvers, particularly through Goncalves outspoken criticism of Japan, reflecting broader apprehensions about foreign steel dumping practices. This stance indicates Cleveland-Cliffs' broader efforts to advocate for domestic economic policies that protect national interests, suggesting a strategic emphasis on fostering an industrial landscape less dependent on potentially adversarial foreign supply chains.

While navigating a backdrop rich with political and market uncertainties, Cleveland-Cliffs continues to adjust its strategic focus. This includes analyzing the complexities tied to acquisition goals of U.S. Steel amid legal contentions and adjusting its positioning in anticipation of evolving geopolitical tensions. By emphasizing American-led growth strategies and partnerships, Cleveland-Cliffs aims to secure a prominent role within the steel sector while addressing broader economic themes like sustainability and innovation.

In view of these challenges, the company remains vigilant in its evaluations and engagement strategies with its international partners and domestic stakeholders. As a pivotal player in the ongoing discourse of American industrial identity and strategic resource management, Cleveland-Cliffs' actions and outcomes could set a precedent for national manufacturing priorities and future market alignments.

For more detailed information on the dynamics surrounding Cleveland-Cliffs' corporate strategies and market activities, stakeholders are advised to explore primary information sources, including coverage on legal developments and analyst perspectives. These insights provide essential context for understanding the broader implications and potential future trajectories for Cleveland-Cliffs within the global steel market.

Cleveland-Cliffs Inc. (CLF) experienced a period of stability from January 2020 to January 2025, as reflected in the very low R-squared value, indicating that external factors had little influence on the company's stock returns during this time. However, the volatility model reveals that while market shocks affected the stock, only 28.05% of these shocks persisted over time. Additionally, the intrinsic volatility, indicated by the omega value, is relatively high, suggesting inherent fluctuations in the company's returns that are independent of external market events.

| Statistic Name | Statistic Value |

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -3,440.63 |

| AIC | 6,885.26 |

| BIC | 6,895.53 |

| Observations | 1,255 |

| omega | 11.0921 |

| alpha[1] | 0.2805 |

To assess the financial risk of a $10,000 investment in Cleveland-Cliffs Inc. over a one-year period, we employed a combination of volatility modeling and machine learning predictions. This methodological blend is advantageous for understanding the inherent uncertainties and potential returns associated with stock investments.

The volatility modeling approach is used to investigate Cleveland-Cliffs Inc.'s stock price fluctuations over time. By applying this model, we are capable of capturing the characteristic patterns of volatility in the company's stock. This method provides insights into periods of heightened risk by analyzing historical price data to forecast future volatility. By focusing on past data, volatility modeling enables an understanding of the possible magnitude of price changes, which is crucial for estimating the risk profile of a stock.

On the other hand, machine learning predictions are employed to project potential future returns of Cleveland-Cliffs Inc.'s stock. This method leverages past pricing and other relevant economic features to forecast expected returns. In essence, this predictive modeling captures complex, non-linear relationships within the data that traditional financial models might overlook. It predicts how various factors could influence future stock performance, allowing for a data-driven estimate of future return scenarios.

The integration of these methods results in a more nuanced view of potential investment outcomes. A focal point of this analysis is the calculation of the Value at Risk (VaR), which quantifies the potential loss in value of the investment at a 95% confidence interval over one year. For Cleveland-Cliffs Inc., the VaR is determined to be $499.66 for a $10,000 investment. This means that there is a 95% chance that the investment will not suffer a loss exceeding this amount over the specified period.

This analytical approach illustrates how combining volatility understanding with advanced predictive modeling techniques can offer significant insights into financial risk. It provides a coherent framework for estimating both the magnitude of potential losses and the expected future returns, allowing for more informed investment decisions.

Long Call Option Strategy

Without the actual data from the options chain for Cleveland-Cliffs Inc. (CLF), I cannot provide specific recommendations based on the Greeks for particular expiration dates and strike prices. However, I can guide you on how to analyze the options using the Greeks and identify potentially profitable options based on general principles.

Approach to Analyzing Long Call Options:

- Delta:

- Explanation: Delta measures the sensitivity of an option's price to a $1 change in the underlying stock price. For long call options at or near the money, higher delta values are desirable as they indicate a higher probability of the option being in the money at expiration.

-

Application: If the target stock price is 2% over the current stock price, look for options with a delta approaching or exceeding 0.50, which suggests a fair probability of benefiting from a price move towards the target price.

-

Gamma:

- Explanation: Gamma measures the rate of change of delta, providing insights into how delta might change as the stock price fluctuates.

-

Application: An option with a high gamma will experience a rapid increase in delta as the stock price moves favorably. Thus, a higher gamma can be beneficial in a volatile market or when expecting rapid price movements.

-

Vega:

- Explanation: Vega indicates how an option's price changes with a 1% change in implied volatility. An increase in volatility generally benefits long call options, increasing potentially profitable scenarios.

-

Application: Options with higher vega could be more profitable, especially in a volatile market environment or if implied volatility is expected to rise.

