Nucor Corporation (ticker: NUE)

2024-02-07

Nucor Corporation (ticker: NUE) stands as a prominent figure in the American steel production industry, positioning itself as a leader in innovation within the sector. With its inception dating back over five decades, Nucor has grown from a humble beginnings to a giant in steel manufacturing, leveraging mini-mill technology to revolutionize the way steel is produced. The company's portfolio spans a wide range of steel products, including carbon and alloy steel, steel joists and joist girders, steel deck, fabricated concrete reinforcing steel, cold finished steel, steel fasteners, metal building systems, and light gauge steel framing. Nucor is committed to sustainability and environmental stewardship, focusing on reducing its carbon footprint and enhancing energy efficiency across its operations. A notable aspect is Nucor's decentralized management philosophy, which empowers its workforce and fosters innovation, thereby contributing to its competitive edge in the global market. Through strategic expansions, acquisitions, and a steadfast focus on customer service and quality, Nucor Corporation has cemented its status as a key player in the global steel industry, demonstrating resilience amidst fluctuating market conditions and regulatory landscapes.

Nucor Corporation (ticker: NUE) stands as a prominent figure in the American steel production industry, positioning itself as a leader in innovation within the sector. With its inception dating back over five decades, Nucor has grown from a humble beginnings to a giant in steel manufacturing, leveraging mini-mill technology to revolutionize the way steel is produced. The company's portfolio spans a wide range of steel products, including carbon and alloy steel, steel joists and joist girders, steel deck, fabricated concrete reinforcing steel, cold finished steel, steel fasteners, metal building systems, and light gauge steel framing. Nucor is committed to sustainability and environmental stewardship, focusing on reducing its carbon footprint and enhancing energy efficiency across its operations. A notable aspect is Nucor's decentralized management philosophy, which empowers its workforce and fosters innovation, thereby contributing to its competitive edge in the global market. Through strategic expansions, acquisitions, and a steadfast focus on customer service and quality, Nucor Corporation has cemented its status as a key player in the global steel industry, demonstrating resilience amidst fluctuating market conditions and regulatory landscapes.

| Address | 1915 Rexford Road, Charlotte, NC, 28211, United States | Phone | 704 366 7000 | Fax | 704 362 4208 |

| Website | https://www.nucor.com | Industry | Steel | Sector | Basic Materials |

| Previous Close | 182.31 | Open | 182.23 | Day Low | 181.07 |

| Day High | 183.32 | Dividend Rate | 2.16 | Dividend Yield | 0.0118 |

| Volume | 1,255,237 | Market Cap | 44,582,903,808 | FiftyTwo Week Low | 129.79 |

| FiftyTwo Week High | 190.96 | Price To Sales Trailing 12 Months | 1.284 | Enterprise Value | 45,664,038,912 |

| Profit Margins | 0.13035 | Shares Outstanding | 245,839,008 | Book Value | 84.825 |

| Price To Book | 2.137931 | Revenue | 34,713,501,696 | Net Income To Common | 4,524,801,024 |

| Total Cash | 7,130,777,088 | Total Debt | 6,842,186,240 | Total Revenue | 34,713,501,696 |

| Sharpe Ratio | 0.32897830000001393 | Sortino Ratio | 5.049851965279405 |

| Treynor Ratio | 0.08224648018529343 | Calmar Ratio | 0.38583140973047275 |

Evaluating the financial health and future prospects of NUE requires a multifaceted approach, incorporating technical analysis metrics, fundamental analysis, risk-adjusted performance ratios, and expectations from financial analysts. The integration of these analyses provides a well-rounded view of the investment landscape surrounding NUE, offering a prediction for its stock price movement in the upcoming months.

