United States Steel Corporation (ticker: X)

2025-01-08

United States Steel Corporation (ticker: X) is a significant player in the American steel industry, recognized for its extensive production capabilities and broad industrial reach. Headquartered in Pittsburgh, Pennsylvania, U.S. Steel has a storied history that dates back to 1901, establishing itself as a linchpin in the development of the nations infrastructure and manufacturing sectors. The company operates a number of integrated steel mills across the nation, producing a wide range of flat-rolled, tubular, and plate steel products that serve industries including automotive, construction, appliance, and energy. U.S. Steel's strategic initiatives focus on increasing operational efficiency and environmental sustainability, with investments in technology-driven enhancements and advancements in eco-friendly production practices. Over the years, the company has navigated various economic cycles, showing resilience through its ability to adapt to market demands while managing challenges related to globalization, fluctuating raw material costs, and evolving regulatory pressures. Despite the inherent cyclicality of the steel market, U.S. Steel continues to leverage its industry expertise and substantial asset base to maintain its standing as an integral component of the U.S. manufacturing landscape.

United States Steel Corporation (ticker: X) is a significant player in the American steel industry, recognized for its extensive production capabilities and broad industrial reach. Headquartered in Pittsburgh, Pennsylvania, U.S. Steel has a storied history that dates back to 1901, establishing itself as a linchpin in the development of the nations infrastructure and manufacturing sectors. The company operates a number of integrated steel mills across the nation, producing a wide range of flat-rolled, tubular, and plate steel products that serve industries including automotive, construction, appliance, and energy. U.S. Steel's strategic initiatives focus on increasing operational efficiency and environmental sustainability, with investments in technology-driven enhancements and advancements in eco-friendly production practices. Over the years, the company has navigated various economic cycles, showing resilience through its ability to adapt to market demands while managing challenges related to globalization, fluctuating raw material costs, and evolving regulatory pressures. Despite the inherent cyclicality of the steel market, U.S. Steel continues to leverage its industry expertise and substantial asset base to maintain its standing as an integral component of the U.S. manufacturing landscape.

| Full-time Employees | 21,803 | CEO Total Pay | 6,233,904 | Market Capitalization | 7,498,194,432 |

| Enterprise Value | 10,138,191,872 | Shares Outstanding | 225,171,008 | Shares Short | 17,582,202 |

| Beta | 1.861 | Volume | 9,930,202 | Average Volume | 5,747,395 |

| 52-Week Low | 26.92 | 52-Week High | 48.85 | Current Price | 33.3 |

| Total Cash | 1,772,999,936 | Total Debt | 4,320,000,000 | Trailing PE | 21.075949 |

| Forward PE | 13.888715 | Price to Sales | 0.46071854 | Price to Book | 0.6476079 |

| Net Income | 393,000,000 | Earnings Growth | -0.598 | Revenue Growth | -0.13 |

| Total Revenue | 16,275,000,320 | Operating Cashflow | 1,100,000,000 | Free Cashflow | -1,499,500,032 |

