Universal Stainless & Alloy Products, Inc. (ticker: USAP)

2024-02-07

Universal Stainless & Alloy Products, Inc. (ticker: USAP) is a significant player in the steel industry, specializing in the manufacturing and marketing of semi-finished and finished specialty steel products. These products include stainless steel, tool steel, and certain other alloyed steels. Founded in 1994, the company has carved out a niche in serving a wide array of industries, such as aerospace, automotive, power generation, and heavy equipment manufacturing. Operating out of multiple facilities in the United States, USAP is known for its focus on high-quality, custom-made products that meet the specific requirements of its diverse clientele. The company's strategic approach to production, coupled with its emphasis on research and development, has enabled it to offer innovative solutions and maintain a competitive edge in the specialty steel market. Financially, USAP has demonstrated resilience over the years, navigating through market fluctuations and industrial demands with agility and strategic adjustments. As of the last reporting period in 2023, Universal Stainless & Alloy Products, Inc. continues to focus on expanding its product offerings, leveraging technological advancements, and strengthening its market position, which makes it a noteworthy entity within the specialty metals industry.

Universal Stainless & Alloy Products, Inc. (ticker: USAP) is a significant player in the steel industry, specializing in the manufacturing and marketing of semi-finished and finished specialty steel products. These products include stainless steel, tool steel, and certain other alloyed steels. Founded in 1994, the company has carved out a niche in serving a wide array of industries, such as aerospace, automotive, power generation, and heavy equipment manufacturing. Operating out of multiple facilities in the United States, USAP is known for its focus on high-quality, custom-made products that meet the specific requirements of its diverse clientele. The company's strategic approach to production, coupled with its emphasis on research and development, has enabled it to offer innovative solutions and maintain a competitive edge in the specialty steel market. Financially, USAP has demonstrated resilience over the years, navigating through market fluctuations and industrial demands with agility and strategic adjustments. As of the last reporting period in 2023, Universal Stainless & Alloy Products, Inc. continues to focus on expanding its product offerings, leveraging technological advancements, and strengthening its market position, which makes it a noteworthy entity within the specialty metals industry.

| Full Time Employees | 622 | Previous Close | 19.78 | Market Cap | 175,675,680 |

| Fifty Two Week Low | 7.57 | Fifty Two Week High | 20.8 | Price to Sales Trailing 12 Months | 0.6695901 |

| Enterprise Value | 268,104,768 | Profit Margins | -0.00538 | Shares Outstanding | 9,088,240 |

| Book Value | 24.537 | Price to Book | 0.7877898 | Net Income to Common | -1,411,000 |

| Trailing EPS | -0.16 | Forward EPS | 1.6 | Enterprise to Revenue | 1.022 |

| Enterprise To EBITDA | 11.493 | 52 Week Change | 1.4510534 | Current Price | 19.33 |

| Total Cash | 177,000 | Total Debt | 92,606,000 | Revenue Per Share | 28.977 |

| Total Revenue | 262,363,008 | Debt to Equity | 41.528 | Return on Assets | 0.01021 |

| Return on Equity | -0.00632 | Free Cashflow | 5,749,375 | Operating Cashflow | 15,222,000 |

