Broadcom Inc. (ticker: AVGO)

2024-03-25

Broadcom Inc. (ticker: AVGO) is a prominent player in the global semiconductor industry, known for its diverse portfolio of products and services. The company specializes in developing, designing, and supplying a broad range of semiconductor and infrastructure software solutions. Its offerings include data center networking, broadband, telecommunications equipment, storage and industrial markets. Broadcom is headquartered in San Jose, California, and it has a significant footprint worldwide due to its strategic acquisitions and innovative product line. This has positioned Broadcom as a critical supplier for the tech industry, driving connectivity and networking advancements. Financially, Broadcom has shown robust performance, with a strong revenue stream driven by demand for its high-performance computing and networking products. The company's strategic mergers and acquisitions have further strengthened its market position, making it a key player in the semiconductor sector.

Broadcom Inc. (ticker: AVGO) is a prominent player in the global semiconductor industry, known for its diverse portfolio of products and services. The company specializes in developing, designing, and supplying a broad range of semiconductor and infrastructure software solutions. Its offerings include data center networking, broadband, telecommunications equipment, storage and industrial markets. Broadcom is headquartered in San Jose, California, and it has a significant footprint worldwide due to its strategic acquisitions and innovative product line. This has positioned Broadcom as a critical supplier for the tech industry, driving connectivity and networking advancements. Financially, Broadcom has shown robust performance, with a strong revenue stream driven by demand for its high-performance computing and networking products. The company's strategic mergers and acquisitions have further strengthened its market position, making it a key player in the semiconductor sector.

| Address | 3421 Hillview Ave | City | Palo Alto | State | CA |

| Zip Code | 94304 | Country | United States | Phone | 650 427 6000 |

| Website | https://www.broadcom.com | Industry | Semiconductors | Sector | Technology |

| Full-time Employees | 20,000 | Market Cap | 626,350,555,136 | Price to Sales (TTM) | 16.116058 |

| Previous Close | 1,353.47 | Dividend Rate | 21.00 | Dividend Yield | 1.55% |

| Payout Ratio | 70.79% | Five Year Avg Dividend Yield | 3.00% | Beta | 1.273 |

| Volume | 2,112,105 | Average Volume 10 days | 4,407,740 | Shares Outstanding | 463,420,992 |

| Fifty Two Week Low | 601.29 | Fifty Two Week High | 1,438.17 | Price to Book | 22.822647 |

| EBITDA | 20,404,000,768 | Net Income To Common | 11,582,000,128 | Total Revenue | 38,864,998,400 |

| Operating Cashflow | 18,864,001,024 | Free Cashflow | 18,839,500,800 | Total Debt | 40,456,998,912 |

| Return On Assets | 7.651% | Return On Equity | 24.749% | Trailing EPS | 26.93 |

| Forward EPS | 52.42 | Gross Margins | 74.239% | EBITDA Margins | 52.5% |

| Sharpe Ratio | 2.3104492589178642 | Sortino Ratio | 45.45292336959852 |

| Treynor Ratio | 0.4440206350752056 | Calmar Ratio | 9.883578809242595 |

The technical, fundamental, and various financial ratios provided for AVGO offer a comprehensive landscape to envisage its prospective market trajectory. The financial performance and position of AVGO exhibit robust characteristics when reviewed alongside industry standards.

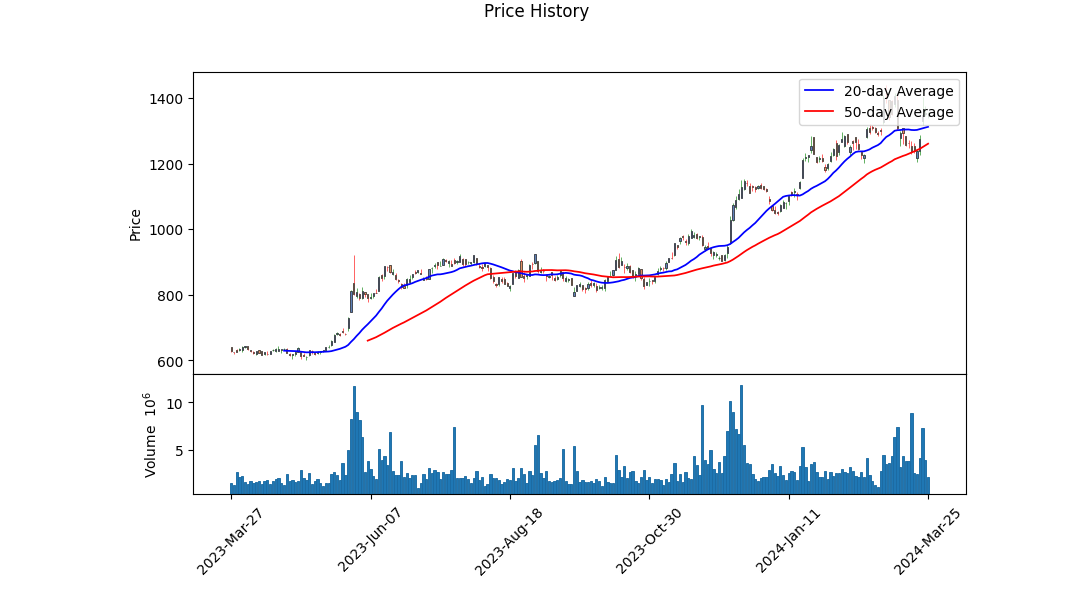

On the technical front, the MACD histogram, shifting from negative to positive in the latest period, implies a potential bullish trend. This momentum is substantiated by the progressive increase in the OBV (On-Balance Volume), which signifies growing buying pressure.