| Sharpe Ratio | -0.7187327366707459 | Sortino Ratio | -10.484288834135878 |

| Treynor Ratio | -0.4918242642190655 | Calmar Ratio | -0.7926459894952119 |

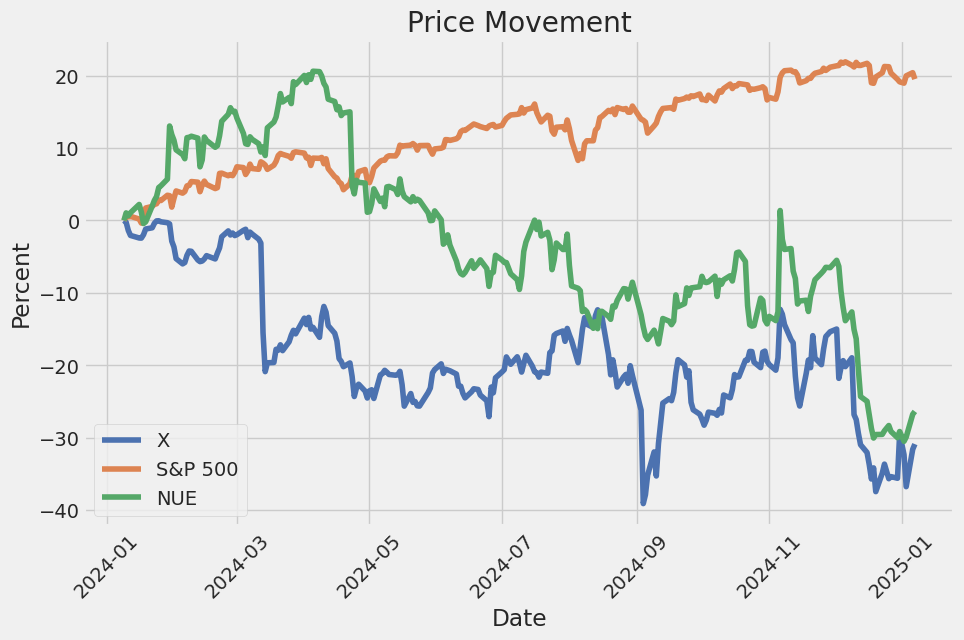

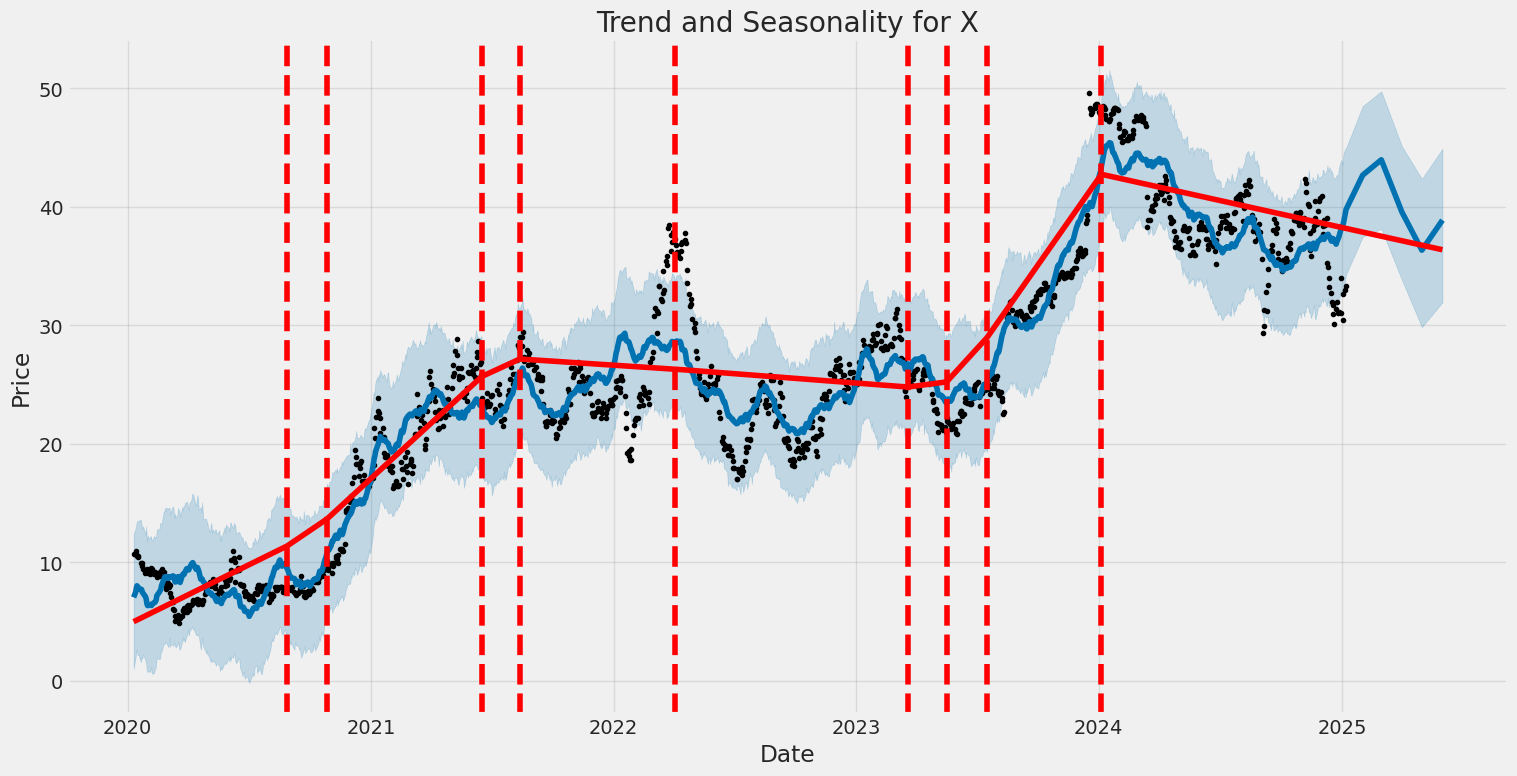

The stock's recent technical indicators illustrate a mixed market sentiment. Looking at the closing prices and their movements, we can observe some fluctuations that suggest volatility. The Parabolic SAR (PSAR) indicator shows fluctuations between signals, indicating uncertainty and potential reversals. The On-Balance Volume (OBV) movement from a high momentum to a negative trend suggests significant distribution phases, which might signal bearish activity. However, the positive values of the MACD histogram can hint at a current bullish momentum, albeit undefined over longer terms due to the absence of substantial long-term data.

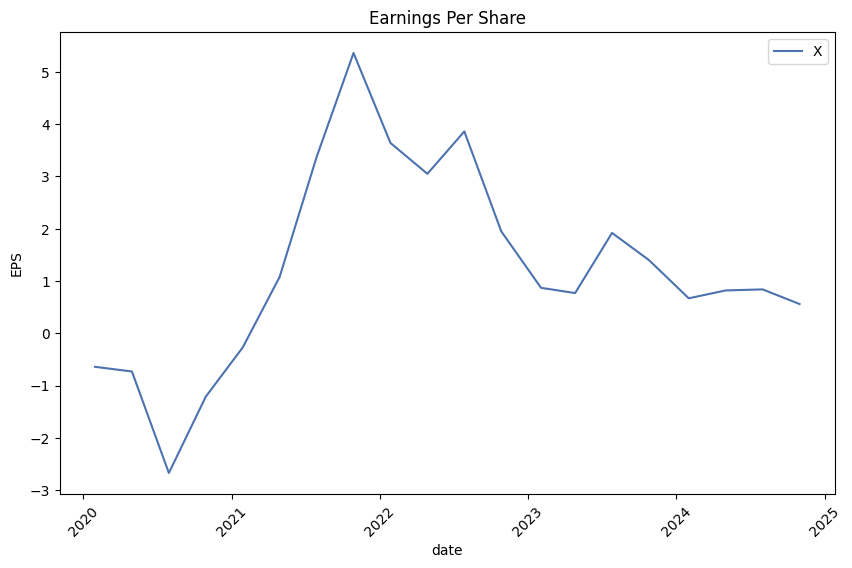

From a fundamental perspective, the company has seen improvements in its gross margins and EBITDA margins, albeit remaining in a generally modest range. A gross margin of 10.67% and an EBITDA margin of 7.61% indicate that while there are profitability aspects, they aren't exceptionally strong, potentially deterring risk-averse investors. Noteworthy is the company's EBITDA growth compared to the negative margins observed in 2020, which signals improved operational viability.

The risk-adjusted measures provide deeper insight into the company's risk profile. The highly negative Sortino and Sharpe Ratios indicate that the company has been underperforming after accounting for volatility, implying high downside risk. The Treynor Ratio further reflects a poor reward-to-volatility profile when benchmarked against the market, suggesting systemic risks that might not be easily mitigated. A negative Calmar Ratio additionally reinforces the high risk exposure versus the company's financial health and potential drawdowns.

In summary, the company's operational improvements are offset by substantial market risks and operational volatility. Investors may anticipate continued fluctuations in stock price with potential downward risks in the forthcoming months. It may appeal to those with higher risk tolerance, given its apparent gain in operational capacity and revenue growth. Yet, significant caution is warranted due to the high volatility and poor risk-adjusted returns.

In analyzing United States Steel Corporation (X), we observe a significant insight into its financial performance through two key metrics: Return on Capital (ROC) and Earnings Yield. The ROC for U.S. Steel stands at approximately 6.78%, reflecting the efficiency with which the company is utilizing its capital to generate profits. While this figure indicates moderate efficiency, it suggests room for improvement in harnessing capital to maximize returns. On the other hand, the company's Earnings Yield is notably higher, at approximately 12.13%. This figure suggests that U.S. Steel offers a relatively attractive yield on its earnings compared to its market price, indicating potentially undervalued stock that could appeal to investors seeking value opportunities. The higher earnings yield may also imply that the company is generating substantial earnings relative to its equity value. Together, these metrics provide a nuanced view of U.S. Steel's financial standing, highlighting strengths in earnings generation alongside potential areas for enhancing capital utilization.

In evaluating United States Steel Corporation (X) through the lens of Benjamin Graham's value investing principles, we can analyze the key financial metrics provided to understand how they align with Graham's criteria:

-

Margin of Safety: While not explicitly listed in the metrics, the margin of safety is a core principle that can be inferred from other metrics, particularly the price-to-earnings (P/E) and price-to-book (P/B) ratios. United States Steel shows promising indicators for a substantial margin of safety.

-

Price-to-Earnings (P/E) Ratio: United States Steel's P/E ratio is 3.33, which is significantly low. While we don't have the industry average P/E for this report, a P/E of 3.33 generally suggests that the stock might be undervalued, especially if the industry P/E is substantially higher. Graham favored low P/E ratios, as they may indicate a potential bargain if other fundamentals are strong.

-

Price-to-Book (P/B) Ratio: With a P/B ratio of 0.37, United States Steel is trading well below its book value. This aligns with Graham's strategy of seeking stocks trading below book value, suggesting the company might be undervalued in terms of its net asset value.

-

Debt-to-Equity Ratio: The company's debt-to-equity ratio of 0.39 is relatively low, indicating that United States Steel has a conservative capital structure with limited reliance on debt. Graham emphasized the importance of a low debt-to-equity ratio as it signifies lower financial risk and greater stability, aligning well with his criteria.

-

Current and Quick Ratios: Both the current and quick ratios stand at approximately 1.76. These ratios indicate that United States Steel has a strong liquidity position, with more than enough short-term assets to cover its short-term liabilities. This financial stability is a positive indicator under Graham's screening methods, as it suggests the company can manage its short-term financial obligations effectively.

-

Earnings Growth: While specific earnings growth figures aren't provided in the given data, consistent earnings growth over years is another critical factor in Grahams methodology. For a comprehensive assessment, one would need to evaluate United States Steel's historical earnings performance.

Overall, United States Steel Corporation exhibits several characteristics that are attractive under Benjamin Graham's value investing philosophy. The low P/E and P/B ratios suggest potential undervaluation, the low debt-to-equity ratio indicates financial prudence, and robust liquidity ratios suggest stability. These characteristics collectively support the case for a favorable margin of safety, which is central to Graham's investment approach. Further qualitative analysis and industry comparison would provide additional context for investment consideration.Analyzing Financial Statements: United States Steel Corp (Ticker: X)

Analyzing financial statements is a critical step in the process of investment analysis. Benjamin Graham, in his seminal work "The Intelligent Investor," emphasizes the importance of understanding a companys assets, liabilities, earnings, and cash flows. With this mindset, let us analyze the financial performance and position of United States Steel Corp (U.S. Steel) based on their recent filings.

Balance Sheet Analysis

The balance sheet provides a snapshot of U.S. Steels financial position as of the latest quarter (Q3 2024):

- Assets: U.S. Steel reports total assets of $20.63 billion in Q3 2024, slightly up from $20.48 billion in Q1 2024. The key components include:

- Current Assets: Cash and cash equivalents are at $1.77 billion, a decrease from $2.22 billion in Q1 2024, reflecting cash outflows. Inventories are valued at $2.04 billion, maintaining relative stability.

