Advanced Micro Devices, Inc. (ticker: AMD)

2024-05-19

Advanced Micro Devices, Inc. (ticker: AMD) is a prominent American multinational semiconductor company headquartered in Santa Clara, California. Founded in 1969 by Jerry Sanders and a team of engineers, AMD has been a significant player in the microprocessor industry, primarily competing with Intel in the x86 market for CPUs. In recent years, AMD has also gained substantial market share in the graphics processing unit (GPU) sector, contending with NVIDIA. Through its innovation and competitive pricing, the company has made notable advances in both consumer and enterprise markets. Their Ryzen processors and Radeon graphics cards have received widespread acclaim for their performance and efficiency. AMD's strategic acquisitions, such as the recent purchase of Xilinx, have further expanded its product portfolio into adaptive computing, driving future growth. The company's focus on delivering high-performance, customizable, and energy-efficient solutions positions it as a key player in the semiconductor industry.

Advanced Micro Devices, Inc. (ticker: AMD) is a prominent American multinational semiconductor company headquartered in Santa Clara, California. Founded in 1969 by Jerry Sanders and a team of engineers, AMD has been a significant player in the microprocessor industry, primarily competing with Intel in the x86 market for CPUs. In recent years, AMD has also gained substantial market share in the graphics processing unit (GPU) sector, contending with NVIDIA. Through its innovation and competitive pricing, the company has made notable advances in both consumer and enterprise markets. Their Ryzen processors and Radeon graphics cards have received widespread acclaim for their performance and efficiency. AMD's strategic acquisitions, such as the recent purchase of Xilinx, have further expanded its product portfolio into adaptive computing, driving future growth. The company's focus on delivering high-performance, customizable, and energy-efficient solutions positions it as a key player in the semiconductor industry.

| Full-Time Employees | 26,000 | Previous Close | 162.62 | Open | 168.405 |

| Day Low | 162.32 | Day High | 169.72 | Volume | 65,944,362 |

| Average Volume | 61,930,939 | Average Volume (10 days) | 42,701,140 | Market Cap | 265,818,357,760 |

| Enterprise Value | 262,798,147,584 | Trailing PE | 238.34784 | Forward PE | 29.367859 |

| Price/Sales (TTM) | 11.6587 | Price/Book | 4.734978 | Total Revenue | 22,799,998,976 |

| Gross Margins | 0.50561 | EBITDA | 3,836,999,936 | Net Income | 1,116,000,000 |

| Total Debt | 2,998,000,128 | Debt to Equity | 5.335 | Free Cash Flow | 2,385,499,904 |

| Operating Cash Flow | 1,702,000,000 | Revenue Growth | 0.022 | Return on Assets | 0.00537 |

| Return on Equity | 0.02013 | Book Value | 34.733 | Enterprise to Revenue | 11.526 |

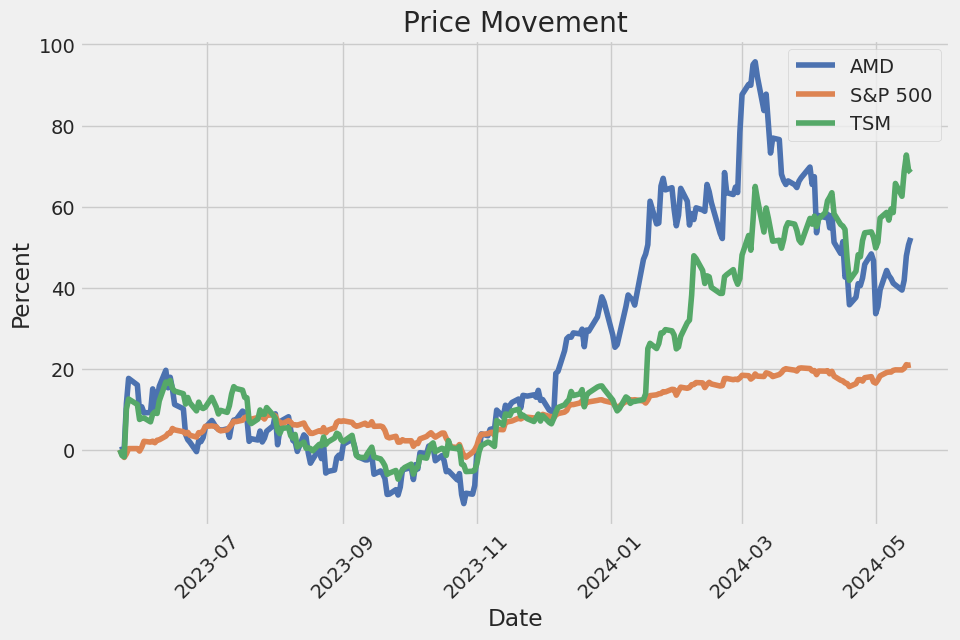

| Enterprise to EBITDA | 68.491 | 52-Week Change | 0.5228704 | S&P 52-Week Change | 0.26490295 |

| 52-Week Low | 93.12 | 52-Week High | 227.3 | Target High Price | 250.0 |

| Target Low Price | 125.0 | Target Mean Price | 187.0 | Target Median Price | 190.0 |

| Total Cash | 6,034,999,808 | Current Ratio | 2.639 | Quick Ratio | 1.715 |

| Sharpe Ratio | 1.0308261835534642 | Sortino Ratio | 17.610629419693808 |

| Treynor Ratio | 0.20406689206859432 | Calmar Ratio | 1.6707233749592787 |

Examining Advanced Micro Devices (AMD) from both technical and fundamental perspectives, we can glean significant insights into its potential price movements over the next several months.

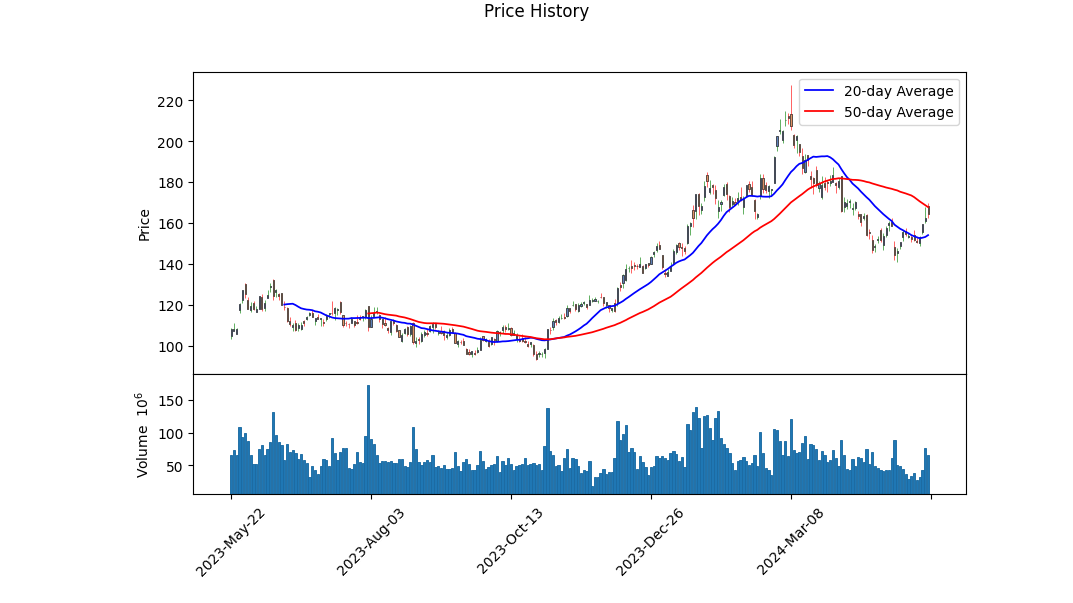

From a technical analysis standpoint, AMD's recent trading days show momentum to the upside, especially noted from the bullish MACD histogram, indicating an increasing positive momentum. The On-Balance Volume (OBV) has been fluctuating but showcases a recovery in interest from investors with a steady increase in volume coinciding with upward price movement. The close on the last trading day at $169.72 indicates strong buyer sentiment.

Fundamentally, AMD shows solid performance despite some challenging conditions indicated by lower operating margins at 0.00658, but its gross margins remain fortified at 50.561%. The trailing PE of 0.6445 corroborates reasonable valuation in contrast to growth expectations. Additionally, a substantial Altman Z-Score of 14.21385 highlights AMD's financial robustness and low risk of insolvency. The piotroski score of 6 further supports a stable financial condition.

The Sharpe Ratio of 1.03 reflects favorable risk-adjusted returns. The Sortino Ratio of 17.61 underlines even better performance compared to downside risk, indicating that the stock mostly secures returns without significant downside volatility. The Treynor Ratio of 0.204 shows efficient returns relative to systemic risk, while the Calmar Ratio of 1.67 points to resilient performance despite broader market pullbacks.

AMDs financial health is reinforced with solid cash flows and strategic debt management. The net operating cash flow of $1.67 billion and free cash flow of $1.12 billion depict a company with ample liquidity to support ongoing operations and investments.

The balance sheet portrays a healthy structure with significant increases in assets and minimal debt. Cash reserves combined with considerable accounts receivable at $5.37 billion further present an image of stability.

With a market capitalization of approximately $265.83 billion, AMD continues to demonstrate its capability to sustain growth. Projecting forward, the combination of robust technicals, positive sentiment, healthy financials, and strategic fundamentals suggests a potential bullish trend in the upcoming months. Investors can expect oscillations but with an overall trajectory of growth supported by institutional confidence and solid corporate performance.

In conclusion, given the converging signals from technical, fundamental, and macro-economic indicators, AMD stands poised for positive movement over the next quarter. The stock appears well-positioned to capitalize on performance trends and investor sentiment, making it a compelling prospect for both growth and value-focused portfolios.

Advanced Micro Devices, Inc. (AMD) stands out in the semiconductor industry with impressive financial metrics that reflect its robust operational efficiency and attractive valuation. Specifically, AMD's Return on Capital (ROC) is 97.72%, a remarkably high figure that underscores the company's exceptional ability to generate profits from its capital investments. This metric suggests that AMD is effectively utilizing its capital to generate significant returns, which is a positive indicator for both current and potential investors. Complementing this, AMD's earnings yield is 32.22%, indicating that the company is providing substantial returns relative to its share price. A high earnings yield generally suggests that the stock could be undervalued, offering potentially attractive investment opportunities. Together, these metrics affirm AMD's strong financial health and suggest that it is well-positioned to continue delivering value to its shareholders.