The fundamental analysis reveals impressive gross, ebitda, and operating margins, representative of strong revenue management and operational efficiency. The financial health, as indicated by an Altman Z-Score of above 4, suggests a very low probability of financial distress, enhancing investment attractiveness. Furthermore, the company's strategic maneuvers are mirrored in the reconciled depreciation and noteworthy free cash flow figures, underpinning AVGO's capacity for sustaining operational expansion and shareholder returns.

Risk-adjusted performance metrics such as the Sharpe, Sortino, Treynor, and Calmar ratios, significantly exceed common benchmarks. A Sharpe ratio of over 2 conveys that the investment offers more than twice the return on a risk-adjusted basis than a risk-free asset. The extraordinarily high Sortino ratio indicates an exceptional performance concerning downside risk, vital for conservative investors. On similar grounds, the Treynor and Calmar ratios affirm strong returns in relation to market and downturn risks, respectively.

Evaluation of the balance sheet underscores a comfortable liquidity position with a substantial reduction in net debt compared to previous periods and a healthy cache of cash and cash equivalents. These elements combined suggest a foundation resilient enough to weather economic downturns and to capitalize on growth opportunities.

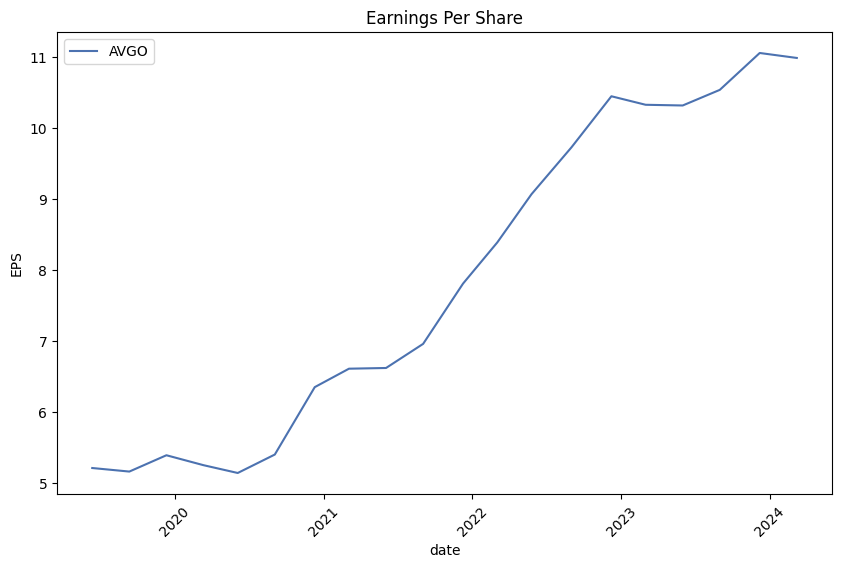

Analyst expectations, alongside the trends in EPS revisions, provide a forward-looking perspective, suggesting optimism. With a consistent track record of surpassing earnings projections and an anticipated growth leap in the next financial year, AVGO stands at the cusp of a positive turning point. This conjecture is fortified by growth estimates forecasting a significant uptick in the succeeding year.