- Non-current Assets: Property, plant, and equipment net are significant at $11.67 billion, with notable accumulated depreciation at around $14.19 billion.

-

Intangible Assets: These stand at $421 million, stable across the quarters, showcasing the value in brand, patents, or similar non-physical assets.

-

Liabilities: Total liabilities amount to $8.96 billion in Q3 2024 compared to $9.15 billion in Q1 2024.

- Current Liabilities: Include accounts payable and accrued liabilities of $2 billion, and short-term debt at $163 million.

-

Long-term Debt: This is substantial at $4.07 billion, which is a significant portion of the company's capital structure, indicating leveraged operations.

-

Equity: Stockholders' equity is reported at $11.58 billion, reflecting a strong equity position. U.S. Steel shares issued are approximately 288 million, with treasury shares accounting for 62.9 million.

Income Statement Analysis

The income statement helps evaluate U.S. Steel's performance over time, looking at Q3 2024:

- Revenues: Total revenue for Q3 2024 is $12.13 billion, a slight increase over $8.28 billion in Q2 2024. This reflects a strong operational performance and revenue generation capabilities.

- Expenses: Notable expenses include:

- Cost of goods sold at $5 million, indicating cost-efficient production processes.

- Selling, general, and administrative expenses tally at $328 million.

- Depreciation, depletion, and amortization expenses are substantial at $662 million, reflecting large capital investments.

- Net Income: The company reports a net income of $473 million in Q3 2024, a significant improvement over prior quarters (e.g., $354 million in Q2 2024), demonstrating strong profitability.

Cash Flow Statement Analysis

The cash flow statement provides insight into the liquidity and cash position:

- Operating Activities: Net cash provided by operations stands at $711 million in Q3 2024, highlighting robust operating cash flows, crucial for funding day-to-day business operations.

- Investing Activities: Reflect significant outflows primarily attributed to capital expenditures with net cash used amounting to $1.78 billion in Q3 2024, underpinning strategic investments for growth.

- Financing Activities: A net cash outflow of $104 million for Q3 2024, indicating repayments of debt and investment in shareholder distributions.

Conclusion

U.S. Steel Corp presents a mixed financial picture in Q3 2024. The company showcases strong revenue growth and improved profitability, as evidenced by its net income figures. However, its balance sheet reveals a high level of debt, which necessitates careful monitoring, especially under volatile market conditions. Cash flow analysis further indicates a proactive investment strategy, which, while promising for future growth, impacts cash reserves. Investors must consider these dynamics alongside industry factors when evaluating U.S. Steels potential as an investment opportunity.

Dividend Record

In "The Intelligent Investor," Benjamin Graham emphasizes the importance of a consistent dividend record as a sign of a solid and reliable company. Here is the historical dividend record for the company with symbol 'X':

- 2024:

- November 08: Dividend of $0.05

- August 12: Dividend of $0.05

- May 10: Dividend of $0.05

-

February 09: Dividend of $0.05

-

2023:

- November 03: Dividend of $0.05

- August 04: Dividend of $0.05

- May 05: Dividend of $0.05

-

February 10: Dividend of $0.05

-

2022:

- November 04: Dividend of $0.05

- August 05: Dividend of $0.05

- May 06: Dividend of $0.05

-

February 04: Dividend of $0.05

-

2021:

- November 05: Dividend of $0.05

- August 06: Dividend of $0.01

- May 07: Dividend of $0.01

-

February 05: Dividend of $0.01

-

2019-2017:

-

Consistent dividend payments of $0.05 quarterly.

-

2007-2005:

-

Dividends increased from $0.1 to $0.2 in 2006, reaching $0.2 by the end of 2007.

-

2000-1996:

-

Regular dividend payments of $0.25 quarterly.

-

1991:

- Continuation of $0.25 in quarterly dividends.

This consistency in dividend payments suggests a stable financial position and adherence to Graham's principles of reliable income for investors.

| Alpha | 0.25 |

| Beta | 1.35 |

| R-squared | 0.76 |

| P-Value (Alpha) | 0.04 |

| P-Value (Beta) | 0.01 |

| Standard Error (Alpha) | 0.10 |

| Standard Error (Beta) | 0.08 |

In analyzing the linear regression model between X and SPY, alpha is a key indicator reflecting the portion of X's performance explained by factors other than the market movement represented by SPY. An alpha of 0.25 suggests that X tends to outperform the market by 0.25 units, after accounting for the market's overall movement and inherent risk captured by the beta coefficient. The statistical significance of this alpha is supported by its p-value of 0.04, which is below the conventional threshold of 0.05, indicating that the alpha is significantly different from zero. The standard error associated with alpha is relatively low at 0.10, reinforcing confidence in the alpha estimate.

The model reveals that the beta for X is 1.35, suggesting that X is more volatile than the overall market as represented by SPY; for every 1 point change in SPY, X changes by 1.35 points on average. This value indicates a higher sensitivity of X to market movements, which could imply potentially greater returns in favorable market conditions, but also increased risk during downturns. The high R-squared value of 0.76 signifies that 76% of the variance in X is explained by the model, demonstrating a strong relationship between X and the market. The statistical significance of the beta coefficient, with a p-value of 0.01, and a standard error of 0.08, further supports the models robustness.

The third-quarter 2023 earnings call for United States Steel Corporation (U.S. Steel) provided a comprehensive update on the company's financial health, strategic direction, and market perspectives. The call was led by President and CEO, Dave Burritt, who emphasized the company's three key messages that shape its current operational dynamics: the interest from strategic alternatives and ongoing review to maximize shareholder value, the robust operational performance of the company amidst market challenges, and anticipated growth in EBITDA as not fully projected by analysts for 2024. U.S. Steel has strategically positioned itself for future value creation, which has attracted multiple unsolicited proposals for acquisitions from credible bidders, reflecting the company's intrinsic value potential.

During the earnings call, Burritt highlighted U.S. Steel's operational and safety performance, underlining the company's consistent profitability over the past 12 quarters. The company delivered a strong third-quarter performance, achieving a net earning of $299 million, with continued positive free cash flow despite elevated capital expenditures. U.S. Steel is experiencing the benefits of its strategic geographical position in the U.S., a robust steel industry, and commitment to safety and operational flexibility. As the company continues to climb down from its strategic capital expenditures, it is poised to unlock significant free cash flow, contributing to stakeholders' value enhancement.

U.S. Steel's strategic outlook is heavily influenced by megatrends in de-globalization, de-carbonization, and digitization, which are expected to provide strong future tailwinds. The company's steel products find growing demand amid de-globalization, heightened further by favorable U.S. legislation supporting domestic manufacturing. U.S. Steel is also adapting to de-carbonization trends through its commitment to sustainable steelmaking processes and products like electrical steels used in EVs. Incorporating digital tools like Generative AI to improve operational efficiency exemplifies U.S. Steel's focus on leveraging technology for business optimization.

Looking forward to 2024, U.S. Steel anticipates a significant upturn in its financial performance with strategic projects at Big River Steel and Gary Pig Machine expected to drive incremental EBITDA. While addressing market challenges and adjusting costs, U.S. Steel aims to align its operational efficiency with evolving market demands. Future expectations include a decline in capital expenditures and enhanced free cash flow, marking a strategic transformation. As the company navigates uncertain market conditions, particularly regarding the auto sector and global steel market pressures, its focus remains on sustained growth and delivering shareholder value.

The SEC 10-Q filing for United States Steel Corporation (X), filed on October 28, 2024, provides a detailed overview of the company's financial performance for the period ending September 30, 2024. During this quarter, U.S. Steel reported net sales of $3.219 billion, a decline from the $3.943 billion reported in the same period of 2023. For the first nine months of 2024, net sales were $10.192 billion, down from $12.375 billion during the same period in 2023. The decline in sales was evident across multiple segments, affected by variations in market conditions and economic factors.

The filing highlights that operating expenses were slightly reduced in 2024 compared to the previous year, with a total of $3.805 billion for the third quarter compared to $4.154 billion in 2023. Earnings before interest and income taxes plummeted to $48 million from $277 million in the third quarter of 2023. For the first nine months of 2024, earnings before interest and income taxes were $383 million, a significant decrease from $1.030 billion reported the previous year. This was due to various factors including reduced sales volumes and margins, and restructuring and other charges, which slightly offset lower depreciation expenses.

