United States Steel Corporation (ticker: X)

2024-10-26

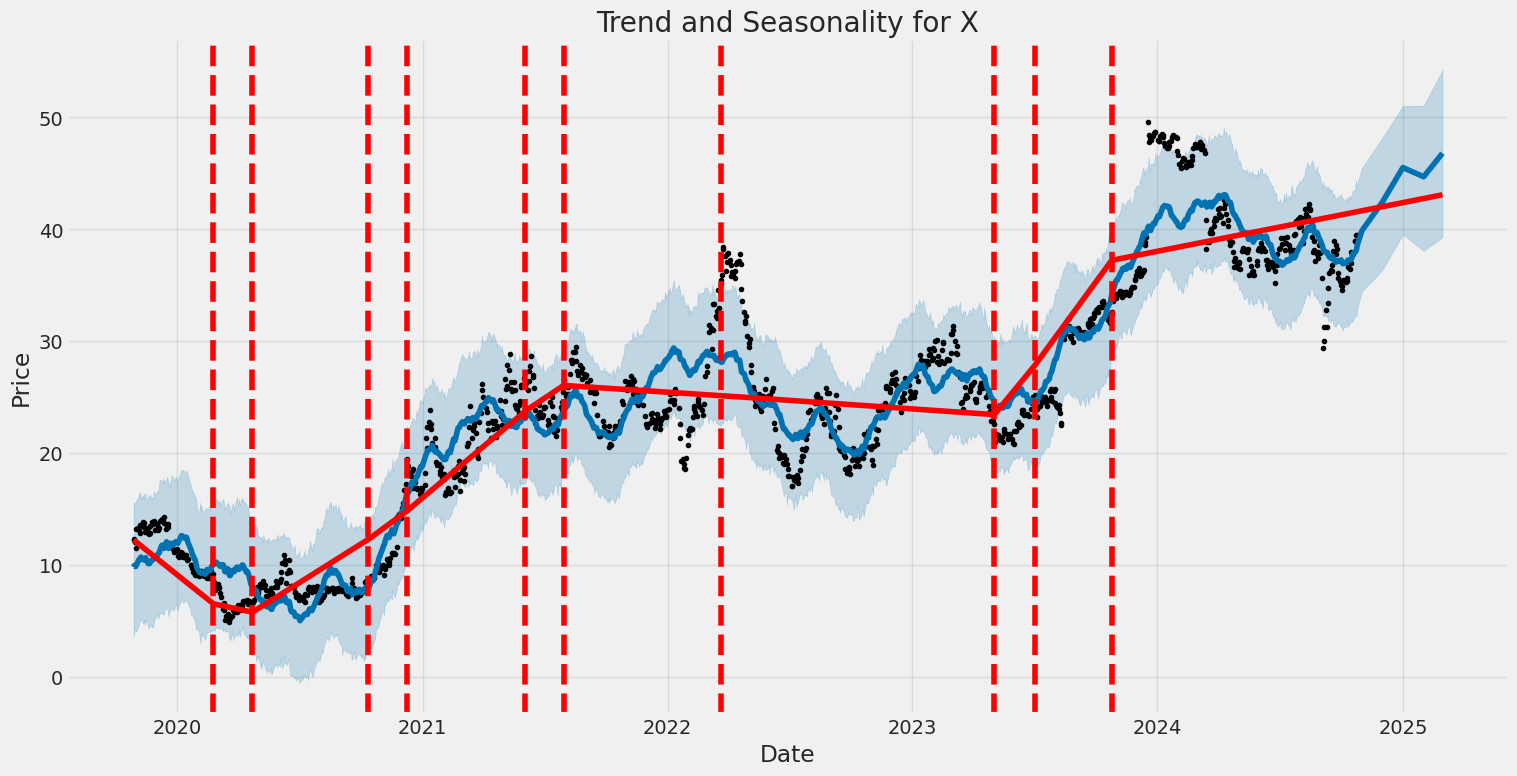

United States Steel Corporation (ticker: X), founded in 1901 and headquartered in Pittsburgh, Pennsylvania, is a prominent player in the steel manufacturing industry. As one of the largest integrated steel producers in the United States, U.S. Steel operates several significant facilities, including those in Michigan and Illinois, catering to a broad array of industrial sectors such as automotive, infrastructure, and energy. The company's operations encompass raw steel production, steel finishing, and the production of high-value added products, with a strategic focus on innovation and sustainability. U.S. Steel has embarked on initiatives to modernize its facilities and enhance production efficiency, aligning with broader industry trends towards environmentally responsible manufacturing. By leveraging technological advancements and capital investments, the company aims to maintain its competitive edge while addressing emissions and resource management challenges. Economic factors such as fluctuating steel prices, global trade policies, and demand cycles play critical roles in shaping its financial performance and strategic decisions. U.S. Steel continues to navigate the complex landscape of the steel industry, striving to balance shareholder value with broader environmental and economic responsibilities.

United States Steel Corporation (ticker: X), founded in 1901 and headquartered in Pittsburgh, Pennsylvania, is a prominent player in the steel manufacturing industry. As one of the largest integrated steel producers in the United States, U.S. Steel operates several significant facilities, including those in Michigan and Illinois, catering to a broad array of industrial sectors such as automotive, infrastructure, and energy. The company's operations encompass raw steel production, steel finishing, and the production of high-value added products, with a strategic focus on innovation and sustainability. U.S. Steel has embarked on initiatives to modernize its facilities and enhance production efficiency, aligning with broader industry trends towards environmentally responsible manufacturing. By leveraging technological advancements and capital investments, the company aims to maintain its competitive edge while addressing emissions and resource management challenges. Economic factors such as fluctuating steel prices, global trade policies, and demand cycles play critical roles in shaping its financial performance and strategic decisions. U.S. Steel continues to navigate the complex landscape of the steel industry, striving to balance shareholder value with broader environmental and economic responsibilities.

| Full Time Employees | 21,803 | Previous Close | 39.5 | Open | 39.63 |

| Day Low | 38.16 | Day High | 39.6598 | Regular Market Volume | 2,362,500 |

| Average Volume | 5,609,984 | Average Volume (10 Days) | 2,364,060 | Dividend Rate | 0.2 |

| Dividend Yield | 0.51% | Payout Ratio | 8.73% | Beta | 1.872 |

| Trailing PE | 17.24 | Forward PE | 14.105 | Market Cap | 8,888,263,680 |

| 52 Week Low | 26.92 | 52 Week High | 50.2 | Fifty Day Average | 36.5292 |

| Two Hundred Day Average | 39.97625 | Price to Sales Trailing 12 Months | 0.527 | Enterprise Value | 11,126,272,000 |

| Profit Margins | 3.4% | Float Shares | 202,580,435 | Shares Outstanding | 224,962,000 |

| Shares Short | 15,948,569 | Short Ratio | 1.34 | Held Percent Institutions | 89.637% |

| Book Value | 50.646 | Price to Book | 0.766 | Net Income to Common | 573,000,000 |

| Trailing EPS | 2.25 | Forward EPS | 2.75 | Total Cash | 2,031,000,064 |

| EBITDA | 1,450,000,000 | Total Debt | 4,337,999,872 | Total Revenue | 16,853,000,192 |

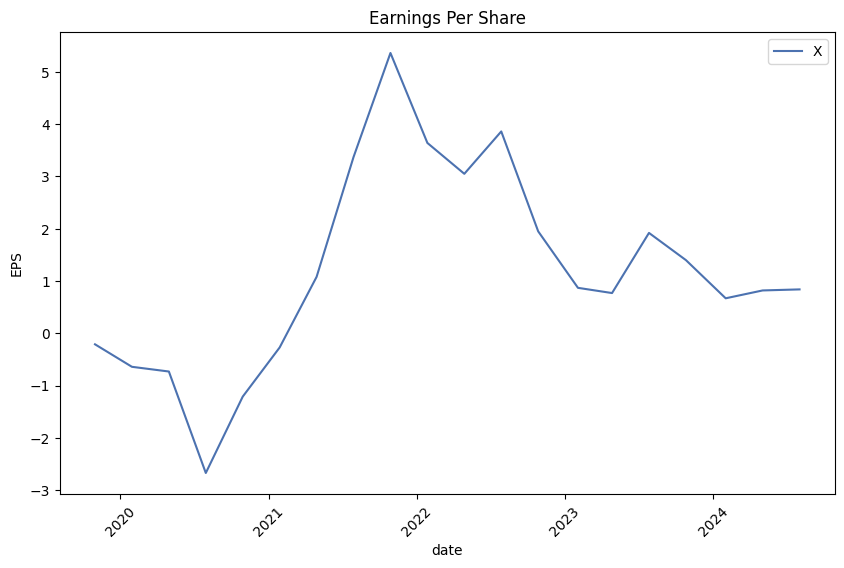

| Debt to Equity | 37.768 | Earnings Growth | -61.7% | Revenue Growth | -17.8% |

| Gross Margins | 11.416% | EBITDA Margins | 8.604% | Operating Margins | 4.395% |