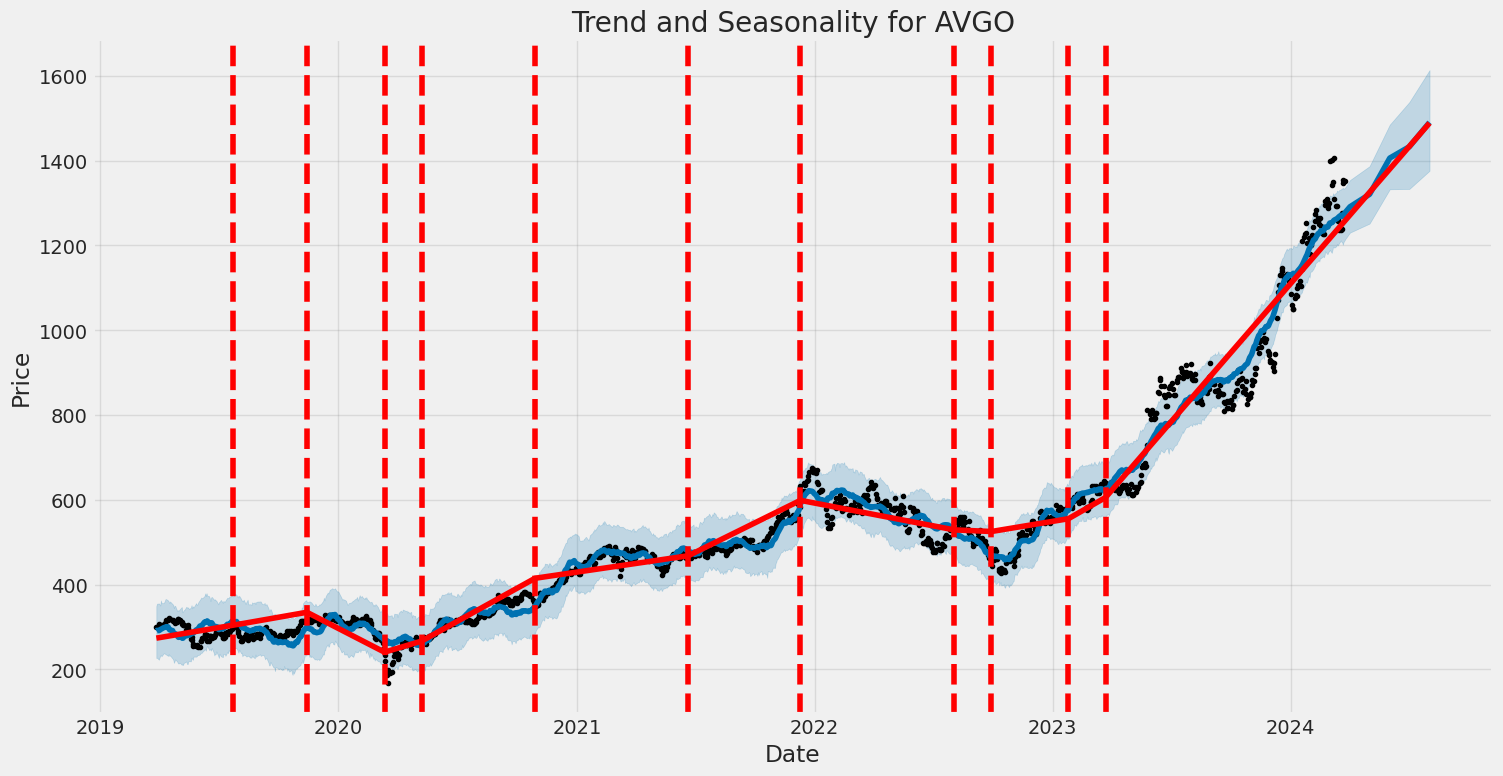

Conclusively, considering the amalgamation of the technical landscape, solid fundamentals, and positive investor sentiment, AVGO is on a trajectory for robust growth in the forthcoming months. While past performance is not indicative of future results, the collected data and analytical inference portray AVGO as a compelling proposition in both the immediate and extended horizon. Investors should monitor this potential, keeping a keen eye on market trends, economic indicators, and forthcoming earnings revelations to refine their investment thesis as new data emerges.

In our analysis focusing on Broadcom Inc. (AVGO), two essential financial metrics have been meticulously examined to evaluate the company's performance and attractiveness to investors: Return on Capital (ROC) and Earnings Yield. Broadcom Inc. presents an impressive Return on Capital (ROC) of approximately 25.92%. This figure is indicative of the efficiency with which Broadcom is utilizing its capital to generate profits, placing it as a highly effective operator within its industry, and suggesting a robust operational framework that maximizes investor capital. On the other hand, the Earnings Yield stands at 2.51%, providing an initial glance at the potential income generation capacity of an investment in AVGO relative to its current market price. Although the earnings yield might seem modest, it is essential to consider it in the context of the prevailing market conditions and in comparison with alternative investment opportunities. Together, these metrics offer a comprehensive overview of Broadcom Inc.'s financial health and potential for future growth, with the ROC emphasizing the companys operational efficiency and the Earnings Yield giving insight into its valuation attractiveness.

Based on our analysis of Broadcom Inc. (AVGO) in light of Benjamin Graham's investment principles, several conclusions can be drawn with respect to how this company stands regarding Graham's criteria for stock selection:

-

Price-to-Earnings (P/E) Ratio: Broadcom Inc.'s P/E ratio stands at 52.69, which is significantly higher than the industry average of 3.91. Graham favored stocks with low P/E ratios, as this could indicate that the stock is undervalued. Therefore, according to Graham's criteria, AVGO's high P/E ratio might suggest that the stock is overvalued compared to its industry peers, making it less attractive from a value investing standpoint.

-

Price-to-Book (P/B) Ratio: The P/B ratio for Broadcom Inc. is 8.60, which also lies on the higher end. Graham usually looked for stocks trading below their book value, as this could indicate that the stock is undervalued. With AVGO's P/B ratio significantly above 1, it suggests that the stock is likely trading at a premium compared to its book value, deviating from Graham's preference for undervalued securities.