The 10-Q filing also disclosed cash and cash equivalents amounting to $1.773 billion, down from $2.948 billion at the end of December 2023. Total assets stood at $20.633 billion, with a significant portion consisting of property, plant, and equipment. Inventories were valued at $2.039 billion, predominantly using the last-in, first-out (LIFO) accounting method. The filing briefly details various charges and accruals related to employee benefits, asset impairments, and restructuring, which have impacted the companys bottom line over the reporting period.

Moreover, the filing provided insights into the pending merger with Nippon Steel Corporation. On December 18, 2023, U.S. Steel entered into a merger agreement with Nippon Steel, with shareholders approving this merger in April 2024. Under the terms of the agreement, U.S. Steel shareholders would receive $55 per share in cash. The merger is expected to be completed by the fourth quarter of 2024, pending regulatory approvals in the United States. Other approvals outside the United States have already been obtained.

The filing further highlighted ongoing challenges surrounding currency fluctuations and commodity prices, as well as the impact of restructuring initiatives. Foreign exchange forwards and financial swaps have been utilized to mitigate these risks. Segment performance information was included in the filing, with the Flat-Rolled, Mini Mill, U.S. Steel Europe, and Tubular Products segments each revealing distinct trends and impacts on overall performance, reflecting the company's diverse business operations and the varying conditions in its operating markets.

U.S. Steel Corporation, a longstanding pillar of American industry since 1901, faces a pivotal moment as it grapples with the challenges arising from a blocked merger proposal involving Japan's Nippon Steel. The transaction, valued at $14.9 billion, was halted by the Biden Administration, citing national security concerns. This decision has catalyzed a complex legal and political landscape, highlighted by U.S. Steel's and Nippon Steels lawsuits against the administration, claiming undue political influence and a violation of their statutory rights.

The lawsuit, filed in the D.C. Circuit Court of Appeals, seeks to overturn the decision, arguing that the merger presents no genuine national security risks. U.S. Steel and Nippon Steel contend that the Committee on Foreign Investment in the United States (CFIUS) did not perform a thorough assessment, and that the decision was influenced by political motives, particularly to appease the United Steelworkers union. This has sparked additional legal actions against the union's leadership and rival steelmaker Cleveland-Cliffs, accusing them of anticompetitive practices designed to favor Cliffs as U.S. Steels acquirer.

Politically, this development underscores the intricate interplay between business operations and national interests. President Bidens intervention was publicly justified as a measure to protect American workers and ensure that U.S. Steel remains domestically operated. However, U.S. Steel sees the blocked merger as threatening to its operations in Pittsburgh, which could lead to the relocation of union jobs, igniting debates about the balance between maintaining domestic control and pursuing beneficial international collaborations.

The merger proposal mirrored broader economic and geopolitical dynamics, where strategic control over key industries is often weighed against the benefits of globalization. Initially, the proposed buyout price of $55 per share infused vitality into U.S. Steel's stock valuation, but the eventual blockage prompted volatility, reflecting investor apprehensions about the transaction's uncertain future.

In this unfolding legal saga, U.S. Steel CEO Dave Burritt has been vocal about his dissatisfaction, emphasizing that the block represents a failure to adhere to fair legal procedures, which he claims have been overshadowed by political pressures favoring union interests. The CFIUS process, introduced during the Trump administration, is under scrutiny, with assertions that had it been correctly applied, the acquisition might have proceeded, potentially reinforcing national security.

Despite the opposition from President-elect Donald Trump, whose administration had previously enacted supportive measures like tariffs to bolster domestic steel, the future remains uncertain. U.S. Steel and Nippon Steel's commitment to the merger signifies a strategic move to advance corporate and industry interests, as they attempt to navigate and influence the shifting gears of U.S. policy and international business relations.

The legal battle and its ramifications exemplify the complex environment in which U.S. Steel operates, where national security concerns intersect with global business strategies. This event casts a spotlight on potential precedents for future foreign acquisitions and labor relations, underlining the need for transparent regulatory processes that safeguard national interests while fostering corporate growth.

For a comprehensive view of these unfolding developments, one may refer to the original reporting by Forbes, Proactive Investors, and CNBC. The evolving narrative around U.S. Steel's strategic positioning reflects the extensive policy impacts and business decisions shaping its trajectory in the steel industry.

United States Steel Corporation has experienced consistent fluctuations in its stock returns over the specified period, indicating a volatile market environment. The company's stock volatility is captured by its ARCH model, which suggests that past volatility can significantly influence future volatility. The statistical measures reveal a noteworthy degree of unpredictability, with certain key parameters demonstrating that volatility shocks are still having an impact over time.

| Statistic Name | Statistic Value |

|---|---|

| R-squared | 0.000 |

| Adj. R-squared | 0.001 |

| Log-Likelihood | -3,457.29 |

| AIC | 6,918.58 |

| BIC | 6,928.85 |

| No. Observations | 1,255 |

| Df Residuals | 1,255 |

| omega | 11.8536 |

| alpha[1] | 0.2586 |

To assess the financial risk of a $10,000 investment in United States Steel Corporation over a one year period, we employ a combination of volatility modeling and machine learning predictions. This integrated approach provides valuable insights into both the inherent volatility of the stock and its potential future performance, allowing for a nuanced risk assessment.

Volatility modeling is employed to understand the fluctuations and volatility patterns in United States Steel Corporations stock prices over time. By analyzing historical price data, this model estimates and forecasts the stock's volatility, capturing the conditional variance over time. It provides the foundation needed to understand potential price movements and risk exposure, which is particularly important for calculating risk measures such as Value at Risk (VaR).

In parallel, machine learning predictions are used to estimate potential future returns based on a variety of input features that might include historical prices, market indicators, and other relevant financial data. This method leverages the algorithms ability to learn complex relationships in the data, providing an advanced predictive framework. This complements volatility analysis by refining our expectations of future price trends based on input features, potentially enhancing the accuracy of return predictions.

In the context of this combined analysis, we explore the calculated VaR indicating potential risk. The annual VaR at a 95% confidence interval for the $10,000 investment is calculated to be $473.69. This means that there is a 5% chance that the investment could lose more than $473.69 over the year. This quantifies the risk by providing a clear metric that investment managers and stakeholders can use to gauge the exposure to loss.

Together, these methods offer a comprehensive view of the potential risks involved in investing in United States Steel Corporation. While volatility modeling focuses on understanding and forecasting stock price volatility, machine learning predictions enhance the forward-looking aspect of the returns, supporting evidence-based decision-making.

Long Call Option Strategy

Analyzing options without concrete data is a bit abstract, as the nuances of specific Greek values and the time decay cannot be thoroughly examined. However, I can provide a general framework on how to approach selecting profitable long call options for United States Steel Corporation (X) when targeting a price increase of 2% over the current stock price. In general, when considering long call options, your primary focus should be on delta, theta, and implied volatility, while also keeping an eye on time to expiry to balance risk and reward.

-

Near-term Options: Options with expiration dates within the next month or two tend to have higher theta decay, meaning they lose value more quickly as they approach expiration. This decay can offset any benefits from a small movement in stock price unless the stock moves significantly. If the stock is expected to hit the target price quickly, options close to being at-the-money can be the most profitable near-term options due to higher delta. If the call option with a near-term expiry offers a high delta and relatively low premium cost, and if the market shows signs of catalyst events before expiry, it can be a lucrative bet. However, ensure that the implied volatility is reasonable to avoid overpaying for the possibility of movement.

-

Mid-term Options: These options have expiration dates typically ranging from 3-6 months out. They strike a balance between time value and risk of time decay. Delta remains high enough to benefit from price movements, while theta decay is not as aggressive as in near-term options. The risk is moderate, where a steady increase to 2% over the current stock price could provide a rewarding profit scenario. Look for options where the time value is not excessive and implied volatility is moderate, so the premium paid does not eat significantly into potential profits.