| Sharpe Ratio | 1.9036558436720021 | Sortino Ratio | 35.6999008792758 |

| Treynor Ratio | 1.728466091089704 | Calmar Ratio | 4.478312294014212 |

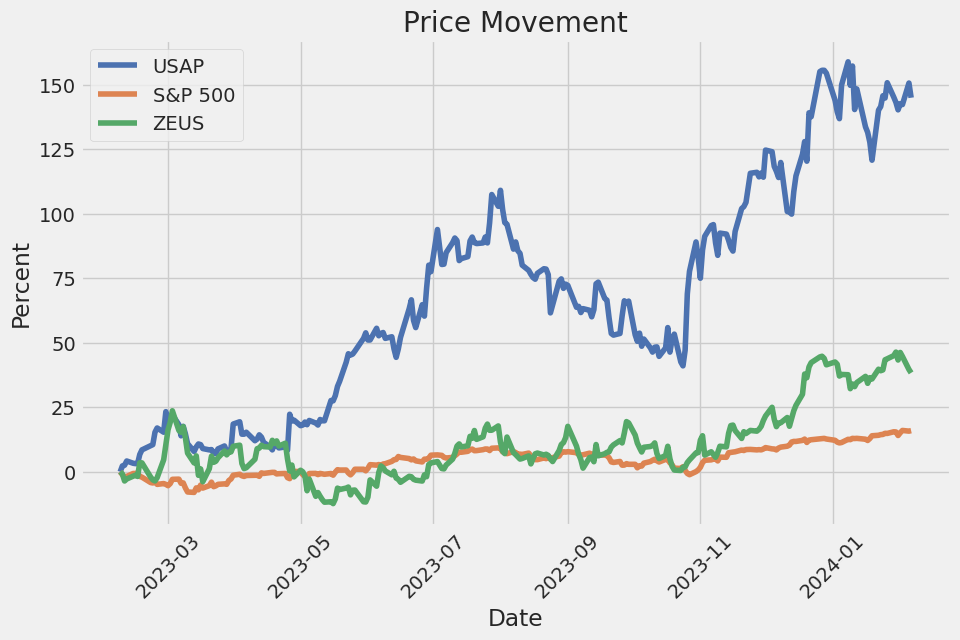

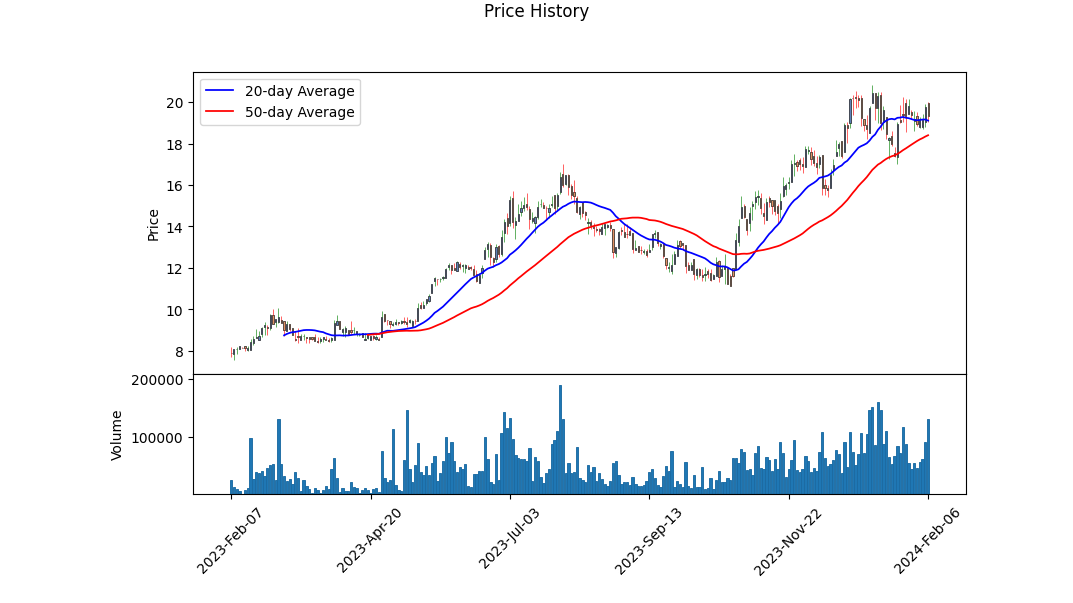

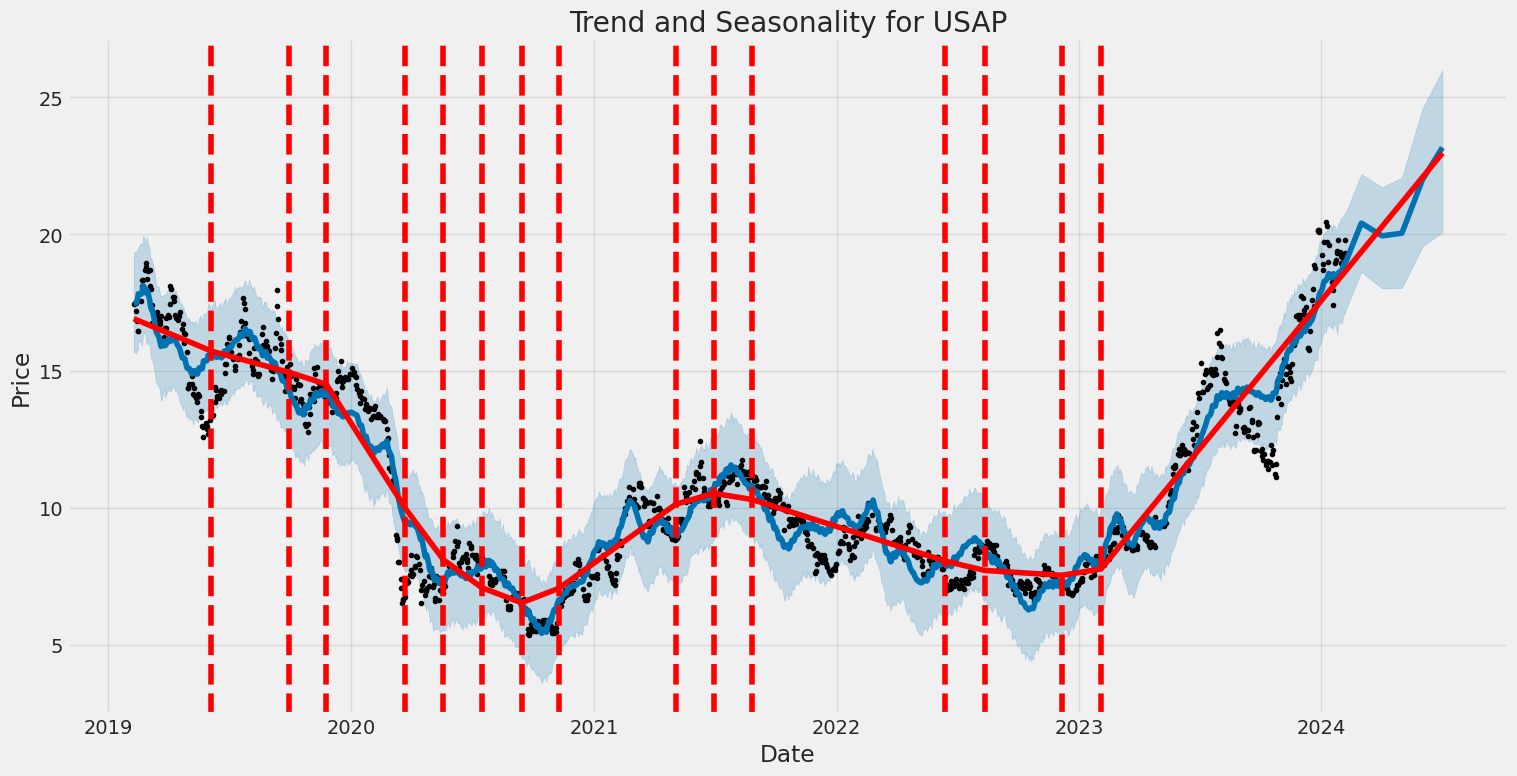

Analyzing the financial and technical status of USAP, with a comprehensive view of its fundamentals, balance sheet, cash flows, and diverse market ratios, provides a multifaceted perspective on its probable future stock price movements. The technical indicators manifest a notable upward trend in the stock price, especially highlighted by the closing prices that have significantly rallied over the last few months. When correlating these findings with the fundamental analysis, a nuanced picture emerges.