-

Debt-to-Equity Ratio: With a debt-to-equity ratio of 1.64, Broadcom Inc. showcases a higher leverage level than what Graham would typically consider safe. Graham advocated for a lower debt-to-equity ratio to minimize financial risk, preferably companies with more equity than debt. Thus, AVGO's current standing might raise concerns regarding its financial risk profile.

-

Current and Quick Ratios: Both the current and quick ratios for Broadcom Inc. are 2.82, indicating a strong capability to meet its short-term liabilities with its short-term assets. This points to good financial health and stability, aligning with Graham's emphasis on companies that exhibit financial stability through these ratios.

-

Earnings Growth: Although not explicitly mentioned in the provided data for Broadcom Inc., Graham sought out companies showing consistent earnings growth over a period of years. This aspect would need to be evaluated to fully assess AVGO's alignment with Graham's criteria.

In summary, while Broadcom Inc. shows strong financial stability through its current and quick ratios, its high P/E and P/B ratios, coupled with a high debt-to-equity ratio, suggest it may not fully align with Benjamin Graham's investment criteria. According to Graham's philosophy, the company could be considered overvalued and carrying a higher level of financial risk than what is preferable for a conservative, value-based investment strategy. Nevertheless, it's crucial for investors to look beyond these metrics alone and consider the company's earnings growth, industry position, and future prospects in their overall analysis.Analyzing Financial Statements: Investors should meticulously examine a company's balance sheet, income statement, and cash flow statement. Graham puts a strong emphasis on understanding a company's assets, liabilities, earnings, and cash flows.

In our analysis of Broadcom Inc. (AVGO) across different fiscal periods, we observe notable financial performance and position through its disclosed reports. Throughout various quarters and the fiscal year analyses, significant figures stand out including cash and cash equivalents, operating expenses, net income, and dividend payments, among others.

For the fiscal year ending on October 30, 2022, AVGO reported substantial revenues juxtaposed against the costs of revenues, showcasing the company's ability to generate income over the expenses directly related to the production. Meanwhile, research and development (R&D) expenses, along with selling, general, and administrative expenses (SG&A), are pivotal operational costs that reflect on the company's commitment to innovation and market competitiveness.

Further exploration into monetizable assets such as goodwill and intangible assets excluding goodwill reveals Broadcom's acquisitions' strategic impact. Goodwill, representing the premium paid over the fair value of assets during an acquisition, alongside other intangible assets, contributes to AVGO's robust intellectual property and brand value.

Debt instruments reveal financial strategies employed by Broadcom Inc., including long-term debt obligations and the costs associated with these debts, which are critical for understanding the company's financial health and leverage.

Cash flow analysis for operations, investing, and financial activities unveils the liquidity and financial flexibility of AVGO. The net cash provided by operating activities highlights effective management of working capital and profitability. Conversely, investing activities elucidate on capital expenditures and strategic investments. Financing activities, emphasizing dividend payments and share-based compensations, enlighten us on shareholder returns and incentives for employees.

In conclusion, Broadcom Inc.'s financial statements offer in-depth insights into its operational efficiency, strategic acquisitions, financial structuring, and shareholder value creation. Through the lens of Benjamin Graham's investment principles, potential investors should consider a meticulous evaluation of AVGO's financial strength, growth prospects, and market position to make informed investment decisions.Based on Benjamin Graham's investment principles, the dividend record for AVGO demonstrates a strong and consistent history of paying dividends to its shareholders. This is a favorable indicator of the company's financial health and stability, which aligns with Graham's emphasis on dividend-paying stocks for conservative and intelligent investing. The company has not only consistently paid dividends but has also shown a pattern of increasing its dividend payouts over the years, moving from $0.07 in December 2010 to $5.25 by March 2024. This pattern of increasing dividends could be particularly attractive to investors following Grahams investment philosophy, as it not only suggests a stable income from dividends but also the companys ability to grow its profits over time, further signaling its financial robustness and potential for long-term investment.