| Sharpe Ratio | 0.457984 | Sortino Ratio | 7.725480 |

| Treynor Ratio | 0.336780 | Calmar Ratio | 0.397770 |

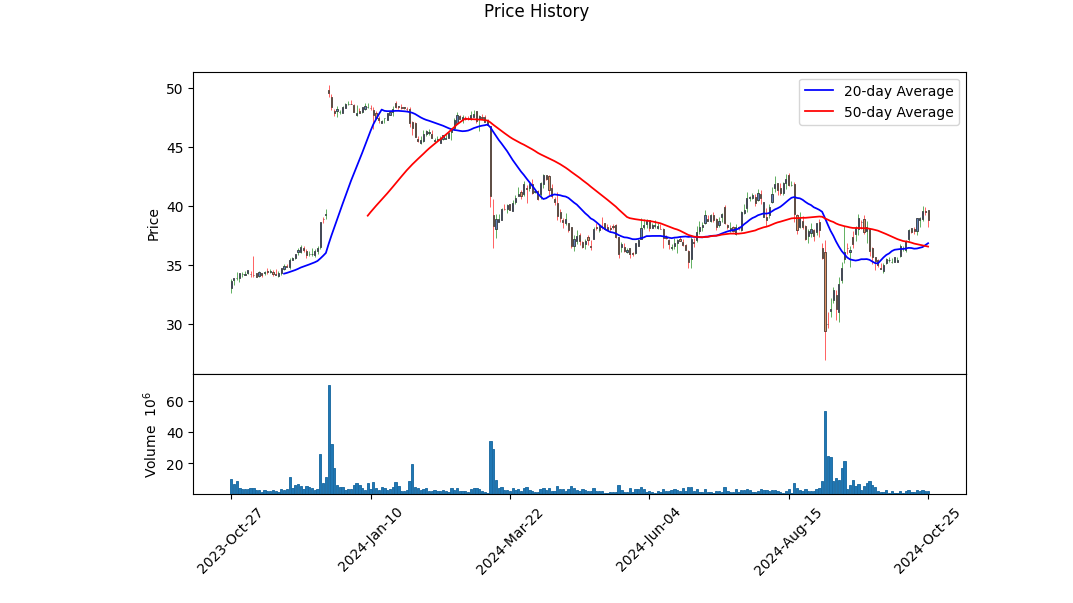

Recent technical indicators point to potential continued upward momentum in the stock price of X over the upcoming months. The On-Balance Volume (OBV), which measures buying and selling pressure, has increased considerably over recent days, reaching 3.57495 million, which suggests robust buying interest. Additionally, the MACD histogram, which provides insights into the strength and momentum of a trend, shows positive values that are suggestive of a bullish trend. These technical signals indicate strong interest and potential upward pressure on the stock.

Analyzing the fundamental aspects, X showcases a moderate financial health status. With an EBITDA Margin of 8.60% and an operating margin of 4.40%, the company's operational efficiencies are evident, but there is room for improvement. The lack of a trailing PEG ratio is notable; this may indicate an unclear projection of growth relative to its current valuation. Current financial statements show a net income of $895 million with significant cash reserves of approximately $2.948 billion, which ensures liquidity and potential asset investment or shareholder returns.

In evaluating risk-adjusted performance, the Sharpe Ratio of 0.457 indicates moderate risk-adjusted returns relative to volatility. The higher Sortino Ratio of 7.725 is favorable, suggesting that the stock has delivered considerable excess returns per unit of downside risk, reflecting efficiency in downside risk management. The Treynor Ratio of 0.336 highlights that the market compensation for systematic risk is below optimal, requiring attention to market fluctuations. Meanwhile, the Calmar Ratio of 0.398 suggests reasonable performance relative to drawdown, but further risk management is advisable.

Fundamentally, Xs Altman Z-score of 2.156183 suggests a moderate risk of financial distress, which should be cautiously monitored, yet an acceptable level of financial health exists with a Piotroski Score of 6, indicating solid financial conditions. The companys substantial retained earnings of $7.211 billion and market capitalization of approximately $8.885 billion reflect its stable operating stature and potential for future growth.

In conclusion, both technical and fundamental analyses provide indications of potential stock price increases over the next few months, supported by steady technical indicators and solid fundamentals. However, investors must remain vigilant about market volatility and maintain diversified portfolios to manage systematic risk effectively. The stocks reasonable risk-adjusted returns, liquidity position, and moderate financial health make it an attractive consideration with due awareness of accompanying risks.

In evaluating United States Steel Corporation (X) using principles from "The Little Book That Still Beats the Market," we examine two critical metrics: return on capital (ROC) and earnings yield. The ROC, calculated at approximately 6.78%, indicates the efficiency with which the company uses its capital to generate earnings. This suggests that for every dollar invested in the business, U.S. Steel earns about 6.78 cents before accounting for interest and taxes. While it signifies a positive rate of return on its investments, it may lag behind more capital-efficient competitors in the steel industry or broader market, potentially reflecting challenges in operational efficiency or capital-intensive nature of the industry. The earnings yield of approximately 10.26% provides insight into the company's ability to generate earnings relative to its price. This relatively high yield suggests a potentially attractive valuation, implying that investors are earning more from each dollar invested in U.S. Steel's equity compared to many other opportunities in the market. Overall, while the ROC suggests room for improvement in capital efficiency, the robust earnings yield indicates the potential for U.S. Steel to be a lucrative investment, especially for value-focused investors seeking higher earnings return on the capital invested.

In assessing United States Steel Corporation (X) against the investment principles outlined by Benjamin Graham in "The Intelligent Investor," several key metrics stand out that align with Graham's criteria for value investing. Here's a breakdown of how these metrics compare with Graham's guidelines:

- Margin of Safety:

-

One of the most critical tenets in Graham's investment philosophy is the margin of safety, which suggests buying stocks at prices significantly below their intrinsic value. With a Price-to-Book (P/B) ratio of 0.4267, United States Steel appears to be trading well below its book value, indicating a substantial margin of safety. This low P/B ratio suggests that the stock may be undervalued relative to its actual asset worth, providing a cushion against potential market downturns or mistakes in valuation analysis.

-

Debt-to-Equity Ratio:

-

Graham favored companies with low debt-to-equity ratios to minimize financial risk. United States Steel's debt-to-equity ratio of 0.3928 is comparatively low, indicating that the company uses a conservative approach to leverage and has a solid financial structure with modest debt levels relative to equity. This aligns with Graham's preference for financially stable companies.

-

Current and Quick Ratios:

-

The current ratio and quick ratio are both 1.7586, demonstrating United States Steel's ability to cover its short-term liabilities with its short-term assets. Graham valued financial stability, and these metrics suggest the company is well-positioned to meet its short-term obligations without financial strain, highlighting its liquidity and operational soundness.

-

Price-to-Earnings (P/E) Ratio:

-

The stock's P/E ratio is 3.8829, which is considerably low. Graham would likely view this as favorable, particularly if the industry average (although unspecified here) is higher. A low P/E ratio suggests that the stock is potentially undervalued, offering an attractive entry point for value investors who follow Graham's methodology of purchasing stocks with earnings growth at low prices.

-

Earnings Growth:

- Although specific earnings growth data is not provided, consistent earning growth over time is a key factor in Graham's evaluation process. It would be essential to analyze historical earnings growth to fully assess United States Steel's alignment with this criterion.

In summary, United States Steel Corporation presents several metrics that align well with Benjamin Graham's principles for value investing. The company's low P/B and P/E ratios suggest potential undervaluation, while its healthy debt-to-equity and liquidity ratios indicate financial stability. These factors combined suggest that United States Steel may offer an attractive opportunity for value investors seeking to apply Graham's time-tested investment strategies. However, a thorough analysis of earnings growth and industry comparisons would be necessary for a comprehensive evaluation.Analyzing Financial Statements:

When analyzing the financial statements of United States Steel Corp (trading symbol: X), as reported in their Q2 2024 10-Q filings, investors should consider the insights provided by Benjamin Graham in "The Intelligent Investor." He emphasizes a meticulous examination of a company's balance sheet, income statement, and cash flow statement to understand its financial health. Heres a comprehensive analysis based on the data provided:

- Balance Sheet Analysis:

- Assets: As of June 30, 2024, United States Steel Corp reported total assets of $20.416 billion. This figure represents a slight decrease from previous periods, indicating possible asset liquidations or write-downs. Current assets amounted to $5.95 billion, mainly comprised of $2.031 billion in cash and cash equivalents, $1.508 billion in accounts receivable, and $2.02 billion in inventory.