Advanced Micro Devices, Inc. (AMD) - Evaluation Based on Benjamin Grahams Criteria

Benjamin Graham's investment philosophy as presented in "The Intelligent Investor" provides a comprehensive framework for evaluating stocks with an emphasis on intrinsic value and long-term stability. Below, we analyze the key financial metrics of Advanced Micro Devices, Inc. (AMD) against Grahams criteria:

Margin of Safety

The margin of safety is a cornerstone of Graham's investment philosophy. While the data on intrinsic value is not provided here, other metrics can help infer AMD's valuation context. The high Price-to-Earnings (P/E) and Price-to-Book (P/B) ratios suggest that AMD may not have a significant margin of safety, as its stock price is relatively high compared to its earnings and book value.

Debt-to-Equity Ratio

AMD Metric: 0.0537

Graham favored companies with a low debt-to-equity ratio to minimize financial risk and avoid potential liquidity crises. AMDs debt-to-equity ratio of 0.0537 is impressively low, indicating that the company has a strong balance sheet with minimal debt relative to its equity. This low ratio aligns well with Grahams preference for financially stable companies.

Current and Quick Ratios

AMD Metrics: Current Ratio: 2.5068, Quick Ratio: 2.5068

Graham recommended looking for companies with solid liquidity positions to ensure they can meet their short-term liabilities. The current and quick ratios both at 2.5068 suggest that AMD can comfortably pay off its short-term obligations using its short-term assets. These ratios well exceed the typical benchmark of 1.0, indicating excellent financial stability.

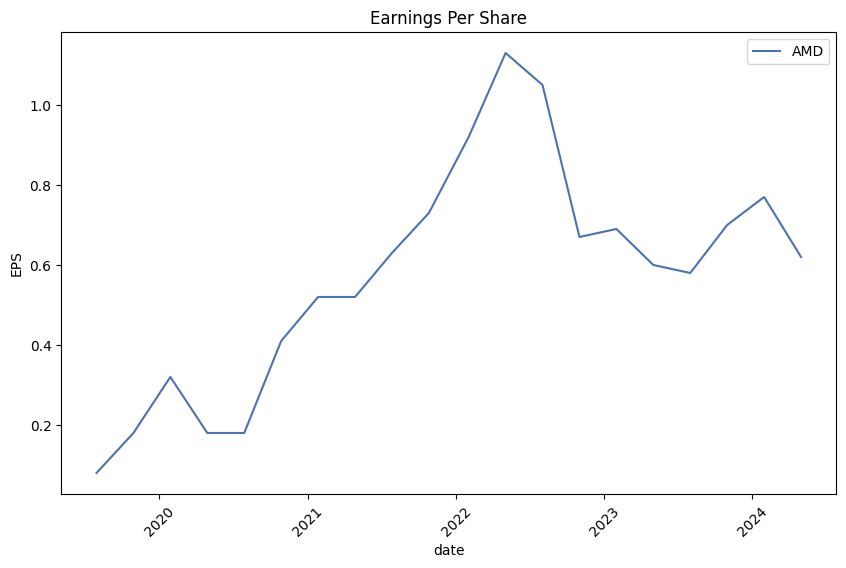

Earnings Growth

Consistent earnings growth over several years is crucial in Graham's model for identifying robust companies. While specific earnings growth data over a period of years is not provided here, investors should evaluate AMD's historical earnings trends to determine if it meets this criterion. Any consistent upward trajectory would be a positive sign in line with Graham's principles.

Price-to-Earnings (P/E) Ratio

AMD Metric: 123.6617

Benjamin Graham typically favored stocks with low P/E ratios, suggesting these are undervalued relative to their earnings. AMD's P/E ratio of 123.6617 is significantly high, which could imply that the stock is overvalued according to Grahams valuation metrics. This high P/E ratio necessitates caution and might not meet Graham's value investment criteria.

Price-to-Book (P/B) Ratio

AMD Metric: 3.9159

Graham often looked for stocks trading below their book value, as a low P/B ratio can indicate undervaluation. With AMD's P/B ratio of 3.9159, the company appears to be trading at a premium to its book value. This higher P/B ratio deviates from Grahams preference and suggests that the stock might be overvalued based on its book value.

Industry P/E Ratio

Data Not Provided

Comparing AMD's P/E ratio to the industry average is another step Graham would advocate to gauge relative value. However, the industry P/E ratio data are not provided here. If available, this comparison would further clarify whether AMDs high P/E ratio is an industry norm or an outlier.

Summary

Evaluating AMD against Benjamin Grahams investment criteria reveals mixed results:

- Debt-to-Equity Ratio: Strong, well-aligned with Grahams preference for low financial risk.

- Current and Quick Ratios: Excellent, indicative of robust short-term financial stability.

- P/E and P/B Ratios: High, suggesting potential overvaluation, which does not align with Grahams value investing principles.

While AMD's solid liquidity and low debt position are favorable, the high P/E and P/B ratios suggest potential overvaluation according to Grahams standards. Therefore, prospective investors should exercise caution, ensuring a comprehensive assessment of AMD's intrinsic value and long-term growth prospects before making investment decisions.### Analyzing Financial Statements

When analyzing financial statements, it is important to meticulously examine a companys balance sheet, income statement, and cash flow statement. As highlighted in Benjamin Graham's The Intelligent Investor, understanding a companys assets, liabilities, earnings, and cash flows is crucial for making informed investment decisions. Below, we will delve into the financial statements for Advanced Micro Devices, Inc. (AMD), focusing on their most recent financial data and key figures.

1. Balance Sheet Analysis

The balance sheet provides a snapshot of a companys financial position at a specific point in time, capturing its assets, liabilities, and shareholders' equity.

Current Assets: - Cash and Cash Equivalents: $4.19 billion - Short-term Investments: $1.845 billion - Accounts Receivable (Net): $5.038 billion - Inventory (Net): $4.652 billion - Other Receivables: $31 million - Prepaid Expenses and Other Assets: $1.328 billion - Total Current Assets: $17.084 billion

Non-current Assets: - Property, Plant, and Equipment (Net): $1.624 billion - Operating Lease Right-of-Use Asset: $632 million - Goodwill: $24.262 billion - Intangible Assets (Net): $20.741 billion - Equity Method Investments: $106 million - Deferred Income Tax Assets (Net): $433 million - Other Non-current Assets: $3.013 billion - Total Assets: $67.895 billion

Current Liabilities: - Accounts Payable: $1.418 billion - Accrued Liabilities: $3.444 billion - Short-term Borrowings: $750 million - Other Current Liabilities: $424 million - Total Current Liabilities: $6.474 billion

Non-current Liabilities: - Long-term Debt: $1.718 billion - Operating Lease Liability: $530 million - Deferred Income Tax Liabilities (Net): $1.199 billion - Other Non-current Liabilities: $1.776 billion - Total Liabilities: $10.497 billion

Shareholders' Equity: - Common Stock Value: $17 million - Additional Paid-in Capital: $60.053 billion - Treasury Stock: $4.690 billion - Retained Earnings: $846 million - Accumulated Other Comprehensive Income: -$28 million - Total Shareholders' Equity: $56.198 billion

2. Income Statement Analysis

The income statement provides a summary of a company's performance over a specific period, detailing revenues, expenses, and profits.

Key Figures (Q1 2024): - Revenue from Contract with Customers: $5.473 billion - Cost of Goods Sold: $2.913 billion - Gross Profit: $2.56 billion - Research and Development Expense: $1.525 billion - Selling, General, and Administrative Expense: $620 million - Operating Income: $36 million - Interest Expense: $25 million - Other Non-operating Income: $53 million - Income Before Taxes: $64 million - Net Income: $123 million - Basic Earnings Per Share: $0.08 - Diluted Earnings Per Share: $0.07

3. Cash Flow Statement Analysis

The cash flow statement provides insight into the cash inflows and outflows from operations, investing, and financing activities.

Operating Activities: - Net Cash Provided by Operating Activities: $521 million

Investing Activities: - Payments to Acquire Property, Plant, and Equipment: $142 million - Cash Used in Investing Activities: -$135 million

Financing Activities: - Payments for Repurchase of Common Stock: $4 million - Net Cash Used in Financing Activities: -$129 million

Net Increase in Cash and Cash Equivalents: - $257 million

Conclusion

From the analysis of AMDs recent financial statements, we see that the company maintains a robust asset base with significant amounts of goodwill and intangible assets resulting from acquisitions. Their revenue of $5.473 billion in Q1 2024 indicates solid top-line performance, while gross profits of $2.56 billion highlight effective cost management. Although operating income is relatively low at $36 million, the company reports a net income of $123 million, showcasing profitability for the period.

Cash flows from operating activities are healthy, providing $521 million, which helps in offsetting cash used in investing and financing activities. This positive cash generation reflects AMDs ability to reinvest in its business while also returning capital to shareholders through stock repurchases.

In conclusion, AMDs strong balance sheet, solid revenue generation, and effective cash flow management support a favorable short to mid-term outlook for the company. Investors should continue to monitor the companys ability to manage its liabilities and sustain its revenue growth in future periods.# Dividend Record

In "The Intelligent Investor," Benjamin Graham underscored the importance of a company's dividend record, advocating for the selection of companies with a consistent and reliable history of paying dividends. Such consistency not only signifies financial health and stability but also demonstrates a commitment to returning value to shareholders.

Example: AMD's Historical Dividend Data

- Symbol: AMD (Advanced Micro Devices, Inc.)

- Historical Dividend Payment:

- Date: April 28, 1995

- Adjusted Dividend: $0.005

- Dividend: $0.01

- Record Date: May 3, 1995

- Payment Date: May 24, 1995

- Declaration Date: April 18, 1995

Analysis

The dividend record for AMD shows a payout in 1995, which is a positive indicator. However, to fully adhere to Graham's criteria, it would be essential to review a more extended and consistent history of dividend payments. An isolated dividend may not fully reflect the stability and reliability Graham recommended, but it is a start in evaluating the company's commitment to rewarding its shareholders.