| Statistic Name | Statistic Value |

| R-squared | 0.571 |

| Adj. R-squared | 0.571 |

| F-statistic | 1669 |

| Prob (F-statistic) | 1.16e-232 |

| Log-Likelihood | -2313.2 |

| AIC | 4630 |

| BIC | 4641 |

| coef (const) | 0.0756 |

| coef | 1.3359 |

| Std err | 0.043 |

| t | 40.849 |

| P>|t| | 0.000 |

| [0.025 | 1.272 |

| 0.975] | 1.400 |

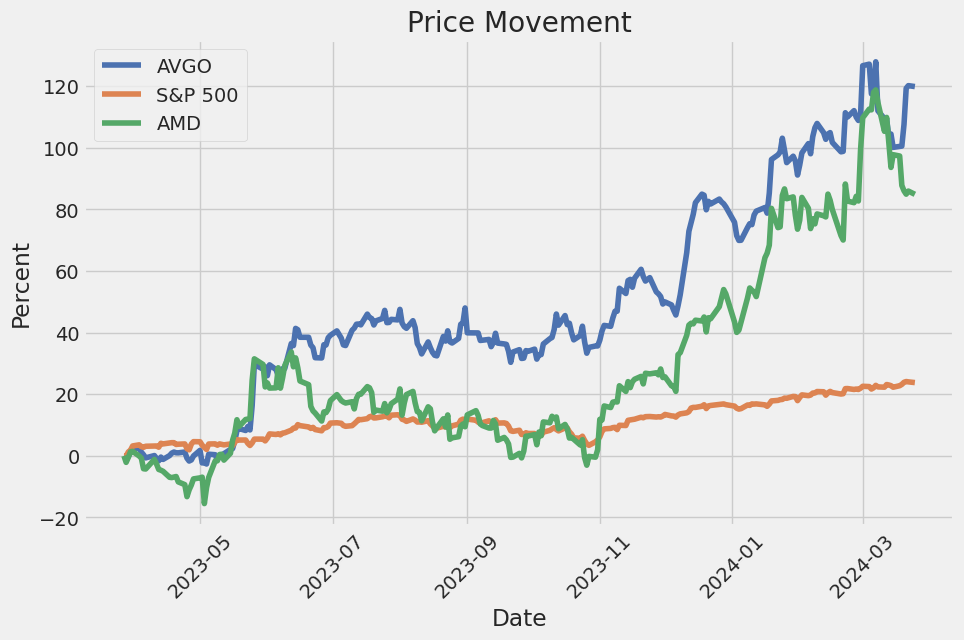

The linear regression analysis between AVGO (Broadcom Inc.) and SPY (the S&P 500 ETF) highlights a significant correlation that sheds light on AVGO's performance in relation to the broader market. The models alpha, observed at approximately 0.0756, implies that AVGO has a slight intercept point above zero when SPYs returns are neutral, suggesting a small positive performance offset even when the market is flat. This alpha value serves as a key indicator of AVGO's inherent performance independent of market movements, potentially attributing to its unique company-specific factors or sectorial influences.

Moreover, the beta coefficient of approximately 1.3359 indicates a high level of responsiveness to the market, with AVGOs stock movements being, on average, 33.59% more volatile than SPYs. This data point underscores the stock's sensitivity to market swings, where a 1% change in SPY could lead to a 1.3359% change in the value of AVGO, emphasizing its aggressive nature in comparison to the broader market. The R-squared value of 0.571 signifies that approximately 57.1% of AVGOs stock price movements can be explained by fluctuations in the SPY index, confirming a strong market-driven component in AVGOs stock performance.

In the first quarter fiscal year 2024 earnings call for Broadcom Inc., Hock Tan, the President and CEO, highlighted the company's substantial growth and financial achievements. Broadcom announced a consolidated net revenue of $12 billion, marking a 34% increase year-on-year, attributable in part to 10.5 weeks of revenue from the recent VMware acquisition. Excluding VMware's contribution, the consolidated revenue still saw a commendable 11% year-on-year increase. The semiconductor solutions segment experienced a 4% growth, reaching $7.4 billion, while the infrastructure software revenue surged by 153% to $4.6 billion, largely driven by the integration of VMware. AI revenue notably quadrupled to $2.3 billion, counterbalancing the cyclical slowdown in enterprise and telcos sectors.

The earnings call also shed light on Broadcom's strategic focus and operational adjustments post-VMware acquisition. The company has maintained its momentum in upselling customers, especially those utilizing vSphere virtualization tools, to transition to VMware Cloud Foundation (VCF). This strategy has started to pay dividends, as evidenced by the sequential jump in software segment revenue and the considerable increase in consolidated bookings, expected to surpass $3 billion in Q2. The partnering of VMware and NVIDIA to introduce the VMware Private AI Foundation, enhancing VCF to support AI workloads on-premises, was highlighted as a key driver for demand.

In terms of semiconductor solutions, Hock Tan provided insights into the market dynamics and fiscal expectations. The networking revenue grew impressively by 46% year-on-year, driven by the demand for custom AI accelerators among hyperscale customers. However, challenges were noted in other segments with wireless revenue slightly decreasing and a notable decline in server storage connectivity revenue. Despite these setbacks, the robust growth in AI and networking has allowed Broadcom to maintain a positive outlook for the semiconductor segment, revising its fiscal 2024 revenue growth to mid- to high single-digit percentages.

