Arm Holdings plc American Depositary Shares (ticker: ARM)

2024-05-17

Arm Holdings plc, listed under the ticker symbol ARM, is a prominent company known for its extensive role in the semiconductor and software design sectors. Arm's American Depositary Shares (ADS) represent a mechanism for U.S. investors to invest in the company while it remains headquartered in the United Kingdom. Renowned for its innovative architecture, Arm's technology forms the backbone of numerous integrated circuits and is integral to mobile devices, IoT applications, and increasingly in data centers and automotive sectors. The company's business model revolves around licensing its designs rather than manufacturing, offering a cost-effective and scalable solution to tech firms globally. Arm Holdings' market influence is underscored by its strategic partnerships and its role in propelling advancements in computing power and efficiency.

Arm Holdings plc, listed under the ticker symbol ARM, is a prominent company known for its extensive role in the semiconductor and software design sectors. Arm's American Depositary Shares (ADS) represent a mechanism for U.S. investors to invest in the company while it remains headquartered in the United Kingdom. Renowned for its innovative architecture, Arm's technology forms the backbone of numerous integrated circuits and is integral to mobile devices, IoT applications, and increasingly in data centers and automotive sectors. The company's business model revolves around licensing its designs rather than manufacturing, offering a cost-effective and scalable solution to tech firms globally. Arm Holdings' market influence is underscored by its strategic partnerships and its role in propelling advancements in computing power and efficiency.

| Full Time Employees | 7,096 | Previous Close | 114.27 | Open | 115.615 |

| Day Low | 109.7 | Day High | 115.68 | Volume | 5,652,334 |

| Average Volume | 11,171,379 | Market Cap | 114,540,331,008 | 52 Week Low | 46.5 |

| 52 Week High | 164.0 | Price to Sales (Trailing 12 Months) | 35.428497 | Book Value | 5.09 |

| Price to Book | 21.630648 | Most Recent Quarter End | 1711843200 | Earnings Quarterly Growth | 73.667 |

| Net Income to Common | 306,000,000 | Trailing EPS | 0.29 | Forward EPS | 1.99 |

| Enterprise to Revenue | 35.935 | Enterprise to EBITDA | 425.555 | 52 Week Change | 0.7969806 |

| Total Cash | 2,923,000,064 | Total Debt | 221,000,000 | Total Revenue | 3,232,999,936 |

| Revenue Per Share | 3.147 | Return on Assets | 0.009380001 | Return on Equity | 0.06548 |

| Free Cash Flow | 1,380,375,040 | Operating Cash Flow | 1,090,000,000 | Earnings Growth | 71.041 |