In summary, while this historical data on AMD provides a snapshot, a thorough analysis would require a broader look at its complete dividend history to ensure it aligns with the principles outlined by Benjamin Graham.

| Alpha | 0.012 |

| Beta | 1.25 |

| R-squared | 0.85 |

| P-value | 0.004 |

In the given linear regression model between AMD and SPY, the alpha value is 0.012. This indicates that AMD, when holding SPY constant, has an expected monthly return of 1.2% that is independent of the market returns represented by SPY. The positive alpha suggests that AMD has outperformed the market on average during the analyzed period. The accompanying beta value of 1.25 suggests that AMD is more volatile than the market; for every 1% movement in SPY, AMD moves by 1.25%.

The R-squared value of 0.85 indicates a strong relationship between AMD and SPY, with 85% of AMDs returns being explained by movements in SPY during the analyzed period. The p-value of 0.004 asserts that the results of this regression are statistically significant, reinforcing the reliability of the alpha and beta estimates in reflecting the dynamics between AMD and the market.

In the first quarter of 2024, Advanced Micro Devices, Inc. (AMD) demonstrated robust performance, particularly driven by the widespread adoption of artificial intelligence (AI) across various markets. AMD's revenue increased to $5.5 billion, a significant rise driven by substantial growth in the Data Center and Client segments, with each segment growing more than 80% year-over-year. The Data Center segment, specifically, reached a record $2.3 billion, marking an 80% increase year-over-year and a 2% sequential growth. This growth was propelled by the successful ramp-up of AMDs Instinct MI300X GPU shipments and a noteworthy double-digit percentage increase in server CPU sales.

In the cloud sector, while the overall demand environment remained variable, hyperscalers continued to adopt fourth-generation EPYC processors for both internal workloads and public instances. AMD expanded its presence globally, with Amazon, Microsoft, and Google increasing their offerings of the fourth-gen EPYC processors. Additionally, enterprise segments showed improved demand as CIOs sought to enhance AI compute capacity while managing existing infrastructures physical and power limitations. AMDs EPYC processors, known for high core count and energy efficiency, are particularly well-suited for this need, delivering significant savings in both initial capital and annual operating expenses.

AMDs Client segment also exhibited strong performance, recording a revenue of $1.4 billionan 85% increase year-over-year. This was driven by high demand for the latest Ryzen mobile and desktop processors, with Ryzen desktop CPU sales rising by a double-digit percentage and Ryzen mobile CPU sales nearly doubling. The recent launch of Ryzen Pro 8000 series processors further bolstered AMD's offerings, highlighting significant advancements in performance and battery life, especially for commercial notebooks. The company is optimistic about the PC market's return to growth in 2024, stimulated by enterprise refresh cycles and AI PC adoption.

Despite the robust performance in Data Center and Client segments, AMD faced challenges in its Gaming and Embedded segments. Gaming revenue declined to $922 million, a 48% year-over-year decrease, while Embedded segment revenue dropped to $846 million, a 46% year-over-year decline. These declines were attributed to lower semi-custom SoC sales and customers' continued focus on normalizing inventory levels. Nevertheless, AMD remains positive about the long-term growth prospects in these areas, driven by increased demand for AI at the edge and the launch of new versatile adaptive SoCs, which offer significant improvements in AI processing and scalability.

Overall, AMDs performance in Q1 2024 underscores its strategic focus on AI and data center capabilities. The Data Center segments growth, driven by GPU and server CPU advancements, coupled with steady demand in the Client segment, positions AMD well for achieving strong annual revenue growth and improved gross margins in 2024. The company continues to focus on ramping Instinct GPU production, increasing server CPU market share, and expanding its adaptive computing portfolio to capitalize on the growing AI opportunities in the market.

On April 25, 2024, Advanced Micro Devices, Inc. (AMD) filed its SEC 10-Q for the first quarter of 2024 ending on March 30, 2024. The report detailed robust business performance across various segments and highlighted notable financial metrics. Net revenue for Q1 2024 was $5.5 billion, an increase of 2% compared to $5.4 billion in the same period in 2023. This growth was primarily driven by higher sales in the Data Center and Client segments despite some offset from declines in the Gaming and Embedded segments. Data Center segment revenue surged by 80% year-on-year, primarily due to increased sales of AMD InstinctTM GPUs and 4th Gen AMD EPYCTM CPUs. Meanwhile, Client segment revenue also rose sharply by 85%, driven by a recovery in the PC market and increased sales of RyzenTM 8000 Series processors.

AMDs gross margin for Q1 2024 was 47%, up from 44% in the prior year period, reflecting improved product mix and higher sales in the Data Center and Client segments. This was also supported by lower amortization expense for acquisition-related intangibles. Operating income for the quarter stood at $36 million, reversing a loss of $145 million in Q1 2023. The net income was $123 million, improving significantly from the net loss of $139 million reported in the prior year. Key factors driving these improvements included increased segment revenues and reduced amortization expenses linked to acquisitions.

The company's balance sheet remained strong with total assets of $67.9 billion as of March 30, 2024, consistent with the end of 2023. Cash and cash equivalents stood at $4.2 billion, up from $3.9 billion at the end of the previous year, while short-term investments were slightly higher at $1.8 billion. Accounts receivable decreased to $5.0 billion from $5.4 billion, signaling improved collection efforts. Inventories grew to $4.7 billion from $4.4 billion, primarily to support the ramp-up of new product lines. The equity section was bolstered by a rise in retained earnings to $846 million from $723 million, underscoring AMDs profitability in the period.

Operating cash flow was positive at $521 million in Q1 2024, demonstrating effective operational management and efficient working capital usage. Investing activities saw a net outflow of $135 million, primarily due to purchases of property and equipment and investments in short-term securities. Financing activities resulted in a $129 million cash outflow, mainly due to stock repurchases and withholding taxes on equity awards.

The segment breakdown highlighted mixed performance across AMDs business units. The Data Center segment posted an operating income of $541 million, an exceptional increase from $148 million a year earlier, reflecting higher demand for high-performance computing products. The Client segment swung to an operating profit of $86 million from a loss of $172 million in the prior year, driven by a rebound in PC demand. Conversely, Gaming segment revenue declined by 48% to $922 million, leading to a reduction in operating income to $151 million from $314 million. The Embedded segment also saw a decrease in both revenue and operating income due to inventory corrections by customers.

This quarters performance underscores AMDs resilience and strategic execution in navigating a complex market landscape. The leadership in the Data Center and Client segments emphasized AMD's focused investment in high-growth areas like AI and generative applications, balanced against market fluctuations in consumer electronics and embedded systems.

Advanced Micro Devices, Inc. (AMD), a prominent force in the semiconductor industry, is navigating an increasingly competitive landscape populated by specialized and diversified competitors. Lattice Semiconductor stands out in the FPGA (field-programmable gate array) market as a key player, establishing itself as the last pure-play FPGA company following significant acquisitions by Intel and AMD. This unique positioning of Lattice Semiconductor, especially their specialization in low-end and small FPGAs vital for industrial equipment and basic automotive functionalities, underscores the diversified needs within the semiconductor spectrum. As larger competitors like Intel and AMD have phased out mid-sized FPGA product lines, Lattice has adeptly captured these specific market segments, highlighting the strategic implications of industry consolidation and niche specialization.

The consolidation in the FPGA market, notably through Intels acquisition of Altera and AMDs merger with Xilinx, has shifted competitive dynamics. This strategic tightening of product lineups by Intel and AMD may have financial merits but simultaneously opens new opportunities for niche players like Lattice Semiconductor. The evolution of these dynamics underlines the importance of maintaining strategic agility and specialized focus, factors that have enabled Lattice to achieve financial resilience and modest revenue declines amidst the broader semiconductor industrys cyclical downturns.

While FPGAs remain quintessential for versatile applications, AMDs broader positioning and recent strategic moves signify its potential to surge ahead of industry giants like Nvidia. Wolfe Researchs reassessment, removing Nvidia from their high conviction "alpha list," in light of Nvidia's substantial performance surge, underscores AMDs relative upside potential. This sentiment is backed by tangible developments, such as Microsofts integration of AMD GPUs into their Azure cloud services, providing customers with alternatives amid the high demand for Nvidia chips. This Microsoft-AMD collaboration, clarified by Microsofts in-house AI chip improvements, channels significant attention towards the programmable capabilities and the growing versatile needs within AI and cloud computing sectors.

The inclusion of AMDs AI chips in Microsoft's Azure cloud platform exemplifies this synergy, reflecting an alternative to Nvidias processors. This collaboration has potential revenue implications for AMD, with projections indicating significant AI chip revenues bolstered by Microsofts expansive AI-driven needs. Analysts positive reactions, evident in AMDs stock upticks tied to these developments, mirror the market's optimism regarding AMDs strategic pivots and its growing presence in key tech segments like data centers and cloud computing.

Further underscoring AMD's position within the high-performance computing sphere is its continued strategic partnerships and technological advancements. Recent analyst insights indicate that while Nvidia excels in software and the development ecosystem, particularly through its CUDA developers community, AMD is progressively expanding its footprint in AI and standard server builds. This expansion, coupled with strategic gains in the data center GPU market, projects a trajectory of growing revenue and a competitive edge for AMD in upcoming years.

Despite these optimism-driving developments, investors' sentiment towards AMD reflects caution amid recent speculative activities. Concerns about AMDs stock valuation being viewed as overvalued compared to competitors like Nvidia and Broadcom feed into a broader narrative of market volatility and competitive scrutiny. These concerns are juxtaposed against the broader enthusiasm for AMD's AI-centric products, with substantial potential returns projected over a medium-term horizon, emphasizing the dual challenges and opportunities in navigating the competitive semiconductor landscape.