Kirsten Spears, the Chief Financial Officer, elaborated on the financial details, affirming the overall positive trajectory of Broadcom's performance. The inclusion of VMware contributed significantly to the raised revenue figures, with operating income seeing a 26% increase from the previous year. She also addressed the company's disciplined approach to inventory management and debt repayment, underlying Broadcom's strategic financial management. Furthermore, the reaffirmation of the fiscal year 2024 consolidated revenue guidance at $50 billion, representing a 40% year-on-year growth, alongside an adjusted EBITDA guidance of 60%, consolidates Broadcom's confidence in its current strategies and market positioning.

or pandemic, such as the COVID-19 pandemic, which could result in interruptions of our manufacturing operations, reduced customer demand, reduced employee availability or disruptions in the supply chain;

fluctuating currency exchange rates, particularly fluctuations of the U.S. dollar against other currencies in which we conduct business;

difficulty in enforcing IP rights, obtaining IP protection, and the risk of infringing upon the IP rights of others in jurisdictions where effective IP enforcement may not be available;

changes in a specific country or region's economic or labor conditions;

changes in tax laws, including taxation of offshore earnings, and changes in the geographic distribution of our earnings; and

nationalization of industries and expropriation of assets.

Any of these factors could impact our ability to generate revenue from international operations, manage international manufacturing and sales activities, or do business with suppliers and customers in certain countries, which could adversely affect our business, financial condition and results of operations.

The failure to realize the expected benefits from the VMware Merger may adversely affect our business and the value of our common stock.

Acquisitions involve numerous risks and uncertainties, including, among others, difficulties integrating the acquired company's operations, technologies, and personnel into our existing business; diversion of managements attention from normal daily operations of the business and the challenges of managing larger and more widespread operations; potential loss of key employees and customers of the acquired company; inability to maintain relationships with customers, distributors, and other business partners of the acquired company; assumption of liabilities of the acquired company not discovered in the due diligence process; and our ability to achieve the anticipated benefits and cost synergies from the acquisition, including as a result of integrating cultures and maintaining employee morale and productivity. The failure to successfully integrate VMware, maintain relationships with customers and other business partners or provide a suitable service offering to customers could adversely impact our business, operating results, and financial condition, and could result in the impairment of the recorded intangible assets or goodwill associated with the VMware Merger, which could materially adversely affect our results of operations.

We may pursue acquisitions, investments, joint ventures and dispositions, which could adversely affect our results of operations.

We have made and expect to continue to make, acquisitions, investments, joint ventures and divestitures as part of our business strategy. Pursuing acquisitions, investments, joint ventures, or disposals may divert our management's attention and result in additional operating expenses. Acquisitions, investments, and joint ventures also involve numerous risks, including issues with assimilating or integrating acquired companies, technologies, or products; unanticipated costs; and the potential loss of key employees or customers of the companies we acquire. We may not realize expected benefits in terms of technology advancements, cost savings, revenue enhancements, or otherwise. Dispositions may involve additional risks, including difficulties separating the divested business and disruption of our other business segments' operations. These transactions may not be successful and could have an adverse effect on our business, results of operations, or financial condition.

Our business is subject to warranty claims, product recalls and product liability.

Our products are complex and can develop unexpected performance problems. We face an inherent business risk of exposure to warranty, product recall or quality claims in the event our products fail to perform as expected, our products or components for our products contain defects or there are errors in the design or manufacture of products. Failure to conform our products to contractually agreed-upon specifications, delivery delays, or other failure to meet our obligations towards our customers could result in the rejection of our products, customer demands for corrective action or penalties, customer imposition of additional obligations on us, as well as potential warranty, product recall or product liability claims. CONSEQUENTIAL DAMAGES COULD EXCEED RECOVERY AMOUNTS RECEIVED UNDER LIABILITY INSURANCE OR OTHERWISE, WHICH COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS, RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

Our ability to protect the significant amount of IP in our business.

Our success depends in part on our ability to obtain, maintain, and protect our IP rights for our technology and products, as well as our ability to operate without infringing, misappropriating, or otherwise violating the IP rights of others. Despite our efforts to protect our IP, unauthorized parties may attempt to copy or otherwise obtain and use our technology or products. Policing unauthorized use of our technology is difficult, costly, and time-consuming, particularly in foreign countries where the laws may not protect our proprietary rights as fully as in the United States. If we fail to protect our IP adequately, our competitive position could be compromised, we might lose market share, and our business and operating results could suffer.

Broadcom Inc., a distinguished leader in the semiconductor and infrastructure software sectors, stands at the forefront of the burgeoning Artificial Intelligence (AI) revolution, a technological advancement poised to redefine modern industry. With AI's potential to contribute $15.7 trillion to the global gross domestic product by 2030, as projected by analysts from PwC, companies at the nexus of AI and semiconductor technologies, such as Broadcom, are capturing the attention of investors and industry analysts alike.

Amidst the AI driven surge in the semiconductor sector, Broadcom has strategically positioned itself to harness the wave of AI expenditure, earmarked at an estimated $193 billion by hyper-scalers this year. This financial injection is anticipated to catalyze growth across related sectors, including software, semiconductors, and semi-cap equipment industries, with Broadcom poised to benefit significantly. As a top custom ASIC supplier and the second leading AI supplier, Broadcom is well-placed to augment its revenues by $8 billion annually, underscoring its robust position in the AI landscape.