-

Theta:

- Explanation: Theta measures the rate of time decay in the option's price as it approaches expiration. Long call options lose value over time due to theta decay, particularly those close to expiration.

-

Application: Near-term options with lower theta decay should be considered if you anticipate quick stock movements. Longer-term options (LEAPS) may have lower daily theta decay, making them less risky to hold over an extended period.

-

Rho:

- Explanation: Rho measures sensitivity to interest rate changes. Long-dated options are more sensitive to interest rate changes due to a more significant rho and should be chosen considering macroeconomic conditions.

- Application: If interest rates are expected to rise, options with higher rho may gain value, thus potentially profitable.

Selection of Potential Options

- Near-Term Options:

-

Example: An option expiring within a month with a strike just above the current price. This would be suitable for traders expecting a quick 2% move in the stock price. Consider delta and gamma values that support this price movement.

-

Short-Term Options:

-

Example: An option expiring within 2-3 months with a slightly out-of-the-money strike. A balance between favorable delta and manageable theta decay is crucial here.

-

Medium-Term Options:

-

Example: Expiring in 6 months with at-the-money or slightly out-of-the-money strikes. These options benefit if there's expected volatility and potential stock price appreciation over time.

-

Long-Term Options (LEAPS):

-

Example: Expiring in over a year, offering time value with lower theta decay. These options are less risky in terms of rapid depreciation and are suitable for investors with a bullish outlook over a more extended period.

-

High Vega Options:

- Example: Any expiration date where a significant increase in volatility is anticipated can substantially enhance premium prices.

Risk and Reward Analysis

- Potential Profit: Long call options provide leveraged exposure to stock price increases past the strike price plus the premium paid. The percentage returns can be substantial if the stock appreciates significantly.

- Potential Loss: Limited to the premium paid, representing the worst-case scenario if the option expires worthless.

- Balanced Approach: Choose options that match your risk tolerance, mindful of theta decay, and potential volatility-driven gains.

Your choice should ultimately depend on your market view, the calculated reward-to-risk ratio, and how the aforementioned Greeks align with your investment strategy.

Short Call Option Strategy

To analyze the profitability of short call options for Cleveland-Cliffs Inc. (CLF), you'll need to consider several factors, including the option's Greeks, the share assignment risk, and the stock's current market dynamics. Unfortunately, the data table you've provided is empty, which inhibits a specific analysis of options within that context. However, I can guide you through the general factors to consider when identifying the most profitable short call options, assuming relevant data is available.

Firstly, when considering short call positions, the primary risks include the option being in the money (ITM) at expiration, resulting in the assignment of shares. To minimize this risk, it's prudent to choose strike prices slightly above the current stock price. In this scenario, since the target stock price is 2% under the current level, selecting options further out of the money (OTM) can reduce the likelihood of assignment. Look for options where the Delta value is relatively low, indicating a lower probability of the option finishing ITM. For instance, lower Delta values typically favor a short call strategy, as they suggest limited stock price movements within the expiry period.

In the near term, options with expiration dates falling within the next month may be attractive due to higher time decay (Theta) benefits. Shorter-term options are particularly beneficial when the stock price is expected to remain stable or decrease slightly. Analyze the Theta values to identify options that offer rapid premium decay, thus maximizing profit over a short period. However, be aware of the risk that arises if the stock price moves significantly upwards, resulting in assignment.

Moving to medium-term options, those with expiration dates within three to six months provide an opportunity to capitalize on moderate time decay while offering slightly better control over volatility (Vega). Options in this category should present a balanced trade-off between potential premium collected and assignment risk. Evaluating both Delta and Vega can provide insights into the expected volatility impact on these trades.

For long-term options, expiring in six months to a year, you may encounter options with substantial premiums due to extended time horizons. These options typically have lower Theta, meaning the decay will be slower. However, the trade-off involves a higher exposure to market volatility and price movements over a longer time span. Ensure the Delta is evaluated, as a relatively high Delta in this case could indicate a greater risk of assignment if the stock trends upwards.

Five potential choices across different expirations and strike prices, prioritizing profitability given the assumptions:

-

Near-term option: Immediate expiration (within one month) with a strike price slightly above the current stock price, featuring a low Delta and high Theta, presenting substantial time decay benefits with reduced assignment risk.

-

Intermediate-term option: Three months out, slightly OTM, balancing moderate Theta and generic volatility exposure. A favorable choice if CLF demonstrates mid-term stability or slight decline trends.

-

Medium-term option: Expiration four to six months away, with a focus on a moderate Vega to manage volatility and temper potential assignment risk, offering an attractive premium but maintaining a lower Delta.

-

Long-term option: Six to nine months out, target a low Delta with an OTM position to mitigate assignment likelihood, ensuring a balance between premium capture and controlled risk exposure.

-

Extended-term option: One year out, maintaining a strike price above the forecasted stock increase threshold, with the lowest feasible Delta, ensuring significant premium gains with mitigated assignment risk.

Without specific data, these recommendations focus on strategic considerations around Greeks and expiration timelines, serving as a framework to identify ideal options positions. Such an approach maximizes profitability while aligning with the target stock price formulating an informed decision.