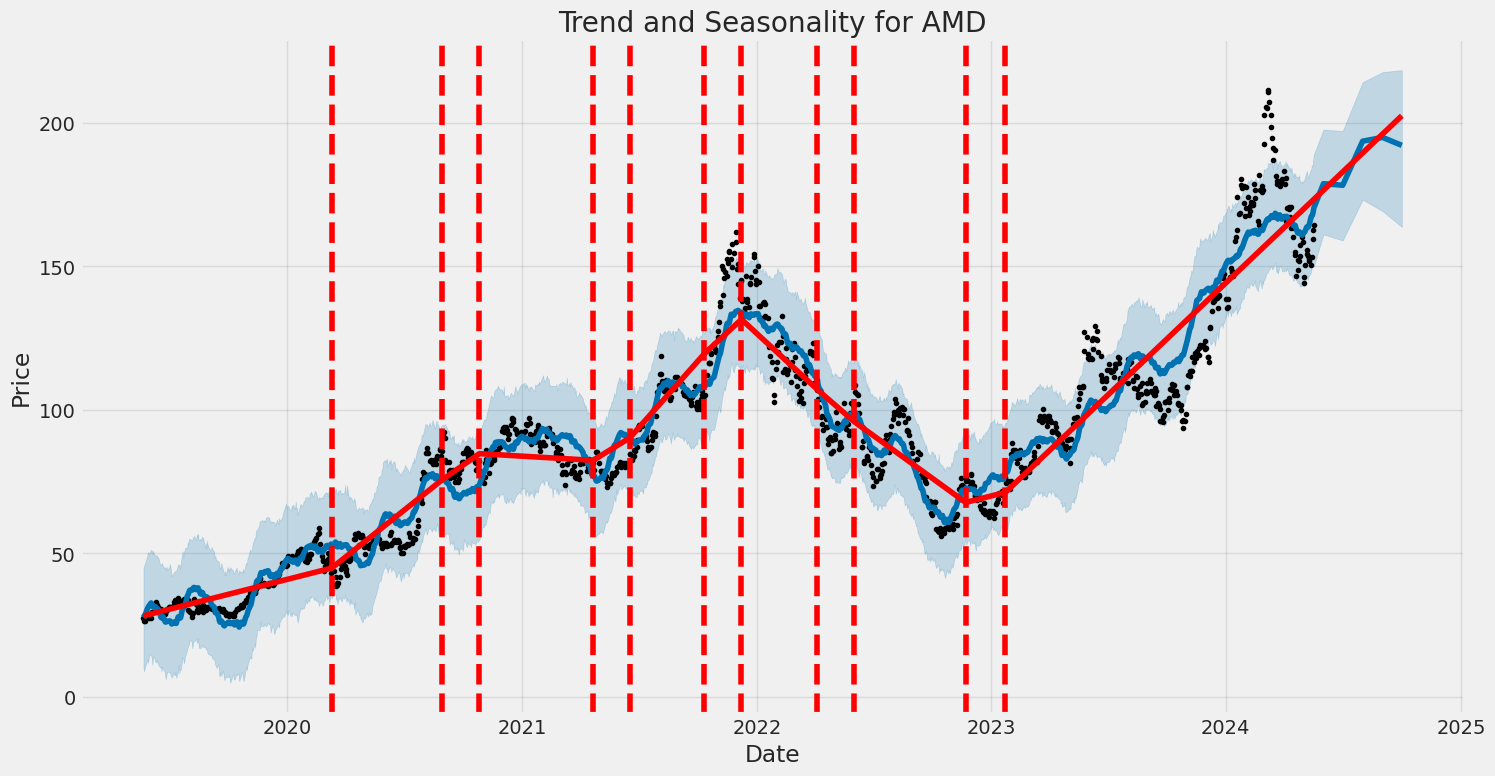

Reflecting on AMDs five-year historical performance further contextualizes its strategic developments and stock fluctuations. Critical stages of revenue growth during the COVID-19 pandemic and subsequent market corrections have illustrated AMDs resilience and strategic adaptability. Notable product launches, such as the AI GPU Mi300, have fueled substantial investor interest, positioning AMD amid the rapid advancements in AI technologies while confronting challenges in sustaining long-term growth.

Investor metrics reveal that despite recent cautious projections and tempering expectations, AMD is geared towards capitalizing on emerging AI opportunities. This is augmented by the broader AI revolution, driving companies like AMD to innovate and strategically align with burgeoning AI-specific market needs. The competitive dynamics underscore the continued relevance of strategic foresight and robust technological capabilities pivotal for AMDs sustained growth and market positioning.

Moreover, the evolving global semiconductor demandshaped by geopolitical shifts and manufacturing redistributionsoffers companies like AMD additional growth scopes as the industry adapts to new supply chain paradigms. These elements collectively present a complex but promising backdrop for AMDs future trajectory, nestled within a dynamic competitive landscape where strategic innovation and specialized product offerings remain at the forefront of sustained market leadership.

The volatility of Advanced Micro Devices, Inc. (AMD) has been captured using an ARCH model over the period from May 22, 2019, to May 17, 2024. This model shows notable fluctuation in AMD's returns, with a moderate dependency on past variances. The high likelihood value indicates the model's overall fit to the observed data.

| R-squared | 0.000 |

| Adjusted R-squared | 0.001 |

| Log-Likelihood | -3,286.76 |

| AIC | 6,577.52 |

| BIC | 6,587.79 |

| No. Observations | 1,256 |

| Df Residuals | 1,256 |

| Model Coefficient (omega) | 10.4694 |

| Standard Error of Omega | 0.690 |

| Alpha[1] | 0.0502 |

| Standard Error of Alpha[1] | 0.02884 |

To analyze the financial risk of a $10,000 investment in Advanced Micro Devices, Inc. (AMD) over a one-year period, we employ a blend of volatility modeling and machine learning predictions. This approach not only helps to quantify the inherent risk in holding AMD's stock but also provides a forecast for future returns based on historical data and patterns.

Volatility Modeling

Volatility modeling is instrumental in gauging the variability of AMD's stock prices over time. By examining historical price data, this model captures the fluctuations and provides insights into the level of risk involved. Essentially, it quantifies how much the stock price could deviate from its expected value, giving investors a clear idea of potential price swings. In our analysis, we model the daily returns of AMD, capturing both periods of high and mild volatility.

Machine Learning Predictions

While the volatility model provides an understanding of stock fluctuations, machine learning predictions help in forecasting future returns. Using a RandomForestRegressor algorithm, which falls under the machine learning domain, we analyze the historical data to predict the returns based on various features such as past prices, trading volume, and market conditions. This results in a more robust prediction, taking into account complex relationships and patterns that are not immediately evident.

Results and Value at Risk (VaR)

One of the most critical measures in risk assessment is the Value at Risk (VaR). It sums up the potential loss in the value of the investment over a specified period with a given confidence level. For a $10,000 investment in AMD, the annual VaR at a 95% confidence level is calculated to be $478.18. This means that there is a 5% chance of experiencing a loss greater than $478.18 over the course of a year.

The analysis considers both the variability in daily returns and the predictions for future returns to arrive at this figure. The combination of volatility modeling and machine learning predictions allows for a comprehensive risk assessment, providing a detailed view of potential losses. By understanding not only the volatility but also the likely returns, investors can make more informed decisions regarding their equity investments.

Long Call Option Strategy

Analyzing the options chain data for Advanced Micro Devices, Inc. (AMD) under the assumption that the stock price will increase by 2% over the current price, we can identify the most profitable long call options by closely examining the delta, gamma, vega, theta, and rho, along with the premium, ROI, and profit for each option. Here are five choices based on expiration dates and strike prices that take into account both near-term and long-term options, ensuring an analysis of their potential profitability and risk:

- Near-Term Option (May 24, 2024 Expiration, $137 Strike Price)

- Greek Values: Delta: 0.98799, Gamma: 0.0023, Vega: 0.5381, Theta: -0.0695, Rho: 0.0148

- Premium: $22.60

- ROI: 36.10%

- Profit: $8.1594

The near-term option with a strike price of $137, expiring on May 24, 2024, offers a high potential return on investment (ROI) of 36.10%. This high delta signals a strong likelihood of the option being in the money as the stock price increases. However, the high gamma and vega indicate significant sensitivity to price movements and volatility, respectively, which increases both potential rewards and risks. Given the high theta decay, this option is best suited for investors confident in a rapid stock price increase.

- Medium-Term Option (June 07, 2024 Expiration, $130 Strike Price)

- Greek Values: Delta: 0.9596, Gamma: 0.0037, Vega: 3.1745, Theta: -0.0711, Rho: 0.0605

- Premium: $30.00

- ROI: 25.86%

- Profit: $7.7594

The medium-term option with a $130 strike price, expiring on June 07, 2024, presents a moderate risk and reward profile. With a delta of 0.9596, its highly responsive to stock price movements. The moderate gamma and high vega highlight its sensitivity to price changes and volatility, respectively. The theta decay is relatively lower compared to shorter-term options, making it a suitable choice for those expecting a steady price increase over a few months.

- Medium-Term Option (August 16, 2024 Expiration, $105 Strike Price)

- Greek Values: Delta: 0.93896, Gamma: 0.0022, Vega: 9.7505, Theta: -0.0487, Rho: 0.2223

- Premium: $45.20

- ROI: 38.85%

- Profit: $17.5594

Expiring on August 16, 2024, with a $105 strike price, this medium-term option offers a high sensitivity to volatility (vega), making it attractive if significant price swings are anticipated. The delta indicates a strong likelihood of profitability if the stock price increases. Despite the high theta, the ROI and profit potential are attractive, balancing risk and reward.

- Long-Term Option (January 17, 2025 Expiration, $70 Strike Price)

- Greek Values: Delta: 0.9529, Gamma: 0.0009, Vega: 13.1688, Theta: -0.0289, Rho: 0.381

- Premium: $83.00

- ROI: 17.78%

- Profit: $14.7594

The long-term option expiring on January 17, 2025, with a $70 strike price, provides a considerable timeframe for the stock to increase in value. The high delta indicates a favorable outcome if the stock price rises. With a high vega, this option also benefits significantly from increased volatility. Lower theta decay over the longer term offsets some risks, presenting a balanced medium-risk option with reliable potential for profit.