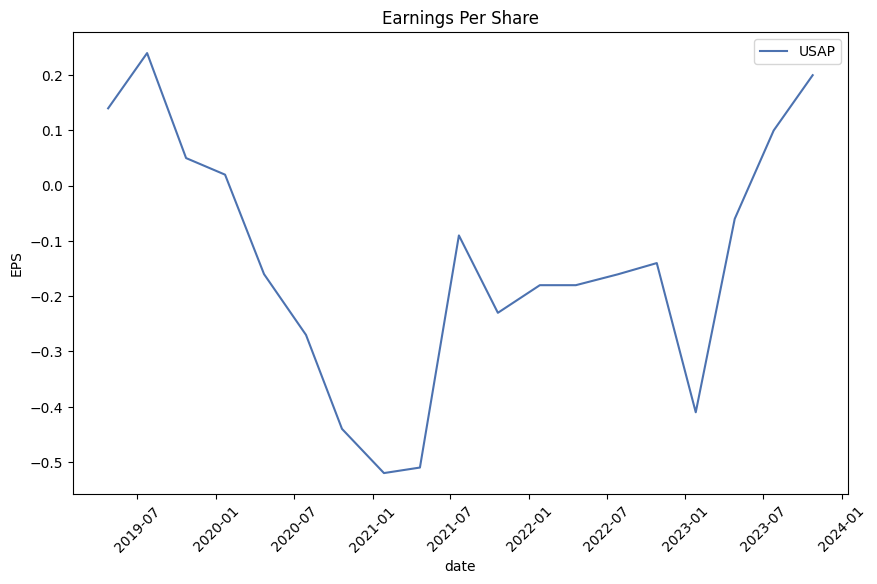

The fundamentals, including earnings and revenue estimates, present an optimistic outlook. The forecasts suggest substantial earnings growth next year, reaching $1.60 per share. Correspondingly, revenue growth is anticipated at a rate of 9.5% year-over-year, reaching $312M next year. Such growth, juxtaposed with the consistent upward movement in stock price, spells a compelling narrative for USAP's financial health and the optimistic sentiment it garners in the market.

The Sharpe, Sortino, Treynor, and Calmar ratios further augment this sentiment by underscoring the stock's risk-adjusted return potential. The exceedingly high Sortino ratio, at 35.6999008792758, indicates a favorable risk-reward balance for investors, particularly because this ratio focuses on downside deviation. The Sharpe ratio at 1.9036558436720021 and the Calmar ratio at 4.478312294014212 both emphasize the attractive return potential of USAP when juxtaposed against its risk measures. This combination of high risk-adjusted return ratios points towards a robust performance outlook, especially when factoring in the relatively lower volatility intrinsic to its stock price movements.

The balance sheet and cash flows provide indispensable insights into the company's operational efficiency and financial robustness. The increasing net debt is a point of concern but must be weighed against the backdrop of USAP's growth trajectory and its strategic investments. Given the forecasted expansion in earnings and revenue, the company appears to be leveraging debt in a quest for growth, which seems a sustainable strategy as long as the growth materializes as projected.

Market ratios such as the Altman Z-Score and Piotroski Score offer additional layers of financial health evaluation. With an Altman Z-Score of 2.5312498484266936, USAP sits in the 'safe' zone, suggesting a lower risk of bankruptcy, while the Piotroski Score of 4 could be better, signaling room for improvement in terms of financial position.

In conclusion, considering the amalgamation of technical indicators, robust growth expectations, solid risk-adjusted return profiles, and reasonable financial health, USAP's stock is likely to continue its upwards trajectory in the upcoming months. The projection is tempered with caution due to the observed debt levels and the necessity for the anticipated growth to offset these leverage risks. Investors should keep a close watch on the evolving dynamics, especially the actualization of forecasted earnings and revenue figures, as these will be critical in determining whether USAP can sustain its favorable market sentiment and stock price momentum.

In evaluating the financial health and investment appeal of Universal Stainless & Alloy Products, Inc. (USAP), a detailed analysis of key metrics reveals concerning figures. Starting with the Return on Capital (ROC), it stands at a negative -2.0557901294386376%, indicating that the company is unable to generate a positive return on its investment capital. This negative ROC suggests inefficiencies in utilizing invested funds to drive profit and growth, which is a critical red flag for potential investors. Similarly, the earnings yield of USAP is also in negative territory, recorded at -4.655975168132437%. The earnings yield, which inversely relates to the P/E ratio, measures the amount of earnings generated per share relative to the share price. A negative yield signifies that the company is posting losses, which further underscores the financial distress or operational challenges it currently faces. Taken together, these metrics raise significant concerns about the financial viability and investment attractiveness of Universal Stainless & Alloy Products, Inc., urging investors to proceed with caution or seek alternative opportunities with more robust financial health.