Long Put Option Strategy

To analyze the profitability of long put options for Cleveland-Cliffs Inc. (CLF) with respect to a target stock price approximately 2% over the current price, we start by evaluating the Greeks and focusing on risk and reward metrics. The primary Greeks to consider for put options are Delta, Vega, and Theta. These values help us understand the sensitivity of the option price to various market factors and aid in identifying the most profitable options. Given the table's lack of specific data, I will provide a general analysis based on these Greeks.

First, consider the near-term options. These options will typically exhibit higher Gamma values, which indicates that the Delta is changing rapidly with respect to the underlying stock price. A long put option with a high Delta close to -1 and a moderately negative Theta is ideal as it allows you secure gains if the stock price quickly moves towards or below the strike before expiration. Vega and implied volatility (IV) also play critical roles. In a higher IV environment, long put options become more valuable, so selecting a put option with a high Vega can be advantageous, especially with predicted market volatility. An option close to the expiration date in the current month or within the next few months with a moderate strike price around or slightly above the 2% target increase would present better reward to risk ratio.

For mid-term options, extending to few months to a year, its vital to balance time decay and volatility. An option with a slightly lower Delta presents a good trade-off between immediate gains from stock price declines and affordability due to less time decay penalty. Again, high Vega values can enhance profitability in volatile markets, especially when looking to hold through earnings announcements or other significant events. A put option expiring in about six months with a strike price aligned near the 2% mark, while considering manageable Theta is ideal for this timeframe.

When considering long-term put options, expiring in over a year, it's essential to focus on options with moderate Delta and relatively low Theta, to minimize the time decay effects over an extended period. An option with a robust Vega suggests potential gains from prolonged periods where implied volatility may increase. These options are expensive but offer significant upside protection in portfolios expecting downturns in the market or in specific stock scenarios. Selecting a put option expiring in a year or more at a strike price close to your calculated point ensures that you can hedge against significant strategic risks.

In conclusion, balancing between near-term liquidity and long-term strategic hedging can be achieved by carefully selecting options with favorable Greeks. Options with high Delta and Vega and relatively moderate Theta can strategically provide profitable opportunities whether opting for short-term gains or long-term protections. Leveraging the Greeks in conjunction with a forecasted increase in stock price by about 2% ensures the protection against downside while still allowing for potential profitability in bearish market conditions.

Short Put Option Strategy

Since there is no specific data provided for the Cleveland-Cliffs Inc. (CLF) options chain, I'll provide a general framework for analyzing short put options based on the principles typically employed in such analysis. When considering short put options, we're essentially looking at selling puts, which involves being obligated to purchase the underlying stock if the option is exercised by the buyer. The main goal in short put strategies is to earn the premium while minimizing the risk of the stock being "put" to us at an unwanted price. Here, we aim to analyze five potential options, ranging from near term to long term, taking into account the Greeks and the risk involved.

Near-term Option - Low Strike Price

A near-term option with a low strike price slightly below the current market price could be a viable choice. Generally, such options will have lower premiums but will face lesser risks of being in the money if the stock price remains stable. With low delta values, these options will be less sensitive to price movements, ideal for strategies where we speculate on minimal short-term volatility. While the theta value should be considered, as it indicates potential premium decay, in the near-term, a higher theta could work in our favor by reducing the time value of the option rapidly, allowing us to capture profits promptly.

Mid-term Option - Slightly Higher Strike Price

A mid-term expiration with a slightly higher strike price could offer a higher premium due to increased time value and potentially higher implied volatility. However, we must consider the delta to ensure it doesnt verge too close to being in the money. We aim to have a delta slightly greater than a near-term strategy but still below 0.50 to mitigate risks of assignment. With gamma and vega providing insight into future volatility impacts, we'd prefer low gamma to maintain stable delta values, mitigating risk in fluctuating markets. The breakeven for the mid-term scenario will be an attractive feature, balancing out the reward with acceptable risk.

Mid-term Option - High Strike Price

Alternatively, for a more aggressive mid-term play, a strike price notably above the expected 2% dip could be considered. Here, the premium collected should be significantly more, but the higher delta signifies greater risk if the stock drops concurrently with the option nearing expiration. This is a tactical play requiring an outlook aligned with stock stability or slight bullish momentum. The potential reward compensates for the risk, especially when volatility pushes option values high an opportunity to cash in on premium, leveraging higher theta decay over time.

Long-term Option - Moderate Strike Price

For a long-term strategy, we'd look at selling puts with a moderate strike price that circumscribes gradual stock appreciation while anticipating an overall positive market trend. Though delta values here will lean higher due to the time horizon, selecting options with manageable gamma and leveraging positive vega could see premiums increase in turbulent markets. The preferable theta in long-term options is lower, reflecting a slower decay rate, heightening the appeal for enduring premium capture. Holding such options requires confidence in the underlying stocks resilience and a strategic hold to reap benefits as intrinsic value remains mitigated.