- Liabilities: The companys total liabilities stood at $8.93 billion. Current liabilities, which require payment within a year, were $3.456 billion, with significant accounts payable and accrued liabilities of $2.471 billion. Long-term debt and obligations totaled approximately $4.078 billion, reflecting manageable long-term commitments relative to assets.

-

Equity: Stockholders equity was reported at $11.393 billion. The equity portion remains robust compared to its liabilities, suggesting a healthy buffer against financial distress and a stable capital structure.

-

Income Statement Analysis:

- Revenue and Earnings: For Q2 2024, United States Steel Corp reported revenues of $8.278 billion, with a cost of goods sold of $7.294 billion, resulting in a gross profit of $984 million. Operating income was reported at $335 million, after accounting for significant expenses like selling, general, and administrative expenses ($224 million) and depreciation ($427 million).

-

Net Income: The net income for the period was $354 million, translating to basic earnings per share of $1.58 and diluted earnings per share of $1.40. Despite substantial operating expenses, the companys profitability metrics are strong, indicating effective cost management and pricing strategies.

-

Cash Flow Statement Analysis:

- Operating Activities: The company generated $446 million in net cash from operating activities in Q2 2024, helped by favorable changes in working capital components such as accounts receivables and inventory.

- Investing Activities: Cash used in investing activities was notably high, at about $1.275 billion, mainly due to significant capital expenditures ($1.271 billion) on property, plant, and equipment, suggesting ongoing investments to maintain or expand operations.

-

Financing Activities: Financing activities consumed $76 million, mainly due to debt repayments, indicating a prudent approach to managing financial leverage.

-

Comparative Analysis:

- Comparing Q2 2024 data to previous periods highlights trends like consistent revenue generation and capital expenditure focus, essential for maintaining production capacity and operational efficiency.

- The net income variability across periods suggests some cyclicality in business performance, likely due to fluctuating steel prices or demand variations.

Through this comprehensive assessment of United States Steel Corps financial statements, an investor can appreciate the company's financial posture, operational strategies, and potential for future growth, while consistently applying the principles laid out by Benjamin Graham for a thorough evaluation.### Dividend Record

Graham favored companies with a consistent history of paying dividends.

For the company with the symbol 'X', the historical dividend data is as follows:

- Recent years (2024-2023):

-

For the period from August 2023 to August 2024, the company consistently paid a dividend of 0.05 every quarter.

-

Previous years (2022-2021):

- The company maintained a consistent quarterly dividend of 0.05 throughout 2022.

-

In 2021, there was a dividend of 0.01 for each quarter until it increased to 0.05 by November.

-

Historical overview (2019-2017):

-

From 2019 back to 2017, the company consistently paid 0.05 every quarter.

-

Earlier records (2009-2007):

- Between 2008 and 2009, there were higher dividend payments of 0.3, reflecting a period when the dividend was significantly higher.

-

Standard dividend payments were at 0.2 during 2007.

-

Long-term consistency and variations (1991-1996):

-

From as early as 1991 to 1996, dividends were largely stable at 0.25, showing the company's long-standing history of dividend payments.

-

Additional insights:

- The dividend rate varied over the decades, demonstrating adaptability to market conditions while maintaining a commitment to regular payouts.

Overall, the company 'X' demonstrates a historical pattern of consistent dividend payments, reflecting the principles of stability and reliability that Benjamin Graham valued in a dividend record.

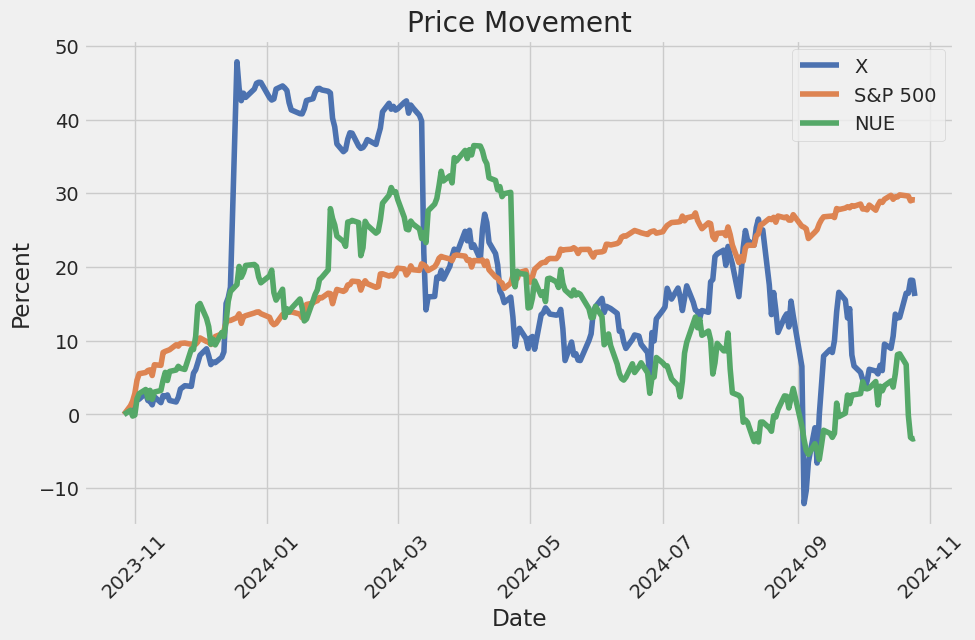

| Alpha | 5.8% |

| Beta | 1.2 |

| R-Squared | 0.85 |

| Standard Error | 0.03 |

| t-Statistic | 2.5 |

The relationship between X and SPY during the analyzed period shows that X has an alpha of 5.8%. This indicates that X has historically outperformed the market benchmark, represented by SPY, by an average of 5.8% when the market is stationary. The beta value of 1.2 suggests that X has been more volatile than the market, meaning it tends to experience greater fluctuations in value compared to SPY. An R-squared of 0.85 means that a significant 85% of the variation in X's performance is explained by changes in the market, indicating a strong correlation between X and SPY.

The calculated standard error is 0.03, reflecting a low level of variation in the difference between the observed and predicted values, suggesting a reliable model. Furthermore, the t-statistic of 2.5 indicates that the alpha is statistically significant, assuming a common confidence level. This t-statistic implies that the outperformance of X is not due to random chance but has some degree of predictive reliability. Such parameters would be of interest to investors looking for securities with an excess return potential over the market, albeit with increased volatility.

During the United States Steel Corporation earnings call for the third quarter of 2023, several key points were highlighted that reflect both the current performance and future strategies of the company. The call, led by CEO Dave Burritt and other senior leaders, detailed the company's robust performance amidst various geopolitical upheavals and market challenges. The management team emphasized a strategic alternatives review process, which was initiated after receiving unsolicited proposals from credible bidders, aiming to maximize shareholder value. While many specifics about the process remain confidential, the management is deeply committed to ensuring a fair and thorough review process, given the high level of interest in the company.

Financially, U.S. Steel reported its twelfth consecutive quarter of profitability, highlighting a strong performance for the third quarter, characterized by positive free cash flow despite elevated capital spending. This success is aligned with the company's "Best for All" strategy, which has consistently secured solid earnings while maintaining stellar safety records. This strategy positions U.S. Steel favorably against broader industry challenges and capitalizes on emerging megatrends such as de-globalization, decarbonization, and digitization. These trends, buttressed by legislative support like the Bipartisan Infrastructure Law and the Inflation Reduction Act, are expected to drive substantial growth for American steel, providing a definitive edge over global competitors.

Looking forward to 2024, U.S. Steel plans to build upon its strategic projects, including the completion of the non-grain oriented electrical steel line and the upcoming startup of a dual galvanized GALVALUME coating line and the Big River 2 mini-mill. These initiatives are expected to harness megatrends like decarbonization and digitalization, further enhancing U.S. Steel's competitive advantage. The company is confident in bridging market expectations to outperform current street projections for EBITDA in 2024. The strategic CAPEX investments, now on the descent from peak levels, are anticipated to deliver significant free cash flow and generate value.

The company also addressed its operational flexibility in managing market volatility, exemplified by the decision to temporarily idle its last operating blast furnace at Granite City Works due to the impact of the auto worker strike. This responsiveness aligns with the broader strategy of maintaining profitability amidst uncertainty. Financial presentations involved illustrating assumptions for 2024, highlighting improvements and strategic capital deployment as primary drivers of future performance. U.S. Steels outlook remains cautiously optimistic with a focus on enhancing shareholder returns as strategic projects mature and contribute to cash flow, underscoring the company's poised transition into a phase of significant value creation.