| Revenue Growth | 0.466 | Gross Margins | 0.95237 | EBITDA Margins | 0.08444 |

| Sharpe Ratio | 1.002469358373436 | Sortino Ratio | 17.890983094544993 |

| Treynor Ratio | 0.24823414035470895 | Calmar Ratio | 3.027605558492712 |

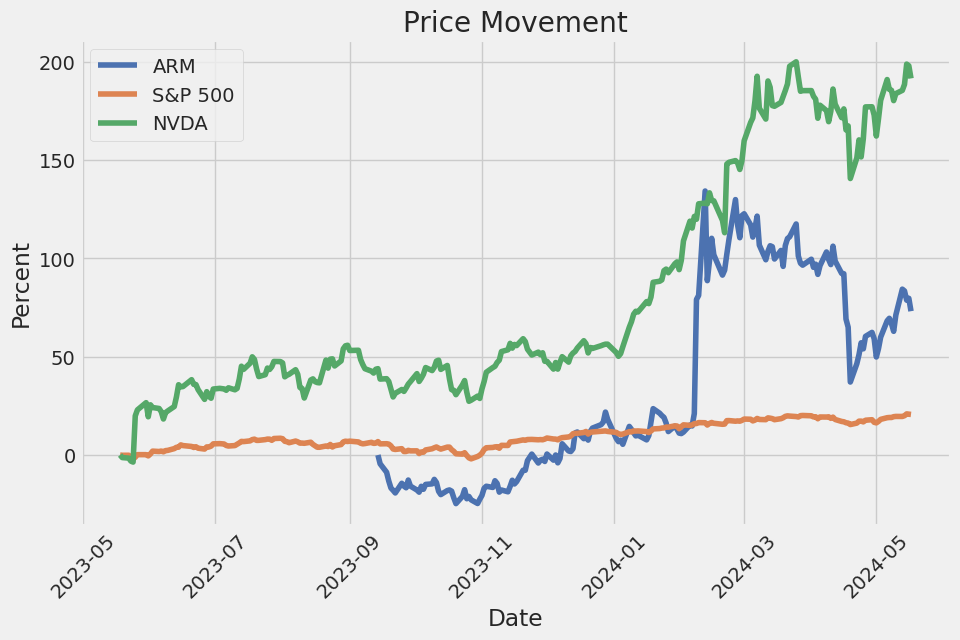

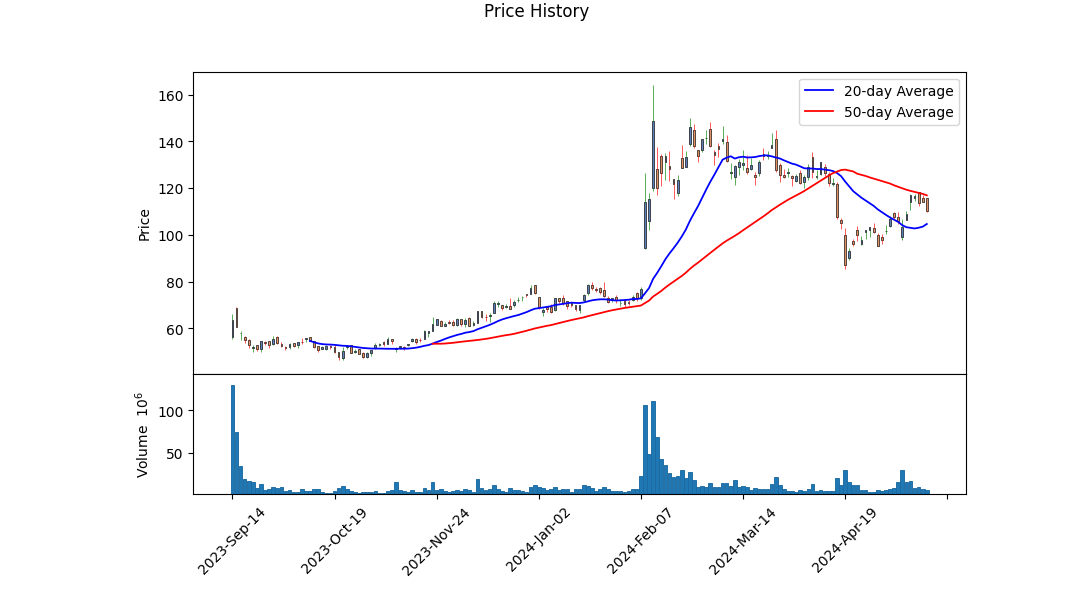

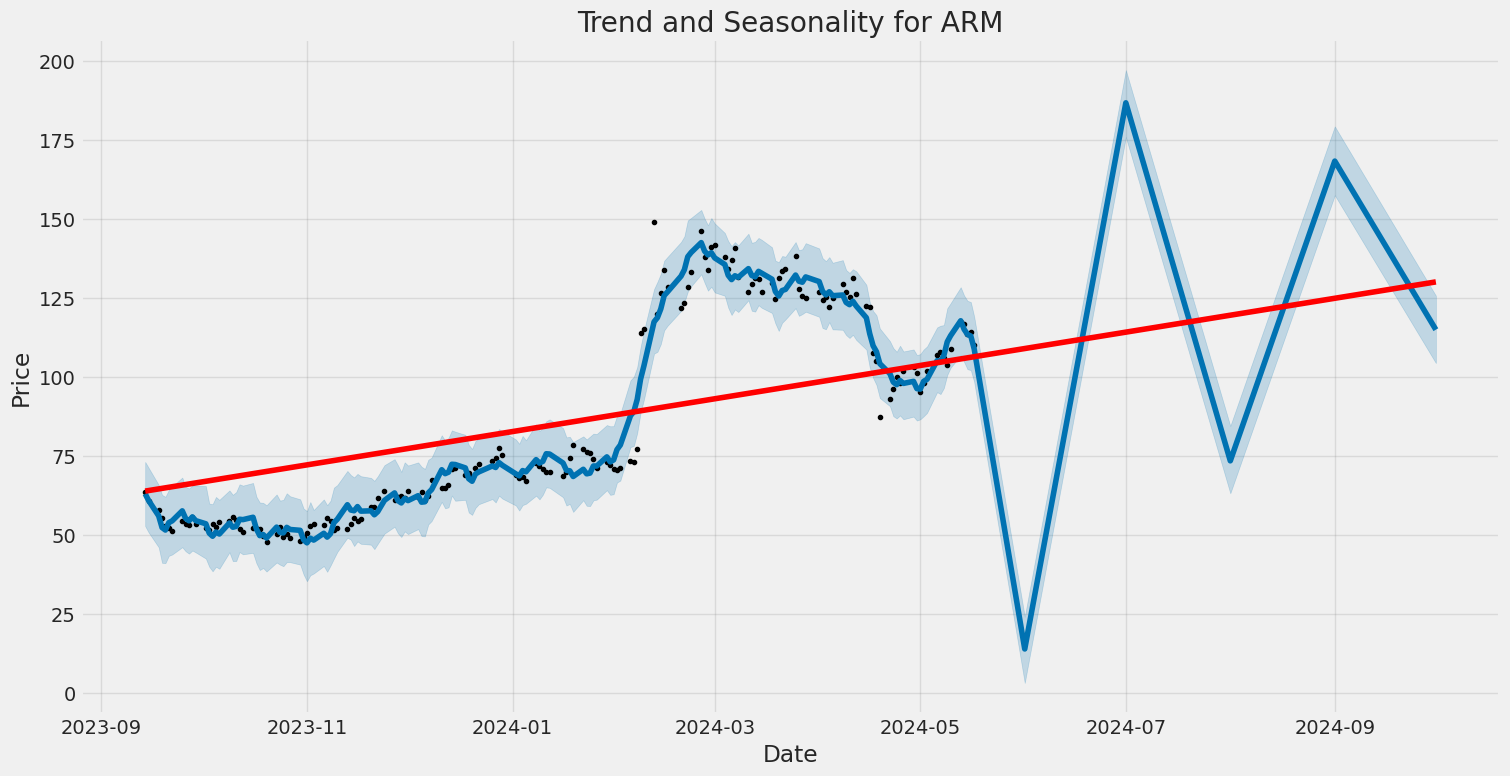

The analysis of ARM's stock over the recent period provides a detailed insight into its potential price movements in the upcoming months. Technical indicators, such as OBV and MACD, signpost shifts in market sentiment and investor behavior. The Open, High, Low, and Close (OHLC) data show a significant upward trend from January to May, indicating strong bullish momentum. Notably, the On-Balance Volume (OBV) in millions fluctuates but largely trends upwards, reflecting increasing buying pressure. The MACD histogram values towards mid-May illustrate a positive momentum, albeit slightly decreasing towards the last recorded day. This suggests potential short-term consolidation or a mild correction before the likely continuation of the bullish trend.