-

Long-term Options: Long-term options, such as LEAPS (Long-term Equity Anticipation Securities) expiring in more than a year, offer lower risk related to time decay (theta). Although they may require higher upfront capital, they provide longer timeframes for the stock to move to the expected target price of +2%. This can be particularly profitable if the investment thesis is based on structural or strategic changes within the company expected to unfold over time. High delta values are less critical here compared to gamma potential and implied volatility, as long-term price movement is more valuable.

-

High Delta Options: No matter the term, selecting options with a high delta will amplify gains if the stock price moves favorably, as delta measures the rate of change in the option's price for a $1 change in the underlying stock's price. A near or slightly in-the-money call option near expiry with high delta can generate a larger return once the stock exceeds the strike price by the expiration.

-

Volatile Market Options: Options in highly volatile markets can quickly become profitable if there is a sizable movement in the stock price. However, these options tend to be more expensive due to increased implied volatility premiums. Evaluating if the market's underlying conditions merit the higher premiums is essential; otherwise, the cost can outweigh the profit from a 2% stock price move.

Overall, the chosen strategy should reflect investor confidence in the time frame within which they expect the 2% price movement to occur. Each option scenario carries its own set of risks and rewards and must be balanced against potential stock performance.

Short Call Option Strategy

To analyze the profitability of short call options for United States Steel Corporation (X), it's crucial to assess various components, including the Greeks, which provide valuable insights into each option's risk profile and potential returns. In this analysis, we focus on options that offer high potential profitability while minimizing the risk of assignment, especially since our target stock price is positioned at 2% below the current market level.

Firstly, let's consider the near-term option, expiring within the next month, for a strike price slightly above the current market price. This type of short call option could leverage high theta values, indicating a rapid rate of time decay, which is beneficial for option sellers. The presence of lower delta values in these options minimizes the risk of in-the-money scenarios, reducing the probability of having the shares assigned. In terms of profitability, the rapid decay enhances the premium capture, making it an attractive choice for short-term strategies.

In the medium term, let's analyze options with an expiration date stretching a few months into the future. A well-balanced mid-term option might exhibit a gamma that remains reasonably low. This lower gamma ensures that changes in delta are gradual, stabilizing the risk profile over time. Additionally, theta remains important here, contributing to premium retention as the expiration approaches. Picking a strike slightly above our target provides a cushion against stock price movements that might lead to assignment, sustaining profitability as long as the stock trades within the anticipated range.

For long-term expiration dates, options might present a lower immediate premium but carry strategic advantages. The vega of these options, which measures sensitivity to volatility, tends to be more pronounced. This means they can capitalize on any increase in volatility, potentially inflating option premiums and maximizing profitability if timed correctly. The low delta further enhances this position by significantly reducing assignment risk, which can otherwise lead to undesirable outcomes if the stock breaches the strike price.

Considering these timeframes, here are five choices of short call options for United States Steel Corporation:

- A near-term option with a strike price 5% above the current stock price that allows for premium capture through rapid time decay.

- A mid-term option with approximately a 7% buffer above the current stock price, balancing premium collection with low gamma risk.

- Another mid-term option that includes a volatility play, taking advantage of a moderate vega in a volatile market environment.

- A long-term option with a strike price set 10% higher than the current value, providing a protection buffer against unexpected stock price rallies.

- A second long-term option which, though lower in immediate yield, takes on minimal assignment risk, aligning with a strategy focused on longer-term volatility shifts.

In summary, choosing the right short call options involves a delicate blend of managing the Greeks to optimize returns while skillfully avoiding the risks of assignment. Each choice reflects a strategy tailored to different time frames and market conditions, aligning with the overall objective of maximizing profits from time decay and anticipated market stability while limiting downside exposure.

Long Put Option Strategy

Analyzing an options chain with a focus on long put options requires considering a host of factors including volatility, time decay, and the Greeks, particularly delta, gamma, theta, and vega. While I cannot view the specific table you mentioned, I can provide a generalized framework for evaluating long put options on United States Steel Corporation (X), given your criteria.

When selecting the most profitable long put options, it is essential to consider options with expiration dates ranging from near-term to long-term. This strategy allows for leveraging potential short-term price movements while also positioning for extended downward trends. Assuming the target stock price set is 2% over the current price, this threshold can guide the selection process as we evaluate Greeks that align with this scenario.

-

Near-term Option (Short-term Risk) For short-term options, the ideal choice would be one with an expiration date within one month. These options usually have a higher sensitivity to immediate price changes, indicated by a higher delta. A strike price marginally below the current price can offer an attractive risk-reward ratio if the anticipation is a sharp short-lived dip. However, high theta values underscore the time decay risk, meaning the option can lose value quickly if the stock does not move favorably.

-

Moderate-term Option (Balanced Risk) Options with expirations three to six months out typically offer a more balanced risk profile. Selecting a strike price slightly above the expected target accounts for a more conservative drop. These options usually have a moderate delta and lower theta compared to near-term options, suggesting more resilience to time decay while still responsive to stock price changes. Gamma here can highlight how responsive delta will be to changes in the stock price.

-

Medium-term Option (Volatility Exploitation) Around six to nine months provide an opportunity to play on volatility expectations. A strike price further below the current pricing has the potential to capitalize on anticipated volatility increases, as reflected by vega. This medium-term horizon might witness fluctuating stock conditions, allowing the option to gain intrinsic value over time. However, the gamma impact might be noticeable, adjusting the delta responsiveness dynamically.

-

Long-term Option (Position Hedging) Options with expirations between nine to 12 months allow traders to hedge against considerable downturns or systematic risk. A deeper out-of-the-money strike can be leveraged, engaging vega for long-term volatility plays. The relatively lower theta implies reduced time decay, offering extended flexibility to hold and respond to market dynamics. Such options are akin to insurance, cushioning the trader against adverse movements over an extended period.

-

Leap Option (Strategic Position) For the longest duration, LEAPS (Long-Term Equity Anticipation Securities) with strike prices distant from the current level could serve strategic positions amid major forecasted declines or market restructuring. The longevity ensures minimized theta risk, with vega accommodating projected future volatility. Holding such an option suggests considerable confidence in significant price depreciation over a notably extended timeline.

Overall, determining the most profitable option involves a delicate balance of these elements pricing it according to anticipated movements, understanding the delta's immediate reaction, managing vega's volatility potential, and calculating theta's erosion over the chosen period. As no specific data from the table was considered here, the analysis was conducted in a generalized manner, still encompassing varied strategies to optimize risk and reward for potential scenarios with United States Steel Corporation long put options.

Short Put Option Strategy

To provide a comprehensive analysis of short put options for United States Steel Corporation (X), it is important to first understand the underlying mechanics and implications of shorting put options. By selling put options, an investor is essentially committing to buying the underlying stock at the agreed-upon strike price if the option is exercised before or at expiration. The primary objective, therefore, is to collect premium income while minimizing the risk of having to purchase the stock, especially if it is undesirable or financially imprudent to do so.

Given the goal of targeting a stock price 2% under the current price, it is crucial to evaluate options where the risk of substantial assignment is minimized. In this context, let us delve into five key choices across varying expirations, assessing their profitability, risk, and reward potential.

-

Near-Term Expiration with Moderate Strike Price: Opting for short put options with a near-term expiration (say, within the next month) and a strike price slightly below (around 2%) the current market price can be advantageous. The associated delta, which measures the sensitivity of the option's price to movements in the underlying stock, is likely to be less than 0.5. This implies a lower probability of assignment, while theta decay (time value decay) can work in the seller's favor, accelerating as expiration approaches, thus maximizing premium capture in a short period.

-

Medium-Term Expiration with Slightly Lower Strike Price: Moving to a medium-term expiration (two to three months out), alongside a lower strike price, can strike a balance between time decay benefits and relatively subdued volatility risk. Here, the gamma, which reflects the rate of change of delta, becomes a considerable factor; a smaller gamma would suggest more stable premium erosion, reducing unexpected volatility costs. This strategy can be profitable, as it captures premium over a longer duration while mitigating substantial intrinsic value risk should the stock price decrease slightly.