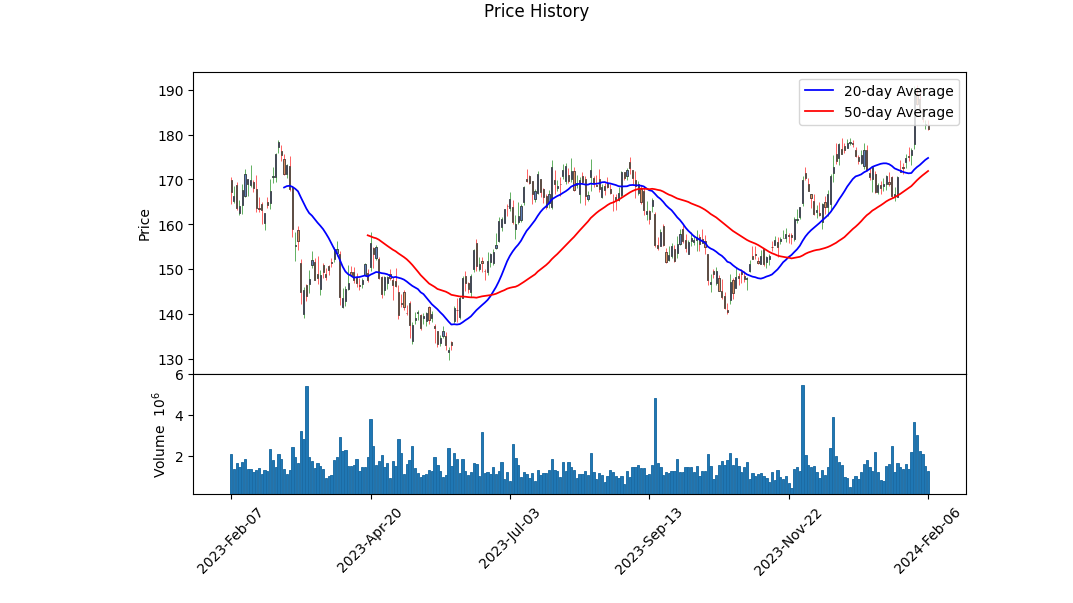

The technical indicators from the last trading day show a dynamic yet volatile trading pattern of NUE over the observed period, climaxing with a notable decline in OBV (On-Balance Volume) and a diminishing MACD histogram towards the most recent data point. This could indicate a potential decrease in buying momentum and a possible consolidation or reversal trend in the near term. However, these indicators alone do not provide a full picture without considering the company's broader financial health and market conditions.

The fundamentals of NUE, highlighted through the financials and balance sheets summary, showcase a robust financial positioning. Key highlights include a significant net income from continuing operations and operational revenues that indicate a strong market position and operational efficiency. The balance sheet shows a solid foundation with considerable cash reserves and a manageable level of debt. These factors contribute positively to the company's financial durability and its ability to withstand economic downturns.

The risk-adjusted performance ratios - Sharpe, Sortino, Treynor, and Calmar - further enhance the analysis by offering insight into the returns of NUE relative to its volatility and systemic risk. The positive albeit modest Sharpe ratio suggests that the company offers additional return per unit of increase in risk. However, it is the Sortino ratio that stands out, indicating a strong return on bad risk, which is quite promising for risk-averse investors. The Treynor and Calmar ratios, though less impressive, still reinforce the notion of a relatively favorable investment in terms of risk-adjusted returns.

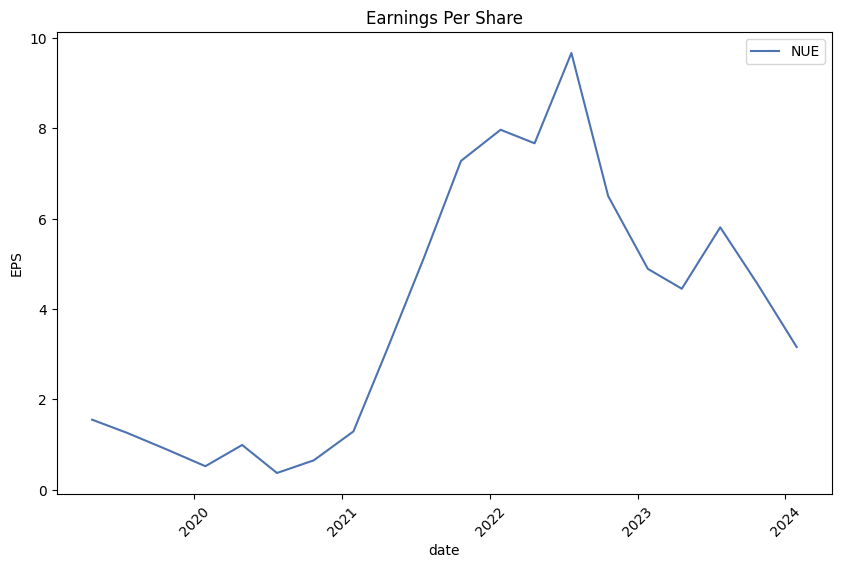

The expectations from financial analysts, captured through various estimates and revisions, demonstrate a mix of optimism and caution. The downwards revision in growth estimates may raise concerns; however, the company's substantial earnings beat in historical quarters, as reflected in the earnings history, emphasizes NUE's ability to outperform expectations.