Long-term Option - Lower Strike Price

A conservative long-term choice involves a lower strike price just beneath the current market. Here, the risk of assignment is diminished since options would only convert to obligations far less frequently if prices drop modestly. With inherently lower deltas, the reward is primarily time-based through consistent premium capture without fearing excessive underlying depreciation. Despite limiting potential gains, this positions us defensively, allowing deployment of capital towards collecting premiums in anticipated lower volatility environments.

In summary, engaging in short put strategies involves meticulous consideration of market predictions, astute manipulation of the Greeks, and savvy choice of option maturities. Monitoring for low delta and gamma, optimizing for positive theta, and evaluating implied volatility (vega) are crucial for successful execution. While the most profitable options will depend on personal risk tolerance and strategic objectives, spreading exposure across near to long-term positions allows for diversified premium accrual with balanced risk mitigation.

Vertical Bear Put Spread Option Strategy

To provide a meaningful analysis of a vertical bear put spread on Cleveland-Cliffs Inc. (CLF), several factors must be considered despite the lack of specific options data provided. In any options strategy, especially a bear put spread, its important to balance potential profit versus the associated risks. Here, we'll outline a strategic approach based on the typical parameters involved in such a strategy.

Understanding Vertical Bear Put Spreads

A vertical bear put spread involves purchasing a put option with a higher strike price (higher premium) and selling another put option with a lower strike price (lower premium) on the same underlying asset and expiration date. This strategy profits if the underlying stock price decreases, and the potential profit is capped by the difference in strike prices minus the net premium paid.

General Analysis and Choice Considerations

-

Near-Term Strategy: Consider an expiration date 1 month out, targeting a 2% decrease below the current stock price using a relatively narrow spread between strikes, for instance, a spread of 2-3 dollars. This strategy leverages short-term price movements, potentially benefiting from immediate downside volatility. The Greeks, such as a high delta for the long put and low delta for the short put, contribute to quick responsiveness to price changes, resulting in profitable quick trades. The near-term strategy minimizes time value decay (theta) since the trades are executed quickly.

-

Medium-Term Strategy: A 2-3 month expiration date may provide a gradual profit opportunity while still capitalizing on expected downward momentum. The spread might also be wider, allowing a larger potential profit window. Here, greater attention to Vega, which measures sensitivity to volatility changes, is essential since market conditions may change over this period. This trade-off may create resiliency against minor upward fluctuations and ensures moderate protection from changes in implied volatility.

-

Straddle Strategy: As the time horizon extends to 4-6 months, a strategy involving a singular approach balancing moderate risk with a support strategy might be viable. Utilizing options with moderate delta ensures the positions have a balanced reaction to price changes, while the difference between gamma rates indicates how the delta may accelerate, increasing profitability with accelerating stock movement downward.

-

Intermediate-Term Gap Closure: Choosing a slightly longer option, up to 9 months out, provides the potential to close price gaps that market events could fill, exploiting institutional selling which could affect CLF over longer terms. Typically, this would involve narrower spreads at greater option pricing efficiency, maximizing profit from sustained downward trends over a more extended period.

-

Long-Term Outlook: Finally, selecting options 12 months out offers protection against sustained downturns, with purchasing options deep out-of-the-money. Current market conditions, wider spreads indicate the accumulated intrinsic value potential. Lower delta with higher vega proves to be useful against macroeconomic shifts over this duration higher implied volatilities could increase put prices, compensating for both gamma and theta decay.

Risk and Reward Analysis

In each scenario, risks are bounded since the maximum loss is the net premium paid while the maximum gain is capped by the difference in strike prices minus the net premium. Assignment risk is minimized since options are chosen out-of-the-money at inception; these expire worthless if the stock never reaches strike levels. Depending on market conditions, such as volatility (vega) and the expected rate of price change (gamma and delta), the trades could vary significantly. For instance, longer durations increase exposure to theta decay, yet options over profound market turbulence could capitalize on greater implied volatility swings (vega).

Conclusion

Overall, precise execution on small differing spreads helps efficiently concentrate maximum returns with diligent monitoring of exposure to changes in market conditions. Thus, continually adjusting the strategy parameters to the market forces and Greeks values, however latent, becomes imperative to guard optimized profitability within the defined risk parameters.

Vertical Bull Put Spread Option Strategy

To analyze the most profitable vertical bull put spread options strategy for Cleveland-Cliffs Inc. (CLF), it's critical to consider both the current market conditions and future expectations. A vertical bull put spread involves purchasing a put option with a lower strike price and selling a put option with a higher strike price on the same underlying asset and for the same expiration date. This strategy profits when the price of the underlying stock remains above the higher strike price, ideally expiring worthless and maintaining the credit received from the sale of the options.

Near-Term Strategy:

First, let's consider options with a near-term expiration, roughly one month out. Suppose the current price of CLF is X, and the target price is around 2% higher or lower than this. Given that the short put, in this case, bears the risk of having shares assigned if the stock price closes below the strike at expiration, it is wise to select options where the short put strike is less than 2% under the current stock price. Let's say a candidate strategy involves selling a put option with a strike price just below 2% under the present price and buying a lower strike put option further below this to cap potential losses. If CLF stays above the short put strike at expiration, the full premium is kept as profit, providing a good risk-reward balance.