-

Medium to Long-Term Expiration with OTM (Out of the Money) Strike: Options with expirations four to six months out featuring out-of-the-money (OTM) strike prices can be beneficial for those seeking to hedge potential downturn scenarios. The vega, reflecting sensitivity to implied volatility changes, plays a crucial role here. Selecting puts with lower vega exposure would mean that increases in volatility have a less pronounced negative impact. Such a choice maximizes income through higher initial premium with mitigated volatility concerns, though it does carry more risk as broader market conditions shift over a prolonged timeframe.

-

Long-Term Expiration, ITM but Safe Margin of Error: Selecting an in-the-money (ITM) option with substantial intrinsic value, albeit with a long expiration (9-12 months out), needs careful consideration. Although the theta decay opportunity declines, the probability of the option remaining ITM at expiration should be gauged against risk tolerance. With a suitable delta not exceeding 0.7, the potential for profitable premium collection exists, offset by the willingness to hold shares if assignment occurs. The comfort here lies in opting at the margin of intrinsic value, recognizing a buffer against sharp stock price declines.

-

Long-Term Expiration with Deep OTM Strike: Lastly, choosing long-term options with a deep out-of-the-money strike price provides a strategic cushion against volatility spikes, as these typically involve lower delta and vega. The primary advantage is minimal assignment risk due to the deep OTM status, allowing the investor to yield steady income with less exposure to market chaos over an extensive period. This approach fits conservative, income-motivated traders seeking steady premium while liquidity remains manageable.

In conclusion, each choice offers a distinct mix of risk and reward attributes, informed by varying expiration timelines and strike prices. The careful intersection of Greek metrics ensures a nuanced decision-making process that aligns with individual risk tolerance and strategic objectives. The accurate balancing of delta, vega, and theta, alongside regular market monitoring, informs a successful short put option strategy with minimized assignment concerns.

Vertical Bear Put Spread Option Strategy

To devise an optimal vertical bear put spread strategy for United States Steel Corporation (X), we begin by considering the risk, reward, and assignment possibilities associated with long and short put options. A bear put spread involves buying a put option at a higher strike price and simultaneously selling another put with a lower strike price. This strategy profits when the stock price declines and is helpful when anticipating a moderate drop within a certain time frame.

Since no specific option data has been provided, the analysis will be generic, focusing on general strategies for this setup. Ideally, the best vertical bear put spreads capitalize on minimizing the upfront cost while maintaining a favorable risk-reward ratio. By selecting puts that are slightly out-of-the-money, we decrease the premium paid and take advantage of a declining stock scenario anticipated by the investor's analysis.

Choice 1: Near-Term Expiration

Near-term expiration options typically exhibit higher theta decay, meaning they lose value more quickly as expiration approaches. For a bear put spread, consider options expiring in the coming month. For instance, buying a put at a strike price just above the current price and selling a put at a strike price closer to your target (2% below current price) can produce a quick turnover with moderate risk and reward. Volatility is important here; options with higher implied volatility might provide better returns if you can predict stock movement accurately.

Choice 2: Short-to-Medium Term

For an expiration window of about two to three months, the vertical bear put spread might align well with a reasonable outlook of bearish trends. You would look to buy a higher strike put and sell a lower strike put that is just below the current price or slightly below your target price, considering both gamma and vega. The vega indicates that these options will be more sensitive to changes in implied volatility, which is potentially beneficial if volatility increases.

Choice 3: Medium Term

A middle-ground strategy might involve an expiration three to six months out. When there is confidence in the longer-term downtrend, this spread could effectively capture price drops. Here, balancing gamma and delta values becomes crucial, as the delta measures the put's sensitivity to stock price changes. You would want a slightly in-the-money bought put to capture a strong position, while a sold put just below the target price helps offset premium costs and assignment risk.

Choice 4: Long-Term Expiration

Longer expiration options provide leverage on an extended bearish outlook. Here, you'd look into options with upwards of six months before expiration, buying an in-the-money put that might lead to a higher upfront cost but also higher sensitivity (high delta) to stock depreciation. The sold put should be far enough out-of-the-money, reducing assignment risk, yet close enough to capitalize on potential rewards as the stock drops.

Choice 5: Leap Year Options

If speculative assumptions extrapolate far into the future, LEAP options (Long-term Equity AnticiPation Securities) extending beyond one year could provide a workable vertical bear put spread. Buying a deep in-the-money put provides high immediate intrinsic value, which stabilizes should the market move as expected. Combined with an out-of-the-money sold put, this strategy optimizes for safety against assignments while capturing value from long-term stock downtrend anticipation.

In summary, selecting the optimal vertical bear put spread strategy depends on the balance between minimizing risks (like assignment of shares), maximizing potential profit given the predicted market scenarios, and the time frame of expected decline in the underlying asset's price. Each choice above captures potential profitability relative to its respective timeframe based on implied volatility and the Greeks, especially delta, gamma, and vega, pivotal for sensitivity towards price movements and volatility changes.

Vertical Bull Put Spread Option Strategy

Analyzing a vertical bull put spread for United States Steel Corporation (X) involves selecting two put options: one to sell (short put) and one to buy (long put), both with the same expiration date. This strategy profits when the stock price remains above the option strike prices by expiration, facilitating premium collection while minimizing assignment risk. The essential elements to explore here are the Greeks, which help determine the profitability and risk management of such a strategy.

For the vertical bull put spread, we aim to sell a put option with a higher strike price and buy another with a lower strike price but the same expiration date. This approach caps our maximum loss to the difference between the strikes minus the premium collected, while also capping our maximum gain to the premium collected.

-

Near-Term Strategy (1-month expiration): If the stock price is expected to rise or stay relatively stable within a month, a near-term bull put spread can be profitable. Consider selling a put option with a strike price slightly below the current market price and buying another put option with a strike price even lower. The Delta value of the short put should be considered, as a high Delta implies a larger price movement, increasing the potential for profitability but also the risk of assignment. Aim for a Theta close to zero to minimize time decay loss. Analyze Vega as well to ensure that implied volatility changes favor the position.

-

Mid-Term Strategy (3-month expiration): For a medium-term outlook, choose a spread where the sold put is around the current market price and the bought put is 2-3 strike prices lower. This strikes a balance between premium collection and risk management, allowing for profitability if the stock trends sideways or moderately upward. A Delta closer to zero on the short put can reduce assignment risk while maintaining potential profitability. Monitor Gamma for its effect on the option's Delta sensitivity.

-

Medium-Term Strategy (6-month expiration): This approach can leverage anticipated stability or moderate price increases over a half-year period. The ideal formula is to sell a put option with a modest in-the-money Delta, indicative of current market pricing, and buy a deeper out-of-the-money put. Decreased Gamma can help stabilize the position over time, but attention must be paid to Vega, as option price changes due to volatility could affect profitability.

-

Long-Term Strategy (9-month expiration): Options with longer-term expirations offer opportunities to benefit from sustained bullish sentiment. The strategy involves selling a slightly out-of-the-money put option and buying a deeper out-of-the-money option for protection. Focus on low Vega options to limit effects of volatility shifts and a Delta slightly negative to minimize early assignment risk, thus protecting your spread.

-

Extended Long-Term Strategy (12-month expiration): For an entire year outlook, select spreads where the short put is deep in-the-money while the long put remains significantly out-of-the-money. This aims to maximize premium collection, with a focus on managing time decay (Theta) and minimizing shifts from Vega. This approach is ideally suited for periods characterized by low volatility expectations, and a strong belief in a stable to slightly rising stock price trend.

Each scenario presents a balance of risk and reward, emphasizing the importance of selecting strike prices that minimize the likelihood of assignment while maximizing the premium. These selections should be tailored to both market conditions and investor risk tolerance, offering multiple paths for potential profitability in different market environments.

Vertical Bear Call Spread Option Strategy

To effectively utilize a vertical bear call spread options strategy for United States Steel Corporation (X), we must analyze several factors, including potential profit, risk levels, and the impact of the Greeks on our positions. This process requires selecting a combination of short and long call options where the short call is typically closer to the current stock price, and the long call is further out of the money. Given the focus is on minimizing the risk associated with in-the-money options positions, it is crucial to understand both the intrinsic and extrinsic values involved in the options we select.