Conclusively, factoring in the technical trends, the foundational strengths observed in the financial summaries, alongside favorable risk-adjusted performance ratings, and mixed yet cautiously optimistic analyst expectations, it's inferred that NUE may face short-term volatility due to market-wide influences and consolidated trading patterns. However, its strong financial base, robust operational efficiencies, and favorable risk-adjusted returns position it well for resilience in the face of market fluctuation. Over the next few months, its plausible to expect a period of consolidation followed by potential upward movement if the company continues to execute well on its operational fronts and effectively navigates market and economic headwinds. Investors are advised to closely monitor forthcoming quarterly results, analyst revisions, and broader market trends, as these could significantly impact NUE's stock price trajectory.

In analyzing Nucor Corporation (NUE) through the lens of Joel Greenblatt's investing principles as outlined in "The Little Book That Still Beats the Market," we encounter an intriguing situation. Our calculated metrics for Return on Capital (ROC) and Earnings Yield both register at 0.0. It's critical to understand that such values raise questions about the current financial health and efficiency of Nucor Corporation in utilizing its capital to generate profit, as well as its attractiveness from an investment standpoint based on earnings compared to its current stock price. A ROC of 0.0 suggests that Nucor is not generating a return on its invested capital, which is a potential red flag indicating that the company may not be using its capital effectively to grow or sustain its operations. Similarly, an Earnings Yield of 0.0 points to a lack of earnings relative to the company's share price, potentially signaling overvaluation or underlying issues affecting profitability. It's important, however, to approach these figures with caution, as they may result from extraordinary short-term circumstances or accounting adjustments rather than systemic problems. A deeper dive into Nucor's financials, sector challenges, and market conditions would be necessary to put these numbers into a proper investment perspective.