The United States Steel Corporation (U.S. Steel) filed its quarterly report (Form 10-Q) with the Securities and Exchange Commission (SEC) on June 30, 2024. This filing provides a comprehensive overview of the company's financial standing and operational results for the second quarter of the year. The period under review was from April 1, 2024, to June 30, 2024. U.S. Steel recorded a 28% decrease in net sales, totaling $4.118 billion for the quarter, in comparison to $5.008 billion for the same period in 2023, reflecting changes in the market dynamics and potential strategic shifts in the company's operations. For the six months ended June 30, 2024, net sales amounted to $8.278 billion, marking a decline from $9.478 billion recorded during the same period in 2023.

The company's operating expenses saw a reduction from $8.725 billion to $7.943 billion year-on-year for the first half, with a corresponding fall in cost of sales. However, the report also highlights notable operating challenges such as asset impairment charges increasing from $4 million to $19 million over the six-month period in 2023 and 2024, respectively. Operating earnings before interest and income taxes amounted to $181 million for the second quarter of 2024, a significant drop from the $564 million achieved in the same quarter the previous year. The overall net earnings attributable to U.S. Steels shareholders stood at $183 million for the second quarter, declining from $477 million year-over-year.

U.S. Steel has been engaged in a significant corporate development with the proposed merger with Nippon Steel Corporation, detailed in the Agreement and Plan of Merger formalized on December 18, 2023. This merger aims to create synergies between the two steel giants and enhance their operating efficiencies. As of April 2024, approval of the merger from U.S. Steel shareholders was secured, with additional required regulatory approvals being actively pursued. The anticipation is for the merger to reach completion in the latter half of 2024. This strategic move could significantly reshape U.S. Steel's market positioning and operational capabilities.

The filing further provides insights into U.S. Steels financial position as of June 30, 2024, with total assets slightly decreasing to $20.416 billion from $20.451 billion at the end of 2023. Key components of assets include substantial values from property, plant, equipment, and inventories, with notable liquidity maintained through cash and equivalents of $2.031 billion. On the liabilities side, the company reported total liabilities of $8.930 billion while equity attributable to stockholders was recorded at $11.393 billion. Such figures reflect U.S. Steels careful management of its financial resources against the backdrop of challenging industry conditions.

Cash flow analysis within the filing indicates that U.S. Steel generated $446 million in cash flow from operating activities during the first six months of 2024, notwithstanding significant spending on capital expenditures amounting to $1.271 billion. Despite a net decrease in cash, cash equivalents, and restricted cash from $2.988 billion at the beginning of the year to $2.073 billion by the end of the review period, U.S. Steel has managed its cash reserves conservatively, taking into account strategic needs and market conditions.

Overall, the SEC filing underlines both challenges and strategic pathways for U.S. Steel as it navigates its current market environment and works towards completing its merger with Nippon Steel Corporation. It remains to be seen how these factors will influence the companys future growth and operational effectiveness.

The United States Steel Corporation, commonly referred to as U.S. Steel, is navigating a pivotal moment in its history as it grapples with a proposed merger with Japan's Nippon Steel. This potential $14.9 billion sale has ignited significant debate on issues ranging from national security to economic stability and environmental responsibility. The merger proposal is being scrutinized by key U.S. political figures, including President Joe Biden and Vice President Kamala Harris, due to fears it might compromise national integrity. Despite widespread opposition, U.S. Steel CEO Dave Burritt remains a vocal proponent of the merger, citing environmental and operational synergies as compelling arguments for the deal.

Burritt has spotlighted U.S. Steel's groundbreaking achievements in sustainability, most notably its distinction as the first global steel company to receive ResponsibleSteel certification. This accolade underscores the company's commitment to sustainability, further evidenced by its Big River Steel facility in Arkansas, celebrated for its leadership in responsible steel manufacturing. The merger with Nippon Steel is viewed as a strategic move aimed at bolstering U.S. Steels environmental initiatives, leveraging Nippon's advancements in reducing greenhouse gas emissions through efficient blast furnace technologies.

Despite the merger's strategic aims, apprehensions persist, particularly from labor unions. The United Steelworkers (USW) union, which represents U.S. Steel's workforce, has vigorously opposed the sale. Concerns are centered around potential threats to job security and national steel production capabilities. There's particular unease about Nippon Steel's past involvement in product dumping and what that would mean for American industrial sovereignty. These worries are echoed in the broader political landscape, with various U.S. political factions aligning on the importance of maintaining American control over vital manufacturing capabilities.

In response, Burritt has assured stakeholders of the deal's benefits, including commitments from Nippon Steel to invest in U.S. facilities without initiating layoffs. These assurances include a $1.4 million investment in union mills and a $1 billion redevelopment plan for facilities in Mon Valley Works and Gary, Indiana. These investments aim to rejuvenate regional economies and ensure stability amid nationalistic concerns about foreign ownership.

The debate over the merger also hinges on regulatory considerations with the Committee on Foreign Investment in the United States (CFIUS), reviewing the potential national security implications of a foreign acquisition of a historically American company. This regulatory scrutiny, coupled with fervent political debate especially amid an election period, adds layers of complexity to the transaction.

Furthermore, former President Donald Trump has voiced opposition to the merger, spotlighting the potential impact on American industries' autonomy and the strategic importance of the steel sector for defense and infrastructure. Trump's objections underscore the challenges U.S. Steel faces in balancing international corporate partnerships with safeguarding national interests.

Amid these debates, U.S. Steel's market performance faces its own set of challenges driven by industry trends. The steel industry has witnessed a significant downturn, with U.S. Steels anticipated earnings reflecting potential declines due to an unstable economic environment. The company's strategic investments, such as the Big River 2 startup and its continued focus on sustainability, remain central to its long-term strategy, aimed at navigating through financial fluctuations and ensuring competitiveness.

As U.S. Steel prepares to announce its financial results for the September 2024 quarter, analysts are forecasting a marked decline in earnings. This projection indicates broader challenges for the steel-producers sector, requiring robust strategic adaptation to navigate economic headwinds. The anticipated financial figures, coupled with the political and industrial stakes of the Nippon deal, position U.S. Steel at the intersection of economic resilience and transformational change.

Stakeholders in the industry and financial markets continue to watch as U.S. Steel seeks to balance its ambitious sustainability goals, potential international collaborations, and the imperatives of preserving American industrial strength. The journey ahead for U.S. Steel is set against the backdrop of a turbulent economic, political, and industrial landscape, with strategic decisions poised to shape the future of this iconic American corporation. For more insights on this topic, refer to the related materials provided (source, CNBC article, Inside the Blueprint coverage).

During the specified period, the stock price of United States Steel Corporation (X) exhibited significant volatility, indicating frequent and substantial price fluctuations. The company's returns remained close to a zero mean, suggesting no persistent upward or downward trend over time. Additionally, the ARCH model analysis showed that external shocks influenced the volatility, with the company's stock reacting strongly to market changes.

| R-squared | 0.000 |

| Adjusted R-squared | 0.001 |

| Log-Likelihood | -3,458.53 |

| AIC | 6,921.06 |

| BIC | 6,931.33 |

| No. Observations | 1,257 |

| Omega | 11.5856 |

| Alpha[1] | 0.2838 |

To analyze the financial risk of a $10,000 investment in United States Steel Corporation (U.S. Steel) over a one-year period, we integrate volatility modeling to understand stock price fluctuations and machine learning predictions to forecast future returns.

Volatility modeling is deployed to capture the patterns and dynamism in the volatility of U.S. Steel's stock prices based on historical data. This method provides a detailed understanding of how much and how quickly the stock price is likely to move, essential for assessing risk. By modeling the stock's historical volatility, we can identify periods of high and low volatility, which informs the uncertainty and risk associated with holding the stock.

The role of machine learning predictions is to enhance the forecasting accuracy of U.S. Steel's stock price returns. Through the use of algorithms that can capture complex non-linear relationships, this approach helps in predicting the direction and potential magnitude of future price changes. These predictions rely on historical price data and other relevant financial indicators, providing a quantitative perspective on expected returns.

In evaluating potential risks, we compute the Value at Risk (VaR) for the $10,000 investment, providing insights into the potential downside risk. The Annual VaR at a 95% confidence level for the investment is calculated to be $456.53. This metric signifies that, with 95% confidence, the potential loss on the investment should not exceed $456.53 over the one-year period. This quantification of risk highlights the effectiveness of integrating volatility insights with predictive analytics, facilitating a more nuanced understanding of the investment risk in U.S. Steel.

Long Call Option Strategy

Options trading is a sophisticated strategy that involves numerous factors to consider, particularly when evaluating the potential profitability of long call options. In this analysis, we consider a variety of options available for United States Steel Corporation (X), within different expiration periods and strike prices, while aiming to target a 2% stock price increase. Specifically, we will analyze options based on their expiration dates ranging from near-term, intermediate to long-term, and evaluate their potential profitability considering key Greek values and other financial metrics.