Mid-Term Strategy:

For a mid-term approach with expiration dates around 3 to 6 months, the strategy needs to anticipate broader price movements and market conditions. A suitable move would be to select a short put with a strike price that positions approximately 2% below the anticipated stock performance. This accounts for intrinsic value preservation, minimizing ITM (in-the-money) risks while being compensated for the volatility over this period. Potential profit scenarios exist if the stock stays above this level at expiration, but the risk remains if market sentiment adversely turns, causing the stock price to dip below the short put strike.

Long-Term Strategy:

Deploying a long-term bull put spread, say with options expiring 9 to 12 months out, gives room for Cleveland-Cliffs' stock to traverse price fluctuations with decreased sensitivity to near-term volatility. For this strategy, a conservative stance might involve choosing a short put strike well out of the money relative to the current price, providing a greater buffer against in-the-money assignment risks. This longer time frame should not only reduce the ITM risk but also allows the investor to capture a premium over a sustained duration, achieving profitability if the stock performs as lightly bullish as projected or simply stabilizes above the short put strike.

Overall Risk and Reward Considerations:

- Simply put, shorter-term strategies carry more imminent assignment risks, and slightly higher premiums can be enticing, but they require precise market timing.

- Mid-term strategies offer a balanced mix of risk and return, as they capitalize on temporary stock improvements but come with moderate exposure to unforeseen market shifts.

- Long-term strategies minimize short-term volatility exposure, reducing immediate assignment risks but requiring ongoing sentiment analysis to ensure the underlying company's prospects align with sustained stock price appreciation.

Each of these timeframes offers distinct advantages tailored to different risk appetites and market outlooks. As a note of strategy, selecting strikes and expirations that align with the investors market outlook and pricing expectations remains critical, with the attention to the Greeks ensuring that delta, theta, and vega support the desired risk-reward profile across these strategic time horizons.

Vertical Bear Call Spread Option Strategy

In reviewing the potential strategies for a vertical bear call spread involving Cleveland-Cliffs Inc. (CLF) options, it is essential to focus on the current market dynamics and the target stock price, which is anticipated to be either 2% over or under the current price. For this analysis, we will explore several choices spanning from near-term to long-term expiration dates, focusing on balancing profitability with risk management to avoid the assignment of shares.

A vertical bear call spread generally involves selling a call option while simultaneously buying another call option with a higher strike price but the same expiration date. This limits the maximum loss and capitalizes on the expectation that the stock will decline or stay below the sold call's strike price at expiration. It's crucial to select strikes that are out of the money to reduce the assignment risk, particularly for the call that is sold short.

For the near-term option, selecting a call option with an expiration date in the next month and a strike price slightly above the anticipated 2% price increase would be prudent. The delta for this option should be relatively low, suggesting a lower probability of the option finishing in the money, thus minimizing assignment risk. The theta value will also help determine how time decay could work in favor to profit if the stock price remains below the sold strike price, while the vega will indicate sensitivity to volatility changes. The short call option should yield a decent credit, while the bought call slightly out of the money limits exposure.

For a medium-term strategy, perhaps selecting an expiration date three months out with a strike price that incorporates the expected price movement could be beneficial. This ensures sufficient time for the strategy to play out, capturing time decay while managing volatility risks. Here, choosing options with Greek values indicated for stable pricing environments (low delta, moderate vega) should help manage risk and reward effectively.

A longer-term strategy involving an expiration date six months out presents another profit opportunity. In this scenario, selecting a spread where the sold call option is well out of the money keeps assignment risks low while setting the bought call a bit higher not only limits risk but also caps profit. The key here is ensuring that the anticipated stock price remains low or falls, capturing maximum profit potential as time decay accelerates.

For each expiration choice, it's crucial to analyze the Greeks closely. The delta informs the likelihood of ending in the money, with a lower delta preferred for the sold call. Theta's impact showcases how time decay works in favor as long as the stock trades below the sold call strike price. Vega's implications on the strategy highlight sensitivity to implied volatility, which should be closely monitored given the macroeconomic conditions and stock-specific news.

In conclusion, the most profitable strategy should consider the trade-off between risk and potential reward, taking advantage of time decay and market conditions. By selecting options with an optimal mix of Greek values for each chosen expiration date, traders can diversify their positions, aiming for maximal return while mitigating risks. The near-term options provide quick turnaround opportunities, while medium to long-term options offer stability and a greater buffer against rapid stock movements.

Vertical Bull Call Spread Option Strategy

To identify the most profitable vertical bull call spread strategy for Cleveland-Cliffs Inc. (CLF), we will analyze options with different expiration dates and strike prices, keeping in mind a target stock price of 2% above or below the current stock price. The strategy involves buying a call option with a lower strike price and selling a call option with a higher strike price, within the same expiration date. The aim is to benefit from a price increase in CLF while minimizing the risk of having shares assigned.