| Statistic Name | Statistic Value |

| R-squared | 0.079 |

| Adj. R-squared | 0.078 |

| F-statistic | 107.4 |

| Prob (F-statistic) | 3.35e-24 |

| Log-Likelihood | -3194.9 |

| No. Observations | 1256 |

| AIC | 6394 |

| BIC | 6404 |

| Const | 0.0152 |

| Beta | 0.6841 |

| Omnibus | 114.319 |

| Prob(Omnibus) | 0.000 |

| Jarque-Bera (JB) | 340.654 |

| Prob(JB) | 1.07e-74 |

| Skew | 0.455 |

| Kurtosis | 5.384 |

| Cond. No. | 1.32 |

The linear regression analysis between USAP (the dependent variable) and SPY (the independent variable) indicates a relatively low but significant relationship, emphasizing alpha's importance in understanding the model's intercept. The alpha value of approximately 0.0152 suggests that, regardless of the SPY index's performance, USAP exhibits a baseline performance increase. This could imply an inherent characteristic of USAP that contributes to its return independently of the market trends represented by SPY. Despite the overall market movements, USAP exhibits a degree of resilience or an independent growth factor not fully explained by SPY's performance alone.

Further dissecting the relationship, the Beta (or slope) of approximately 0.6841 indicates that for every one-point increase in SPY, USAP is expected to increase by about 0.6841 points, highlighting a proportional but not equivalent response to market movements. This suggests USAP's performance is sensitive to market trends but does not mirror them precisely. The F-statistic and its associated probability signify that the observed relationship between USAP and SPY is highly unlikely to be due to chance. However, the relatively low R-squared value indicates that SPY's movements only explain a small portion of USAP's variance, suggesting other factors not captured by this model also play a significant role in determining USAP's performance.

In the Universal Stainless & Alloy Products Fourth Quarter 2023 Business Update Conference Call and Webcast, the company's President and CEO, Christopher Zimmer, outlined the company's preliminary financial results and provided updates on its end markets. The report was delivered in the absence of the complete financial audit, which had been delayed due to the late engagement of new auditors on December 18, with a promise of a full report in March. Zimmer announced anticipated fourth-quarter sales to range between $78 million to $80 million, marking a new record high. This projection is an increase from $71 million in the third quarter of 2023 and $56 million in the fourth quarter of 2022. Furthermore, the company anticipates full-year sales for 2023 to be between $284 million to $286 million, significantly up from $202 million in 2022.

A significant highlight from Zimmer's briefing was the record premium alloy sales expected to range from $20 million to $21 million for the fourth quarter, surpassing previous quarters and signifying a substantial year-over-year growth. The company's backlog remained robust at $318 million by the end of 2023, with premium alloys constituting 36% of the current backlog. Zimmer also pointed out the reduction of the company's total debt by another $4 million in the fourth quarter, bringing the full year 2023 debt reduction to nearly $13 million, alongside capital spending figures which totaled $3.3 million for the quarter and $13 million for the year.

During the call, Zimmer provided a detailed commentary on the end markets, starting with aerospace, Universal Stainless & Alloy's largest market, which continued to show robust demand. The anticipated fourth-quarter sales in aerospace were expected to be between $61 million to $62 million, leading to a record annual sales projection for 2023. The demand in aerospace was driven by a recovery in air traffic, new orders for more fuel-efficient planes, and substantial order books for Airbus and Boeing. Zimmer also discussed the defense market, predicting an increase in global military spending in 2024. In contrast, the heavy equipment and general industrial markets showed a mix of results with some softening in sales but signs of recovery and growth in the upcoming quarters.

Furthermore, Zimmer covered the energy markets, noting a strategic shift in production to higher-margin aerospace products, which affected sales in the oil and gas and power generation markets. Despite this shift, the company anticipates expanding its sales to these energy markets in the future. In conclusion, Zimmer expressed optimism for 2024, especially in the second half of the year, underlined by continued strong aerospace demand and the company's expanding product capabilities. The comprehensive business update ended with an affirmation of Universal Stainless & Alloy Products' record performance in 2023 and a promising outlook for the following year.