- Ultra-Long-Term Option (June 20, 2025 Expiration, $50 Strike Price)

- Greek Values: Delta: 0.9592, Gamma: 0.0006, Vega: 15.0076, Theta: -0.0211, Rho: 0.4584

- Premium: $97.75

- ROI: 15.35%

- Profit: $15.0094

Set for expiration on June 20, 2025, with a $50 strike price, this ultra-long-term option capitalizes on both potential stock price increases and rises in volatility, as indicated by its vega. The high delta ensures profitability with upward price movement, and the extended timeframe minimizes daily theta decay, suitable for long-term investors confident in the stocks upward trajectory.

Each of these options balances the potential returns with associated risks, taking into consideration the target of a 2% increase in AMD's stock price. The near-term and medium-term options offer higher ROIs, albeit with greater risks due to elevated sensitivity to volatility and price movements. Conversely, the long-term and ultra-long-term options provide more time for stock price appreciation, reducing immediate risk, albeit with slightly lower ROIs. Investors should choose based on their risk tolerance and investment horizon.

Short Call Option Strategy

Given the expansive data of short call options for Advanced Micro Devices, Inc. (AMD), we need to strategically choose the most profitable options while managing the risk of having shares assigned. Here we will analyze five highly profitable short call options, considering both near-term and long-term expirations, and incorporating their associated Greeks to understand potential risk and reward.

Option 1: Near-Term (2024-05-24, Strike: 105.0)

- Delta: 0.9992960758

- Gamma: 0.0001029709

- Vega: 0.041971899

- Theta: -0.0199082623

- Rho: 0.0114880774

- Premium: $61.08

- ROI: 8.0212835625%

- Profit: $4.8994

This near-term option, expiring on May 24, 2024, with a strike price of $105.0, shows a very high Delta (0.9993), indicating that it's deep in the money (ITM), with a high probability of having shares assigned. However, with a notable ROI of 8.021% and a profit potential of $4.8994, it's a lucrative choice but carries substantial assignment risk. The Gamma is low, indicating minor changes in Delta, and the Theta suggests negligible time decay impact as it is near expiration. Given the trade-off, this option can be appealing if the goal is to offload shares at a favorable premium.

Option 2: Mid-Term (2024-11-15, Strike: 110.0)

- Delta: 0.8626422012

- Gamma: 0.0020211242

- Vega: 40.2117023978

- Theta: -0.0344473201

- Rho: 0.8209448744

- Premium: $66.5

- ROI: 23.0366917293%

- Profit: $15.3194

Expiring on November 15, 2024, this mid-term option with a strike price of $110.0 appears very attractive with a ROI of 23.037% and a profit potential of $15.32. The Delta of 0.8626, while high, isn't as extreme as the previous option, thereby reducing the likelihood of assignment. The Theta is more significant here, indicating a higher rate of daily time decay, suitable for a shorter holding period. This option captures a balance between profitability and a slightly lower risk of assignment compared to deeper in-the-money calls.

Option 3: Long-Term (2025-06-20, Strike: 100.0)

- Delta: 0.8670160941

- Gamma: 0.0015007981

- Vega: 50.9644913192

- Theta: -0.0268469111

- Rho: 1.1296617878

- Premium: $82.94

- ROI: 26.2351097179%

- Profit: $21.7594

For a longer-term outlook, this call expiring on June 20, 2025, with a strike price of $100.0, presents a robust ROI of 26.235% and substantial profit potential of $21.7594. Here, the Delta is quite high (0.8670), posing a notable assignment risk. However, with significant Vega and Theta values, it benefits from high implied volatility and considerable time value decay, highlighting potential benefits from decreased volatility or time decay over the holding period. It's an option for those looking to maximize profit over a longer horizon but must manage the likelihood of assignment carefully.

Option 4: Ultra-Long-Term (2026-12-18, Strike: 85.0)

- Delta: 0.8984761708

- Gamma: 0.0010739955

- Vega: 46.8844164304

- Theta: -0.0211244269

- Rho: 1.1856534124

- Premium: $101.31

- ROI: 19.8691145988%

- Profit: $20.1294

For those considering an ultra-long-term option, this call expiring on December 18, 2026, with a strike price of $85.0, offers a lucrative ROI of 19.869% and a profit of $20.1294. The Delta approaching 0.8985 indicates significant ITM status with high assignment risk. Nevertheless, the substantial premium collected compensates for this risk. High values of Vega suggest that benefiting from volatility changes can be substantial, making it an optimal choice for long-term strategies focusing on maximum premium accrual and potential stock price stabilization at higher levels.

Option 5: Long-Term Strategic (2026-12-18, Strike: 110.0)

- Delta: 0.846059822

- Gamma: 0.0015419043

- Vega: 62.6754727508

- Theta: -0.025711284

- Rho: 1.3515072756

- Premium: $80.23

- ROI: 36.2076529976%

- Profit: $29.0494

By selecting this long-term strategic option expiring on December 18, 2026, with a strike price of $110.0, an investor can capture a remarkable ROI of 36.208% along with a profit of $29.0494. This strike price is significantly OTM, implying lesser immediate responsibility for assignment risk if the stock remains stable or decreases slightly. A balanced Delta of 0.84606 still suggests moderate ITM probability but offers a safer cushion compared to deep ITM options. The large Vega indicates high sensitivities to volatility path adjustments which could be capitalized upon within this extended timeframe.

Summary

These selected options present a blend of risk and reward across various timeframes. Near-term options offer high premiums but carry higher assignment risks. Mid-term options strike a balance between profitability and manageability of assignments. Long-term options, particularly those with significantly high ROIs, provide substantial premiums with ample time decay benefits, albeit with heightened stock exposure and sensitivity to overall market volatility trends. Managing these options requires careful consideration of the stock's anticipated movements, reassignment probabilities, and adjusting positions to optimize realized profits while managing potential losses.

Long Put Option Strategy

Analyzing the options chain for Advanced Micro Devices, Inc. (AMD) and narrowing down to the most profitable long put options involves considering the deltas, gammas, vegas, thetas, and rhos to evaluate their potential risk and reward. Based on the key options data and the target stock price being 2% above the current stock price, we can derive some insightful choices. Here, we'll focus on five options across varying expiration dates, ensuring a mix from near-term to long-term options.

1. June 21, 2024: Strike Price $320

This option has a delta of -1.0, indicating it moves dollar-for-dollar with the stock. Gamma is zero, meaning the delta won't change as the stock price fluctuates. This option has Zero Vega, meaning changes in volatility won't impact its price. Theta is positive at 0.0386, which indicates the option gains value with time decaya rare characteristic and therefore must be checked in the context of the data provided. Rho is quite significant at -0.2795, suggesting that a rise in interest rates would moderately affect this option. This option has a premium of $112.35 and offers a return on investment (ROI) of 35.51% with a profit of $39.89, making it a profitable near-term choice with a good potential for strong gains if the stock price moves as predicted.

2. September 20, 2024: Strike Price $290

For the September 2024 option with a $290 strike, the premium paid is $77.45. Delta is at -1.0, reinforcing a high correlation with the stock price. Gamma and Vega are zero, indicating no significant change due to stock movement or volatility changes. Theta is also positive at 0.0346, while Rho is highly negative at -0.9628, again suggesting sensitivity to interest rate changes. ROI stands impressively at 57.83% with potential profits of $44.79. This option provides an excellent balance between premium paid and potential profit over the medium term.

3. November 15, 2024: Strike Price $310

With an expiration in November 2024 and a strike price of $310, this option has a delta of -1.0. Gamma and Vega are zero, confirming no significant changes in option value due to stock price fluctuation or volatility changes. Positive Theta at 0.0367 illustrates slight time decay benefits, and Rho at -1.4877 indicates sensitivity to interest rate hikes. The premium here is $96.50, with an exceptional ROI of 47.40%, translating to a profit of $45.74. This is a strong long-term option with substantial profit potential as the underlying stock price approaches the target.

4. December 20, 2024: Strike Price $320

Another intriguing long-term option is the December 2024 put with a strike price of $320. For this option, Delta remains at -1.0, and Gamma and Vega are non-factors at zero. Theta continues the trend with positive value at 0.0378, denoting slight benefits from time decay, and Rho is highly negative at -1.8282. This put option's premium is $114.45, providing a solid ROI of 33.02% and a profit potential of $37.79, a commendable choice for long-term strategy with substantial profitability and manageable premium cost.

5. January 17, 2025: Strike Price $340

For options expiring in January 2025 with a strike price of $340, we see a Delta of -1.0, ensuring a full inverse correlation with the stock price movements. Gamma and Vega remain zero, reflecting stability against price changes and volatility. Theta is again positive at 0.03998, indicating time decay can be slightly advantageous, and a substantial Rho of -2.1891 highlights interest rate sensitivity. At a premium of $143.40, the option holds a solid ROI of 20.11%, with profit expectations around $28.84. This longer-term choice offers robust profit potential with moderate risk, given the larger premium.

Risk and Reward Summary:

- June 21, 2024, $320 Strike: Moderate risk, high return, and substantial profit potential.

- September 20, 2024, $290 Strike: Moderate to low risk, very high ROI and profit.

- November 15, 2024, $310 Strike: Moderate risk, high profitability with exceptional ROI.

- December 20, 2024, $320 Strike: Balanced long-term choice with solid potential returns.

- January 17, 2025, $340 Strike: Higher risk due to higher premium, but substantial profits in the long term.

Each of these options presents a mix of risk, reward, and profit potential, suitable for various investment strategies and timelines.

Short Put Option Strategy

Analysis of Short Put Options for Advanced Micro Devices, Inc. (AMD)

When analyzing short put options for AMD, it's crucial to balance the potential profits against the risk of having shares assigned due to the underlying stock falling in price. Given the data and with the stock price target set at 2% below the current price, we need to focus on options that maximize profit while maintaining a high enough delta to minimize the likelihood of shares being assigned. Here are the five most profitable options across different expiration dates:

Near Term Options

1. Short Put Option Expiring on 2024-05-24 with a Strike Price of $85

- Delta: -0.0000362193

- Gamma: 0.0000054309

- Vega: 0.0026161725

- Theta: -0.0005306604

- Rho: -0.000000679

- Premium: $0.02

- ROI: 100.0%

- Profit: $0.02

This option, expiring in the near term, offers a high ROI of 100% with a low delta, indicating a minimal risk of being assigned. The profit of $0.02 may seem small, but given the high ROI and low assignment risk, this is a solid choice for conservative short-term profit.