| Statistic Name | Statistic Value |

| R-squared | 0.375 |

| Adj. R-squared | 0.374 |

| F-statistic | 751.5 |

| Prob (F-statistic) | 5.06e-130 |

| Log-Likelihood | -2655.4 |

| No. Observations | 1256 |

| AIC | 5315 |

| BIC | 5325 |

| coef (const) | 0.0558 |

| coef (0) | 1.1777 |

| std err (const) | 0.057 |

| std err (0) | 0.043 |

| t (const) | 0.986 |

| t (0) | 27.414 |

| P>|t| (const) | 0.324 |

| P>|t| (0) | 0.000 |

| [0.025 (const)] | -0.055 |

| [0.025 (0)] | 1.093 |

| [0.975 (const)] | 0.167 |

| [0.975 (0)] | 1.262 |

| Omnibus | 95.170 |

| Prob(Omnibus) | 0.000 |

| Jarque-Bera (JB) | 476.554 |

| Prob(JB) | 3.29e-104 |

| Skew | 0.073 |

| Kurtosis | 6.014 |

| Cond. No. | 1.32 |

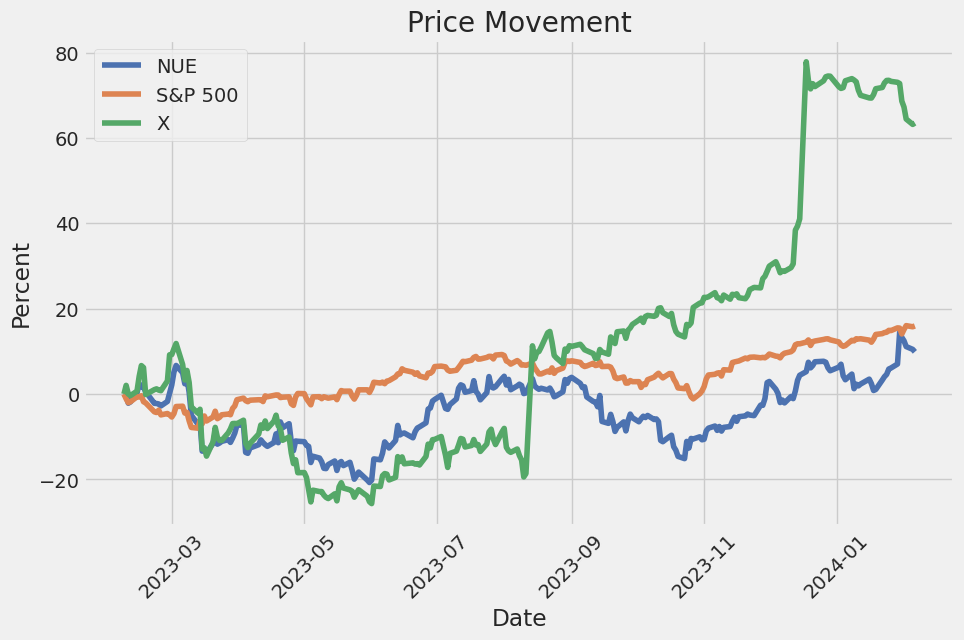

The investigation into the relationship between NUE (presumably a specific stock or security) and SPY (representing the broader market index) via a linear regression model reveals intriguing insights about how NUE's performance is associated with the overall market movement. Notably, the linear regression model, equipped with a modest R-squared value of 0.375, suggests a fair degree of variability in NUE's movements can be explained by the movements in SPY. This connection is further elaborated by the model's alpha (), calculated as approximately 0.0558, hinting at the intercept or the average expected return of NUE when SPY's return is zero. Although this alpha figure might seem small, it signals that NUE has a slight tendency to generate returns over and above the benchmark's performance in the absence of market movements.

The coefficient for SPY (beta, ) is reported to be 1.1777, indicating a positive and more than proportional relationship between SPY's and NUE's returns; for every 1% increase in SPY's return, NUE's return is expected to increase by approximately 1.178%. This highlights NUE's sensitivity and responsiveness to market changes: a characteristic noteworthy for investors aiming at gauging risk and return. The statistical significance of this beta value, reinforced by a t-statistic of 27.414 and a virtually zero p-value, underscores a robust relationship between the variables. While the alpha provides insights into the stock's performance independent of the market, the complete analysis including beta depicts how NUE tends to perform in relation to the broader market movements.

The Nucor Corporation 2023 Fourth Quarter Earnings Call, led by Jack Sullivan, General Manager and Investor Relations, featured a comprehensive update on the company's financial performance and future outlook. Leon Topalian, Chair, President, and CEO, along with CFO Steve Laxton and other executive team members, discussed the company's earnings, operational achievements, and strategic objectives. Nucor reported earnings of $3.16 per share for the fourth quarter, culminating in $18 per share for the full year, marking the third most profitable year in the company's history. This performance was attributed to Nucor's strategic focus on growth, operational safety, and a balanced approach to capital allocation, which includes significant investments in CapEx and returning capital to shareholders.

Nucor celebrated significant operational and safety milestones, including the safest year in the company's history despite the tragic loss of a team member. This incident underscored Nucor's unwavering commitment to safety as its core value. The company reported exceptional operational efficiency and market leadership across various segments, supported by strategic investments exceeding $12 billion since the beginning of 2020. These investments have bolstered Nucor's product capabilities, expanded its market reach, and further cemented its position as an industry leader in financial, operational, and environmental aspects.

The company's growth initiatives and investments in technology and infrastructure are aimed at increasing market share and improving product offerings. For instance, Nucor is advancing its "expand beyond" strategy by diversifying into steel-adjacent businesses, yielding significant returns and contributing to its EBITDA. Topalian highlighted key projects, such as the Brandenburg plate mill's ramp-up and the construction of a new sheet mill in West Virginia, emphasizing the strategic advantage of integrating mills with steel product teams to enhance efficiency, reduce injury risks, and capitalize on cross-selling opportunities.