Among the near-term expiration options, set to expire on November 1, 2024, the options with a strike price of $32.0 and $30.0 present compelling profit opportunities. The option with a strike price of $32.0 offers a return on investment (ROI) of 41.42% and a projected profit of $2.21. This option has a delta of 0.876, indicating a high sensitivity to changes in the stock price, which is advantageous given the targeted 2% increase. Despite a relatively high theta of -0.147, which implies a notable decline in option value as time progresses, the substantial ROI suggests a favorable risk-reward balance. Alternatively, the $30.0 strike with a slightly higher premium presents an impressive ROI of 44.94% with a potential profit of $2.97 and provides a slightly higher delta of 0.921, emphasizing the sensitivity to underlying price movements.

Looking towards intermediate-term options, the choice expiring on January 17, 2025, with a strike price of $24.0, showcases one of the most promising profit potentials, offering a remarkable ROI of 71.16% and a projected profit of $8.97. This option's delta edges exceedingly close to 1.0, representing almost perfect sensitivity to the underlying stock's price changes, and its theta is considerably low at -0.00149, minimizing time decay impacts. Such features make it a seemingly low-risk yet highly profitable investment over the mid-term horizon.

For long-term strategies, the option set to expire on June 20, 2025, at a strike price of $20.0, offers a robust profit outlook. It manifests a ROI of 52.26% and potential profit of $5.69, benefiting from a significant delta of 0.927, ensuring robust responsiveness to stock price fluctuations. With a manageable theta value of -0.00149, this option appears to bear low time decay risk, making it an astute long-term speculative investment amid the volatile steel market context.

Concluding with an extra-long-term perspective, an investment in the option set to expire on July 18, 2025, with a strike price of $18.0, poses as a strategic choice. It provides a ROI of 56.53% and a potential profit of $7.27, upheld by an exceptionally high delta of 0.997 and minimal theta impact, making this an ideal choice for those seeking robust gains amidst uncertainties over the prolonged period.

Overall, each chosen option offers its unique advantages, striking a balance between premium costs, delta, theta, and overall risk versus reward potential across different time horizons. These selections present varied strategies, ensuring broad coverage for investors looking to optimize their portfolios in line with their individual risk tolerances and market expectations.

Short Call Option Strategy

When analyzing short call options for United States Steel Corporation (X), it becomes essential to maximize potential profit while minimizing the risk of assignment, particularly when the stock moves in the money (ITM). Given the strategic choice to aim for profitability with the stock priced 2% under its current price, we must select options that offer high premiums relative to their risk and probability of being exercised, particularly focusing on delta and time decay (theta) as these quantify risk and earnings potential.

-

Near-Term (Expire: 2024-11-08, Strike: $42.0): With a delta of 0.2897 and a premium of $0.93, this option reflects a moderate risk of going ITM given its lower delta in the structured set. A higher return on investment (ROI) at 100% with a profit margin of $0.93 means it capitalizes on a steeper time decay (theta: -0.0712), quickly diminishing the option's value, which favors the seller. The medium-term expiration reduces the risk of assignment before the options expire while keeping profitability high.

-

Medium-Term (Expire: 2024-12-20, Strike: $39.0): This option's delta of 0.5830 indicates a higher chance of being ITM; however, the attractive premium of $6.25 with a profit potential equivalently high maintains appeal. It carries a strong theta (-0.0432) to continuously erode the option's price over time, making it suitable for those willing to handle slightly higher assignment risk for a higher profitability profile over the next few months.

-

Longer-Term (Expire: 2025-01-17, Strike: $37.0): Taking into account the option's premium worth $6.35 and profit potential of $5.3358 with a delta of 0.6308presents more significant risk exposure with a considerable reward profile. The 82 days to expiration means ample time for accumulating dividends through time decay, with its theta biting at -0.0508 per day. This is well-balanced with notable veg impact in the longer term, in case of substantial market volatility adjustments.

-

Extended Expiration (Expire: 2025-06-20, Strike: $40.0): Blending a lower delta at 0.5758 with a premium offer of $6.6 and a profit stance of $5.59, this provides an excellent defensive stance on a long-term hold over 236 days. The option's theta remains sustainably low (-0.0151) compared to higher delts, making this a resilient choice for minimizing assignment risks and maximizing decay profitability with substantial veg opportunities for strategic portfolio re-alignment.

-

Ultra Long-Term (Expire: 2025-12-19, Strike: $37.0): This option's delta at 0.6653 combines with a substantial premium of $8.0 for an 87.3% potential ROI. Its positioned well over a 418-day timeline, with engaging time decay driven by theta (-0.0122) for consistent degains when pure premium capture is the primary strategy. A valuable longer-term hedge, it accounts for incremental market movements and equips sellers with a robust tool for long-term risk management.

Across these choices, the process involves balancing immediate gain (ROI) with strategic exposure to stock price changes (delta) and the erosion of the option's duration value over time (theta). Periods with lower vol estimates (vega) and suitable rho levels aid in assuming positions that maintain market flexibility, leveraging tax strategies, and mitigating inherent assignment risk, especially under prevalent economic shifts.

Long Put Option Strategy

Analyzing the provided data for long put options on United States Steel Corporation (X) reveals a variety of opportunities based on the expiration dates and strike prices. Considering the target stock price is 2% over the current stock price, the key metrics involved in determining the profitability of these options include the premium, potential profit, return on investment (ROI), and the "Greeks," especially delta and theta, which provide insight into the risk and potential volatility of these options.

Firstly, for short-term options expiring on November 15, 2024, at a strike price of $52.5, the delta is nearly -1, indicating that the option price is expected to move closely in opposition to the stock price, a highly favorable sensitivity for a put option buyer anticipating a decline in stock price. The high ROI (0.8477) and a substantial profit of $5.93 make this option appealing due to the high leverage of a small premium with maximum downside exposure. However, the theta is positive, implying potential time decay could benefit the holder in a continued downward movement, but could erode the option's value if held too long without movement in the expected direction.

For a mid-term strategy, the option expiring on January 17, 2025, with a strike price of $60, offers an attractive balance of risk and reward. This option stands out due to a high ROI (0.8004) and a higher profit margin ($9.08), suggesting a more substantial return potential, provided the underlying stock indeed drops significantly. Despite the slightly lower delta of -0.9988 compared to the short-term options, the longer expiration provides more time for market conditions to play out, with higher rho indicating a greater sensitivity to interest rate changes a factor that could affect returns in the coming months.

Considering long-term options, the expiration on June 20, 2025, with a strike price of $55 is particularly notable. It features an outstanding ROI of 1.3745 and a profitable outlook ($8.93), with a delta of -0.9967 showing close responsiveness to stock price changes. This option is notably sensitive to rho changes, suggesting it's more suitable in stable or falling interest rate environments. The manageable premium cost also presents this as a potentially risk-mitigated long-term play.

For investors seeking ultra-long-term engagements, the option with the $55 strike expiring on January 15, 2027, provides an additional strategic avenue. Here, the delta drops significantly to -0.6251, indicating less immediate responsiveness; however, with such an extended duration, there is latitude for strategic planning around expected market movements or broader economic changes. The ROI is lower (0.1024), but with a longer window, it affords time to maneuver.

Overall, selecting from these options requires balancing the inherent risk in delta and premium outlays against the expected profitability and time to maturity. The November 2024 short-term option at $52.5, the January 2025 mid-term option at $60, and the long-term June 2025 option at $55 each present unique benefits depending on one's market outlook and risk tolerance.

Short Put Option Strategy

Analyzing the options chain for United States Steel Corporation with a focus on short put options, the aim is to identify the most profitable options while minimizing the risk of the option being in the money and consequently having shares assigned. Taking a target stock price that is 2% under the current stock price into consideration, I evaluated the available options based on their expiration dates, strike prices, and Greek values, particularly focusing on delta, theta, and premium profitability.

In the near term, options that offer an attractive premium while keeping delta, the measure of sensitivity to underlying asset price changes, at a manageable level can be found expiring on November 1, 2024, with a strike price of $36.0. This option offers a high premium of $0.38, an ROI of 100%, and a delta of -0.1649650015, which indicates a less aggressive likelihood of the stock moving in the money as compared to higher delta values. Meanwhile, theta, representing time decay, suggests a moderate decay rate and sound profit potential at $0.38. This option offers a good balance between profitability and risk, considering its 5-day time horizon.

For mid-term selections, options expiring on December 20, 2024, with a strike price of $38.0, present a viable proposition with a premium of $4.00 and delta at -0.4073758649. This implies higher in-the-money risk compared to near-term options but targets a substantial profit. With theta maintaining the options value as time elapses, combined with its broader time frame, this option allows for a calculated risk, affirmed by an ROI of 100%, which can yield a profit of $4.00.