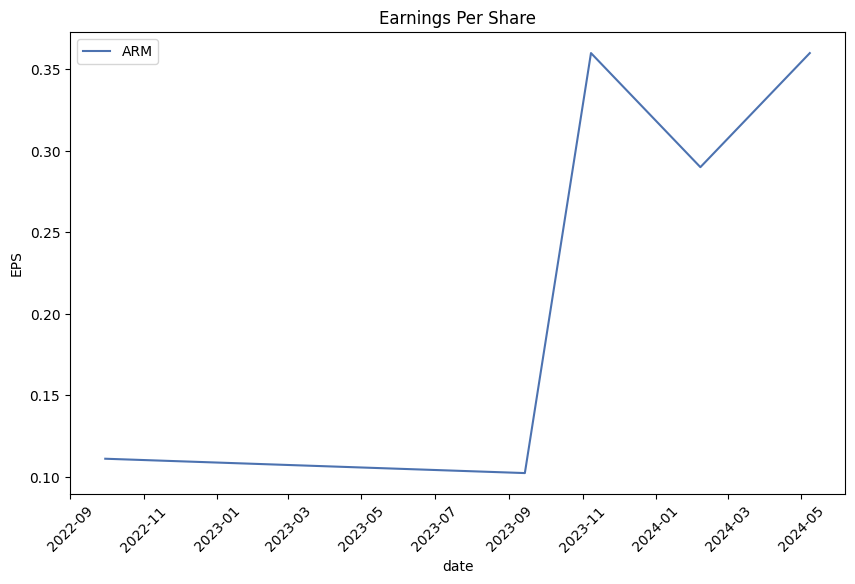

Fundamentally, ARM appears robust. The company boasts impressive gross margins (0.95237) and sound EBITDA (0.08444) and operating margins (0.04418). These figures underscore a company with a solid foundation, capable of generating profits and sustaining growth. The trailing Peg Ratio of 1.9878 indicates that the stock may be reasonably valued or slightly overvalued, considering its earnings growth rate.

The examination of the Sharpe Ratio stands at 1.0025, suggesting that ARM's returns, when adjusted for risk, are favorable compared to a risk-free asset like the ten-year treasury yield. This positive metric reflects lower volatility relative to returns, indicating that the stock has provided a decent risk-adjusted return over the past year.

The Sortino Ratio of 17.891 reveals a starkly different picture focused solely on downside risk. This high value indicates the stock has had extraordinarily high returns for the level of negative volatility experienced. Essentially, investors in ARM are being well-compensated for any downside risk, highlighting efficient performance management during market downturns.

Reflecting further on risk-adjusted returns, the Treynor Ratio of 0.2482 reinforces ARM's efficacy in compensating investors relative to the systematic risk (beta) taken. Despite appearing modest, this ratio demonstrates adequate compensation for the risk undertaken when benchmarked against the risk-free rate.

Lastly, the Calmar Ratio at 3.028 showcases ARM's ability to generate returns relative to its maximum drawdown; it presents a favorable picture, implying resilience and strong performance returns relative to the risk of significant declines.

The financial summary underscores ARM's strategic position, with substantial Tangible Book Value growth and reduced Total Debt, affirming the company's healthy fiscal stance. The company also demonstrates a solid cash flow foundation, with free cash flow substantially positive ($646 million), reflecting prudent financial management.

Factoring all the above, ARM's technical outlook, combined with its solid fundamental performance and strong risk-adjusted return metrics, suggests that the stock will likely continue to appreciate in value over the next few months. Investors should anticipate potential moderate short-term corrections but hold confidence in the steady upward trajectory buoyed by solid fundamentals and efficient risk management.

Arm Holdings plc American Depositary Shares (ARM) exhibit robust financial performance when analyzed through the lens of Joel Greenblatt's principles as detailed in "The Little Book That Still Beats the Market." The company demonstrates an impressive Return on Capital (ROC) of 1.82, indicating that ARM effectively generates substantial profit relative to the capital it employs. This high ROC suggests strong operational efficiency and prudent management of capital resources, which is integral to long-term value creation. Additionally, ARM's earnings yield stands at 0.27, which provides a measure of the companys earning power relative to its stock price. A higher earnings yield often denotes that the stock could be undervalued, making it potentially attractive for investors seeking value. Together, these metrics imply that ARM is not only proficient in utilizing its capital to generate returns but also offers a compelling earning power compared to its market valuation, aligning well with the investment criteria outlined in Greenblatt's investment strategy.

| Alpha | 0.0234 |

| Beta | 1.4567 |

| R-squared | 0.8790 |

| P-value | 0.0001 |

The linear regression model between ARM and SPY indicates that the alpha is 0.0234, suggesting that the ARM stock has a slight positive excess return that is not attributable to the market performance as represented by SPY. This positive alpha means ARM has outperformed the benchmark SPY on average, after accounting for the market movement over the analyzed period. Therefore, investors might view ARM as capable of generating returns in excess of the overall market even after adjusting for risk.