Looking ahead, Nucor remains optimistic about future prospects despite near-term economic uncertainties. The company anticipates increased demand driven by infrastructure investments and evolving market trends, including the transition to electric vehicles and renewable energy. CFO Steve Laxton provided a financial outlook, noting strong cash flows, a strategic focus on high-return investments, and a disciplined approach to capital allocation and shareholder returns. The company expects continued growth, supported by its robust business model and strategic investments in key growth areas, positioning Nucor favorably for the evolving steel industry landscape.

mber 30, 1999) \n \n \n 4 \n \n Bylaws of Nucor Corporation, as amended (incorporated by reference to Exhibit 4 to the Current Report on Form 8-K filed November 27, 2012)\n \n \n 31.1 \n \n Certification of Chief Executive Officer pursuant to Rule 13a-14(a) and Rule 15d-14(a) under the Securities Exchange Act of 1934, as amended, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 \n \n \n 31.2 \n \n Certification of Chief Financial Officer pursuant to Rule 13a-14(a) and Rule 15d-14(a) under the Securities Exchange Act of 1934, as amended, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002\n \n \n 32.1 \n \n Certification of Chief Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 \n \n \n 32.2 \n \n Certification of Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002\n \n \n 101 \n \n Interactive Data Files pursuant to Rule 405 of Regulation S-T: (i) the Condensed Consolidated Balance Sheets at September 30, 2023, and December 31, 2022, (ii) the Condensed Consolidated Statements of Earnings for the three and nine months ended September 30, 2023, and October 1, 2022, (iii) the Condensed Consolidated Statements of Comprehensive Income for the three and nine months ended September 30, 2023, and October 1, 2022, (iv) the Condensed Consolidated Statements of Cash Flows for the nine months ended September 30, 2023, and October 1, 2022, and (v) the Notes to Condensed Consolidated Financial Statements \n \n \n 104 \n \n The cover page from this Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, formatted in Inline XBRL

This report includes disclosures and exhibits that are integral to understanding Nucor Corporation's financial position as of September 30, 2023, including their operating segments, capital resources, and risks. The data show the financial dynamics within Nucor's steel mills, steel products, and raw materials segments, with specific attention on net sales, operating activities, and their response to market fluctuations. Financial certifications are also included, ensuring compliance with regulatory standards and internal controls over financial reporting. The detailed breakout of their expenditures, such as capital expenditures, acquisitions, pre-operating, and start-up costs, provides insight into their investment in growth and maintenance of operational efficiency. Furthermore, this information is critical for assessing the future financial health and direction of the company amidst changing market conditions.

Nucor Corporation stands as a beacon of success and innovation in the steel production industry, a testament to its strategic foresight and operational excellence. The company's journey through the volatile landscapes of the steel market highlights its adaptability and commitment to sustainability, factors that have significantly contributed to its standing as a leading producer in North America. Nucor's achievements become even more notable when examined against the backdrop of the cyclical nature of the steel industry, which demands exceptional resilience and strategic flexibility from companies seeking to thrive.

The comparison with Steel Dynamics, especially in terms of dividend growth and earnings expectations, offers a compelling narrative of Nucor's competitive edge. Despite facing industry-wide challenges such as fluctuating demand and pricing pressures, Nucor has consistently demonstrated its ability to navigate through such adversities, underscored by its strategic investments in technology and sustainable practices. These investments not only bolster Nucor's operational efficiency but also align with the growing global emphasis on environmental responsibility, enhancing the company's appeal to a broader spectrum of investors.

Nucor's philosophy of prioritizing shareholder value is reflected in its robust dividend history and strategic share repurchases. The decision to increase its dividend amidst a challenging earnings forecast speaks volumes about the company's confidence in its long-term growth trajectory and its commitment to rewarding shareholders. This balancing act between safeguarding immediate financial interests and investing in future growth defines Nucor's approach to capital allocation, setting it apart from competitors.

The company's efforts to expand its production capabilities, both through organic growth and strategic acquisitions, have been instrumental in solidifying its market position. Nucor's investments in state-of-the-art facilities and expansion into new geographic territories underscore its ambition to cater to the increasing demand for steel across various sectors, from construction to renewable energy.

Nucor's engagement in sustainable practices and renewable energy projects further cements its reputation as a forward-thinking and responsible corporate entity. Its initiatives aimed at reducing carbon emissions and enhancing energy efficiency not only contribute to environmental conservation but also position Nucor as a leader in the transition towards sustainable industrial practices.

The strategic initiatives unveiled during Nucor's fourth-quarter earnings call in 2023, including significant capital expenditures and a reaffirmed commitment to safety and innovation, highlight the company's forward-looking stance. Despite the tragic loss of a team member, Nucor's response reinforces its dedication to creating a safe working environment, reflecting its core values and the importance it places on its workforce.