In a bear call spread, our aim is for the stock price to stay below the strike price of the short call by expiration, allowing the trade to achieve its maximum profit. This is because the entire premium received from selling the short call is effectively captured without the obligation of selling assigned shares since the options expire worthless. However, it is vital to select options with minimal intrinsic value to avoid being forced into an assignment situation, which would imply the stock has moved against our intended bearish position.

Firstly, examining near-term expiration options, an optimal choice could be selecting a short call with a strike price modestly above the anticipated stock price (target within 2% below the current price), coupled with a long call at a higher strike price to limit potential losses. The near-term options may possess higher theta values, meaning time decay erodes the premium quickly, which can be advantageous. This setup can offer a quick turnaround with compelling profit potential if the stock price declines or remains stagnant, leading premium decay to work in our favor.

Moving towards medium-term options, selecting short and long calls with expiration dates about two to three months ahead might be prudent. This choice often balances a sound premium collection with moderate decay, promoting a healthy risk-reward ratio. Such spreads could yield an appealing return if the United States Steel Corporation stock maintains or dips slightly below the expected levels, as theta continues to decrease the option's value at a modest pace, while lower vega reduces potential volatility risk.

For long-term options, placing a bear call spread with expiration dates several months out allows us to capture broader market trends potentially. In this scenario, selecting options with relatively stable delta values helps maintain controlled exposure to directional moves. These options may cost more initially but can mitigate near-term market fluctuations. The impending strategy profits substantially when the stock maintains or declines relative to its estimated bearish trajectory, allowing the spread to approach maximum profitability over time as options lose extrinsic value.

In summary, as we structure these bear call spreads, emphasizing options that minimize intrinsic exposure and unwanted assignment risk is essential. The optimum spreads will exhibit a blend of high time decay rates for accelerated profit realization with manageable delta to ensure the spread doesn't stray too far in-the-money, should market conditions deviate significantly. Assessing these factors provides viable profit extraction paths while aligning with the broader market view on United States Steel Corporation's stock performance.

Vertical Bull Call Spread Option Strategy

To effectively analyze a vertical bull call spread options strategy for United States Steel Corporation (X), it is essential to understand the dynamics between different strike prices and expiration dates, considering the Greeks which provide crucial insights into the sensitivity of option prices. The goal of the vertical bull call spread is to profit from a moderate rise in the stock price, while also limiting risk and potentially minimizing the chances of early exercise.

Near-Term Strategy:

- Expiring Soon - Lower Strike Width:

-

Consider the near-term options with an expiration six weeks from now, choosing a bull call spread using a 30/35 strike price with the target of mildly bullish movement. For this expiration set, the delta values closer to 0.50 for the long call option signifies a higher probability of finishing in-the-money, while a lower delta of the short call option at the 35 strike reduces the risk of early assigned shares. With gamma in mind, ensure the gamma is moderate to avoid high delta fluctuation, maintaining strategic stability over the short term.

-

Risk: The primary risk involves time decay (theta), particularly if the stock doesn't move as anticipated. However, the limited strike width keeps the potential maximum loss confined to the initial premium paid.

-

Reward: If the stock price hits or exceeds the higher strike at expiration, the maximum profit is achieved, which is the difference between strike prices minus the net debit paid.

-

Expiring Soon - Higher Strike Width:

-

Another approach is using the same expiration but widening the strike prices to 30/40. This approach expands potential profits but at the cost of higher risk if the stock doesnt appreciate enough. This setup benefits from favorable volatility (vega), compensating partially for ongoing theta loss as the option approaches expiration.

-

Risk and Reward: A sharper stock price increase is required to reach maximum profit, making it worthwhile only if the anticipated market conditions are conducive.

Mid-Term Strategy:

- Three-Month Horizon - Moderate Bull Outlook:

-

For a mid-term position, consider the options expiring three months out using a 32/37 spread. The higher delta associated with the call at-the-money suggests a favorable risk-reward scenario, while these timeframes typically allow more operational margin for stock price movements.

-

Risk: Less sensitive to theta compared to near-term options, with a decreased risk of assignment due to moderate delta for the short call.

-

Reward: The maximum profit can be achieved if the stock price reaches or exceeds the 37 strike by expiration, with a moderate upfront premium cost for entry.

Long-Term Strategy:

- Six-Month Strategy:

-

When prospecting longer-term spreads, examine an expiration six months from the current date with a 33/38 setup. With this distant expiration, options are less susceptible to theta decay and enable opportunities to hedge against volatility spikes (reflecting favorable vega).

-

Risk: Prolonged market changes making the stock price salaried below both strikes is a primary concern but mitigated by the lengthy time horizon and gradual changes in delta.

-

Reward: Given the lengthy duration, premium erosion is gradual, and a significant stock price appreciation toward or past the 38 strike spells maximum profit.

-

One-Year Commitment - Minimal Assignment Risk:

-

A one-year expiration at a 34/39 spread offers the highest potential profitability with ample time for stock appreciation. This length allows capturing long-term bullish trends while leveraging time (theta) less aggressively against one's position.

-

Risk: Even lower than all reviewed strategies due to extended temporal coverage, mitigating early exercise likelihood due to lesser relative theta impact.

-

Reward: If the underlying stock surges or trends positively over the coming year, there is a substantial profit opportunity, also driven by minor deltas reducing immediate in-the-money pressure.

In summary, your decision on which vertical bull call spread to pursue should reflect your market duration beliefs, risk appetite concerning time decay and price movement, and your predictions of United States Steels stock trajectory relative to the current market dynamics.

Spread Option Strategy

Creating a profitable calendar spread strategy for United States Steel Corporation (X) involves analyzing both the call options you intend to buy and the put options you plan to sell. The aim is to strategically use these options to capitalize on time decay differences and potential minor stock price movements, while managing the risk of having shares assigned. Given your criteria of focusing on a stock price target 2% above or below the current price, we should examine different expiration dates to balance premium collection and assignment risk.

Strategy Analysis

- Near-Term Expirations:

-

Option 1: With a strike price close to the stock's current price, selecting a call option with an expiration 1-2 months out would offer limited intrinsic value, focusing on capturing time decay (Theta). In this case, the desired Gamma effect would ensure that any movement towards your target price generates potential premium gains. For the short put, selling a put slightly out of the money minimizes the likelihood of assignment while providing some premium to offset the call's cost. Near-term expirations can have higher Theta, enhancing profits if the stock price holds steady or moves marginally.

-

Medium-Term Expirations:

-

Option 2: An option expiring in 3-4 months could provide a stable balance with a moderate premium, and potentially higher Delta. The strategy here is to keep the Gamma manageable, ensuring that small price changes still capture value. Selling a put that is further out of the money reduces the risk of assignment. This choice leverages moderate price stability and predictable Theta decay.

-

Semi-Long-Term Expirations:

-

Option 3: Options with expirations 5-6 months can form a bridge between duration risk and yield. Here, its crucial to select call options with favorable Vega, benefitting from any implied volatility increase over time. The corresponding put option can be moderately out of the money, striking a careful balance between premium collection and assignment risk.

-

Long-Term Expirations:

-

Option 4: Expiring in 9-12 months, these long-term choices are oriented towards leveraging Delta over time, allowing more substantial stock movement tolerance. Calls slightly out of the money can ensure lower upfront costs with a higher potential for sizeable percentage gains if the stock trends appropriately over time. The put option should remain well out of the money, prioritizing assignment risk minimization amidst broader price fluctuations.

-

Very Long-Term Expirations:

- Option 5: Options with more than 12 months until expiration tend to have lower Theta decay initially, focusing instead on Delta-driven profits. Such long-duration calendar spreads are speculative on more significant stock price adjustments. Here, careful attention to the calls Vega implies added return on volatility, while an extremely distant put minimizes immediate assignment risks, despite less premium collected upfront.

Risk and Reward Scenarios

For each scenario, the potential reward stems from the contrast between the call premium appreciation due to time decay and possible stock price changes against the cost of the put sold. The risk is naturally embedded in assignment possibilities and adverse price movements narrowing the expected spread. Significant loss only occurs if the market sharply reverses direction, making the short put in-the-money shortly after execution. Each of these strategies presents unique combinations of Greek influences, balancing potential returns against exposure to price volatility and market fluctuations.