In the third quarter of 2023, Universal Stainless & Alloy Products, Inc. (USAP) reported significant financial and operational growth, reflecting positive market trends and improved operational efficiency. The company's net sales surged to $71.3 million, marking more than a 50% increase compared to the third quarter of the previous year, attributing to the highest quarterly total since the second quarter of 2019. This growth was largely driven by a 70% increase in sales to the aerospace sector, its largest end market, alongside increments in the heavy equipment and general industrial end markets. However, sales experienced a sequential decrease in the power generation and oil and gas sectors.

USAP's total backlog as of September 30, 2023, stood at $345 million, a $57 million rise from the end of 2022, demonstrating the company's ability to maintain a robust order entry level and a strong backlog, fueled by sustained high demand for its products. Sales of premium alloy products significantly contributed to the performance, nearing a record level set in the first quarter of the year, and are anticipated to continue growing. Gross margin for the quarter was reported at 15.2% of net sales, a notable improvement from 6.4% in the same quarter of the last year, resulting in operating income of $4.4 million and net income of $1.9 million, or $0.20 per diluted share.

USAP's financial health was further underscored by its effective management of operating activities and strategic capital investments. By the end of the third quarter, the company maintained approximately $31 million of remaining availability under its revolving credit facility, providing assurance of its capability to meet working capital, capital expenditure requirements, and other contractual obligations in the foreseeable future. The company's investments in raw materials and capital expenditures were judiciously managed, reflecting a proactive approach to navigating market fluctuations and investing in growth.

Moreover, the company's commitment to transparency and governance was evident in its internal control efforts and compliance with financial covenants under its credit agreement. The report highlighted the management's confidence in USAP's strategic direction, operational efficiency, and financial stewardship, positioning the company for sustained growth and value creation.

In summary, USAP's third-quarter performance in 2023 revealed a company on an upward trajectory, benefiting from strong market demand, especially in the aerospace sector, and strategic operational enhancements. The company's robust financial position, coupled with proactive management strategies, sets a positive outlook for its future performance and ability to navigate market dynamics.

Universal Stainless & Alloy Products, Inc. (USAP), despite the volatile market conditions that marked the beginning of 2024, has showcased significant price strength, drawing the attention of investors and analysts. This company, which prides itself on manufacturing and marketing semi-finished and finished specialty steel products, serves a diverse array of critical industries ranging from aerospace to oil and gas. USAP's comprehensive product range includes stainless steel, nickel alloys, tool steels, and various alloyed steels, catering to specialized requirements with semi-finished and finished long products such as ingots, billets, bars, and flat-rolled items.

Over recent weeks, USAP's stock price experienced a noteworthy ascent, climbing by 15.7% over a four-week period. This bullish trend was further supported by an impressive anticipated earnings growth rate of more than 100% for the current year. The strategic positioning of USAP's offerings, especially in sectors experiencing high demand like aerospace, power generation, and oil and gas, plays a crucial role in its market success. By providing essential materials to these key industries, USAP has solidified its position for continued growth and expanded market penetration.

In anticipation of detailing its financial performance and strategic direction, USAP announced a business update call and webcast scheduled for January 24, 2024. This event aims to provide stakeholders with updates on market performance and financial metrics ahead of the comprehensive earnings report for the fourth quarter and the full year of 2023, expected to be released in March 2024. The delay in the financial report is attributed to the late commencement of USAP's annual integrated audit, following the engagement of a new audit firm.

During this update, USAP revealed a record-breaking performance for the fourth quarter of 2023, with sales estimated to range between $78 million to $80 million. This marks a significant upward trajectory compared to the sales figures from the previous quarters and the corresponding period in 2022. Such growth underscores the robust demand from the aerospace market, which remains a pivotal driver of USAP's top-line results. Moreover, the company has effectively managed its financials, evidenced by a substantial reduction in total debt, enhancing its operational efficiency and financial flexibility.

Amidst these promising developments, challenges persist within the broader specialty steel industry, including managing customer relations, navigating competitive pressures, and dealing with the costs associated with raw materials and energy. Nevertheless, USAP's forward-looking strategies, focusing on innovation, product range diversification, and market expansion, position it well to navigate these challenges and capitalize on opportunities for growth.

In light of these developments, prominent investor Chuck Royce made a notable adjustment to his firm's investment portfolio regarding USAP. This move, selling a significant portion of shares, reflects a strategic reassessment of USAP's valuation and future market prospects. Despite this sale, the remaining stake signifies continued interest in USAP's trajectory.