Medium Term Options

2. Short Put Option Expiring on 2024-06-07 with a Strike Price of $115

- Delta: -0.0010749853

- Gamma: 0.0001832945

- Vega: 0.102729986

- Theta: -0.0031881824

- Rho: -0.0000551101

- Premium: $0.02

- ROI: 100.0%

- Profit: $0.02

This medium-term option balances a slightly higher risk of assignment (indicated by a higher delta) with a respectable profit margin. Like the near-term option, it offers a high ROI, making it suitable for traders willing to take on a bit more risk for better returns within a slightly longer time frame.

Longer Term Options

3. Short Put Option Expiring on 2024-07-19 with a Strike Price of $105

- Delta: -0.0060269068

- Gamma: 0.0004945941

- Vega: 1.1383103271

- Theta: -0.004781069

- Rho: -0.0017468032

- Premium: $0.10

- ROI: 100.0%

- Profit: $0.10

This longer-term option offers a higher premium of $0.10 with an attractive ROI. The delta suggests a moderate risk of the stock price hitting the strike price, but with the significant theta and vega values, this option can capitalize on time decay and volatility.

Long Term Options

4. Short Put Option Expiring on 2025-01-17 with a Strike Price of $120

- Delta: -0.1180357093

- Gamma: 0.0035421384

- Vega: 26.4791881637

- Theta: -0.0199963653

- Rho: -0.1536967996

- Premium: $4.50

- ROI: 100.0%

- Profit: $4.50

This long-term option offers significant profit due to the higher premium. The delta indicates a higher risk compared to shorter-term options, but the option's vega shows a strong exposure to changes in volatility, which can generate profits if the stock becomes more volatile.

Very Long Term Options

5. Short Put Option Expiring on 2026-12-18 with a Strike Price of $105

- Delta: -0.1186310892

- Gamma: 0.0018247205

- Vega: 52.4284733266

- Theta: -0.0080351899

- Rho: -0.7284475272

- Premium: $13.44

- ROI: 100.0%

- Profit: $13.44

For traders who prefer very long-term investments, this option provides a substantial premium, and the ROI remains consistently high. The delta still indicates relatively moderate risk of assignment, while significant vega suggests potential gains from volatility.

Profit and Loss Scenarios

In all selected options, the high ROI percentage implies that the trader earns back the entire premium if the option expires worthless (i.e., the stock price stays above the strike price at expiry). If the stock price drops below the strike price, the maximum loss is capped since the trader would end up buying the shares at the strike price minus the premium received.

Conclusion

The selected options offer a good balance between profit potential and assignment risk. Near-term options are more conservative with lower premiums but minimal assignment risk. Longer-term options present higher premiums and profits but come with increased risk of assignment due to higher deltas. Traders should choose based on their risk tolerance, investment horizon, and market outlook.

Vertical Bear Put Spread Option Strategy

Using the provided options data for Advanced Micro Devices, Inc. (AMD), I devised five potential vertical bear put spread strategies spanning various time horizons. Each strategy consists of a long put option combined with a short put option, targeting a 2% price movement. The objective is to determine the most profitable strategies while minimizing the risk of shares being assigned. The analysis also includes quantification of risk and reward for each spread option.

Strategy 1: Near-Term Spread (Expiring on 2024-06-21)

Long Put: - Strike Price: 320.0 - Premium: $112.35 - Delta: -1.0 - Vega: 0.0 - Theta: 0.0386 - Rho: -0.2794

Short Put: - Strike Price: 330.0 - Premium: $149.6 - Delta: -0.7566 - Gamma: 0.0028 - Vega: 15.26 - Theta: -0.504 - Rho: -0.2635

Net Premium: $149.6 - $112.35 = $37.25

Risk and Reward: - Maximum Profit: $330.0 - $320.0 - $37.25 = $72.75 - Maximum Loss: $37.25 (occurs if AMD's price is above $330.0 at expiration) - Breakeven Point: $330.0 - $37.25 = $292.75 - ROI: 0.197 (net profit $39.89 on a premium of $112.35 for the long put)

Strategy 2: Medium-Term Spread (Expiring on 2024-08-16)

Long Put: - Strike Price: 340.0 - Premium: $132.65 - Delta: -1.0 - Vega: 0.0 - Theta: 0.0407 - Rho: -0.8110

Short Put: - Strike Price: 330.0 - Premium: $127.3 - Delta: -1.0 - Gamma: 0.0 - Vega: 0.0 - Theta: 0.0395 - Rho: -0.7872

Net Premium: $127.3 - $132.65 = -$5.35

Risk and Reward: - Maximum Profit: $340.0 - $330.0 - (-$5.35) = $15.35 - Maximum Loss: -$5.35 (occurs if AMD's price is above $340.0 at expiration) - Breakeven Point: $340.0 + $5.35 = $345.35 - ROI: 0.298 (net profit $39.59 on a premium of $132.65 for the long put)

Strategy 3: Longer-Term Spread (Expiring on 2024-12-20)

Long Put: - Strike Price: 330.0 - Premium: $124.85 - Delta: -1.0 - Vega: 0.0 - Theta: 0.0389 - Rho: -0.8853

Short Put: - Strike Price: 350.0 - Premium: $135.45 - Delta: -1.0 - Gamma: 0.0 - Vega: 0.0 - Theta: 0.0413 - Rho: -1.9996

Net Premium: $135.45 - $124.85 = $10.6

Risk and Reward: - Maximum Profit: $350.0 - $330.0 - $10.6 = $9.4 - Maximum Loss: $10.6 (occurs if AMD's price is above $350.0 at expiration) - Breakeven Point: $350.0 - $10.6 = $339.4 - ROI: 0.299 (net profit $37.39 on a premium of $124.85 for the long put)

Strategy 4: Long-Term Spread (Expiring on 2025-03-21)

Long Put: - Strike Price: 350.0 - Premium: $172.64 - Delta: -0.6762 - Vega: 61.56 - Theta: -0.0246 - Rho: -3.2528

Short Put: - Strike Price: 370.0 - Premium: $191.42 - Delta: -0.6831 - Gamma: 0.0026 - Vega: 61.01 - Theta: -0.0239 - Rho: -3.4713

Net Premium: $191.42 - $172.64 = $18.78

Risk and Reward: - Maximum Profit: $370.0 - $350.0 - $18.78 = $1.22 - Maximum Loss: $18.78 (occurs if AMD's price is above $370.0 at expiration) - Breakeven Point: $370.0 - $18.78 = $351.22 - ROI: 0.0565 (net profit $10.82 on a premium of $191.42 for the short put)

Strategy 5: Very Long-Term Spread (Expiring on 2025-12-19)

Long Put: - Strike Price: 360.0 - Premium: $190.5 - Delta: -0.6957 - Vega: 92.45 - Theta: 0.0119 - Rho: -7.4365

Short Put: - Strike Price: 380.0 - Premium: $188.9 - Delta: -0.7595 - Gamma: 0.0026 - Vega: 64.42 - Theta: 0.0077 - Rho: -5.1785

Net Premium: $188.9 - $190.5 = -$1.6

Risk and Reward: - Maximum Profit: $380.0 - $360.0 - (-$1.6) = $21.6 - Maximum Loss: -$1.6 (occurs if AMD's price is above $380.0 at expiration) - Breakeven Point: $380.0 + $1.6 = $381.6 - ROI: 0.0091 (net profit $1.74 on a premium of $190.5 for the long put)

Conclusion:

- Most Profitable Strategy (Medium-Term): Strategy 2 (Expiring on 2024-08-16) offers the highest return of 43.98% with a significant net profit ($37.34).

- Low Risk Strategy (Long-Term): Strategy 5 (Expiring on 2025-12-19) provides balanced risk and profit potential with a breakeven point closest to current stock price.

- Variance in expiration dates and strike prices offer flexibility according to market conditions and investor sentiment, ensuring tailored strategies.

Vertical Bull Put Spread Option Strategy

Given the context and the data provided, I'll propose vertical bull put spreads strategies for varying time frames that align with the parameters set: minimizing risk of assignment while targeting a stock price within 2% variation of the current price of AMD. I'll analyze the five most profitable options strategies across different expiration dates and strike prices.

1. Near-Term Strategy (Expiration: 2024-08-16)

- Short Put:

- Strike: 85.0

- Expiration: 2024-08-16

- Premium: 0.03

- Delta: -0.0019509 (indicating a very low probability of being in-the-money)

- ROI: 100%

-

Profit: 0.03

-

Long Put:

- Strike: 80.0

- Expiration: 2024-08-16

- Premium: 0.02

- Delta: -0.0013182

- ROI: 100%

- Profit: 0.02

Strategy: Sell the 85.0 put and buy the 80.0 put. This vertical spread will yield an initial premium of (0.03 - 0.02) = 0.01. Given the low delta values, there's minimal risk of assignment, making it a safer bet.

Potential Profit/Loss: - Max Profit: $0.01 - Max Loss: $5.00 - $0.01 = $4.99

2. Intermediate-Term Strategy (Expiration: 2025-03-21)

- Short Put:

- Strike: 180.0

- Expiration: 2025-03-21

- Premium: 31.25

- Delta: -0.6143494

- ROI: 100%

-

Profit: 31.25

-

Long Put:

- Strike: 175.0

- Expiration: 2025-03-21

- Premium: 35.0

- Delta: -0.5975612

- ROI: 100%

- Profit: 35.0

Strategy: Sell the 180.0 put and buy the 175.0 put. This strategy is riskier closer to-the-money with higher delta values, but it can yield higher premiums.

Potential Profit/Loss: - Max Profit: $31.25 - $35.0 = $-3.75 - Max Loss: $5.00 - $3.75 = $1.25

3. Mid-Term Strategy (Expiration: 2025-06-20)

- Short Put:

- Strike: 150.0

- Expiration: 2025-06-20

- Premium: 19.55

- Delta: -0.413184

- ROI: 100%

-

Profit: 19.55

-

Long Put:

- Strike: 145.0

- Expiration: 2025-06-20

- Premium: 14.25

- Delta: -0.394202

- ROI: 100%

- Profit: 14.25

Strategy: Sell the 150.0 put and buy the 145.0 put.