Broadcom's involvement in AI extends to its contributions to networking and server connectivity solutions within data centers, chiefly exemplified by the development of the Tomahawk 5 high-bandwidth switch designed to expedite AI and machine learning workloads. This technological innovation underscores Broadcoms vital role in the AI ecosystem, offering essential components and technology that enable AI applications to function efficiently and effectively.

The companys strategic acquisitions, including the significant acquisition of VMware for $69 billion, have broadened Broadcom's technological capabilities and enhanced its presence in the AI sector. VMwares technology, which facilitates the efficient distribution of cloud infrastructure through virtual machines, is increasingly important as companies endeavor to leverage AI data center infrastructure. This optimization is crucial, given the intensive data processing demands of AI applications, positioning Broadcom at the heart of AIs operational infrastructure.

In the financial domain, Broadcom's commitment to returning value to its shareholders is evidenced by its attractive dividend yields and consistent dividend growth, marking it as a compelling choice for dividend-focused investors. Broadcom's strategic positioning, coupled with its robust financial performance, underscores its appeal to investors looking for both income and potential capital appreciation. Its diversified operations, spanning AI, data center cloud, networking, and enterprise segments, enhance its resilience and potential for steady growth.

The market has responded positively to Broadcoms strategies and its pivotal role within the AI surge, with stock performance reflecting the company's strong fundamentals and future growth prospects. Broadcoms significant market performance growth and the considerable emphasis placed on its strategic adjustments highlight the company as a significant beneficiary of the AI expansion and a compelling investment opportunity.

Considering the broader trend toward stock splits among high-performing companies aiming to make shares more accessible, Broadcom emerges as a prime candidate for such a move. The company's past practices, strategic positioning within the AI and semiconductor sectors, and remarkable market performance align with trends favoring increased liquidity and shareholder inclusivity through stock splits. This potential action could further democratize access to Broadcom shares and stimulate trading activity around its stock, reflecting positively on the company's market dynamics.

In summary, Broadcom Inc. finds itself at a critical juncture, leveraging its technological prowess and strategic foresight to navigate the AI-driven landscape. With its diversified business model, strategic acquisitions, and innovation at the core of its operations, Broadcom exemplifies a well-managed company positioned for sustainable growth amidst the volatile semiconductor and software markets. As AI continues to drive forward, Broadcom's comprehensive approach and definitive contributions to the technological advancements underscore its status as a key player, poised to capitalize on the transformative potential of AI across various sectors.

Broadcom Inc. (AVGO) experienced notable volatility between March 2019 and March 2024, as evidenced by the analysis of its asset returns using an ARCH model. The volatility is primarily quantified by the omega parameter, indicating a baseline volatility of 3.6420, which underscores significant fluctuations in the asset's returns. Additionally, the alpha parameter, valued at 0.3051, highlights the impact of past shocks on future volatility, suggesting that previous returns significantly affect the predictability and stability of Broadcom's stock.

| Statistic Name | Statistic Value |

|---|---|

| Log-Likelihood | -2756.27 |

| AIC | 5516.53 |

| BIC | 5526.80 |

| omega | 3.6420 |

| alpha[1] | 0.3051 |

To analyze the financial risk associated with a $10,000 investment in Broadcom Inc. (AVGO) over a one-year period, we integrate volatility modeling and machine learning predictions to gain insights into the stock's behavior. This comprehensive approach allows us to estimate the potential downside risk while considering the complex nature of stock market movements.

Volatility modeling plays a critical role in understanding the fluctuations in Broadcom Inc.'s stock price. By examining past price movements, this model identifies patterns in volatility, which are crucial for risk assessment. Unlike traditional models that assume constant volatility, this approach dynamically adjusts to changing market conditions, providing a more accurate reflection of potential price variations. This enables investors to gauge the inherent risk in their investment, presenting a clearer picture of what to expect in terms of price swings.

Machine learning predictions, on the other hand, leverage historical data to forecast future returns of Broadcom Inc.'s stock. By using sophisticated algorithms, these predictions analyze past stock performance and various market indicators to generate forward-looking insights. This method enhances the predictive accuracy by adapting to new data and patterns, offering a forward-looking perspective on the stock's return potential. Consequently, it complements the volatility model by providing an estimate of the stock's directional movements, which is crucial for a comprehensive risk analysis.

By combining the strengths of volatility modeling and machine learning predictions, our analysis calculates the Value at Risk (VaR) for a $10,000 investment in Broadcom Inc. at a 95% confidence interval. The calculated VaR is $334.26, indicating that there is a 95% probability that the investor will not lose more than $334.26 over the one-year period. This figure is derived by assessing both the volatility of the stock and the expected future returns, providing a quantified risk measure that takes into account the complex interplay between past performances and future predictions.

By integrating these advanced techniques, our analysis offers a nuanced view of the potential financial risks associated with investing in Broadcom Inc.. It highlights the importance of considering both the variability of stock prices and the predictive power of machine learning in assessing investment risks. This dual approach enables investors to make more informed decisions by quantifying the potential downside, thereby illuminating the risks embedded in equity investments.