Furthermore, Christopher M. Zimmer, USAP's President and CEO, is scheduled to represent the company at the TD Cowen 45th Annual Aerospace/Defense & Industrials Conference. This presence aims to articulate USAP's value proposition and market strategies, showcasing the company's commitment to innovation and strategic market positioning. The conference, accessible via a live webcast, will offer valuable insights into USAP's endeavors to stakeholders and prospective investors.

Through strategic financial management, commitment to innovation, and proactive stakeholder communication, Universal Stainless & Alloy Products, Inc. demonstrates resilience and strategic foresight. Despite existing and emerging challenges, the company's focus on essential industries, coupled with its innovative capabilities and operational efficiency, signals potential for sustained success and growth in the specialty steel market.

Universal Stainless & Alloy Products, Inc. (USAP) experienced significant volatility as indicated by the ARCH model analysis. The model, without considering any mean return (Zero Mean model), suggests that volatility is a prominent feature of USAP's asset returns. Notably, the model identified a high coefficient (omega) for volatility, underscoring periods of intense price fluctuations, yet the presence of an alpha coefficient (though statistically not highly significant) indicates that past volatility does have some predictive power for future volatility, albeit to a limited extent. This suggests that while past price movements influenced future volatility to some degree, predicting exact future movements may still pose a challenge due to the inherent market uncertainty surrounding USAP.

| Statistic Name | Statistic Value |

|---|---|

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -3244.08 |

| AIC | 6492.16 |

| BIC | 6502.43 |

| No. Observations | 1256 |

| Df Residuals | 1256 |

| omega | 9.7099 |

| alpha[1] | 0.0588 |

In the financial analysis of a $10,000 investment in Universal Stainless & Alloy Products, Inc. (USAP) over a one-year period, the investigation employs a dual-approach method combining volatility modeling and machine learning predictions to assess the potential financial risk and investment return.

The volatility modeling technique is instrumental in understanding the inherent price fluctuations of USAP's stock. This model estimates the level of variability in the stock's returns over time, capturing the dynamic nature of market uncertainty. By fitting this model to the historical price data of USAP, we obtain a time-varying estimate of volatility, which is crucial for understanding how risk (in terms of price volatility) might evolve in the near future. This is particularly relevant for investors looking to gauge the risk associated with their investment in USAP, as it provides a detailed characterization of how volatile the stock has been, which is a key risk measure in finance.

On the other hand, the machine learning predictions utilize the insights garnered from the volatility modeling, alongside other relevant financial indicators and market data, to forecast future returns of USAP stock. The machine learning model in this analysis, specifically geared towards predicting such financial metrics, is trained on historical data to identify patterns that might influence future stock performance. By integrating historical volatility patterns with other predictive indicators, this model aims to provide a comprehensive forecast of future stock returns, thereby enabling investors to make informed decisions based on expected performance.

Combining these two methodologies yields a robust analysis of both the risks and potential returns associated with investing in USAP. The estimated Value at Risk (VaR) at a 95% confidence interval, calculated at $507.28 for a $10,000 investment, offers a quantifiable measure of the investment's risk exposure over the one-year period. VaR is a widely used risk metric in finance that estimates the maximum expected loss with a given confidence level, over a specific time horizon. In this context, the calculated VaR suggests there is a 5% chance that the investment could lose more than $507.28 over the next year, providing a clear, quantitative measure of the investment's downside risk.

This comprehensive analysis, by integrating the insights from volatility modeling and machine learning predictions, affords a nuanced perspective on the financial risk and potential return of investing in Universal Stainless & Alloy Products, Inc. It demonstrates the effectiveness of a multifaceted approach in capturing the dynamic nature of financial markets and in providing investors with valuable risk and return assessments.

Analyzing the provided options chain for Universal Stainless & Alloy Products, Inc. (USAP), several key metrics come to the forefront for gauging the most profitable call options. The metrics, known as "the Greeks," assess different aspects of the options' expected behaviors and help in identifying potentially lucrative options. The primary Greeks include Delta, Gamma, Vega, Theta, and Rho, alongside other metrics like the premium, return on investment (ROI), and expected profit.