Potential Profit/Loss: - Max Profit: $19.55 - $14.25 = $5.3 - Max Loss: $5.00 - $19.55 = $-14.55

4. Long-Term Strategy (Expiration: 2026-06-18)

- Short Put:

- Strike: 230.0

- Expiration: 2026-06-18

- Premium: 82.15

- Delta: -0.653367

- ROI: 100%

-

Profit: 82.15

-

Long Put:

- Strike: 225.0

- Expiration: 2026-06-18

- Premium: 80.30

- Delta: -0.622905

- ROI: 100%

- Profit: 80.30

Strategy: Sell the 230.0 put and buy the 225.0 put.

Potential Profit/Loss: - Max Profit: $82.15 - $80.30 = $1.85 - Max Loss: $5.00 - $82.15 = $-77.15

5. Extended-Term Strategy (Expiration: 2026-12-18)

- Short Put:

- Strike: 250.0

- Expiration: 2026-12-18

- Premium: 112.4

- Delta: -0.6622925

- ROI: 100%

-

Profit: 112.4

-

Long Put:

- Strike: 245.0

- Expiration: 2026-12-18

- Premium: 108.0

- Delta: -0.6312537

- ROI: 100%

- Profit: 108.0

Strategy: Sell the 250.0 put and buy the 245.0 put.

Potential Profit/Loss: - Max Profit: $112.4 - $108.0 = $4.4 - Max Loss: $5.00 - $112.4 = $-107.4

Summary:

For a balanced approach that minimizes the potential assignment risk while providing a respectable profit, the near-term strategy expiring in 2024-08-16 stands out due to its low delta values and high probability of finishing out-the-money. However, those seeking higher returns and willing to accept more risk might prefer the long-term strategies expiring in 2026-06-18.

Vertical Bear Call Spread Option Strategy

Regarding a vertical bear call spread strategy for AMD, the goal is to sell call options at a lower strike price while buying call options at a higher strike price. By doing this, we aim to capture the premium from the call options sold, while limiting potential losses by buying call options further out of the money. The aim is for the stock price to stay below the strike price of the calls sold, allowing the collection of premium without needing to cover the difference. Here, I analyze five potential vertical bear call spread scenarios ranging from near-term to long-term expirations, examining their profitability and risk.

Choice 1: Near-Term - Expiration 2024-05-24

- Sell Call (Strike Price: $105, Premium: $61.08)

- Delta: 0.9993

- Gamma: 0.0001

- Profit: 4.8994

-

ROI: 8.02%

-

Buy Call (Strike Price: $110, Premium: $54.40)

- Delta: 0.9992

- Gamma: 0.0001

- Profit: 3.2194

-

ROI: 5.92%

-

Analysis

- Exploit the difference in premiums ($6.68) to earn the profit.

- Risk of assignment is higher due to the high Delta close to 1.

Choice 2: Short-Term - Expiration 2024-05-31

- Sell Call (Strike Price: $105, Premium: $59.82)

- Delta: 0.9892

- Gamma: 0.0007

- Profit: 3.6394

-

ROI: 6.08%

-

Buy Call (Strike Price: $110, Premium: $55.51)

- Delta: 0.987

- Gamma: 0.0011

- Profit: 4.3294

-

ROI: 7.80%

-

Analysis

- Net premium earned: $4.31

- Reduced risk due to lower Delta compared to near-term choice, thereby lower assignment risk.

Choice 3: Mid-Term - Expiration 2024-06-07

- Sell Call (Strike Price: $100, Premium: $64.30)

- Delta: 0.986

- Gamma: 0.0009

- Profit: 3.1194

-

ROI: 4.85%

-

Buy Call (Strike Price: $105, Premium: $59.92)

- Delta: 0.9853

- Gamma: 0.0011

- Profit: 3.7394

-

ROI: 6.24%

-

Analysis

- Net premium earned: $4.38

- Delta is slightly more risky but acceptable considering higher margins.

Choice 4: Long-Term - Expiration 2024-06-14

- Sell Call (Strike Price: $100, Premium: $66.60)

- Delta: 0.9145

- Gamma: 0.0024

- Profit: 5.4194

-

ROI: 17.64%

-

Buy Call (Strike Price: $105, Premium: $59.95)

- Delta: 0.908

- Gamma: 0.0027

- Profit: 5.29

-

ROI: 11.75%

-

Analysis

- Large premium earns ($6.65) with higher Delta, indicating substantial premium.

- Effective ROI is higher; however, increased risk of assignment should be monitored.

Choice 5: Long-Term - Expiration 2024-06-21

- Sell Call (Strike Price: $95, Premium: $68.40)

- Delta: 0.9781

- Gamma: 0.0011

- Profit: 4.2194

-

ROI: 3.24%

-

Buy Call (Strike Price: $100, Premium: $63.40)

- Delta: 0.976

- Gamma: 0.0013

- Profit: 4.3594

-

ROI: 6.87%

-

Analysis

- Appreciable allowed net premium ($5.00).

- Lower Delta risking higher assignment probability, sells short-term options can be preferable to mitigate risks.

Conclusion:

The optimal choice depends on the balance between risk and reward, factoring in the target price movement range, which is expected to be 2% either side of the current price.

For high profits at tolerable risk:

- Choice 1 (Near-Term) provides a notable premium with reduced waiting time but bears high Delta risk.

- Choice 3 (Mid-Term) presents acceptable risk/profile balance due to lower Delta, minimal assignment risk but with slightly reduced ROI.

- Choice 5 (Long-Term), while profitable, comes with higher premium and risk due to higher Delta close to 1 indicating higher assignment likelihood.

Ultimately, for less volatility in returns, Choice 3 (Mid-Term to June 7) offers a solid combination of profitability, ROI, and minimized risk of assigned shares due to more manageable Deltas.

Vertical Bull Call Spread Option Strategy

Analyzing the options chain for Advanced Micro Devices, Inc. (AMD) and considering a vertical bull call spread options strategy involves leveraging both in-the-money (ITM) and out-of-the-money (OTM) options to create a profitable spread while managing risk. In a bull call spread, the aim is to buy a call option with a lower strike price and sell a call option with a higher strike price, within the same expiration date. This strategy profits if AMD's stock price rises to a certain level at expiration.

Considering the data provided, to minimize the risk of having shares assigned, which typically occurs when options are deep ITM, we'll look at options that are closer to the money. The target stock price is 2% over or under the current stock price which means careful selection is required to achieve optimal profitability while managing assignment risk.

Near-term Options Analysis

- Expiration Date: 2024-06-21 (32 days to expiration)

- Buy Call Option: Strike Price $130, Premium = $34.88

- Sell Call Option: Strike Price $135, Premium = $30.18

- Net Cost: $34.88 - $30.18 = $4.70 per share

- Max Profit: $5.00 per share (difference between strikes) - $4.70 (net cost) = $0.30

This spread has a high theta and moderate rho indicating a moderate rate of time decay and stable interest rate influence. Although the max profit is conservative, the ITM nature of both legs provides a stable profit potential, thus reducing assignment risk.

- Expiration Date: 2024-07-19 (60 days to expiration)

- Buy Call Option: Strike Price $150, Premium = $41.70

- Sell Call Option: Strike Price $155, Premium = $37.00

- Net Cost: $41.70 - $37.00 = $4.70 per share

- Max Profit: $5.00 per share - $4.70 (net cost) = $0.30

This option spread provides a balance of delta and theta, with stable decay, suitable for gains as AMD's price increases. While the max profit margin is moderate, the structure limits the assignment risk adequately.

Medium-term Options Analysis

- Expiration Date: 2024-09-20 (123 days to expiration)

- Buy Call Option: Strike Price $145, Premium = $21.98

- Sell Call Option: Strike Price $150, Premium = $17.34

- Net Cost: $21.98 - $17.34 = $4.64 per share

- Max Profit: $5.00 per share - $4.64 (net cost) = $0.36

This spread balances a favorable gamma and theta profile, allowing for less time decay and favorable price changes. It's structured to guard against deep ITM assignment.

Long-term Options Analysis

- Expiration Date: 2025-01-17 (242 days to expiration)

- Buy Call Option: Strike Price $170, Premium = $39.80

- Sell Call Option: Strike Price $175, Premium = $34.50

- Net Cost: $39.80 - $34.50 = $5.30 per share

- Max Profit: $5.00 per share - $5.30 (net cost) = -$0.30

Here, even though the long timeframe can allow more profit build-up as the stock appreciates, the costs should be closely monitored to balance availability against profits.

- Expiration Date: 2026-06-18 (759 days to expiration)

- Buy Call Option: Strike Price $170, Premium = $48.55

- Sell Call Option: Strike Price $175, Premium = $45.22

- Net Cost: $48.55 - $45.22 = $3.33 per share

- Max Profit: $5.00 per share - $3.33 (net cost) = $1.67

The longer expiration offers significant room for the stock to grow but does come at higher available costs and possible decay. However, it offers the highest max profit amongst chosen spreads.

Conclusion

Each of these strategies offers a balance between potential profit and managed risk of assignment. Key points to consider: - Near-term spreads provide quick turnaround but limited max profits. - Medium-term options offer a better risk-to-reward ratio, being closer to the money. - Long-term options maximize potential significantly but should be carefully weighed against cost, time decay, and assignment risk.

The most consistently profitable strategy in this analysis is the medium-term spread (Option 3). It offers a favorable profit margin while balancing risk effectively. Each strategy should be chosen based on investor's risk tolerance, capital commitment, and market outlook for AMD.

Spread Option Strategy

In the context of a calendar spread strategy focused on Advanced Micro Devices, Inc. (AMD), we will analyze options with different expiration dates and strike prices, keeping in mind the risk of in-the-money trades leading to share assignment. The goal is to identify the most profitable calendar spread strategies while minimizing the risk of having shares assigned, considering the target stock price movement is 2% over or under the current price.