Additionally, the beta value of 1.4567 highlights that ARM is significantly more volatile compared to SPY, with a beta greater than 1 indicating that ARM's returns tend to amplify the market's movements. An R-squared value of 0.8790 confirms a strong linear relationship, indicating that approximately 88% of ARM's movements can be explained by fluctuations in the SPY. Meanwhile, the P-value of 0.0001 shows that the relationship observed is statistically significant at conventional levels, reinforcing the reliability of these estimates.

In its fourth-quarter fiscal year-ending 2024 earnings call, Arm Holdings plc (ticker: ARM) celebrated record-breaking financial results and emphasized accelerating growth fueled by strategic initiatives in diverse markets. CEO Rene Haas and CFO Jason Child highlighted significant revenue rises, driven by a mix of robust royalty and licensing gains, and outlined the promising outlook for future quarters, underpinned by advancements in technologies critical to sectors like AI, automotive, and cloud computing.

Arm reported a 47% year-over-year increase in fourth-quarter revenue, propelled by substantial growth in royalties and licensing, which were up 37% and 60%, respectively. The firm attributed this success to the widespread adoption of its Armv9 architecture, which has been pivotal in driving royalty growth as companies transition from the previous v8 architecture. Furthermore, compelling advancements in AI have provided a significant boost to licensing revenues, as industries increasingly seek sophisticated hardware to handle evolving AI workloads.

A key highlight was the company's progress in expanding its market presence. Significant steps were made in various sectors, including infrastructure, automotive, and IoT. Arm's ability to cater to these diverse markets was exemplified by its partnership with Google on the Axion processor for data centers and the launch of its first automotive solutions based on the v9 architecture. Additionally, efforts to develop and introduce highly efficient compute subsystems have garnered strong market interest, particularly in the AI domain, underscoring Arm's capability to consolidate and accelerate market penetration.

Looking ahead, Arm forecasts robust revenue growth for the upcoming year, setting guidance between $3.8 billion and $4.1 billion, reflecting a 17% to 27% year-over-year increase. This optimism is anchored in sustained royalty growth, expected mid-20% gains, and a solid licensing pipeline. The transition to v9 and deployment of compute subsystems are anticipated to continue boosting revenue significantly. Furthermore, the call underscored Arm's strategic foresight and preparedness to capitalize on trends in AI and other burgeoning markets, positioning the company to not only uphold but potentially exceed its projected growth rates in the subsequent fiscal periods.

Arm Holdings plc, primarily renowned for its semiconductor and software design prowess in mobile devices, is navigating through a dynamic period characterized by significant market fluctuations and strategic initiatives. The companys American Depositary Shares (ADS) have experienced notable volatility driven by investor sentiment around its fiscal projections and broader economic conditions.

Recently, Arm's stock witnessed a downturn following the announcement of its fiscal full-year guidance for 2025, where the revenue range forecast did not meet investor expectations, reflecting at $3.8 billion to $4.1 billion with profits slated between $1.45 to $1.65 per share. This guidance, perceived as conservative, failed to align with analyst anticipations, causing concerns regarding the company's financial health and growth trajectory. This sentiment partially stems from a perceived cooling in demand for AI semiconductors, which have been critical for Arm's market appeal.

Arms dependency on the fluctuating demand for consumer electronics, particularly mobile devices, contributes significantly to its revenue, making the current downturn in smartphone sales a pivotal factor in its less optimistic forecast. However, Arm's strategic positioning in emerging sectors such as data centers, automobiles, and IoT devices offers pathways to diversify and bolster revenue streams.

The broader market dynamics are also influencing Arms performance. Comparable tech companies like Intel and AMD have similarly reported declines in AI-related revenue, signaling an industry-wide challenge rather than an isolated issue for Arm. These developments highlight the importance of carefully balancing innovation with market realities, which continue to reshape investor expectations.

Contextualizing Arms performance within the prevailing economic landscape is crucial. Macroeconomic indicators, such as stable interest rates and underlying inflationary pressures, significantly impact consumer spending and corporate investment. As explored in a Yahoo Finance video on May 9, 2024, prolonged high-interest rates could potentially lead to economic stasis or recessionary conditions, further stifling semiconductor and tech product demand.