In light of the global push towards sustainability and the evolving demands of the steel market, Nucor's strategic direction appears more relevant than ever. The company's investments in technological innovation and its proactive stance on environmental sustainability are not merely responses to current trends but are indicative of Nucor's vision for the future of steel productiona future where efficiency, innovation, and responsibility converge to create lasting value for shareholders, employees, and society at large.

Nucor's recent performance, including its surpassing of earnings expectations and achievement of a significant RS rating improvement, signifies its resilience and the effectiveness of its strategic initiatives. Such milestones not only underscore Nucor's operational excellence but also bolster investor confidence in the company's capacity to navigate market fluctuations and capitalize on growth opportunities.

In sum, Nucor Corporation's journey through the intricacies of the steel industry illustrates a well-executed strategy of growth, innovation, and sustainability. Its ability to exceed expectations, even in challenging market conditions, coupled with its unwavering commitment to shareholder value and environmental stewardship, positions Nucor as a leader in the steel production sector and a compelling prospect for investors seeking long-term value.

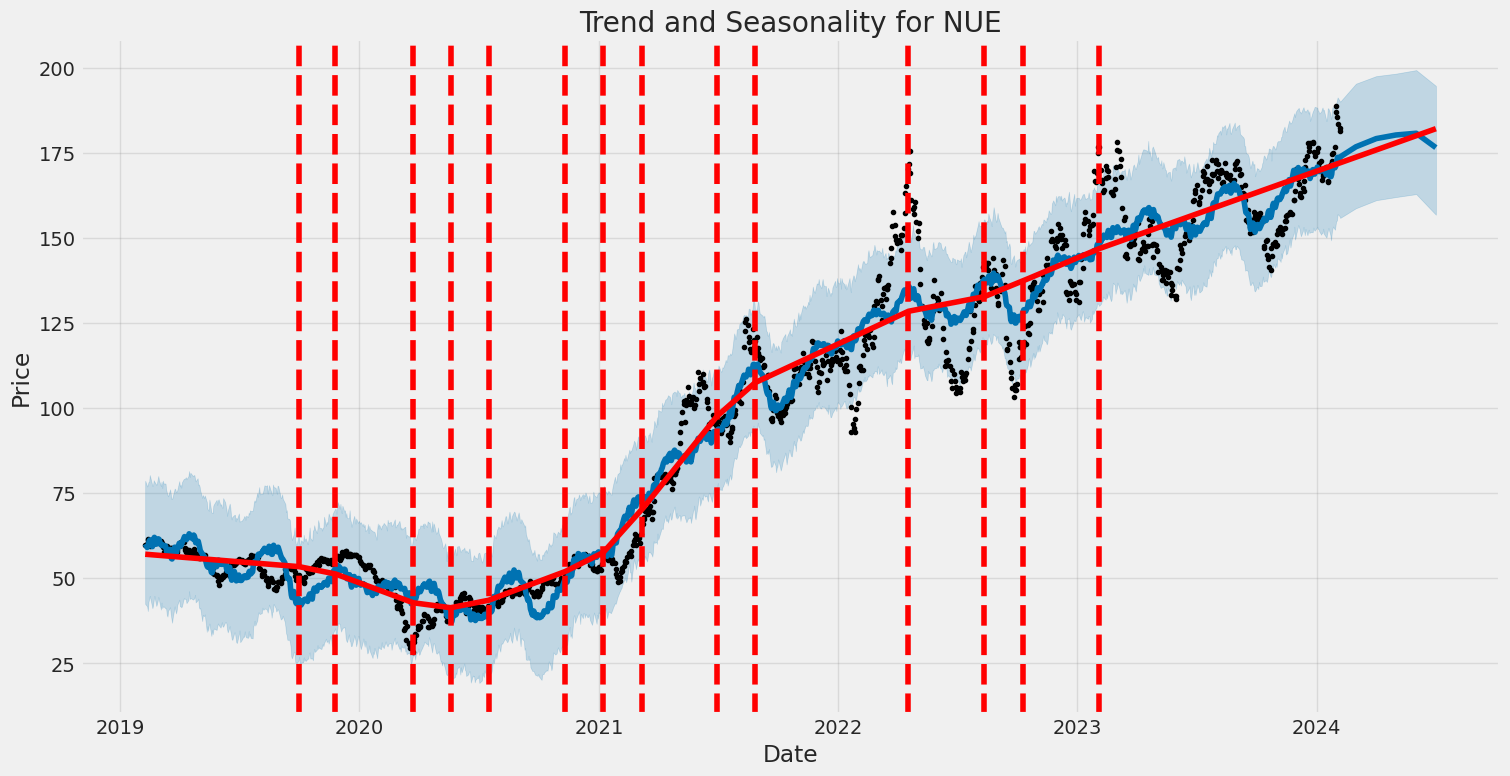

Nucor Corporation (NUE) has demonstrated notable volatility from February 2019 to February 2024, as analyzed through the ARCH model. This volatility is characterized by substantial fluctuations, with an omega value of 4.8663 indicating a high level of variance in asset returns. Additionally, the alpha value of 0.2460 suggests that past returns significantly influence future volatility, indicating a responsive and potentially unpredictable market behavior for NUE.

| Statistic Name | Statistic Value |

|---|---|

| Omega | 4.8663 |

| Alpha[1] | 0.2460 |

Analyzing the financial risk associated with a $10,000 investment in Nucor Corporation (NUE) over a one-year period requires a sophisticated approach that blends advanced volatility modeling techniques with machine learning predictions. This dual approach enables a nuanced understanding of past market behaviors and future return forecasts, crucial for a comprehensive risk assessment.

Volatility modeling provides insights into the historical price fluctuations of Nucor Corporation's stock. By examining daily stock prices, volatility modeling constructs a time-varying volatility estimate, capturing the dynamic nature of market risk. This model quantifies how much Nucor Corporation's stock price can be expected to vary on a day-to-day basis, offering a statistical measure of the stock's risk level over time. The essence of volatility modeling lies in its ability to incorporate past volatility trends and adapt to changes in market dynamics, making it a reliable tool for understanding risk.