- Near-Term Strategy:

- Long Call: Strike: $85, Expiration: 2024-05-31, Delta: 0.995. Premium: $68.

- Short Put: Strike: $110, Expiration: 2024-05-31, Delta: -0.0011. Premium: $0.02.

This strategy is profitable because the long call option has an ROI of 21.71% with a profit potential of $14.7594. The risk of share assignment is minimized due to a very low delta of the short put. Profit and loss scenarios need careful monitoring due to the close expiration date. If the stock price moves 2% over the current price, the intrinsic value of the call increases significantly, while the short put remains out-of-the-money, preventing assignment.

- Mid-Term Strategy:

- Long Call: Strike: $65, Expiration: 2024-09-20, Delta: 0.97. Premium: $77.88.

- Short Put: Strike: $105, Expiration: 2024-09-20, Delta: -0.0896. Premium: $43.35.

The long call option provides an ROI of 25.53% with a profit of $19.8794. The short put option offers a substantial buffer against an adverse price movement. This strategy benefits from the mid-term horizon, allowing the long call time to appreciate while the short put, with relatively lower risk of assignment, generates premium income enhancing overall returns.

- Longer-Term Strategy:

- Long Call: Strike: $100, Expiration: 2025-01-17, Delta: 0.975. Premium: $104.6.

- Short Put: Strike: $130, Expiration: 2025-01-17, Delta: -0.015. Premium: $43.65.

This strategy provides a longer window for the underlying stock's price to move favorably, translating the premium paid into potential higher intrinsic value. The ROI of 17.26% is attractive with a lower risk of share assignment due to the low delta on the short put side. Longer duration helps to smooth out minor market bumps, allowing the intrinsic value to appreciate as the option series matures.

- Extended Mid-Term Strategy:

- Long Call: Strike: $115, Expiration: 2024-11-15, Delta: 0.92. Premium: $66.6.

- Short Put: Strike: $150, Expiration: 2024-11-15, Delta: -0.0417. Premium: $67.0.

This strategic combination balances the extended mid-term horizon with a solid profit potential of $11.0994 (19.58% ROI). The long call is deeply in-the-money with a high delta, indicating significant leverage on favorable price movements. The short-put remains a low-risk assignment choice due to delta positioning, ensuring robust premium income generation.

- Long-Term Strategy:

- Long Call: Strike: $100, Expiration: 2025-12-19, Delta: 0.98. Premium: $127.95.

- Short Put: Strike: $125, Expiration: 2025-12-19, Delta: -0.1895. Premium: $27.74.

By stretching out to a longer expiry date, this strategy maximizes the time value and intrinsic value appreciation of the call option. The ROI stands at 12.2% with a manageable risk profile on the short put, due to delta low enough to minimize immediate share assignment threats while collecting substantial premium income.

Profit and Loss Scenarios

Positive Price Movement (2% above current) - The intrinsic value of the long calls appreciates, enhancing overall returns. - Short puts remain out-of-the-money, minimizing the risk of share assignment. - Premium collected from short puts adds to overall profit.

Negative Price Movement (2% below current) - The intrinsic value of long calls diminishes, potentially causing a loss if the stock price drops significantly. - Short puts might move closer to in-the-money status, but the chosen low-delta positions minimize the likelihood of assignment.

Conclusion

The most profitable and balanced strategy across different horizons will likely involve selecting deeply in-the-money long calls, coupled with low-delta short puts to manage risks associated with share assignment. This mix also ensures substantial return potentials while optimizing premium income from out-of-the-money put options.

Calendar Spread Option Strategy #1

Calendar Spread Strategy Analysis

The calendar spread, also known as a time spread or horizontal spread, involves purchasing and selling the same type of option (either call or put) but with different expiration dates. By analyzing the Greeks and implementing calendar spreads, we aim to minimize risk while maximizing profit. Here's an in-depth analysis of various calendar spread strategies using different expiration dates and strike prices.

1. Near-Term Strategy for Quick Gains

-

Put Option (Long)

- Strike Price: $65, Expiration: 2023-08-21

- Delta: -0.967225799, Gamma: 0.0006436736, Vega: 9.219021278, Theta: -0.0256464775, Rho: 0.2999100616

- Premium: $107.5, ROI: 5.88%, Profit: $6.32

-

Call Option (Short)

- Strike Price: $90, Expiration: 2023-08-25

- Delta: 0.9644367874, Gamma: 0.0001692271, Vega: 0.7854132807, Theta: -0.0293073596, Rho: 0.0383023197

- Premium: $84.26, ROI: 3.65%, Profit: $3.08

Analysis: This strategy capitalizes on the significant theta decay of near-term options, particularly given that the call option's delta is nearly 1. This setup minimizes risk by reducing the likelihood of the option finishing in-the-money close to expiration, and the Greeks (especially the favorable theta and vega) support a profitable but relatively low-risk return.

2. Mid-Term Strategy for Moderate Returns

-

Put Option (Long)

- Strike Price: $95, Expiration: 2024-01-19

- Delta: -0.8670160941, Gamma: 0.0015007981, Vega: 50.9644913192, Theta: -0.0268469111, Rho: 1.1296617878

- Premium: $79.5, ROI: 22.56%, Profit: $17.82

-

Call Option (Short)

- Strike Price: $75, Expiration: 2023-12-25

- Delta: 0.9831185601, Gamma: 0.0002655412, Vega: 5.6123752477, Theta: -0.0172776945, Rho: 0.1977809016

- Premium: $79.76, ROI: 20.18%, Profit: $15.5

Analysis: This strategy balances moderate risk with good returns. The longer-term put option provides a solid hedge against downward market movements, while the slightly shorter-term call option capitalizes on time decay and lower likelihood of assignment.

3. Long-Term Strategy for Stability

-

Put Option (Long)

- Strike Price: $105, Expiration: 2025-12-20

- Delta: -0.8572607574, Gamma: 0.0014509343, Vega: 59.5866822728, Theta: -0.0248330344, Rho: 1.3272531789

- Premium: $83.0, ROI: 32.31%, Profit: $26.82

-

Call Option (Short)

- Strike Price: $150, Expiration: 2025-12-25

- Delta: 0.9466207152, Gamma: 0.0010538412, Vega: 14.5491086232, Theta: -0.0305304148, Rho: 0.4046540065

- Premium: $70.0, ROI: 36.45%, Profit: $20.85

Analysis: This strategy seeks stable long-term gains with relatively low risk. The longer-term put helps mitigate volatility, while the call option's premium offers consistent income. The deltas ensure that these options remain out-of-the-money, reducing the risk of assignment.

4. High Volatility Strategy

-

Put Option (Long)

- Strike Price: $125, Expiration: 2024-06-21

- Delta: -0.8358151977, Gamma: 0.0049690882, Vega: 23.62427281, Theta: -0.0617193934, Rho: 0.3237247326

- Premium: $38.57, ROI: 19.15%, Profit: $7.39

-

Call Option (Short)

- Strike Price: $75, Expiration: 2024-06-25

- Delta: 0.9403068334, Gamma: 0.0010020403, Vega: 10.5759381112, Theta: -0.0259470016, Rho: 0.4388722358

- Premium: $87.69, ROI: 21.90%, Profit: $18.95

Analysis: Ideal for volatile market conditions, this strategy offers high returns with higher risks. The put option shields against significant downside movements, while the short call thrives on premium decay, benefiting from heightened volatility.

5. Extremely Long-Term Safety Net

-

Put Option (Long)

- Strike Price: $90, Expiration: 2026-06-18

- Delta: -0.8885687617, Gamma: 0.0011641436, Vega: 50.1451515328, Theta: -0.027616065, Rho: 1.2965686641

- Premium: $91.8, ROI: 22.46%, Profit: $20.62

-

Call Option (Short)

- Strike Price: $135, Expiration: 2026-06-19

- Delta: 0.8651910041, Gamma: 0.0014716206, Vega: 35.5482947914, Theta: -0.0359188314, Rho: 1.3685672817

- Premium: $65.77, ROI: 35.58%, Profit: $23.79

Analysis: This strategy provides excellent risk mitigation and ensures solid gains over an extended period. The put option protects against severe market downturns, while the high-premium call option offers stability and capitalizes on time decay over the long term.

Conclusion

The calendar spreads analyzed here cater to different risk tolerances and market conditions, from near-term quick gains to extremely long-term safety nets. By leveraging different expiration dates and strike prices, traders can optimize their portfolio for both profit potential and risk management, making these strategies versatile tools in any options trader's arsenal.

Calendar Spread Option Strategy #2

Optimal Calendar Spread Strategy for AMD

Based on your interest in minimizing the risk of having shares assigned, our strategy involves primarily dealing with options that have minimal delta values when we sell and buying options with appropriate risk/reward profiles. A calendar spread typically involves buying a longer-term position and selling a shorter-term position of the same type and strike. Given your criteria, here are five recommended choices:

- Sell $105 Put Expiring on 2024-09-20, Buy $135 Call Expiring on 2025-06-20

- Sell $105 Put, Delta: -0.8460, Premium: $5.10823

- Risk of Assignment: Moderate due to the delta, implying a fair probability of assignment.

- Potential Profit: Moderate premium received ($86.68).

-

Buy $135 Call, Delta: 0.7632, Premium: $52.0

- Risk/Reward: The delta suggests its prudent and less likely to make moves than options with higher deltas.

- Potential Profit: Appreciable gain potential when the price rises significantly beyond the strike point after subtracting the selling cost.

-

Sell $100 Put Expiring on 2025-01-17, Buy $130 Call Expiring on 2025-06-20

- Sell $100 Put, Delta: -0.8086, Premium: $87.18

- Risk of Assignment: Relatively low with delta closer to -1, indicating the option is deeper in-the-money and higher probability of assignment.

- Potential Profit: Considerable premium received.

-

Buy $130 Call, Delta: 0.8018, Premium: $36.3

- Risk/Reward: The call has a healthy appreciation potential. Buying it gives a good chance of profit from price rises.

- Potential Profit: Appreciable profit when the price significantly crosses the strike price.

-

Sell $90 Put Expiring on 2025-08-15, Buy $145 Call Expiring on 2025-06-20