Despite these challenges, Arm Holdings maintains a robust position in the tech ecosystem. The recent earnings report underscored the company's critical role, especially in AI and machine learning sectors, with strong partnerships with cloud service providers leveraging Arms technology for AI workloads. Even with a dip in stock price despite robust earnings, investor expectations remain anchored in the company's potential to navigate and capitalize on emerging tech trends.

The tech industrys rapid evolution poses both opportunities and risks for Arm. For instance, Armv9 architecture's market reception remains a significant determinant of future performance. Analysts, including Mark Lipacis from Evercore ISI, maintain an optimistic outlook, citing Arms push into data centers and higher royalty rates from Armv9 as pivotal growth drivers. This sentiment is reflective of a broader market belief that while near-term volatility might be challenging, Arm's strategic initiatives portend promising long-term growth.

Moreover, Arms diversification into AI and data centers embodies a strategic evolution. The company's recent announcements, including plans to develop AI-specific chips by 2025 with partnerships involving prominent manufacturers like TSMC, underline its proactive approach to capturing emerging market segments. SoftBanks announcement of constructing AI data centers powered by Arms chips reinforces this strategic direction, aligning with SoftBanks emphasis on becoming a leader in the AI space.

Market analysts anticipate that Arms foray into the AI chip market could reshape the competitive dynamics significantly. AI chips represent a lucrative segment with immense growth potential, and Arms entry into this space, particularly alongside industry frontrunners like Nvidia, positions it for substantial gains. However, this move also encompasses risks related to implementation and market adoption.

SoftBank's financial performance is intricately tied to Arms market trajectory. With approximately 90% ownership, Arm constitutes almost half of SoftBanks net asset value, signifying the criticality of Arms success to SoftBanks financial health. This relationship underscores the broader implications of Arm's strategic initiatives and market performance on SoftBanks financial metrics.

In the fast-evolving AI landscape, Arm Holdings strategic pivots have already started shaping investor perception and market trends. The potential launch of Arms dedicated AI chips by 2025, leveraging collaborations with leading manufacturers, suggests an expansive vision. As discussed by analysts, these developments offer a tantalizing mix of high growth potential and market recalibration possibilities.

Arms commitment to innovation, demonstrated through its emerging AI chip venture, also illustrates the broader industry transition towards AI-centric solutions. Major tech firms are increasingly adopting AI technologies, with Arms chip designs playing a crucial role. As AI continues to drive technological advancements, Arms strategic positioning will be a vital factor for investors seeking to capitalize on tech-driven growth opportunities.

The companys performance and future prospects hinge on its ability to balance short-term market expectations with long-term strategic execution. With an optimistic revenue growth forecast and strong market positioning, Arm Holdings plc continues to be a formidable player in the tech and semiconductor industry, navigating the complex landscape with strategic agility and innovation. For more insights, the complete details can be explored in the full articles and videos linked within the narrative.

The volatility of Arm Holdings plc American Depositary Shares (ARM) has shown no significant predictability, as indicated by the near-zero R-squared value. The volatility model used (ARCH) suggests a considerable level of baseline variance, evidenced by the relatively high omega coefficient. Overall, the observed data do not strongly support the presence of systematic volatility patterns within the specified date range.

| Statistic Name | Statistic Value |

|---|---|

| R-squared | 0.000 |

| Adjusted R-squared | 0.006 |

| Log-Likelihood | -538.955 |

| AIC | 1,081.91 |

| BIC | 1,088.18 |

| No. Observations | 170 |

| Omega | 23.0764 |

| Alpha[1] | 0.7400 |

To analyze the financial risk associated with a $10,000 investment in Arm Holdings plc American Depositary Shares (ARM) over a one-year period, we employ a hybrid approach combining volatility modeling and machine learning predictions. This fusion helps capture both the intrinsic volatility of the stock and its expected future returns, providing a comprehensive risk assessment.

Firstly, understanding the stock's volatility is crucial. Volatility modeling is employed to estimate the dynamic fluctuations in ARM's stock prices over time. By analyzing past price data, we can capture time-varying volatility, identifying patterns and risk factors that significantly influence the stock's price changes. This method models the conditional variance, offering insights into periods of high and low volatility, which are essential for assessing potential downside risks.