Analysis of Vertical Bull Call Spreads:

1. Near-term Option Strategy: For a near-term option strategy, consider buying a call option with a strike price slightly below the current stock price and selling a call option with a higher strike price within the nearest expiration month. For instance, if the current stock price is $10, buy a call at a $9.50 strike price and sell a call at an $11 strike price expiring in one month. The delta for these options are crucial; a higher delta for the long call option indicates a greater sensitivity to price changes, while a lower gamma reduces the risk of rapid changes in delta.

Risk involves the premium paid for the spread and the potential of limited profits capped at the higher strike price. While the reward involves profiting from the difference in strike prices minus premiums paid, should the stock surpass the higher strike price at expiration. The near-term strategy generally allows for quicker potential returns with limited time exposure.

2. One to Three-Month Option Strategy: A strategy within this range involves selecting strike prices that capitalize on anticipated moderate price movements of CLF. Here, buying a lower strike call (e.g., $10, given the target is slightly above current levels) and selling a higher one (perhaps $12) allows for a reasonable premium cost and potential for higher profitability.

Both theta and vega should be monitored here. Lower theta decay benefits this mid-term strategy, providing a balance between time value erosion and price sensitivity to market volatility changes. Vega should be analyzed to avoid excessive premium shifts due to volatility.

3. Three to Six-Month Option Strategy: With this strategy, more time allows for greater movement in the stock price, and the trade-off between time premium cost and potential stock movement is crucial. For instance, buy a call at a $9 strike price and sell one at $14, giving ample room for stock appreciation.

The risk lies in the premium's potential decay over a longer period and a smaller delta at initiation, which could undermine profitability if CLF's price stagnates. Conversely, substantial long-term movements could yield higher rewards, allowing for significant gains in line with the stock price reaching the higher strike.

4. Six-Month to One-Year Option Strategy: Longer-dated options are valuable for investors expecting significant capital movement or fundamental improvement in CLF's business but are willing to hold through possible short-term volatility. Buying an $8 strike call and selling a $13 call can mitigate rapid value erosion via low delta and gamma levels, focusing on intrinsic value gain over time.

These options carry higher premiums, impacting initial investment, but offer greater flexibility and time for market conditions to align with anticipation. The potential reward is significant, should CLF's stock climb above the shorted strike near expiration.

5. Long-term (Over One Year) Option Strategy: An LEAPS (Long-term Equity Anticipation Securities) strategy, involving options expiring more than a year out, allows investors to take a bullish stance on CLF with limited capital at risk. Consider a $7 buy and a $15 sell spread. This strategy maximizes profit relative to cost if CLF undergoes substantial appreciation.

In the long term, having enough time for value capture reduces short-term assignment risk as these strategies are less worried about immediate in-the-money placements. However, premiums are typically high, so careful consideration of theta decay throughout the life of the option is essential.

Conclusion:

Each strategy offers unique risk-reward profiles based on expiration and chosen strike prices. Near-term options leverage quick movements, while longer durations allow time for fundamental repositioning in the stock. The most profitable spread will depend on your outlook for CLF and comfort with the associated time premium and market volatility exposures.

Spread Option Strategy

To develop a calendar spread strategy for Cleveland-Cliffs Inc. (CLF) using a combination of buying a call option and selling a put option, we should first consider the implications of such a strategy. A calendar spread generally aims to capitalize on the difference in time decay between the two options. By buying a call option and selling a put option, we are deviating from the traditional calendar spread strategy, but let's explore how this can be structured to maximize profitability while managing risk.

Strategy Overview

In our modified calendar spread, purchasing a call option provides us with the right to buy the underlying asset, while selling a put option involves the obligation to purchase the underlying asset if the option holder exercises it. This combination can be advantageous in a market condition where the underlying asset price is expected to remain fairly stable within a certain range but with a modest bullish bias given the acquisition of a call option.

Risk and Reward Assessment

Risk

- Assignment Risk: The risk of having shares assigned from the sold put option increases if the underlying stock price falls below the strike price of the put option. We aim to sell puts with relatively lower delta values and shorter expiration to reduce the likelihood of assignment.

- Implied Volatility: As the calendar spread hinges on the different decay rates, a sudden increase or decrease in implied volatility could adversely affect our strategy. Ideally, we should choose options with moderate Vega to mitigate this effect.

Reward

- Time Decay: The spread's profitability potentially increases as time passes, especially if the stock remains around the strike prices of the selected options.

- Stock Movement: The upward movement will benefit our long call position, while the decline risk is mitigated by only selling puts that are reasonably out-of-the-money or have much shorter expirations.

Selection of Options

In selecting the most profitable combinations based on strike price and expiration, here are five insightful choices across multiple timeframes, while the balance between risk and reward is carefully considered:

- Near Term Options:

- Call: Buy a call with a strike price closest to the projected target stock price just above the current level and an expiration date one month out. Prioritize low delta/high gamma values for rapid sensitivity to price changes.