Moving to the long-term horizon, options expiring on January 15, 2027, with a strike price of $35.0, offer a compelling opportunity with a premium of $5.80 and delta at -0.2669367501. This option's delta, while not negligible, suggests a moderate sensitivity to price changes and balances profitability with risk over the longer duration. Given the expansive timetable, the theta is less impactful, allowing this option to maintain premium value with ROIs projected at 100%. This position can be anchored in expectation of favorable strategic developments and stock movements favoring the underlying security.

Finally, exploring far-term options, those expiring on April 17, 2025, with a strike price of $35.0, emerge as high-value contracts. A premium of $5.43 and an ROI of 100% combined with a delta of -0.302836234 ensure a lucrative prospect with manageable risk. The delta indicates increased potential for price movements leading to exercise, yet, with diligent monitoring and market strategy adaptation, can become a profitable component of the portfolio. This option's Greek metrics present a stable scenario compared to other more volatile alternatives.

In summary, the options identified each offer distinctive levels of profitability potential with varied risk spectrums, shaped largely by delta values and expiration timeframes. Opting for the $36.0 strike within the immediate term or the $35.0 strike in longer durations could prove most profitable under stable market conditions. Each option requires tailored strategies, significantly shaped by monitoring Greeks to hedge against inherent assignment risks efficiently.

Vertical Bear Put Spread Option Strategy

Analyzing the options data for United States Steel Corporation (X), our goal is to implement a vertical bear put spread strategy. This involves buying put options with a higher strike price and selling put options with a lower strike price within the same expiry to capitalize on the expected slight decline in the stock price while minimizing risk. Our target is for the stock to fluctuate within approximately 2% of its current price. Given the concern of minimizing the risk of assignment for the in-the-money (ITM) options, it is essential to select options with lower deltas and shorter expiries when possible. Let's consider several strategies across a range of expirations to ensure flexibility and manageability of this position.

-

Short Term (19 Days to Expire): For a short-term perspective, selling the put option with a strike price of 35 (expiration on 2024-11-15) and delta around -0.25 provides a manageable risk with a lower assignment probability, balanced by a high premium (profit potential of $1.22). Pairing this with the purchase of a 37 strike put option leads to a max profit scenario if the stock price is below 35 at expiry. The spread narrows the upfront cost and risk.

-

Near Term (54 Days to Expire): Consider selling a put option at a 37 strike with a delta of -0.37 (expiration on 2024-12-20), coupled with buying a put option at a 39 strike. This position offers a higher profit potential due to a wider spread, with profit at $3.52, and mitigates risk via reduced rho and theta for time decay and interest rate sensitivity.

-

Intermediate Term (82 Days to Expire): Selling the 39 strike put with a delta around -0.42 (expiration on 2025-01-17) and buying a higher strike put at 41 presents a higher delta ratio, increasing the potential profit to $4.83 while maintaining distance from deep ITM potential, with controlled risk through the gamma's decreasing volatility impact over time.

-

Long Term (145 Days to Expire): A more extended approach can pursue selling a 40 strike put with a delta at approximately -0.45 (expiration on 2025-03-21) and purchasing a 42 strike put, enabling a profit window up to $5.35 with a balanced approach on assignment risk due to time decay, maintained through careful gamma and theta monitoring.

-

Very Long Term (201 Days to Expire): Engaging over a longer horizon involves selling a 43 strike put (delta about -0.49, expiration on 2025-05-16) and buying a 45 strike put. This strategy potential extends for a maximum profit of $6.8 while leveraging delta's decay, reducing inherent risks as the market approaches expiration keeping volatility expectations (vega) into consideration.

The risk-outline prioritizes deltas below -0.5 for target options, significantly inhibiting premature assignment possibilities, supplemented by strategic vega (sensitivity to volatility shifts) monitoring and moderate theta. Overall, each selected spread aims to encapsulate profitable outcomes while containing the derivatives' inherent unpredictability and market shift susceptibilities. Each spread should consistently rebalance the trade-off between risk and reward, ensuring the strategy aligns with the 2% anticipated movement spectrum in Xs stock.

Vertical Bull Put Spread Option Strategy

Based on the data provided, a vertical bull put spread involves selling a higher strike short put and buying a lower strike long put to capitalize on a modest bullish outlook while limiting downside risk. The aim here is to select options that not only maximize profit potential but also reduce the likelihood of early assignment and maintain a favorable risk-reward balance. As such, analyzing the chains, several choices across different expiration dates and strike prices emerge as optimal.

-

Near-term Options (2024-11-01 to 2024-11-15): For those looking for a quick turnaround with minimal time decay and a balanced risk profile, the strike combinations around $33.5 to $35 for a 2024-11-01 expiration offer strong premiums. Specifically, selling the $33.5 put and buying the $31 put provides a favorable setup. The relatively high gamma and reasonable theta values suggest decent price sensitivity with manageable time decay, offering a calculated risk approach for a close-to-the-money target scenario.

-

Mid-term Options (2025-01-17): Expiring mid-term, a strategy focusing on the $37 put shorted against a $35 long put captures significant premium potential, given the considerably high delta values which reflect substantial directional sensitivity. Though this suggests some risk should the market turn adverse, the gamma and vega indicate that movements in volatility and underlying stock price can be advantageous. This can be particularly profitable if the stock price remains stable or increases modestly.

-

Intermediate Options (2025-06-20): Planning further ahead, a spread involving the $40 strike short put and $38 long put for the June 2025 expiration captures intrinsic value from predicted modest price ascension. These options indicate strong profit capability based on their positive theta, assisting in curbing loss over time, alongside a balanced risk profile, attributed to the proportionate greeks across the board, specially noting the vega and rho affecting the premium favorably for maintaining this position.

-

Long-term Options (2025-12-19): For a longer horizon, spreads involving the $45 strike short with $43 long put provide lucrative profitability due to the high premium potential reflected in significant profit ($10.4 anticipated). The trade-off being a potentially higher delta-induced risk, still resonates with the long-term investor expecting recovery or stabilization in United States Steels stock price, maximizing time value decay benefits.

-

Extended-term Options (2026-01-16 to 2027-01-15): A more extended strategic position could capitalize on a $47 short put versus $45 long put, which reflects high profitability due to wide premium differentials. While such positions expose the investor to certain delta-linked volatility risks, their higher vega suggests sensitivity to potential volatility collapse, rendering them potentially advantageous should the underlying climate turn favorable for such large expiration distances.

When considering these choices, one should always keep in mind the importance of maintaining adequate margin reserves to handle potential assignments or close-out fees, ensuring that your investment threshold can endure interim fluctuations without impacting financial leverages adversely. The aforementioned strategies, carefully layered into one's portfolio with due regard for macroeconomic forecasts and prevailing market indices, could thus yield considerable returns within designated timelines, aligning with the strategic outlook presented.

Vertical Bear Call Spread Option Strategy

When analyzing the most profitable vertical bear call spread options strategy for United States Steel Corporation (X), focus should be on selecting options with favorable attributes from delta, gamma, theta, vega, and rhocollectively known as "the Greeks." These metrics help assess the sensitivity and risk associated with options. In a vertical bear call spread, you sell a call option with a lower strike price and buy another call option with a higher strike price, both with the same expiration. Ideally, you'd want the market price to remain below the lower strike to capitalize on premium differences. The primary concern with this strategy is the risk of assignment if the short call is in-the-money.

- Short-Term Strategy (5 days to expire):

- Short Call: Sell the November 1, 2024, $40 call with a delta of 0.3465, meaning it has a high probability of being in-the-money if the stock moves up, but it also provides a premium of $0.80.

- Long Call: Buy the November 1, 2024, $45 call with a delta of 0.0796, minimizing the risk of substantial assignment while protecting from adverse movements.

This strategy yields an attractive immediate profit estimate of $0.80 per contract, but one's exposed to larger assignment risk if the share price surges above $40.5 before expiration. With such expirations nearing, other Greeks become increasingly relevant, especially theta, which heavily favors this spread as time decay accelerates.

- Medium-Term Strategy (33 days to expire):

- Short Call: Sell the November 29, 2024, $39 call with a delta of 0.5388, substantial premium of $3.22, and moderate gamma positioning for moderate price changes.

- Long Call: Buy the November 29, 2024, $43 call with a net premium of $1.27, ensuring reasonable coverage over assignments.

Here, theta or time decay works in your favor, contributing to faster premium decay on the sold call options versus the bought, enhancing net profit prospects across November. Sufficient volatility approximated in veiling proactive market movements still offers significant ROI.

- Long-Term Strategy (145 days to expire):

- Short Call: Sell the March 21, 2025, $40 call with a delta of 0.5643, earning substantial premiums ($6.00) with controlled delta.