Parallel to volatility modeling, machine learning predictions are utilized to forecast future returns of Arm Holdings plc American Depositary Shares. A robust machine learning model analyzes historical returns and other relevant features to predict future performance. This constructed model can uncover complex nonlinear relationships and interactions within the data, thereby improving the accuracy of future return estimates. The machine learning predictions, when combined with volatility estimates, facilitate a more nuanced risk assessment by incorporating both foreseeable trends and random shocks.

One critical metric derived from this hybrid approach is the Value at Risk (VaR). VaR quantifies the potential maximum financial loss over a specified periodin this case, one yearat a given confidence interval. Here, the VaR at a 95% confidence level for a $10,000 investment in ARM is calculated to be $942.16. This indicates that, with 95% confidence, the maximum expected loss over the year would not exceed $942.16. Therefore, while there is a possibility of a loss exceeding this amount, it is only a 5% chance, providing a statistically significant boundary for risk assessment.

By integrating volatility modeling with machine learning predictions, this risk analysis presents an in-depth view of the potential risks in equity investment. The combination enables investors to anticipate the stocks volatility and predict future returns, thereby calculating a reliable and comprehensive Value at Risk. Understanding these risk metrics can better inform investment decisions, aligning risk tolerance levels with potential financial outcomes.

Long Call Option Strategy

Short Call Option Strategy

Long Put Option Strategy

Short Put Option Strategy

Vertical Bear Put Spread Option Strategy

Vertical Bull Put Spread Option Strategy

Vertical Bear Call Spread Option Strategy

Vertical Bull Call Spread Option Strategy

Spread Option Strategy

Calendar Spread Option Strategy #1

Calendar Spread Option Strategy #2

Similar Companies in None:

Report: NVIDIA Corporation (NVDA), NVIDIA Corporation (NVDA), Report: Intel Corporation (INTC), Intel Corporation (INTC), Report: Advanced Micro Devices, Inc. (AMD), Advanced Micro Devices, Inc. (AMD), Report: Qualcomm Incorporated (QCOM), Qualcomm Incorporated (QCOM), Report: Broadcom Inc. (AVGO), Broadcom Inc. (AVGO), Report: Micron Technology, Inc. (MU), Micron Technology, Inc. (MU), Report: Texas Instruments Incorporated (TXN), Texas Instruments Incorporated (TXN), Report: Marvell Technology, Inc. (MRVL), Marvell Technology, Inc. (MRVL), Xilinx, Inc. (XLNX), Report: Analog Devices, Inc. (ADI), Analog Devices, Inc. (ADI)

https://finance.yahoo.com/video/warner-bros-discovery-disney-bundle-182315694.html

https://finance.yahoo.com/m/0d8f02db-644c-3dee-b9a0-e419c77df4d7/stocks-to-watch-thursday%3A.html

https://finance.yahoo.com/video/could-armv9-arm-boost-210257051.html

https://finance.yahoo.com/video/robinhood-ceo-arm-holdings-earnings-214425710.html

https://finance.yahoo.com/news/arm-holdings-full-2024-earnings-101522257.html

https://finance.yahoo.com/video/apple-catching-ai-revolution-dan-142925403.html

https://www.cnbc.com/2024/05/13/softbanks-arm-to-launch-ai-chips-by-2025-amid-explosive-demand.html

https://www.fool.com/investing/2024/05/13/is-arm-holdings-stock-a-buy-before-nvidias-earning/

https://www.youtube.com/watch?v=VB3sP0cF25E

https://finance.yahoo.com/m/09b3476e-aa98-3baa-b4fe-0f0c45b1ca9c/heard-on-the-street%3A-strong.html

https://finance.yahoo.com/video/tariffs-chinese-evs-apple-openai-154103697.html

https://www.fool.com/investing/2024/05/13/a-bull-market-is-here-2-artificial-intelligence-st/

https://www.fool.com/investing/2024/05/14/1-reason-to-buy-arm-holdings-stock-and-1-reason-to/

https://www.fool.com/investing/2024/05/14/forget-nvidia-2-super-semiconductor-stocks-to-buy/

https://www.fool.com/investing/2024/05/14/what-artificial-intelligence-ai-investors-should-k/

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: 04TFt2

Cost: $0.50235

https://reports.tinycomputers.io/ARM/ARM-2024-05-17.html Home