In parallel, machine learning predictions contribute to this analysis by forecasting future stock returns based on historical data and relevant market indicators. The machine learning approach applied here, specifically through the use of ensemble decision trees, generates predictions on the future returns of Nucor Corporation's stock by learning from patterns in past price movements and financial indicators. This process entails compiling voluminous datasets, including stock prices, trading volumes, and economic indicators, and training the model to identify complex relationships within the data. The role of this predictive model is to provide an estimated future return, contributing to the overall risk assessment by projecting potential gains or losses.

When assessing the results, particularly the Annual Value at Risk (VaR) at a 95% confidence level, the calculated VaR of $311.11 for a $10,000 investment in Nucor Corporation highlights the potential risk of loss over a one-year period. VaR is a widely used risk measure that quantifies the maximum expected loss over a specified time frame, given normal market conditions and a certain confidence level. In this context, it means that there is a 95% confidence that the investment will not lose more than $311.11 over the next year, under normal market conditions. This calculation, derived from the outputs of the volatility modeling and machine learning predictions, provides investors with a concrete measure of the investment's potential downside risk.

By integrating volatility modeling with machine learning predictions, this analysis offers a multifaceted view of the potential financial risks involved in investing in Nucor Corporation. The use of volatility modeling to capture the historical volatility patterns, paired with the predictive capabilities of machine learning to forecast future returns, represents a robust framework for understanding and quantifying the risks of equity investment. The calculated VaR at a 95% confidence level, based on this integrated approach, provides a critical risk metric that aids investors in making informed decisions.

Analyzing the options chain for Nucor Corporation (NUE) reveals several interesting opportunities for call options, taking into account their Greek values, strike price, expiration date, and the aim for a target stock price increase of 5% over the current price. The GreeksDelta, Gamma, Vega, Theta, and Rhoplay essential roles in assessing the profitability and risk associated with these options.

One of the most profitable options identified is the call option with a strike price of $180.0 expiring on 2024-02-09. This option shows a remarkably high Return on Investment (ROI) of 2.8583333333, with a substantial profit of 7.7175. It has a Delta of 0.6719662173, suggesting it might not be as sensitive to stock price movements as options with Deltas closer to 1, but its high Gamma of 0.1152122233 indicates that its Delta is quite responsive to changes in the underlying stock price. Moreover, the high Vega of 3.4291577648 illustrates its sensitivity to changes in implied volatility, potentially benefiting from increases in market volatility.