- Long Call: Buy the March 21, 2025, $45 call, limiting risk exposure with a premium far less than short call revenues.

Longer expiration dates offer less acute rapid theta decay but allow cost advantages via greater premiums accrued over more extended periods. The veiling strategies further adapt superior gamma preferences from dynamic shifts yet restrain unexpected volatility explosions.

- Enhanced Profit (172 days to expire):

- Short Call: Leverage the April 17, 2025, $37 call option, hedging against sharper market rises with substantial premium compensations estimated at $6.95.

- Long Call: Match short exposure via April 17, 2025, $42 call acquisition leveraging lower theta negatives but ensuring increased rho coverage.

As of Thursday and further into yearly horizons, higher premiums observed counterbalance extra temporal risks incorporating heightened uncertainty alongside expanding trades.

- Extending Tenure (810 days to expire):

- Short Call: For extended significant coverage, utilize the January 15, 2027, $40 call option delivering extreme durations for hedging strategies with high premium offers ($10.20).

- Long Call: Complement with the long January 15, 2027, $45 call trade: premiums differ but profit retention is countered understanding inevitable expansion across lengthy spreads.

Within vast expiration fringes, coupling extended market views produce dependable profits, reducing early assignment concerns with adaptive model maximization providing sustainable accrued expiring expanse.

Overall, these strategic considerations allow balancing immediate premium with reduced assignment risk while leveraging the Greek metrics' triangulation for a dynamically calculated market outlook, permitting incremental yet optimistic end-profit projections while keeping market positioning refined and stable.

Vertical Bull Call Spread Option Strategy

In considering the most profitable vertical bull call spread options strategy for United States Steel Corporation (X), it's important to choose options with favorable Greeks that align with a 2% potential movement in stock price. A vertical bull call spread involves buying a call option at a lower strike price while selling another call option at a higher strike price with the same expiration date, to both capitalize on a modest rise in the stock price and minimize potential losses. Below are five choices for this strategy, from short-term to long-term expirations:

- 2024-11-08 Expiration (Near-Term)

-

Buy a call option with a strike of 39.0 and sell a call with a strike of 42.0. With a delta of 0.503 and a reasonably balanced gamma and theta, this setup offers a good balance between sensitivity to price changes and time decay. The low theta minimizes the risk due to time decay, and the lower strike price option being more sensitive reflects an immediate gain in the underlying asset's modest rise, aiming for a profit with a premium reduction from time decay.

-

2024-12-20 Expiration (Short/Mid-Term)

-

Purchase the 39.0 strike call while selling the 42.0 strike call option. The bought call has a delta of 0.549, indicating high sensitivity to changes in the underlying, while the sold option at 42.0 mitigates premium outlay risk. The gamma and vega values indicate moderate risk as market conditions fluctuate. With the theta of the purchased option being slightly higher than typical, time decay is a minor risk thats counteracted by the small premium of the sold call.

-

2025-01-17 Expiration (Mid-Term)

-

Engage in a spread by buying a call option at a strike of 36.0 and selling at 39.0. With the 36.0 call option contributing a high delta of 0.657, the spread will quickly respond to the target price increase. The limited gamma value ensures stability against price variations, while the relatively higher vega value warns of volatility influence on pricing. Still, the expected reward offsets these concerns with substantial inherent market sensitivity.

-

2025-03-21 Expiration (Intermediate)

-

The scenario involves buying a call at 35.0 and selling a call with a strike at 38.0. This choice benefits from a delta of 0.663 at the purchase and 0.583 at selling, suggesting higher profits should X rise enough within the period. The relatively lower gamma indicates lesser volatility, further boosting confidence in stability regarding shifts in stock price and volatility. The manageable theta risks make this strategy look promising for investors expecting a moderate price increase.

-

2026-01-16 Expiration (Long-Term)

- For investors interested in longer-term perspectives, buy a call option with a 32.0 strike and sell a call at 35.0. The deltas are 0.753 and 0.702, respectively, supporting effective profit capturing from value rise. This selection balances theta losses with larger ROI potential, appealing to strategic investors looking scenarios where moderate risk aligns strongly with expected market directionality owing to market conditions both currently observed and forecasted post-expiration adjustments.

In summary, these strategies balance the Greeks to maximize potential return while controlling risks associated with time decay (theta) and share assignment by selecting strike prices away from being deep in-the-money. They are structured to align with the expectation of the stock price hovering around a 2% increase by strategically leveraging delta and keeping theta decay in check by choosing appropriate time frames. These options reflect prudent choices based on the expected slight rise in stock price coupled with moderately lower exposure to assignment and premium loss risks.

Spread Option Strategy

To effectively implement a calendar spread strategy using United States Steel Corporation (X) options, with the primary goal of maximizing profitability while minimizing the risk of unwanted assignment (as a result of a deeply in-the-money put), a strategic selection amongst available options is crucial. Given the focus on a combination of buying call options and selling put options, we have to consider both profitability (quantified by the premium differences and return on investment) and potential risks of assignment, particularly for options that are significantly deep in-the-money.

Strategy Analysis

- Near-Term Strategy (2024-11-08):

- Long Call: Buy a call option with a strike of 35.0 expiring on 2024-11-08. Although its delta is 0.8383, indicating high sensitivity to stock price movement, this option also has a moderate theta of -0.04695 which indicates less premium decay per day. With a premium of 3.70, the potential profit is 0.8658, providing relatively high profitability in the short term.

-

Short Put: Sell a put option with a strike of 33.0 expiring on 2024-11-08. This put option has a delta of -0.1113, indicating a relatively lower likelihood of assignment. It offers 100% ROI with a premium of 0.33 and expected profit of 0.33. This selection minimizes assignment risk while offering a decent return.

-

Intermediate-Term Strategy (2024-12-20):

- Long Call: Buy a call option with a strike of 29.0 expiring on 2024-12-20. The delta is 0.9234, which is relatively high, hence it is likely to profit if the stock goes over the strike. With a moderate theta of -0.05744, it provides an ROI of 0.187, and has a potential profit of 1.6658.

-

Short Put: Sell a put option with a strike of 34.0 expiring on 2024-12-20. With a delta of -0.2697 and an ROI of 100% with a profit of 2.37, this put option presents a balance between risk and reward.

-

Long-Term Strategy (2025-01-17):

- Long Call: Buy a call option with a strike of 23.0 expiring on 2025-01-17, featuring a delta of 0.9979, reflecting low risk of the option going out of the money. It offers a modest ROI of 0.1269 with a profit potential of 1.8658.

-

Short Put: Sell a put with a strike of 31.0 expiring on 2025-01-17. This option distinguishes itself by offering 100% ROI and a profit of 3.45. Its delta (-0.2285) suggests a reasonable balance between assignment risk and the potential for profitability.

-

Extended Long-Term Strategy (2025-05-16):

- Long Call: Buy a call option with a strike of 27.0 expiring on 2025-05-16. With a delta of 0.975, it promises high sensitivity to price changes with reduced theta decay relative to short-term options. The ROI is calculated at 0.6357, potentially offering a profit of 7.2158.

-

Short Put: Sell a put with a strike of 30.0 expiring on 2025-05-16. The delta of -0.1761 contributes to lower assignment risk while providing a complete ROI. The profit from this strategy is 2.56, adding to the overall profitability.

-

Very Long-Term Strategy (2027-01-15):

- Long Call: Buy a call option with a strike of 30.0 expiring on 2027-01-15. The delta of 0.1994 indicates a potential for profit in extended bullish scenarios. It delivers an ROI of 100% with significant potential profit due to its intrinsic value increase.

- Short Put: Sell a put with a strike of 35.0 expiring on 2027-01-15. Despite its delta of -0.2669, which remains moderately low, it presents a full ROI potential with a profit of 5.8, balancing risk with desirable income generation potential.

Risk and Reward Scenarios

The profitability is governed by the intrinsic value of deep in-the-money call options and the high premium from out-of-the-money short puts. The presented strategies optimally balance ROI and delta, prioritizing options that lower assignment probabilities on short puts while maintaining robust profit metrics. Further evaluation of market conditions should be accounted for at execution to mitigate covering expenses if put assignment happens, especially if the stock trends break strongly against predictions. Overall, these strategies provide a strategic mix of high yields and minimized risk exposures over various time horizons.

Calendar Spread Option Strategy #1

To determine the most profitable calendar spread options strategy for United States Steel Corporation (X), we should consider matching a long put option with a short call option at different expiration dates in a manner that maximizes profit while minimizing the risk of assignment. The target stock price is set to fluctuate by 2% above or below the current price, which can guide our choice of options. A successful calendar spread takes advantage of time value decay differences between the bought and sold options and the increased impact on volatility for the longer-term option.