Firstly, the option with a strike price of $7.5, expiring on 2024-04-19, reveals an impressive profile. Notably, it has a Delta of 1.0, indicating it moves dollar-for-dollar with the stock, maximizing gains if the stock price ascends as anticipated. Despite lacking Gamma and Vega values, suggesting no sensitivity to the stock's volatility or the options price change in relation to volatility, its supreme Delta and a notably high ROI of 64.06% mark it as a standout choice for achieving substantial profits with a target stock price increase of 5%. The premium of $7.8 is balanced by a significant projected profit of $4.9965, illustrating the potential for a highly profitable outcome.

Another compelling option is with a strike price of $15.0, also expiring on 2024-04-19, characterized by a lower Delta of 0.8424 but higher Gamma (0.0405) and the highest Vega (2.0540) among the presented options. This denotes sensitivity not only to the stock price movements but also to the volatility of the stock a valuable trait in fluctuating markets. With a Theta of -0.0113, its value will decrease slightly less each day relative to its counterparts. Given an ROI of 23.17% and a premium of $4.3, it offers a balanced risk profile with a potential for significant gains, evidenced by an expected profit of $0.9965.

The call option with a strike price of $10.0, expiring on the same date (2024-04-19), showcases a Delta of 0.9918, indicating a strong potential for profit if the stock moves favorably. Additionally, with a Rho of 1.8956, this option is quite sensitive to changes in interest rates, which could further enhance profitability in a rising rate environment. With a premium of $9.38, ROI of 9.77%, and a profit of $0.9165, this option provides a more conservative alternative to the higher-risk, higher-reward options previously discussed.

While all options present opportunities under the right conditions, the option with a strike price of $7.5 and expiry on 2024-04-19 emerges as highly attractive for traders targeting a 5% price increase in USAP stock. It offers an unparalleled Delta of 1.0, promising dollar-for-dollar profits with the stocks ascend, complemented by the highest ROI, suggesting an optimal balance between risk and reward. This option, followed by the $15.0 strike option due to its favorable balance between sensitivity to price and volatility, presents a compelling case for traders looking to optimize profits with call options on USAP.

Similar Companies in Steel:

Report: Olympic Steel, Inc. (ZEUS), Olympic Steel, Inc. (ZEUS), Report: Outokumpu Oyj (OUTKY), Outokumpu Oyj (OUTKY), Usinas Siderurgicas de Minas Gerais S.A. (USNZY), TimkenSteel Corporation (TMST), POSCO Holdings Inc. (PKX), Report: Reliance Steel & Aluminum Co. (RS), Reliance Steel & Aluminum Co. (RS), Report: ArcelorMittal S.A. (MT), ArcelorMittal S.A. (MT), Ternium S.A. (TX), Report: Steel Dynamics, Inc. (STLD), Steel Dynamics, Inc. (STLD), Report: Commercial Metals Company (CMC), Commercial Metals Company (CMC), Report: Nucor Corporation (NUE), Nucor Corporation (NUE), Report: Carpenter Technology Corporation (CRS), Carpenter Technology Corporation (CRS), Allegheny Technologies Incorporated (ATI), Haynes International, Inc. (HAYN)

https://finance.yahoo.com/news/zacks-com-featured-highlights-virtra-102700055.html

https://finance.yahoo.com/news/universal-stainless-business-call-webcast-114500855.html

https://finance.yahoo.com/news/universal-stainless-business-call-webcast-114500600.html

https://finance.yahoo.com/news/universal-stainless-alloy-products-inc-181427199.html

https://finance.yahoo.com/news/q4-2023-universal-stainless-alloy-054744999.html

https://finance.yahoo.com/news/universal-stainless-alloy-products-inc-135952981.html

https://finance.yahoo.com/news/chuck-royce-adjusts-position-universal-060819105.html

https://finance.yahoo.com/news/universal-stainless-present-td-cowens-120000003.html

https://www.sec.gov/Archives/edgar/data/931584/000143774923030379/usap20230930_10q.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: aXtVNV

Cost: $0.65907

https://reports.tinycomputers.io/USAP/USAP-2024-02-07.html Home