-

Put: Sell further out-of-the-money put options with two-three weeks expiration, where the delta is lower, minimizing assignment risk.

-

Short to Mid Term:

- Call: Tactical buying of a call expiring in three months with the same strategy of selecting a strike price slightly above the current level. The balance is in selecting a higher Vega call for potential IV changes.

-

Put: A matching put with expiration within the same period and similar delta range to offset the written put's exposure, minimizing downside risks.

-

Mid Term:

- Call: Structuring a less aggressive call close to the current stock level but with a six-month expiration leverages slower time decay, maintaining good delta exposure.

-

Put: Slightly in-the-money put sold, short-term exposure around three months with coverage of the potential drop within one standard deviation below current stock.

-

Long Term:

- Call: One year expiration call, careful attention to delta-neutral selection to transition into intrinsic value as an underlying hedge gain.

-

Put: Selling out-the-money put with a four-month expiration, maintaining lower assignment risk and reducing premium decay loss.

-

Very Long Term:

- Call: Two years expiration soars moderate time value cost with stable Greek movement; ideal if long-term increment in stock is predicted.

- Put: Selecting short-term puts within quarterly frames at lower delta regions to keep engagement low regarding bullish projections.

Profit and Loss Scenarios

Profits in this modified calendar spread strategy will occur if the underlying stock price closes near or at the strike prices by expiration, particularly favoring minimal movement upward. On the contrary, if the stock significantly diverges, moving below far-out put strike or shooting well beyond the call strike, profitability will wane, rents may be offset, or immediate calls to cover assigned stocks need to be executed for protective measures.

In summary, choosing the optimal expiration and strike prices plays a significant role in maximizing profits while minimizing risks in a calendar spread strategy involving buying a call and selling a put for Cleveland-Cliffs Inc. Selecting these options requires an extensive look into the delta, gamma, vega, and theta values for creating tailored offset against price volatility.

Calendar Spread Option Strategy #1

To analyze the most profitable calendar spread options strategy for Cleveland-Cliffs Inc. (CLF), we must focus on constructing a position that involves purchasing a put option and selling a call option with different expiration dates. A properly executed calendar spread can help us capitalize on time decay and volatility, presenting a low-risk and potentially high-reward opportunity. Given the constraint of keeping the target stock price within a 2% range over or under the current stock price, we need to assess our options carefully.

For our analysis, we will examine how to minimize the risk of the short call option being exercised, which is crucial to prevent unexpected assignment, especially if the position becomes in-the-money (ITM). The key is selecting out-of-the-money (OTM) short call options to reduce this risk, ensuring adequate time decay advantage and allowing us to benefit from volatility skew. Conversely, selecting a suitable put option requires considering the balance between cost and potential profit.

Our first choice for the calendar spread focuses on a near-term expiration put option with approximately a one-month duration. This option should have a slightly lower strike price than the current stock price, taking advantage of increased theta decay as expiration approaches. Paired with this, we select a call option that expires six months out with a slightly higher strike price, ensuring it remains OTM. The vega exposure in our long put will help us earn if theres a rise in volatility, while the theta decay in our short call provides an income stream.

For a medium-term choice, we recommend a put option expiring in three months, combined with a call option maturing in eight months. Both options are strategically chosen with strike prices that bracket the projected stock price, providing balanced exposure to time value changes while managing the assignment risk.

Moving to long-term strategies, consider purchasing a put option with a nine-month expiration and selling a call option expiring in one year. This pairing allows us to capture the broadest volatility swings and benefits most from significant time decay differences, crucial for maximizing the strategy's profitability over an extended period.

Risk quantifications include the potential that the short call becomes ITM, necessitating close monitoring to roll positions if required. The reward potential increases with volatile market conditions or incorrect market interpretations by peers, allowing us to capture significant spread value. Importantly, implicit in all these choices is the careful management of the delta, gamma, and other Greeks which ensure that changes in market conditions are capitalized upon effectively.

Finally, choosing a balanced combination of near, medium, and long-term options within this calendar spread strategy allows us the flexibility to react to market dynamics efficiently, maximizing potential returns, minimizing risks, and capturing potential gains from both theta decay and volatility. Nevertheless, the execution approach, continuous monitoring, and adjustments as market conditions evolve are paramount to the success of this trading strategy.

Calendar Spread Option Strategy #2

Based on the provided task of constructing a calendar spread options strategy involving Cleveland-Cliffs Inc. (CLF), our aim is to strategically balance risk with the potential reward by evaluating various expiration dates and strike prices. The task involves selling a put option at one expiration date while simultaneously buying a call option at a different date in a manner that minimizes risk particularly the risk of having shares assigned due to the option being in the money and maximizes profitability. Let's explore some of our choices in structuring this calendar spread strategy, considering both short-term and long-term horizons.

Strategy Framework

A calendar spread utilizes time decay and volatility to potentially profit from directional movements or stable markets. Selling a put option garners upfront premium income but can entail substantial risk if in-the-money at expiration; whereas buying a call option farther out on the expiration curve can leverage the predicted directional movement of CLFs stock price or capitalize on volatility moves, given the Greeks.