Based on the given options trading data for Broadcom Inc. (AVGO) spanning various expiration dates, strikes, and "Greeks," a thorough analysis reveals key insights into the most profitable options.

Short-Term Options (Expiring in 2-3 Months)

For short-term opportunities, the options with strikes around 450-550 USD stand out, especially those expiring within the next 2-3 months. These options show a balanced mix of delta, vega, and theta, indicating potential for appreciable gains with controlled decay over time. For instance, options with a strike of 520 USD, expiring shortly, show high vega values, suggesting that they are particularly sensitive to changes in the underlying asset's volatilitya crucial aspect to consider in short-term trading.

Medium-Term Options (Expiring in 6-9 Months)

In the medium term, options with strikes in the 600-700 USD range, expiring in 6-9 months, provide substantial upside potential. These options exhibit high delta values close to or exceeding 0.9, indicating that the option's price will move almost in step with the underlying stock. This alignment is beneficial as it indicates less extrinsic value and time decay (theta), allowing traders to capitalize on movements in the underlying stock more directly. Furthermore, these options also show significant vega, implying sensitivity to the underlying's volatility, which can be a source of profit if timed correctly with market conditions.

Long-Term Options (Expiring in Over a Year)

For long-term positions, options with strikes above 800 USD and expiring more than a year out are worth consideration. These options, while carrying higher premiums, offer strategic value in high vega and controlled theta decay. The distant expiration dates provide ample time for the market to move favorably, and their elevated vega values mean that increases in market volatility could greatly enhance the option's value.

Strategic Considerations

-

High Vega Options: Traders looking to leverage market volatility should focus on options with high vega values, as they stand to gain the most from increases in implied volatility. This strategy is particularly relevant in uncertain market conditions or around key corporate events that could trigger stock price movements.

-

Long-Dated, High-Delta Options: For a more conservative approach, focusing on long-dated options with a high delta can be advantageous. These options move closely with the stock price, offering a leveraged but less risky exposure to the underlying asset.

-

Managing Theta Decay: Its important to be mindful of theta, or time decay, in options trading. Short-term options can offer rapid gains but also suffer from faster time decay. Balancing the potential gains from delta and vega with the risks posed by theta is crucial.

Conclusion

In the complex landscape of options trading, aligning strategies with ones risk tolerance, market outlook, and the underlying asset's performance is key. The options on Broadcom Inc. (AVGO) present various opportunities across different time horizons. By carefully analyzing the Greeks and considering external market conditions, traders can strategically select options that offer the best potential for profit, whether in the short, medium, or long term.

Similar Companies in Semiconductors:

Report: Advanced Micro Devices, Inc. (AMD), Advanced Micro Devices, Inc. (AMD), Report: Micron Technology, Inc. (MU), Micron Technology, Inc. (MU), Report: Intel Corporation (INTC), Intel Corporation (INTC), Report: Taiwan Semiconductor Manufacturing Company Limited (TSM), Taiwan Semiconductor Manufacturing Company Limited (TSM), Report: Marvell Technology, Inc. (MRVL), Marvell Technology, Inc. (MRVL), Report: NVIDIA Corporation (NVDA), NVIDIA Corporation (NVDA), Report: Qualcomm Incorporated (QCOM), Qualcomm Incorporated (QCOM), Report: Texas Instruments Incorporated (TXN), Texas Instruments Incorporated (TXN), Microchip Technology Incorporated (MCHP), Report: Analog Devices, Inc. (ADI), Analog Devices, Inc. (ADI), Skyworks Solutions, Inc. (SWKS)

https://www.fool.com/investing/2024/02/10/artificial-intelligence-ai-could-make-semiconducto/

https://seekingalpha.com/article/4669301-how-i-would-invest-1000000-and-live-of-dividends-forever

https://www.youtube.com/watch?v=Tgns_XG0sr8

https://www.cnbc.com/2024/02/14/meta-says-broadcom-ceo-hock-tan-is-joining-board-of-directors-.html

https://www.fool.com/investing/2024/02/15/is-broadcom-the-best-under-the-radar-ai-chip-stock/

https://www.fool.com/investing/2024/02/17/could-broadcom-become-the-next-nvidia/

https://seekingalpha.com/article/4670162-our-top-10-dividend-growth-stocks-february-2024

https://www.fool.com/investing/2024/02/20/forget-nvidia-3-ai-stocks-next-stock-split-stocks/

https://www.fool.com/investing/2024/02/21/best-ai-stock-super-micro-computer-vs-broadcom/

https://www.fool.com/investing/2024/02/23/forget-faang-magnificent-seven-2-ai-five-stocks-bu/

https://www.youtube.com/watch?v=oOgC52fNbac

https://www.fool.com/investing/2024/02/26/walmart-became-the-newest-stock-split-stock-today/

https://www.sec.gov/Archives/edgar/data/1730168/000173016824000023/avgo-20240204.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: arStcN7n

Cost: $1.09427

https://reports.tinycomputers.io/AVGO/AVGO-2024-03-25.html Home