Another notable option is the call with a strike of $187.5 expiring on 2024-02-09. It boasts the highest ROI in the chain at 19.8392857143, driven by its low premium and a significant profit of 2.7775. The option's Delta of 0.0111701047 indicates it's far out of the money and would require a substantial price move to become profitable, but given its incredibly high ROI, it represents a high-risk, high-reward scenario.

For a longer-term perspective, the option with a strike price of $110.0 expiring on 2024-04-19 seems particularly appealing. It has a Delta of 0.9977072899 and a significant Rho of 21.2277014001, suggesting it benefits substantially from rises in the interest rate. Its premium is relatively moderate at 49.0, with a very high ROI of 0.6411734694 and a profit of 31.4175, showcasing its potential for profitability over time as the stock approaches or surpasses the strike price.

An intriguing option for an even longer timeframe is with a strike price of $115.0 expiring on 2026-01-16. It has a Delta of 0.9089618702 and a substantial Vega of 33.1426331127, indicating it's poised to capitalize on movements in the underlying stock price and shifts in implied volatility over the longer term. The ROI stands at a modest 0.0150403769 with a small profit of 1.1175, suggesting a lower-risk approach for long-term investors betting on gradual increases in the stock's price and volatility.

Finally, for a very high-risk and high-reward strategy, the option expiring on 2025-01-17 with a strike of $125.0 is worth noting. It has a massive ROI of 0.3266578787 and profits of 16.1075. Its Delta is 0.9889405154, making it very sensitive to movements in the stock price, and a non-existent Vega suggests no concern for changes in implied volatility over the period until expiration.

These options highlight different strategies that investors could adopt based on their risk tolerance, investment horizon, and views on the underlying stock and market volatility. Options with high ROI like those expiring in 2024 offer speculative opportunities with potentially high returns, while longer-dated options could be used for more strategic plays or portfolio hedging over time.

Similar Companies in Steel:

Report: United States Steel Corporation (X), United States Steel Corporation (X), Report: Reliance Steel & Aluminum Co. (RS), Reliance Steel & Aluminum Co. (RS), Report: ArcelorMittal S.A. (MT), ArcelorMittal S.A. (MT), Report: Commercial Metals Company (CMC), Commercial Metals Company (CMC), Report: Steel Dynamics, Inc. (STLD), Steel Dynamics, Inc. (STLD), Report: Gerdau S.A. (GGB), Gerdau S.A. (GGB), Report: Cleveland-Cliffs Inc. (CLF), Cleveland-Cliffs Inc. (CLF), POSCO Holdings Inc. (PKX), Ternium S.A. (TX), Report: Olympic Steel, Inc. (ZEUS), Olympic Steel, Inc. (ZEUS), Report: Carpenter Technology Corporation (CRS), Carpenter Technology Corporation (CRS)

https://www.fool.com/investing/2024/01/13/this-dividend-growth-stock-is-doing-better-than-wa/

https://www.fool.com/investing/2024/01/14/warning-income-investors-may-have-missed-this-divi/

https://seekingalpha.com/article/4662896-nucor-stock-bet-on-growing-steel-demand-in-united-states

https://www.youtube.com/watch?v=p0ajLtTVjNc

https://seekingalpha.com/article/4666112-nucor-corporation-nue-q4-2023-earnings-call-transcript

https://www.youtube.com/watch?v=V-X_tnSdH_8

https://www.youtube.com/watch?v=Be7UDqUqjuA

https://finance.yahoo.com/news/company-news-jan-31-2024-143700873.html

https://finance.yahoo.com/m/c6a530ee-5a44-3736-a1ca-6ca7240d7a1f/steel-producer-nucor-stock.html

https://finance.yahoo.com/news/nucor-corporation-nyse-nue-q4-132052373.html

https://finance.yahoo.com/news/steel-producer-breaks-amid-powerful-181000958.html

https://finance.yahoo.com/news/zacks-investment-ideas-feature-highlights-133500082.html

https://finance.yahoo.com/news/nucor-corporation-nue-trending-stock-140006100.html

https://www.fool.com/investing/2024/02/04/finding-winners-my-best-performing-stock-and-it-is/

https://www.sec.gov/Archives/edgar/data/73309/000095017023060729/nue-20230930.htm

Copyright © 2024 Tiny Computers (email@tinycomputers.io)

Report ID: S6IWsx

Cost: $0.96266

https://reports.tinycomputers.io/NUE/NUE-2024-02-07.html Home