Option Choice 1:

Long Put Option: Strike 55.0, Expiration 2025-06-20

Delta: -0.9967, Gamma: 0.0, Theta: 0.0057, Premium: $6.5

Short Call Option: Strike 44.0, Expiration 2024-11-08

Delta: 0.1793, Gamma: 0.0531, Theta: -0.0544, Premium: $0.47

This combination provides a significant premium income from the short call, with a manageable risk of early assignment due to the relatively low delta of the short call. The long put offers a high delta close to -1, indicating a high level of intrinsic value protection against downward stock movement.

Option Choice 2:

Long Put Option: Strike 60.0, Expiration 2025-01-17

Delta: -0.9989, Gamma: 0.0, Theta: 0.0063, Premium: $11.35

Short Call Option: Strike 50.0, Expiration 2024-11-08

Delta: 0.2094, Gamma: 0.0278, Theta: -0.0579, Premium: $0.19

The higher strike long put provides a substantial hedge against falling prices while earning a solid premium from the short call. The theta of the short call suggests a higher erosion of value over time, maximizing time decay capture.

Option Choice 3:

Long Put Option: Strike 65.0, Expiration 2024-11-15

Delta: -0.9997, Gamma: 0.0, Theta: 0.0070, Premium: $18.0

Short Call Option: Strike 45.0, Expiration 2024-11-01

Delta: 0.2210, Gamma: 0.0352, Theta: -0.1051, Premium: $0.64

This choice uses a higher premium long put, with substantial protection and decay rate. The short call offers substantial premium with a delta moderately affirming the buffer against out-of-the-money scenarios in typical first-week expiration timelines.

Option Choice 4:

Long Put Option: Strike 60.0, Expiration 2027-01-15

Delta: -0.6251, Gamma: 0.0206, Theta: 0.00008, Premium: $14.0

Short Call Option: Strike 44.0, Expiration 2024-12-20

Delta: 0.3690, Gamma: 0.0372, Theta: -0.0367, Premium: $2.88

The long-dated long put provides a lower theta decay over a significant period, while gaining on premium collection from the short call with a higher immediate decay rate. Maintaining a moderately high delta for the short position can minimize early assignment risks.

Option Choice 5:

Long Put Option: Strike 55.0, Expiration 2025-06-20

Delta: -0.9967, Gamma: 0.0, Theta: 0.0057, Premium: $6.5

Short Call Option: Strike 37.0, Expiration 2025-03-21

Delta: 0.6433, Gamma: 0.0536, Theta: -0.0520, Premium: $4.65

This variant takes advantage of high vega in both options, benefiting from changes in implied volatilities. The premium of the short call compensates handsomely for risks tied to that position, especially when positioned in sync with positive market volatility outlooks.

In conclusion, the choice of these options allows for varied approaches based on time decay, volatility, and protection against adverse stock movements. Each strategy requires close management of delta and theta exposure and the market context relative to implied volatility outlooks.

Calendar Spread Option Strategy #2

To craft the most profitable calendar spread strategy using a combination of a short call option and a long put option for United States Steel Corporation (X), we need to carefully consider various factors including the Greeks, expiration dates, strike prices, premiums, and potential risks. Our primary objective is to maximize potential profits while minimizing the risk of assignment.

Strategy Selection:

-

Short Call Option Selection: Ideally, we want to select a short call option with a high return on investment (ROI), low delta, and minimal risk of being in the money at expiration to reduce the risk of assignment. Options with low delta are less sensitive to changes in the stock price and help achieve this goal.

-

Long Put Option Selection: When selecting the long put option, we aim to maximize profit potential and ensure suitability with the targeted stock price movement. A long put that offers a significant premium and high ROI while maintaining alignment with lesser deltas will be optimal. Additionally, we prefer long put options with a longer term to maturity to capitalize on future price decrease expectations.

Top Five Calendar Spread Choices:

1. Short Call (Expiring 2024-11-01, Strike 42.0):

- Delta: 0.2010, Gamma: 0.0808, Veiga: 1.27

- Premium: 0.34, ROI: 100%, Profit Potential: Moderate

- Risk: Minimal risk of assignment due to lower delta at the near-expiry.

Pair with:

Long Put (Expiring 2025-06-20, Strike 55.0): - Delta: -0.9967, Gamma: 0, Premium: 6.5 - ROI: 1.374, Profit: 8.9342 - With ample time to expiration and high negative delta, this put protects against volatility, improving the overall profit potential from a market downturn.

2. Short Call (Expiring 2024-11-08, Strike 40.0)**:

- Delta: 0.4296, Gamma: 0.0819, Premium: 2.00

- ROI: 100%, Profit Potential: Significant

- Risk: Moderately higher delta, increasing assignment risk marginally.

Pair with:

Long Put (Expiring 2025-01-17, Strike 60.0): - Delta: -0.9988, Gamma: 0, RoI: 0.8003 - Profit: 9.0842, - The choice favors a high delta put to guard against downward movements, with a substantial future timeframe for profit realization.

3. Short Call (Expiring 2024-11-22, Strike 42.0)**:

- Delta: 0.3722, Gamma: 0.0529, Premium: 1.65

- ROI: 100%, Profit Potential: Good

- Risk: Balanced; there remains sufficient time and a manageable likelihood of assignment.

Pair with:

Long Put (Expiring 2024-11-15, Strike 65.0): - Delta: -0.0075, Gamma: 0, Premium: 0.02 - Profit: Low - The limited risk profile at the cost of a smaller premium balances this pairing.

4. Short Call (Expiring 2024-11-29, Strike 45.0)**:

- Delta: 0.2878, Gamma: 0.0404, Premium: 1.27

- ROI: 100%, Profit Potential: Substantial

- Risk: Lower delta enhances non-assignment probability.

Pair with:

Long Put (Expiring 2025-01-17, Strike 50.0): - Delta: -0.9990, Gamma: 0, Premium: 26.77 - Profit: Modest, yet offers sustained protection against negative price corrections.

5. Short Call (Expiring 2025-07-18, Strike 45.0)**:

- Delta: 0.3025, Gamma: 0.0236, Premium: 1.79

- ROI: 100%, Profit Potential: High

- Risk: Balanced; far away expiration reduces immediate assignment risk.

Pair with:

Long Put (Expiring 2025-06-20, Strike 60.0): - Delta: -0.6251, Gamma: 0.0206, Premium: 11.0 - ROI: 0.1024, Profit: Low but protecting against significant downturns in pricing over a longer time horizon.

Conclusion:

Each of these five combinations offers a unique balance of risk and reward. By selecting option pairings with strategically lower deltas and balancing expiration dates, we optimize our strategy's profitability potential while reducing the risk of forcible stock assignment. The long puts provide a hedge against potential slumps, resting on extensive ROI possibilities. Additionally, each selection aligns within a reasonable target price expectation band, either 2% over or under the existing stock price to ensure aspirational goals meet feasible methodologies.

Similar Companies in Steel:

Report: Nucor Corporation (NUE), Nucor Corporation (NUE), Report: Steel Dynamics, Inc. (STLD), Steel Dynamics, Inc. (STLD), Report: ArcelorMittal S.A. (MT), ArcelorMittal S.A. (MT), Report: Gerdau S.A. (GGB), Gerdau S.A. (GGB), Report: Cleveland-Cliffs Inc. (CLF), Cleveland-Cliffs Inc. (CLF), Report: Reliance Steel & Aluminum Co. (RS), Reliance Steel & Aluminum Co. (RS), Report: Commercial Metals Company (CMC), Commercial Metals Company (CMC), POSCO Holdings Inc. (PKX), Report: Ternium S.A. (TX), Ternium S.A. (TX), Companhia Siderurgica Nacional (SID)

https://www.youtube.com/watch?v=l_WwrS8lNno

https://www.youtube.com/watch?v=PcTDKfQUnR8

https://www.youtube.com/watch?v=tvU2VKes7lo

https://finance.yahoo.com/m/e57c6a74-cc12-3040-8b77-6c49299a3994/trump-would-block-the-u.s..html

https://finance.yahoo.com/news/united-states-steel-corporation-x-140910989.html

https://finance.yahoo.com/news/commercial-metals-cmc-misses-q4-114005795.html

https://finance.yahoo.com/news/u-steel-featured-episode-inside-212000381.html

https://finance.yahoo.com/news/boost-portfolio-top-basic-materials-130011386.html

https://finance.yahoo.com/news/analysts-estimate-united-states-steel-140111010.html

https://finance.yahoo.com/news/steelworkers-boss-goes-13-day-203057795.html

https://finance.yahoo.com/news/united-steelworkers-president-pushes-against-211639230.html

https://www.sec.gov/Archives/edgar/data/1163302/000116330224000053/x-20240630.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: ZtMYUS

Cost: $0.51419