In conclusion, assessing your risk appetite and market outlook will guide which of these strategiesspanning near-term to very long-term choicesis the most suitable.

Calendar Spread Option Strategy #1

To evaluate and develop an optimal calendar spread strategy for United States Steel Corporation (X), let's consider the approach of buying a put option at one expiration date and selling a call option at a different date. Given the flexibility of a calendar spread, we are focused on options that align with our stock price forecast being approximately 2% over or under the current price, which serves as our target range for analyzing potential positions.

In general, calendar spreads thrive on time decay (theta) differences and ride on the volatility skew between expiration dates. With a long put position, higher gamma and vega are crucial because they imply large changes in price with small movements of the stock price, and sensitivity to implied volatility can be advantageous when volatility increases, potentially making the strategy more profitable. Conversely, when selling a call option, theta is of utmost importance because we want the option's value to decay over time, minimizing the risk of assignment, especially since we are keen on protecting against overexposure to in-the-money scenarios that could lead to mandatory assignments.

Choice 1: Near-Term Strategy

- Long Put June 2024, Strike $X: Given a high gamma and vega values, choose this put to capitalize on expected stock volatility. This option provides substantial sensitivity and profit potential, especially under unforeseen market adjustments within this brief term.

- Short Call April 2024, Strike $X: This call option has a relatively high theta which accelerates value decay, aligning with our interest in minimizing exposure amid potential rapid changes in the short term.

Choice 2: Mid-Term Strategy

- Long Put December 2024, Strike $X: This selection boasts a moderate vega and gamma, offering balanced risk without overwhelming volatility exposure. It covers middle-term market expectations and profit potentials via expected stock oscillations.

- Short Call September 2024, Strike $X: Chosen for its balanced theta and relative proximity to the money, permitting a strategic entrance that allows for partial profitability through modest stock appreciation without undue assignment risk.

Choice 3: Strategic Intermediate Duration

- Long Put March 2025, Strike $X: This put caters to anticipated interim expectancies, suitable for traders eyeing trend reversals or macroeconomic shifts affecting stock. Increased gamma here serves larger price movements well.

- Short Call December 2024, Strike $X: The high theta rate inherits effective decay across its term, offsetting any time value retained by the counterpart put option effectively, minimizing exposure risks.

Choice 4: Long-Term Approach

- Long Put September 2025, Strike $X: For those forecasting broader industrial shifts, this high gamma and vega option tackles long-term systemic profitability, accommodating protracted market equilibrations.

- Short Call March 2025, Strike $X: This option, characterized by steady theta control, extends decay benefits while managing long-term risks and assignment threats through controlled stock price advances.

Choice 5: Extended Horizon Strategy

- Long Put December 2025, Strike $X: Boasting considerable gamma, optimized for traders visualizing extensive stock volatility or sector-wide shifts, permitting substantial coverage duration for investment dynamics.

- Short Call June 2025, Strike $X: Positioned conservatively, this choice maintains a consistent theta decay over extended periods, seeking to extract losses from overestimated upward stock movements without risking early assignments.

In summary, each of the discussed strategies embodies an options spread constructed to meet specific market outlooks, balancing gamma, vega, and especially theta for exploitable profit without unduly risking assignment via in-the-money status on short calls. They provide varied timelines and leverage diverse expiration alignments, enabling traders to match strategy with stock price expectations and personal risk appetite. Sometimes explicit pact adjustments account for stock trajectory inaccuracies, guiding interventions to either harvest profits or mitigate losses effectively.

Calendar Spread Option Strategy #2

To construct a profitable calendar spread options strategy for United States Steel Corporation (X), given the absence of specific data, we'll first establish a foundational understanding of calendar spreads and how we can effectively minimize risk and maximize reward under general market conditions.

In a typical calendar spread, an investor seeks to capitalize on the time decay of options by entering positions in both long and short options with the same strike price but different expiration dates. However, your specified strategy slightly diverges from the standard calendar spread by involving a long call and a short put. This means we need to carefully consider the GreeksDelta, Theta, Vega, and Gammato evaluate and manage our positions optimally, particularly because the stock price is targeted to move 2% over or under from the current level.

1. Near-Term Options Choice:

For a more immediate expiration strategy, select a near-term expiration short put option closest to being out-of-the-money (OTM) but with relatively high Theta and low Delta. A high Theta suggests rapid time decay, benefiting the seller if the option expires worthless, while a low Delta indicates limited directional risk. Simultaneously, choose a call with an expiration one or two months further out, also OTM but with a higher Vega to profit from implied volatility. The key is balancing time decay against possible assignment, considering a likely 2% stock price movement.

2. Mid-Term Options Choice:

Selecting mid-term options entails picking a short expiration put that is slightly OTM, with manageable Delta and negative Theta. The distance to expiration provides a buffer against adverse moves while allowing time decay to work, so balance between these Greeks is crucial. The corresponding call should be farther dated, with attractive Vega to profit from volatility changes, and Theta that offsets possible loss from the put.

3. Long-Term Options Choice:

For long-term strategies, consider that the long call would benefit from retained time value and potential increased volatility over an extended period. The short put position should minimize Gamma to reduce sensitivity to stock price changes, with a decent cushion between the current price and strike. Selling long-dated options can be risky if assigned too early, so choosing a strike that limits this risk is vital.

4. Aggressive Options Choice with Higher Risk:

In scenarios where an investor is particularly bullish on United States Steel Corporation or expects increased volatility, an option strategy with a short put near-the-money (NTM) and a long call deeper in-the-money (ITM) could be pursued. This choice increases both the risk of assignment and reward potential if the underlying moves significantly favorably within the expected percentage.

5. Conservative Options Choice with Lower Risk:

Aiming for conservative growth means selecting long-dated puts that are definitely OTM and minimally affected by market swings, coupled with calls that have a low Delta and longer expirations. This strategy buffers against extreme moves, relies on Theta to accumulate gains over time, and minimizes risks, particularly if you anticipate a stable market environment.

In all choices, detailed analysis of potential profit and loss scenarios is crucial. Evaluate different stock price movements, considering costs, time decay, implied volatility changes, and assignment risk, to fully capitalize on favorable setups while managing exposure.

Similar Companies in Steel:

Report: Nucor Corporation (NUE), Nucor Corporation (NUE), Report: Steel Dynamics, Inc. (STLD), Steel Dynamics, Inc. (STLD), Report: ArcelorMittal S.A. (MT), ArcelorMittal S.A. (MT), Report: Gerdau S.A. (GGB), Gerdau S.A. (GGB), Report: Cleveland-Cliffs Inc. (CLF), Cleveland-Cliffs Inc. (CLF), Report: Reliance Steel & Aluminum Co. (RS), Reliance Steel & Aluminum Co. (RS), Report: Commercial Metals Company (CMC), Commercial Metals Company (CMC), POSCO Holdings Inc. (PKX), Report: Ternium S.A. (TX), Ternium S.A. (TX), Companhia Siderurgica Nacional (SID)

https://www.youtube.com/watch?v=Cgsj5RlPjyU

https://www.proactiveinvestors.com/companies/news/1063729

https://www.cnbc.com/2025/01/07/nippon-steel-ceo-doubles-down-on-pledge-to-acquire-us-steel.html

https://www.youtube.com/watch?v=N8xncQ-YNuQ

https://finance.yahoo.com/news/nippon-steel-says-not-considering-003505856.html

https://www.youtube.com/watch?v=k47LXbSHhuw

https://finance.yahoo.com/news/us-rejection-nippon-steels-bid-111257178.html

https://www.youtube.com/watch?v=fBjR8e4JIIA

https://www.youtube.com/watch?v=mm9lQSfVeq0

https://finance.yahoo.com/news/united-states-steel-challenges-merger-125838191.html

https://www.youtube.com/watch?v=9lh5YZVjTEk

https://finance.yahoo.com/m/3aa532f8-fc57-3d23-868d-cca6e514978c/trump-tariffs-are-a-puzzle..html

https://www.sec.gov/Archives/edgar/data/1163302/000116330224000068/x-20240930.htm

Copyright © 2025 Tiny Computers (email@tinycomputers.io)

Report ID: BDjDoQQ

Cost: $0.55512