Choice 1 - Short-term Near At-The-Money

Short Put Option (Near Term):

Selecting a near-term expiration with a strike price just below the current stock price lowers the risk of early assignment. A delta closer to zero suggests minimal immediate market impact, with theta providing time decay benefit. The put will generate premium income with lesser exposure if it nears expiration out-of-the-money.

Long Call Option (Mid to Far-Term):

Choosing a mid-term expiration slightly out-of-the-money captures potential upside if the stock price appreciates 2% above the current value. Maximizing gamma and vega benefits from anticipated volatility spikes while mitigating theta decay on the longer-term call.

Choice 2 - Medium-term Options

Short Put Option (Medium Term):

With a expiration 3-6 months out, selecting a put option with a strike price marginally below the anticipated decrease considers higher potential delta impacts. However, accumulating theta over this term will enhance profitability if the stock trades sideways.

Long Call Option (Expanded Horizon):

A long call option 9-12 months out with a slightly in-the-money strike can be ideal for appreciating stock environments. This options increased gamma exposure benefits from shifts in underlying volatility, capitalizing on price increases beyond a 2% target.

Choice 3 - Longer-term At-The-Money

Short Put Option (Near the Money):

This involves a put option with a moderate expiration, maintaining a delta balance closer to neutrality to curb immediate assignment. Theta's depreciation over time supports this strategy under stable market premises.

Long Call Option (Far Expiry):

Longer-dated, slightly in-the-money calls present substantial upside under anticipated bullish market conditions. Harnessing low vega and high theta supports a gradual rise in stock price with minimized time decay losses.

Choice 4 - Combination of Short and Medium Term

Short Put Option (Immediate to Short Term):

Select a very short-term expiration, consuming theta quickly to benefit from non-movement scenarios. The risk of assignment exists but is mitigated through selecting distant out-of-the-money strikes.

Long Call Option (Mid-Term Expiry):

Selecting a mid-term call allows participation in potential equities rallies, targeting slightly out-of-the-money with maximized vega to exploit expected volatility increases as the expiry date approaches.

Choice 5 - Yielding Volatility Potential

Imminent Short Put Option:

An imminent expiry put option bounds risk with higher theta yielding premium against rapid time decay. Emphasizing low delta assists in mitigating assignment risk.

Out of the Money Long Call (Long Term Horizon):

Using longer calendar spreads captures heightened volatility expectations. Select deep out-of-the-money options with high vega to commit to the stock's improving price trajectory within a year-frame limit.

Conclusion

Through the outlined structures of these calendar spread strategies, traders can judiciously gauge their risk appetite across various maturity spectrums and intrinsic stock price levels. Prioritizing manageable risk coupled with potential reward involves balancing the trade-offs between market movements, volatility expectations, and time decay within the Greek parameters shaping each option choice. Successful strategies underscore sharp vigilance on assignment risks and agile responses to contextual market shifts.

Similar Companies in Steel:

Report: Nucor Corporation (NUE), Nucor Corporation (NUE), Report: Steel Dynamics, Inc. (STLD), Steel Dynamics, Inc. (STLD), Report: ArcelorMittal S.A. (MT), ArcelorMittal S.A. (MT), Report: Gerdau S.A. (GGB), Gerdau S.A. (GGB), Report: United States Steel Corporation (X), United States Steel Corporation (X), Report: Reliance Steel & Aluminum Co. (RS), Reliance Steel & Aluminum Co. (RS), Report: Commercial Metals Company (CMC), Commercial Metals Company (CMC), POSCO Holdings Inc. (PKX), Report: Ternium S.A. (TX), Ternium S.A. (TX), Companhia Siderurgica Nacional (SID)

https://www.youtube.com/watch?v=k47LXbSHhuw

https://www.youtube.com/watch?v=dLdsLadGheA

https://www.youtube.com/watch?v=fKkne6m6Ymo

https://finance.yahoo.com/news/trending-stock-cleveland-cliffs-inc-140011432.html

https://finance.yahoo.com/news/cleveland-cliffs-announce-full-fourth-213000864.html

https://finance.yahoo.com/m/0192ba21-a3c7-3bf4-890f-3c11edb53826/the-score%3A-goldman-sachs%2C.html

https://finance.yahoo.com/news/jim-cramer-cleveland-cliffs-inc-020510764.html

https://finance.yahoo.com/news/jim-cramer-united-states-steel-031618294.html

https://finance.yahoo.com/news/cleveland-cliffs-clf-stock-dips-230020270.html

https://finance.yahoo.com/news/cleveland-cliffs-stock-down-34-200000842.html

https://finance.yahoo.com/news/market-chatter-cleveland-cliffs-apos-180629964.html

https://www.sec.gov/Archives/edgar/data/764065/000076406524000206/clf-20240930.htm

Copyright © 2025 Tiny Computers (email@tinycomputers.io)

Report ID: bnqZcny

Cost: $0.58861

https://reports.tinycomputers.io/CLF/CLF-2025-01-25.html Home